Fundings & Exits

Auto Added by WPeMatico

Auto Added by WPeMatico

Wavecell, a cloud-communications platform for companies in Southeast Asia, announced today that it has been acquired by 8×8 in a deal worth about $125 million. The acquisition will help San Jose, Calif.-based 8×8 expand in Asia, where Wavecell already has offices in Singapore, Indonesia, the Philippines, Thailand and Hong Kong.

Wavecell’s cloud API platform, which includes SMS, chat, video and voice messaging, is used by companies such as Paidy, Lalamove and Tokopedia. It has relationships with 192 network operators and partners like WhatsApp and claims its infrastructure is used to share more than two billion messages each year.

The terms of the deal includes $69 million in cash and about $56 million in 8×8 common shares. Founded in 2010, Wavecell’s investors included Qualgro VC, Wavemaker Partners and MDI Ventures.

In a prepared statement, 8×8 CEO Vik Verma said “8×8 is now the only cloud provider that owns the full, global-scale, cloud-native, technology stack offering voice, video, messaging, and contact center delivered both as pre-packaged applications and as enterprise-class APIs. We’re excited to welcome the Wavecell employees to the 8×8 family. We now have a significant market presence in Asia and expect to continue to expand in the region and globally in order to meet evolving customer requirements.”

Powered by WPeMatico

Round sizes are up. Valuations are up. There are more investors than ever hunting unicorns around the globe. But for all the talk about the abundance of venture funding, there is a lot less being said about what it all means for entrepreneurs raising their early funding rounds.

Take for instance Seed-stage dilution. Since 2014, enterprise-focused tech companies have given up significantly more ownership during Seed rounds. What gives?

Scale is an investor in early-in-revenue enterprise technology companies, so we wanted to better understand how this trend in Seed-stage dilution impacts companies raising Series A and Series B rounds.

Using our Scale Studio dataset of performance metrics on nearly 800 cloud and SaaS companies as well as Pitchbook fundraising records covering B2B software startups, we started connecting the dots between trends in valuations, round sizes, and winner-take-all markets.

Bottom line for founders: Don’t let all the capital in venture mislead you. There’s an important connection between higher Seed-stage dilution and increased investor expectations during Series A and Series B rounds.

These days, successful startups are growing up faster than ever.

Powered by WPeMatico

Billie, the Berlin-based fintech startup that offers a B2B invoicing and payments platform, has raised €30 million in Series B funding. Leading the round is Creandum, alongside SpeedInvest, Rocket Internet’s GFC and Picus.

Founded in 2017 by the same team behind SME online lending platform Zencap, which exited to Funding Circle in 2015, Billie wants to bring to B2B invoicing and payments the same level of convenience seen in B2C payments and e-commerce.

Claiming to be Germany’s leading “one-stop shop” for handling all outgoing invoices of B2B sellers, including sending invoices, collecting payments and invoice financing, Billie’s customers range from SMEs, large e-commerce players and transnational marketplaces.

“As B2B transactions are more than twice the volume of B2C transactions, the potential to help our customers is enormous. And, up to now, this market is unserved,” Billie co-founder Dr. Matthias Knecht tells me.

“We’re able to place ourselves in the middle of B2B payments because B2B sellers often face long payment terms until getting paid, administrative burden to handle collections on unpaid invoices and severe economic risks from payment defaults. Meanwhile, B2B buyers often face rigid one-size-fits-all payment terms that are not tailored to the cash-cycle needs of their business. As a result, they revert to old-fashioned working capital loans to cover their liquidity needs.”

To fix this, Billie currently provides two core solutions.

The first is a checkout financing solution for B2B online stores, which embeds a financing option in the online checkout process. “It enables instant financing of the customer’s purchase directly at the online point-of-sale, and takes away all administrative hassle and default risk from the seller,” explains Knecht.

The second is SME invoice factoring, which the Billie co-founder describes as a fully automated platform that handles all outgoing invoices of SMEs.

