Fundings & Exits

Auto Added by WPeMatico

Auto Added by WPeMatico

Tilting Point announced yesterday that it has acquired Gondola, a company that aims to increase game monetization by optimizing in-game offers and video ads.

Tilting Point CEO Kevin Segalla described his company’s model as “progressive publishing” — usually, mobile game developers start working with Tilting Point because they need help with user acquisition, and then develop a deeper publishing relationship over time.

“With a select group of our development partners, we’ll acquire an IP, and we’ll … have them take the engine that they already have and create a whole new game,” Segalla said. “It’s really a dual effort between us and the developer.”

To accomplish all this, the company has built artificial intelligence tools to improve user acquisition. But the other side of that equation, in Segalla’s view, is increasing the lifetime value of the users acquired.

“At the end of the day, scaling a game boils down to two simple things, [cost per install] and LTV,” he said. “Strong developers are working to improve the LTV of their players, but there’s a lot of low-hanging fruit that with the right toolset you can use to improve the lifetime values. That’s what Gondola is about … We’ve been following for years, and we said, ‘Let’s bring this in-house.’ ”

Gondola currently offers four modules: Target Optimization (choosing the best offer for a player), Rewarded Video Ad Optimization (choosing the right amount of virtual currency to reward a player for watching a video ad), Store Optimization (choosing the right store items to show a player) and Currency Optimization (choosing the best virtual currency amounts for offers and promotions).

The financial terms of the acquisition — Tilting Point’s first — were not disclosed. As part of the deal, Gondola CTO André Cohen is joining Tilting Point as its head of data science, while his co-founder and CEO Niklas Herriger remains involved as an executive advisor.

Powered by WPeMatico

Airbnb may be another overvalued “unicorn,” but it’s no WeWork.

The Information this morning reported new Airbnb financials — indicating a massive increase in operating losses — that immediately call Airbnb’s future into question. Precisely, Airbnb lost $306 million on operations on $839 million in revenue, namely as a result of marketing spend, in the first quarter of 2019. In total, Airbnb invested $367 million in sales and marketing, representing a 58% increase year-over-year, in Q1. The company is gearing up for a major liquidity event next year and is making a concerted effort to rake in new customers, as any soon-to-be-public business would.

Given WeWork’s sudden demise, coupled with Uber and Lyft’s lukewarm performances on the stock markets, many have wondered how Wall Street will respond to Airbnb’s eventual IPO prospectus. Will money managers have an appetite for another over-valued Silicon Valley darling? Or will the market compete like mad for shares in the massive home-sharing marketplace?

But Airbnb, again, is no WeWork, and I wager Wall Street will have a much friendlier approach to its offering. For one, Airbnb’s co-founder and chief executive officer Brian Chesky isn’t dropping $60 million on private jets — I don’t think. CEO behaviors aside, Airbnb has more capital in the bank than it has raised in its entire 11-year history, which is a whole lot of money. This is all according to a source who is familiar with Airbnb’s financials and shared this detail with TechCrunch following The Information’s Thursday morning report. As for Airbnb, the company told TechCrunch, “we can’t comment on the figures, but 2019 is a big investment year in support of our hosts and guests.”

Airbnb’s CEO Brian Chesky speaks at TechCrunch Disrupt SF 2014

Airbnb has attracted more than $3.5 billion in equity funding at a $31 billion valuation and has even more locked away in its bank account. Additionally, Airbnb has an untouched $1 billion credit line, the source said. Presumably, the referenced credit line is the 2016 $1 billion debt financing from JPMorgan, CitiGroup, Morgan Stanley and others.

Moreover, Airbnb has been “cumulatively” free cash flow positive for some time, meaning that it’s seen more money coming in than going out during recent quarters, according to our source. It has been reported that Airbnb surpassed $1 billion in revenue in the second quarter of 2019 and in the third quarter of 2018, but we’re guessing the business did not top $1 billion in Q4 of 2018 or Q1 of 2019 because it if had, that information would probably have been “leaked.”

Finally, Airbnb has been profitable on an EBITDA (earnings before interest, taxes, depreciation and amortization) basis for two consecutive years, the company announced in January. Gross bookings, meanwhile, are growing, as is Airbnb’s business offering and its experiences product.

