Fundings & Exits

Auto Added by WPeMatico

Auto Added by WPeMatico

Missing out on a month’s rent because you can’t find a tenant is a huge loss. Searching for someone to fill a home takes work, while property managers are incentivized to price your place too high, leading to costly vacancies.

But new startup Doorstead wants to take on the risk and the work for you. It acts as a property manager for single-family homes, but guarantees you rent at a specific rate starting in a certain number of days, even if it can’t fill the house or apartment. It also handles all the algorithmic pricing, advertising, tenant interviews, repairs, maintenance, leases and online payments in exchange for 8% of rent. Owners just sit back and receive the money, making it much easier to profit off of distant real estate. The startup claims to earn users 3% to 9% more than other property management models.

Doorstead’s approach to the hot sector of “iRenting” has attracted a $3.3 million seed round co-led by M13 and Silicon Valley Data Capital, and joined by Venture Reality Fund and SOMA Capital. They’re betting on co-founders Jennifer Bronzo, whose parents ran a construction and property management firm, and Ryan Waliany, who worked in product at Uber after his recipe platform Kitchenbowl was acqui-hired.

Doorstead co-founders (from left): Jennifer Bronzo and Ryan Waliany

“I grew up going to job sites and learning about construction,” Bronzo says. “In the recent decade, my family purchased a lot of properties in the Bay and they needed help filling capacity. I saw so many opportunities in property management because of how antiquated the industry is.” Doorstead is now operating in five cities around the San Francisco Bay Area.

As consumers grow accustomed to zero-friction services, that approach is branching into bigger and bigger sectors like the trillions paid for long-term rentals. Waliany, Doorstead’s CEO, tells me, “We’re in the process of Uber’izing each step of the property management life cycle.” The startup is hoping to become the OpenDoor of rentals.

First, property owners contact Doorstead and provide some basic information on the home they want to rent out. They receive a preliminary offer before the startup does an inspection and takes professional marketing photos while digging through reams of data on local pricing, availability and demand to pick a rate its algorithm believes it can fill the home for quickly. Owners then receive a final offer agreement saying they’ll be paid $X per month starting in Y number of days (typically 21 to 45 days), with Doorstead absorbing all the risk if it can’t find a tenant.

First, property owners contact Doorstead and provide some basic information on the home they want to rent out. They receive a preliminary offer before the startup does an inspection and takes professional marketing photos while digging through reams of data on local pricing, availability and demand to pick a rate its algorithm believes it can fill the home for quickly. Owners then receive a final offer agreement saying they’ll be paid $X per month starting in Y number of days (typically 21 to 45 days), with Doorstead absorbing all the risk if it can’t find a tenant.

From there, the startup does approved maintenance and cleaning as necessary, and then methodically lists the home on all the top rental platforms. It handles open house walk-throughs and runs background checks on potential tenants to find who will most reliably pay rent. Doorstead prepares a lease and gets it signed by a tenant, but even if it doesn’t, owners still get their guaranteed payments. Rent is collected online, and if a move-out or eviction is necessary, Doorstead takes care of the transition to finding a new tenant.

There’s plenty of margin for Doorstead to earn if it can consistently fill homes faster. Most property managers charge at least 50% of the first month’s rent, but instead, Doorstead keeps all the rent of any extra days if it fills the spot before the guaranteed due date. From there, it charges 8% of monthly rent with no tenant placement fee, which is close to or under the common 10% fee on single-family home property management. And if it manages to secure a higher rate from tenants than its guarantee, it gives 70% to the owner.

