Fundings & Exits

Auto Added by WPeMatico

Auto Added by WPeMatico

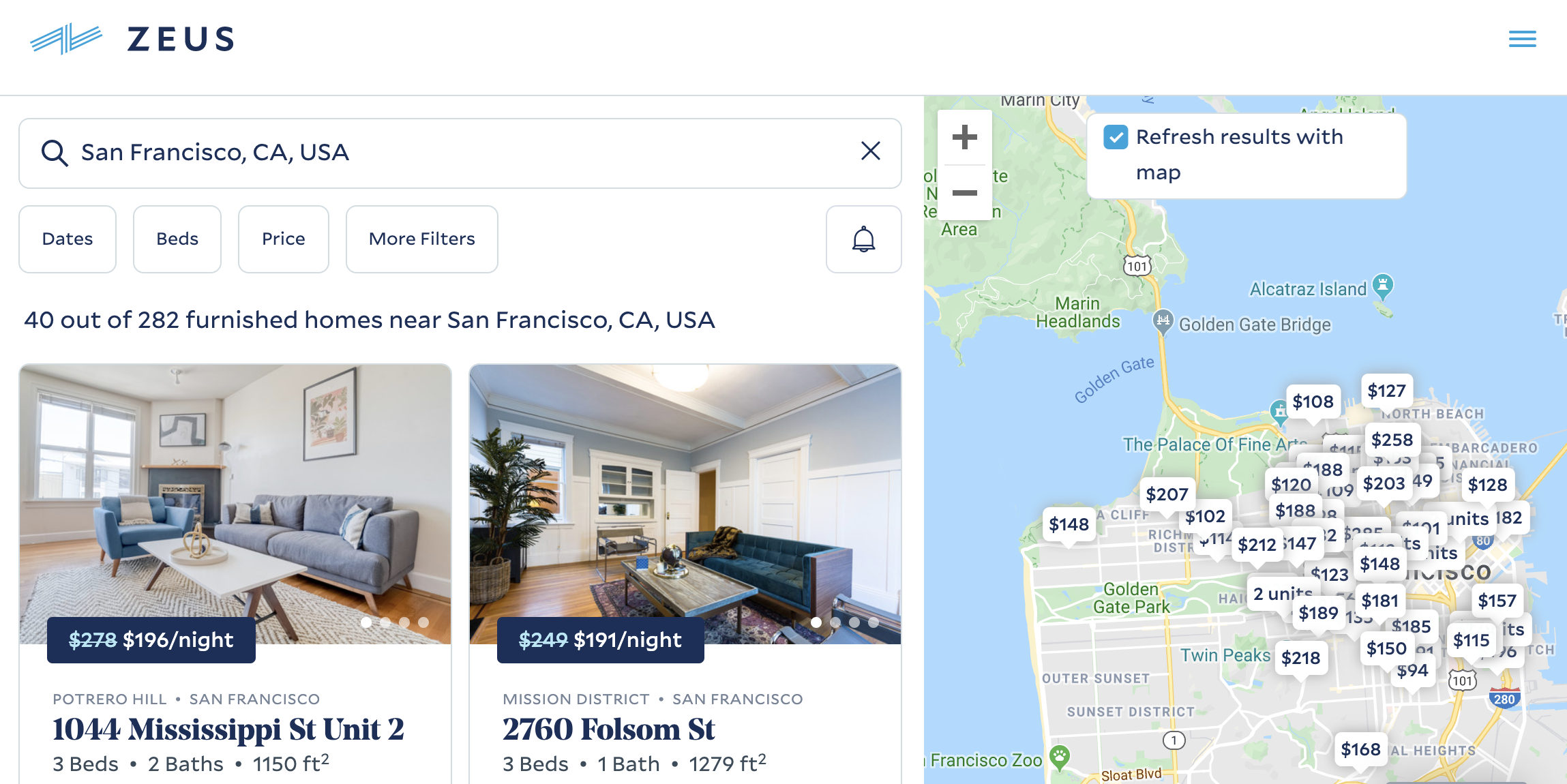

As Airbnb absorbs more and more of the demand for housing, it’s exploring how to monetize opportunities beyond vacation rentals. A marketplace for longer-term corporate housing could be a huge business, but rather than build that itself, Airbnb is making a strategic investment in one of the market leaders called Zeus Living, which will list its homes on the Airbnb site.

In just four years of redecorating landlords’ homes and renting them to relocated workers for 30-day stays (or longer), Zeus Living has grown to a $100 million revenue run rate. It boosted revenue 300% in 2019, and now has 250 employees and more than 2,000 homes under management. Zeus makes money by charging landlords one free month of usage, and marking up the rent charged to customers. It could rent out a $4,000 per month home for $5,000 plus take the extra month to earn $16,000 in a year.

