Fundings & Exits

Auto Added by WPeMatico

Auto Added by WPeMatico

Oakland-based Mighty Buildings, which is on a quest to build homes using 3D printing, robotics and automation, has raised a $22 million extension to its Series B round of funding.

The additional capital builds upon a $40 million raise the company announced earlier this year, bringing its total funding since its 2017 inception to $100 million.

Mighty Building’s self-proclaimed mission is to create “beautiful, sustainable and affordable” homes.

The company claims to be able to 3D print structures “two times as quickly with 95% less labor hours and 10-times less waste” than conventional construction. For example, it says it can 3D print a 350-square-foot studio apartment in just 24 hours.

Execs say the new capital will go toward making supply chain improvements and moving up research and development timelines. The money will also go toward helping it achieve a new goal of achieving Net-Zero carbon neutrality by 2028 — which it says is 22 years ahead of the construction industry overall.

“As a founding team, we have long been passionate about solving productivity for construction in a sustainable way,” said co-founder and CEO Slava Solonitsyn. “We have spent four years figuring out what it takes to achieve that. We believe that we have a master plan now that can work.”

Since its launch, the company has produced and installed a number of accessory dwelling units (ADUs).

Sam Ruben, co-founder and chief sustainability officer of Mighty Buildings, said the new funds will also go toward kicking off development of the startup’s multistory offering. The multistory efforts will likely initially focus on two to three-story single family homes and townhouses with an eye toward expanding into low-rise apartment buildings. The company hopes to have at least a prototype multistory offering in late 2022 or early 2023, according to Ruben.

“Along with the sustainability improvements already captured by our new formula, this will allow us to develop our next-generation material to get us even closer to our goal of being carbon neutral by 2028,” Ruben said. “It will also give us opportunities to implement improvements in our existing design by reducing the impact of our foundations and other, nonprinted elements.”

Specifically, Mighty Buildings plans to speed up its carbon neutrality roadmap by building “high-throughput, sustainable” micro factories, forming strategic supply chain partnerships, accelerating “blue skies” technology research and developing new composite materials produced from recycled or bio-based feedstock.

The micro factories, according to the company, will be able to produce 200 to 300 homes per year in locations where housing gaps exist. Mighty Buildings plans to create single-family residential developments with its panelized “Mighty Kit System.”

Mighty Buildings has seen quarter over quarter growth in sales, Ruben said, with the company seeing a record of over $7 million in total contracted revenue in the second quarter.

The company is also excited about its new fiber-reinforced printing material, which is currently undergoing testing with certification expected to be completed later this year. Mighty Buildings claims that its new formula shows “over 50% improvement” in embodied carbon from its original material and a strength profile similar to reinforced concrete, with more than four times less weight.

The round extension was supported by a few new and existing investors including ArcTern Ventures, Core Innovation Capital, Decacorn Capital, Gaingels, Khosla Ventures, Klaff Realty, MicroVentures, Modern Venture Partners, Polyvalent Capital, Vibrato Capital and others.

Powered by WPeMatico

Cadoo, a US-startup that’s gamifying fitness by turning it into a betting opportunity, using the prospect of winning (or losing) cold hard cash to motivate people to get off the couch, has collected $1.5 million in seed funds from Sam & Max Altman’s Apollo VC and the student-focused Dorm Room Fund.

The app itself has been around since 2018 but in March 2020 it launched a “challenge model” that lets users stake money to join a challenge related to a specific fitness goal — be it running 10 miles in 10 days, or walking three miles in three days.

Participants who achieve the challenge goal get their stake back and a pro-rata share of losers’ staked entry fees.

A range of fitness levels are catered to by Cadoo’s challenges (“from daily steps to marathon training”), with some 50 public challenges hosted per week.

It’s also adding private challenges this month — which will enable users to host and configure fitness challenges for themselves/family and friends, or larger groups, such as companies, clubs, or schools.

