Fundings & Exits

Auto Added by WPeMatico

Auto Added by WPeMatico

Waresix, one of a handful of startups aiming to modernize logistics in Indonesia — the world’s fourth most populous country — has pulled in $14.5 million to grow its 18-month-old business.

This new investment, Waresix’s Series A, is led by EV Growth — the growth-stage fund co-run by East Ventures — with participation from SMDV — the investment arm of Indonesia corporation Sinar Mas — and Singapore’s Jungle Ventures . The startup previously raised $1.6 million last year from East Ventures, SMDV and Monk’s Hill Ventures. It closed a seed round in early 2018.

Waresix is aiming to digitize logistics, the business of moving goods from A to B, which it believes is worth a total of $240 billion in Indonesia.

A large part of that is down to the country’s geography. The archipelago officially has more than 17,000 islands, but there are five main ones. That necessitates a lot of challenges for logistics, which are said to account for 25-30% of GDP — a figure that is typically below 5% in Western markets — while Indonesia barely scraped the top 50 rankings in World Bank’s Logistics Performance Index.

But, as Southeast Asia’s largest economy and the key market for digital growth in the region, that makes this an attractive problem to solve… or, rather, attractive industry to modernize.

Like others in its space worldwide — which include Chinese unicorn Manbang and BlackBuck in India — Waresix is focused on optimizing logistics by making the process more transparent for clients and more efficient for haulage companies and truckers. That includes removing the chain of “middle man” brokers, who add costs and reduce transparency, and provide a one-stop solution for transportation by land or sea, as well as cold storage and general cargo handling.

As of today, Waresix claims a fleet of more than 20,000 trucks and over 200 warehouse partners across Indonesia. The company said it plans to use this new capital to expand that coverage further. In particular, that’ll include additional land transport options and additional warehouse capacity in tier-two cities and more remote areas. That’s a push that founders Andree Susanto (CEO) and Edwin Wibowo (CFO) — who met at UC Berkeley in the U.S. — believe fits with Indonesia’s own $400 billion commitment to improve national infrastructure and transport.

Waresix trucks

It is also consistent with East Ventures, the long-standing early-stage VC, which has backed a pack of young companies aiming to inject internet smarts into traditional industries in Indonesia. Some of that portfolio includes Warung Pintar, which develops smart street vendor kiosks, Kedai Sayur, which is digitizing street vendors, and Fore Coffee, which draws inspiration from China’s digital-first brand Luckin Coffee, which recently listed in the U.S.

Now with EV Growth, which reached a final close of $200 million thanks to LPs that include SoftBank, East Ventures has the firepower to write larger checks that go beyond seed and pre-Series A deals, as it has done with Waresix.

But the company is far from alone in going after the logistics opportunity in Indonesia. Its rivals include Kargo, which was started by a former Uber Asia exec and is backed by Uber co-founder Travis Kalanick’s 10100 fund among others, and Ritase.

Ritase, which claims to be profitable, closed an $8.5 million Series A this week. It said it has 7,500 trucks and, on the client side, some 500 SMEs and a smattering of well-known global brands. Kargo has kept its metrics quiet, but it is a later arrival on the scene. The startup only came out of stealth in March of this year when it announced a $7.6 million funding round.

Powered by WPeMatico

SoftBank Vision Fund has single-handedly changed the game when it comes to tech startup investment. And that’s why I’m excited to announce that SoftBank Vision Fund partner David Thevenon is joining us at TechCrunch Disrupt Berlin.

Thevenon spent most of his career working for Google on international and strategic partnerships, especially in Latin America, Asia, Europe and the Middle East. He ended up heading the business development teams working on Android partnerships globally.

While his career as an investor is still relatively recent, he’s currently a board member for DiDi, Grab and Kabbage. As a reminder, SoftBank’s Vision Fund invested $5 billion in DiDi — it’s not every day that you get to cut such a big check.

So Thevenon has become a sort of expert in ride-hailing and mobile transportation platforms. It’s going to be interesting to hear what he thinks about the concept of “super apps” that Grab pioneered, for instance. Can you transform ride-hailing apps into apps that you open every day to make payments, get insurance products and loans?

