Fundings & Exits

Auto Added by WPeMatico

Auto Added by WPeMatico

India’s Oyo said on Monday it has acquired Copenhagen-based data science firm Danamica as the fast-growing lodging startup works to expand its business in Europe.

Neither of the parties disclosed financial terms of the deal, but a source familiar with the matter told TechCrunch that Oyo paid about $10 million to acquire the Danish firm.

Danamica, which was founded in 2016, has built machine learning tools and “business intelligence capabilities” to specialize in dynamic pricing of rental properties. The firm’s algorithm analyzes 144,000 data points every hour and makes 60 million price changes every day with a prediction accuracy of 97% to help hotels boost their revenue, Oyo said. The Indian startup said Danamica would help it scale its technical expertise as it expands its footprint in overseas markets.

Oyo, which is the largest hotel chain in India, is rapidly expanding in other countries. It has already established presence in 80 countries, the six-year old startup said. About half of its 1 million rooms are in China, where it launched last year.

Today’s announcement comes weeks after Oyo said it planned to invest €300 million in its vacation rental business in Europe, and $300 million toward U.S. expansion over the coming years. In May this year, Oyo bought Amsterdam-based holiday rental company Leisure from Axel Springer for $415 million.

In a prepared statement, Maninder Gulati, Global Head of OYO Vacation and Urban Homes and Chief Strategy Officer of OYO Hotels & Homes, said, “We are delighted to announce our acquisition of Danamica, a Europe based, machine learning and business intelligence company specialized in dynamic pricing, that will help us be more accurate with pricing, leading to higher efficiencies and yield for our real estate owners and value for money for our millions of global guests, both everyday travellers and city dwellers, that choose an OYO Vacation Homes as their abode.”

In July this year, Oyo entered co-working spaces market with the launch of Oyo Workspaces. At a media conference in New Delhi, startup executives said they aim to make Oyo Workspaces the largest business in its category in Asia by end of next year. To immediately capture some market share, Oyo said it had acquired Indian co-working spaces startup Innov8. Sources told TechCrunch then that Oyo had paid about $30 million to acquire Innov8.

In the same month, 25-year-old Ritesh Agarwal (pictured above), founder of SoftBank-backed Oyo, invested $2 billion to triple his stake in the company as early investors Lightspeed and Sequoia partly cashed out. The deal pushed Oyo’s valuation to $10 billion.

Powered by WPeMatico

Spotawheel, a startup operating in Greece and Poland with a car dealership model quite similar to Carvana in the U.S., has picked up €5 million in new funding. Backing the online used car dealership is VentureFriends, which led the round, with participation from Velocity Partners and unnamed “strategic” investors.

The investment includes both equity and debt financing, since part of Spotawheel’s business includes purchasing used cars upfront. It brings total raised by the Athens-headquartered startup to €8 million since launching in 2016.

“Used cars is one of the largest markets in value worldwide growing at a 5-7% rate annually, operating still primarily offline in a notoriously non-transparent way,” says Charis Arvanitis, Spotawheel co-founder and CEO.

This sees potential buyers fear buying a “lemon,” coupled with over-complicated processes, hidden-fees, and fragmented supply. The latter is largely a combination of private sellers via classified ads, and traditional offline used car dealerships.

“The lack of centralized control on the industry’s hugely fragmented seller structure, has prevented any meaningful innovation over the past 20 years, when the typical online classified ads emerged,” says Arvanitis. “That problem is even more evident in Europe, where car trade flows between countries make it much harder to control quality and trace cars history”.

To address this, Spotawheel offers an online B2C platform for used cars that Arvanitis says has redesigned the buy-sell process from scratch to create a “frictionless” and trusted buying experience. The idea is to bring e-commerce levels of convenience and protection to purchasing a used car.

“Customers can opt in for a test drive or have the car delivered countrywide under a 7-day return policy, while enjoying up to 5 years of limited warranty, the largest in Europe,” he says. This is underpinned by Spotawheel’s “predictive analytics” covering the condition and expected failures on a per car basis.