Challenge-related activity is verified by the app via API data from activity trackers and fitness apps. (Which hopefully means Cadoo is smart enough to detect if someone has attached their Fitbit to their dog… )

The app has support for a number of third party fitness services, including Strava, Fitbit and Apple Health.

CEO and founder Colm Hayden describes the startup as “DraftKings for your own fitness goals”.

“Our audience consists of 25-50 year old fitness fanatics’ who use Cadoo to stay committed to their monthly/weekly fitness goals,” he told TechCrunch, adding: “When people are serious about a goal they are trying to reach, they want intense motivation to back their ambitions.”

He says the app has attracted around 7,000 wager-loving users so far.

Cadoo’s business model is based on taking a fee from challenge losers before their entry fee stakes are distributed to challenge winners — which does potentially give the business an incentive to set harder challenges than users are able to complete.

But of course it’s up to users to pick which challenges to enter and thereby commit their hard earned cash to.

It also claims that 90% of users who sign up for Cadoo challenges successfully complete them.

Hayden says it has future plans to expand monetization potential by offering winners fitness products — and taking a margin on those products. And also by expanding into other types of verifiable goals, not just running/walking.

“We are working to build a motivation platform that enables anybody to reach their goals,” he says. “Financial incentives is an intense motivator, and 90% of users who sign up for Cadoo challenges reach their fitness goals. We are making Cadoo much bigger than just running goals, and in the future incentivizing almost any goal verifiable on the internet.”

While the app is US-based payments are processed by PayPal and Hayden says it’s able to support participation internationally — at least everywhere where PayPal is available.

Commenting on the seed raise in a statement, Apollo VC’s Altman brothers added: “Cadoo makes it easy to motivate users to stay active with financial incentives. We believe the motivation industry that Cadoo is pioneering will be an important digital money use-case.”

Before the seed round, Cadoo says it had raised $350,000 via an angel round from Tim Parsa’s Cloud Money Ventures Angel Syndicate, Wintech Ventures, and Daniel Gross’s Pioneer.

Of course gamification of health is nothing new — given the data-fuelled quantification and goal-based motivation that’s been going on around fitness for years, fuelled by wearables that make it trivially easy to track steps, distances, calories burned etc.

But injecting money into the mix adds another competitive layer that may be helpful for motivating a certain type of person to get or stay fit.

Cadoo isn’t the only fitness-focused startup to be taking this tack, either, though — with a number of apps that pay users to lose weight or otherwise be active (albeit, sometimes less directly by paying them in digital currency that can be exchanged for ‘rewards’). Others in the space include the likes of HealthyWage (a TC50 company we covered all the way back in 2009!); Runtopia and StepBet, to name a few.

Powered by WPeMatico

ZoomInfo announced this morning it intends to acquire conversational sales intelligence tool Chorus.ai for $575 million. Shares of ZoomInfo are unchanged in premarket trading following the news, per Yahoo Finance data.

Sales intelligence, Chorus’s market, is a hot space that uses AI to “listen” to sales conversations to help improve interactions between salespeople and customers. ZoomInfo is mostly known for providing information about customers, so the acquisition expands the acquiring company’s platform in a significant way.

The company sees an opportunity to bring together different parts of the sales process in a single platform by “combining ZoomInfo’s historic top-of-the-funnel strength with insights driven from the middle of the funnel in the customer conversations that Chorus captures,” it said in a release.

“With Chorus, the entire organization can make better decisions by surfacing insights and analytics that you would only get if you sat in on every sales or customer success call,” ZoomInfo CEO and founder Henry Schuck said in a blog post announcing the deal.

Ahead of the transaction, ZoomInfo was valued at just under $21 billion.

Chorus looks for what it calls “smart themes” in sales calls, which help managers steer sales teams toward the types of conversation and tone that is likely to drive more revenue. In fact, Chorus holds the largest patent portfolio related to conversational intelligence, according to the company.

Chorus was founded in 2015 and raised more than $100 million along the way, according to PitchBook data. The most recent round was a $45 million Series C last year.