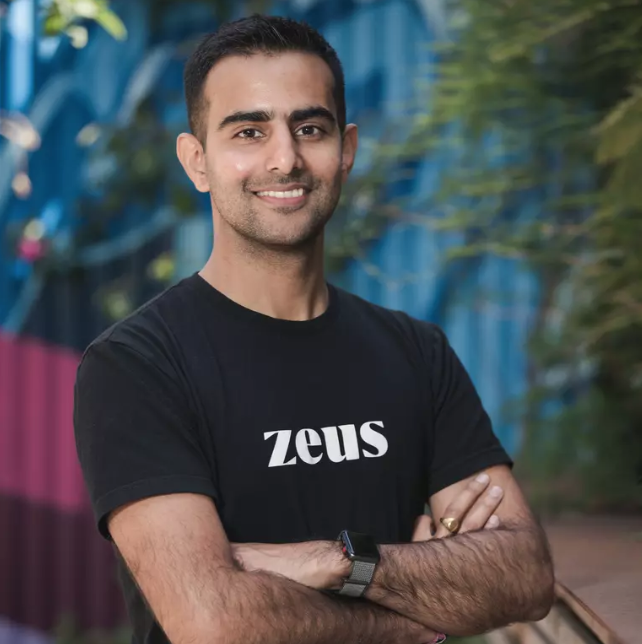

Zeus CEO and co-founder Kulveer Taggar tells me, “I fundamentally believe that a lot of human potential is bound by location. At Zeus, we’re deeply committed to making it easier for people to live where opportunity takes them.” It’s already hosted 27,000 residents for a total of 650,000 nights.

Strong margins, swift momentum and that megatrend of more mobile workforces have earned Zeus Living a new $55 million Series B round it’s announcing on TechCrunch today. The funding comes from Airbnb, Comcast, CEAS Investments and TI Platform Management, plus existing investors Alumni Ventures Group, Initialized Capital, NFX and Spike Ventures. The funding comes at a $205 million post-money valuation.

“The opportunity here is huge, consumer spend is going toward housing and everyone needs to stay somewhere. But it’s Kulveer and Zeus’ go-to-market strategy that is impressive,” says Initialized co-founder and managing partner Garry Tan. “Zeus decided to start with corporate rentals, which we believe is the best go-to-market since it is the highest margin, and capital efficiency wins in a space with many competitors. Corporate needs are longer term, consistent and predictable, and partnering with Airbnb strengthens this approach as they expand to build a platform for every city.”

Zeus co-founder and CEO Kulveer Taggar

Zeus previously raised a $2.5 million seed and then an $11.5 million Series A led by Initialized, as well as $10 million in debt to cover taking on properties in the San Francisco Bay Area, Los Angeles, New York, Seattle and D.C. Now that it’s scaling up, Zeus could add a sizable debt facility to cover the risk of filling apartments with employees from clients like Brex, Disney, ServiceTitan and Samsara.

Instead of moving into a bland corporate housing block, struggling to find a place themselves or ending up in expensive long-term Airbnbs, workers moving to new cities can go to Zeus. It takes over apartments, handles maintenance and fills them with branded comforts like Parachute bedding and Helix mattresses that Zeus gets at bulk rates. The startup is betting that as workers move between jobs and cities more frequently, fewer will own furniture and instead look for furnished homes like those Zeus offers.

Thanks to the premium stays it provides, Zeus can charge clients a lucrative rate, while Taggar claims his service is still about half the price of standard corporate housing. For property owners, Zeus makes it easy to get a consistent rent paycheck with none of the traditional landlord work. Zeus takes care of cleaning and key exchanges so owners don’t need to do any chores like if they were running an Airbnb. Its goal is to get the first renters in within 10 days of taking on a property.

The new funding will help Zeus expand to more neighborhoods and cities while retaining a focus on breadth within each market so clients have plenty of homes from which to choose. The startup will be revamping its booking and invoicing tools for enterprise partners, and improving how it sources real estate. Meanwhile, it will be investing in customer care to maintain its high 70s NPS scores so relocated workers brag to their colleagues about how nice their new place is.

“Finding housing is stressful and time-consuming for both individuals and employers. As someone who has moved countries four times, I’ve lived through that tension,” says Taggar. “Zeus Living has built technology to remove complexity from housing, turning it into a service that enables a more mobile world.”

Taggar got into the real estate business early, remortgaging his mom’s house to buy a condo in Mumbai to rent out. After moving to the U.S., he built and sold Y Combinator-backed auction tool Auctomatic with co-founder and future Stripe starter Patrick Collison. It was while working on NFC-triggered task launcher Tagstand that Taggar recognized the hassle of both finding new corporate housing and reliably renting out one’s home. With Uber, Stripe and more startups growing huge by simplifying processes that move a lot of money around, he was inspired to do the same with Zeus Living.

“Modern professionals travel more frequently, stay longer and seek accommodations that feel like home. As more companies look to Airbnb for Work for extended-stay and relocation solutions, this segment remains a key focus for Airbnb,” says David Holyoke, global head of Airbnb for Work.

“We have great alignment with the Airbnb team in terms of serving the changing needs of business travelers that want the comforts of home when traveling for extended 30-day stays for work or a project,” Taggar follows. Airbnb can help Zeus drive demand thanks to all its inbound traffic, while Zeus offers Airbnb more supply for customers seeking longer stays.

