Fundings & Exits

Auto Added by WPeMatico

Auto Added by WPeMatico

Seismic is announcing that it’s acquiring Percolate in a deal that it says is combining “two essential pillars of the marketing technology stack.”

It sounds like the two companies aren’t direct competitors, but they offer related tools: Seismic helps companies create and manage the content they use in sales and marketing, while Percolate expanded from a social media publishing tool to a broader suite of software for managing the marketing process.

As part of the acquisition, Percolate CEO Randy Wootton is joining the Seismic team, where he will continue to lead Percolate, and where he will report to Seismic CEO Doug Winter. The combined company will have a headcount of more than 800 people.

“Both of our companies endeavor to foster better alignment between marketing and sales and improve the buyer/seller interaction, resulting in accelerated deals and pipeline for our customers,” Wootton said in a statement. “Combining with Seismic allows Percolate to provide even more capability to our customer base and more value to the marketing ecosystem.”

The financial terms of the acquisition were not disclosed. Percolate raised a total of $106.5 million from investors including GGV Capital, Sequoia Capital, Lightspeed, Slow Ventures, Lerer Hippeau and First Round Capital, according to Crunchbase.

Seismic, meanwhile, raised a $100 million investment at a $1 billion valuation last year.

Powered by WPeMatico

Workday announced this afternoon that it has entered into an agreement to acquire online procurement platform Scout RFP for $540 million. The company raised more than $60 million on a post valuation of $184.5 million, according to PitchBook data.

The acquisition builds on top of Workday’s existing procurement solutions, Workday Procurement and Workday Inventory, but Workday chief product product officer Petros Dermetzis wrote in a blog post announcing the deal that Scout gives the company a more complete solution for customers.

“With increased importance around the supplier as a strategic asset, the acquisition of Scout RFP will help accelerate Workday’s ability to deliver a comprehensive source-to-pay solution with a best-in-class strategic sourcing offering, elevating the office of procurement in strategic importance and transforming the procurement function,” he wrote.

Ray Wang, founder and principal analyst at Constellation Research says that Workday has been trying to be the end-to-end cloud back office player. In spite of their own offerings in this area, he says, “One of their big gaps has been in procurement.”

Wang says that Workday has been investing with eye toward filling gaps in the product set for some time. In fact, Workday Ventures has been an investor in Scout RFP since 2018, and it’s also an official Workday partner.

“A lot of the Workday investments are in portfolio companies that are complimentary to Workday’s larger vision of the future of Cloud ERP. Today’s definition of ERP includes finance, HCM (human capital management), projects, procurement, supply chai and asset management, Wang told TechCrunch

As the Scout RFP founders stated in a blog post about today’s announcement, the two companies have worked well together and a deal made sense. “Working closely with the Workday team, we realized how similar our companies’ beliefs and values are. Both companies put user experience at the center of product focus and are committed to customer satisfaction, employee engagement and overall business impact. It was not surprising how easy it was to work together and how quickly we saw success partnering on go-to-market activities. From a culture standpoint, it just worked,” they wrote. A deal eventually came together as a result.

Scout RFP is a fairly substantial business, with 240 customers in 155 countries. There are 300,000 users on the platform, according to data supplied by the company. The company’s 160 employees will be moving to Workday when the deal closes, which is expected by the end of January, pending standard regulatory review.

Powered by WPeMatico

There’s too much hype about mythical “10X developers.” Everyone’s desperate to hire these “ninja rockstars.” In reality, it’s smarter to find ways of deleting annoying chores for the coders you already have. That’s where CTO.ai comes in.