Crunchbase News reports that at the time of its Series C round of funding, Chorus had “doubled its headcount to more than 100 employees and tripled its revenue over the past year.” That’s the sort of growth that venture capitalists covet, making the company’s 2020 funding round a nonsurprise.

Notably PitchBook data indicates that the company’s final private valuation was around the $150 million mark; if accurate, it would imply that the company’s last private round was expensive in dilution terms, and that its investors did well in the exit, quickly more than trebling the capital that was last invested, with investors who put capital in earlier doing even better.

But we’re slightly skeptical of the company’s available valuation history given the growth that it claimed at the time of its Series C; it feels low. If that’s the case, the company’s exit multiple would decrease, making its final sale price slightly less impressive.

Of course, a half-billion-dollar exit is always material, even if venture capitalists in today’s red-hot, and expensive, market are more interested in $1 billion exits and larger.

Chorus.ai will likely not be the final exit in the conversational intelligence space. Its rival Gong (often known by its URL, Gong.io) is one of the hotter startups in this space, having raised over $500 million. Its most recent raise was $250 million on a $7.25 billion valuation last month.

The implication of the Chrous.ai exit and Gong’s enormous private valuation is that the application of AI to audio data in a sales environment is incredibly useful, given the number of customers the two companies’ aggregate valuation implies.

Powered by WPeMatico

Today we have new filings from Couchbase and Kaltura: Couchbase set an initial price range for its IPO, something we’ve been waiting for, and Kaltura’s offering is back from hiatus with a new price range and some fresh financial information to boot.

Both bits of news should help us get a handle on how the Q3 2021 IPO cycle is shaping up at the start.

TechCrunch has long expected the third quarter’s IPO haul to prove strong; investors said as 2020 closed that quarters one, three and four would prove very active in terms of public market exits this year. Then the second quarter surpassed expectations, with more companies going public than at least some market observers anticipated.

With that in mind, you can imagine why the newly launched Q3 could prove an active period.

So! Let’s start with a dig into the filing from NoSQL provider Couchbase, working to understand its first price range and what the numbers may say about market demand for technology debuts. Here’s our first look at the company’s value. Then we are taking the Kaltura saga back up, checking into the pricing and second-quarter results from the technology company that provides video-streaming software and services.

Frankly, I’ve been waiting for these filings to drop. So, let’s cut the chat and get into the numbers:

In its new S-1/A filing, Couchbase reports that it anticipates a $20 to $23 per share IPO price. With a maximum sale of just over 8 million shares, Couchbase could raise as much as $185.15 million in its public offering.

The company will have 40,072,801 shares outstanding after its IPO, not including 1,050,000 shares that are reserved for possible release. The math from here is simple. To calculate Couchbase’s possible simple IPO valuation we can just do a little multiplication:

If you want to include the company’s reserved shares, add $21 million to the first figure, and $24.2 million to the second. Notably, TechCrunch wrote before it priced that using a historical analog from the Red Hat-IBM sale — both Couchbase and Red Hat work in the OSS space — the company would be worth around $900 million. So, we were pretty close.

Powered by WPeMatico

French startup PowerZ has raised another $8.3 million (€7 million at today’s exchange rate) including $1.2 million (€1 million) in debt — the rest is a traditional equity round. The company is both an edtech startup and a video game studio with an ambitious goal — it wants to build a game that is as engaging as Minecraft or Fortnite, but with a focus on education.

In February, PowerZ launched the first version of its game on computers. It doesn’t have a lot of content, but the company wanted to start iterating as quickly as possible. Aimed at kids who are six years old and over, PowerZ teleports the player into a fantasy world with cute dragons and magic spells.

“The idea is really to build a sort of Harry Potter,” co-founder and CEO Emmanuel Freund told me. “You have this world that is super nice and very interesting. Like with Hogwarts, you want to come back regularly, and the story will progress over a very long time.”

15,000 children tried out the first chapter. On average, they spent four hours in the game. I asked whether Freund was satisfied with those metrics. He told me he thought his company’s vision was “completely validated.”