In addition, Arvanitis explains Spotawheel’s car sourcing model combines both debt-financed and marketplace practices, allowing the startup to source the best cars from private owners and B2B resellers across Europe. This includes deploying working capital purchasing vehicles upfront or via a commission-basis agreement.

Powered by WPeMatico

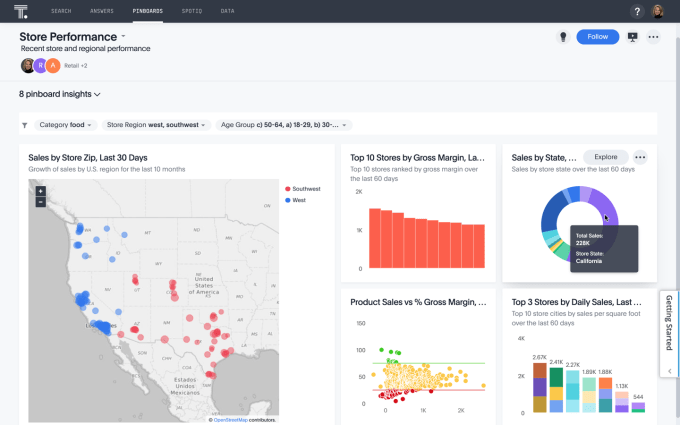

ThoughtSpot was started by a bunch of ex-Googlers looking to bring the power of search to data. Seven years later the company is growing fast, sporting a fat valuation of almost $2 billion and looking ahead to a possible IPO. Today it announced a hefty $248 million Series E round as it continues on its journey.

Investors include Silver Lake Waterman, Silver Lake’s late-stage growth capital fund, along with existing investors Lightspeed Venture Partners, Sapphire Ventures and Geodesic Capital. Today’s funding brings the total raised to $554 million, according to the company.

The company wants to help customers bring speed to data analysis by answering natural language questions about the data without having to understand how to formulate a SQL query. As a person enters questions, ThoughtSpot translates that question into SQL, then displays a chart with data related to the question, all almost instantly (at least in the demo).

It doesn’t stop there though. It also uses artificial intelligence to understand intent to help come up the exact correct answer. ThoughtSpot CEO Sudheesh Nair says that this artificial intelligence underpinning is key to the product. As he explained, if you are looking for the answer to a specific question, like “What is the profit margin of red shoes in Portland?,” there won’t be multiple answers. There is only one answer, and that’s where artificial intelligence really comes into play.

“The bar on delivering that kind of answer is very high and because of that, understanding intent is critical. We use AI for that. You could ask, ‘How did we do with red shoes in Portland?’ I could ask, ‘What is the profit margin of red shoes in Portland?’ The system needs to know that we both are asking the same question. So there’s a lot of AI that goes behind it to understand the intent,” Nair explained.

Image: ThoughtSpot

ThoughtSpot gets answers to queries by connecting to a variety of internal systems, like HR, CRM and ERP, and uses all of this data to answer the question, as best it can. So far, it appears to be working. The company has almost 250 large-company customers, and is on a run rate of close to $100 million.

Nair said the company didn’t necessarily need the money, with $100 million still in the bank, but he saw an opportunity, and he seized it. He says the money gives him a great deal of flexibility moving forward, including the possibility of acquiring companies to fill in missing pieces or to expand the platform’s capabilities. It also will allow him to accelerate growth. Plus, he sees the capital markets possibly tightening next year and he wanted to strike while the opportunity was in front of him.

Nair definitely sees the company going public at some point. “With these kind of resources behind us, it actually opens up an opportunity for us to do any sort of IPO that we want. I do think that a company like this will benefit from going public because Global 2000 kind of customers, where we have our most of our business, appreciate the transparency and the stability represented by public companies,” he said.

He added, “And with $350 million in the bank, it’s totally [possible to] IPO, which means that a year and a half from now if we are ready to take the company public, we can actually have all options open, including a direct listing, potentially. I’m not saying we will do that, but I’m saying that with this kind of funding behind us, we have all those options open.”

Powered by WPeMatico

Airship announced today that it has acquired Apptimize, an A/B testing company whose customers include Glassdoor, HotelTonight and The Wall Street Journal.

