Fundings & Exits

Auto Added by WPeMatico

Auto Added by WPeMatico

Hello and welcome back to Equity, TechCrunch’s venture-capital-focused podcast where we unpack the numbers behind the headlines.

This is Equity Monday Tuesday, our weekly kickoff that tracks the latest private market news, talks about the coming week, digs into some recent funding rounds and mulls over a larger theme or narrative from the private markets. You can follow the show on Twitter here and myself here.

What a busy weekend we missed while mostly hearing distant explosions and hugging our dogs close. Here’s a sampling of what we tried to recap on the show:

It’s going to be a busy week! Chat tomorrow.

Equity drops every Monday at 7:00 a.m. PST, Wednesday, and Friday at 6:00 a.m. PST, so subscribe to us on Apple Podcasts, Overcast, Spotify and all the casts!

Powered by WPeMatico

Business trip booking platform TravelPerk has bagged another rival — picking up UK-based Click Travel. Terms of the deal are not being disclosed but we’re told it’s the third — and largest — acquisition for TravelPerk to date.

The Barcelona-based startup has been on a bit of a shopping spree since the pandemic crisis hit Europe last year, picking up risk management startup Albatross in summer 2020 to bolster resilience to COVID-19’s impacts, before going on to acquire US-based NexTravel in January to expand its presence in the US market.

The latest acquisition deepens TravelPerk’s UK and European business, adding Click Travel’s 2,000+ SME clients (which includes the likes of Five Guys, Red Bull and Talk Talk) to its customer base — which will total just over 5,000 post-acquisition.

The UK company handles some £300M in business travel for its client base, which will bolster TravelPerk’s revenues going forward. The latter now bills itself as the “leading” travel management platform for the SME market globally and the UK as a whole.

“We are a global travel management platform but our core markets are the US and Europe and we expect both markets to be our primary growth areas this year,” said CEO and co-founder Avi Meir. “At the current moment, the US is our largest market due to the covid restrictions in the EU & UK.”

“Assuming travel restrictions won’t be imposed again, we expect to grow by 200% in 2022 with strong growth in our core markets in the US & EU,” he added.

Click Travel, which is based in Birmingham, was founded all the way back in 1999 — and appears to have raised relatively little venture capital over the years, per Crunchbase. However, in 2018, the veteran player participated in the government-backed Future Fifty scale-up program — and also took in a “multi-million pound” investment from the UK-based Business Growth Fund.

Whether there will be any domestic hang-wringing over a high growth UK business being sold to a European rival remains to be seen.

In a statement on its sale to TravelPerk, CEO James McLean omitted to mention the pandemic’s impact on the travel sector — choosing instead to highlight what he couched as the pair’s shared “mission” to reduce the cost and complexity of business travel.

“Those shared objectives, combined with the natural cultural fit between our two companies, means we are incredibly excited to bring our teams together. Combining TravelPerk’s industry-leading knowledge, technology, experience and first class customer support with our own is a powerful proposition and we can’t wait to get started,” McLean added.

While Click Travel has focused on serving the UK market, TravelPerk has had a global focus from the start.

It has also attracted a large amount of external investment (totalling just under $300M) over its shorter run (founded in 2015).

Back in April, for example, it raised a $160M Series D round. It had also topped up its Series C round in July 2019 before the pandemic hit. So TravelPerk hasn’t been short of funds to ride out the COVID-19 revenue crunch — and as well as shopping for competitors it has also been able to avoid making any layoffs over the travel crisis.

Per a press release, capital to fund the Click Travel acquisition was provided by Boston-based investment manager, The Baupost Group.

TravelPerk’s Meir remains bullish about the near-term prospects for growth in the business travel sector, despite ongoing concerns in Europe and the US about the more infectious ‘Delta’ variant of the virus which is contributing to surging rates of COVID-19 in some markets (including the UK) — claiming it’s already seeing green shoots of recovery in “key markets”.

