Fundings & Exits

Auto Added by WPeMatico

Auto Added by WPeMatico

Digital media startup Brut is announcing that it has raised $40 million in Series B funding. The money will be used, in part, to finance its launch in the United States.

CEO Guillaume Lacroix said that he and his co-founders all come from the French TV industry, where they were all “frustrated not to be able to follow up the conversation” on social media. So they created Brut as a way to deliver video news that felt conversational and authentic, hoping to spark viewer conversation, then take advantage of that commentary to find future stories.

“We always say to journalists, ‘Forget the audience, think about your two best friends,’ ” Lacroix told me. “Would you be excited to have this conversation tonight with your friends? If yes, let’s do it.”

The publisher focuses on topics like social good and social impact — for example, it published the first viral video featuring climate change activist Greta Thunberg. Lacroix argued that Brut’s audience is looking for solutions, not just problems, in contrast to the “negative news cycle” that they see on traditional media.

“People are not waiting anymore — they don’t wait for institutions to do it, they don’t wait for the collectivity to do it,” he said. “It’s very inspiring to see someone who takes even a small action.”

At the same time, he doesn’t want Brut’s journalists to veer too heavily into advocacy or activism themselves: “We don’t do a call to action, we’re not activists, we don’t point a finger. We just shine a light on people who are trying to do something to change the world.”

In many ways, Brut seems to check off the same boxes (it aims to reach a millennial/Gen Z audience with short videos on Facebook, Instagram and Snapchat) that many U.S. digital media startups did before they started to struggle and consolidate over the past few years.

But Lacroix said the startup’s approach is working — not just in terms of reaching an audience, but also building a real business. Brut is already profitable in France, and it plans to be profitable in the U.S. within three years.

Asked whether he’s worried about relying on social platforms to reach his audience, Lacroix argued that even if you focus on publishing on your own website, you’re reliant on Google for traffic.

“For me, it’s not a problem of distribution, if you’re diversified enough,” he said. “It’s a problem of: What’s your business model? Why did Spotify explode from day one? They have a global DNA. It’s exactly the same for us.”

For example, Lacroix said that Brut’s audience is concerned about many of the same issues no matter what country they’re in. And the company is able to produce content for them in a relatively low-cost way, because it can shoot a video in French or English, then add subtitles in a variety of languages — most audiences won’t even notice because they’re watching on their phones, with the sound off.

To be clear, Brut hasn’t exactly been ignoring the U.S. market before this. The company said it has an audience of 30 million daily active viewers across the globe, including in the United States, and it opened an office in New York City a couple of years ago. By “launching” here, Brut means it’s hiring an advertising sales force to start monetizing that audience.

The company previously raised €10 million (approximately $11.1 million) from Kima Ventures, according to Crunchbase. The new funding was led by Red River West and blisce, with participation from Aryeh Bourkoff, Eric Zinterhofer and others.

“When deciding where to invest, we look for mission-driven companies whose values are aligned with our own,” said blisce founder and CEO Alexandre Mars in a statement. “Like blisce’s previous investments in Spotify, Pinterest and Bird, we believe that Brut’s unique global approach represents a special competitive advantage, as well as an understanding that business success and positive social impact are inextricably linked.”

Powered by WPeMatico

Workiz, a startup whose software helps field service professionals manage their work, said today it has raised $5 million in Series A funding. The funding was led by Magenta Venture Partners, with participation from returning investor Aleph. The company announced the launch of Workiz Voice, an Amazon Alexa-powered feature that allows the app to be controlled with voice commands, making it safer to use while field service workers are driving.

Magenta Venture Partners general partner Ran Levitzky will join Workiz’s board of directors. The Series A brings Workiz’s total funding so far to $7.3 million. The company says it grew 247% last year and CEO Adi Azaria told TechCrunch that the company currently has thousands of customers in the U.S. and Canada. Many are home or equipment maintenance companies, including locksmiths, garage door repair, junk removal, appliance repair and carpet cleaning businesses. The software has also been used by medical transport companies, including Trinity Air Medical, to manage highly time-sensitive delivery of organ donations to their recipients. The company targets field services businesses with fewer than 50 employees, but can scale up to organizations with many more technicians and franchises.