“Small and medium-sized businesses can handle all their outgoing invoices through our platform, get instant financing for each invoice (i.e. they do not need to wait 90 days to get paid by their customers), and also outsource the collections process as well as coverage of default risk to Billie,” he says. “It’s an exciting, highly automated ‘piece of mind’ product that let’s SMEs focus on what they do best and have Billie handle the operational burden of invoice management and default coverage.”

With today’s injection of capital, Knecht says the startup plans to offer new solutions that are specifically targeted at the buyer side of B2B transactions by handling all processes around payables. This could include letting B2B buyers flexibly choose payment terms and reducing the bookkeeping hassle by acting as a single creditor.

“We will furthermore start rolling out our solutions across Europe at some point, as the need to turn B2B transactions into a frictionless experience exists across countries,” he adds.

Powered by WPeMatico

Private equity firm Blackstone just announced that it has reached an agreement to acquire mobile advertising company Vungle.

The companies aren’t disclosing the financial terms, but as part of the transaction, Vungle has also reached a settlement with founder Zain Jaffer, who filed a wrongful termination lawsuit against the company earlier this year.

(Update: Multiple sources with knowledge of the deal said that the acquisition price was around — or north of — $750 million. One of those sources also said it was an all-cash transaction.)

“As a best-in-class performance marketing platform, Vungle represents a key growth engine for the mobile app ecosystem,” said Blackstone principal Sachin Bavishi in a statement. “Our investment will help deliver on the company’s tremendous growth potential and we look forward to partnering with management to extend Vungle’s strength across mobile gaming and other performance brands.”

Meanwhile, CEO Rick Tallman said the deal will allow the company to “further accelerate Vungle’s mission to be the trusted guide for growth and engagement, transforming how users discover and experience mobile apps.”

Vungle was founded back in 2011, and, according to the acquisition release, it’s currently working with 60,000 mobile apps worldwide, serving more than 4 billion video views per month and working with publishers like Rovio, Zynga, Pandora, Microsoft and Scopely.

Jaffer led Vungle as CEO until October 2017, when he was arrested on charges including performing a lewd act upon a child and assault with a deadly weapon. The charges were ultimately dropped, with the San Mateo County District Attorney’s office stating that it did “not believe that there was any sexual conduct by Mr. Jaffer that evening,” while “the injuries were the result of Mr. Jaffer being in a state of unconsciousness caused by prescription medication.”

In his lawsuit, Jaffer alleged that after the charges were dropped, “Vungle unfairly and unlawfully sought to destroy my career, blocked my efforts to sell my own shares or transfer shares to family members, and tried to prevent me from purchasing shares in the Company.”

In a statement today, Jaffer said, he is “pleased with the terms of the settlement, which are confidential.” He also commented on the acquisition:

It is extremely gratifying for me to see our early vision, execution and the hard work of so many talented people rewarded like this. From Day 1, Vungle has been at the forefront of the changing advertising landscape. Today, companies of all sizes, and in all industries, are utilizing in-app video ads as an integral part of their customer acquisition strategies.

The acquisition is expected to close later this year. According to Crunchbase, Vungle previously raised more than $25 million from Crosslink Capital, Thomvest Ventures, Seven Peaks Ventures, GV, AOL Ventures, Uncork Capital, 500 Startups and Angelpad, where the startup was incubated. (AOL Ventures was backed by TechCrunch’s parent company AOL, a.k.a. Oath, a.k.a. Verizon Media.)

Powered by WPeMatico

Could Roblox create a new entertainment and communication category, something it calls “human co-experience”?

When it was a small startup, few observers would have believed in that future. But after 15 years — as told in the origin story of our Roblox EC-1 — the company has accumulated 90 million users and a new $150 million venture funding war chest. It has captured the imagination of America’s youth, and become a startup darling in the entertainment space.

But what, exactly, is human co-experience? Well, it can’t be described precisely — because it’s still an emerging category. “It’s almost like that fable where the nine blind men are touching and describing an elephant.

Everyone has a slightly different view,” says co-founder and CEO Dave Baszucki. In Roblox’s view, co-experience means immersive environments where users play, explore, talk, hang out, and create an identity that’s as thoroughly fleshed out (if not as fleshy) as their offline, real life.

