Fundings & Exits

Auto Added by WPeMatico

Auto Added by WPeMatico

As the holiday slowdown looms, the final U.S.-listed technology IPOs have come in and begun to trade.

Three tech, tech-ish or venture-backed companies went public this week: Bill.com, Sprout Social and EHang. Let’s quickly review how each has performed thus far. These are, bear in mind, the last IPOs of the year that we care about, pending something incredible happening. 2020 will bring all sorts of fun, but, for this time ’round the sun, we’re done.

Our three companies managed to each price differently. So, we have some variety to discuss. Here’s how each managed during their IPO run:

How do those results stack up against their final private valuations? Doing the best we can, here’s how they compare:

So EHang priced low and its IPO is hard to vet, as we’re guessing at its final private worth. We’ll give it a passing grade. Sprout Social priced mid-range, and managed a slight valuation bump. We can give that a B, or B+. Bill.com managed to price above its raised range, boosting its valuation sharply in the process. That’s worth an A.

Trading just wrapped, so how have our companies performed thus far in their nascent lives as public companies? Here’s the scorecard:

You can gist out the grades somewhat easily here, with one caveat. The Bill.com IPO’s massive early success has caused the usual complaints that the firm was underpriced by its bankers, and was thus robbed to some degree. This argument makes the assumption that the public market’s initial pricing of the company once it began trading is reasonable (maybe!) and that the company in question could have captured most or all of that value (maybe!).

Bill.com’s CEO’s reaction to the matter puts a new spin on it, but you should at least know that the week’s most successful IPO has attracted criticism for being too successful. So forget any chance of an A+.

Image via Getty Images / Somyot Techapuwapat / EyeEm

Powered by WPeMatico

Hello and welcome back to our regular morning look at private companies, public markets and the grey space in between.

Today we’re taking stock of a cohort of special companies: still-private startups that have reached $100 million in annual recurring revenue (ARR). Our goal is to understand which startup companies are actually exceptional. This late in the unicorn era, hundreds of companies around the world have reached a valuation of $1 billion, making the achievement somewhat pedestrian.

Reaching $100 million in ARR, however, still stands out.

We explored the idea earlier this week, citing Asana, Druva and WalkMe as private companies that recently reached $100 million ARR. In addition to that trio, Bill.com and Sprout Social, both of which went public this week, also crossed the nine-figure annual recurring revenue mark in 2019.

After we posted that short list, four other companies either just shy of $100 million ARR, or with a little bit more, reached out to TechCrunch, touting their own successes. Given that our point was that companies which reach the revenue threshold million are neat, it’s worth taking a moment to look at the other companies joining the $100 million ARR club.

For extra fun I got on the phone with a number of their CEOs to chat about their progress. We’ll start with a look at a company that is nearly a member of the club, and then talk about a few that recently punched their membership cards.

To be frank, I did not know that GitLab was as large as it is. Backed by more than $400 million in private capital, GitLab competes with the now-purchased GitHub as a developer resource and service. Its backers include Goldman Sachs, ICONIQ, GV, August Capital and Khosla.

GitLab became a unicorn back in September of 2018, when it raised $100 million at a $1 billion post-money valuation. Its more recent $268 million Series E raised this September pushed that valuation to nearly $2.8 billion.

It’s a good company for us to include, as it provides a good example of how far in advance a $1 billion valuation can precede a $100 million ARR business; in GitLab’s case, provided that it grows as expected, its unicorn valuation came nearly 1.5 years before reaching nine-figure ARR.

To understand more about the company’s growth, we caught up with its CEO Sid Sijbrandij (full discussion here), learning that he views the unicorn tag as a way to help a company brand itself, but something that is outside of his company’s control. Revenue, in his view, is “much more within your control.” According to Sijbrandij, GitLab is aiming for $1 billion in revenue in 2023 and has a November, 2020 IPO targeted.

GitLab is sharing its impending ARR milestone as it runs its whole business very transparently (hence why my chat with its CEO was live-streamed, and archived on YouTube). It will be super interesting to see if the company hits the ARR target on time, and then if it can also stick the landing with a Q4 2020 IPO.

Egnyte, a player in the enterprise productivity, storage and security spaces, has kept growing since its $75 million Series E it raised last October.

