Fundings & Exits

Auto Added by WPeMatico

Auto Added by WPeMatico

Looks like there’s still money to be made in news aggregation — at least according to the investors backing the news app SmartNews.

The company is announcing the close of a $92 million round of funding at a valuation of $1.2 billion. The funding was led by Japan Post Capital Co. and ACA Investments, with participation from Globis Capital Partners Co., Dentsu and D.A. Consortium.

This includes the $28 million that SmartNews announced in August, and it brings the startup’s total funding to $182 million.

News aggregation apps seemed to everywhere a few years ago, and while they haven’t exactly disappeared, they didn’t turn into unicorns, with many of them acquired or shut down.

However, Vice President of U.S. Marketing Fabien-Pierre Nicolas told me that SmartNews has a few unique advantages. For one thing, it uses machine learning rather than human curation to “thoughtfully generate a news discovery experience” that’s personalized to each user.

Secondly, he said that many news aggregators treat the publishers creating the content that they rely on “like a commodity,” whereas SmartNews treats them as “true partners.” For example, it’s working with select publishers like Business Insider, Bloomberg, BuzzFeed and Reuters on a program called SmartView First, where articles are presented in a custom format that gives publishers more revenue opportunities and better analytics.

Lastly, he said SmartNews has focused on only two key markets — Japan (where the company started) and the United States. And it sounds like one of the main goals with the new funding is to continue growing in the United States.

Nicolas also suggested that there are some broader trends that SmartNews is taking advantage of, like the fact that the shift to mobile news consumption is still underway, particularly for older readers.

And then there’s “the loss of trust in some news sources — political news, especially,” which makes SmartNews’ curated approach seem more valuable. (It also recently launched a News From All Sides feature to show coverage from different political perspectives.)

As for monetization, he said SmartNews remains focused on advertising.

Yes, there’s a growing interest in subscriptions and paywalls, which is also reflected in subscription news aggregators like Apple’s News+, but Nicolas said, “Eighty-five to ninety percent of Americans are not subscribing to news media. We believe those 85 to 90 percent have a right to have quality information as well.”

Update: Also worth noting is that SensorTower says SmartNews has been downloaded 45 million times since the beginning of 2014, with 11 million of those downloads in 2019.

Powered by WPeMatico

Silicon is apparently the new gold these days, or so VCs hope.

What was once a no-go zone for venture investors, who feared the long development lead times and high technical risk required for new entrants in the semiconductor field, has now turned into one of the hottest investment areas for enterprise and data VCs. Startups like Graphcore have reached unicorn status (after its $200 million series D a year ago) while Groq closed $52M from the likes of Chamath Palihapitiya of Social Capital fame and Cerebras raised $112 million in investment from Benchmark and others while announcing that it had produced the first trillion transistor chip (and who I profiled a bit this summer).

Today, we have another entrant with another great technical team at the helm, this time with a Santa Clara, CA-based startup called NUVIA. The company announced this morning that it has raised a $53 million series A venture round co-led by Capricorn Investment Group, Dell Technologies Capital (DTC), Mayfield, and WRVI Capital, with participation from Nepenthe LLC.

Despite only getting started earlier this year, the company currently has roughly 60 employees, 30 more at various stages of accepted offers, and the company may even crack 100 employees before the end of the year.

What’s happening here is a combination of trends in the compute industry. There has been an explosion in data and by extension, the data centers required to store all of that information, just as we have exponentially expanded our appetite for complex machine learning algorithms to crunch through all of those bits. Unfortunately, the growth in computation power is not keeping pace with our demands as Moore’s Law slows. Companies like Intel are hitting the limits of physics and our current know-how to continue to improve computational densities, opening the ground for new entrants and new approaches to the field.

There are two halves to the NUVIA story. First is the story of the company’s founders, which include John Bruno, Manu Gulati, and Gerard Williams III, who will be CEO. The three overlapped for a number of years at Apple, where they brought their diverse chip skillsets together to lead a variety of initiatives including Apple’s A-series of chips that power the iPhone and iPad. According to a press statement from the company, the founders have worked on a combined 20 chips across their careers and have received more than 100 patents for their work in silicon.

Gulati joined Apple in 2009 as a micro architect (or SoC architect) after a career at Broadcom, and a few months later, Williams joined the team as well. Gulati explained to me in an interview that, “So my job was kind of putting the chip together; his job was delivering the most important piece of IT that went into it, which is the CPU.” A few years later in around 2012, Bruno was poached from AMD and brought to Apple as well.

