Fundings & Exits

Auto Added by WPeMatico

Auto Added by WPeMatico

Hello and welcome back to our regular morning look at private companies, public markets and the gray space in between.

A million dollars isn’t cool. You know what’s cool? Positive adjusted EBITDA, or something close to it.

That’s the message from scooter unicorn Lime, which announced this week that it was cutting about 14% of its staff and closing a dozen markets. The staff reductions, numbering about 100, come as the company has touted efforts to improve its profitability — going as far as setting targets for when it might reach capital freedom, as well as highlighting the matter in a recent corporate blog post.

(Bird, a Lime competitor, also underwent layoffs this year.)

What’s going on? Unicorns, once hungry for growth, are now hell-bent to show current (and future) investors that their businesses aren’t unprofitable quagmires. Profitability, or movement towards it, is hot, and Lime is a good example of the trend — as is Getaround, which also wrote about its own layoffs this week. Let’s dig in.

Powered by WPeMatico

Hello and welcome back to Equity, TechCrunch’s venture capital-focused podcast, where we unpack the numbers behind the headlines.

This week we had TechCrunch’s Alex Wilhelm and Danny Crichton on hand to dig into the news, with Chris Gates on the dials and more news than we could possibly cram into 30 minutes. So we went a bit over; sorry about that.

We kicked off by running through a few short-forms to get things going, including:

Turning to longer cuts, the team dug into the latest from SoftBank, its Vision Fund and the successes and struggles of its enormous startup bets. Leading the news cycle this week were layoffs at Zume, a robotic pizza delivery venture that is no longer pursuing robotic pizza delivery. Now it’s working on sustainable packaging. Cool, but it’s going to be hard for the company to grow into its valuation while pivoting.

Other issues have come up — more here — that paint some cracks onto the Vision Fund’s sunny exterior. Don’t be too beguiled by the bad news, Danny says; venture funds run like J-Curves, and there are still winners in that particular portfolio.

After that, we turned to China, in particular its venture slowdown. The bubble, in Danny’s view, has burst. The story discussed is here, if you want to read it. The short version for the lazy is that not only has China’s venture scene slowed down dramatically, but startups — even those with ample capital raised — are dying by the hundred. But one highly caffeinated Chinese startup continues to find growth in the world’s greatest tea market.

Finally we hit on the Sam Altman wager and the latest from Sisense, which is now a unicorn. All that and we had some fun.

Equity drops every Friday at 6:00 am PT, so subscribe to us on Apple Podcasts, Overcast, Spotify and all the casts.

Powered by WPeMatico

Just Spices, the German-founded spice mix brand, is disclosing €13 million in Series B funding. The round is led by Five Seasons Ventures and Coefficient Capital, with Bitburger Ventures also joining.

A direct to consumer play, Just Spices offers two main product lines: Spice Mixes and “IN MINUTES”.

The first consists of various spice blends, with new blends being developed based on the sales and customer feedback data the startup is amassing.

The second, launched in 2018, is recipe-driven, offering 27 “fix” meal preparations that sees Just Spices provide the recipe and spice mix needed to prepare a quick meal, with only a few additional fresh ingredients required to complete the dish. It appears to share some similarities with SimplyCook in the U.K.

“The need for innovative, fast and still balanced solutions in the food sector is greater than ever,” says Just Spices co-founder and CEO Florian Falk. “On the one hand, people have less time available so food has to be as uncomplicated as possible, but on the other, we still have wants and needs… With Just Spices, and especially with IN MINUTES, we offer a carefree alternative, which consumers can be confident is fast and tasty whilst still fitting into a conscious, healthy diet.”

“The need for innovative, fast and still balanced solutions in the food sector is greater than ever,” says Just Spices co-founder and CEO Florian Falk. “On the one hand, people have less time available so food has to be as uncomplicated as possible, but on the other, we still have wants and needs… With Just Spices, and especially with IN MINUTES, we offer a carefree alternative, which consumers can be confident is fast and tasty whilst still fitting into a conscious, healthy diet.”

As part of its customer acquisition strategy and to power a product development feedback loop, Just Spices says it has built a vibrant, active digital community of home cooks. More than 60% of its sales are generated online, and the company claims to be one of the most followed spices brands in Europe (on social media). And certainly the startup is investing in content, including operating its own in-house studio and producing podcasts.

“We want to become the world’s largest lifestyle spice brand,” adds Falk. “To achieve this, we have not only built a fantastic partnership network, we have brought together an amazing team. We want to bring the joy and fun of cooking to many more people.”