Bpifrance Digital Venture, RAISE Ventures and Bayard are investing in today’s round. Existing investors Educapital, Hachette Livres, Pierre Kosciusko-Morizet and Michaël Benabou are also investing once again.

Image Credits: PowerZ

Now, it’s time to add content, expand to other platforms and launch new languages. When it comes to content, the company wants to partner with other game studios. They’re going to create new islands and design games that make you learn new stuff. Zero Games, Opal Games and ArkRep are the first third-party studios to contribute to PowerZ.

When those new chapters are available, kids will be able to practice mental calculation, geometry, vocabulary, foreign languages, sign language, but also astronomy, photography, architecture, sculpture, cooking, wildlife, yoga, etc.

“Basically we want to position ourselves as a publisher,” Freund said. “The only thing we want to keep in-house is the main storyline.”

As for new platforms, PowerZ is launching its game on the iPad this week. The company realized that launching on computers was a mistake. Adults are already using computers or don’t want to leave your kid on the computer. That’s why PowerZ is starting with the iPad and the iPhone will follow suite. In 2022, the company expects to release its game on the Nintendo Switch and potentially other game consoles.

While the game is only available in French for now, the startup is also thinking about launching an English version soon.

“The game is completely free right now. We have an idea to monetize it. We’ll copy every other games with in-app purchases for visual items,” Freund said.

When you look further down the roadmap, PowerZ has some radically ambitious goals. Freund believes that educational games will become mainstream really quickly. Many companies don’t want to develop this kind of stuff because screens are bad for kids.

“If we just say that screens are bad, we’ll end up with an Amazon product to learn math. I feel a sense of urgency to develop an educational platform for screens that can scale,” Freund told me.

PowerZ wants to reach hundreds of thousands of children as quickly as possible. And just like Fortnite or Minecraft, the company believes its game can act as a platform for other stuff that can evolve over time.

Powered by WPeMatico

In the wake of Coinbase’s direct listing earlier this year, other crypto companies may be looking to go public sooner than later. That appears to be the case with Circle, a Boston-based technology company that provides API-delivered financial services and a stablecoin.

The Exchange explores startups, markets and money.

Read it every morning on Extra Crunch or get The Exchange newsletter every Saturday.

Circle will not direct list or pursue a traditional IPO. Instead, the company is combining with Concord Acquisition Corp., a SPAC, or blank-check company. The transaction values the crypto shop at an enterprise value of $4.5 billion and an equity value of around $5.4 billion.

The offering marks an interesting moment for the crypto market. Unlike Coinbase, which operates a trading platform and generates fees in a manner that is widely understood by public-market investors, Circle’s offerings are a bit more exotic.

The offering marks an interesting moment for the crypto market. Unlike Coinbase, which operates a trading platform and generates fees in a manner that is widely understood by public-market investors, Circle’s offerings are a bit more exotic.

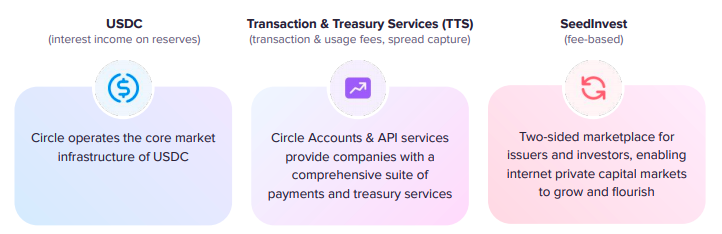

Circle’s SPAC presentation details a company whose core business deals with a stablecoin — a crypto asset pegged to an external currency, in this case, the U.S. dollar — and a set of APIs that provide crypto-powered financial services to other companies. It also owns SeedInvest, an equity crowdfunding platform, though Circle appears to generate the bulk of its anticipated revenues from its other businesses.

For more on the deal itself, TechCrunch’s Romain Dillet has a piece focused on the transaction. Here, we’ll dig into the company’s investor presentation, talk about its business model, and riff on its historical and anticipated results and valuation multiples.