Gulati said that when Bruno joined, it was expected he would be a “silicon person” but his role quickly broadened to think more strategically about what the chipset of the iPhone and iPad should deliver to end users. “He really got into this realm of system-level stuff and competitive analysis and how do we stack up against other people and what’s happening in the industry,” he said. “So three very different technical backgrounds, but all three of us are very, very hands-on and, you know, just engineers at heart.”

Gulati would take an opportunity at Google in 2017 aimed broadly around the company’s mobile hardware, and he eventually pulled over Bruno from Apple to join him. The two eventually left Google earlier this year in a report first covered by The Information in May. For his part, Williams stayed at Apple for nearly a decade before leaving earlier this year in March.

The company is being stealthy about exactly what it is working on, which is typical in the silicon space because it can take years to design, manufacture, and get a product into market. That said, what’s interesting is that while the troika of founders all have a background in mobile chipsets, they are indeed focused on the data center broadly conceived (i.e. cloud computing), and specifically reading between the lines, to finding more energy-efficient ways that can combat the rising climate cost of machine learning workflows and computation-intensive processing.

Gulati told me that “for us, energy efficiency is kind of built into the way we think.”

The company’s CMO did tell me that the startup is building “a custom clean sheet designed from the ground up” and isn’t encumbered by legacy designs. In other words, the company is building its own custom core, but leaving its options open on whether it builds on top of ARM’s architecture (which is its intention today) or other architectures in the future.

Outside of the founders, the other half of this NUVIA story is the collective of investors sitting around the table, all of whom not only have deep technical backgrounds, but also deep pockets who can handle the technical risk that comes with new silicon startups.

Capricorn specifically invested out of what it calls its Technology Impact Fund, which focuses on funding startups that use technology to make a positive impact on the world. Its portfolio according to a statement includes Tesla, Planet Labs, and Helion Energy.

Meanwhile, DTC is the venture wing of Dell Technologies and its associated companies, and brings a deep background in enterprise and data centers, particularly from the group’s server business like Dell EMC. Scott Darling, who leads DTC, is joining NUVIA’s board, although the company is not disclosing the board composition at this time. Navin Chaddha, an electrical engineer by training who leads Mayfield, has invested in companies like HashiCorp, Akamai, and SolarCity. Finally, WRVI has a long background in enterprise and semiconductor companies.

I chatted a bit with Darling of DTC about what he saw in this particular team and their vision for the data center. In addition to liking each founder individually, Darling felt the team as a whole was just very strong. “What’s most impressive is that if you look at them collectively, they have a skillset and breadth that’s also stunning,” he said.

He confirmed that the company is broadly working on data center products, but said the company is going to lie low on its specific strategy during product development. “No point in being specific, it just engenders immune reactions from other players so we’re just going to be a little quiet for a while,” he said.

He apologized for “sounding incredibly cryptic” but said that the investment thesis from his perspective for the product was that “the data center market is going to be receptive to technology evolutions that have occurred in places outside of the data center that’s going to allow us to deliver great products to the data center.”

Interpolating that statement a bit with the mobile chip backgrounds of the founders at Google and Apple, it seems evident that the extreme energy-to-performance constraints of mobile might find some use in the data center, particularly given the heightened concerns about power consumption and climate change among data center owners.

DTC has been a frequent investor in next-generation silicon, including joining the series A investment of Graphcore back in 2016. I asked Darling whether the firm was investing aggressively in the space or sort of taking a wait-and-see attitude, and he explained that the firm tries to keep a consistent volume of investments at the silicon level. “My philosophy on that is, it’s kind of an inverted pyramid. No, I’m not gonna do a ton of silicon plays. If you look at it, I’ve got five or six. I think of them as the foundations on which a bunch of other stuff gets built on top,” he explained. He noted that each investment in the space is “expensive” given the work required to design and field a product, and so these investments have to be carefully made with the intention of supporting the companies for the long haul.

That explanation was echoed by Gulati when I asked how he and his co-founders came to closing on this investor syndicate. Given the reputations of the three, they would have had easy access to any VC in the Valley. He said about the final investors:

They understood that putting something together like this is not going to be easy and it’s not for everybody … I think everybody understands that there’s an opportunity here. Actually capitalizing upon it and then building a team and executing on it is not something that just anybody could possibly take on. And similarly, it is not something that every investor could just possibly take on in my opinion. They themselves need to have a vision on their side and not just believe our story. And they need to strategically be willing to help and put in the money and be there for the long haul.

