Fundings & Exits

Auto Added by WPeMatico

Auto Added by WPeMatico

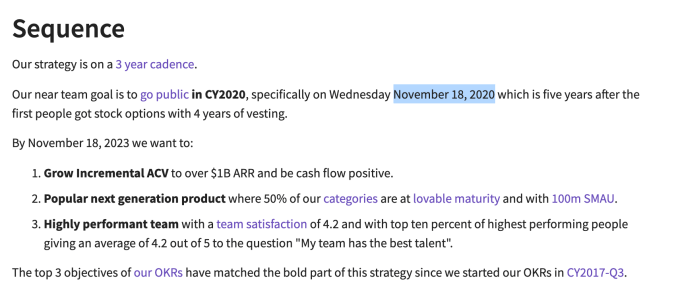

GitLab is a company that doesn’t pull any punches or try to be coy. It actually has had a page on its website for some time stating it intends to go public on November 18, 2020. You don’t see that level of transparency from late-stage startups all that often. Today, the company announced a huge $268 million Series E on a tidy $2.75 billion valuation.

Investors include Adage Capital Management, Alkeon Capital, Altimeter Capital, Capital Group, Coatue Management, D1 Capital Partners, Franklin Templeton, Light Street Capital, Tiger Management Corp. and Two Sigma Investments.

The company seems to be primed and ready for that eventual IPO. Last year, GitLab co-founder and CEO Sid Sijbrandij said that his CFO Paul Machle told him he wanted to begin planning to go public, and he would need two years in advance to prepare the company. As Sijbrandij tells it, he told him to pick a date.

“He said, I’ll pick the 16th of November because that’s the birthday of my twins. It’s also the last week before Thanksgiving, and after Thanksgiving, the stock market is less active, so that’s a good time to go out,” Sijbrandij told TechCrunch.

He said that he considered it a done deal and put the date on the GitLab Strategy page, a page that outlines the company’s plans for everything it intends to do. It turned out that he was a bit too quick on the draw. Machle had checked the date in the interim and realized that it was a Monday, which is not traditionally a great day to go out, so they decided to do it two days later. Now the target date is officially November 18, 2020.

GitLab has the date it’s planning to go public listed on its Strategy page.

As for that $268 million, it gives the company considerable runway ahead of that planned event, but Sijbrandij says it also gives him flexibility in how to take the company public. “One other consideration is that there are two options to go public. You can do an IPO or direct listing. We wanted to preserve the optionality of doing a direct listing next year. So if we do a direct listing, we’re not going to raise any additional money, and we wanted to make sure that this is enough in that case,” he explained.

Sijbrandij says that the company made a deliberate decision to be transparent early on. Being based on an open-source project, it’s sometimes tricky to make that transition to a commercial company, and sometimes that has a negative impact on the community and the number of contributions. Transparency was a way to combat that, and it seems to be working.

He reports that the community contributes 200 improvements to the GitLab open-source product every month, and that’s double the amount of just a year ago, so the community is still highly active in spite of the parent company’s commercial success.

It did not escape his notice that Microsoft acquired GitHub last year for $7.5 billion. It’s worth noting that GitLab is a similar kind of company that helps developers manage and distribute code in a DevOps environment. He claims in spite of that eye-popping number, his goal is to remain an independent company and take this through to the next phase.

“Our ambition is to stay an independent company. And that’s why we put out the ambition early to become a listed company. That’s not totally in our control as the majority of the company is owned by investors, but as long as we’re more positive about the future than the people around us, I think we can we have a shot at not getting acquired,” he said.

The company was founded in 2014 and was a member of Y Combinator in 2015. It has been on a steady growth trajectory ever since, hauling in more than $426 million. The last round before today’s announcement was a $100 million Series D last September.

Powered by WPeMatico

Cloudian, a company that enables businesses to store and manage massive amounts of data, announced today the launch of Edgematrix, a new unit focused on edge analytics for large data sets. Edgematrix, a majority-owned subsidiary of Cloudian, will first be available in Japan, where both companies are based. It has raised a $9 million Series A from strategic investors NTT Docomo, Shimizu Corporation and Japan Post Capital, as well as Cloudian co-founder and CEO Michael Tso and board director Jonathan Epstein. The funding will be used on product development, deployment and sales and marketing.

Cloudian itself has raised a total of $174 million, including a $94 million Series E round announced last year. Its products include the Hyperstore platform, which allows businesses to store hundreds of petrabytes of data on premise, and software for data analytics and machine learning. Edgematrix uses Hyperstore for storing large-scale data sets and its own AI software and hardware for data processing at the “edge” of networks, closer to where data is collected from IoT devices like sensors.