Formerly known as Urban Airship, the more concisely named Airship has built a platform for companies to manage their customer communication across SMS, push notifications, email, mobile wallets and more.

It says that by acquiring Apptimize, it can help customers test the impact of their messages. That means integrating Apptimize’s testing capabilities into the Airship platform, but the company says it will also continue to support Apptimize as a standalone platform.

“By combining Apptimize mobile app and web testing with Airship’s deep insight into customer engagement across channels, marketers and developers can focus innovation on the most critical areas while creating the seamless end-to-end experiences customers really want,” said Airship president and CEO Brett Caine in a statement.

The financial terms of the acquisition were not disclosed. Apptimize had raised a total of $18.6 million from US Venture Partners, Costanoa Ventures and others, according to Crunchbase.

Airship says it will be bringing over 19 Apptimize team members (a little less than two-thirds of the startup’s total workforce) across engineering, customer service and sales.

Powered by WPeMatico

Boll & Branch, which sells sustainably sourced sheets, pillows, mattresses and towels, is announcing that it has raised $100 million in a strategic investment from L Catterton’s Flagship Buyout Fund.

This looks like a big change from the company’s previous approach to funding. It was self-funded for its first two years (resulting in what CEO Scott Tannen described as “a lot of maxed out credit cards and five mortgages on my house”), and even when it started looking at venture capital, it only raised a total of $12 million from a single institutional backer, Silas Capital.

In fact, when Recode wrote about Boll & Branch’s Series B last year, it described the startup as one “that wants to raise as little venture capital as possible.”

Tannen said that when he founded the company with his wife Missy, they wanted to “build a sustainable business from the ground up,” and that wasn’t just about the products — they didn’t want to build a company that was “ultimately designed from day one to be sold.”

As a result, he said, Boll & Branch has been profitable for the past four years and is now bringing in “nine-figure revenue.” He compared it to other L Catterton investments like The Honest Company and Peloton, companies that “have become the winner in the startup competition” and are ready to “really become household names.”

In a statement, L Catterton’s Nik Thukral described Boll & Branch as “one of the most beloved bedding brands” and said it “capitalizes on several compelling trends including the emergence of authentic, pure, and chemical free products that can be traced back to their origin, as well as consumers’ heightened focus on healthy living.”

The company’s next steps include expanding internationally — Tannen said that while the company doesn’t currently sell outside the United States, “It’s hard to imagine a country or market in the world that doesn’t make sense for Boll & Branch.”

It will also continue expanding the product lineup. Tannen hinted at “really interesting product introductions” coming in the next few months. They might not be the most obvious additions to the lineup, but he said these decisions come from asking, “What does the home goods brand of the future look like?”

He added, “That’s what we’re trying to be, versus trying to look in the shopping mall and just creating a new version of something [that already exists].”

Powered by WPeMatico

Megvii Technology, the Beijing-based artificial intelligence startup known in particular for its facial recognition brand Face++, has filed for a public listing on the Hong Kong stock exchange.

Its prospectus did not disclose share pricing or when the IPO will take place, but Reuters reports that the company plans to raise between $500 million and $1 billion and list in the fourth quarter of this year. Megvii’s investors include Alibaba, Ant Financial and the Bank of China. Its last funding round was a Series D of $750 million announced in May that reportedly brought its valuation to more than $4 billion.

Founded by three Tsinghua University graduates in 2011, Megvii is among China’s leading AI startups, with its peers (and rivals) including SenseTime and Yitu. Its clients include Alibaba, Ant Financial, Lenovo, China Mobile and Chinese government entities.

The company’s decision to list in Hong Kong comes against the backdrop of an economic recession and political unrest, including pro-democracy demonstrations, factors that have contributed to a slump in the value of the benchmark Hang Seng index. Last month, Alibaba reportedly decided to postpone its Hong Kong listing until the political and economic environment becomes more favorable.