In short, we get to have a little fun. Let’s begin.

As noted above, Circle has three main business operations. Here’s how it describes them in its deck:

Image Credits: Circle investor presentation

Let’s consider each one, starting with USDC.

Stablecoins have become popular in recent quarters. Because they are pegged to an external currency, they operate as an interesting form of cash inside the crypto world. If you want to have on-chain buying power, but don’t want to have all your value stored in more volatile, and tax-inducing, cryptos that you might have to sell to buy anything else, stablecoins can operate as a more stable sort of liquid currency. They can combine the stability of the U.S. dollar, say, and the crypto world’s interesting financial web.

Powered by WPeMatico

Amsterdam-based challenger bank Bunq has been self-funded by its founder and CEO Ali Niknam for several years. But the company has decided to raise some external capital, leading to the largest Series A round for a European fintech company.

The startup is raising $228 million (€193 million) in a round led by Pollen Street Capital. Bunq founder Ali Niknam is also participating in the round — he’s investing $29.5 million (€25 million) while Pollen Street Capital is financing the rest of the round.

As part of the deal, Bunq is also acquiring Capitalflow Group, an Irish lending company that was previously owned by … Pollen Street Capital.

Founded in 2012, Ali Niknam has already invested quite a bit of money into his own company. He poured $116.6 million (€98.7 million) of his own capital into Bunq — that doesn’t even take into account today’s funding round.

But it has paid off as the company expects to break even on a monthly basis in 2021. The company passed €1 billion in user deposits earlier this year. So why is the company raising external funding after turning down VC firms for so many years?

“Everything has a right time. In the beginning of Bunq, it was important to get a laser user focus in the company. Having to also focus on fundraises and the needs of investors distracts. Bunq now is mature enough to start scaling up significantly, so more capital is welcome,” Niknam said.

In particular, the company expects to acquire smaller companies to fuel its growth strategy. Challenger banks have also represented a highly competitive market over the past years in Europe. It’s clear that there will be some consolidation at some point.

Bunq offers bank accounts and debit cards that you can control from a mobile app. It works particularly well if your friends and family are also using Bunq as you can instantly send money, share a bunq.me payment link with other people, split payments and more.

In particular, if you’re going on a weekend trip, you can start an activity with your friends. It creates a shared pot that lets you share expenses with everyone. If you live with roommates, you can also create subaccounts to pay for bills from that account.

The company offers different plans that range from €2.99 per month to €17.99 per month — there’s also a free travel card with a limited feature set. By choosing a subscription-based business model, the startup has a clear path to profitability as most users are paid users.

Powered by WPeMatico

The SPAC parade continues in this shortened week with news that community social network Nextdoor will go public via a blank-check company. The unicorn will merge with Khosla Ventures Acquisition Co. II, taking itself public and raising capital at the same time.

Per the former startup, the transaction with the Khosla-affiliated SPAC will generate gross proceeds of around $686 million, inclusive of a $270 million private investment in public equity, or PIPE, which is being funded by a collection of capital pools, some prior Nextdoor investors (including Tiger), Nextdoor CEO Sarah Friar and Khosla Ventures itself.

Notably, Khosla is not a listed investor in the company per Crunchbase or PitchBook, indicating that even SPACs formed by venture capital firms can hunt for deals outside their parent’s portfolio.

Per a Nextdoor release, the transaction will value the company at a “pro forma equity [valuation] of approximately $4.3 billion.” That’s a great price for the firm that was most recently valued at $2.17 billion in a late 2019-era Series H worth $170 million, per PitchBook data. Those funds were invested at a flat $2 billion pre-money valuation.

So, what will public investors get the chance to buy into at the new, higher price? To answer that we’ll have to turn to the company’s SPAC investor deck.

Our general observations are that while Nextdoor’s SPAC deck does have some regular annoyances, it offers a clear-eyed look at the company’s financial performance both in historical terms and in terms of what it might accomplish in the future. Our usual mockery of SPAC charts mostly doesn’t apply. Let’s begin.