But the next decade at Roblox will also be its most challenging time yet, as it seeks to expand from 90 million users to, potentially, a billion or more. To do so, it needs to pull off two coups.

First, it needs to expand the age range of its players beyond its current tween and teen audience. Second, it must win the international market. Accomplishing both of these will be a puzzle with many moving parts.

One thing Roblox has done very well is appeal to kids within a certain age range. The company says that a majority of all 9-to-12-year-old children in the United States are on its platform.

Within that youthful segment, Roblox has arguably already created the human co-experience category. Many games are more cooperative than competitive, or have goals that are unclear or don’t seem to matter much. One of Roblox’s most popular games, for instance, is MeepCity, where players can run around and chat in virtual environments like a high school without necessarily interacting with the game mechanics at all.

What else separates these environments from what you can see today on, say, the App Store or Steam? A few characteristics seem common.

For one, the environments look rough. One Robloxian put the company’s relaxed attitude toward looks as “not over-indexing on visual fidelity.”

Roblox games also ignore the design principles now espoused by nearly every game company. Tutorials are infrequent, user interfaces are unpolished, and one gets the sense that KPIs like retention and engagement are not being carefully measured.

That’s similar to how games on platforms like Facebook and the App Store started out, so it seems reasonable to say Roblox is just in a similarly early stage. It is — but it’s also competing directly with mobile games that are more rigorously designed. Over half of its players are on smartphones, where they could have chosen a free game that looks more polished, like Fortnite or Clash of Clans.

The more accurate explanation of why Roblox draws big player numbers is that there’s a gap in the kids entertainment market. So far, only Roblox fills that gap, despite its various shortcomings.

“The amount of unstructured, undirected play has been declining for decades. [Kids] have much more homework, and structured activities like theater after school.

One of the big unmet needs we solve is to give kids a place to have imagination,” explains Craig Donato, Roblox’s chief business officer. “If you play the experiences on our platform, you’re not playing to win. You go into these worlds with people you know and share an experience.”

Games like The Sims tried to do the same, but eventually faded in the children’s demo. Roblox’s trick has been continued growth: it provides kids with an endless array of games that unlock their imagination. But just like we don’t expect adults to have fun with Barbie dolls, it’s unlikely most adults would enjoy Roblox games.

Of course, it would be easy to point at Roblox and laugh off its ambitions to win over people of all ages. That laughter would also be short-sighted.

As David Sze, the Greylock Partners investor who led Roblox’s most recent round, pointed out: “When we invested in Facebook there was a huge amount of pushback that nobody would use it outside college.” Companies that have won over one demographic have a good chance of winning others.

Roblox has also proven its ability to evolve. At one time, the platform’s players were 90 percent male. Now, that’s down to about 60 percent. Roblox now has far more girls playing than the typical game platform.

Powered by WPeMatico

There are successful companies that grow fast and garner tons of press. Then there’s Roblox, a company which took at least a decade to hit its stride and has, relative to its current level of success, barely gotten any recognition or attention.

Why has Roblox’s story gone mostly untold? One reason is that it emerged from a whole generation of gaming portals and platforms. Some, like King.com, got lucky or pivoted their business. Others by and large failed.

Once companies like Facebook, Apple and Google got to the gaming scene, it just looked like a bad idea to try to build your own platform — and thus not worth talking about. Added to that, founder and CEO Dave Baszucki seems uninterested in press.

But overall, the problem has been that Roblox just seemed like an insignificant story for many, many years. The company had millions of users, sure. So did any number of popular games. In its early days, Roblox even looked like Minecraft, a game that was released long after Roblox went live, but that grew much, much faster.

Yet here we are today: Roblox now claims that half of all American children aged 9-12 are on its platform. It has jumped to 90 million monthly unique users and is poised to go international, potentially multiplying that number. And it’s unique. Essentially all other distribution services offering games through a portal have eventually fizzled, aside from some distant cousins like Steam.

This is the story of how Roblox not only survived, but built a thriving platform.