Zeus Living’s co-founders

Zeus’ biggest threat is that it could get overextended, misjudge demand and end up on the hook to pay rent for two-year leases it can’t fill. And now with more funding, there will be added scrutiny regarding its margins, especially in the wake of the WeWork implosion.

Taggar recognizes these threats. “This is a business where we have to be focused on maximizing the gross profit we generate for the investments we make, with the least amount of risk. At Zeus Living, we’re continuously improving the ways we predict and secure demand.” He’s also building out teams on the ground in different markets to ensure regulatory compliance and push for more conducive laws around 30-day (or longer) rental stays.

Property tech has become a heated space, though, so Zeus will have heavy competition. There are traditional corporate housing providers, pure marketplaces that don’t deal with logistics and direct competitors like $66 million-funded Domio and juggernaut Sonder, which has raised a whopping $360 million. Zeus might also see its model copied abroad before it can get there. Over time, landlords and real estate investment trusts like Blackstone could force Zeus, Sonder and others to compete to pay them the most for leases, eating into all the startups’ margins.

At least with Airbnb as an investor, Zeus won’t have to fear a bitter battle with the tech giant over corporate housing. Instead, Airbnb could keep investing to coin off this adjacent market while listing Zeus properties, or potentially acquired the startup one day. For now though, Taggar just wants to prove startups can be accountable in the real world, acknowledging that taking over people’s homes is “a lot of responsibility! Our homes represent hundreds of millions of dollars of assets we manage and we take that very seriously.”

Powered by WPeMatico

Jow, the French e-grocery app — which combines recipes, recommendations and online grocery ordering — has raised $7 million in new funding.

The round is led by Stride.VC, alongside Caterina Fake and Jyri Engeström from Yes VC, and Shan-Lyn Ma, the co-founder and CEO of Zola. Previous seed backers, DST global partners and eVentures also participated.