“TravelPerk is outgrowing the market pace and is already at above 2019 revenue figures,” Meir told TechCrunch. “When it comes to the rest of the industry, the recovery of travel is well underway but moving at different speeds in different markets. For instance in the US, according to TSA Checkpoint figures, at the current rate of recovery the US travel market is expected to reach pre-pandemic volume at the end of August 2021.

“We anticipate the global market may take a little longer but are optimistic we will see close to pre-pandemic levels in 2022.”

“We’re one of the few players in the travel industry that continued scaling and growing since the beginning of the pandemic with a strategy that didn’t involve any layoffs,” he also told us. “Since March last year, our strategy has been not to sit back but to be aggressive and invest massively in our product offering and in our global reach, so that we are in the best position possible to capitalise when travel makes its full recovery. Today’s news is a major part of that plan.

“We will aim to continue being aggressive in our growth strategy and we are open to more acquisitions if they make strategic sense and are aligned with our vision and culture.”

Per Meir, Click Travel and TravelPerk will initially continue to run as two independent platforms but he confirmed that an “eventual full integration” is planned — with both set to operate under the TravelPerk brand in time.

The startup also says it will retain all Click Travel’s staff — denying it has plans to axe any jobs. It also intends to hold onto the company’s Birmingham base — having the city as another UK hub for its business (in addition to its existing London office).

“The 150 amazing people working for Click Travel were a big reason why we wanted to acquire the company, and were priced into the deal,” said Meir. “We have no plans of redundancies. We rather aim to integrate the entire team into the TravelPerk Group.”

Asked if TravelPerk might consider expanding its focus to also target the enterprise segment, he noted that it’s seen interest from larger businesses — and said he’s “open” to the idea — but for now Meir said TravelPerk remains fully focused on the SME market: “where we think there is the biggest need, and the biggest growth potential”.

“That’s why this acquisition is so exciting for us; it makes us undoubtedly the leading travel management platform for SMEs globally,” he added.

Discussing how the pandemic has changed business travel, Meir highlighted two “important trends” he said TravelPerk will continue to invest it: Namely flexibility for bookings; and sustainability so environmental impact can be reduced.

TravelPerk plans to invest more than $100M in two key products in these areas (aka: FlexiPerk and GreenPerk), per Meir.

“We’ve noticed on our platform that travellers are booking closer to their departure date: Before the pandemic, trip searches were usually conducted between 7 and 30 days prior to the selected departure date,” he said, elaborating on the importance of flexibility for the sector. “Now we are seeing most trip searches are for trips less than 6 days away. Flexibility is therefore one of the most in-demand perks in business travel. Travellers will rely on flexible fares to give them the peace of mind that they won’t lose money if they need to change or cancel a trip on short notice.”

On sustainability, Meir said businesses are already looking for ways to reduce their carbon footprint and general environmental impact, while consumers are also wanting to make conscientious decisions to reduce carbon emission — suggesting that train-based travel is set to gain ground (vs flights) as a result. (That might, ultimately, require some creative retooling of TravelPerk’s logo — which prominently features an airplane icon… )

“We expect to see significant interest in our carbon offsetting product, GreenPerk, as a result but we also expect to see changes in how people are choosing to travel,” he said.

“For instance, rail is undoubtedly the more environmentally-friendly travel option. In fact, taking a train over a domestic flight can reduce an individual’s carbon emissions by about 84%. We have been building out our rail inventory for a number of years now and we expect train travel to be an increasingly popular business travel option for customers this year and next.”

As for the changing mix of business-related travel in a pandemic-reconfigured world of remote work, Meir continues to argue that more businesses providing employees with remote working options will sum to more business travel overall.

“This might be bad news for the daily commute but it will result in more business travel,” he suggested. “Whether they are going fully remote and ‘working from anywhere’, or operating on a hybrid model, distributed teams will need (and want) to come together. We believe there will be a new type of business trip — one where team members will travel from different working hubs to get together for teambuilding and brainstorming sessions, for meetings with clients and colleagues, and even for ‘bleisure’ (business and leisure) trips.”