Megvii’s prospectus discloses both rapid growth in revenue and widening losses, which the company attributes to changes in the fair value of its preferred shares and investment in research and development. Its revenue grew from 67.8 million RMB in 2016 to 1.42 billion RMB in 2018, representing a compound annual growth rate of about 359%. In the first six months of 2019, it made 948.9 million RMB. Between 2016 and 2018, however, its losses increased from 342.8 million RMB to 3.35 billion RMB, and in the first half of this year, Megvii has already lost 5.2 billion RMB.

Investment risks listed by Megvii include high R&D costs, the U.S.-China trade war and negative publicity over facial recognition technology. Earlier this year, Human Rights Watch published a report that linked Face++ to a mobile app used by Chinese police and officials for mass surveillance of Uighurs in Xinjiang, but it later added a correction that said Megvii’s technology had not been used in the app. Megvii’s prospectus alluded to the report, saying that in spite of the correction, the report “still caused significant damages to our reputation which are difficult to completely mitigate.”

The company also said that despite internal measures to prevent misuse of Megvii’s tech, it cannot assure investors that those measures “will always be effective,” and that AI technology’s risks and challenges include “misuse by third parties for inappropriate purposes, for purposes breaching public confidence or even violate applicable laws and regulations in China and other jurisdictions, bias applications or mass surveillance, that could affect user perception, public opinions and their adoption.”

From a macroeconomic perspective, Megvii’s investment risks include the restrictions and tariffs placed on Chinese exports to the U.S. as part of the ongoing trade war. It also cited reports that Megvii is among the Chinese tech companies the U.S. government may add to trade blacklists. “Although we are not aware of, nor have we received any notification, that we have been added as a target of any such restrictions as of the date this Document, the existence of such media reports itself has already damaged our reputation and diverted our management’s attention,” the prospectus said. “Whether or not we will be included as a target for economic and trade restrictions is beyond our control.”

Powered by WPeMatico

When Dell acquired EMC in 2016 for $67 billion, it created a complicated consortium of interconnected organizations. Some, like VMware and Pivotal, operate as completely separate companies. They have their own boards of directors, can acquire companies and are publicly traded on the stock market. Yet they work closely within Dell, partnering where it makes sense. When Pivotal’s stock price plunged recently, VMware saved the day when it bought the faltering company for $2.7 billion yesterday.

Pivotal went public last year, and sometimes struggled, but in June the wheels started to come off after a poor quarterly earnings report. The company had what MarketWatch aptly called “a train wreck of a quarter.”

How bad was it? So bad that its stock price was down 42% the day after it reported its earnings. While the quarter itself wasn’t so bad, with revenue up year over year, the guidance was another story. The company cut its 2020 revenue guidance by $40-$50 million and the guidance it gave for the upcoming 2Q 19 was also considerably lower than consensus Wall Street estimates.

The stock price plunged from a high of $21.44 on May 30th to a low of $8.30 on August 14th. The company’s market cap plunged in that same time period falling from $5.828 billion on May 30th to $2.257 billion on August 14th. That’s when VMware admitted it was thinking about buying the struggling company.

Powered by WPeMatico

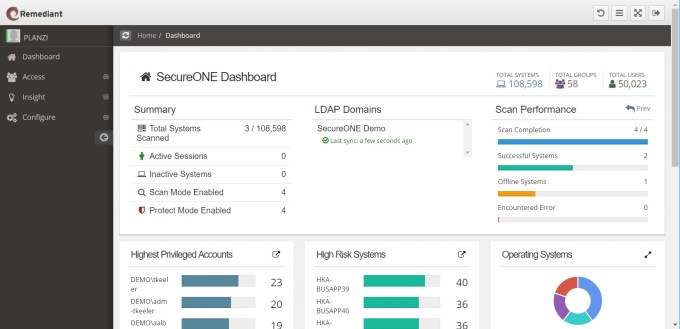

Remediant, a startup that helps companies secure privileged access in a modern context, today announced a $15 million Series A led by Dell Technologies Capital and ForgePoint Capital.

Remediant’s co-founders, Paul Lanzi and Tim Keeler, worked in biotech for years and saw a problem first-hand with the way companies secured privileged access. It was granted to certain individuals in the organization carte blanche, and they believed if you could limit access, it would make the space more secure and less vulnerable to hackers.