The company, backed by Goldman Sachs (again), GV (again) and Kleiner Perkins, has raised just $137.5 million to date. Reaching $100 million ARR on that level of funding means that Egnyte has run efficiently as a business. In fact, as TechCrunch has reported, Egnyte has occasionally made money on its path to the public markets.

TechCrunch has spoken to Egnyte’s CEO Vineet Jain a number of times, but it seemed appropriate to get him back on the phone now that his company is nearly ready to go public (at least in terms of size). According to Jain, in fresh data released to Extra Crunch:

Powered by WPeMatico

On the heels of Bill.com’s debut, Chicago-based social media software company Sprout Social priced its IPO last night at $17 per share, in the middle of its proposed $16 to $18 per-share range. Selling 8.8 million shares, Sprout raised just under $150 million in its debut.

Underwriters have the option to purchase an additional 1.3 million shares if they so choose.

The IPO is a good result for the company’s investors (Lightbank, New Enterprise Associates, Goldman Sachs and Future Fund), but also for Chicago, a growing startup scene that doesn’t often get its due in the public mind.

At $17 per share, not including the possible underwriter option, Sprout Social is worth about $814 million. That’s just a hair over its final private valuation set during its $40.5 million Series D in December of 2018. That particular investment valued Sprout at $800.5 million, according to Crunchbase data.

Sprout’s debut is interesting for a few reasons. First, the company raised just a little over $110 million while private, and will generate over $100 million in trailing GAAP revenue this year. In effect, Sprout Social used less than $110 million to build up over $100 million in annual recurring revenue (ARR) — the firm reached the $100 million ARR mark between Q2 and Q3 of 2019. That’s a remarkably efficient result for the unicorn era.

And the company is interesting, as it gives us a look at how investors value slower-growth SaaS companies. As we’ve written, Sprout Social grew by a little over 30% in the first three quarters of 2019. That’s a healthy rate, but not as fast as, say, Bill.com . (Bill.com’s strong market response puts its own growth rate in context.)

Thinking very loosely, Sprout Social closed Q3 2019 with ARR of about $105 million. Worth $814 million now, we can surmise that Sprout priced at an ARR multiple of about 7.75x. That’s a useful benchmark for private companies that sell software: If you want a higher multiple when you go public, you’ll have to grow a little faster.

All the same, the IPO is a win for Chicago, and a win for the company’s investors. We’ll update this piece later with how the stock performs, once it begins to trade.

Powered by WPeMatico

Reliance Industries, one of India’s largest industrial houses, has acquired a majority stake in NowFloats, an Indian startup that helps businesses and individuals build online presence without any web developing skills.

In a regulatory filing on Thursday, Reliance Strategic Business Ventures Limited said (PDF) it has acquired an 85% stake in NowFloats for 1.4 billion Indian rupees ($20 million).

Seven-and-a-half-year old, Hyderabad-headquartered NowFloats operates an eponymous platform that allows individuals and businesses to easily build an online presence. Using NowFloats’ services, a mom and pop store, for instance, can build a website, publish their catalog, as well as engage with their customers on WhatsApp.

The startup, which has raised about 12 million in equity financing prior to today’s announcement, claims to have helped over 300,000 participating retail partners. NowFloats counts Blume Ventures, Omidyar Network, Iron Pillar, IIFL Wealth Management, and Hyderabad Angels among its investors.

Last year, NowFloats acquired LookUp, an India-based chat service that connects consumers to local business — and is backed by Vinod Khosla’s personal fund Khosla Impact, Twitter co-founder Biz Stone, Narayana Murthy’s Catamaran Ventures and Global Founders Capital.

Reliance Strategic Business Ventures Limited, a wholly-owned subsidiary of Reliance Industries, said that it would invest up to 750 million Indian rupees ($10.6 million) of additional capital into the startup, and raise its stake to about 89.66%, if NowFloats achieves certain unspecified goals by the end of next year.

In a statement, Reliance Industries said the investment will “further enable the group’s digital and new commerce initiatives.” NowFloats is the latest acquisition Reliance has made in the country this year. In August, the conglomerate said it was buying a majority stake in Google-backed Fynd for $42.3 million. In April, it bought a majority stake in Haptik in a deal worth $100 million.

There are about 60 million small and medium-sized businesses in India. Like hundreds of millions of Indians, many in small towns and cities, who have come online in recent years thanks to world’s cheapest mobile data plans and inexpensive Android smartphones, businesses are increasingly building online presence as well.