Powered by WPeMatico

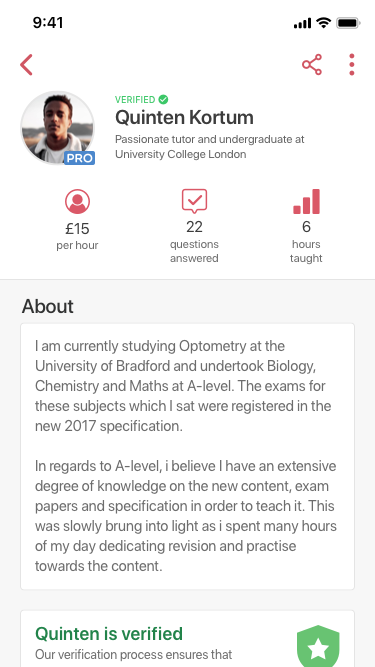

Scoodle, a U.K.-based startup that, in its own words, wants to help tutors become influencers, is disclosing $760,000 in pre-seed funding.

Backing the round is Twitter co-founder Biz Stone, alongside Tiny VC, IFG Ventures and a number of unnamed angels. Scoodle is also the first ed tech company to join the University of Oxford’s accelerator, Oxford Foundry.

Launched in late 2018, Scoodle might be thought of as Quora-meets-tutoring. The platforms lets students post questions, which tutors are then invited to answer as a way of boosting their reputation and influence, from which they can generate more tutoring work.

Tutors also can create a comprehensive profile and share learning resources as a further way of demonstrating their expertise. And, crucially, take tutor bookings.

Co-founder and CEO Ismail Jeilani, who most recently worked at Google, says the idea was born from his own experience tutoring so that he could save up for university and avoid taking out a student loan.

“It’s difficult to find good tutors, because parents don’t know what to look for,” he tells me. “We solve this with a content-driven approach. Our tutors share content like learning resources on their profiles, which parents get to view before booking a lesson. Through this approach, tutors begin to develop their own brands, like ‘an educator’s LinkedIn.’ ”

Scoodle says it hosts thousands of tutors from the U.K.’s best educational institutions, including the University of Oxford, the University of Cambridge, Imperial College London and others.

Scoodle says it hosts thousands of tutors from the U.K.’s best educational institutions, including the University of Oxford, the University of Cambridge, Imperial College London and others.

Perhaps most noteworthy, Scoodle is operating like a content-led marketplace for tutor bookings, but doesn’t currently charge a booking fee.

Having grown to 100,000 users across mobile and web, the startup instead has introduced a subscription model: tutors pay £10 per month for boosted listings, and the company claims this secures tutors up to 30 times more enquiries.

Similarly, there is also a subscription option for students whereby anybody can book, message and access tutor content for free, but a higher tier Scoodle Pro membership lets you ask questions directly to tutors for a more on-demand service.

“It’s very common that a student discovers Scoodle on the back of a Google search,” adds Jeilani. “When they view an answer, they also see other answers from that tutor, along with how many students they’ve helped. This helps create trust.”

In the U.K., the tutoring space includes companies like Tutorful, Tutorhunt and myTutor, but remains fragmented. Jeilani argues that Scoodle’s key differentiator is its focus on tutor branding driven by content.

“Unique content gives us a different user acquisition channel along with long-term defensibility,” he says. “This tutor-focused approach also means we’re the first to have a 0% commission model. This keeps tutors on our platform longer than anywhere else.”

Powered by WPeMatico

PayU is acquiring a controlling stake in fintech startup PaySense at a valuation of $185 million and plans to merge it with its credit business LazyPay as the nation’s largest payments processor aggressively expands its financial services offering.

The Prosus-owned payments giant said on Friday that it will pump $200 million — $65 million of which is being immediately invested — into the new enterprise in the form of equity capital over the next two years. PaySense, which employs about 240 people, has served more than 5.5 million consumers to date, a top executive said.

Prior to today’s announcement, PaySense had raised about $25.6 million from Nexus Venture Partners, and Jungle Ventures, among others. PayU became an investor in the five-year-old startup’s Series B financing round in 2018. Regulatory filings show that PaySense was valued at about $48.7 million then.

The merger will help PayU solidify its presence in the credit business and become one of the largest players, said Siddhartha Jajodia, global head of Credit at PayU, in an interview with TechCrunch. “It’s the largest merger of its kind in India,” he said. The combined entity is valued at $300 million, he said.