Workiz’ new funding is being used on its automation platform for field service workers and Workiz Voice, as well as hiring for its North American team and operations.

The startup was founded in 2015 by Saar Kohanovitch, Idan Kadosh and Erez Marom. Kadosh and Marom worked as locksmiths for more than 15 years in San Diego, Calif. They were frustrated by the field service management software options available and reliance on pen, paper and Excel spreadsheets to manage their business. They also carried multiple cell phones, as most customer appointments were arranged by phone calls and they could not hide their personal numbers.

Workiz was created to give field service companies a full set of tools, including the ability to monitor interactions between technicians and customers, keep detailed records of client calls and texts, send clients reminders, track advertising spending and effectiveness and process credit card payments.

“At Workiz, we have a vision to transform tradespeople into business professionals, and the Workiz platform is able to successfully do so. While 75% of small businesses close within their first five years of business, businesses who are using Workiz are able to slash that number down to just 20%,” said Azaria.

About 52% of field services companies still rely on pen and paper to manage their businesses, presenting a growth opportunity for Workiz. To get them to switch, Workiz provides free help for onboarding, which can be completed in as little as one or two days. The software syncs with QuickBooks or CSV files.

The startup says Workiz Voice, which enables workers to look up job schedules, sort through leads, communicate with team members or clients and find directions to their next job, is the first feature of its kind on the market. It helps Workiz Voice differentiate from other field service management software like Jobber or HouseCall Pro.

In a press statement, Levitzky said “We are constantly on the lookout for exciting companies transforming industries, and Workiz ticked all of the boxes. The company’s approach levels the playing field so that businesses of all sizes can better secure and manage job opportunities, given the on-demand nature of the field service industry.”

Powered by WPeMatico

ShareGrid, the U.S.-based marketplace for sharing, buying and selling film and photography equipment, has acquired the U.K’s BorrowFox as part of its international expansion plans.

BorrowFox operates a “peer-to-peer” film and camera rental community that lets people rent out their under-utilised gear. ShareGrid says it expects to launch in the U.K. in 2020 (where it will compete with the likes of Fat Lama).

Terms of the deal remain undisclosed, although I understand ShareGrid is acquiring all of BorrowFox’s assets outright. The two companies aren’t disclosing if it was a cash or stock deal or mixture of the two, or who BorrowFox’s investors were.

Meanwhile, I’m told that BorrowFox’s founders, Arthur Pierse and Alastair Woods, won’t be joining ShareGrid.

In the U.S., ShareGrid lets users rent film and camera equipment from each other, including cinema cameras, still cameras, lenses, audio equipment, drones, lighting equipment, gimbals and other accessories, as well as studio space, locations and production vehicles.

The idea behind the service is to help creatives access world-class equipment at lower rental fees, and earn an income from their unused gear. The company also offers a buy-and-sell service, custom production quotes and instant insurance, acting as a “one-stop shop” for filmmakers, photographers and production professionals.

Following the acquisition, ShareGrid says it will host more than 100,000 users, with more than $1 billion worth of film and camera equipment available on its combined platform. Once the acquisition is complete and ShareGrid has launched in the U.K., existing BorrowFox members will be asked to transfer their account to ShareGrid.

“At ShareGrid, our mission is to enable all filmmakers and photographers, regardless of background, budget or location, to have access to cutting-edge and affordable equipment,” says Marius Ciocirlan, co-founder and CEO of ShareGrid in a statement. “We see the acquisition of BorrowFox as an exciting opportunity to enter the U.K. market, and build on a company that has had a similar vision from the start.”