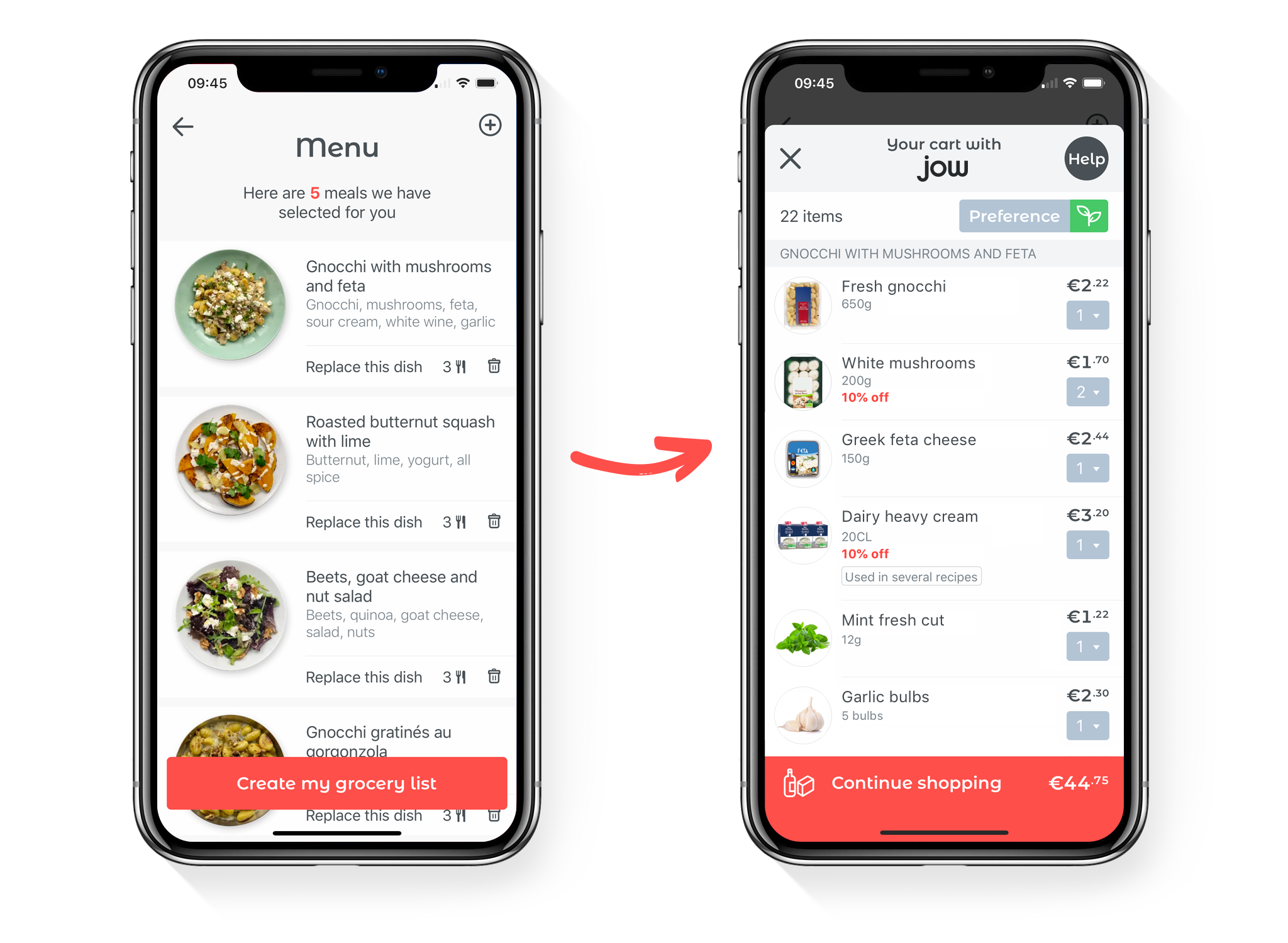

Launched in 2018 and now supporting five of France’s leading grocery retailers (Monoprix, Carrefour, Auchan, Chronodrive and E.Leclerc), Jow’s app claims to let you complete your weekly online food shop in as little as a minute (once you’ve been on-boarded, of course).

It does this by creating customised menus, tailored to each user and household, and then automatically fills your online shopping cart with the required ingredients. The idea is to answer the question: “what’s for dinner tonight?” while providing a more cost-effective alternative to recipe kits such as Blue Apron or HelloFresh, and less reliance on take-outs from the likes of Deliveroo or Uber Eats.

“Doing your weekly shopping online can take you up to one hour,” says Jow co-founder and CEO Jacques-Edouard Sabatier. “You waste a lot of time looking for the right product category, sub category, scrolling through hundreds of references, you finally find your product, put it in your cart, and repeat this process up to 40 times (the number of items in your cart)! It’s a horrendous experience, with no added value at all for the customer.”

That’s in contrast to brick and mortar grocery shopping, argues Sabatier, where there is an opportunity to “feel, taste and smell the products.” He says it’s the terrible user experience of grocery shopping online that has limited its e-grocery growth. Jow aims to change that.

“Jow creates a customised menu, just for you, with simple and delicious recipes,” explains Sabatier. “Our food recommendation engine considers your tastes, your kitchen appliances, whether or not you have children and checks the availability of the ingredients in your supermarket. Jow then automatically fills your cart with all the ingredients you need to cook the meals.”

In addition, Jow offers a customised list of your repeat purchases, and its recommendation engine claims to help you choose the exact quantities needed to avoid waste. You also can check out with a single click, and the app will synchronise with your chosen supermarket delivery or pickup service.

Noteworthy is that the app’s recipe-to-cart feature represents on average 75% of the products Jow users add to their cart. Staple products such as toilet paper, beverages, toothpaste etc. make up the remaining 25%.

The app is free for end users, seeing the Paris and New York-based startup generate affiliate revenue from supermarkets that want to use the service to acquire younger, mobile-first customers. The business model is asset light, too, as Jow is largely built on top of the existing infrastructure and capabilities of larger supermarkets.

“Apart from the 50x improvement on the e-grocery funnel, it’s unbelievable to see that to date, in a world where you have tailored and recommended experiences around music, video etc., you have no strong recommendation engine or experiences around food,” adds Sabatier.

In addition, the startup believes that more broadly it has created a mobile e-grocery experience that actually works. “E-grocery is one of the only e-commerce segments where desktop still prevails,” says Sabatier. “[Bucking this trend], 90% of Jow’s customers shop using their mobile devices, the experience is so smooth and fast that you can do your weekly shopping in just one minute on the subway or the bus.”

Powered by WPeMatico

Uberflip is acquiring SnapApp, bringing together two startups that promise to help marketers use their content more effectively.

President and Chief Marketing Officer Randy Frisch argued that Uberflip focuses on content experience, not content marketing. In other words, it’s not selling productivity and workflow tools for marketers to write blog posts and create videos. Instead, it helps them present their existing content in a smarter and more personalized way.

For example, it worked with data warehousing company Snowflake to create content streams highlighting the topics most likely to grab the attention of different sales prospects, then embedded those content streams in Snowflake’s marketing emails.

“Content marketing has gotten a bad rap in some ways,” Frisch said, noting that there’s been “a lot of consolidation in that space in the last number of years,” so Uberflip has been working to distance itself from that term. (To that end, Frisch recently published a book with the colorful title “F#ck Content Marketing.”)

As for SnapApp, I wrote about the company’s interactive content tools back in 2015, but Uberflip CEO Yoav Schwartz told me that the product has changed dramatically in the last 18 months — it now offers “a better, smarter way to understand a visitor” by “peppering them with questions” as they’re browsing a marketer’s website.

So Schwartz sees this acquisition — Uberflip’s first — as a way to help the company improve its personalized content recommendations.

“We’re going to let SnapApp continue to run as is,” he added. “We’re not going to attempt to integrate on day one. We’re going to allow time to understand how those two technologies can work together.”

Frisch and Schwartz said that 10 to 15 SnapApp team members will be joining Uberflip, bringing the total headcount to around 150. And SnapApp’s current headquarters will become the Boston office of Toronto-based Uberflip.

The financial terms of the acquisition were not disclosed. SnapApp previously raised $22 million in funding, while Uberflip has raised $36 million.

Powered by WPeMatico

Salv, an anti-money laundering (AML) startup founded by former TransferWise and Skype employees, has raised $2 million in seed funding.