But vast majority of them are still offline, a fact that has created immense opportunities for startups — and VCs looking into this space — and major technology giants. New Delhi-based BharatPe, which helps merchants accept online payments and provides them with working capital, raised $50 million in August. Khatabook and OkCredit, two digital bookkeeping apps for merchants, have also raised significant amount of money this year.

In recent years, Google has also looked into the space. It has launched tools — and offered guidance — to help neighborhood stores establish some presence on the web. In September, the company announced that its Google Pay service, which is used by more than 67 million users in India, will now enable businesses to accept digital payments and reach their customers online.

Powered by WPeMatico

DataRobot, a company best known for creating automated machine learning models known as AutoML, announced today that it intends to acquire Paxata, a data prep platform startup. The companies did not reveal the purchase price.

Paxata raised a total of $90 million before today’s acquisition, according to the company.

Up until now, DataRobot has concentrated mostly on the machine learning and data science aspect of the workflow — building and testing the model, then putting it into production. The data prep was left to other vendors like Paxata, but DataRobot, which raised $206 million in September, saw an opportunity to fill in a gap in their platform with Paxata.

“We’ve identified, because we’ve been focused on machine learning for so long, a number of key data prep capabilities that are required for machine learning to be successful. And so we see an opportunity to really build out a unique and compelling data prep for machine learning offering that’s powered by the Paxata product, but takes the knowledge and understanding and the integration with the machine learning platform from DataRobot,” Phil Gurbacki, SVP of product development and customer experience at DataRobot, told TechCrunch.

Prakash Nanduri, CEO and co-founder at Paxata, says the two companies were a great fit and it made a lot of sense to come together. “DataRobot has got a significant number of customers, and every one of their customers have a data and information management problem. For us, the deal allows us to rapidly increase the number of customers that are able to go from data to value. By coming together, the value to the customer is increased at an exponential level,” he explained.

DataRobot is based in Boston, while Paxata is in Redwood City, Calif. The plan moving forward is to make Paxata a west coast office, and all of the company’s almost 100 employees will become part of DataRobot when the deal closes.

While the two companies are working together to integrate Paxata more fully into the DataRobot platform, the companies also plan to let Paxata continue to exist as a standalone product.

DataRobot has raised more than $431 million, according to PitchBook data. It raised $206 million of that in its last round. At the time, the company indicated it would be looking for acquisition opportunities when it made sense.

This match-up seems particularly good, given how well the two companies’ capabilities complement one another, and how much customer overlap they have. The deal is expected to close before the end of the year.