More generally, given the size of SoftBank’s Vision Fund ($100 billion), it has had a huge impact on the growth trajectory of some companies. I’m personally curious to know SoftBank’s approach as board members, whether they get involved in the strategy of those companies or let the executive teams make decisions on their own.

Buy your ticket to Disrupt Berlin to listen to this discussion and many others. The conference will take place on December 11-12.

In addition to panels and fireside chats, like this one, new startups will participate in the Startup Battlefield to compete for the highly coveted Battlefield Cup.

Before joining SoftBank in 2014, David had a 10-year tenure at Google, where he last led global partnerships for the Android platform and was in charge of product-related partnerships and business development activities across Asia, Europe, the Middle East, Africa and Latin America.

Prior to Google, David led strategic partnerships at T-Mobile International, and worked as a finance executive at Dell, ICL-Fujitsu and Elf-Atochem. David received a Master in Management from ESCEM.

Powered by WPeMatico

The new era of tech-enabled banks is coming, even in regulation-heavy Japan. Kyash, a fintech company with visions on becoming Japan’s first challenger bank, said today it has raised $14 million to continue its expansion.

To be clear, Kyash isn’t a bank. Yet. But it is currently applying for a host of licenses in Japan that could allow it to offer banking-style features, including checking accounts, ATM withdrawals and money remittance. Right now, it is a payment app that offers a connected Visa card in the style of Monzo, N26, Revolut (which has a Japan license) and others of that ilk.

The startup was founded in 2015 by Shinichi Takatori, a former banker and management consultant who saw the potential to merge tech and finance.

“I really noticed that information and communication has become ubiquitous but money itself hasn’t changed for a long time,” Takatori told TechCrunch in an interview.

The company took some time — two years — before it released a consumer product, but it quickly tied up with Visa to offer a prepaid debit card that connects to the Kyash app. That provides benefits like instant payment notifications, clear balance and lower fees for overseas spending, while costs are borne by merchants rather than users. They might seem elementary today, but they are still not standard among Japan’s traditional banks, Takatori explained.

The company declined to share its user numbers, but Takatori said this new round of funding — Kyash’s Series B — is a validation of the progress it has made.

The $14 million investment is co-led by Goodwater Capital, a U.S. investor that has backed fintech startups like Monzo, Stash and Toss in Korea, and Mitsubishi UFJ Capital, the investment arm of Japan’s largest bank.

Mitsubishi’s involvement means that Kyash counts Japan’s three largest banks as investors, with SMBC and Mizuho having previously put money into the company. Others that took part in this Series B include Toppan Printing, JAFCO and Shinsei Corporate Investment Limited.

So many banks on the cap table might seem like a strange thing for a disruptor — let alone the banks, which tend to behave territorially — but Takatori believes that there’s the potential for cooperation, not to mention that it will help the startup with its licensing efforts. Already, he revealed, Mitsubishi plans to integrate its card with the Kyash app to provide its customers with the best of both worlds.

“We’re not here to win over existing banks, but instead inform [them of] how money should work in next decade,” explained Takatori. “So why not collaborate in some way.”

Kyash has a tie-up with Visa that allows it to offer its customers a connected debit card and also provide issuing services to other fintech startups

There’s also the fact that, even with a license, Kyash and others are unlikely to be able to offer full banking services. That means they will have to serve as complementary offerings to the industry, which would likely mean that cooperation is good — essential — for both sides.

But, beyond the consumer play, a notable piece of Kyash’s business that has investors excited is its B2B payment business.

The company developed its own payment processing system to reduce costs, which is one reason it took time to launch. Thanks to a tie-up with Visa, it offers both issuing and processing of prepaid Visa cards to fintech companies in Japan that want to go down the payment route.

That’s increasingly popular, given the government push to make the country a “cashless society” ahead of the 2020 Olympic Games next year. It also could appeal to crypto companies in Japan, which offers the world’s most robust licensing, that want to follow the example of the Coinbase card in Europe or startups like Crypto.com and TenX, which offer similar prepaid cards.