Powered by WPeMatico

Pendo, the late-stage startup that helps companies understand how customers are interacting with their apps, announced a $100 million Series E investment today on a valuation of $1 billion.

The round was led by Sapphire Ventures . Also participating were new investors General Atlantic and Tiger Global, and existing investors Battery Ventures, Meritech Capital, FirstMark, Geodesic Capital and Cross Creek. Pendo has now raised $206 million, according to the company.

Company CEO and co-founder Todd Olson says that one of the reasons they need so much money is they are defining a market, and the potential is quite large. “Honestly, we need to help realize the total market opportunity. I think what’s exciting about what we’ve seen in six years is that this problem of improving digital experiences is something that’s becoming top of mind for all businesses,” Olson said.

The company integrates with customer apps, capturing user behavior and feeding data back to product teams to help prioritize features and improve the user experience. In addition, the product provides ways to help those users either by walking them through different features, pointing out updates and new features or providing other notes. Developers can also ask for feedback to get direct input from users.

Olson says early on its customers were mostly other technology companies, but over time they have expanded into lots of other verticals, including insurance, financial services and retail, and these companies are seeing digital experience as increasingly important. “A lot of this money is going to help grow our go-to-market teams and our product teams to make sure we’re getting our message out there, and we’re helping companies deal with this transformation,” he says. Today, the company has more than 1,200 customers.

While he wouldn’t commit to going public, he did say it’s something the executive team certainly thinks about, and it has started to put the structure in place to prepare should that time ever come. “This is certainly an option that we are considering, and we’re looking at ways in which to put us in a position to be able to do so, if and when the markets are good and we decide that’s the course we want to take.”

Powered by WPeMatico

Pensando, an edge computing startup founded by former Cisco engineers, came out of stealth mode today with an announcement that it has raised a $145 million Series C. The company’s software and hardware technology, created to give data centers more of the flexibility of cloud computing servers, is being positioned as a competitor to Amazon Web Services Nitro.

The round was led by Hewlett Packard Enterprise and Lightspeed Venture Partners and brings Pensando’s total raised so far to $278 million. HPE chief technology officer Mark Potter and Lightspeed Venture partner Barry Eggers will join Pensando’s board of directors. The company’s chairman is former Cisco CEO John Chambers, who is also one of Pensando’s investors through JC2 Ventures.

Pensando was founded in 2017 by Mario Mazzola, Prem Jain, Luca Cafiero and Soni Jiandani, a team of engineers who spearheaded the development of several of Cisco’s key technologies, and founded four startups that were acquired by Cisco, including Insieme Networks. (In an interview with Reuters, Pensando chief financial officer Randy Pond, a former Cisco executive vice president, said it isn’t clear if Cisco is interested in acquiring the startup, adding “our aspirations at this point would be to IPO. But, you know, there’s always other possibilities for monetization events.”)

The startup claims its edge computing platform performs five to nine times better than AWS Nitro, in terms of productivity and scale. Pensando prepares data center infrastructure for edge computing, better equipping them to handle data from 5G, artificial intelligence and Internet of Things applications. While in stealth mode, Pensando acquired customers including HPE, Goldman Sachs, NetApp and Equinix.

In a press statement, Potter said “Today’s rapidly transforming, hyper-connected world requires enterprises to operate with even greater flexibility and choices than ever before. HPE’s expanding relationship with Pensando Systems stems from our shared understanding of enterprises and the cloud. We are proud to announce our investment and solution partnership with Pensando and will continue to drive solutions that anticipate our customers’ needs together.”

Powered by WPeMatico

French startup Strapi has raised a $4 million seed round led by Accel and Stride.vc. The company has been working on an open-source Node.js headless content management system.

That’s a lot of technical words in a row, but it’s not that hard to understand what Strapi is. Content management systems, or CMS, are web applications that let you publish and manage content on a website. It can be a blog, a corporate website with multiple pages, a portfolio, etc. The most popular CMS in the world is WordPress.

Over the past few years, many companies and developers have started to separate the CMS back end (the administration pages where you write and upload content) and the front end (the public website accessible to anyone).