The company’s solutions were created for situations where real-time analytics is necessary. For example, it can be used to detect the make, model and year of cars on highways so targeted billboard ads can be displayed to their drivers.

Tso told TechCrunch in an email that Edgematrix was launched after Cloudian co-founder and president Hiroshi Ohta and a team spent two years working on technology to help Cloudian customers process and analyze their data more efficiently.

“With more and more data being created at the edge, including IoT data, there’s a growing need for being able to apply real-time data analysis and decision-making at or near the edge, minimizing the transmission costs and latencies involved in moving the data elsewhere,” said Tso. “Based on the initial success of a small Cloudian team developing AI software solutions and attracting a number of top-tier customers, we decided that the best way to build on this success was establishing a subsidiary with strategic investors.”

Edgematrix is launching in Japan first because spending on AI systems there is expected to grow faster than in any other market, at a compound annual growth rate of 45.3% from 2018 to 2023, according to IDC.

“Japan has been ahead of the curve as an early adopter of AI technology, with both the governmetn and private sector viewing it as essential to boosting productivity,” said Tso. “Edgematrix will focus on the Japanese market for at least the next year, and assuming that all goes well, it would then expand to North America and Europe.”

Powered by WPeMatico

Home ownership has long been touted as the American dream. But rising rates of mortgage debt and student loan debt are making the pursuit of home ownership a nightmare. Debt-burdened individuals or those with inconsistent or tight cash flow can not only struggle to get credit loan approval when buying a home but also struggle to satisfy monthly mortgage payments even after purchase.

Patch Homes is hoping to keep the proverbial American dream alive. Patch looks to provide homeowners with cash flow and liquidity by allowing them to monetize their homes without taking on debt, interest or burdensome monthly payments.

Today, Patch took another big step in making its vision a far-reaching reality. The company has announced it has raised a $5 million Series A round led by Union Square Ventures (USV), with participation by from Tribe Capital and previous investors Techstars Ventures, Breega Capital and Greg Schroy.

Patch Home looks to partner with homeowners by investing up to $250,000 (with an average investment of ~$100,000) for an equity stake in the home’s value, generally in the 5% to 20% range. Homeowners aren’t subject to any interest or recurring payments and have 10 years to pay back Patch’s investment. Upon doing so, the only incremental money Patch receives is its portion of the change in the home’s value over the course of the 10-year period. If the value of the home goes down in value, Patch willingly takes a loss on its investment.

According to Patch Homes CEO and co-founder Sahil Gupta, one of the major motivations behind the company’s model is to align Patch’s incentives with the homeowners’, allowing both parties to think of each other as trusted partners even after financing. After Patch’s investment, the company provides a number of ancillary services to homeowners, such as credit score monitoring, as well as home value and property tax tracking.

In one instance recounted by Gupta in an interview with TechCrunch, Patch even covered three months of an owner’s mortgage during a liquidity crunch for his small business, allowing him to maintain his home and credit score. Patch is incentivized to provide all services that can help ensure an increase in home value, benefiting both Patch and the homeowner, with the homeowner earning the majority of the asset’s appreciated value.

Additionally, since Patch’s model isn’t focused on a homeowner’s ability to pay back a loan, interest or periodic payments, Patch is able to provide financing to more people. Patch is able to help those with more variable qualifications that struggle to get traditional loans — such as a 1099 contracted worker — monetize their illiquid assets with less harsh or restrictive terms and without increasing their debt burden. Gupta described this as solving the core problem of providing liquidity to asset-rich but cash-flow sensitive people.

Patch is not only looking to provide easier liquidity to more homeowners, but they’re trying to do so faster than traditional lenders. Interested customers can first receive a free estimate of whether Patch will invest in their home or not, how much it’s willing to invest and what percentage equity it will take — primarily based on Patch’s machine learning models that focus on asset, market and location-level attributes.

After the initial estimate, a Patch home advisor will educate the customer on the product and start a formal application process, which includes your standard income and credit score verification, which takes 5-10 days. All-in, homeowners have the ability to get money in as little as 14 days, a significantly shorter timeline than your standard home credit process. Once the investment is made, owners have full freedom with how they use the money.

According to Patch, while its customers come from a diverse set of backgrounds, many either with accumulated debt have to pay down the net or may struggle making monthly payments. The average Patch homeowner uses 40% of the investment to eliminate debt, adds 40% to their savings account or passive income and invests 20% into home improvements.