It may be a long haul, but Gulati noted that “on a day-to-day basis, it’s really awesome to have mostly friends you work with.” With perhaps 100 employees by the end of the year and tens of millions of dollars already in the bank, they have their war chest and their army ready to go. Now comes the fun (and hard) part as we learn how the chips fall.

Update: Changed the text to reflect that NUVIA is intending to build on top of ARM’s architecture, but isn’t a licensed ARM core.

Powered by WPeMatico

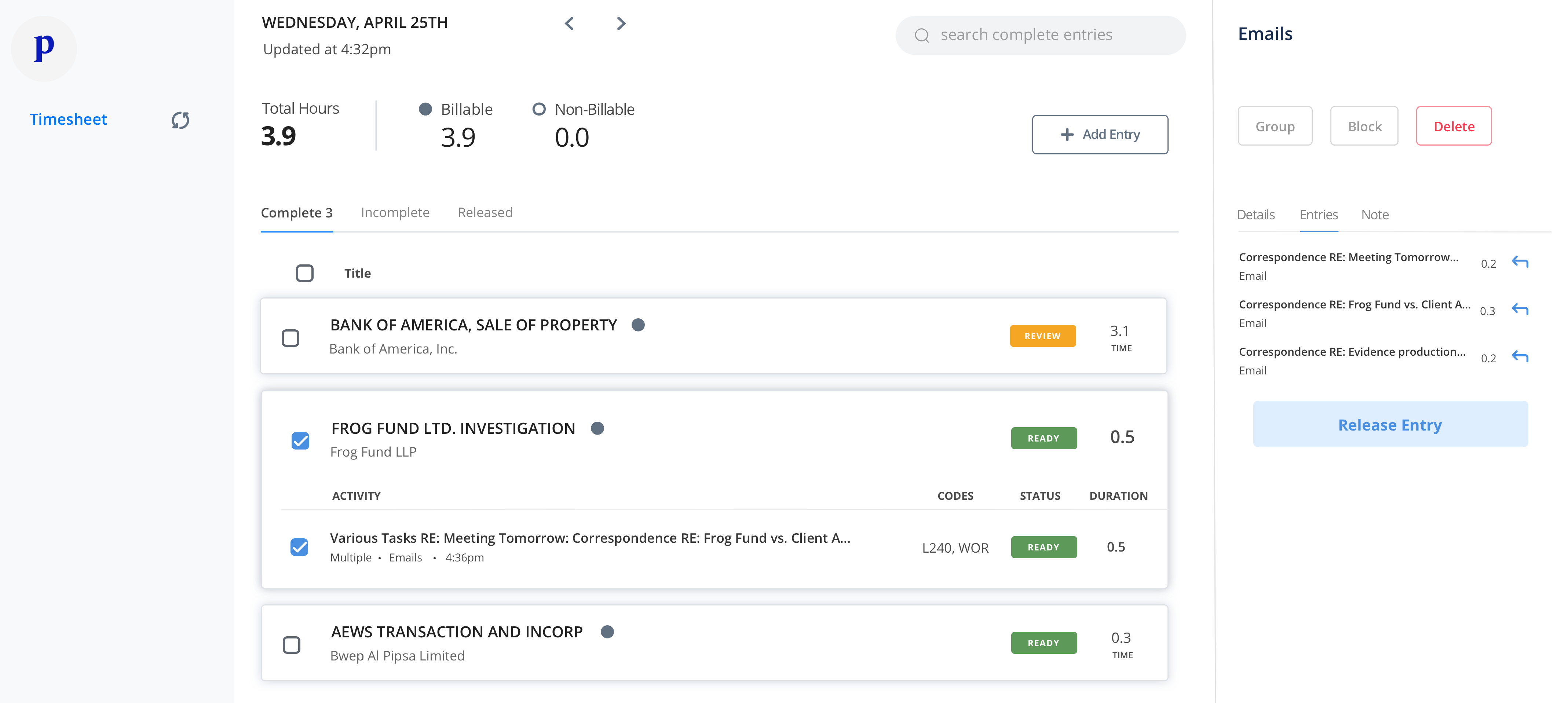

Counting billable time in six-minute increments is the most annoying part of being a lawyer. It’s a distracting waste. It leads law firms to conservatively under-bill. And it leaves lawyers stuck manually filling out timesheets after a long day when they want to go home to their families.