Powered by WPeMatico

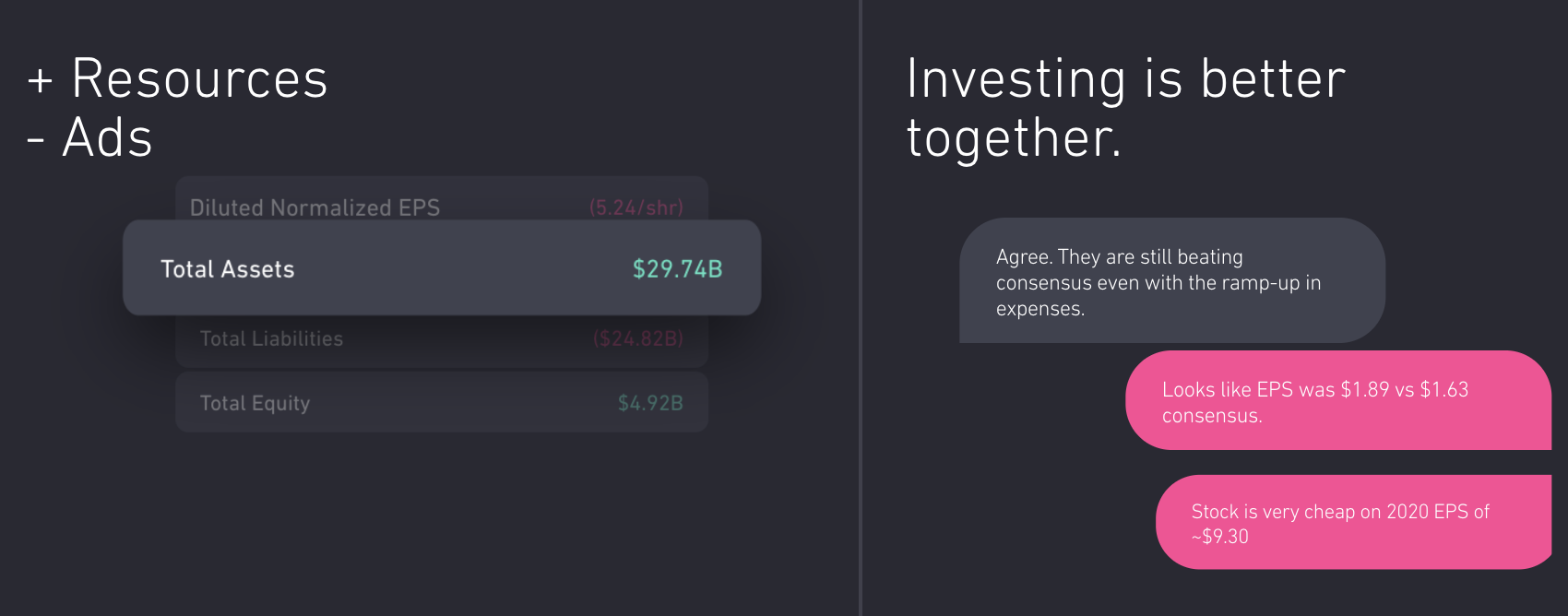

If you want to win on Wall Street, Yahoo Finance is insufficient but Bloomberg Terminal costs a whopping $24,000 per year. That’s why Atom Finance built a free tool designed to democratize access to professional investor research. If Robinhood made it cost $0 to trade stocks, Atom Finance makes it cost $0 to know which to buy.

Today Atom launches its mobile app with access to its financial modeling, portfolio tracking, news analysis, benchmarking and discussion tools. It’s the consumerization of finance, similar to what we’ve seen in enterprise SaaS. “Investment research tools are too important to the financial well-being of consumers to lack the same cycles of product innovation and accessibility that we have experienced in other verticals,” CEO Eric Shoykhet tells me.

In its first press interview, Atom Finance today revealed to TechCrunch that it has raised a $10.6 million Series A led by General Catalyst to build on its quiet $1.9 million seed round. The cash will help the startup eventually monetize by launching premium tiers with even more hardcore research tools.

Atom Finance already has 100,000 users and $400 million in assets it’s helping steer since soft-launching in June. “Atom fundamentally changes the game for how financial news media and reporting is consumed. I could not live without it,” says The Twenty Minute VC podcast founder and Atom investor Harry Stebbings.

Individual investors are already at a disadvantage compared to big firms equipped with artificial intelligence, the priciest research and legions of traders glued to the markets. Yet it’s becoming increasingly clear that investing is critical to long-term financial mobility, especially in an age of rampant student debt and automation threatening employment.

“Our mission is two-fold,” Shoykhet says. “To modernize investment research tools through an intuitive platform that’s easily accessible across all devices, while democratizing access to institutional-quality investing tools that were once only available to Wall Street professionals.”

Shoykhet saw the gap between amateur and expert research platforms firsthand as an investor at Blackstone and Governors Lane. Yet even the supposedly best-in-class software was lacking the usability we’ve come to expect from consumer mobile apps. Atom Finance claims that “for example, Bloomberg hasn’t made a significant change to its central product offering since 1982.”

The Atom Finance team

So a year ago, Shoykhet founded Atom Finance in Brooklyn to fill the void. Its web, iOS and Android apps offer five products that combine to guide users’ investing decisions without drowning them in complexity:

“Our Sandbox feature allows users to create simple financial models directly within our platform, without having to export data to a spreadsheet,” Shoykhet says. “This saves our users time and prevents them from having to manually refresh the inputs to their model when there is new information.”

Shoykhet positions Atom Finance in the middle of the market, saying, “Existing solutions are either too rudimentary for rigorous analysis (Yahoo Finance, Google Finance) or too expensive for individual investors (Bloomberg, CapIQ, Factset).”

With both its free and forthcoming paid tiers, Atom hopes to undercut Sentieo, a more AI-focused financial research platform that charges $500 to $1,000 per month and raised $19 million a year ago. Cheaper tools like BamSEC and WallMine are often limited to just pulling in earnings transcripts and filings. Robinhood has its own in-app research tools, which could make it a looming competitor or a potential acquirer for Atom Finance.