Takatori said Kyash is “in discussions” with crypto companies, but that it has not made a decision on how to proceed yet. The company is also eyeing potential overseas expansions, although that is some way down the line.

“We have open eyes for globalization, it’s just a matter of when,” he told TechCrunch. “We still have a far way to go [in Japan, but] maybe after the Olympics.”

More pressingly, he sees the company looking to raise a “pretty quick” Series C round to give it acceleration into next year. That’s likely to go to more expansion and user acquisition as the licenses the startup has applied for are unlikely to be granted this year.

Powered by WPeMatico

Only six months after snapping up virtualization specialist Parallels, Canadian software company Corel is itself getting acquired. TechCrunch has learned and confirmed with multiple sources that private equity giant KKR has closed a deal to buy the company from Vector Capital, which has owned some or all of Corel since 2003.

KKR’s interest in Corel was first rumored in May, when PE Hub reported the two were in talks for a sale valued at over $1 billion. At the time, representatives of Corel declined to comment, although our sources inside the company indicated that the reports were not inaccurate.

Fast-forward to today, and both KKR and and a spokesperson for Parallels/Corel declined to comment. But, we now have a copy of the memo provided by an internal source that has been sent out to staff announcing that the deal has indeed closed, and that Corel is now officially part of the KKR family of companies.

According to the memo, KKR is very optimistic about Corel’s prospects. It plans to give Corel an “infusion of capital” to accelerate its growth, which will go into two areas. First will be expanding operations for the existing business: Corel is the company behind a number of longstanding software brands including WordPerfect, Corel Draw, WinZip, PaintShop Pro. Second will be making acquisitions (and the sheer proliferation of promising startups in the last decade dedicated to all variety of apps and other software that may have found it a challenge to scale means Corel could have rich pickings).

There are no layoffs planned as part of the deal, and the official announcement had been planned to go out next week, but now looks like it may be moved up to tomorrow (Wednesday).

Vector and Corel itself have never publicly disclosed much on user numbers or financials, but Vector has described the company as “highly profitable,” with dividends of more than $300 million to date. The memo we’ve seen notes that Corel (including Parallels) has millions of customers across its various software platforms and apps.

The acquisition of Corel by KKR marks another chapter in the company’s long corporate history.

Founded in the 1980s — when personal computers were just starting to enter the mainstream but well before we had anything like the internet (not to mention the world of cloud-based apps) that we know today — Corel once positioned itself as a potential competitor to Microsoft in the software wars.

When Corel purchased WordPerfect from Novel in 1996, Corel founder Michael Cowpland viewed the software package as an integral part of that rivalry, describing it as the Pepsi to Microsoft’s Coke — that is, Word.

Microsoft proved the mightier of the two, and it even eventually signed a partnership with Corel that saw it investing in the company: a sell out, as one disappointed Canadian journalist described it at the time. The two have also sparred over patents.

Corel, which went public early in its life, got battered in the first dot-com bust (which was not helped by an insider trading scandal that led to Cowpland’s departure). Vector stepped in and took it private in 2003.

After restructuring the company, Vector listed Corel again in 2006. But, amid another recession that again hit Corel hard, it once more took it private in 2010. In the intervening years, Corel has been focused on modernising its offerings, bringing in e-commerce, direct downloads, subscriptions and acquisitions to bring the company’s products and wider business closer to how consumers and workers use computers today.

Parallels was a part of that strategy: its products help people work seamlessly across multiple platforms, letting employees (and IT managers) run a unified workflow regardless of the device or operating system, with Parallels providing support for Windows, Mac, iOS, Android, Chromebook, Linux, Raspberry Pi and cloud — a timely offering in the current, fragmented IT market.

If the $1 billion+ figure is accurate, that strategy seems to have worked: across the two times that Vector took Corel private, it never paid more than $124 million for the company (the second time, as its stock was tanking, it paid just $30 million).

Powered by WPeMatico

Equinix, one of the world’s largest data center companies, announced that it will form a $1 billion joint venture with GIC, Singapore’s sovereign wealth fund. The partnership will focus on building xScale data centers in Europe. Instead of targeting the wholesale market, Equinix is developing xScale data centers to handle the demands of the biggest cloud service providers in the world. Equinix’s clients have already included Alibaba Cloud, Amazon Web Services, Microsoft Azure, Oracle Cloud Infrastructure, Google Cloud and other hyperscale cloud providers.