The round is led by Fly Ventures, alongside Passion Capital and Seedcamp. Angel investors also participating include N26 founder Maximilian Tayenthal (who seems to be doing quite a bit of angel investing), former Twilio CTO Ott Kaukver, and Taavi Kotka, former CIO for Estonia (the actual country!).

Founded in June 2018 and initially offering consultancy, Estonia-based Salv has built a software platform that helps banks find and stop financial crime. The idea, says co-founder and CEO Taavi Tamkivi, is to move AML beyond just compliance to something more proactive that actually does defeat crime. That’s quite the promise, although he and his co-founders have a lot experience to draw from, both within fast-growing startups and AML.

Tamkivi built the AML, fraud, and Know Your Customer (KYC) teams at TransferWise and Skype. COO Jeff McClelland also worked in the anti-fraud team at Skype, followed by a stint at TransferWise, first as an analyst and then in HR. And CTO Sergei Rumjantsev was also formerly at TransferWise, leading the engineering team responsible for KYC and verification.

“This was a highly demanding role, especially given how fast TransferWise was growing, how many new markets were coming online, and how central user verification is for compliance,” Tamkivi tells me. “Under Sergei’s leadership, the team made the verification process incredibly smooth over time for genuine customers. But also robust enough to protect TransferWise from on-boarding bad actors”.

Bad actors within financial services are aplenty, of course. Yet, despite the European banking sector spending billions tackling the problem, it is estimated that only 1-2% of global money-laundering is detected.

“AML should be all about stopping money laundering but, particularly in the last decade, layer upon layer of regulations have been added for banks to comply with,” says Tamkivi. “This would be great if that meant that there was no more money laundering, but sadly, that’s a long way off. Today, between $1-2 trillion a year is still laundered. But the excessive regulations mean that nearly all of a bank’s compliance team’s effort goes into compliance. They have very little energy left to actually focus on improving their financial crime-fighting abilities. The software they’re using is similar, focused almost wholly on compliance, not crime-fighting”.

That is where Salv wants to step in, and Tamkivi says the main difference between the startup’s AML software and other existing solutions is a much greater emphasis on crime-fighting rather than a box-ticking compliance exercise.

“We’re aiming to create a transformation similar to what’s happened in virus scanning,” he says. “10-15 years ago virus scanners on everyone’s PCs were an enormous hassle, consumed tons of resources and stopped you from getting work done. The same is true in financial institutions today. They’re using outdated, heavy software and processes to handle AML. But today, virus scanning still happens, but nobody’s worried about it. It happens in the background, with few resources. We’ll do the same in the AML world”.

In addition, the Salv CEO claims that the company’s software is faster than competitors’ offerings, both in terms of set up time and integration, and making changes to the rules the system adheres to.

“Our system, by contrast, takes a month or less to set up and minutes to modify the rules,” he says. “As a result, our customers can take everything they learn today from new criminal patterns, encode it in automated rules tomorrow, and repeat that cycle every day to protect their bank. Moving fast is the only way to keep up with the innovative organised criminals moving millions or billions around the world”.

To that end, Salv already counts Estonian bank LHV as its first customer. “They offer a full suite of banking products across Estonia,” says Tamkivi. “They’re also active in London, in particular, supporting fintechs. We have another couple of customers in the Lithuanian fintech scene. One of those is DeVere e-Money”.

More generally, Salv’s product is said to be suitable for Tier 2 and Tier 3 banks, as well as regulated fintechs and challenger banks.

Meanwhile, the business model is straightforward enough. Salv charges a monthly subscription, while the price varies based on the number of active customers a bank or fintech has.

Powered by WPeMatico

Xometry, the U.S.-based marketplace for on-demand manufacturing that raised $55 million in Series D funding this summer, has acquired Munich-based Shift as a path to European expansion.

Exact terms of the deal remain undisclosed, although the exit sees at least some of Shift’s investors, such as Cherry Ventures, picking up shares in Xometry . I also understand the Shift team is staying on and the company’s founders — Albert Belousov, Dmitry Kafidov and Alexander Belskiy — will now be heading up Xometry’s newly formed European business.

Specifically, via this acquisition, Xometry says it will accelerate international expansion into 12 new countries, leveraging a now worldwide network of over 4,000 manufacturers. The company’s on-demand manufacturing marketplace is already used by global companies like BMW and Bosch, which are Europe-based, and so it makes sense to have much stronger operations in the continent.

“We’re eager to leverage Xometry’s technology to continue to scale our business in Europe,” says Shift’s Kafidov in a statement. “We look forward to providing our customers additional manufacturing capabilities, including additive manufacturing and injection molding.”

Shift claims to have built the largest on-demand manufacturing network in Europe and a customer base that includes some of the leading manufacturing companies in the region. Now operating as Xometry Europe, the subsidiary will continue to be headquartered in Munich, Germany, an area known for its manufacturing heritage.