Powered by WPeMatico

HowNow, the workforce learning platform, has raised $3 million (£2.4 million) in a “pre-series A” funding round. The round is led by Mark Pearson’s Fuel Ventures and brings the total raised by the startup to $4.5 million.

Other investors include Andy Murray OBE; Michael Whitfield and Chris Bruce (founders of Thomsons Online Benefits); Bernie Sinniah (former managing director at Citi Bank); and Alwin Magimay (a former partner at McKinsey).

Designed for organisations that want to support teams with self-directed learning and the development of “business-critical” skills, HowNow is described as an integrated learning platform that autonomously curates learning resources, “business intelligence” and market insights that live in various internal and external sources.

The idea is to bring together these different learning resources — ranging from “nuggets” of knowledge shared by existing employees to internal data to external content libraries, blogs and podcasts — and match these to different job descriptions and employee skill-sets.

This is powered by a browser extension and integrations with Slack, Salesforce, HubSpot and more than 300 other apps. Machine-learning is also employed to push the right content to the right employee.

“Employers can also use HowNow to identify skills gaps within the company based on job market data, via HowNow’s real-time analytics and built-in certification,” adds the company. To achieve this, the platform claims to monitor more than 20,000 job specifications to understand the in-demand skills and requirements companies are searching for.

“Based on self-review, peer-review and real-time job market data we build the user’s skill profile as they onboard the platform,” explains HowNow co-founder and CEO Nelson Sivalingam. “Once in HowNow, they see learning recommendations based on assigned learning pathways, their role, skill requirements and internal benchmarks. This content is brought together from a variety of their internal sources (G Drive, Sharepoint, CRM, etc.), external sources (content libraries, blogs, podcasts, etc.) and the autonomously organised knowledge shared by their peers directly on HowNow.”

Employees can then access these learning resources directly within the applications they already work with and receive contextually relevant suggestions powered by HowNow’s “AI.” “For example, they can be in Slack and search all of their learning resources directly from their using the HowNow Slack app,” says Sivalingam. “They can also convert a message from a colleague into a nugget that will get stored and autonomously organised in HowNow.”

Similarly, Sivalingam says that, via HowNow, client-facing teams are able to access up-to-date product knowledge, business intelligence and market insights directly within their inbox, CRM and help desk, which enables them to reduce customer response times.

“Fast-growing companies like GymShark are able to capture the knowledge in the heads of their internal subject matter experts by giving them a quick and easy way to share knowledge, build a glue between scattered content, avoid repeat questions and get everyone on the same page,” he adds.

To that end, I’m told that more than 500,000 users currently use HowNow within over 125 businesses. These range from SMEs to larger organisations, across 14 different countries. A classic SaaS play, the startup generates revenue through a licence fee per user.

Powered by WPeMatico

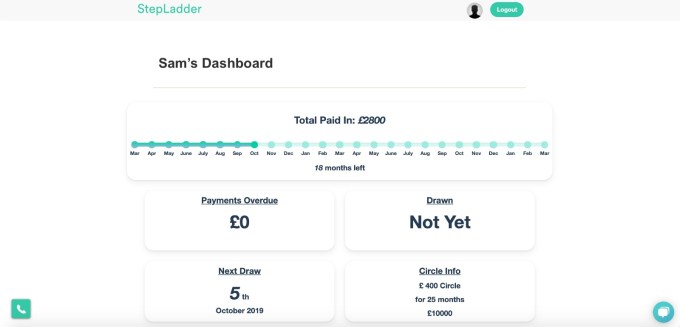

StepLadder, another London-based startup aiming to help so-called “generation rent” get onto the housing ladder, has raised £1.5 million in seed funding.

Backing the round is Spanish banking giant BBVA and fintech VC Anthemis via the London-based venture studio on which the pair have partnered. Early investor Seedcamp also followed on, in addition to unnamed angel investors.