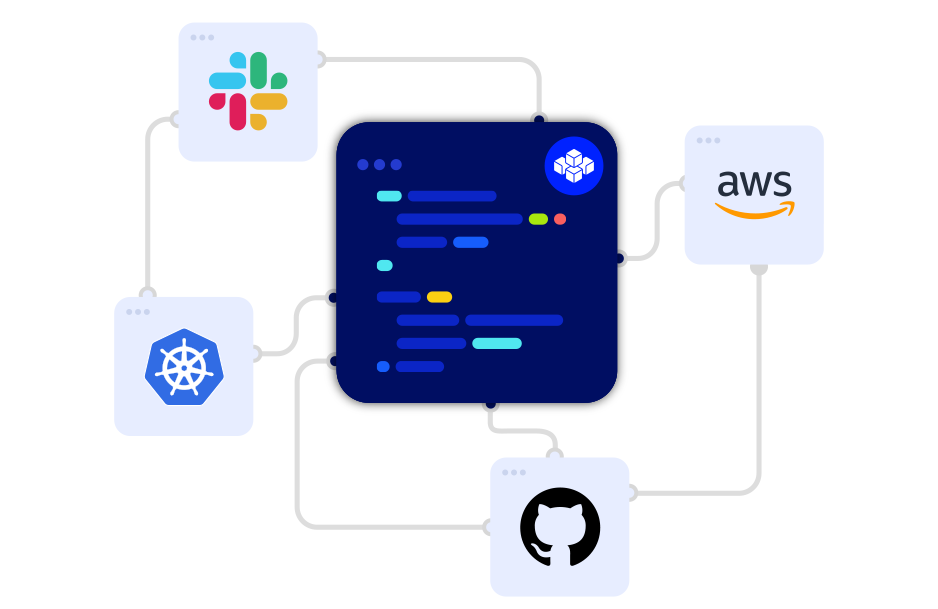

Emerging from stealth today, CTO.ai lets developers build and borrow DevOps shortcuts. These automate long series of steps they usually have to do manually, thanks to integrations with GitHub, AWS, Slack and more. CTO.ai claims it can turn a days-long process like setting up a Kubernetes cluster into a 15-minute task even sales people can handle. The startup offers both a platform for engineering and sharing shortcuts, and a service where it can custom build shortcuts for big customers.

What’s remarkable about CTO.ai is that amidst a frothy funding environment, the 60-person team quietly bootstrapped its way to profitability over the past two years. Why take funding when revenue was up 400% in 18 months? But after a chance meeting aboard a plane connected its high school dropout founder Kyle Campbell with Slack CEO Stewart Butterfield, CTO.ai just raised a $7.5 million seed round led by Slack Fund and Tiger Global.

“Building tools that streamline software development is really expensive for companies, especially when they need their developers focused on building features and shipping to customers,” Campbell tells me. The same way startups don’t build their own cloud infrastructure and just use AWS, or don’t build their own telecom APIs and just use Twilio, he wants CTO.ai to be the “easy button” for developer tools.

“I’ve been a software engineer since the age of 8,” Campbell recalls. In skate-punk attire with a snapback hat, the young man meeting me in a San Francisco Mission District cafe almost looked too chill to be a prolific coder. But that’s kind of the point. His startup makes being a developer more accessible.

After spending his 20s in software engineering groups in the Bay, Campbell started his own company, Retsly, that bridged developers to real estate listings. In 2014, it was acquired by property tech giant Zillow, where he worked for a few years.

That’s when he discovered the difficulty of building dev tools inside companies with other priorities. “It’s the equivalent of a snake swallowing an elephant,” he jokes. Yet given these tools determine how much time expensive engineers waste on tasks below their skill level, their absence can drag down big enterprises or keep startups from rising.

CTO.ai shrinks the elephant. For example, the busywork of creating a Kubernetes cluster such as having to the create EC2 instances, provision on those instances and then provision a master node gets slimmed down to just running a shortcut. Campbell writes that “tedious tasks like running reports can be reduced from 1,000 steps down to 10,” through standardization of workflows that turn confusing code essays into simple fill-in-the-blank and multiple-choice questions.

The CTO.ai platform offers a wide range of pre-made shortcuts that clients can piggyback on, or they can make and publish their own through a flexible JavaScript environment for the rest of their team or the whole community to use. Companies that need extra help can pay for its DevOps-as-a-Service and reliability offerings to get shortcuts made to solve their biggest problems while keeping everything running smoothly.

Campbell envisions a new way to create a 10X engineer that doesn’t depend on widely mocked advice on how to spot and capture them like trophy animals. Instead, he believes one developer can make five others 2X more efficient by building them shortcuts. And it doesn’t require indulging bad workplace or collaboration habits.

With the new funding that also comes from Yaletown Partners, Pallasite Ventures, Panache Ventures and Jonathan Bixby, CTO.ai wants to build deeper integrations with Slack so developers can run more commands right from the messaging app. The less coding required for use, the broader the set of employees that can use the startup’s tools. CTO.ai may also build a self-service tier to augment its seats, plus a complexity model for enterprise pricing.