This way, you can run a CMS in the back end, and develop your own custom front end that queries the back end using API calls — this is what’s called a headless CMS. It provides a ton of flexibility and should make your website faster. This is how TechCrunch.com works for instance, with WordPress running as a headless CMS.

Strapi has become quite popular in the headless CMS space, with 500,000 downloads and 250 contributors to the open-source project. The first version was released on GitHub in 2015.

Anybody can download Strapi and run it on their own server. You can then develop your front end, fetch content in your mobile app using the Strapi API and more. Strapi lets you customize the admin panel so that you only see the fields you need when you add content. It works with SQLite, MongoDB, MySQL and Postgres databases.

The company plans to build an ecosystem of plugins to expand the features of your CMS installation. Eventually, the startup could launch a hosted version of Strapi so you don’t have to manage the server infrastructure yourself.

Solomon Hykes, Guillermo Rauch and Eli Collins are also participating in today’s round. Existing investors include Bpifrance, SGPA, François-Charles Debeunne, Jean-Philippe Bellaiche, Kima Ventures, Nicolas Debock, Patrick Dalsace and Nicolas Rosset.

Powered by WPeMatico

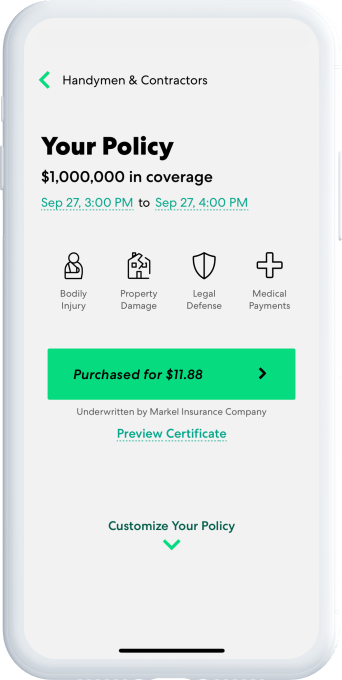

Thimble, which offers flexible, short-term insurance to small businesses and freelancers, is announcing that it has raised $22 million in a Series A funding round led by IAC.

Until today, the startup was known as Verifly, a name tied to the company’s initial aim of providing insurance to drone pilots. However, founder and CEO Jay Bregman (who previously founded ridesharing company Hailo) said that thanks to customer demand, the team kept adding insurance for different types of businesses — and now it’s rebranding to reflect that broader vision.

While it’s easy to talk about Thimble customers as being part of the “gig economy,” Bregman noted that these aren’t just people driving for Uber or delivering for Postmates — only 4% of the company’s customers identify as gig economy workers.

“There is this larger thing called the gig economy: People working in flexible ways, on their own terms,” he said.

In fact, Thimble now says it provides liability coverage for customers in more than 100 professions, including handymen, landscapers, DJs, musicians, beauticians and dog walkers. Policies can be purchased directly from the Thimble website or app by the hour, day, week, month or year.

The idea, Bregman said, is that as work becomes shorter term and “more transactional,” it doesn’t make sense to buy an annual insurance policy. To illustrate that point, he noted that 75% of customers didn’t have insurance before buying from Thimble, and that 50% of customers are buying policies to cover a single day or less. And the company says it’s on track to sell 100,000 by the end of the year.

Thimble’s policies are underwritten by Markel, an insurance company that Bregman praised for its “infrastructure and talent.”

At the same time, he said, “We have always been the owner of the product itself. Basically, we worked with carrier partners to bring [our products] to market; the way we do that may evolve slightly as we get older and more mature.”

Thimble has received regulatory approval to sell insurance in 48 states so far. Asked whether the broader political debates about whether gig workers are employees could affect the company’s business, Bregman pointed again to the fact that the vast majority of Thimble customers don’t consider themselves gig workers.

“Our only fear here is that in trying to solve a very particular problem with long-term gig employment, that some of these laws may actually unintentionally scare off or capture legitimate freelancers,” he said.

As for the investment, IAC’s chief strategy officer Mark Stein acknowledged that the digital media holding company doesn’t make many early-stage, minority investments. But he said that deals like this are about “planting seeds.”