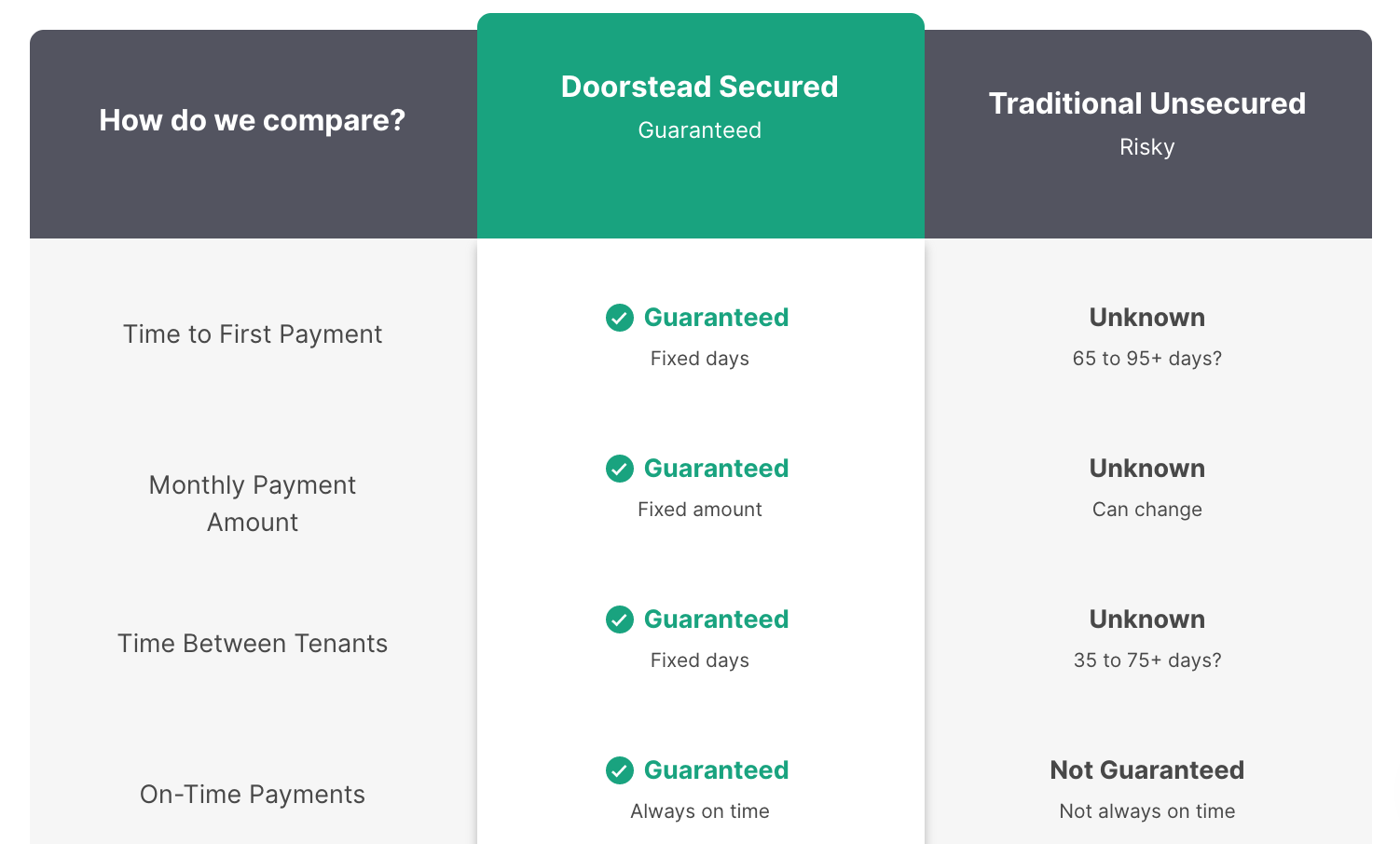

Doorstead claims to be less risky than alternatives

“Property management incumbents have a 43-day vacancy average which leads to $86 billion in economic waste in the U.S. alone,” Waliany tells TechCrunch. “This means that landlords could earn the same money and lower rents by 12% for tenants with an efficient market.”

With Doorstead, even if the owner lives far away, the turn-key service lets them efficiently rent their home. That’s not only important to them, but to overcrowded cities like San Francisco that often see apartments left vacant by overseas owners because they’re too much effort to rent out. To date, Doorstead’s algorithm has allowed it to recoup 100% of its guarantees and it’s shooting to stay above 90%, while maintaining its NPS of 80.

But if the startup is working that well, it’s only a matter of time until incumbents try to barge in.

“It would be a no brainer for Airbnb to enter this market and Zillow to open this,” Waliany admits, given their existing pricing algorithms and popularity as rental destinations. But Bronzo says “the biggest barrier is the operations piece that an Airbnb and Zillow haven’t stepped into.” It would be a big departure from their lean software-based marketplaces. Other property management startups like Mynd, OneRent and BelongHome only offer guaranteed rent once tenants are found, absolving themselves of most of the risk. They’d have to take on a more precarious business model.

What about Zeus, Sonder and Lyric, which offer property management of homes they then use for corporate housing or as boutique hotels? “An owner of ours considered Zeus versus Doorstead and went with Doorstead because: 1) our offer was ~12% higher, and 2) they didn’t want the wear-and-tear that comes with having people move in and out of the property every few days or few months,” Waliany explains. “Sonder and Lyric have 300 move-in and move-outs over a six-year period. Doorstead has ~4 move ins/outs and that results in significantly less wear-and-tear and a much easier operations to manage. Not only that, the long-term rental market is 42x larger and has 12x more addressable revenue.” Doorstead will have to build a brand and product moat to defend against inevitable direct competition.

As iRenting is still a fresh concept, Waliany warns that “with any new business model, there will inevitably be ‘unknown unknowns’ that we cannot predict, black swan events and things that we might only be able to learn through calculated bets.” Luckily, because it doesn’t hold the leases for very long, and home rentals typically increase in an economic downturn, Doorstead’s liability is manageable in the event of a recession or other crisis.

“There are three large trillion-dollar industries — food, transportation and housing. At Doorstead, we have an opportunity to completely redefine the housing value chain by creating a new class of property management that eliminates unnecessary vacancies. In the end, this redefinition of the value chain allows ourselves to become the Blackstone of the future,” Waliany concludes. “It seems like we’re giving everyone free money.” That will prove either the startup’s downfall or a powerful growth tactic.

Powered by WPeMatico

In a wide-ranging conversation at TechCrunch Disrupt San Francisco last week, Postmates co-founder and chief executive officer Bastian Lehmann made light of the company’s lack of IPO documents.

The San Francisco-based on-demand delivery business was expected to publicly file its IPO prospectus in September in preparation for a fall exit, sources familiar with the matter told TechCrunch this summer. September, however, has come and gone and we’re still waiting on Postmates to release the critical document.

“The reality is that we will IPO when we believe we find the right time for the business and the right time for the markets,” Lehmann told TechCrunch. “And if you look at the markets right now, I believe they are a little choppy. They are a little choppy when it comes to growth companies specifically … We are hopeful that we find a good window to get out there.”

Lehmann made reference to Uber and other companies to recently float, citing market conditions as an IPO deterrent. Uber, Lyft, Slack and other fast-growing unicorns have struggled since entering the public markets earlier this year despite sky-high private market valuations. WeWork, a money-losing endeavor, recently decided to delay its IPO after demand from Wall Street devalued the business by the billions. Whether Postmates will complete its debut by the end of the year is unclear.

Postmates confidentially filed with the U.S. Securities and Exchange Commission for an IPO in February. Shortly after, Postmates held M&A talks with DoorDash, another food delivery unicorn, according to people familiar with the matter, but failed to come to mutually favorable terms. DoorDash has previously declined to comment on these reports. On stage last week, Lehmann declined to confirm the reports.

“I don’t think it does any good to speculate on M&A,” he said. “I think you have four well-funded players here in the U.S. in this space. I think everyone is well aware of the strengths and the weaknesses of each other and you know at some point down the line, if we take Europe for example, you will see consolidation in the market. People have conversations all the time but I wouldn’t read too much into it.”

Postmates operates its on-demand delivery platform, powered by a network of local gig economy workers, in more than 3,500 cities across all 50 states. The company does not yet operate in any international markets aside from Mexico City, however, Lehmann’s comments suggest the business could be plotting a foray into Europe, where Deliveroo, Just Eat and others dominate the market.

Postmates has raised about $900 million to date, including a $225 million round announced last month that valued the company at $2.4 billion. DoorDash, on the other hand, reached a $12.6 billion valuation in May with a $600 million Series G and has raised more than double that of Postmates. When asked why DoorDash, a similar and competing business, needed that much more capital, Lehmann joked “Maybe [DoorDash CEO Tony Xu] needs a jet, I don’t know.”