Now it’s time to ramp up community outreach to drive adoption. CTO.ai recently released a podcast that saw 15,000 downloads in its first three weeks, and it’s planning some conference appearances. It also sees virality through its shortcut author pages, which, like GitHub profiles, let developers show off their contributions and find their next gig.

One risk is that GitHub or another core developer infrastructure provider could try to barge directly into CTO.ai’s business. Google already has Cloud Composer, while GitHub launched Actions last year. Campbell says its defense comes through neutrally integrating with everyone, thereby turning potential competitors into partners.

The funding firepower could help CTO.ai build a lead. With every company embracing software, employers battling to keep developers happy and teams looking to get more of their staff working with code, the startup sits at the intersection of some lucrative trends of technological empowerment.

“I have a three-year-old at home and I think about what it will be like when he comes into creating things online,” Campbell concludes. “We want to create an amazing future for software developers, introducing automation so they can focus on what makes them such an important aspect. Devs are defining society!”

[Image Credit: Disney/Pixar via WallHere Goodfon]

Powered by WPeMatico

Sumo Logic, a mature security event management startup with a valuation over $1 billion, announced today that it has acquired JASK, a security operations startup that raised almost $40 million. The companies did not share the terms of the deal.

Sumo’s CEO Ramin Sayar says the combined companies give customers a complete security solution. Sumo offers what’s known in industry parlance as a security information and event management (SIEM) tool, while JASK provides a security operations center or SOC (pronounced “sock“). Both are focused on securing workloads in a cloud native environment and can work in tandem.

Sayar says that as companies shift workloads to the cloud they need to reevaluate their security tools. “The interesting thing about the market today is that the traditional enterprises are much more aggressively taking a security-first posture as they start to plan for new workloads in the cloud, let alone workloads that they are migrating. Part of that requires them to evaluate their tools, teams and, more importantly, a lot of their processes that they’ve built in and around their legacy systems as well as their SOC,” he said.

He says that combining the two organizations helps customers moving to the cloud automate a lot of their security requirements, something that’s increasingly important due to the lack of highly skilled security personnel. That means the more that software can do, the better.

“We see a lot of dysfunction in the marketplace and the whole movement towards automation really complements and supplements the gap that we have in the workforce, particularly in terms of security folks. This is what JASK has been trying to do for four-plus years, and it’s what Sumo has been trying to do for nearly 10 years in terms of using various algorithms and machine learning techniques to suppress a lot of false alerts, triage the process and help drive efficiency and more automation,” he said.

JASK CEO and co-founder Greg Martin says the shift to the cloud has also precipitated two major changes in the security space that have driven this growing need for security automation. “The perimeter is disappearing and that fundamentally changes how we have to perform cybersecurity. The second is that the footprint of threats and data are so large now that security operations is no longer a human scalable problem,” he said. Echoing Sayar, he says that requires a much higher level of automation.

JASK was founded in 2015, raising $39 million, according to Crunchbase data. Investors included Battery Ventures, Dell Technologies Capital, TenEleven Ventures and Kleiner Perkins. Its last round was a $25 million Series B led by Kleiner in June 2018.

Deepak Jeevankumar, managing director at Dell Technologies Capital, whose company was part of JASK’s Series A investment and who invests frequently in security startups, sees the two companies joining forces as a strong combination.

“Sumo Logic and JASK have the same mission to disrupt today’s security industry, which suffers from legacy security tools, siloed teams and alert fatigue. Both companies are pioneers in cloud-native security and share the same maniacal customer focus. Sumo Logic is therefore a great culture and product fit for JASK to continue its journey,” Jeevankumer told TechCrunch.

Sumo has raised $345 million, according to the company. It was valued at over $1 billion in its most recent funding round last May, when it raised $110 million.

CRN first reported this deal was in the works in an article on October 22.

Powered by WPeMatico

As we move from a world dominated by virtual machines to one of serverless, it changes the nature of monitoring, and vendors like New Relic certainly recognize that. This morning the company announced it was acquiring IOpipe, a Seattle-based early-stage serverless monitoring startup, to help beef up its serverless monitoring chops. Terms of the deal weren’t disclosed.