To date, Patch has raised a total of $6 million and believes the latest round of funding will help scale its operations as they team up with advisors like USV that have experience scaling fintech companies (such as a Lending Club or Carta). The funds will be used to invest in product and Patch’s clearing technology in order to further expedite Patch’s lending process.

Patch also hopes to use the investment to help them gradually expand their footprint, with the goal of eventually having a presence all 50 states. (Patch is currently available in 11 regional markets within California and Washington and expects to be in 18 regional markets by the end of the year including those in Utah, Colorado and Oregon.)

Image via Patch Homes

What makes home ownership so galvanizing for the Patch team? Patch CEO Sahil Gupta spent years putting his Carnegie Mellon financial engineering degree to work in banking and finance, as well as in financial products and strategy positions at fintech startups backed by heavy hitters such as YC and Goldman Sachs.

After realizing the majority of the U.S. population are homeowners, but were struggling to make monthly payments or save for the future, Sahil wanted to figure out to take an illiquid asset like a home and make it easily accessible.

Around the same time, Sahil’s co-founder Sundeep Ambati was working as a contractor on a new business venture of his and was struggling to get a home equity loan. While these circumstances ultimately led Sahil and Sundeep to found Patch Homes in 2016 out of the Techstars New York accelerator program, the deeper motivation behind Patch can be traced back nearly 30 years when Sahil’s father made an equity-sharing agreement with his brother as they were building his family’s home in India.

With a growing family and a pregnant wife, Sunil’s father was adamant about living debt-free, so his brother provided an investment in exchange for an equity stake in the house. According to Sahil, the home is still in the family and has appreciated substantially in value to the benefit of both Sahil’s father and his brother. Longer-term, Patch wants to be the preferred partner for home ownership, helping reduce cash-tight owners’ financial anxiety without the debilitating weight of debt.

“Some companies want to help people buy or sell homes, but home ownership really begins after that point. Patch is built to be inside the home with you and everything that comes thereafter,” Gupta told TechCrunch.

“Patch was created to partner with homeowners to help them unlock their home equity so they can achieve their financial goals along every step of their home ownership journey.

Powered by WPeMatico

Bryn Mooser, co-founder of virtual and augmented reality studio RYOT, said he’s “hanging up my VR and AR hats to really focus on more, shall we say, traditional nonfiction storytelling.”

Back in 2016, Mooser sold RYOT to The Huffington Post and AOL (TechCrunch’s parent company, now known as Verizon Media), and he left RYOT at the end of last year. Today he’s announcing XTR, a production company focused on documentary films and nonfiction series.

The company’s name comes from the 16 millimeter camera that Mooser said was part of a “first wave” of tools making documentary filmmaking more accessible. With XTR, Mooser said he wants to continue that process.

“Technology is front-and-center of this revolution that’s happening,” he told me. “What’s happening in documentary films right now is a direct result of cameras getting cheaper,” making it easier for anyone to create a “beautiful, professional film.”

At the same time, he noted that documentary distribution was previously limited to art-house cinemas, HBO and “one row at your local Blockbuster.” Now, social media and streaming services like Netflix and Hulu have opened up new distribution channels that are bringing documentaries to broader audiences.

XTR studio

XTR will be based out of LA’s Echo Park neighborhood, in a warehouse that will serve as office, post-production facility and event space. And rather than operating like a traditional production company, Mooser said he wants XTR to take “more of a tech startup approach.”

He explained, “We have a vision to really scale it out: How do we work with a lot of new directors? How do we work with all the platforms? How do we think about audiences globally?”

That approach also involves outside capital. XTR said it has already raised an undisclosed amount of funding from former AOL CEO Tim Armstrong, Airbnb co-founder Joe Gebbia, Franklin McLarty, Christina and David Arquette, Josh Kushner, Lyn and Norman Lear, Bryan Baum, Mark McLarty and Zem and James Joaquin.

While Mooser is officially unveiling the company today, he said it’s already developing eight documentaries (which will be announced later this year) with partners like Vice Studios, Futurism and Anonymous Content.

“There’s a real opportunity to have a new company in there, looking out for those new filmmakers, and [trying] to shift the power balance a little bit,” he said. “The way we do that is, we look for great talent and we empower them to do what they want to do … at every step of the way.”

Powered by WPeMatico

Veo, a Copenhagen, Denmark-based startup that offers an “AI camera” to make it easier for amateur soccer clubs to video and stream matches, has raised $6 million in Series A funding.