(Photo by Steve Jennings/Getty Images for TechCrunch)

Before Roblox, there was Knowledge Revolution, a company that made teaching software. While designed to allow students to simulate physics experiments, perhaps predictably, they also treated it like a game.

“The fun seemed to be in building your own experiment,” says Baszucki. “When people were playing it and we went into schools and labs, they were all making car crashes and buildings fall down, making really funny stuff.” Provided with a sandbox, kids didn’t just make dry experiments about mass or velocity — they made games, or experiences they could show off to friends for a laugh.

Knowledge Revolution was founded in 1989, by Dave Baszucki and his brother Greg (who didn’t later co-found Roblox, but is now on its board). Nearly a decade later, it was acquired for $20 million by MSC Software, which made professional simulation tools. Dave continued there for another four years before leaving to become an angel investor.

Baszucki put money into Friendster, a company that pre-dated Facebook and MySpace in the social networking category. That investment seeded another piece of the idea for Roblox. Taken together, the legacy of Knowledge Revolution and Friendster were the two key components undergirding Roblox: a physics sandbox with strong creation tools, and a social graph.

Baszucki himself is a third piece of the puzzle. Part of an older set of entrepreneurs, which might be called the Steve Jobs generation, Baszucki’s archetype seems closer to Mr. Rogers than Jobs himself: unfailingly polite and enthusiastic, never claiming superior insight, and preferring to pass credit for his accomplishments on to others. In conversation, he shows interests both central and tangential to Roblox, like virtual environments, games, education, digital identity and the future of tech. Somewhere in this heady mix, the idea of Roblox came about.

Powered by WPeMatico

Car shoppers now have several new options to avoid long-term debt and commitments. Automakers and startups alike are increasingly offering services that give buyers new opportunities and greater flexibility around owning and using vehicles.

In the first part of this feature, we explored the different startups attempting to change car buying. But not everyone wants to buy a car. After all, a vehicle traditionally loses its value at a dramatic rate.

Some startups are attempting to reinvent car ownership rather than car buying.

My favorite car blog Jalopnik said it best: “Cars Sales Could Be Heading Straight Into the Toilet.” Citing a Bloomberg report, the site explains automakers may have had the worst first half for new-vehicle retail sales since 2013. Car sales are tanking, but people still need cars.

Companies like Fair are offering new types of leases combining a traditional auto financing option with modern conveniences. Even car makers are looking at different ways to move vehicles from dealer lots.

Fair was founded in 2016 by an all-star team made up of automotive, retail and banking executives including Scott Painter, former founder and CEO of TrueCar.