Powered by WPeMatico

French startup ManoMano has raised a Series F funding round of $355 million led by Dragoneer Investment Group. The company operates an e-commerce platform focused on DIY, home improvement and gardening products. It is currently available in six European countries. Following today’s funding round, the company has reached a valuation of $2.6 billion.

In addition to Dragoneer Investment Group, Temasek, General Atlantic, Eurazeo, Bpifrance’s Large Venture fund, Aglaé Ventures, Kismet Holdings and Armat Group are also participating.

“We operate in Europe and we are the industry leader in online sales,” co-founder and co-CEO Philippe de Chanville told me. In France in particular, the company has been profitable for a couple of years already. In 2020 alone, the company’s gross merchandise volume doubled to €1.2 billion ($1.42 billion at today’s rate).

So why did the company raise given that it’s already in a strong position to replicate the same model in other European markets? Because they could and because they didn’t need to. With a high valuation, ManoMano could raise quite a bit of money without having to sell a significant chunk of its equity.

In addition to France, the startup operates in Spain, Italy, Belgium, Germany and the U.K. With today’s funding round, the company wants to develop its activities in the U.K. and Germany in particular — they are Europe’s two biggest markets for home improvement and gardening.

ManoMano sells products to hobbyists and also targets the B2B market with ManoManoPro. It’s already working well in France with very small teams (1 to 5 employees) and the company is expanding this offering to Spain and Italy.

The startup will also invest more heavily in its product and build a better logistics infrastructure. “For the logistics part, we work with third-party logistics companies — we are a tech company,” co-founder and co-CEO Christian Raisson told me.

ManoMano doesn’t have its own warehouses and doesn’t own any inventory. That’s why ManoMano plans to recruit 1,000 people over the next 18 months and most of them will be tech profiles.

While ManoMano has 7 million clients, sales of home improvement and gardening items still mostly happen in brick-and-mortar stores. The startup is well aware that it’s not just a matter of having the best products at good price points.

ManoMano works with advisors (or Manodvisors) so that experts can give advice whenever customers need some tips. Overall, customers have initiated 2.3 million conversations with advisors in 2020. Recommendations and advice will be key to gain market shares. And the company is now well capitalized to innovate on this front and differentiate itself from other e-commerce platforms.

Powered by WPeMatico

E-commerce is booming in Southeast Asia, but in many markets, the fragmented logistics industry is struggling to catch up. This means sellers run into roadblocks when shipping to buyers, especially outside of major metropolitan areas, and managing their supply chains. Locad, a startup that wants to help with what it describes as an “end-to-end solution” for cross-border e-commerce companies, announced today it has raised a $4.9 million seed round.

The funding was led by Sequoia Capital India’s Surge (Locad is currently a part of the program’s fifth cohort), with participation from firms like Antler, Febe Ventures, Foxmont, GFC and Hustle Fund. It also included angel investors Alessandro Duri, Alexander Friedhoff, Christian Weiss, Henry Ko, Huey Lin, Markus Bruderer, Dr. Markus Erken, Max Moldenhauer, Oliver Mickler, Paulo Campos, Stefan Mader, Thibaud Lecuyer, Tim Marbach and Tim Seithe.

Locad was founded in Singapore and Manila by Constantin Robertz, former Zalora director of operations Jannis Dargel and Shrey Jain, previously Grab’s lead product manager of maps. It now also has offices in Australia, Hong Kong and India. The startup’s goal is to close the gap between first-mile and last-mile delivery services, enabling e-commerce companies to offer lower shipping rates and faster deliveries while freeing up more time for other parts of their operations, such as marketing and sales conversions.

Since its founding in October 2020, Locad has been used by more than 30 brands and processed almost 600,000 items. Its clients range from startups to international brands, and include Mango, Vans, Payless Shoes, Toshiba and Landmark, a department store chain in the Philippines.