PaySense enables consumers to secure long-term credit for financing their new vehicle purchases and other expenses. Some of its offerings overlap with those of LazyPay, which primarily focuses on providing short-term credit to consumers to facilitate orders on food delivery platforms, e-commerce websites and other services. Its credit ranges between $210 and $7,030.

Cumulatively, the two services have disbursed more than $280 million in credit to consumers, said Jajodia. He aims to take this to “a couple of billion dollars” in the next five years.

PaySense’s Prashanth Ranganathan and PayU’s Siddhartha Jajodia pose for a picture

As part of the deal, PaySense and LazyPay will build a common and shared technology infrastructure. But at least for the immediate future, LazyPay and PaySense will continue to be offered as separate services to consumers, explained Prashanth Ranganathan, founder and chief executive of PaySense, in an interview with TechCrunch.

“Over time, as the businesses get closer, we will make a call if a consolidation of brands is required. But for now, we will let consumers direct us,” added Ranganathan, who will serve as the chief executive of the combined entity.

There are about a billion debit cards in circulation in India today, but only about 20 million people have a credit card. (The official government figures show that about 50 million credit cards are active in India, but many individuals tend to have more than one card.)

This has meant that most Indians don’t have a traditional credit score, so they can’t secure loans and a range of other financial services from banks. Scores of startups in India today are attempting to address this opportunity by using other signals and alternative data of users — such as the kind of a smartphone a person has — to evaluate whether they are worthy of being granted some credit.

Digital lending is a $1 trillion opportunity (PDF) over the next four and a half years in India, according to estimates from Boston Consulting Group.

PayU’s Jajodia said PaySense and LazyPay will likely explore building new offerings, such as credit for small and medium businesses. He did not rule out the possibility of getting stakes in more fintech startups in the future. PayU has already invested north of half a billion dollars in its India business. Last year, it acquired Wibmo for $70 million.

“At PayU, our ambition is to build financial services using data and technology. Our first two legs have been payments [processing] and credit. We will continue to scale both of these businesses. Even this acquisition was about getting new capabilities and a strong management team. If we find more companies with some unique assets, we may look at them,” he said.

PayU leads the payments processing market in India. It competes with Bangalore-based RazorPay. In recent years, RazorPay has expanded to serve small businesses and enterprises. In November, it launched corporate credit cards and other services to strengthen its neo banking play.

Powered by WPeMatico

Hello and welcome back to our regular morning look at private companies, public markets and the gray space in between.

Today, we’re exploring fundraising from outside the venture world.

Founders looking to raise capital to power their growing companies have more options than ever. Traditional bank loans are an option, of course. As is venture capital. But between the two exists a growing world of firms and funds looking to put capital to work in young companies that have growing revenues and predictable economics.

Firms like Clearbanc are rising to meet demand for capital with more risk appetite than a traditional bank looking for collateral, but less than an early-stage venture firm. Clearbanc offers growth-focused capital to ecommerce and consumer SaaS companies for a flat fee, repaid out of future revenues. Such revenue-based financing is becoming increasingly popular; you could say the category has roots in the sort of venture debt that groups like Silicon Valley Bank have lent for decades, but there’s more of it than ever and in different flavors.

While revenue-based financing, speaking generally, is attractive to SaaS and ecommerce companies, other types of startups can benefit from alt-capital sources as well. And, some firms that disburse money to growing companies without an explicit equity stake are finding a way to connect capital to them.

Today, let’s take a quick peek at three firms that have found interesting takes on providing alternative startup financing: Earnest Capital with its innovative SEAL agreement, RevUp Capital, which offers services along with non-equity capital, and Capital, which both invests and loans using its own proprietary rubric.

After all, selling equity in your company to fund sales and marketing costs might not be the most efficient way to finance growth; if you know you are going to get $3 out from $1 in spend, why sell forever shares to do so?

Before we dig in, there are many players in what we might call the alt-VC space. Lighter Capital came up again and again in emails from founders. Indie.vc has its own model that is pretty neat as well. In honor of starting somewhere, however, we’re kicking off with Earnest, RevUp and Capital. We’ll dive into more players in time. (As always, email me if you have something to share.)

Powered by WPeMatico

Last year Insight Partners invested $500 million in cloud data management company Veeam. It apparently liked the company so much that today it announced it has acquired the Swiss startup for $5 billion.

Veeam helps customers with cloud data backup and disaster recovery. The company, which has been based in Baar, Switzerland, says that it had $1 billion in revenue last year. It boasts 365,000 customers worldwide, including 81% of the Fortune 500.