Powered by WPeMatico

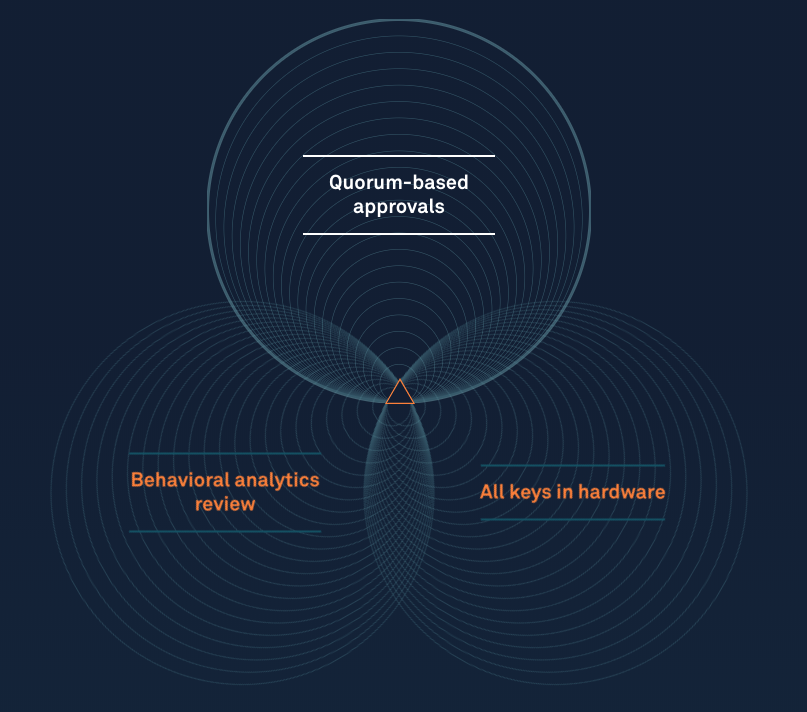

Visa and Andreessen Horowitz are betting even bigger on cryptocurrency, funding a big round for fellow Facebook Libra Association member Anchorage’s omnimetric blockchain security system. Instead of using passwords that can be stolen, Anchorage requires cryptocurrency withdrawals to be approved by a client’s other employees. Then the company uses both human and AI review of biometrics and more to validate transactions before they’re executed, while offering end-to-end insurance coverage.

This new-age approach to cryptocurrency protection has attracted a $40 million Series B for Anchorage, led by Blockchain Capital and joined by Visa and Andreessen Horowitz. The round adds to Anchorage’s $17 million Series A that Andreessen led just six months ago, demonstrating extraordinary momentum for the security startup.

“As a custodian, our work is focused on building financial plumbing that other companies depend on for their operations to run smoothly. In this regard we have always looked at Visa as a model,” Anchorage co-founder and president Diogo Mónica tells me.

“Visa was ‘fintech’ before the term existed, and has always been on the vanguard of financial infrastructure. Visa’s investment in Anchorage is helpful not only to our company but to our industry, as a validation of the entire ecosystem and a recognition that crypto will play a key role in the future of global finance.”

Cold-storage, where assets are held in computers not connected to the internet, has become a popular method of securing Bitcoin, Ether and other tokens. But the problem is that this can prevent owners from participating in governance of certain cryptocurrency where votes are based on their holdings, or earning dividends. Anchorage tells me it’s purposefully designed to permit this kind of participation, helping clients to get the most out of their assets like capturing returns from staking and inflation, or joining in on-chain governance.

As three of the 28 founding members of the Libra Association that will govern the new Facebook-incubated cryptocurrency, Anchorage, Visa and Andreessen Horowitz will be responsible for ensuring the stablecoin stays secure. While Facebook is building its own custodial wallet called Calibra for users, other Association members and companies hoping to dive into the ecosystem will need ways to protect their Libra stockpiles.

“Libra is exactly the kind of asset that Anchorage was created to hold,” Mónica wrote the day Libra was revealed. “Our custody solution enables online participation with offline assets, so that asset-holders don’t face a trade-off between security and usability.” The company believes that custodians shouldn’t dictate which coins their clients hold, so it’s working to support all types of digital assets. Anchorage tells me that will include support for securing Libra in the future.

You’ve probably already used technology secured by Anchorage’s founders, who engineered Docker’s containers that are used by Microsoft, and Square’s first encrypted card reader. Mónica was at Square when he met his future Anchorage co-founder Nathan McCauley, who’d been working on anti-reverse-engineering tech for the U.S. military. When a company that had lost the password to a $1 million cryptocurrency account asked for their help with security, they recognized the need for a more idiot-proof take on asset protection.

“Anchorage applies the best of modern security engineering for a more advanced approach: we generate and store private keys in secure hardware so they are never exposed at any point in their life cycle, and we eliminate human operations that expose assets to risk,” Mónica says. The startup competes with other crypto custody firms like Bitgo, Ledger, Coinbase and Gemini.

Last time we spoke, Anchorage was cagey about what I could reveal regarding how its transaction validation system worked. With the new funding, it’s feeling a little more secure about its market position and was willing to share more.

Last time we spoke, Anchorage was cagey about what I could reveal regarding how its transaction validation system worked. With the new funding, it’s feeling a little more secure about its market position and was willing to share more.