Backing the round is U.S.-based CourtsideVC, France’s Ventech Capital and Danish firm VC Seed Capital. Veo says the new capital will be used to launch in the U.S.

Founded in 2015 by Henrik Teisbæk, Jesper Taxbøl and Keld Reinicke, Veo has set out to “democratise” the filming of soccer matches and training by negating the need for multiple camera operators and/or a vision mixer.

It does this by employing a 4K lens camera that records the entire pitch (it’s designed to be mounted on a 23-foot tripod for optimal view), coupled with its AI video technology that processes the resulting video. This sees Veo follow the action via virtual panning and zooming to create a TV-like viewing experience.

As we’ve noted before, that does mean a portion of the image will often be cropped out, resulting in a loss of resolution overall. However, the idea is that by starting with 4K, the video quality is more than sufficient for playback on smaller screens, such as smartphones and tablets.

“Our immediate goal is to establish a foothold for Veo on the U.S. market, and a lot of the investment will go towards achieving that,” Veo CEO Henrik Teisbæk tells TechCrunch with regards to the new funding round. “In the long term, we want to use our U.S. market presence as a stepping stone towards becoming a central player on the global football market, and to hopefully break into other sports.”

Teisbæk says the U.S. was chosen because it is one of the “biggest and most exciting” soccer markets, and North American soccer players, coaches, clubs and associations are very data-driven and open to new technology. “That represents a huge potential for us,” he adds.

Meanwhile, Veo says that in the last year it has seen 25,000 games recorded by 1,000 clubs in 50 countries. The company now employs 35 people in its Copenhagen HQ, where it develops the Veo software and hardware.

Powered by WPeMatico

French startup Zyl has raised $1 million (€1 million) in a round led by OneRagtime. The company has developed an app that uses artificial intelligence to find the most interesting photos and videos in your photo library.

Now that smartphones have been around for a while, many people have thousands of unsorted photos on their iPhone or Android device. And chances are you don’t often scroll back to look at past vacations and important life events.

Zyl is well aware of that. That’s why the company does the heavy lifting for you. The app scans your photo library to find important memories and photos you may have forgotten. It has even registered patents for some of its algorithms.

But identifying photos and videos is just one thing. In order to turn that process into a fun, nostalgia-powered experience, the app sends you a notification every day to tell you that Zyl has identified a new memory — they call it a Zyl. When you tap on it, the app reveals that memory and you can share it with your friends and family.

You then have to wait another 24 hours to unlock another Zyl. That slow-paced approach is key as you spend more time looking at Zyls and sharing them with loved ones.

It’s also worth noting that Zyl processes your photo library on your iPhone or Android device directly. Photos aren’t sent to the company’s server.

Up next, Zyl plans to enrich your collection of Zyls with more photos and videos from your friends and family. You could imagine a way to seamlessly share photos of the same life event with your loved ones, even if they are currently spread out over multiple smartphones.

With today’s funding round, the company wants to improve the app and reach millions of users. Zyl already has impressive retention rates, with 38% of users opening the app regularly during five weeks or more.

Powered by WPeMatico

Sex, despite being one of the most fundamental human experiences, is still one of those businesses that some advertisers reject, banks are hesitant to financially support and some investors don’t want to fund.

Given how sex is such a huge part of our lives, it’s no surprise founders are looking to capitalize on the space. But the idea of pleasure versus function, plus the stigma still associated with all-things sex, is at the root of the barriers some startup founders face.

Just last month, Samsung was forced to apologize to sextech startup Lioness after it wrongfully asked the company to take down its booth at an event it was co-hosting. Lioness is a smart vibrator that aims to improve orgasms through biofeedback data.

Sextech companies that relate to the ability to reproduce or, the ability to not reproduce, don’t always face the same problems when it comes to everything from social acceptance to advertising to raising venture funding. It seems to come down to the distinction between pleasure and function, stigma and the patriarchy.

This is where the trajectories for sextech startups can diverge. Some startups have raised hundreds of millions from traditional investors in Silicon Valley while others have struggled to raise any funding at all. As one startup founder tells me, “Sand Hill Road was a big no.”

Powered by WPeMatico

JobTeaser, the graduate recruitment and career guidance platform, has raised £45 million in new funding to help it expand its careers service to more students across the U.K. and Europe.

The investment is led by Highland Europe, with continued backing from existing investors Alven, Idinvest Partners, Seventure Partners and Korelya Capital. It brings the total amount raised to £61 million since the company was founded all the way back in 2008.