We’ll proceed through the deck in its original slide order to better understand the company’s argument for its value today, as well as its future worth.

The company kicks off with a note that it has 27 million weekly active users (neighbors, in its own parlance), and claims users in around one in three U.S. households. The argument, then, is that Nextdoor has scale.

A few slides later, Nextdoor details its mission: “To cultivate a kinder world where everyone has a neighborhood they can rely on.” While accounts like @BestOfNextdoor might make this mission statement as coherent as ExxonMobil saying that its core purpose was, say, atmospheric carbon reduction, we have to take it seriously. The company wants to bring people together. It can’t control what they do from there, as we’ve all seen. But the fact that rude people on Nextdoor is a meme stems from the same scale that the company was just crowing about.

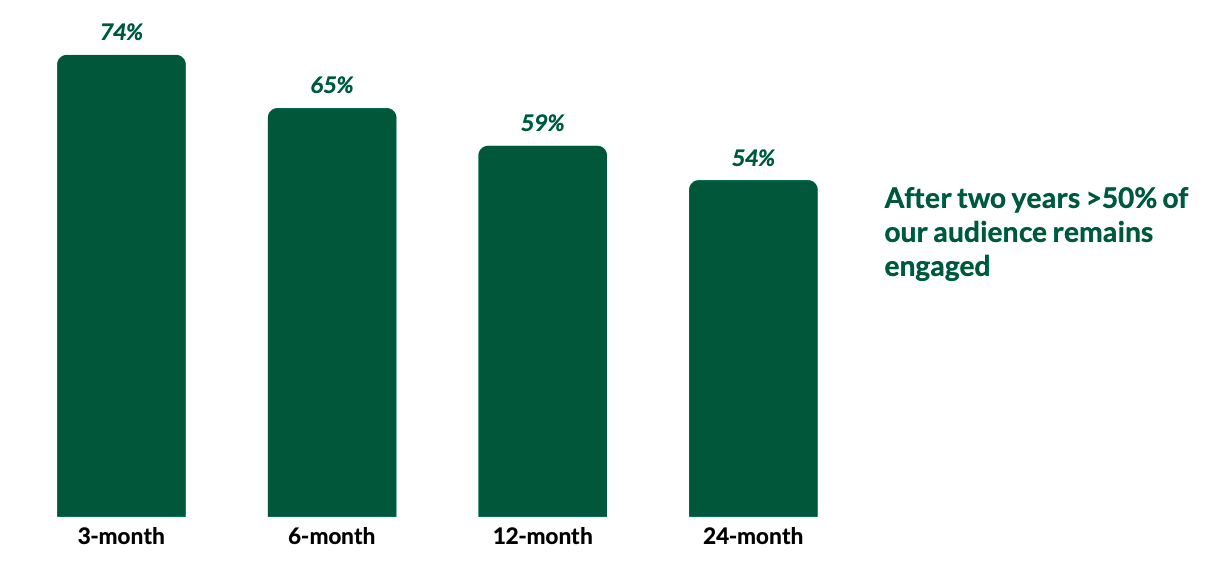

Underscoring its active user counts are Nextdoor’s retention figures. Here’s how it describes that metric:

Image Credits: Nextdoor SPAC investor deck

These are monthly active users, mind, not weekly active, the figure that the company cited up top. So, the metrics are looser here. And the company is counting users as active if they have “started a session or opened a content email over the trailing 30 days.” How conservative is that metric? We’ll leave that for you to decide.

The company’s argument for its value continues in the following slide, with Nextdoor noting that users become more active as more people use the service in a neighborhood. This feels obvious, though it is nice, we suppose, to see the company codify our expectations in data.

Nextdoor then argues that its user base is distinct from that of other social networks and that its users are about as active as those on Twitter, albeit less active than on the major U.S. social networks (Facebook, Snap, Instagram).