Life is already short, as Ping CEO and co-founder Ryan Alshak knows too well. The former lawyer spent years caring for his mother as she battled a brain tumor before her passing. “One minute laughing with her was worth a million doing anything else,” he tells me. “I became obsessed with the idea that we spend too much of our lives on things we have no need to do — especially at work.”

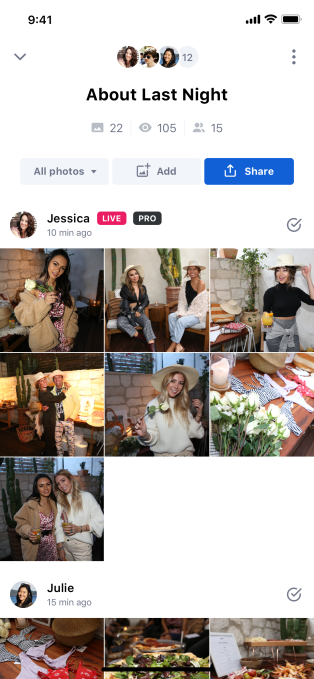

That’s motivated him as he’s built his startup Ping, which uses artificial intelligence to automatically track lawyers’ work and fill out timesheets for them. There’s a massive opportunity to eliminate a core cause of burnout, lift law firm revenue by around 10% and give them fresh insights into labor allocation.

Ping co-founder and CEO Ryan Alshak (Image Credit: Margot Duane)

That’s why today Ping is announcing a $13.2 million Series A led by Upfront Ventures, along with BoxGroup, First Round, Initialized and Ulu Ventures. Adding to Ping’s quiet $3.7 million seed led by First Round last year, the startup will spend the cash to scale up enterprise distribution and become the new timekeeping standard.

“I was a corporate litigator at Manatt Phelps down in LA and joke that I was voted the world’s worst timekeeper,” Alshak tells me. “I could either get better at doing something I dreaded or I could try and build technology that did it for me.”

The promise of eliminating the hassle could make any lawyer who hears about Ping an advocate for the firm buying the startup’s software, like how Dropbox grew as workers demanded easier file sharing. “I’ve experienced first-hand the grind of filling out timesheets,” writes Initialized partner and former attorney Alda Leu Dennis. “Ping takes away the drudgery of manual timekeeping and gives lawyers back all those precious hours.”

Traditionally, lawyers have to keep track of their time by themselves down to the tenth of an hour — reviewing documents for the Johnson case, preparing a motion to dismiss for the Lee case, a client phone call for the Sriram case. There are timesheets built into legal software suites like MyCase, legal billing software like TimeSolv and one-off tools like Time Miner and iTimeKeep. They typically offer timers that lawyers can manually start and stop on different devices, with some providing tracking of scheduled appointments, call and text logging, and integration with billing systems.

Ping goes a big step further. It uses AI and machine learning to figure out whether an activity is billable, for which client, a description of the activity and its codification beyond just how long it lasted. Instead of merely filling in the minutes, it completes all the logs automatically, with entries like “Writing up a deposition – Jenkins Case – 18 minutes.” Then it presents the timesheet to the user for review before they send it to billing.

The big challenge now for Alshak and the team he’s assembled is to grow up. They need to go from cat-in-sunglasses logo Ping to mature wordmark Ping. “We have to graduate from being a startup to being an enterprise software company,” the CEO tells me. That means learning to sell to C-suites and IT teams, rather than just build a solid product. In the relationship-driven world of law, that’s a very different skill set. Ping will have to convince clients it’s worth switching to not just for the time savings and revenue boost, but for deep data on how they could run a more efficient firm.

Along the way, Ping has to avoid any embarrassing data breaches or concerns about how its scanning technology could violate attorney-client privilege. If it can win this lucrative first business in legal, it could barge into the consulting and accounting verticals next to grow truly huge.

With eager customers, a massive market, a weak status quo and a driven founder, Ping just needs to avoid getting in over its heads with all its new cash. Spent well, the startup could leap ahead of the less tech-savvy competition.

Alshak seems determined to get it right. “We have an opportunity to build a company that gives people back their most valuable resource — time — to spend more time with their loved ones because they spent less time working,” he tells me. “My mom will live forever because she taught me the value of time. I am deeply motivated to build something that lasts . . . and do so in her name.”