Postmates, founded in 2011 by Lehmann, is backed by Spark Capital, Founders Fund, Uncork Capital, Slow Ventures, Tiger Global, Blackrock and others. In our interview with Lehmann, the long-time CEO discussed the ‘choppy’ public markets, competitors, the company’s autonomous robotics delivery efforts and more.

Powered by WPeMatico

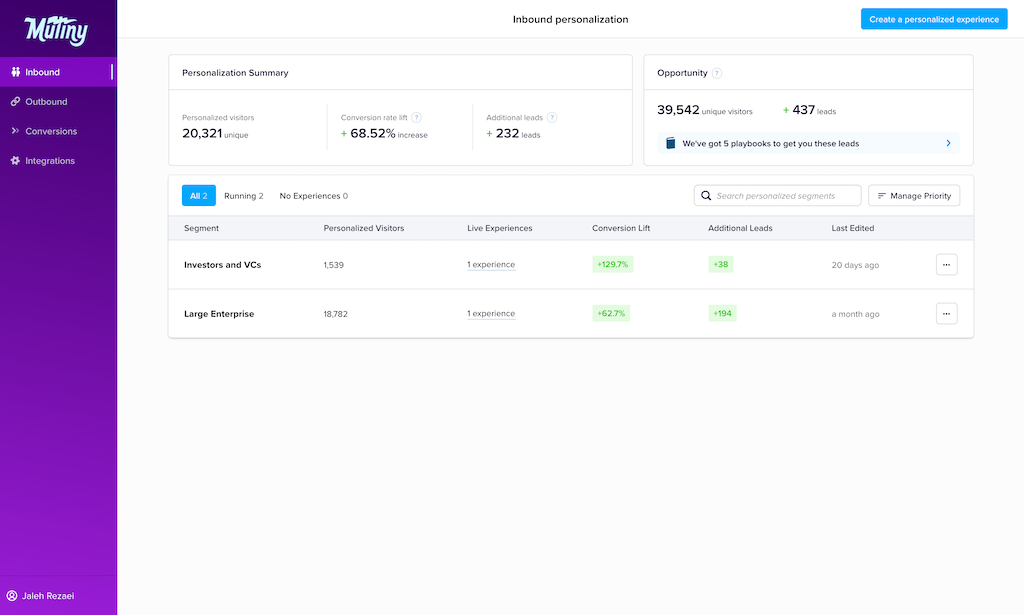

Mutiny, a personalized marketing startup for businesses that sell to other businesses, is taking the stage today at TechCrunch’s Startup Battlefield, where it’s announcing new funding and new features.

CEO Jaleh Rezaei told me that she and co-founder Nikhil Mathew created Mutiny to solve a problem they saw as early employees at HR services company Gusto — trying to personalize their messages to different sales prospects.

With Mutiny, they’ve built easy-to-use tools allowing marketers to show different landing pages to different customers. To do this, the product draws on pre-built data integrations to identify customer segments, then allows customers to use a visual editor to build different versions of landing pages for those segments.

“When we think about the B2B journey, it has changed quite a bit,” Rezaei said. “Today, 67% of that B2B buyer’s journey is online. Without engineering, it’s really hard to change that journey and have an impact. What’s exciting about Mutiny is we empower these great marketers to improve their customer experience without that constant dependence on technical teams.”

Mutiny was part of the Summer 2018 class at accelerator Y Combinator. Rezaei said that shortly after demo day, the startup raised $3 million in funding from Cowboy Ventures, Uncork Capital and various angel investors.

It’s since added features to support targeted, account-based marketing. Rezaei said Mutiny pulls account data from Salesforce, cleaning it up and surfacing it, so that when a prospective customer responds to your marketing, they could end up on a landing page showing their own name, title and company.

For example, Brex is creating landing pages for its email marketing campaigns, where each page shows the recipient’s name and company; Gusto is tailoring landing pages based on the AdWords search terms that brought a prospective customer to that page; and Amplitude is customizing landing pages based on company size and other attributes.

As a result, Mutiny says Brex has seen a 200% lift in outbound leads, while Amplitude has increased all inbound leads by more than 40%. (Other customers include Segment, Carta, TripActions and Elastic.)

Today, Mutiny is also announcing that it will offer personalized recommendations to marketers. So if all these ideas are new to you, the product can recommend specific customer segments that you should consider personalizing for based on things like your traffic data and conversion data.

Mutiny can also create entire “playbooks,” recommending not just the segment to personalize, but what that personalized experience should look like for that segment.

“The goal of Mutiny is always to make personalization really easy and really guided,” Rezaei said.