Lanzi says they started the company with two core concepts. “The first concept is the ability to assess or detect all of the places where privileged accounts exist and what systems they have access to. The second concept is to strip away all of the privileged access from all of those accounts and grant it back on a just-in-time basis,” Lanzi explained.

If you’re thinking that could get in the way of people who need access to do their jobs, as former IT admins, they considered that. Remediant is based on a Zero Trust model where you have to prove you have the right to access the privileged area. But they do provide a reasonable baseline amount of time for users who need it within the confines of continuously enforcing access.

“Continuous enforcement is part of what we do, so by default we grant you four hours of access when you need that access, and then after that four hours, even if you forget to come back and end your session, we will automatically revoke that access. In that way all of the systems that are protected by SecureOne (the company’s flagship product) are held in this Zero Trust state where no one has access to them on a day-to-day basis,” Lanzi said.

Remediant SecureONE Dashboard (Screenshot: Remediant)

The company has bootstrapped until now, and has actually been profitable, something that’s unusual for a startup at this stage of development, but Lanzi says they decided to take an investment in order to shift gears and concentrate on growth and product expansion.

Deepak Jeevankumar, managing director at investor Dell Technologies Capital, says it’s not easy for security startups to rise above the noise, but he saw something in Remediant’s founders. “Tim and Paul came from the practitioner’s viewpoint. They knew the actual problems that people face in terms of privileged access. So they had a very strong empathy towards the customer’s problem because they lived through it,” Jeevankumar told TechCrunch.

He added that the privileged access market hasn’t really been updated in two decades. “It’s a market ripe for disruption. They are combining the just-in-time philosophy with the Zero Trust philosophy, and are bringing that to the crown jewel of administrative access,” he said.

The company’s tools are installed on the customer’s infrastructure, either on-prem or in the cloud. They don’t have a pure cloud product at the moment, but they have plans for a SaaS version down the road to help small and medium-sized businesses solve the privileged access problem.

Lanzi says they are also looking to expand the product line in other ways with this investment. “The basic philosophies that underpin our technology are broadly applicable. We want to start applying our technology in those other areas as well. So as we think toward a future that looks more like cloud and more like DevOps, we want to be able to add more of those features to our products,” he said.

Powered by WPeMatico

Splunk, the publicly traded data processing and analytics company, today announced that it has acquired SignalFx for a total price of about $1.05 billion. Approximately 60% of this will be in cash and 40% in Splunk common stock. The companies expect the acquisition to close in the second half of 2020.

SignalFx, which emerged from stealth in 2015, provides real-time cloud monitoring solutions, predictive analytics and more. Upon close, Splunk argues, this acquisition will allow it to become a leader “in observability and APM for organizations at every stage of their cloud journey, from cloud-native apps to homegrown on-premises applications.”

Indeed, the acquisition will likely make Splunk a far stronger player in the cloud space as it expands its support for cloud-native applications and the modern infrastructures and architectures those rely on.

Ahead of the acquisition, SignalFx had raised a total of $178.5 million, according to Crunchbase, including a recent Series E round. Investors include General Catalyst, Tiger Global Management, Andreessen Horowitz and CRV. Its customers include the likes of AthenaHealth, Change.org, Kayak, NBCUniversal and Yelp.

“Data fuels the modern business, and the acquisition of SignalFx squarely puts Splunk in position as a leader in monitoring and observability at massive scale,” said Doug Merritt, president and CEO, Splunk, in today’s announcement. “SignalFx will support our continued commitment to giving customers one platform that can monitor the entire enterprise application lifecycle. We are also incredibly impressed by the SignalFx team and leadership, whose expertise and professionalism are a strong addition to the Splunk family.”

Powered by WPeMatico

Nearly 200 startups have just graduated from the prestigious San Francisco startup accelerator Y Combinator . The flock of companies are now free to proceed company-building with a fresh $150,000 check and three-months full of tips and tricks from industry experts.

As usual, we sent several reporters to YC’s latest demo day to take notes on each company and pick our favorites. But there were many updates to the YC structure this time around and new trends we spotted from the ground that we’ve yet to share.

Powered by WPeMatico