Shoykhet admits his startup will face stiff competition from well-entrenched tools like Bloomberg. “Incumbent solutions have significant brand equity with our target market, and especially with professional investors. We will have to continue iterating and deliver an unmatched user experience to gain the trust/loyalty of these users,” he says. Additionally, Atom Finance’s access to users’ sensitive data means flawless privacy, security, and accuracy will be essential.

The $12.5 million from General Catalyst, Greenoaks, Global Founders Capital, Untitled Investments, Day One Ventures and a slew of angels gives Atom runway to rev up its freemium model. Robinhood has found great success converting unpaid users to its subscription tier where they can borrow money to trade. By similarly starting out free, Atom’s eight-person team hailing from SoFi, Silver Lake, Blackstone and Citi could build a giant funnel to feed its premium tiers.

Fintech can feel dry and ruthlessly capitalistic at times. But Shoykhet insists he’s in it to equip a new generation with methods of wealth creation. “I think we’ve gone long enough without seeing real innovation in this space. We can’t be complacent with something so important. It’s crucial that we democratize access to these tools and educate consumers . . . to improve their investment well-being.”

Powered by WPeMatico

Acquia announced it has acquired customer data platform (CDP) startup AgilOne today. The companies did not disclose the purchase price.

CDPs are all the rage among customer experience vendors, as they provide a way to pull data from a variety of channels to build a more complete picture of the customer. The goal here is to deliver meaningful content to the customer based on what you know about them. Having a platform like this to draw upon makes it more likely that you will hit the target more accurately.

Acquia co-founder and CTO Dries Buytaert says he has been watching this space for the last year, and wanted to add this piece to the Acquia tool chest. “Adding a CDP like AgilOne to our existing platform will help our customers unify their data across various tools in their technology stack to drive better, more personal customer experiences,” he said.

In particular, he says he liked AgilOne because it used an intelligence layer while building the customer record. “What sets AgilOne apart from other CDPs are its machine learning capabilities, which intelligently segment customers and predict customer behaviors (such as when a customer is likely to purchase something). This allows for the creation and optimization of next-best action models to optimize offers and messages to customers on a 1:1 basis.”

Like most startup founders, AgilOne CEO Omer Artun sees this as an opportunity to grow his company, probably faster than he could have on his own. “Since AgilOne’s inception, our vision has been to give marketers the direct power to understand who their customers are and engage with them in a genuine way in order to boost profitability and create the omnichannel experiences that customers crave. Through this acquisition, Acquia will enable us to continue to deliver, and build upon, this vision,” he wrote in a blog post announcing the acquisition.

Tony Byrne, founder and principal analyst at the Real Story Group, has been watching the marketing automation space for some time, as well as the burgeoning CDP market. He sees this move as good for Acquia, but wonders how it will fit with other pieces in the Acquia stack. “This in theory allows them to support the unification of customer data across their suite,” Byrne told TechCrunch.

But he cautions that the company could struggle incorporating AgilOne into its platform. “The Marketing Automation platform they purchased targets mostly B2B. AgilOne is dialed in on B2C use cases and a fairly narrow set of vertical segments. It will take a lot of work to make it into a CDP that could adequately serve Acquia’s diverse customer base,” he said.

Acquia was acquired by Vista Equity Partners for $1 billion in September, and it tends to encourage its companies to be more acquisitive than they might have been on their own. “Vista has been supportive of our M&A strategy and believes strongly in AgilOne as a part of Acquia’s vision to redefine the customer experience stack,” Buytaert said.

AgilOne raised over $41 million, according to PitchBook data. Investors included Tenaya Capital, Sequoia Capital and Mayfield Fund. It had a post valuation of just over $115 million and was pegged as likely acquisition target by Pitchbook.

AgilOne customers will be happy to hear that Acquia plans to continue to sell it as a stand-alone product in addition to making it part of the Acquia Open Marketing Cloud.

Powered by WPeMatico

Childcare is one of the biggest expenses for American parents — and it’s not just families that are taking a hit. Childcare issues cost the United States’ economy an estimated $4.4 billion in lost productivity each year and also impacts employee retention rates. Kinside wants to help with a platform that not only enables families to get the most out of their family care benefits, but also find the right providers for their kids. The startup announced the public launch of its platform today, along with $3 million in a new funding round led by Initialized Capital.