“What we think about at IAC is: How can we go about planting seeds of growth for the future? What will become the next ANGI Homeservices? What will become the next Match Group?” Stein said, alluding to two IAC-owned businesses that may get spun off. “We need to find these kinds of large, addressable market opportunities now in the hopes of creating very large, industry-changing companies in the future.”

Previous investors Slow Ventures, AXA Venture Partners and Open Ocean also participated in the round, bringing Thimble’s total funding to $29 million.

Powered by WPeMatico

Seoul-based education technology startup Mathpresso announced today that it has raised $14.5 million in Series B funding. The company’s flagship app is Qanda, which provides students with math and science help and tutoring. Participants in the round include Legend Capital, InterVest, NP Investments and Mirae Asset Venture Investment.

This brings Mathpresso’s total funding so far to $21.2 million. Its previous round of funding was a $5.3 million Series A announced at the end of last year.

Mathpresso says Qanda (the name stands for “Q and A”) is currently used by a third of students in South Korea. The app launched in markets including Japan, Vietnam, Indonesia and Singapore last year and now has users in more than 50 countries. Qanda uses AI-based optical character recognition to scan math problems. Students take a photo of a problem and upload it to get instructions for how to solve it from the app or tutors.

In a statement, Legend Capital managing director Joon Sung Park said, “As an early investor of China’s leading mobile education companies such as Zuoyebang and Onion Math, Legend Capital has witnessed robust growth of China’s mobile education market. We strongly believe that Mathpresso has the technological and operation capabilities to expand overseas and grasp new opportunities emerging from the digitization of education, such as offering personalized learning for each student.”

Powered by WPeMatico

Extra Crunch offers members the opportunity to tune into conference calls led and moderated by the TechCrunch writers you read every day. This week, TechCrunch’s Connie Loizos hopped on the line with prominent investor, entrepreneur, thought leader, and Techstars co-founder Brad Feld to chat about the latest edition of his book “Venture Deals,” his advice to founders and investors, and his take on hot-button issues of the day.

In their conversation, Brad and Connie discuss the need to know information when it comes to preparing for, structuring and executing venture deals, and how that information has changed over the past several decades. Feld walks through the major topics that have been added in the latest edition of the book, such as how to handle venture debt, along with tactical attributes that aren’t currently in the book, such as secondary market trading.

Brad also shares his take on the most effective fundraising tactics for founders, and which common pieces of advice might be overblown.

Brad Feld: “I think the approach to the amount of money that you’re raising is both nuanced and evolves based on what financing round you’re at. So if you’re in an early round, some of the characteristics are different than if you’re in a later round. But I think the general truism… that I like to use when people say, ‘Well, how much money should I raise?’

I start with two variables and you the entrepreneur get to define those two variables. The two variables are: the amount of money you raise and what getting to the next level means. The amount of money you should raise is the amount of money that you need to get your business to the next level. There are lots of different ways to define what next level is and by forcing yourself internally to define next level and then define what you need in terms of capital to get to that next level… when you’re raising that first round of financing or even the second or third round of financing, it helps you size rationally what you need versus reactively to whatever the market characteristics are.

I actually encourage entrepreneurs to raise the least amount of money they need to get to the next level, or at least that’s the number that they go out to market with. Not a range, not a big number because you’re trying to drive some kind of valuation characteristic off a big number, but the amount of money that you actually think you need to get to the next level. Then if you can be oversubscribed, that’s an awesome situation.”

Feld and Connie dive deeper into current issues in the startup and venture landscape, including Brad’s take on the impact of the SoftBank Vision Fund, what went down internally and externally at both WeWork and Uber, as well as how boards, executives and founders can manage cult of personality and static company cultures.

For access to the full transcription and the call audio — and for the opportunity to participate in future conference calls — become a member of Extra Crunch. Learn more and try it for free.

Connie Loizos: I think the last time I saw you in person was out here in San Francisco at an event I was hosting and that was maybe two years ago?

Brad Feld: Yup, that’s right. That was at the Autodesk Lab if I remember correctly.