Ray Wang, founder and principal analyst at Constellation Research, says that data management is an increasingly important tool for companies working with data on prem and in the cloud. “This is a smart move, as the data management space is rapidly consolidating. There’s a lot of investment in managing hybrid clouds, and data management is key to enterprise adoption,” Wang told TechCrunch.

The deal is coming with some major changes. Veeam’s EVP of Operations, William H. Largent, will be promoted to CEO. Danny Allan, who was VP of product strategy, will be promoted to CTO. In addition, the company will be moving its headquarters to the U.S. Veeam currently has around 1,200 employees in the U.S., but expects to expand that in the coming year.

New CEO Allan says in spite of their apparent success in the market, and the high purchase price, he believes under Insight’s ownership, the company can go further than it could have on its own. “While Veeam’s preeminence in the data management space, currently supporting 81% of the Fortune 500, is undeniable, this commitment from Insight Partners and deeper access to its unmatched business strategy [from its scale-up] division, Insight Onsite, will bring Veeam’s solutions to more businesses across the globe.”

Insight Onsite is Insight Partners’ strategy arm that is designed to help its portfolio companies be more successful. It provides a range of services in key business areas, like sales, marketing and product development.

Veeam has backup and recovery tools for both Amazon Web Services and Microsoft Azure, along with partnerships with a variety of large enterprise vendors, including Cisco, IBM, Dell EMC and HPE.

The company, which was founded in 2006, had a valuation of more than $1 billion prior to today’s acquisition, according to Crunchbase data. The deal is expected to close in the first quarter this year.

Powered by WPeMatico

Hello and welcome back to our regular morning look at private companies, public markets and the gray space in between.

Today we’re digging into seed-stage companies, the vanguard of the venture market. In particular, we’re trying to understand why the ratio of seed deals now favor enterprise startups over their consumer-focused brethren. The fact that seed investors recently inverted their preferences, cutting more checks to enterprise (B2B) startups in 2019 than consumer-oriented companies (B2C) was news.

We wrote about the trend here, as regular readers will recall.

To better understand what’s going on, I spoke with a number of early-stage venture investors who recently dropped by Equity, came highly recommended by peers, and several I know personally. The goal was to get a handful of inputs from different firms to get under the skin of the trend.

What in the hell is going on in seed? Let’s find out.

This morning we’ll hear from Jenny Lefcourt at Freestyle Capital, Jomayra Herrera of Cowboy Ventures, Hunter Walk from Homebrew, Iris Choi of Floodgate, Sarah Guo from Greylock and Ajay Agarwal of Bain Capital Ventures. As you can see, we picked a list of investors form firms of different sizes, theses and focus. However, each investing group either focuses on early-stage investments that include seed deals or dabbles in them.

Here’s what we want to know: why did the the majority of seed deals swap from consumer-focused startups to enterprise-focused deals?

Our investing group detailed a number of explanations, a handful of which echoed each other. To best convey their thinking, we’ll quote each investor at moderate length. If you are in a hurry, the most common point made against consumer-focused seed deals is go-to-market difficulty in the current market.

Other reasons include price, secular changes to the technology landscape, and the changing experience profile of the investing class themselves. (Minor edits made to select responses for clarity.)

Freestyle’s Jenny Lefcourt said via email that consumers are an increasingly difficult cohort to sell to, because they “became fickle with the proliferation of VC-backed, consumer-focused startups over the past few years.” As a result, consumers became “harder and more expensive to acquire and even harder to retain,” meaning higher customer acquisition costs (CAC) and lower lifetime value (LTV).

Powered by WPeMatico

Cloudflare announced that it has acquired S2 Systems, a browser isolation startup founded by former Microsoft execs. The two companies did not reveal the acquisition price.

Matthew Prince, co-founder and CEO at Cloudflare, says that this acquisition is part of a new suite of products called Cloudflare for Teams, which has been designed to protect an organization from threats on the internet. S2 developed a solution specifically to help prevent browser-based code attacks.

Prince said the company had been thinking for some time about how to incorporate this kind of technology into the Cloudflare family of products. As with many companies, it had to decide if it should partner, build or acquire a company. Prince says that when he met the founding team from S2 and tested its technology, he was impressed with the speed and execution.

The team felt like a good fit, so Cloudflare made an offer. It had to bid against some other companies (which he did not name), but in the end S2 chose Cloudflare. He sees technology like this helping to even the playing field for internet users around the world.