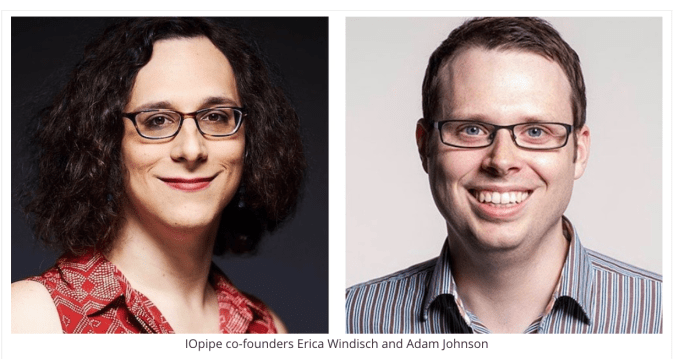

New Relic gets what it calls “key members of the team,” which at least includes co-founders Erica Windisch and Adam Johnson, along with the IOpipe technology. The new employees will be moving from Seattle to New Relic’s Portland offices.

“This deal allows us to make immediate investments in onboarding that will make it faster and simpler for customers to integrate their [serverless] functions with New Relic and get the most out of our instrumentation and UIs that allow fast troubleshooting of complex issues across the entire application stack,” the company wrote in a blog post announcing the acquisition.

It adds that initially the IOpipe team will concentrate on moving AWS Lambda features like Lambda Layers into the New Relic platform. Over time, the team will work on increasing support for serverless function monitoring. New Relic is hoping by combining the IOpipe team and solution with its own, it can speed up its serverless monitoring chops.

Eliot Durbin, an investor at Bold Start, which led the company’s $2 million seed round in 2018, says both companies win with this deal. “New Relic has a huge commitment to serverless, so the opportunity to bring IOpipe’s product to their market-leading customer base was attractive to everyone involved,” he told TechCrunch.

The startup has been helping monitor serverless operations for companies running AWS Lambda. It’s important to understand that serverless doesn’t mean there are no servers, but the cloud vendor — in this case AWS — provides the exact resources to complete an operation, and nothing more.

Photo: New Relic

Once the operation ends, the resources can simply get redeployed elsewhere. That makes building monitoring tools for such ephemeral resources a huge challenge. New Relic has also been working on the problem and released New Relic Serverless for AWS Lambda earlier this year.

As TechCrunch’s Frederic Lardinois pointed out in his article about the company’s $2.5 million seed round in 2017, Windisch and Johnson bring impressive credentials:

IOpipe co-founders Adam Johnson (CEO) and Erica Windisch (CTO), too, are highly experienced in this space, having previously worked at companies like Docker and Midokura (Adam was the first hire at Midokura and Erica founded Docker’s security team). They recently graduated from the Techstars NY program.

IOpipe was founded in 2015, which was just around the time that Amazon was announcing Lambda. At the time of the seed round the company had eight employees. According to PitchBook data, it currently has between 1 and 10 employees, and has raised $7.07 million since its inception.

New Relic was founded in 2008 and has raised more than $214 million, according to Crunchbase, before going public in 2014. Its stock price was $65.42 at the time of publication, up $1.40.

Powered by WPeMatico

Forecast, a Denmark-based startup that has developed “AI-powered” project management software, has raised $5.5 million in new funding.

The round is led by Crane Venture Partners, with participation from existing backers SEED Capital and Heartcore. Forecast has raised $10 million in total funding to date.

Founded in late 2016, Forecast describes itself as an AI-powered project management solution that automates manual project management tasks, and brings extra visibility and predictive capabilities to project management. The idea is to help increase collaboration across teams with a better workflow and to improve planning.

Forecast claims that by using its project management software, customers reduce their administrative tasks by 20-40% and gain much better insights into “project risk, resource management and more.”

“Work is going more project-based… leading to an increased need for project management skills and expertise,” Forecast co-founder and CEO Dennis Kayser tells TechCrunch. “Plus, projects are getting more complex. Project management depends on many manual, ongoing updates to stay on time, on budget and on track. That’s why 66% of all projects fail due to human error.”

In addition, as projects become more complex and the data associated with a project increases exponentially, Kayser says the problem is getting worse, which, of course, is where machine intelligence can help. “We don’t learn from our mistakes because no one can keep track of every influencing factor to make crucial adjustments,” he adds.