JobTeaser says the funding will be used to expand JobTeaser’s partner network of schools and universities across the U.K. and Ireland.

That company’s aim is to become the official careers website for its education partners. The promise is that it can connect more students and graduates to the careers they seek and in turn help corporates and organisations plug gaps in the talent and skills they need.

“We believe the transition between University and the professional world is very difficult for young talent,” Adrien Ledoux, co-founder of JobTeaser, tells me. “A lot of young talent feel lost when it comes to choosing their career; in the survey that we conducted with WISE this year, we discovered that 9 out of 10 young people in Europe want better support to define their career choices.”

Ledoux says JobTeaser’s goal is to transform the way students and recent graduates find work by helping them choose a career path that fits with their aspirations and ambitions. “We are convinced that if each young talent puts their energy into the right job, all of society benefits from it,” he says

To achieve this mission, JobTeaser has built a platform that combines bespoke career guidance with internships, job opportunities and ongoing career and interview support.

In order to reach the largest number of students and recent graduates, JobTeaser provides its “Career Centre by JobTeaser” platform free of charge to universities. It then charges businesses a fee to advertise jobs to that captive audience.

“Businesses can access talent at the right place (the university) and at the right time (when they are looking for their first job),” explains Ledoux. “Our platform allows businesses to pay once to multi-post their job ads and employer-branded content in a single click, which then goes out to all of JobTeaser’s partner higher education institutions.”

It’s this business model that allows JobTeaser to reach businesses, universities and prospective young jobseekers across 19 European countries, says the JobTeaser co-founder.

Since its launch, JobTeaser says it has served 2.5 million students and recent graduates. The company works with more than 70,000 businesses, including Amazon, PWC, Deutsche Bank, Blackrock, L’Oréal and LVMH.

Powered by WPeMatico

Palo Alto Networks surely loves to buy security startups. Today it added to its growing collection when it announced its intent to acquire IoT security startup Zingbox for $75 million.

The company had raised $23.5 million, according to Crunchbase data. The three co-founders, Xu Zou, May Wang and Jianlin Zeng, will be joining Palo Alto after the sale is official.

With Zingbox, the company gets IoT security chops, something that is increasingly important as companies deploy internet-connected smart devices and sensors. While these tools can greatly benefit customers, they also often carry a huge security risk.

Zingbox, which was founded in 2014, gives Palo Alto a modern cloud-based solution built on a subscription model along with engineering talent to help build out the solution further. Nikesh Arora, chairman and CEO of Palo Alto Networks, certainly sees this.

“The proliferation of IoT devices in enterprises has left customers facing an enormous gap in protection against cybersecurity attacks. With the proposed acquisition of Zingbox, we will provide a first-of-its-kind subscription for our Next-Generation Firewall and Cortex platforms that gives customers the ability to gain control, visibility and security of their connected devices at scale,” Arora said in a statement.

This is the fourth security startup the company has purchased this year. It acquired two companies, nabbing PureSec and Twistlock, on the same day last Spring. Earlier this year, it bought Demisto for $560 million. All of these acquisitions are meant to build up the company’s portfolio of modern security offerings without having to build these kinds of tools in-house from scratch.

Powered by WPeMatico

Reefknot Investments, a joint venture between Temasek, Singapore’s sovereign fund, and global logistics company Kuehne + Nagel, announced today the launch of a $50 million fund for logistics and supply chain startups. The firm is based in Singapore, but will look for companies around the world that are raising their Series A or B rounds.

Managing director Marc Dragon tells TechCrunch that Reefknot will serve as a strategic investor in its portfolio companies, providing them with connections to partners that include EDBI, SGInnovate, Atlantic Bridge, Vertex Ventures, PSA unBoXed, Unilever Foundry and NUS Enterprise, in addition to Temasek and Kuehne + Nagel .

Dragon, a veteran of the supply chain and logistics industry, says Reefknot plans to invest in about six to eight startups. It is especially interested in companies that are using AI or deep mind tech, digital logistics and trade finance to solve problems that range from analyzing supply chain data and making forecasts to managing the risk of financing trade transactions. Data from Gartner shows that about half of global supply chain companies will use AI, advanced analytics or the Internet of Things in their operations by 2023.

“There is a high level of expectation from vendors that because of technology, there will be new methods to do analytics and planning, and greater visibility in terms of information and product, materials and goods flowing throughout the supply chain,” says Dragon.

Reefknot will also establish a think tank that will work with industry experts and government organizations on forums, research and exploring new logistics and supply chain business models that startups can bring into fruition.

Powered by WPeMatico