Anchorage ditches usernames, passwords, email addresses and phone numbers completely. That way a hacker can’t just dump your coins into their account by stealing your private key or SIM-porting your number to their phone. Instead, clients whitelist devices held by their employees, who use the Anchorage app to submit transactions. You’d propose selling $10 million worth of Bitcoin or transferring it to someone else as payment, and a minimum of two-thirds of your designated co-workers would need to concur to form a quorum that approves the transfer.

But first, Anchorage’s artificial intelligence and human staff would check for any suspicious signals that might indicate a hack in progress. It uses behavioral analysis (do you act like a real human and similar to how you have before), biometric signals (do you look like you) and network signals (is your device what and where it should be) to confirm the transaction is legitimate. The same process goes down if you try to add a new whitelisted device or change who has permission to do what.

The challenge will be scaling security to an ever-broadening range of digital assets, each with their own blockchain quirks and complex smart contracts. Even if Anchorage keeps coins safely in custody, those variables could expose assets to risk while in transit. Now with deeper pockets and the Visa vote of confidence, Anchorage could solve those problems as clients line up.

While most blockchain attention has focused on the cryptocurrencies themselves and the exchanges where you can buy and sell them, a second order of critical infrastructure startups is emerging. Companies like Anchorage could make Bitcoin, Ether, Libra and more not just objects of speculation or the domain of experts, but safely functioning elements of the new world economy.

Powered by WPeMatico

Mobile marketing company AppLovin is announcing that it has acquired SafeDK.

While AppLovin started out as a mobile ad business, it now bills itself as “a comprehensive mobile gaming platform,” offering tools for game developers around user acquisition, monetization, analytics and (through Lion Studios, launched last year) publishing. SafeDK, meanwhile, allows developers to manage all the different SDKs on which their apps rely.

Palo Alto-headquartered AppLovin says that by incorporating SafeDK technology, it will help its publishers ensure GDPR compliance and brand safety.

It also says SafeDK will continue to support existing customers, while its headquarters in Herzliya, Israel will become AppLovin’s first office in Israel. Co-founders Orly Shoavi and Ronnie Sternberg will remain on-board as the heads of SafeDK and general managers of AppLovin Israel.

The companies are not disclosing the financial terms of the deal, except to say that it was all-cash. According to Crunchbase, SafeDK has raised a total of $5.8 million from investors, including Samsung Next Tel Aviv, Marius Nacht, StageOne Ventures and Kaedan Capital.

“We are delighted to be working with the AppLovin team to help mobile game publishers grow their businesses,” Shoavi said in a statement. “AppLovin has been a trusted partner for the biggest mobile game studios around the world and SafeDK’s technology will strengthen that trust.”

Powered by WPeMatico

French startup Karamel wants to help you find things to do for your kids. The company is launching a mobile app that lets you find and book kid-friendly activities around you.

The startup also just raised a $560,000 round (€500,000) from Kima Ventures, Roxanne Varza, Thibaud Elzière and Oleg Tscheltzoff. Varza participates in the Atomico Angel Programme, which means that Atomico handed out $100,000 to invest in multiple early-stage companies. Atomico and Varza both see returns if the company eventually succeeds.

Karamel wants to become a one-stop shop for things your kids can do. When you open the app, you get a curated selection of activities around you so that you can find something to do this weekend, for instance.

If you’re looking for something specific, you can search for activities based on multiple criteria, such as the age of your child, an activity category, price, distance and day of the week.

You also can find recurring activities in case your child really wants to learn a new instrument or start a new sport, for instance.

On the other side of the marketplace, there are many different organizations in charge of activities. It’s a fragmented market, and those organizations don’t always know how to reach parents efficiently.

Thanks to Karamel, those organizations should get more traffic and could focus more on activities themselves. The startup doesn’t charge any monthly subscription fee. Instead, Karamel is taking a cut on transactions. Parents pay the same price if they book directly or though Karamel.

The service is currently live in Paris. And if you live in Marseille, Lyon, Bordeaux or Montpellier, you can search for activities but can’t book through the app just yet.

In the U.S., KidPass provides something vaguely similar, but with a monthly subscription fee. KidPass opted for a credit-based system like Audible or ClassPass.

Powered by WPeMatico