To tackle this, Forecast uses AI to help keep projects on track and make project management more efficient. The software integrates with existing tools — such as Trello, Slack, Gdrive, Githum and Salesforce — and uses these various external data-points as key indicators for how well a project is running.

“[It pulls in] data from disparate systems and synthesizes it into something human-readable with powerful AI,” explains Kayser. “Everyone on your team can continue to use the tool they prefer without sacrificing dead-simple scheduling, reporting and collaboration for project managers and senior executives. With better insights and tools, project managers can be more efficient and gain insights from increasingly complex projects.”

The use of AI is proactive, too. This includes matching the best person and role to the task, automation of time registration, forecasting the size and duration of tasks and being alerted before a project is in trouble.

With regards to target customers, Kayser says that Forecast is focused on helping IT & services, marketing and computer software development companies that “rely on capacity being predictable and project delivery being successful.”

Forecast currently has “hundreds of customers” in more than 40 countries. The software has helped customers manage more than 40,000 projects with more than 1,000,000 tasks created.

Powered by WPeMatico

Paidy, a Japanese financial tech startup that provides instant credit to consumers in Japan, announced today that it has raised a total of $143 million in new financing. This includes a $83 million Series C extension from investors including PayPal Ventures and debt financing of $60 million. The funding will be used to advance Paidy’s goals of signing large-scale merchants, offering new financial services and growing its user base to 11 million accounts by the end of 2020.

In addition to PayPal Ventures, investors in the Series C extension also include Soros Capital Management, JS Capital Management and Tybourne Capital Management, along with another undisclosed investor. The debt financing is from Goldman Sachs Japan, Mizuho Bank, Sumitomo Mitsui Banking Corporation and Sumitomo Mitsui Trust Bank. Earlier this month, Paidy and Goldman Sachs Japan established a warehouse facility valued at $52 million. Paidy also established credit facility worth $8 million with the three banks.

This is the largest investment to date in the Japanese financial tech industry, according to data cited by Paidy and brings the total investment the company has raised so far to $163 million. A representative for the startup says it decided to extend its Series C instead of moving onto a D round to preserve the equity ratio for existing investors and issue the same preferred shares as its previous funding rounds.

Launched in 2014, Paidy was created because many Japanese consumers don’t use credit cards for e-commerce purchases, even though the credit card penetration rate there is relatively high. Instead, many prefer to pay cash on delivery or at convenience stores and other pickup locations. While this makes online shopping easier for consumers, it presents several challenges for sellers, because they need to cover the cost of merchandise that hasn’t been paid for yet or deal with uncompleted deliveries.

Paidy’s solution is to make it possible for people to pay for merchandise online without needing to create an account first or use their credit cards. If a seller offers Paidy as a payment method, customers can check out by entering their mobile phone numbers and email addresses, which are then authenticated with code sent through SMS or voice. Paidy covers the cost of the items and bills customers monthly. Paidy uses proprietary machine learning models to score the creditworthiness of users, and says its service can help reduce incomplete transactions (or items that buyers ultimately don’t pick up and pay for), increase conversion rates, average order values and repeat purchases.

Powered by WPeMatico

Namogoo, the Herzliya, Israel-based company that has developed a solution for e-commerce and other online enterprises to prevent “customer journey hijacking,” has raised $40 million in Series C funding.

The round is led by Oak HC/FT, with participation from existing backers GreatPoint Ventures, Blumberg Capital and Hanaco Ventures. It brings total raised by Namogoo to $69 million, and sees Matt Streisfeld, partner at Oak HC/FT, join the company’s board.

Founded by Chemi Katz and Ohad Greenshpan in 2014, Namogoo’s platform gives online businesses more control over the customer journey by preventing unauthorized ad injections that attempt to divert customers to competitors. It also helps uncover privacy and compliance risks that can come from the use of third and fourth-party ad vendors.

More broadly, Namogoo says that customer journey hijacking is a growing but little-known problem that by some estimates affects 15-25% of all user web sessions and therefore costs e-commerce businesses hundreds of millions in lost revenue.

Unauthorized ads are injected into consumer web browsers — on the consumer side, typically via malware the user has unintentionally installed — meaning that e-commerce sites are often unaware that it is even happening. This results in product ads, banners and pop-ups, which appear when visiting an e-commerce site. The ads disrupt the user experience, hoping to send them to competitor sites.