Locad is among a growing roster of other Southeast Asia-based logistics startups that have recently raised funding, including Kargo, SiCepat, Advotics and Logisly. Locad wants to differentiate by providing a flexible solution that can work with any sales channel and is integrated with a wide range of shipping providers.

Robertz told TechCrunch that Locad is able to keep an asset-light business model by partnering with warehouse operators and facility managers. What the startup brings to the mix is a cloud software platform that serves as a “control tower,” letting users get real-time information about inventory and orders across Locad’s network. The company currently has seven fulfillment centers, with four of its warehouses in the Philippines and the other three in Singapore, New South Wales, Australia and Hong Kong. Part of its funding will be used to expand into more Asia-Pacific markets, focusing on Southeast Asia and Australia.

Locad’s seed round will also used to add integrations to more couriers and sales channels (it can already be used with platforms like Shopify, WooCommerce, Amazon, Shopee, Lazada and Zalora), and develop new features for its cloud platform, including more data analytics.

Powered by WPeMatico

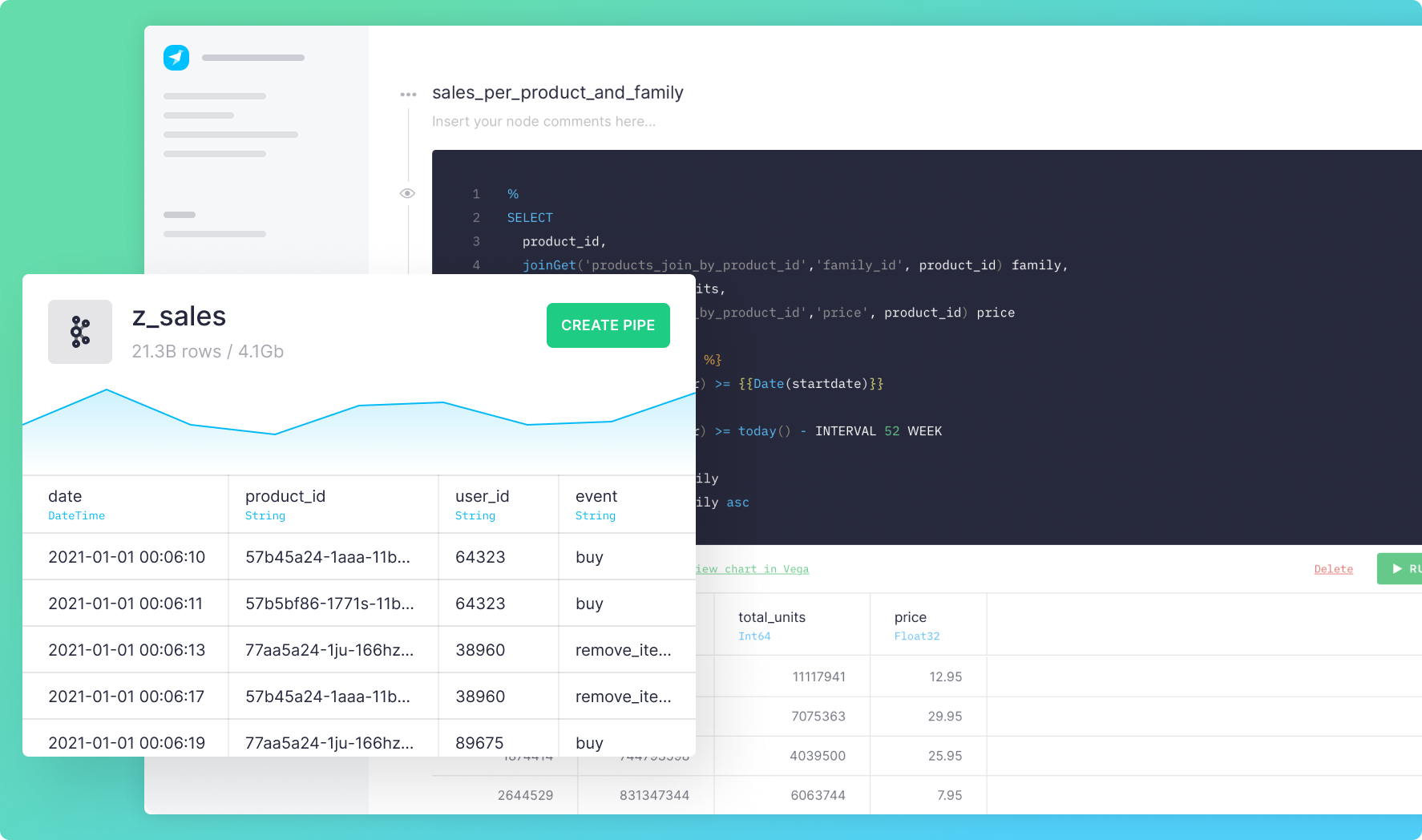

Meet Tinybird, a new startup that helps developers build data products at scale without having to worry about infrastructure, query time and all those annoying issues that come up once you deal with huge data sets. The company ingests data at scale, lets you transform it using SQL and then exposes that data through API endpoints.

Over the past few years, analytics and business intelligence products have really changed the way we interact with data. Now, many big companies store data in a data warehouse or a data lake. They try to get insights from those data sets.

And yet, extracting and manipulating data can be costly and slow. It works great if you want to make a PowerPoint presentation for your quarterly results. But it doesn’t let you build modern web products and data products in general.

“What we do at Tinybird is we help developers build data products at any scale. And we’re really focused on the realtime aspect,” co-founder and CEO Jorge Gómez Sancha told me.

The team of co-founders originally met at Carto. They were already working on complex data issues. “Every year people would come with an order of magnitude more data,” Gómez Sancha said. That’s how they came up with the idea behind Tinybird.

Image Credits: Tinybird

The product can be divided into three parts. First, you connect your Tinybird account with your data sources. The company will then ingest data constantly from those data sources.