Powered by WPeMatico

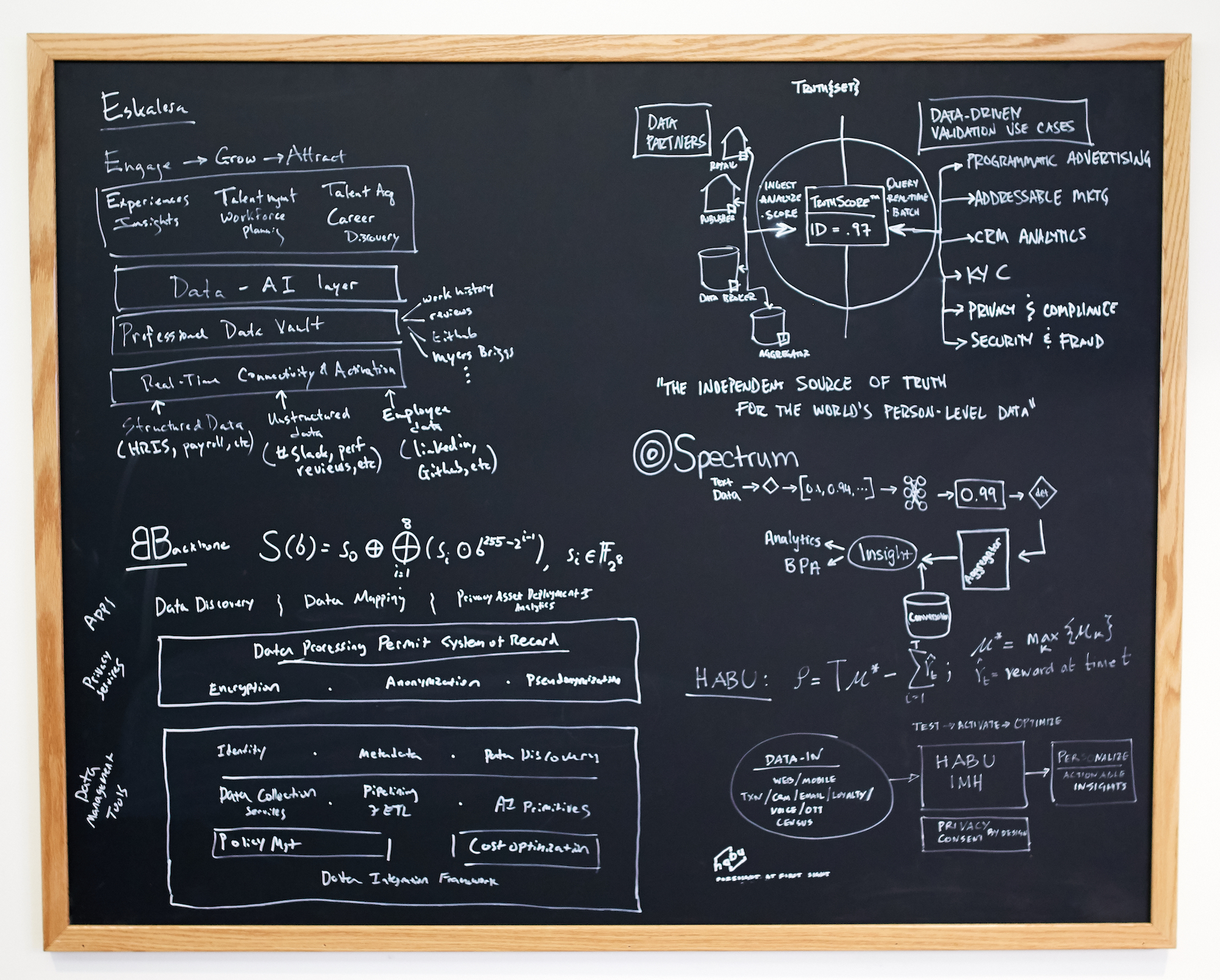

Think Jack Dorsey’s jobs are tough? Well, Tom Chavez is running six startups. He thinks building businesses can be boiled down to science, so today he’s unveiling his laboratory for founding, funding and operating companies. He and his team have already proven they can do it themselves after selling their startups Rapt to Microsoft and Krux to Salesforce for a combined $1.2 billion. Now they’ve raised a $65 million fund for “super{set}”, an enterprise startup studio with a half-dozen companies currently in motion.

The idea is that {super}set either conceptualizes a company or brings in founders whose dream they can make a reality. The studio provides early funding and expertise while the startup works from their shared space in San Francisco, plus future ones in New York and Boston. The secret sauce is the “super{set} Code,” an execution playbook plus technological tools and building blocks that guide the strategy and eliminate redundant work. “Our belief is that we can make the companies 10x faster and increase capital efficiency by 5X,” says Chavez of his partnership with {super}set co-founders Vivek Vaidya, who acts as CTO, and Jae Lim who manages the fund.

The {super}set team (from left): Tom Chavez, Jae Lim, Jen Elena and Vivek Vaidya

Perhaps the question isn’t whether the portfolio startups can scale, but if the humans behind them can without breaking. It’s stressful running a single company, let alone six. Even with the order of operations nailed down, each encounters unique challenges and no plan is one-size-fits-all. But after delivering 17.5X returns to their past investors, Chavez et al. have proven their power to repeatedly recognize what enterprises need and build admittedly boring but bountiful products in customer data management, and advertising yield.

The studio’s playbooks cover business plan formation, pitch strategies, go to market, revenue, machine learning, management principles, HR processes, sales methods, pipeline measurement, product sequencing, finance, legal and more. There’s also shared engineering code it provides, so each startup doesn’t have to reinvent the wheel. “I don’t think you can systemize it but I do think you can accelerate and de-risk the path,” Chavez explains.