Namogoo says that retailers using its technology see conversion rates increase between 2-5%, which in the first half of 2019 totaled more than $575 million in revenue for Namogoo customers. It is used by more than 150 global brands in over 38 countries, including Tumi, Asics, Argos, Dollar Shave Club, Tailored Brands, Upwork and others.

Meanwhile, Namogoo will use the new funding to further expand its client-side platform offerings, beginning with the launch of its “customer privacy protection solution.” “The solution detects and mitigates against customer privacy risks associated with third and fouth-party vendors running on company websites and applications,” explains the company.

Powered by WPeMatico

Berlin-based fem tech startup Inne is coming out of stealth to announce an €8 million (~$8.8M) Series A and give the first glimpse of a hormone-tracking subscription product for fertility-tracking and natural contraception that’s slated for launch in Q1 next year.

The Series A is led by led by Blossom Capital, with early Inne backer Monkfish Equity also participating, along with a number of angel investors — including Taavet Hinrikus, co-founder of TransferWise; Tom Stafford, managing partner at DST; and Trivago co-founder Rolf Schromgens.

Women’s health apps have been having a tech-fuelled moment in recent years, with the rise of a fem tech category. There are now all sorts of apps for tracking periods and the menstrual cycle, such as Clue and Flo.

Some also try to predict which days a women is fertile and which they’re not — offering digital tools to help women track bodily signals if they’re following a natural family planning method of contraception, or indeed trying to conceive a baby.

Others — such as Natural Cycles — have gone further down that path, branding their approach “digital contraception” and claiming greater sophistication vs traditional natural family planning by applying learning algorithms to cycle data augmented with additional information (typically a daily body temperature measurement). Although there has also been some controversy around aggressive and even misleading marketing tactics targeting young women.

A multi-month investigation by the medical device regulator in Natural Cycles’ home market, instigated after a number of women fell pregnant while using its method, found rates of failure were in line with its small-print promises but concluded with the company agreeing to clarify the risk of the product failing.

At issue is that the notion of “digital contraception” may present as simple and effortless — arriving in handy app form, often boosted by a flotilla of seductive social media lifestyle ads. Yet the reality for the user is the opposite of effortless. Because in fact they are personally taking on all of the risk.

For these products to work the user needs a high level of dedication to stick at it, be consistent and pay close attention to key details in order to achieve the promised rate of protection.

Natural contraception is also what Inne is touting, dangling another enticing promise of hormone-free contraception — its website calls the product “a tool of radical self-knowledge” and claims it “protect[s]… from invasive contraceptive methods”. It’s twist is it’s not using temperature to track fertility; its focus is on hormone-tracking as a fertility measure.

Inne says it’s developed a saliva-based test to measure hormone levels, along with an in vitro diagnostic device (pictured above) that allows data to be extracted from the disposable tests at home and wirelessly logged in the companion app.

Founder Eirini Rapti describes the product as a “mini lab” — saying it’s small and portable enough to fit in a pocket. Her team has been doing the R&D on it since 2017, preferring, she says, to focus on getting the biochemistry right rather than shouting about launching the startup. (It took in seed funding prior to this round but isn’t disclosing how much.)

At this stage Inne has applied for and gained European certification as a medical device. Though it’s not yet been formally announced.

The first product, a natural contraception for adult women — billed as best suited for women aged 28-40, i.e. at a steady relationship time-of-life — will be launching in select European markets (starting in Scandinavia) next year, though initially as a closed beta style launch as they work on iterating the product based on user feedback.

“It basically has three parts,” Rapti says of the proposition. “It has a small reader… It has what we call a little mouth opening in the front. It always gives you a smile. That’s the hardware part of it, so it recognizes the intensity of your hormones. And then there’s a disposable saliva test. You basically collect your saliva by putting it in your mouth for 30 seconds. And then you insert it in the reader and then you go about your day.

“The reader is connected to your phone, either via BlueTooth or wifi, depending on where you are taking the test daily… It takes the reading and it sends it over to your phone. In your phone you can do a couple of things. First of all you look at your hormonal data and you look at how those change throughout the menstrual cycle. So you can see how they grow, how they fall. What that means about your ovulation or your overall female health — like we measure progesterone; that tells you a lot about your lining etc. And then you can also track your fluids… We teach you how to track them, how to understand what they mean.”