Powered by WPeMatico

Frontier Car Group, the Berlin-based startup building used car marketplaces targeting high-growth, emerging markets, has picked up another significant round of funding from a strategic backer also focusing on the same geographical opportunity.

Today, OLX, the online classifieds division Prosus (the digital division of Naspers that listed earlier this year in Europe) announced that it would invest up to $400 million in Frontier, in a mix of equity, secondary share acquisitions and existing business shares. The deal will include a primary capital injection of an unspecified amount, which OLX has confirmed to me values Frontier Car Group at $700 million, post-money.

In terms of business shares: OLX also said that it will be contributing its shares in a JV it had in place with Frontier in India and Poland. Meanwhile, the secondary acquisitions — the shares are currently held by other investors, founders and management — are subject to a tender process. The markets that Frontier operates in now include Nigeria, Mexico, Chile, Pakistan, Indonesia and the USA (where it acquired WeBuyAnyCar last year), in addition to India and Poland.

Notably, even before the full $400 million amount is exercised (that is, after the tender process is completed), an OLX spokesperson confirmed that first capital injection will make it Frontier’s largest single shareholder (but not the majority shareholder), which essentially values the deal at less than $350 million (based on the $700 million valuation).

Today, Frontier Car Group offers buyers and sellers a range of services: in addition to basic inventory listings, there are inspection reports, financial, pricing guides, warranties and insurance. The plan will be to expand more services for one of the key players in the used-car space, dealers — via Frontier’s Dealer Management System — more resale services (via OLX) and more CarFax/Blue Book-style pricing guides and other products.

Frontier sold about $700 million worth of cars in the past year, triple its value of a year before.

As a point of reference, in May of last year, when the company raised $58 million, it had sold 50,000 cars to date and was on track for $200 million in annualised revenues. CEO and co-founder Sujay Tyle says the company has been on a growth tear.

“FCG has nearly tripled performance across every key metric since the first OLX Group investment less than 18 months ago and has expanded to four new countries in that time,” said Tyle in a statement. “This is a testament to FCG’s team, the ripe market opportunity, and the results of early integration with OLX in our key markets. Together with OLX and Prosus, we are aiming to revolutionize the used car market in several emerging and developed economies by adding trust, transparency and a comprehensive suite of services to all participants in the ecosystem.”

“Together with FCG, we are aiming to build the leading global used car marketplace, offering a premium and convenient service to millions of car buyers, sellers and dealers,” said Martin Scheepbouwer, CEO of OLX Group. “We’re in a unique position to accelerate the expansion of this platform worldwide. Our experience in India is a great proof of concept, where within the space of a year, our joint venture has already increased the number of stores threefold, with car purchase volumes continuing to grow by 10% month-on-month.”

This is the second time that OLX has invested in Frontier: In May 2018, Naspers invested $89 million in the business, an investment that came just weeks after Frontier had raised $58 million from Balderton, TPG and others.

The deal underscores the longtime trend of consolidation in e-commerce businesses — something Prosus is also seeing played out in a completely different arena, that of food delivery.

The basics of the economy-of-scale principle, as applied to used car sales, goes something like this: economies of scale makes a platform more useful (there will be more cars on it, and less on competitors’ sites); but it also potentially means that Frontier would be making more transactions, thereby more revenues overall; and building and running more sales on the same platform improves the margins on the investment that gets made in building and operating that platform.

Targeting P2P used car sales in emerging markets is a big potential business: In part because of the nature of those economies, car owners are more likely to sweat out assets rather than go for buying completely new vehicles. OLX notes that combining the operations in Frontier’s footprint with those of the JV businesses that it is now taking over, plus OLX’s own business in Latin America, Asia and Poland, results in a market where some 30 million used cars are sold annually, “more than double that of China.”

Powered by WPeMatico

Voi Technology, the “micro-mobility” startup that operates an e-scooter service in a 38 cities across 10 European countries, has raised an $85 million in Series B funding.

Backing the round is a mixture of existing and new investors. They include Balderton Capital, Creandum, Project A, JME Ventures, Raine Ventures, Kreos Capital, Inbox Capital, Rider Global, and Black Ice Capital. The new funding brings the total raised by Voi to $136 million.

Eagled-eyed readers will have noticed that, based on our previous Voi coverage, the total figure is $32 million short. That’s because not all of Voi’s previous Series A commitment was cashed in after the company was offered more favourable terms for its $30 million Series A extension and therefore elected not to draw down the second tranche of its original Series A.