Second, you can transform that data through SQL queries. In addition to the command-line interface, you can also enter your SQL queries in a web interface, divide then into multiple steps and document everything. Every time you write a query, you can see your data filtered and sorted according to your query.

Third, you can create API endpoints based on those queries. After that, it works like a standard JSON-based API. You can use it to fetch data in your own application.

What makes Tinybird special is that it’s so fast that it feels like you’re querying your data in realtime. “Several of our customers are reading over 1.5 trillion rows on average per day via Tinybird and ingesting around 5 billion rows per day, others are making an average of 250 requests per second to our APIs querying several billion row datasets,” Gómez Sancha wrote in an email.

Behind the scene, the startup uses ClickHouse. But you don’t have to worry about that as Tinybird manages all the infrastructure for you.

Right now, Tinybird has identified three promising use cases. Customers can use it to provide in-product analytics. For instance, if you operate a web hosting service and wants to give some analytics to your customers or if you manage online stores and want to surface purchasing data to your customers, Tinybird works well for that.

Some customers also use the product for operational intelligence, such as realtime dashboards that you can share internally within a company. Your teams can react more quickly and always know if everything is running fine.

You can also use Tinybird as the basis for some automation or complex event processing. For instance, you can leverage Tinybird to build a web application firewall that scans your traffic and reacts in realtime.

Tinybird has raised a $3 million seed round led by Crane.vc with several business angels also participating, such as Nat Friedman (GitHub CEO), Nicholas Dessaigne (Algolia co-founder), Guillermo Rauch (Vercel CEO), Jason Warner (GitHub CTO), Adam Gross (former Heroku CEO), Stijn Christiaens (co-founder and CTO of Collibra), Matias Woloski (co-founder and CTO of Auth0) and Carsten Thoma (Hybris co-founder).

Powered by WPeMatico

Therapy is rapidly becoming a standard part of many people’s lives, but 2020 interrupted that trend by nixing in-person sessions and forcing therapists to migrate their entire practice online — and it turns out that’s not so easy. Frame simplifies it with an all-in-one portal for clients and therapists, unifying the listings, tools and management software that run the countless small businesses making up the industry.