As well as a contraception use-case, the fertility tracking element naturally means it could also be used by women wanting to get pregnant.

“This product is not a tracker. We’re not looking to gather your data and then tell you next month what you should be feeling — at all,” she adds. “It’s more designed to track your hormones and tell you look this is the most basic change that happens in your body and because of those changes you will feel certain things. So do you feel them or not — and if you don’t, what does it mean? Or if you do what does it mean?

“It builds your own hormonal baseline — so you start measuring your hormones and we go okay so this is your baseline and now let’s look at things that go out of your baseline. And what do they mean?”

Of course the key question is how accurate is a saliva-based test for hormones as a method for predicting fertility? On this Rapti says Inne isn’t ready to share data about the product’s efficacy — but claims it will be publishing details of the various studies it conducted as part of the CE marking process in the next few weeks.

“A couple more weeks and all the hardcore numbers will be out there,” she says.

In terms of how it works in general the hormone measurement is “a combination of a biochemical reaction and the read out of it”, as she puts it — with the test itself being pure chemistry but algorithms then being applied to interpret the hormonal reading, looping in other signals such as the user’s cycle length, age and the time of day of the test.

She claims the biochemical hormone test the product relies on as its baseline for predicting fertility is based on similar principles to standard pregnancy tests — such as those that involve peeing on a stick to get a binary ‘pregnant’ or ‘not pregnant’ result. “We are focused on specifically fertility hormones,” she says.

“Our device is a medical device. It’s CE-certified in Europe and to do that you have to do all kinds of verification and performance evaluation studies. They will be published pretty soon. I cannot tell you too much in detail but to develop something like that we had to do verification studies, performance evaluation studies, so all of that is done.”

While it developed and “validated” the approach in-house, Rapti notes that it also worked with a number of external diagnostic companies to “optimize” the test.

“The science behind it is pretty straightforward,” she adds. “Your hormones behave in a specific way — they go from a low to a high to a low again, and what you’re looking for is building that trend… What we are building is an individual curve per user. The starting and the ending point in terms of values can be different but it is the same across the cycle for one user.”

“When you enter a field like biochemistry as an outsider a lot of the academics will tell you about the incredible things you could do in the future. And there are plenty,” she adds. “But I think what has made a difference to us is we always had this manufacturability in mind. So if you ask me there’s plenty of ways you can detect hormones that are spectacular but need about ten years of development let alone being able to manufacture it at scale. So it was important to me to find a technology that would allow us to do it effectively, repeatedly but also manufacture it at a low cost — so not reinventing the whole wheel.”

Rapti says Inne is controlling for variability in the testing process by controlling when users take the measurement (although that’s clearly not directly within its control, even if it can send an in-app reminder); controlling how much saliva is extracted per test; and controlling how much of the sample is tested — saying “that’s all done mechanically; you don’t do that”.

“The beauty about hormones is they do not get influenced by lack of sleep, they do not get influenced by getting out of your bed — and this is the reason why I wanted to opt to actually measure them,” she adds, saying she came up with the idea for the product as a user of natural contraception searching for a better experience. (Rapti is not herself trained in medical or life sciences.)

“When I started the company I was using the temperature method [of natural contraception] and I thought it cannot be that I have to take this measurement from my bed otherwise my measurement’s invalid,” she adds.

However there are other types of usage restrictions Inne users will need to observe in order to avoid negatively affecting the hormonal measurements.

Firstly they must take the test in the same time window each time — either in the morning or the evening but sticking to one of those choices for good.

They also need to stick to daily testing for at least a full menstrual cycle. Plus there are certain days in the month when testing will always be essential, per Rapti, even as she suggests a “learning element” might allow for the odd missed test day later on, i.e. once enough data has been inputted.

Users also have to avoid drinking and eating for 30 minutes before taking the test. She further specifies this half hour pre-test restriction includes not having oral sex — “because that also affects the measurements”.

“There’s a few indications around it,” she concedes, adding: “The product is super easy to use but it is not for women who want to not think ever about contraception or their bodies. I believe that for these women the IUD would be the perfect solution because they never have to think about it. This product is for women who consciously do not want to take hormones and don’t want invasive devices — either because they’ve been in pain or they’re interested in being natural and not taking hormones.”