Why go through the exercise of sorting Nextdoor into a cabal of social networks? Well, here’s why:

Powered by WPeMatico

Super.mx, an insurtech startup based in Mexico City, has raised $7.2 million in a Series A round led by ALLVP.

Co-founded in 2019 by a trio of former insurance industry executives, Super.mx’s self-proclaimed mission is to design insurance for “the emerging Latin American middle class,” according to CEO Sebastian Villarreal.

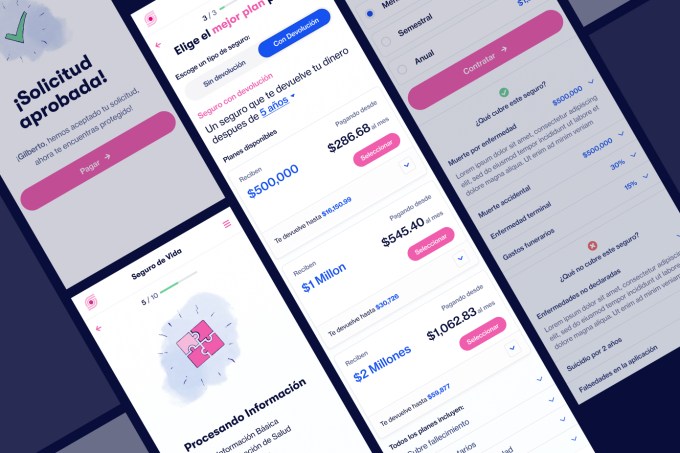

“That means insurance that is easy to buy – it can be bought on a cell phone in minutes – and that pays quickly with no adjusters,” he said. The company has built its offering with proprietary models that are used both on the underwriting side to predict risk and on the claims side to make payments automatically.

Goodwater Capital, Kairos Angels and Bridge Partners also participated in the Series A round in addition to angels such as Joe Schmidt IV, vice president of business development at insurtech Ethos and former investor at Accel and Kyle Nakatsuji, founder and CEO of auto insurance startup Clearcover (and also a former VC). Better Tomorrow Ventures led Super.mx’s $2.4 million seed round, which also saw capital from 500 Startups Mexico, Village Global, Anthemis and Broadhaven Ventures, among others.

Unlike most insurtech startups in Latin America, Villarreal emphasizes that Super.mx is neither an aggregator nor a carrier. Instead, it’s an MGA, or managing general agent.

“This lets us have a ‘best of both worlds’ approach,” Villarreal said. “We handle the entire user experience just like a direct to consumer carrier, but with the breadth of product choice offered by an aggregator.”

That product choice includes property, natural disasters and life insurance. The company soon plans to expand to also offer health insurance.

The founding team brings a variety of insurance experience to the table. Villarreal previously co-founded Chicago-based Kin Insurance (which raised over $150 million in funding from the likes of Flourish Ventures, Commerce Ventures and QED Investors). He was also once head of auto product at Avant, a growth-stage company funded by General Atlantic and Tiger Global, among others.

With over two decades of insurance industry experience, Dario Luna once served as Mexico’s insurance regulator and helped develop Mexico’s disaster risk management strategy. Marco Ahedo has designed parametric insurance products for 19 Caribbean countries. He was also once a solvency expert for life and health insurance lines at MetLife, and has developed financial models for several P&C carriers.

Villarreal lived in the U.S. for a while before deciding to move back to Mexico, which he recognized was home to an “underinsurance problem.”

“That’s actually a very acute problem,” he said. “People in Latin America buy a lot less insurance than they do in the U.S., and people in Mexico, in particular, buy a lot less insurance than they do in other Latin countries.”

Some have blamed the lack of insurance coverage on the country’s culture but Super.mx operates under the belief that this notion is “total BS.”

“It’s not a cultural problem,” Villarreal said. “The problem is that the insurance products that exist in the market just suck. They’re super expensive. They’re really hard to buy, and they pay very little.”

Image Credits: Super.mx

So far, Super.mx has sold “thousands of policies” but is more focused now on increasing the number of products that it’s selling. The company started out by selling earthquake insurance before adding COVID insurance, and more recently, in April, it launched life insurance. Next, it’s going to offer property, renter’s and health insurance.