Cue statement from Christian Meermann, founding partner, Cherry Ventures: “The custom manufacturing industry is a massive global market of over $100 billion. We’re excited for Shift to utilize Xometry’s industry-leading technology as well as leverage the global manufacturing expertise from other Xometry investors, including BMW i Ventures and Robert Bosch Venture Capital.”

Xometry has raised $118 million since being founded in 2013. Over the past two years, the company has grown from 100 employees to over 300 while more than doubling revenue each year. Via its partner manufacturing facilities, the company offers CNC machining, 3D printing, sheet metal fabrication, injection molding and urethane casting.

Contrast that with Shift, which was founded in 2018 and had raised around €4 million (~$4.4 million) to date. Sources also tell me the startup had nearly closed a Series A round before Xometry preempted the investment by making an acquisition offer.

Powered by WPeMatico

Cuvva, the app-based insurance provider that began life offering pay-as-you-go driving cover but has since expanded to also sell travel insurance, has raised £15 million in Series A funding.

Backing comes from RTP Global, Breega and Digital Horizon, joining existing investors LocalGlobe, Techstars Ventures, Tekton and Seedcamp. A number of angels also joined the round, including Dominic Burke, the CEO of Jardine Lloyd Thompson, and Faisal Galaria, the former chief strategy and investments officer of GoCompare.

Launched in 2016 when founder Freddy Macnamara (pictured) become frustrated he couldn’t let others drive his car intermittently because of lack of insurance cover, Cuvva was an early pioneer of pay-as-you-go car insurance.

The idea, which was easier explained than done, was to make it possible to insure a car only when it was being driven, and therefore be cheaper for low-mileage drivers, and, via an app and access to the DVLA database, make it easier to on-board new drivers for pay-as-you-drive cover.

The insurtech still offers hourly car insurance, but its product line has since been expanded to daily covery, as well as a product specifically aimed at learner drivers. In addition, Cuvva entered the travel insurance space, no doubt spotting overlap with its presumably younger, millennial demographic.

To that end, Cuvva says it will use the new capital to launch a new pay-monthly motor product in early 2020 that it says could cut average annual bills for car owners “significantly.” It will do this by cutting out various middle people, including brokers and comparison websites, which it says charge insurers about £70 on each policy sold.

“Unlike legacy insurers, Cuvva will not charge a fee to spread payments over the year and it will not penalise loyal customers with dual pricing,” says the startup. Cuvva also says it will offer the same savings, whether you are signing up as a new customer or are a returning customer, and won’t charge admin fees to alter personal details registered with your policy.

Cue canned statement from Macnamara: “I started Cuvva when I couldn’t find flexible insurance to help me share my car. Four years on from launch we are still discovering how big the problem we are solving really is. We’re now selling 3% of all UK motor insurance policies but we’ve got so much further to go. Cuvva is going to be the place where you buy all your insurance, all through our mobile app.”

Powered by WPeMatico

Uncapped, a London-headquartered and Warsaw-based startup that wants to provide “revenue-based” finance to growing European businesses, is officially launching today and disclosing that it has raised £10 million in funding.

The capital is a mixture of equity funding and debt (money it can use for lending), and sees the fintech company backed by Rocket Internet’s Global Founders Capital, White Star Capital and Seedcamp.

I understand a number of angel investors also participated. They include Robert Dighero (partner at Passion Capital), Carlos Gonzalez-Cadenas (COO of GoCardless) and David Nolan and Kevin Glynn (founders of Butternut Box).

Founded by “serial entrepreneur” Asher Ismail (who was most recently CEO of Midrive) and former VC Piotr Pisarz, Uncapped has set out to use various marketing, sales and accounting data to be able to offer finance for young businesses based on their current (and projected) revenue.

Specifically, Uncapped says it will enable founders to access working capital between £10,000 and £1 million for a flat fee of 6%. It’s being pitched as a smart alternative for growing companies that don’t want to give away equity in return for capital to help grow.

“The first decision that entrepreneurs need to make when raising finance is whether to give away a portion of equity in their company or take on debt,” explains Ismail. “Equity is a slow and very expensive way to fund growth, while loans add more risk. We’re creating an alternative that sits between debt and equity financing, while offering the benefits of both. We started Uncapped so that entrepreneurs wouldn’t have to give up a piece of their company or put up their house.”

Ismail says that Uncapped provides entrepreneurs with access to capital without the need for “personal guarantees, credit checks, warrants or equity,” and promises to move a lot quicker than investors, or for that matter, more traditional forms of debt finance, can.

“We don’t require customers to share any business plans, cap tables or pitch decks,” he adds. “All we need is to verify their business performance. We connect to the business’ existing sales and marketing platforms, like Stripe, Shopify and Facebook. Revenue-based finance also gives founders the flexibility to repay less when their sales slow or the market hits a downturn.”

The only stipulation is that businesses must be based on online payments and have at least nine months trading history. This makes Uncapped particularly suitable for companies operating e-commerce, SaaS, direct-to-consumer, gaming and app development businesses.

“For example, our first customer was online menswear brand, L’Estrange,” Pisarz tells me. “For e-commerce businesses, December is typically the most challenging time to invest in growth, as inventory and marketing costs are at a peak but Christmas sales have not yet come through. We were able to provide the business with an advance within three days.”