Kendall Bird and Sage Grazer are old friends who happened to be in the right place at the right time — a strange thing to say about anyone anywhere at the start of 2020, but it’s true. The startup’s pitch of bringing your practice entirely online and offering all-online sessions, bookkeeping, scheduling and everything turned out to be exactly what would soon be needed — though as they tell it, it has actually been needed for some time.

Grazer, a therapist herself, experienced firsthand the unexpected difficulties of getting up and running.

“When I started my practice in 2016, I was really passionate about the clinical work, but I was very overwhelmed by setting up a business, marketing, financial stuff,” she said. “So we wanted to help other therapists through that.”

She and Bird happened to reconnect around that time and the two saw an opportunity to improve things.

“We think about therapists as being a one-on-one thing, but they’re really a small business,” said Bird, who formerly worked in marketing at Snapchat, Google and YouTube. “They’re underserved and undersupported as mental health professionals — they don’t have the back-office support that doctors do, and they’re not trained how to run businesses. It just made sense to build a scalable SaaS solution that lets these people work for themselves.”

The therapy industry, like other medical institutions, has two sides: client-facing and practitioner-facing. While there are a handful of services online that combine these, many essentially recruit therapists as contractors. If you want to run your own practice, you’ll likely be using a combination of specialty scheduling, telehealth, billing and other tools made with medical privacy considerations in mind.

“The therapy tools and services landscape is incredibly fragmented — the average therapist is using 5-7 tools, and most of those are not built for therapy,” said Bird.

And then of course there’s Psychology Today: a periodical that straddles the roles of pop psych and industry rag, but whose chief reason for existing for many is its voluminous therapist listings, which dominate search and provide an overwhelming first stop for anyone looking to find one in their area. But for such a personal and consequential decision these brief listings don’t give wary potential clients the impression they’re making an informed choice.

“We wanted an experience that was more approachable, uses language that doesn’t feel overwhelming or pathologizing,” said Grazer. “There are people going to therapy feeling alone and confused, who don’t identify with a disorder or checking a check box.”

Frame eschews the oversimplified “scroll through therapists near your area code” with a short quiz — not a diagnosis or personality test but just a few basic questions — that winnows down your choices to a handful of local and appropriate therapists, with whom you can instantly set up free introductory video calls. If you find someone you like, the rest of the professional relationship takes place on Frame, though of course soon in-person sessions may return.

For those not quite ready to take the plunge, the company organizes livestreamed sessions between volunteers and therapists to show what a full hour of work might look like. (Whatever courage it may take to confront one’s issues in therapy, it surely takes even more to do so with an audience.)

On the therapist’s side, Frame is meant to be a one-stop shop. Marketing and telehealth sessions are on there, as noted above, but so are things like scheduling, notes, billing, notifications, and so on, all tailored specifically to the needs of the industry. And while the shift to online services has been a long time coming, the company just happened to drop in just as the need went into overdrive.

“We built it before COVID ever existed — launched in March 2020 and had telehealth as an option, thinking ‘oh, well maybe some people will do this.’ The majority of therapists in America weren’t doing sessions online at the time… but after COVID they all are,” Bird said. “And they’re looking for these tools now because they’re seeing the rewards of running a lot of their business through telehealth.”

Many therapists are finding that after resisting the transition for years, they are encountering all kinds of benefits, explained Grazer. Like other industries, the flexibility inherent to shifting in-person meetings to virtual ones has been freeing and in some cases profitable. The change is here to stay.

The site is in a closed beta limited to a part of California at present, since therapists are limited to operating in-state and there are other regulations to consider, not to mention all the usual struggles of putting together a sprawling professional service. But the $3 million funding round, led by Maven Ventures, will help fill out the product and move the company toward a larger audience. Sugar Capital, Struck Capital, Alpha Edison and January Ventures participated in the raise.

The money is “almost exclusively going to engineering.” The goal is to open up the beta, expand to the rest of California, then move out to other states once they have the infrastructure to do so and have responded to feedback from the initial rollout.