Launched in 2018, the company is best-known for its e-scooter rentals but now pitches itself as a micro-mobility provider, offering a number of different transport devices. These include various e-scooter and e-bike models, in a bid to become a broader transport operator helping to re-shape urban transport and wean people off using cars.

To date, Voi says it has 4 million registered users and has powered 14 million rides. More recently it has launched new, more robust hardware that has been designed to sustain the rigours of commercial e-bike sharing. The idea is that more suitable hardware will help e-scooter companies improve margins since more rides can be extracted from the life-span of each vehicle.

On that note, Voi says it will use the new funding to develop “strong profitable businesses” in the 38 cities where it is already operating, as well as increase its R&D spend to improve its technology platform and products. Earlier this year, the company announced that it is already profitable in the cities of Stockholm and Oslo.

“Clearly, we feel we are on track to achieve this in more of our cities and that is our aim,” Voi co-founder and CEO Fredrik Hjelm tells me. “At this point, a key focus for us is to ensure we continue to increase the lifetime of our e-scooters, forge key partnerships and continue to work in those cities which provide the best conditions for a profitable e-scooter business”.

Hjelm says that Voi’s version 2 scooters are projected to last over 18 months, which means the company should be in profit before it needs to raise again. However, he wouldn’t be drawn on when that might be.

With regards to R&D and improvements to the Voi platform, the company will continue to work on the lifetime of its e-scooters, in addition to improved repair management via integrating “predictive diagnostics”.

Hjelm also says Voi is developing “AI-powered” fleet management and more generally the platform’s capability to support future product portfolio expansion. In other words, we can expect new micro-mobility device categories in the future.

Powered by WPeMatico

Stock trading app Robinhood is valued at $7.6 billion, but it only operates in the U.S. Freshly funded fintech startup Alpaca does the dirty work so developers worldwide can launch their own competitors to that investing unicorn. Like the Stripe of stocks, Alpaca’s API handles the banking, security and regulatory complexity, allowing other startups to quickly build brokerage apps on top for free. It has already crossed $1 billion in transactions within a year of launch.

The potential to power the backend of a new generation of fintech apps has attracted a $6 million Series A round for Alpaca led by Spark Capital . Instead of charging developers, Alpaca earns its money through payment for order flow, interest on cash deposits and margin lending, much like Robinhood.

“I want to make sure that people even outside the U.S. have access” to a way of building wealth that’s historically only “available to rich people” Alpaca co-founder and CEO Yoshi Yokokawa tells me.

Alpaca co-founder and CEO Yoshi Yokokawa

Hailing from Japan, Yokokawa followed his friends into the investment banking industry, where he worked at Lehman Brothers until its collapse. After his grandmother got sick, he moved into day-trading for three years and realized “all the broker dealer business tools were pretty bad.” But when he heard of Robinhood in 2013 and saw it actually catering to users’ needs, he thought, “I need to be involved in this new transformation” of fintech.

Yokokawa ended up first building a business selling deep learning AI to banks and trading firms in the foreign exchange market. Watching clients struggle to quickly integrate new technology revealed the lack of available developer tools. By 2017, he was pivoting the business and applying for FINRA approval. Alpaca launched in late 2018, letting developers paste in code to let their users buy and sell securities.

Now international developers and small hedge funds are building atop the Alpaca API so they don’t have to reinvent the underlying infrastructure themselves right away. Alpaca works with clearing broker NTC, and then marks up margin trading while earning interest and payment for order flow. It also offers products like AlpacaForecast, with short-term predictions of stock prices, AlpacaRadar for detecting price swings and its MarketStore financial database server.

AlpacaForecast

The $6 million from Spark Capital, Social Leverage, Portag3, Fathom Capital and Zillionize adds to $5.8 million in previous funding from investors, including Y Combinator. The startup plans to spend the cash on hiring to handle partnerships with bigger businesses, supporting its developer community and ensuring compliance.

One major question is whether fintech businesses that start to grow atop Alpaca and drive its revenues will try to declare independence and later invest in their own technology stack. There’s the additional risk of a security breach that might scare away clients.

Alpaca’s top competitor, Interactive Brokers, offers trading APIs, but other services as well that distract it from fostering a robust developer community, Yokokawa tells me. Alpaca focuses on providing great documentation, open-source contribution and SDKs in different languages that make it more developer-friendly. It will also have to watch out for other fintech services startups like DriveWealth and well-funded Galileo.