Meanwhile, Ismail claims that Uncapped is the first company of its kind to launch in Europe (which is somewhat of a stretch) and that venture capital — although very different — is probably the closest alternative form of financing.

“Despite the $35 billion invested in Europe by VCs this year, many companies do not fit the venture model,” he says. “They might be a family business that doesn’t intend to sell, an entrepreneur focused on more of a niche market or minority who may be overlooked by traditional funders. Whilst VCs will often meet 1,500 companies and back just five of them a year, we have the ability to provide hundreds of businesses with growth capital for a flat fee much faster and without sacrificing equity at an early stage.”

Powered by WPeMatico

French startup Foodvisor has raised a $4.5 million funding round after generating 2 million app downloads. Agrinnovation is leading the round and various business angels are also participating.

I covered Foodvisor last month, so I’m not going to describe the app once again. In a few words, the startup uses deep learning to enable image recognition to detect what you’re about to eat. It can detect the type of food and it also tries to estimate the weight of each item.

Foodvisor calculates the distance between your plate and your phone using autofocus data from the camera. It then calculates the area of each item in your plate. You can manually correct information before you log it.

With today’s funding round, the startup plans to improve the app and hire 15 more persons. The app recently launched in the U.S. and the company thinks it represents a good market opportunity.

Powered by WPeMatico

The Valley’s affinity for robotics shows no signs of cooling. Technical enhancements through innovations like AI/ML, compute power and big data utilization continue to drive new performance milestones, efficiencies and use cases.

Despite the old saying, “hardware is hard,” investment in the robotics space continues to expand. Money is pouring in across robotics’ billion-dollar sub verticals, including industrial and labor automation, drone delivery, machine vision and a wide range of others.

According to data from Pitchbook and Crunchbase, 2018 saw new highs for the number of venture deals and total invested capital in the space, with roughly $5 billion in investment coming from nearly 400 deals. With robotics well on its way to again set new investment peaks in 2019, we asked 13 leading VCs who work at firms spanning early to growth stages to share what’s exciting them most and where they see opportunity in the sector:

Participants discuss the compelling business models for robotics startups (such as “Robots as a Service”), current valuations, growth tactics and key robotics KPIs, while also diving into key trends in industrial automation, human replacement, transportation, climate change, and the evolving regulatory environment.

Which trends are you most excited in robotics from an investing perspective?

The opportunity to unlock human superpowers:

- Increase productivity to enhance creativity leading to new products and businesses.

- Automating dangerous tasks and eliminating undesirable, dangerous jobs in mining, manufacturing, and shipping/logistics.

- Making the most deadly mode of transport: driving, 100% safe.

How much time are you spending on robotics right now? Is the market under-heated, overheated, or just right?

- Three-quarters of the new opportunities I look at involve some sort of automation.

- The market for robot startups attempting direct human labor replacement, floor-sweeping, and dumb-waiter robots, and robotic lawnmowers and vacuums is OVER heated (too many startups).

- The market for robot startups that assist human workers, increase human productivity, and automate undesirable human tasks is UNDER heated (not enough startups).

Are there startups that you wish you would see in the industry but don’t? Plus any other thoughts you want to share with TechCrunch readers.

I want to see more founders that are building robotics startups that:

- Solve LATENT pain points in specific, well-understood industries (vs. building a cool robot that can do cool things).

- Focus on increasing HUMAN productivity (vs. trying to replace humans).

- Are solving for building interesting BUSINESSES (vs. emphasizing cool robots).

Three years ago, the most compelling companies to us in the industrial space were in software. We now spend significantly more time in verticalized AI and hardware. Robotic companies we find most exciting today are addressing key driver areas of (1) high labor turnover and shortage and (2) new research around generalization on the software side. For many years, we have seen some pretty impressive science projects out of labs, but once you take these into the real world, they fail. In these changing environmental conditions, it’s crucial that robots work effectively in-the-wild at speeds and economics that make sense. This is an extremely difficult combination of problems, and we’re now finally seeing it happen. A few verticals we believe will experience a significant overhaul in the next 5 years include logistics, waste, micro-fulfillment, and construction.

With this shift in robotic capability, we’re also seeing a shift in customer sentiment. Companies who are used to buying outright machines are now more willing to explore RaaS (Robot as a Service) models for compelling robotic solutions – and that repeat revenue model has opened the door for some formerly enterprise software-only investors. On the other hand, companies exploring robotics in place of tasks with high labor shortages, such as trucking or agriculture, are more willing to explore per hour or per unit pick models.

Adoption won’t be overnight, but in the medium term, we are very enthusiastic about the ways robotics will transform industries. We do believe investing in this space requires the right technical know-how and network to evaluate and support companies, so momentum investors looking to dip their hand into a hot space may be disappointed.

We’re entering the early stages of the golden age of robotics. Robotics is already a huge, multibillion-dollar market – but today that market is dominated by industrial robotics, such as welding and assembly robots found on automotive assembly lines around the world. These robots repeat basic tasks, over and over, and are usually separated by caged walls from humans for safety. However, this is rapidly changing. Advances in perception, driven by deep learning, machine vision and inexpensive, high-performance cameras allow robots to safely navigate the real world, escape the manufacturing cages, and closely interact with humans.