{super}set Code

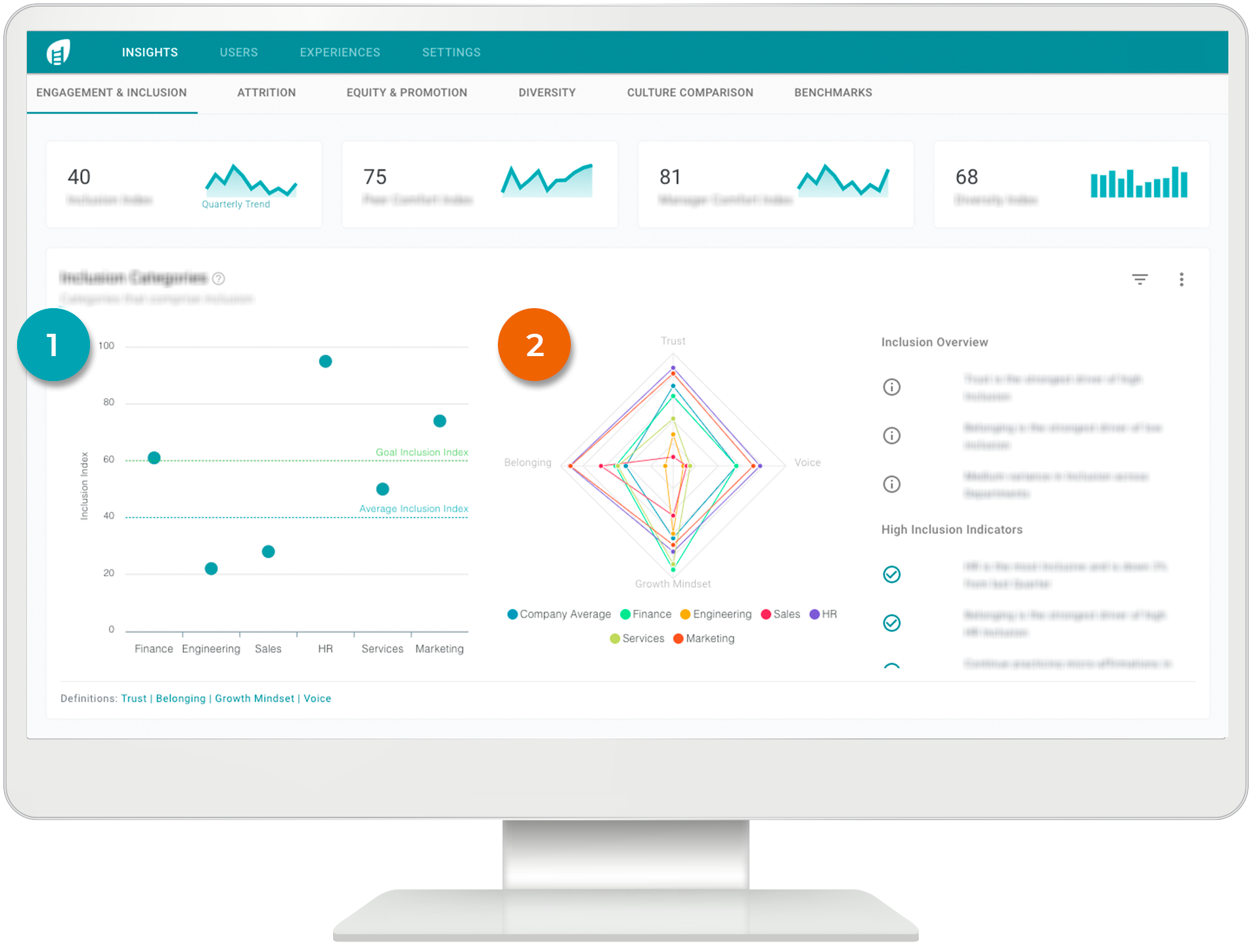

Today, the first {super}set company is coming out of stealth. Eskalera helps enterprises retain top talent by tracking diversity and inclusion stats of employees to engage them with career growth and community programs. Chavez is the CEO, but plans to install a new one shortly so he can focus more time on founding more startups. There are 55 employees across the first six companies, with two already generating revenue and most ready to emerge in the next nine months.

The funding for Eskalera and other {super}set companies comes with unique terms. Because Chavez and the team aren’t just board members you hear from once a quarter but “shoulder to shoulder with the entrepreneurs” as he repeats several times in our interview, the startups pay more equity for the cash.

The hope is having seasoned leadership aboard is worth it. “We’re product people first and foremost,” Chavez tells me. “What are you going to build? Who’s going to buy it? Why? What’s the technical moat? We’re not people doing jazz hands.” The {super}set team has plenty of skin in the game, though, given Chavez himself put in a big chunk of the $65 million, and the fund sticks to a standard management fee.

Eskalera

To supercharge the companies, {super}set brings in expert staffers in artificial intelligence, data science and more, who then align with the most relevant companies in the portfolio. They get equity grants to incentivize them to work hard on the startups’ behalf. “The worry I have about these larger funds is that they have an incentive disconnect where they work for the fees” Chavez says. His fund hopes to win through follow-on funding of its winners.

{super}set co-founder Tom Chavez

If portfolio companies hit hard times, Chavez says {super}set will stick with them. “My first company had multiple layoffs and a major pivot. We had an enterperenur that walked away. They lost conviction, but we brought that company to an $180 million exit after people said there was no effing way and that felt really good,” Chavez says of staying the course. “The good entrepreneurs have that demonic energy.” But if everyone involved agrees a project isn’t working, they’ll shutter it. “It comes back to opportunity cost of people’s time.”

Chavez has respect for studios taking different approaches, like Atomic in consumer startups, Science in e-commerce and Pioneer Square Labs, which maintains a larger fund staff. “What excites me is moving entrepreneurship a step forward. Why couldn’t we franchise this in other cities?” He hopes {super}set can attract top talent that “just want to work on cool shit” rather than getting sucked into a single company.

Can {super}set keep all the plates spinning and really lower their risk? “If we’re wrong there will be a giant orange plume streak across the sky. The early returns are promising but we have to prove it,” Chavez says. But after accruing plenty of wealth for himself, he says the thrill that keeps him in the startup game is seeing life-changing outcomes for his teams. “I have spreadsheets showing the wealth generated by employees of companies I’ve built and nothing makes me happier than seeing them pay for tuitions, property, or retiring.”

Powered by WPeMatico

Books on tape were the lifeblood of self-help. But e-learning startups like Khan Academy and Coursera demanded our eyes, not just our ears. Then came podcasts that make knowledge accessible, yet rarely focus on you retaining and applying what they teach.