Loizos: Yes. It’s good to hear your voice, and thank you for joining us on this call. We have a lot of readers who are big fans of yours that are on the line and are eager to learn about your book “Venture Deals” and your broader thoughts about the current state of the market. That said — and I know you only have so much time — let’s dive first into the book. So Wiley, your publisher has just put out the fourth edition of this book “Venture Deals,” and it’s really easy to appreciate why. I was looking through it and it’s so incredibly instructive how venture deals come together and possible pitfalls to avoid. And given there are always new entrepreneurs emerging, it continues to be highly relevant.

How do you go about updating a book like this, given that some things change and some things stay the same?

Powered by WPeMatico

Southeast Asian real estate portal 99.co has agreed to form a joint venture with iProperty. As part of the deal, iProperty owner REA Group will invest $8 million of working capital into the venture, expected to be finalized by the second quarter of 2020.

99.co and REA Group, a real estate-focused digital advertising conglomerate that is listed on the Australian Securities Exchange (ASX), say that the joint venture immediately makes 99.co the market leader in Indonesia and positions it to take the top spot in Singapore, as well. The deal also makes 99.co a more formidable rival to PropertyGuru. Backed by TPG Capital and KKR, PropertyGuru is expected to raise up to AUD $380.2 million (about USD $255.9 million) in an IPO on the ASX this month.

The joint venture is expected to be finalized by the second quarter of 2020 and 99.co will assume full control of REA Group brands iProperty.com.sg in Singapore and Rumah123.com in Indonesia. The joint venture will be led by 99.co’s management team, including co-founder and CEO Darius Cheung.

99.co’s last round of funding was a $15.2 million Series B, announced in August, that the company says took its valuation to over $100 million.

In a press statement, Cheung said, “We are coming for market leadership. This is a key milestone that positions us instantly as number one in Indonesia, and well on our way to that in Singapore. Our innovative DNA plus REA’s unrivaled experience and resources makes this partnership a lethal combination Southeast Asia has not seen before.”

The company’s existing shareholders, including Facebook co-founder Eduardo Saverin, Sequoia Capital, MindWorks Ventures, Allianz X, East Ventures and 500 Startups, will have a combined stake of 73%, with REA Group holding the remaining 27%.

Launched in 2014, 99.co was created to make real estate listings more navigable for renters and buyers in Singapore and other Southeast Asian markets. REA Group owns portals in Malaysia, Hong Kong, Indonesia, Singapore and China, and a property review site in Thailand. It is also a stakeholder in Move, the American real estate site, and Indian property portal PropTiger.

Powered by WPeMatico

Group Nine — the digital media company formed by the merger of Thrillist, NowThis, The Dodo and Seeker — just announced that it has reached an agreement to acquire women’s lifestyle publisher PopSugar.

The financial terms of the deal were not disclosed, but The Wall Street Journal reports that it’s an all-stock transaction that values PopSugar at more than $300 million.

PopSugar was founded by husband-and-wife Brian and Lisa Sugar in 2006, and previously raised $41 million in funding from Sequoia Capital and IVP. Group Nine, meanwhile, just announced a fresh $50 million in funding from its backers Discovery and IVP, which it said would be used to grow its commerce business and for strategic acquisitions.

Brian and Lisa Sugar are both joining Group Nine’s executive team. Brian Sugar and Sequoia’s Michael Moritz are also joining Group Nine’s board of directors.

Earlier this year, there were reports that Group Nine was in talks to acquire a different women’s lifestyle publisher, Refinery29, which was ultimately acquired by Vice Media instead.

In a statement, Group Nine CEO Ben Lerer (pictured above) said:

When we started Group Nine almost three years ago by combining Thrillist, NowThis, The Dodo, and Seeker, we foresaw the impending consolidation of the industry and set out to create a model for the next-generation media company with significant scale, deeply loyal and engaged audiences, multiplatform expertise, and highly diversified revenue. POPSUGAR hugely expands our reach within an important demographic, bringing us a community that deeply loves the POPSUGAR brand and a company with the proven ability to diversify their revenue across premium advertising, affiliate, direct-to-consumer commerce, licensing, and experiential channels.

In the acquisition announcement, Group Nine says the combined organizations will reach an audience of more than 200 million social media followers and also points to PopSugar’s commerce offerings — including its quarterly subscription Must Have Box and its Glow marketplace for fitness content and merchandise — as a good fit for its broader ambitions in this market.

Powered by WPeMatico