“We’re super excited to have them on board, and we think that combining their better browser isolation technology with our ubiquitous network, we can really redefine how enterprises protect their employees, and over the long term how people generally browse the internet, where we can make it so that a low-end phone can have a similar experience as a brand new modern iPhone,” Prince said. He says that’s due to the tremendous processing power that can take place on its network across 200 cities worldwide, taking that processing burden off of the phone or other device.

The acquisition does not stand in isolation though. It’s part of a broader announcement around a new product category called Cloudflare for Teams. This is designed to provide a set of protections that includes S2 browser isolation as well as VPN and identity protection.

There are two main pieces to Cloudflare for Teams: Cloudflare Access and Cloudflare Gateway. Access is a Zero Trust identity and access management tool designed to help companies ensure their employees are using the most up-to-date software on their devices.

Gateway is designed to protect companies and individuals from threats on the internet, which is where S2 fits in. The company offers three versions: Gateway, which includes DNS-based filtering and audit logging; Gateway Pro, which secures all internet-bound traffic; and Gateway Enterprise, which helps prevent data loss and includes the browser isolation tech from S2.

The S2 acquisition closed on December 31st. S2’s 10 employees are now part of the Cloudflare team, and will remain in Kirkland, Wash. to establish a Cloudflare office there. The company was in stealth prior to the acquisition.