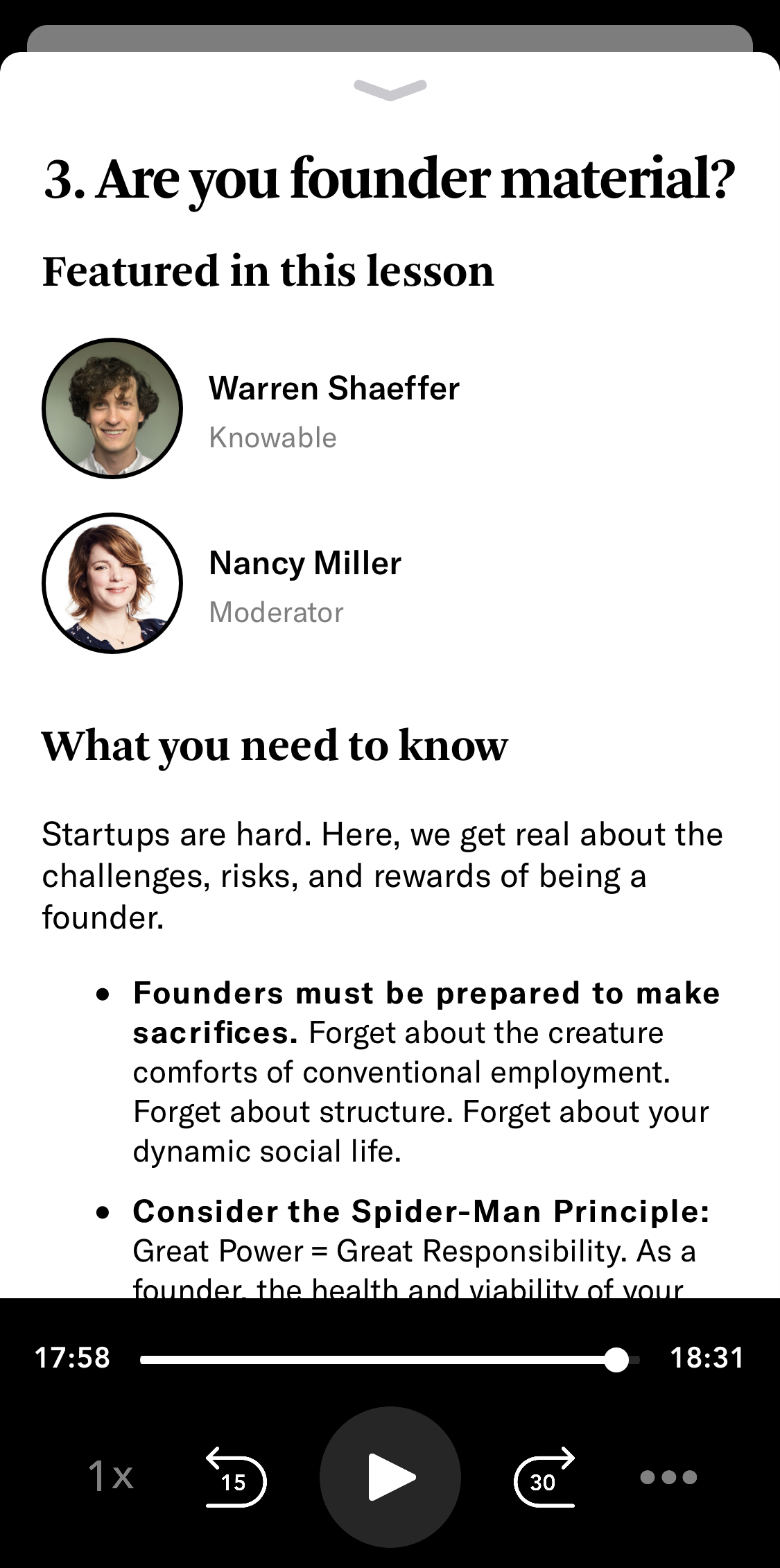

Today, a new startup called Knowable is launching to provide gaze-free audio education at $100 per eight-hour course on topics like how to launch a startup or how to sleep better. The idea is that by layering chapter summaries and eventually interactive activities atop premium, long-form, ad-free lessons, it can become the trusted name in learning anywhere. With always-in Bluetooth earbuds and smart speakers becoming ubiquitous, we can imbibe content in smaller chunks in new environments. Knowable wants to fill that time with self-improvement.

The big question is whether Knowable can differentiate its content from free alternatives and build a moat against copycats through savvy voice-responsive learning exercises so you don’t forget everything.

To evolve beyond the podcast, Knowable has raised a $3.75 million seed round led by Andreessen Horowitz’s partner Connie Chan, and joined by Upfront, First Round and Initialized. “The market is ready for a company like Knowable. Their timing is right and their team possesses the rare combination of product expertise and creative media experience necessary to win. That’s why I’m not just hosting Knowable’s first course, Launch a Startup, we’re also one of the earliest investors in the company,” says Initialized’s Alexis Ohanian.

There’s certainly a market opportunity, as 32% of Americans listen to podcasts monthly, up from 26% in 2018, with 74% of those citing the desire to learn. Half of Americans have listened to an audio book. The e-learning market is $190 billion today, but projected to grow to $300 billion as bloated and expensive higher education succumbs to cheaper and more focused options.

But to score consistent revenue, Knowable must build up its library and execute on plans to offer a subscription service with access to updates on prior lessons. A major challenge will be bundling classes on the right topics that don’t exhaust users so they keep listening and paying.

“My first-generation immigrant parents came here without college degrees. Great teachers let me move up the socioeconomic ladder pretty quickly,” says Knowable co-founder Warren Shaeffer. “The genesis of the idea came from our shared interest in education and the value of great teachers.”

Shaeffer and his co-founder Alex Benzer have already been through the struggles of startup life together. After meeting at MuckerLab in LA and splitting from their respective co-founders, in 2007 they created SocialEngine, a community website builder that sold to Room 214. Next they built up a video platform for independent creators called Vidme that raised $9 million but never became sustainable before selling to Giphy in 2018.

Shaeffer and his co-founder Alex Benzer have already been through the struggles of startup life together. After meeting at MuckerLab in LA and splitting from their respective co-founders, in 2007 they created SocialEngine, a community website builder that sold to Room 214. Next they built up a video platform for independent creators called Vidme that raised $9 million but never became sustainable before selling to Giphy in 2018.

The pair had glimpsed how great content could rope in an audience, but felt like the true potential of the podcast hadn’t been explored. Why did they have to be produced on the cheap, distributed on generic platforms and supported by ads? Knowable emerged as a way to create luxury audio, delivered through a purpose-built app and paid for with direct sales or subscriptions. Instead of recording unscripted discussions as episodes, they mapped out course curriculum and filled them with structured advice from experts.

I’m a few hours into the Ohanian-hosted Launch a Startup. It’s certainly a lot more efficient than trying to learn the basics just through storytelling from podcasts like Reid Hoffman’s Masters of Scale or NPR’s How I Built This. One chapter breaks down the top ways startups die and the traits you’ll need to persevere. From optimism and resilience operating in unstructured environments to a refusal to make excuses why you can’t succeed, Ohanian cooly recaps the learnings at the end of the chapter. Open the app and you’ll get a written summary plus suggested blog posts and books for diving deeper. An accompanying 95-page PDF workbook collects all the key learnings for rapid review later.

The topic is huge, though, and Knowable is at its best when it’s distilling knowledge into neatly packaged lists and frameworks. The course’s weakest moments are when it feels most like a podcast, with somewhat meandering conversations with random founders discussing how they dealt with problems. Meanwhile, it currently lacks some basic tools like in-app notetaking and sharing, or as wide a range of playback speeds and rewind options as you’ll get on Audible. “We don’t think of ourselves as a podcast company,” Shaeffer says, but that’s still who he’s competing against.