StepLadder says it will use the new capital and support provided by BBVA/Anthemis to further develop its “collaborative finance platform.” The startup is also eyeing international expansion.

Founded in 2015 by Matthew Addison and joined by Lucy Mullins and Mihir Bhushan, StepLadder’s collaborative deposit saving platform is designed to motivate renters to save for a deposit so they can purchase their first home.

Using a financial model known as a “Rotating Credit and Savings Association” (ROSCA), StepLadder puts its members into “Circles,” whereby each individual member contributes an identical amount on a monthly basis — ranging from £25 to £1,000. A random draw then takes place each month and the winner is provided with that month’s full pot to use toward their deposit.

“For most first-time buyers, it’s really difficult to get on the property ladder,” says Addison. “Home ownership rates amongst 25 to 34-years-olds have collapsed… [with around] 250,000 fewer first-time buyers every year, for over a decade, in the U.K. alone. Raising the deposit is the biggest hurdle. At StepLadder we’re using something called a ROSCA, a form of collaborative finance where people work together in groups to help our members raise their property deposits, on average, 45% faster.”

As an example, StepLadder might match you to a £500 a month Circle for 20 months to raise £10,000. This would see it find 19 other members to be in the same Circle. “Each month the £10,000 is randomly allocated and you could be drawn at any point in that 20 months,” explains StepLadder’s Lucy Mullins. “You have to keep making your £500 a month payment for the full 20 months, so at the end everybody has paid in £10,000 and everybody has received £10,000.”

To help protect the platform from being abused, Mullins says that while a member is still part of a Circle, the startup will only release the pot to their solicitor for use as a property deposit. “So, if somebody stops paying after they have been drawn then we wouldn’t release their payout until they had made catch-up payments.”

StepLadder also supports members along the house-buying journey. The app lets members engage with a community of like-minded people and access group-buying discounts on services such as mortgages, solicitor fess and surveyors. The latter forms part of the company’s revenue stream.

“We introduce our members (at their request) to high-quality service providers, such as mortgage brokers, lending banks, surveyors and insurance providers,” says Addison. “In return, these partners pay us fees or commissions. We offer discounts on these transaction services via the combined buying power of our members in their Circles.”

In addition, there is a small monthly fee (between 2-5%) to be part of a Circle, which Mullins says covers the cost of delivering the service.

This includes holding money securely in a client money account, a payment waiver if a member were to become sick or unemployed after buying a property with their StepLadder deposit, credit bureau costs and the cost of a Circle host to support members on the journey.

“We do not aim to profit from the monthly administration fees we charge members and would usually be able to save our members much more in discounts than they pay in fees,” says Mullins.

Meanwhile, StepLadder has plans to expand the use cases for Circles and evolve the platform to also cover general savings goals and targeted “big ticket items.”

Explains Addison: “In Brazil, ROSCAs are used by nine million consumers for everything from dishwashers to cars to homes. We have already begun to demonstrate this potential with both our First Step offering (smaller circles from £25 a month) and proposed partnered launches.”

Powered by WPeMatico

Tines, a Dublin-based startup that lets companies automate aspects of their cybersecurity, has raised $4.1 million in Series A funding. Leading the round is Blossom Capital, the venture capital firm co-founded by ex-Index Ventures and LocalGlobe VC Ophelia Brown.

Founded in February 2018 by ex-eBay, PayPal and DocuSign security engineer Eoin Hinchy, who was subsequently joined by former eBay and DocuSign colleague Thomas Kinsella, Tines automates many of the repetitive manual tasks faced by security analysts so they can focus on other high-priority work. The pair have bootstrapped the company until now.

“It was while I was at DocuSign that I felt there was a need for a platform like Tines,” explains Hinchy. “We had a team of really talented engineers in charge of incident response and forensics but they weren’t developers. I found they were doing the same tasks over and over again so I began looking for a platform to automate these repetitive tasks and didn’t find anything. Certainly nothing that did what we needed it to, so I came up with the idea to plug this gap in the market.”