“It’s really a different strategy than what you would find in the U.S.,” Villarreal said. “In the U.S, when you look at insurtechs, it’s like everyone just does one thing, but here, it’s very different because when someone says ‘I want insurance,’ really what they’re saying is ‘Hey, something happened that makes me nervous that didn’t make me nervous before.’”

That something could be a new child, for example, that prompts a need for life insurance.

“What we’re trying to do is like Lemonade, Roots and Hippo or Kin all rolled into one,” he added. It’s a big, big play.”

Digital adoption in Mexico, and Latin America in general, has increased exponentially in recent years. The bigger hurdle for Super.mx, according to Villarreal, has less to do with technology and more to do with Mexicans getting over what he describes a “deep mistrust” based on bad experiences in the past.

“People are really distrustful and that’s a huge hurdle, but once you show them that you actually are different,” Villarreal told TechCrunch, “that you actually do things in a different way, you get this incredible emotional response.”

Eventually, Super.mx plans to outside of Mexico to other countries in Latin America.

ALLVP’s Federico Antoni said his Mexico City-based firm had been looking for a team building in this space “for years” before investing in Super.mx. The venture firm was impressed with the company’s technical knowledge and industry expertise. It was also drawn to their multi-product approach and “capacity to ship highly complex products to the market quickly” — both of which he believes are “unique” in the region.

Citing statistics from MAPFRE Economics, Antoni pointed out that globally, the insurance market has been growing over the last 10 years. During that time, Latin America expanded faster on average (4.4% vs. 2.4% worldwide), albeit with more volatility. Life insurance has been driving this growth, at 6.1%, over the period.

“Insurtech may be even bigger than fintech. Also, harder,” he told TechCrunch via email. “We knew the team to unlock the market potential would need to be highly competent and highly disruptive.”

Antoni said he is also convinced that Insurtech is the “next frontier” in financial inclusion in Latin America especially as digitization continues to increase.

“Providing risk coverage to individuals and businesses in the region, brings financial stability to families and unlocks economic potential for SMEs,” he said. “Moreover, the insurance incumbents have been unable to address a growing and underserved market.”

Powered by WPeMatico

Shares of Chinese ride-hailing business Didi are off 22% this morning after the company was hit by more regulatory activity over the holiday weekend. The recently public company traded as high as $18.01 per share since it held an IPO last week; today, shares of Didi are worth just $12.09, off around a third from their 52-week high.

The Exchange explores startups, markets and money.

Read it every morning on Extra Crunch or get The Exchange newsletter every Saturday.

The decline in value follows a review by a Chinese cybersecurity agency that led to Didi being unable to onboard new users, a decision that arrived as last week rolled to a close.

Over the weekend, Didi was hit with more regulatory action. This time, the Cyberspace Administration of China said, via an internet translation, that “after testing and verification, the ‘Didi Travel’ App [was found to have] serious violations of laws and regulations in collecting and using personal information,” which led the agency to command app stores “to remove the ‘Didi Travel’ app, and required [the company] to strictly follow the legal requirements and refer to relevant national standards to seriously rectify existing problems.”

Over the weekend, Didi was hit with more regulatory action. This time, the Cyberspace Administration of China said, via an internet translation, that “after testing and verification, the ‘Didi Travel’ App [was found to have] serious violations of laws and regulations in collecting and using personal information,” which led the agency to command app stores “to remove the ‘Didi Travel’ app, and required [the company] to strictly follow the legal requirements and refer to relevant national standards to seriously rectify existing problems.”

Being yanked from relevant app stores was enough for Didi to alert investors that its mobile app “had the problem of collecting personal information in violation of relevant PRC laws and regulations.” Didi said that the change in its app availability “may have an adverse impact on its revenue in China.”

Understatement of the year, I reckon.

But there’s more going on than what Didi is enduring. As CNBC reported:

Powered by WPeMatico