— Alexis Ohanian Sr.

(@alexisohanian) May 28, 2019

What’s also missing is any true interactivity. The downside of audio learning is that if you’re not paying full attention, it’s easy to zone out. Knowable needs to develop voice and touch-controlled exercises to help users apply and retain the lessons. There are plans to launch learning communities where students can confer about the classes, akin to Y Combinator’s “Bookface” forum.

However, Shaeffer says that “we’re on a mission to make education more accessible and quizzes might be an impediment to that,” which leaves questions about what the learning activities will look like, even though they’re crucial to users coughing up $100 per class. It’s easy to imagine Spotify/Anchor, Gimlet Media or other major podcast players developing their own interactive features and classes if Knowable doesn’t get there first.

The startup’s bid for virality is the ability to give a friend a code to take the class with you. Knowable is also hoping big-name experts and quality driven by a team cobbled together from NPR, The Washington Post, William Morris Endeavor, Masterclass and Vice will set it apart. They’ve got a lot of work ahead to grow beyond the six courses currently available on topics like climate change activism and real estate, especially because there’s a 100% money-back guarantee if classes fall short.

For the moment, Knowable feels a bit late with its homework. It has the potential and demand to reinvent audio learning but currently sounds too similar to what’s already everywhere. I was hoping for a Bandersnatch for education that made a broadcast experience feel more like a game.

But the opportunity will only continue to grow as we spend more of our lives in earshot of AirPods and Echoes. With a broad enough library and clever editing, one day you might tell Knowable “teach me something about venture capital in eight minutes” as you walk to the coffee shop. That’s going to have a much better impact on your life than just scrolling through another feed.

Powered by WPeMatico

Project A, the Berlin-based VC, just raised a new $200 million fund (€180 million) to continue backing European startups at Seed and Series A stage.

In addition, the firm — whose investments include WorldRemit, Catawiki, Voi and Uberall — announced it will now have a presence in London and Stockholm in order to put people on the ground in what it says are “two of its favorite ecosystems.”

What better time, therefore, to catch up with the team at Project A, where we talked investment thesis, why Stockholm and London, and the increasing interest in Europe from U.S. LPs and VCs. Other subjects we touched on include diversity in venture, and, of course, Brexit!

TechCrunch: You last raised a fund in 2016, totaling €140 million, what changes have you noticed since then with regards to the types of companies you are seeing and the European ecosystem as a whole?

Uwe Horstmann: Entrepreneurs definitely matured a lot over the last few years. We see more and more of serial founders who combine drive with experience delivering great results. We also noticed an increase in more tech / product-centric and in B2B models.

This doesn’t come as a surprise as the market for consumer-oriented models started developing much earlier and is now reaching its limits after a few years. Many entrepreneurs gained experience in the Old Economy or have been consulting companies for a few years, learned about the struggle with products and processes first-hand and developed solutions specifically tailored to the industry’s needs.

We also notice a rise in professionalism in company setups and a higher ambition level in founding teams. This is probably also due to a more professional angel and micro fund scene that has developed in Europe.

TC: I note that you have U.S. LPs in the new fund, which I think is a first for Project A, and more broadly we are seeing a lot more interest from U.S. VCs in Europe these days. Why do you think that is, and how does this change the competitive landscape for deal-flow and the ambition of European founders?

Thies Sander: Having our first U.S. LPs on board makes us proud. LPs have noticed that European VC returns have really picked up during recent fund cohorts.

Powered by WPeMatico

WeWork’s parent organization The We Company just announced that it’s withdrawing the S-1 filing for its IPO.

The co-working company has had a turbulent month since the filing went public, around both the general state of its finances and the behavior of co-founder/CEO Adam Neumann.

As a result, Neumann stepped down down as CEO last week (he will continue to serve as non-executive chairman). In addition, the company is looking to focus on its core co-working business, which means it’s planning major layoffs and even reportedly looking to sell some of the companies it acquired over the last couple of years — namely Managed by Q, Conductor and Meetup.

So it was widely expected that The We Company would delay its IPO. Today, it made things official with the release of a statement from new co-CEOs Artie Minson and Sebastian Gunningham:

We have decided to postpone our IPO to focus on our core business, the fundamentals of which remain strong. We are as committed as ever to serving our members, enterprise customers, landlord partners, employees and shareholders. We have every intention to operate WeWork as a public company and look forward to revisiting the public equity markets in the future.

Powered by WPeMatico

Amboss, the Berlin-based “medtech” startup that originally offered a learning app for students but has since pivoted to a knowledge platform for medical professionals, has raised €30 million in Series B funding.

The round is led by Partech’s growth fund, with Target Global acting as a co-investor. Existing investors Cherry Ventures, Wellington Partners and Holtzbrinck Digital, also participated.

Launched in 2014 as a study platform for medical students, Amboss has since evolved to offer what it claims is the “most comprehensive and technologically-advanced” knowledge platform for medical professionals. It has been developed by a group of 70 doctors and 40 software engineers who work together in small cross-functional teams.

“Medical Knowledge does not find its way into practice efficiently,” argues Amboss co-CEO Benedikt Hochkirchen. “This has two main root causes: the way we educate doctors is outdated, and the way doctors access knowledge is inefficient.”

Specifically, he says that medical students are still taught to memorize facts, which become outdated quickly, and there isn’t enough emphasis on understanding and application. In contract, Amboss’ “smart learning” technology claims to not only help students achieve higher scores in their medical exams but furthers their contextual understanding and therefore lays the foundation “to be better prepared for clinical practice.”

“In clinical practice, doctors would adapt 50% of their decisions if they had the latest and precise knowledge at hand,” says Hochkirchen. “In real life on the wards, doctors lack the time to research and find the relevant knowledge. For them, Amboss’ smart guidance app is there to provide instant, convenient and reliable medical knowledge to carry out the best possible care.”

The end result, says the Amboss co-CEO, is that the startup’s app reduces the average research time needed for doctors to make a clinical decision from 30 minutes to 30 seconds. Crucially, its knowledge base contains the most recent medical facts and guidelines “in every single case.”