This brings Kinside’s total raised since it was founded 18 months ago to $4 million. Its other investors include Precursor Ventures, Kairos, Jane VC and Escondido Ventures.

Founded by Shadiah Sigala, Brittney Barrett and Abe Han, Kinside began its private beta with 10 clients while participating in Y Combinator last summer. Over the past year, it has signed up more than 1,000 employers, underscoring the demand for childcare benefits.

“Getting meetings with employers has not been the hard part,” Sigala, Kinside’s CEO, tells TechCrunch. “Any subject line that says ‘do you want childcare for your employees?’ immediately gets a response. We hit a nerve there and when we talked with them, we found that the biggest pain they expressed was that their employees were having a hard time finding childcare.”

The U.S. is the only industrialized country without a national law that guarantees paid parental leave. Companies like Microsoft, Netflix and Deloitte offer strong family benefits in order to recruit and retain talent, but offering similar packages remains a challenge, especially for small to medium-sized businesses. As a result, many employees, especially women, leave their jobs to care for their children, even if they had planned to continue working.

“The worst case for bigger, more mature companies is a delayed return to work, which has a real impact on the bottom line because of lost productivity, but the deeper pain is when we lose the women,” Sigala says. “It’s documented that 43% of women in the professional sector will leave the workforce within one to two years of having a baby.”

Other startups focused on early childhood care that have recently raised funding include Winnie, for finding providers; Wonderschool, which helps people start in-home daycares and preschools;and London-based childcare platform Koru Kids.

Before Kinside, Sigala co-founded Honeybook, a business management platform for small businesses and freelancers. When she got pregnant, Sigala began developing the company’s family benefit policies and became familiar with the hurdles small companies face.

While in Y Combinator, Kinside focused on streamlining the process of using dependent care flexible spending accounts (FSA), or pre-tax benefits, for caregiving costs, after its founders saw that the complicated claims process meant only a fraction of eligible parents get full use of the program. Kinside still helps parents with their accounts by partnering with FSA administrators. Now their app also includes a network of pre-screened early childcare providers, ranging from home-based daycares to large preschools across the country.

The startup pre-negotiates reserved spots and discounted rates for its users and gives them access to a “concierge” made up of childcare professionals to answer questions. Parents can search for providers based on location, cost and childcare philosophy. Sigala says the startup’s team found that many childcare providers have a 20% to 30% vacancy rate, which Kinside addresses by helping them manage openings and find families who are willing to commit to a spot. In addition to its app, Kinside also plans to integrate into human resources systems.

Initialized was co-founded by Alexis Ohanian, also a founder of Reddit, and a vocal advocate of paid parental leave. One of the areas the firm focuses on is “family tech,” and its portfolio also includes startups like the Mom Project, a job search platform for mothers returning to work.

In an email, Initialized partner Alda Leu Dennis said the firm invested in Kinside because “we have this fundamental problem of gender inequality which can be partially attributed to imbalances in the workplace and at home. We have a gender wage gap and domestic responsibilities, still, largely falling on the mother. By solving a problem that men and women have—access to affordable and high-quality childcare—we can improve this situation.”

Dennis added, “the business model innovation that Kinside brings to the table is to involve employers in the process of bringing peace of mind and stability to their employees’ home lives and in turn making their employees more productive.”

Sigala says Kinside sees itself as part of the benefits equity movement, including paid parental leave and, eventually, universal childcare for all working parents. The platform’s users are split equally between men and women, highlighting that the need for caregiving benefits cross gender lines and impact an entire household.

“It’s a complex issue. Our infrastructure and society is still designed for single breadwinner households and yet the economy means that for most households, being able to pay the bills depends on having two parents working,” she adds. “I see this as a movement. It’s the right time.”

Powered by WPeMatico

It was just a couple of months ago that Tines, the cybersecurity automation startup, raised $4.1 million in Series A funding led by Blossom Capital. The Dublin-based company is now disclosing an $11 million extension to the round.

This additional Series A funding is led by venture capital firm Accel, with participation from Index Ventures and previous backer Blossom Capital. The extra cash will be used to continue developing its cybersecurity automation platform and for further expansion into the U.S. and Europe.