Powered by WPeMatico

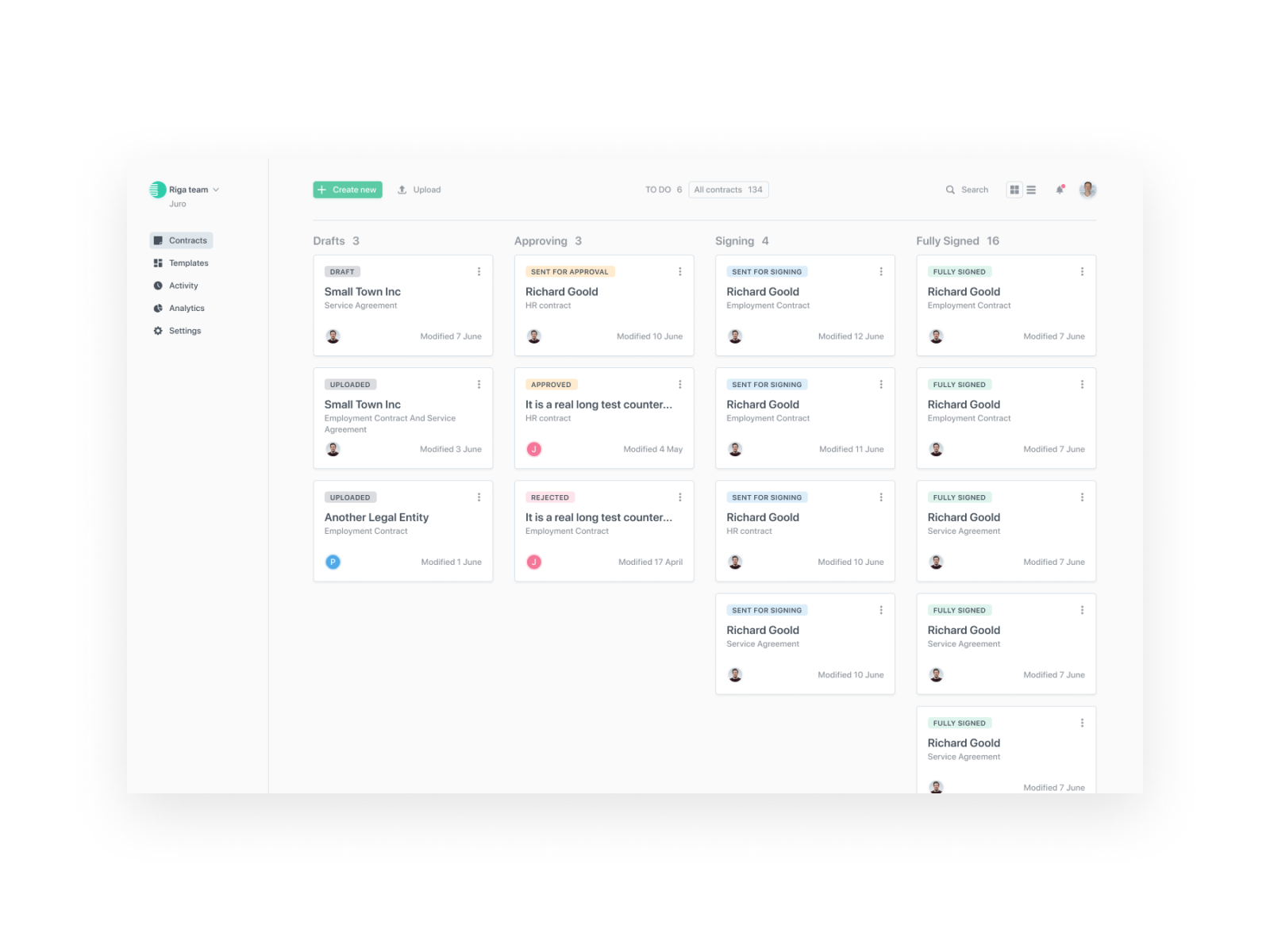

Juro, a UK startup that’s using machine learning tech and user-centric design to do for contracts what Typeform does for online forms, has caught the eye of Union Square Ventures. The New York-based fund leads a $5 million Series A investment that’s being announced this morning.

Also participating in the Series A are existing investors Point Nine Capital, Taavet Hinrikus (co-founder of TransferWise) and Paul Forster (co-founder of Indeed). The round takes Juro’s total raised to-date to $8M, including a $2M seed which we covered back in 2018.

London is turning into a bit of a hub for legal tech, per Juro CEO and co-founder Richard Mabey — who cites “strong legal services industry” and “strong engineering talent” as explainers for that.

It was also, he reckons, “a bit of a draw” for Union Square Ventures — making what Juro couches as a “rare” US-to-Europe investment in legal tech in the city via the startup.

“Having brand name customers in the US certainly helped. But ultimately, they look for product-led companies with strong cross-functional teams wherever they find them,” he adds.

Juro’s business is focused on taking the tedium out of negotiating and drawing up contracts by making contract-building more interactive and trackable. It also handles e-signing, and follows on with contract management services, using machine learning tech to power features such as automatic contract tagging and for flagging up unusual language.

All of that sums to being a “contract collaboration platform”, as Juro’s marketing puts it. Think of it like Google Docs but with baked in legal smarts. There’s also support for visual garnish like animated GIFs to spice up offer letters and engage new hires.

“We have a data model underlying our editor that transforms every contract into actionable data,” says Mabey. “Juro contracts look like contracts, smell like contracts but ultimately they are written in code. And that code structures the data within them. This makes a contract manager’s life 10x easier than using an unstructured format like Word/pdf.”

“Still our main competitor is MS Word,” he adds. “Our challenge is to bring lawyers (and other users of contracts) out of Word, which is a significant task. Fortunately, Word was never designed for legal workflows, so we can add lots of value through our custom-built editor.”

Part of Juro’s Series A funds will be put towards beefing up its machine learning/data science capabilities, per Mabey — who says the overall plan at this point is to “double down on product”, including by tripling the size of the product team.

“That means hiring more designers, data scientists and engineers — building our engineering team in the Baltics,” he tells us. “There’s so much more we are excited to do, especially on the ML/data side and the funding unlocks our ability to do this. We will also be building our commercial team (marketing, sales, cs) in London to serve the EU market and expand further into the US, where we already have some customers on the ground.”

The 2016-founded startup still isn’t breaking out customer numbers but says it’s processed more than 50,000 contracts for its clients so far, noting too that those contracts have been agreed in 50+ countries. (“Everywhere from Estonia to Japan to Kazakhstan,” as Mabey puts it.)

In terms of who Juro users are, it’s still mostly “mid-market tech companies” — with Mabey citing the likes of marketplaces (Deliveroo), SaaS (Envoy) and fintechs (Luno), saying it’s especially companies processing “high volumes of contracts”.

Another vertical it’s recently expanded into is media, he notes.

“E-signature giants have grown massively in the last few years, and some are gradually encroaching into the contract lifecycle — but again, they deal with files (pdfs mostly) rather than dynamic, browser-based documentation,” he argues, adding: “In terms of new legal tech entrants — I’m excited by Kira Systems especially, who are working on unpicking pdf contracts post-signature.”

As part of the Series A, Union Square Ventures parter, John Buttrick, is joining Juro’s board.

Commenting in a supporting statement, Buttrick said: “We look for founders with products equipped to change an industry. While contract management might not be new, Juro’s transformative vision for it certainly is. There’s no greater proof of the product’s ease of use than the fact that we negotiated and closed the funding round in it. We’re delighted to support Juro’s team in making their vision a reality.”

Juro’s contract management platform — dashboard view

Powered by WPeMatico