“Young doctors have to take over a lot of responsibility early in their career,” adds Hochkirchen. “Career starters are regularly the first touch point with a doctor when a patient enters a hospital. Often young doctors do not feel properly prepared for the real-life challenges in those situations. Amboss is the source of choice to master those decisions, e.g. with emergency algorithms and lead symptoms.”

Likewise, more experienced and specialised doctors can also find utility in Amboss, as guidelines and therapies of choice are constantly changing. “It is almost impossible for the doctor to stay up to date for every possible indication,” he says. “Amboss provides them with precise knowledge based on latest guidelines to ensure doctors choose the best therapy possible.”

Or, put a another way, Amboss is attempting to build a “Google for medicine.” “They are tackling a very exciting space which will have a positive impact on society, bringing knowledge levels and skillsets of medical doctors to a higher level,” Cherry Ventures’ Christian Meermann tells me.

Meanwhile, armed with new capital, Amboss says it will accelerate the global rollout of its product with a focus on the U.S. In addition, the startup will further develop its product, for both generalist and specialist doctors, “to help improve their daily clinical decision-making.”

Powered by WPeMatico

DeadHappy, a U.K.-based insurtech startup that wants to offer more flexible life insurance and remove the taboo surrounding death, has raised £4 million in Series A funding. Backing comes from e.ventures, alongside the company’s seed investor Octopus Ventures.

Founded in 2017, DeadHappy claims to be the U.K.’s “first fully digital pay-as-you-go life insurance provider.” It offers flexible life insurance policies that are designed to be “cheaper, easier and better” than existing traditional providers. This includes pricing insurance based on your current circumstances and the option to add (or remove) further coverage on a rolling basis.

More broadly, the startup is developing what it calls its “Deathwish” platform, which is something akin to a will. The idea is that you can specify how you wish any future insurance payout to be used, such as paying off your mortgage. And there are also plans to incorporate other wishes not related to finances.

“Our vision is to change attitudes to death and we are tackling that in a number of ways,” DeadHappy co-founder Phil Zeidler tells me. “Despite death being the one certainty humans face, it remains for many a taboo subject, and the failure to talk about it and plan for it is both counterintuitive and leads to significant further trauma at the most difficult of times for family and loved ones.”

Currently the Deathwish platform offers financially motivated Deathwishes, but the longer-term plan is to enable practical Deathwishes, such as making sure your funeral is the way you want it, and what Zeidler calls emotionally motivated Deathwishes.

The idea is to help offer a way to help loved ones “achieve something meaningful in their lives, whether that’s learning how to play the drums or funding an expedition to the Amazon,” he explains.

“Crucially, customers can share these Deathwishes as they choose, which is a practical tool to ensure their wishes are clear and understood. Our platform acts as a catalyst for opening a conversation with loved ones and a place to share recorded video messages and stories.”

Meanwhile, DeadHappy says it will use the new funding for future growth by further building the technology and capabilities of its Deathwish platform. It also plans to expand its product and partnership offerings to major financial service distributors.

Powered by WPeMatico

This morning, Peloton (NASDAQ: PTON), the tech-enabled stationary bicycle and fitness content streaming company, raised $1.2 billion in its NASDAQ initial public offering. Despite dropping more than 10% in its first day of trading — ultimately closing down 11% at $25.84 per share — the IPO was a bona fide success. Peloton, once denied (over and over again) by VC skeptics, now has hundreds of millions of dollars to take its business into a new era. One in which, the media, hardware, software, logistics and social company attempts to become a generation-defining company akin to Apple.

Founded in 2012 — six years after Soul Cycle opened its first cycling studio in New York’s Upper East Side and two years before a Soul Cycle founder, Ruth Zukerman, jumped ship to launch her own indoor cycling business, Flywheel Sports — a man by the name of John Foley made the ambitious, some might say foolish, decision to start a company that would sell these exercise bikes direct-to-consumer. That way, you could take a Soul Cycle class, in essence, in the comfort of your own home. Even better, technology would improve the experience.

As my colleague Josh Constine recently described it, these bikes come outfitted with a 22-inch Android screen, transforming an outdated exercising experience and bringing it into 2019: “It makes lazy people like me work out. That’s the genius of the Peloton bicycle. All you have to do is Velcro on the shoes and you’re trapped. You’ve eliminated choice and you will exercise,” Constine writes.

Peloton’s ability to get people exercise — a feature driven by its talented instructors (some of whom were poached from competitor Flywheel Sports) — ultimately had venture capital investors funneling $1 billion, roughly, into the business. Today, Peloton operates dozens of showrooms across the U.S., counts 1.4 million total community members — defined as any individual who has a Peloton account — and over 500,000 paying subscribers. Why? Because the company, as stated in its IPO prospectus, “sells happiness.”

“Peloton is so much more than a Bike — we believe we have the opportunity to create one of the most innovative global technology platforms of our time,” writes Foley. “It is an opportunity to create one of the most important and influential interactive media companies in the world; a media company that changes lives, inspires greatness, and unites people.”

Peloton’s flagship product, a tech-enabled stationary bike.

Peloton’s community coupled with the high margins on sales of its $2,245 bikes had the company reporting $915 million in total revenue for the year ending June 30, 2019, an increase of 110% from $435 million in fiscal 2018 and $218.6 million in 2017. Its losses, meanwhile, hit $245.7 million in 2019, up significantly from a reported net loss of $47.9 million last year.

What’s next for Peloton? The opportunities are endless, given the company’s firm seat at the intersection of hardware, software, media content and more. A third product may be in the works, expansion to international markets or new instructors. Peloton is going after a massive market ripe for disruption. What’s certain is that we’ll see a whole lot of cash flowing into fitness tech copycats in the next couple of years.

Peloton, following a number of lukewarm consumer IPOs (Uber), nearly doubled its valuation to $8.1 billion this morning after pricing its IPO at the top of its range, $29 per share. To answer some of our most burning questions, we chatted with Peloton’s president William Lynch, the former CEO of Barnes & Noble, about the float.

The following conversation has been edited for length and clarity.

Peloton president and former Barnes & Noble CEO William Lynch.

Kate Clark: What’s next for Peloton?

William Lynch: We now have over a billion in capital to fuel more growth, especially in the area of product innovation.

Powered by WPeMatico