“Sage and I are really aligned in the belief that the best way to make therapy more accessible to America is to support therapists,” said Bird.

Powered by WPeMatico

Shares of Chinese ride-hailing provider Didi are sharply lower this morning after news broke that its domestic regulators are investigating the newly public company. A loose translation of the probe’s official notice indicates that the cybersecurity review is “in order to prevent national data security risks, maintain national security and protect the public interest.”

Yesterday, regulators ordered Didi to stop registering new users during the investigation.

The move comes amid a larger reset of relations between China’s burgeoning technology sector and its autocratic government. Other fallouts from the campaign included the effective silencing of Jack Ma, the embarrassing cancellation of the Ant IPO and a crackdown on data collection from technology companies more broadly.

The Exchange explores startups, markets and money.

Read it every morning on Extra Crunch or get The Exchange newsletter every Saturday.

China is not the only nation grappling with its technology sector; India has made consistent noise in recent months regarding tech firms inside its borders, for example. And there is effort inside the U.S. Congress to put some cap on Big Tech’s scale and power, though of the trio, the United States appears the least likely to take a real swipe at technology companies’ market influence.

That Didi has run afoul of China’s regulatory bodies is not a surprise; it’s a well-known tech company in the country with lots of consumer data. Similar data-rich tech shops in the country have come under increased scrutiny as well.

But to see Didi get taken to task mere days after its U.S. debut puts a bad taste in our mouths.

The way that this saga reads from the cynical perspective is that the Chinese Communist Party was willing to let the company go public in the United States, allowing it to raise billions of dollars from foreign sources. And that the ruling party was then content to leave them holding a midsized bag by announcing its cybersecurity probe.

Hanlon’s Razor is at play in this situation, naturally.

Didi has not published a new SEC filing since June 30, and, as of the time of writing, its investor relations page is devoid of any information regarding today’s news.

While going public, it’s worth noting that Didi did warn investors that it faces a host of risks relating to its status as a Chinese company, namely its government, and as a Chinese company going public in the United States. Observe the following risk factors that it shared while going public (emphasis added) that dealt with the company’s business operations:

- Our business is subject to numerous legal and regulatory risks that could have an adverse impact on our business and future prospects.

- Our business is subject to a variety of laws, regulations, rules, policies and other obligations regarding privacy, data protection and information security. Any losses, unauthorized access or releases of confidential information or personal data could subject us to significant reputational, financial, legal and operational consequences.

Powered by WPeMatico

Hello and welcome back to Equity, TechCrunch’s venture capital-focused podcast, where we unpack the numbers behind the headlines.

Danny, Natasha, and Alex were on deck this week, with Grace on the recording and edit. But, if you want to hear more about Robinhood, this is not the episode for you. If you want to learn more about the consumer fintech company’s IPO filing this is the episode you want. Basically, Robinhood filed after we had wrapped taping, so we had to do a special pod for the news.

So, this is the everything-but-Robinhood episode. And here’s what’s inside of it:

A four-episode week! With only Grace handling production! She’s amazing.

Equity drops every Monday at 7:00 a.m. PST, Wednesday, and Friday morning at 7:00 a.m. PST, so subscribe to us on Apple Podcasts, Overcast, Spotify and all the casts.

Powered by WPeMatico

Swedish gaming giant Modern Times Group (MTG) has acquired Indian startup PlaySimple for at least $360 million, the two firms said Friday.

MTG said it will pay 77% of the acquisition sum to Indian game developer and publisher in cash and the rest in company shares. There’s also another $150 million reward put aside if certain undisclosed performance metrics are hit, the two firms said.