Founded in February 2018 by ex-eBay, PayPal and DocuSign security engineer Eoin Hinchy, and subsequently joined by former eBay and DocuSign colleague Thomas Kinsella, Tines automates many of the repetitive manual tasks faced by security analysts so they can focus on other high-priority work. The pair had bootstrapped the company as recently as October.

“It was while I was at DocuSign that I felt there was a need for a platform like Tines,” explained Hinchy at the time of the initial Series A. “We had a team of really talented engineers in charge of incident response and forensics but they weren’t developers. I found they were doing the same tasks over and over again so I began looking for a platform to automate these repetitive tasks and didn’t find anything. Certainly nothing that did what we needed it to, so I came up with the idea to plug this gap in the market.”

To remedy this, Tines lets companies automate parts of their manual security processes with the help of six software “agents,” with each acting as a multipurpose building block. The idea is that, regardless of the process being automated, it only requires combinations of these six agent types configured in different ways to replicate a particular workflow.

In addition, the platform doesn’t rely on pre-built integrations to interact with external systems. Instead, Tines is able to plug in to any system that has an API. “This means integration with commercial, off-the-shelf products, or existing in-house tools is quick and simple, with most security teams automating stories (workflows) within the first 24 hours,” says the startup. Its software is also starting to find utility beyond cybersecurity processes, with several Tines customers using it in IT, DevOps and HR.

“We heard that Eoin, a senior member of the security team at DocuSign (another Accel portfolio company), had recently left to start Tines, so we got in touch,” Accel’s Seth Pierrepont tells TechCrunch. “They were in the final stages of closing their Series A. However, we were so convinced by the founders, their product approach and the market timing, that we asked them to extend the round.”

Pierrepont also points out that a unique aspect of the Dublin ecosystem is that many of the world’s largest tech companies have their European headquarters in the country (often attracted by relatively low corporation tax), “so it’s an incredibly rich talent pool despite being a relatively small city.”

Asked whether Accel views Tines as a cybersecurity automation company or a more general automation play that puts automation in the hands of non-technical employees for a multitude of possible use cases, Pierrepont says, given Hinchy and Kinsella’s backgrounds, the cybersecurity automation sector should be the primary focus for the company in the short term. However, longer term it is likely that Tines will be adopted across other functions as well.

“From our investment in Demisto (which was acquired by Palo Alto Networks earlier this year), we know the security automation or SOAR category (as Gartner defines it) very well,” he says. “Demisto pioneered the category and was definitively the market leader when it was acquired. However, we think the category is just getting started and that there is still a ton of whitespace for Tines to go after.”

Meanwhile, in less than a year, Tines says it has on-boarded 10 enterprise customers across a variety of industries, including Box, Auth0 and McKesson, with companies automating on average 100,000 actions per day.

Powered by WPeMatico

According to CEO Afif Khoury, we’re in the middle of “the third wave of social” — a shift back to local interactions. And Khoury’s startup Soci (pronounced soh-shee) has raised $12 million in Series C funding to help companies navigate that shift.

Soci works with customers like Ace Hardware and Sport Clips to help them manage the online presence of hundreds or thousands of stores. It allows marketers to post content and share assets across all those pages, respond to reviews and comments, manage ad campaigns and provide guidance around how to stay on-brand.

It sounds like most of these interactions are happening on Facebook. Khoury told me that Soci integrates with “40 different APIs where businesses are having conversations with their customers,” but he added, “Facebook was and continues to be the most prominent conversation center.”

Khoury and CTO Alo Sarv founded Soci back in 2012. Khoury said they spent the first two years building the product, and have subsequently raised around $30 million in total funding.

“What we weren’t building was a point solution,” he said. “What we were building was a massive platform … It took us 18 months to two years to really build it in the way we thought was going to be meaningful for the marketplace.”

Soci has also incorporated artificial intelligence to power chatbots that Khoury said “take that engagement happening on social and move it downstream to a call or a sale or something relevant to the local business.”

The new round was led by Vertical Venture Partners, with participation from Grayhawk Capital and Ankona Capital. Khoury said the money will allow Soci to continue developing its AI technology and to build out its sales and marketing team.

“Ours is a very consultative sale,” he said. “It’s a complicated world that you’re living in, and we really want to partner and have a local presence with our customers.”

Powered by WPeMatico