There’s a big opportunity to capitalize on the race to integrate stock trading into other finance apps to drive stickiness because it’s a consistent, voluntary behavior rather than a chore or something only done a few times a year. Lender SoFi and point-of-sale system Square both recently became broker dealers as well, and Yokokawa predicts more and more apps will push into the space.

Why would we need so many stock trading apps? “Every single person is involved with money, so the market is huge. Instead of one-player takes all, there will be different players that can all do well,” Yokokawa tells me. “Like banks and investment banks co-exist, it will never be that Bank of America takes 80% of the pie. I think differentiation will be on customer acquisition, and operations management efficiency.”

The co-founder’s biggest concern is keeping up with all the new opportunities in financial services, from cash management and cryptocurrency that Robinhood already deals in, to security token offerings and fractional investing. Yokokawa says, “I need to make sure I’m on top of everything and that we’re executing with the right timing so we don’t lose.”

The CEO hopes that Alpaca will one day power broader access to the U.S. stock market back in Japan, noting that if a modern nation still lags behind in fintech, the rest of the world surely fares even worse. “I want to connect this asset class to as many people as possible on the earth.”

Powered by WPeMatico

Octopus Interactive, a startup bringing an interactive TV and ad experience into Uber and Lyft rides, has raised a $10.3 million funding round led by Sinclair Digital Group.

Backseat TVs mixing show snippets and commercials have become a common part of the taxi experience in New York City and elsewhere. Octopus is offering something of a more interactive version of this concept to rideshare drivers, who can use it to keep their passengers entertained and also earn extra money.

Octopus says it provides drivers with tablets that combine games (which can include cash prizes, and can also be sponsored), ride information (like maps and weather) and advertising in a 13-minute loop. Even if the passenger doesn’t win anything, this could help keep them occupied during a long ride, which could lead to higher driver ratings. And if the passenger isn’t interested, they can just mute the screen.

The company says it’s deploying technology to make the advertising smarter, for example with geofences to target ads or increase their frequency in a certain neighborhood, and by offering real-time analytics to advertisers. It also monitors the seat to confirm that there’s actually a passenger sitting there when an ad plays.

After launching in 2018, Octopus says it’s now reaching more than 3 million people each month across 10,000 screens in markets like New York, Los Angeles, Chicago and Washington, D.C. By working with Sinclair Digital Group — an affiliate of TV giant Sinclair — the startup can bring content from local TV stations onto the platform.

“What we see here is an untapped medium with a truly captive audience that is buckled in and looking to engage,” said Sinclair Executive Chairman David Smith in a statement. “We invested in Octopus because the team has successfully created an innovative and differentiated branding opportunity that we can help scale further.”

MathCapital, an investment firm partnered with programmatic advertising company MediaMath, also participated in the funding.

Powered by WPeMatico

Aircam is a new startup that allows anyone to get instant access to pictures taken by professional photographers at weddings, parties and other events.

The company was founded by brothers Evan and Ryan Rifkin, who previously co-founded Burstly, the company behind mobile app-testing service TestFlight (which was acquired by Apple).

In addition to officially launching Aircam today, they’re also announcing that the company has raised $6.5 million in seed funding led by Upfront Ventures, with participation from Comcast Ventures.

“The process of finding a great photographer still sucks and the tools photographers use to share photos are antiquated for an industry worth over $10 billion,” said Upfront Ventures Managing Partner Mark Suster in a statement. “Aircam provides real-time, location-aware and enhanced photos that today’s consumers expect with booking simplicity that will change the current playing field.”

The Rifkin brothers are pitching Aircam as “a real-time photo-sharing platform for professional and consumer photos.” To try out the technology, I visited the Aircam website and hit a button to see nearby photos. Then, as the Rifkins took photos with a DSLR camera, those photos appeared on the site nearly instantaneously. I, in turn, could send the photos to a printer in their office, or share photos from my phone.

Manufacturers already offer software to transfer photos wirelessly from their cameras to your computer. But with Aircam, the photos became accessible to everyone at an event, without requiring anyone except the photographer to install an app.

Ryan explained that the company is taking advantage of cameras’ Wi-Fi connections (it currently works with Canon, Nikon and Sony devices) to send the photos to an app on the photographer’s phone, which then uploads the photos to the cloud.

He also said the team initially believed that Aircam would become the repository for photos taken by everyone attending an event. But in early testing, they saw that “the opposite is happening — people are putting their phones away.”