I think the biggest opportunities in robotics are those which attack enormous markets where it’s difficult to hire and retain labor. One great example is long-haul trucking. Highway driving represents one of the easiest problems for autonomous vehicles, since the lanes tend to be well-marked, the roads have gentle curves, and all traffic runs in the same direction. In the United States alone, long haul trucking is a multi-hundred billion dollar market every year. The customer set is remarkably scalable with standard trailer sizes and requirements for shipping freight. Yet at the same time, trucking companies have trouble hiring and retaining drivers. It’s the perfect recipe for robotic opportunity.

I’m intrigued by agricultural robots. I’ve seen dozens of companies attacking every part of the farming equation – from field clearing and preparation, to seeding, to weeding, applying fertilizer, and eventually harvesting. I think there’s a lot of value to be “harvested” here by robots, especially since seasonal field labor is becoming harder to find and increasingly expensive. One enormous challenge in this market, however, is that growing seasons mean that the robotic machinery has a lot of downtime and the cost of equipment isn’t as easily amortized in other markets with higher utilization. The other big challenge is that fields are very, very tough on hardware and electronics due to environmental conditions like rain, dust and mud.

There are a ton of important problems to be solved in robotics. The biggest open challenges in my mind are locomotion and grasping. Specifically, I think that for in-building applications, robots need to be able to do all the thing which humans can do – specifically opening and closing doors, climbing stairs, and picking items off of shelves and putting them down gently. Plenty of startups have tackled subsets of these problems, but to date no one has built a generalized solution. To be fair, to get to parity with humans on generalized locomotion and grasping, it’s probably going to take another several decades.

Overall, I feel like the funding environment for robotics is about right, with a handful of overfunded areas (like autonomous passenger vehicles). I think that the most overlooked near-term opportunity in robotics is teleoperation. Specifically, pairing fully automated robotic operations with occasional human remote operation of individual robots. Starship Technologies is a perfect example of this. Starship is actively deploying local delivery robots around the world today. Their first major deployment is at George Mason University in Virginia. They have nearly 50 active robots delivering food around the campus. They’re autonomous most of the time, but when they encounter a problem or obstacle they can’t solve, a human operator in a teleoperation center manually controls the robot remotely. At the same time. Starship tracks and prioritizes these problems for engineers to solve, and slowly incrementally reduces the number of problems the robots can’t solve on their own. I think people view robotics as a “zero or one” solution when in fact there’s a world where humans and robots work together for a long time.

Powered by WPeMatico

The New York Stock Exchange filed paperwork this morning with the U.S. Securities and Exchange Commission to allow companies to raise capital as part of a direct listing.

Direct listings are a way for companies to go public by selling existing shares held by insiders, employees and investors directly to the market, rather than the traditional method of issuing new shares. Direct listings have become increasingly popular since Spotify’s 2018 exit, which allowed its employees immediate liquidity, removed preferred access from bankers and allowed for market-driven price discovery. Companies, like Spotify, that opt to complete a direct listing are able to bypass the financial roadshow, thus avoiding some of Wall Street’s exorbitant fees. Historically, however, these companies have not been able to raise fresh capital as part of the process.

The NYSE’s new proposal seeks to change that. Specifically, the stock exchange plans to amend Chapter One of the Listed Company Manual, which outlines the NYSE’s initial listing requirements for companies completing initial public offerings or direct listings. If the amendment is approved—the NYSE is subject to the regulatory oversight of the SEC—companies going public on the NYSE will be permitted to raise capital through a direct listing.

The document states the proposed change “would allow a company that has not previously had its common equity securities registered under the Act, to list its common equity securities on the Exchange at the time of effectiveness of a registration statement pursuant to which the company will sell shares in the opening auction on the first day of trading on the Exchange (a “Primary Direct Floor Listing”). The proposal would permit a company to conduct a Primary Direct Floor Listing in addition to, or instead of, a Selling Shareholder Direct Floor Listing.”

The proposed hybrid model is likely to appeal to Silicon Valley tech startups, who’ve grown more familiar with the innovate route to the public markets following Spotify and Slack’s direct listings. On the backs of these exits, tech industry leaders have touted direct listings as the latest and greatest path to the public markets. Venture capitalist Bill Gurley, in particular, has encouraged companies to consider the method. Meanwhile Silicon Valley darling Airbnb, which has stated its intent to go public in 2020, is said to be considering a direct listing rather than a traditional IPO.

Gurley, who has expressed his discontent with bankers’ inability to adequately price IPOs, recently hosted a one-day conference focused on direct listings titled Direct Listings: A Simpler and Superior Alternative to the IPO. The event was attended by members of tech’s elite, including Sequoia Capital’s Mike Moritz and Spotify chief financial officer Barry McCarthy .

“Most people are afraid of backlash from the banks so they don’t speak out,” Gurley told CNBC earlier this year of his decision to publicly advocate for direct listings. “I’m at a point in my career where I can handle the heat.”

Powered by WPeMatico