To that end, Tines lets companies automate parts of their manual security processes with the help of six software “agents,” with each acting as a multipurpose building block. Therefore, regardless of the process being automated, it only requires combinations of these six agent types configured in different ways to replicate a particular workflow.

“I wanted there to be as few agent types as possible, to simplify the system, and I haven’t discovered a workflow in which tasks sit outside of these agents yet,” says Hinchy. “Once a customer signs up they can start automating their own workflows immediately, and most of our customers see value from day one. If they need a hand, my team works with them to establish how they currently manually carry out tasks, such as identifying and dealing with a phishing attack. Each step of dealing with the attack — from cross-checking the email address with trusted contacts or a blacklist, to scanning attachments for viruses or examining URLs — will be performed by one of the six agent types. This means we can assign these tasks to an agent to create the workflow, or as we call it, the “story.”

So, for example, once a phishing email triggers the first agent, the following steps in the “story” are automatically carried out. In this way, Tines might be described as akin to IFTTT, “but an exceptionally powerful, enterprise version of the IFTTT concept, designed to manage much more complex workflows.”

Competitors are cited as Phantom, which last year was acquired by Splunk, and Demisto, which was bought by Palo Alto Networks. However, Hinchy argues that a key differentiator is that Tines doesn’t rely on pre-built integrations to interact with external systems. Instead, he says the software is able to plug in to any system that has an API.

Meanwhile, Tines says it will use the new funding to hire engineers in Dublin who can help improve the platform through R&D, as well as grow its customer base with companies in the U.S. and in Europe. Notably, the startup plans to expand beyond cybersecurity automation, too.

“Our background is in security, so with Tines, we’ve initially focused on helping security teams automate their repetitive, manual processes,” says Hinchy. “What makes us different is that nowhere does it say we can’t expand beyond this, to help other teams and sectors automate tasks. The advantage of our direct-integration model is that Tines doesn’t care if you’re talking to a security tool, HR system or CRM, it treats them the same. In the next 18 months, we plan to expand Tines outside security, hire more talent and increase the product team from 8 to 20.”

Powered by WPeMatico

Personal finance startup Truebill announced today that it has raised $15 million in Series B funding.

The new funding was led by Eldridge Industries, with participation from Evolution VC and previous investors, including Cota Capital, Lucas Venture Group and YouTube co-founder Jawed Karim.

When the Y Combinator-backed startup raised seed funding back in 2016, it was focused on what Chief Revenue Officer Yahya Mokhtarzada now describes as “a single function” — helping users track all their subscriptions and recurring expenses, and then to cancel them when desired.

Mokhtarzada said the Truebill team subsequently saw an opportunity, given “the increasing degree of financial complexity in people’s lives,” to take “a more holistic view of personal finance.”

Truebill still offers subscription tracking, and Mokhtarzada said that’s usually what brings new users in. But it’s also added capabilities like automated budgeting, automated saving and bill negotiation. And this fall, it plans to launch additional features, including bill pay, credit score monitoring and a rewards program.

Consumers have plenty of other personal finance tools to choose from, but Mokhtarzada said most of them are focused on fulfilling a specific need and will likely become less relevant as your financial situation changes.

“The other half is, if you look at the App Store, it’s filled with single point solutions,” he said. “As your financial life gets more sophisticated and complex, the consumer is ending up with five or more different point solutions. All of that needs to be consolidated into one place.”

Truebill says it currently has 500,000 active users. The basic product is free, then users can pay a price of their choosing for premium features like custom budget categories; Truebill also takes a cut of the savings when it negotiates lower bills.

The company recently opened new headquarters in Silver Spring, Md. Mokhtarzada said Truebill still has an office in San Francisco, but he noted that he and his co-founders/brothers previously built Webs.com in Silver Spring.