In other words, once attendees realize that they have access to professional-quality photos, they can spend less time worrying about taking their own pictures with their phones and instead focus on being present at the event.

This should also make life easier for photographers, particularly since Aircam includes automated photo editing — the photos are color corrected (with nice touches like teeth whitening) without requiring any extra work from the photographer.

“If you ask photographers what’s their least favorite part of photography — one, it’s finding new business, and two, it’s the edits,” Ryan said. “Some people limit the number of events they’ll accept because of the editing work … With automatic edits, they shoot and they’re done.”

Evan Rifkin

As for finding new business, Evan said that the company tested this out by allowing photographers to offer Aircam as an additional option for their customers. (The company charges the photographers $50 per event.)

But once customers had seen Aircam in action, they wanted to order it again, so Aircam is also launching its own marketplace (currently focused on Southern California) where you can book professional photographers for $99 per hour, with the Aircam service included as part of the package.

Or, if you want to try it out without hiring a pro photographer, you’ll be able to upload photos from your iPhone for free.

The Rifkins told me they haven’t had any issues around privacy or content moderation so far, but they also noted that customers who are concerned about these issues can limit their guests’ upload capabilities. They also can create a custom URL for their event rather than making it discoverable to anyone nearby.

Powered by WPeMatico

The multi-asset investment platform eToro, which spans “social” stock trading to cryptocurrency, has acquired Delta, the crypto portfolio tracker app.

Terms of the deal remain undisclosed, although one source tells me the deal was worth $5 million. It is not clear if it is stock only or cash (or a mixture of both) and if it is contingent on any future targets being met.

The Delta app helps investors make better decisions regarding their crypto investments by providing tools such as portfolio tracking and pricing data. It very much fits with the evolution of eToro, which not only wants to “own” the commission-free stocks (and ETF) space, but has also ventured ambitiously into crypto — most recently bringing crypto asset trading to the U.S.

Delta’s crypto portfolio tracker app has support for more than 6,000 crypto assets from more than 180 exchanges. It provides investors with a range of tools to track and analyse their crypto portfolios. To date, Delta says it has seen 1.5 million downloads and has “hundreds of thousands” of active monthly users.

The acquisition sees Delta become part of the eToro Group, while the Delta team led by Nicolas Van Hoorde will become part of eToroX, reporting to Doron Rosenblum. “The team will continue to be based in Belgium, working in close collaboration with eToro and eToroX employees across the globe,” says eToro.

Meanwhile, eToro is talking up the fact that it is a regulated platform where you can hold crypto and traditional assets in the same portfolio. The idea with the Delta acquisition is to extend that so you’ll be able to track all your investments in once place, starting with crypto and eventually multi-asset. In addition, you’ll be able to trade from the app via eToroX, eToro’s own crypto exchange.

“At a time when other fintechs state that they are not even targeting profitability, we are proud to be a well funded, profitable business that is growing both in terms of geographical coverage but also product range,” says Yoni Assia, co-founder and CEO of eToro, in a statement.

“We are a trading and investing platform that not only provides clients with access to the assets they want, from commission free stocks and ETFs through to FX, commodities and cryptoassets, but also lets customers choose how they invest. They can trade directly, copy another trader or invest in a portfolio. We believe in empowering our clients and the acquisition of Delta will allow us to add an important new element to our offering.”

Powered by WPeMatico

Amperity announced today that it’s acquiring another company in the customer data business, Custora.

Amperity co-founder and CEO Kabir Shahani told me that Custora’s technology complements what Amperity is already offering. To illustrate this point, he said that customer data tools fall into three big buckets: “The first is know your customer, the second is … use insights to make decisions, the third is … activate the data and use it to serve the customer.”

Amperity’s strength, Shahani said, is in that first bucket, while Custora’s is in the second. So with this acquisition (Amperity’s first), the existing Amperity technology will become the Amperity Customer 360, while Custora is rebranded as Amperity Insights.

The products can still be used separately, but Custora CEO Corey Pierson argued that they’re particularly powerful together.

“The stronger you actually know your customer, the stronger you have your customer 360 profile, the better those insights are,” Pierson said. “When we sit on top of Amperity, every insight we produce is more valuable to our customers.”

Shahani said Pierson and the rest of his team will be joining Seattle-based Amperity, with Custora’s New York office becoming the combined company’s East Coast headquarters.

The financial terms of the acquisition were not disclosed. According to Crunchbase, Custora previously raised a total of $20.3 million in funding.

Powered by WPeMatico