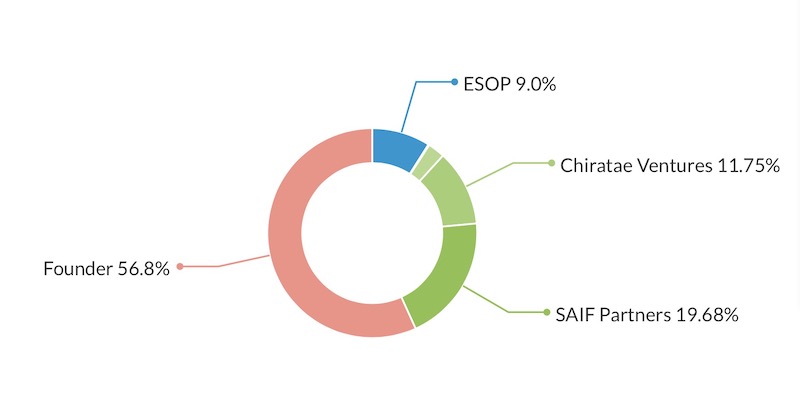

Friday’s deal marks one of the largest exits in the Indian startup ecosystem. PlaySimple had raised $4 million Series A at a valuation of about $16 million from Elevation Capital and Chiratae Ventures in 2016. (The startup, which began its journey in Bangalore, raised just $4.5 million in total from external investors.)

And it’s clear why: the revenues of PlaySimple — which operates nine word games including “Daily Themed Crossword,” “Word Trip,” “Word Jam,” and “Word Wars” — grew by 144% y-o-y to $83 million last year and it was on track to hit over $60 million revenue in the first half of 2021.

Cap table of PlaySimple after Series A in 2016.

“We’re very proud of the games we’ve developed over the years, and of the infrastructure and scale that we’ve achieved with our team,” said PlaySimple co-founders and management team members — Siddhanth Jain, Suraj Nalin and Preeti Reddy — in a joint statement.

“As we join the MTG family, we look forward to leveraging our proprietary technology across MTG’s gaming portfolio, expanding into the European market, investing in cutting-edge technology and building exciting new games.”

PlaySimple, which says its free-to-play games have amassed over 75 million installs and maintain nearly 2 million daily active users, plans to launch a number of games later this year and also expand into the card games genre.

“PlaySimple is a rapidly growing and highly profitable games studio that quickly has established itself as one of the leading global developers of free-to-play word games, an exciting new genre for MTG,” said Maria Redin, MTG Group President and CEO, said in a statement.

The Stockholm-headquartered firm, which has also acquired Hutch and Ninja Kiwi in recent quarters, said PlaySimple will help it build a diversified gaming vertical. “Scaling and diversifying the GamingCo [an MTG subsidiary] helps to accelerate the operational performance while at the same time creating a more stable business,” the firm said.

Powered by WPeMatico

This afternoon Robinhood filed to go public. TechCrunch’s first look at its results can be found here. Now that we’ve done a first dig, we can take the time to dive into the company’s filing more deeply.

Robinhood’s IPO has long been anticipated not only because there are billions of dollars in capital riding on its impending liquidity, but also because the company became something of a poster child for the savings and investing boom that 2020 saw and the COVID-19 pandemic helped engender.

The consumer trading service’s products became so popular and enmeshed in popular culture thanks to both the “stonks” movement and the larger GameStop brouhaha, that the company’s public offering carries much more weight than that of a more regular venture-backed entity. Robinhood has fans, haters, and many an observer in Congress.

Regardless of all that, today we are digging into the company’s business and financial results. So, if you want to better understand how Robinhood makes money, and how profitable or not it really is, this is for you.

We will start with a more in-depth look at growth and profitability, pivot to learning about the company’s revenue makeup, discuss a risk factor or two, and close on its decision to offer some of its own shares to its users. Let’s go!

Before we get into the how of Robinhood’s growth, let’s discuss how big the company has become.

The fintech unicorn’s revenue grew from $277.5 million in 2019 to $958.8 million in 2020, which works out to growth of around 245%. Robinhood expanded even more quickly in the first quarter of 2021, scaling from year-ago revenue of $127.6 million to $522.2 million, a gain of around 309%.

Those are numbers that we frankly do not see often amongst companies going public; 300% growth is a pre-Series A metric, usually.

Powered by WPeMatico