At this stage Inne hasn’t performed any comparative studies vs established contraception methods such as the pill. So unless or until it does users won’t be able to assess the relative risk of falling pregnant while using it against more tried and tested contraception methods.

Rapti says the plan is to run more clinical studies in the coming year, helped by the new funding. But these will be more focused on what additional insights can be extracted from the test to feed the product proposition — rather than on further efficacy (or any comparative) tests.

They’ve also started the process of applying for FDA certification to be able to enter the US market in future.

Beyond natural contraception and fertility tracking, Inne is thinking about wider applications for its approach to hormone tracking — such as providing women with information about the menopause, based on longer term tracking of their hormone levels. Or to help manage conditions such as endometriosis, which is one of the areas where it wants to do further research.

The intent is to be the opposite of binary, she suggests, by providing adult women with a versatile tool to help them get closer to and understand changes in their bodies for a range of individual needs and purposes.

“I want to shift the way people perceive our female bodies to be binary,” she adds. “Our bodies are not binary, they change around the month. So maybe this month you want to avoid getting pregnant and maybe next month you actually want to get pregnant. It’s the same body that you need to understand to help you do that.”

Commenting on the Series A in a supporting statement, Louise Samet, partner at Blossom Capital, said: “Inne has a winning combination of scientific validity plus usability that can enable women to better understand their bodies at all stages in their lives. What really impressed us is the team’s meticulous focus on design and easy-of-use together with the scientific validity and clear ambition to impact women all over the world.”

Powered by WPeMatico

Freetrade, the U.K. challenger stockbroker that offers commission-free investing, has closed $15 million in Series A funding. The round includes a $7.5 million investment from Draper Esprit, the U.K. publicly listed venture capital firm, along with previously announced equity crowdfunding via Crowdcube.

The funding will be used by Freetrade for further growth and product development, including “doubling down” on engineering hires. The firm, which claims more than 50,000 customers, is also planning to expand to Europe next year.

In addition, Adam Dodds, CEO and founder of Freetrade, tells me there will be a marketing and content push to help reach more of the challenger stockbroker’s target millennial customers and help educate the market as a whole that investing in the stock market doesn’t have to be prohibitively expensive or complicated.

Amongst a number of new stock trading and investment apps in the U.K., London-based Freetrade was first out of the gate as a bona fide “challenger broker” after deciding early on to build its own brokerage. This included obtaining a full broker license from the FCA, rather than simply partnering with an established broker.

The Freetrade app lets you invest in stocks and ETFs. Trades are “fee-free” if you are happy for your buy or sell trades to execute at the close of business each day. If you want to execute immediately, the startup charges a low £1 per trade. The idea is to put the heat on the larger incumbents that can charge up to £12 per trade, which is off-putting to people wanting to only invest a small amount or regularly refresh a modestly sized portfolio.

Meanwhile, Dodds says that next on the product roadmap will be a new investment platform that will give users the option to purchase U.K. and European “fractional” shares, not just U.S. ones, which he claims will be a first.

With that said, competition has been steadily increasing since Freetrade set up shop. Silicon Valley’s Robinhood is gearing up for a U.K. launch, having recently received regulatory approval. Bux has also recently launched commission-free trading and now bills itself as a challenger broker just like Freetrade. Then, of course, there’s Revolut, the fast-growing challenger bank that tentatively launched fee-free stock investing in August.

Noteworthy, André Mohamed, previously CTO and a co-founder of Freetrade, joined Revolut as its new head of Wealth & Trading Product, adding a bit of extra spice to that rivalry. As I wrote at the time, the circumstances that saw Mohamed depart Freetrade remain unclear. According to my sources, his contract was terminated last year and the two parties settled, with Freetrade accepting no liability.

“Freetrade are on a mission to open up investment opportunities for everyone, as are we,” says Simon Cook, CEO of Draper Esprit, in a statement. “In this sense, their mission is totally aligned with our own, as a rare tech-focused VC listed on the stock exchange. The company have shown exceptional growth in the short time since they first launched the platform last year. We could not be more delighted to support Adam, Viktor, Ian and their wider team as they enable Europe’s 100 million millennials to benefit from the world’s economic growth.”

Powered by WPeMatico