“San Francisco obviously has a very competitive market — it’s harder to hire and very difficult to retain talent,” he added. “With the D.C. area, it feels like we’ve found an untapped market, with very talented engineers working for the government, working in an area of technology that’s not very exciting for them.”

Powered by WPeMatico

LabGenius, a London-based startup applying AI and “robotic automation” to protein drug discovery, has raised $10 million in Series A funding.

The round is led by Lux Capital and Obvious Ventures, with participation from Felicis Ventures, Inovia Capital, Air Street Capital and existing investors. Also investing is Recursion Pharmaceuticals’ founder and CEO Chris Gibson, as well as Inovia Capital General Partner Patrick Pichette, who was formerly Google’s CFO.

Lux Capital’s Zavain Dar and Obvious Ventures’ Nan Li will join the LabGenius board of directors. Notably, the U.K. company’s early investors include Nathan Benaich, Torsten Reil, EF’s Matt Clifford, and Philipp Moehring, to name just a few.

“LabGenius is a full-stack protein engineering company: we combine artificial intelligence (AI), robotic automation and synthetic biology to evolve next-generation protein therapeutics,” founder and CEO Dr. James Field tells me.

“My central thesis, the thing that’s really the driving force behind the company, is the conviction that we’re entering an age in which humans will no longer be the sole agents of innovation. Instead, new knowledge, technologies and sophisticated real-world products will be invented by smart robotic platforms called empirical computation engines. An empirical computation engine is an artificial system capable of recursively and intelligently searching a solution space.”

LabGenius’ flagship technology is called “EVA,” which Field describes as a “machine learning-driven, robotic platform” capable of evolving new proteins. “As a smart robotic platform, EVA is capable of designing, conducting and critically learning from its own experiments,” he says.

The goal: to discover and develop new protein therapeutics that are currently hard for humans alone to find.

“For decades, scientists, engineers and technologists have dreamt of building ‘robot scientists’ capable of autonomously discovering new knowledge, technologies and sophisticated real-world products,” explains Field.

“For protein engineers, that dream has now entered the realm of possibility. The rapid pace of technological development across the fields of synthetic biology, robotic automation and ML has given us access to all the essential ingredients required to create a smart robotic platform capable of intelligently discovering novel therapeutic proteins.”

To that end, Field frames the development of EVA as a “long-term, ambitious undertaking” that he says will enable the startup to address previously unsolvable protein engineering challenges and in doing so, develop urgently needed therapeutics.

“My ultimate goal for LabGenius is to establish a fully integrated biopharmaceutical company powered by the world’s most advanced protein engineering platform,” he adds. “Quite honestly, this is a gargantuan undertaking and, while we’ve already established one of the world’s most technically sophisticated protein engineering operations, we’re only just scratching the surface of what’s possible.”

More broadly, there is a tension that many deep tech companies face, which is determining how best to develop technology that’s tightly aligned to real-world commercial needs (before running out of capital!). “For LabGenius, we’ve achieved this in a highly intentional way by undertaking a series of commercial projects of increasing complexity from the company’s earliest days,” Field says.

One on-going project is with Tillotts Pharma AG to identify and develop new drug candidates for the treatment of inflammatory bowel disease (IBD).

“Our business model is pretty simple,” says the LabGenius founder. “We use EVA to discover and characterise new drug molecules and then partner with pharma companies who can take these molecules to market. For example in a typical partner-financed early discovery program, we’ll take a project from concept to early pre-clinical stage. Typical deal structures include a blend of R&D payments, milestones & royalties.”

Meanwhile, LabGenius will use the capital to scale its team, expand the scope of its discovery platform and initiate an “internal asset development program.” The next goal is to evolve novel antibody fragments capable of treating conditions that cannot be addressed using conventional antibody formats.

Powered by WPeMatico

Microsoft wants to make it as easy as possible to migrate to Microsoft 365, and today the company announced it had purchased a Canadian startup called Mover to help. The companies did not reveal the acquisition price.

Microsoft 365 is the company’s bundle that includes Office 365, Microsoft Teams, security tools and workflow. The idea is to provide customers with a soup-to-nuts, cloud-based productivity package. Mover helps customers get files from another service into the Microsoft 365 cloud.

As Jeff Tepper wrote in a post on the Official Microsoft Blog announcing the acquisition, this is about helping customers get to the Microsoft cloud as quickly and smoothly as possible. “Today, Mover supports migration from over a dozen cloud service providers — including Box, Dropbox, Egnyte, and Google Drive — into OneDrive and SharePoint, enabling seamless file collaboration across Microsoft 365 apps and services, including the Office apps and Microsoft Teams,” Tepper wrote.

Tepper also points out that they will be gaining the expertise of the Mover team as it moves to Microsoft and helps add to the migration tools already in place.

Tony Byrne, founder and principal analyst at Real Story Group, says that moving files from one system to another like this can be extremely challenging regardless of how you do it, and the file transfer mechanism is only part of it. “The transition to 365 from an on-prem system or competing cloud supplier is never a migration, per se. It’s a rebuild, with a completely different UX, admin model, set of services and operational assumptions all built into the Microsoft cloud offering,” Byrne explained.

Mover is based in Edmonton, Canada. It was founded in 2012 and raised $1 million, according to Crunchbase data. It counts some big clients as customers, including AutoDesk, Symantec and BuzzFeed.

Powered by WPeMatico

Earlier this month at TechCrunch Disrupt San Francisco, we sat down with Box’s Aaron Levie and PagerDuty’s Jennifer Tejada to discuss their respective companies’ paths to an IPO, the general IPO landscape and the pros and cons of going public. With a lot of recent IPOs faltering and increased pressure on startup valuations, now is as good a time as ever to think about the role IPOs play in a company’s lifespan.

“I think it’s really important to think of the IPOs, the beginning, not the end,” said Tejada. “We all live in Silicon Valley and that can be a little bit of an echo chamber and you talk about exits all the time. The IPO is an entrance, right? It is part of the beginning of a long journey for a durable company that you want to build a legacy around. And so, it is a moment — it’s the start of you really sharing a narrative backed by financial data to help people understand your current business, the potential for your business, the market that you’re in, etc. And I think we tend to talk about it like it’s the be-all end-all.”

That’s something Levie definitely agrees with. “I think we have too much of a fixation on the IPO moment versus just building durable business models and how do they end up translating into valuations. The valuation that you get at an IPO is due to variety factors.”

SAN FRANCISCO, CALIFORNIA – OCTOBER 02: (L-R) PagerDuty CEO & Chairperson Jennifer Tejada, Box Co-Founder/Chairman & CEO Aaron Levie, and TechCrunch Writer Frederic Lardinois speak onstage during TechCrunch Disrupt San Francisco 2019 at Moscone Convention Center on October 02, 2019 in San Francisco, California. (Photo by Steve Jennings/Getty Images for TechCrunch)

It’s no secret that Box and PagerDuty had very different experiences as they got ready to go public. Box announced its S-1 only a few days before a major market crash back in 2014. PagerDuty, on the other hand, went public earlier this year, with solid financials and very little drama.

Tejada, in many ways, attributed that to the work she and her team did to get the company ready for this moment. “I get asked a lot by CEOs that are thinking about getting ready to go public, ‘you know, what was your playbook? How do you do this?’ And I think instead of thinking about what’s the playbook, you need to be intellectually honest about what your business looks like,” she said. In her view, CEOs need to focus on the leading indicators for their business — the ones they want the market to understand. But she also noted that the market needs to understand a company’s potential in the long run.

“You want to make sure that the market understands where you think the business can go and gets excited about it, but that they don’t over-rotate in their expectations, because dealing with really high expectations creates a lot of downstream difficulty.”

Powered by WPeMatico