Under the agreement, expected to be finalized in the third quarter, GIC will own an 80% stake in the joint venture, with Equinix owning the remaining 20%. Equinix will also sell its London LD10 and Paris PA8 International Business Exchange (IBX) data centers to the joint venture for new xScale centers. xScale centers will also be built in Amsterdam, Frankfurt and London, bringing the total to six centers that will provide a combined capacity of 155 megawatts once completed.

Equinix says global deployments from hyperscale cloud providers currently exceed about $500 million in annual revenue. The new xScale data centers will be located on or near Equinix’s IBX campuses, to enable providers to handle more customer access points and rapidly-scaling workloads. Equinix currently has more than 200 IBX campuses, covering more than 50 metro areas around the world. xScale data centers will also offer interconnection and edge services to increase connection speeds for cloud service customers and be engineered specifically to meet the needs of hyperscale companies.

In a press statement, Charles Meyers, president and CEO of Equinix, said, “The JV structure will enable us to extend our cloud leadership while providing significant value to a critical set of hyperscale customers. We look forward to launching similar JVs in other operating regions and believe that these efforts will continue to further differentiate Equinix as the trusted center of a cloud-first world.”

Powered by WPeMatico

Meditation app unicorn Calm wants you to doze off to the dulcet tones of actor Matthew McConaughey’s southern drawl or writer Stephen Fry’s English accent. Calm’s Sleep Stories feature that launched last year is a hit, with more than 150 million listens from its 2 million paid subscribers and 50 million downloads. While lots of people want to meditate, they need to sleep. The seven-year-old app has finally found its must-have feature that makes it a habit rather than an aspiration.

Keen to capitalize on solving the insomnia problems plaguing people around the world, Lightspeed tells TechCrunch it has just invested $27 million into a Series B extension round in Calm alongside some celebrity angels at a $1 billion valuation. The cash will help the $70 per year subscription app further expand from guided meditations into more self-help masterclasses, stretching routines, relaxing music, breathing exercises, stories for children and celebrity readings that lull you to sleep.

The funding adds to Calm’s $88 million Series B led by TPG that was announced in February that was also at a $1 billion valuation, bringing the full B round to $115 million and Calm’s total funding to about $141 million. Lightspeed partner Nicole Quinn confirms the fund started talks with Calm around the same time as TPG, but took longer to finish due diligence, which is why the valuation didn’t grow despite Calm’s progress since February.

“Nicole and Lightspeed are valuable partners as we continue to double down on entertainment through our content,” Calm’s head of communications Alexia Marchetti tells me. The startup plans to announce more celebrity content tie-ins later this summer.

Broadening its appeal is critical for Calm amidst a crowded meditation app market that includes Headspace, Simple Habit and Insight Timer, plus newer entrants like Peloton’s mindfulness sessions and Journey’s live group classes. It’s become easy to find guided meditations online for free, so Calm needs to become a holistic mental wellness hub.

While it risks diluting its message by doing so much, Calm’s plethora of services could make it a gateway to more of your personal health spend, including therapy, meditation retreats and health merchandise from airy clothing to yoga mats. But subscription fees alone are powering a big business. Calm quadrupled revenue in 2018 to reach $150 million in ARR and hit profitability.

Calm is poised to keep up its rapid revenue growth. After the launch of Sleep Stories, “it was incredible to see the engagement spike up and also the retention,” says Quinn. Users can choose from having McConaughey describe the wonders of the cosmos, John McEnroe walk them through the rules of tennis, fairy tales like The Little Mermaid and more.

Quinn tells me “Sleep Stories is now a huge percentage of the business, and also the length of time people spend on the app has gone up dramatically.” She tells me that so many startups are “trying to invent a problem where there isn’t one.” But difficulty snoozing is so widespread and detrimental that users are eager to pay for an app instead of a sleeping pill. Having the Interstellar actor talk about the universe until I pass out sounds alright, alright, alright.

Powered by WPeMatico

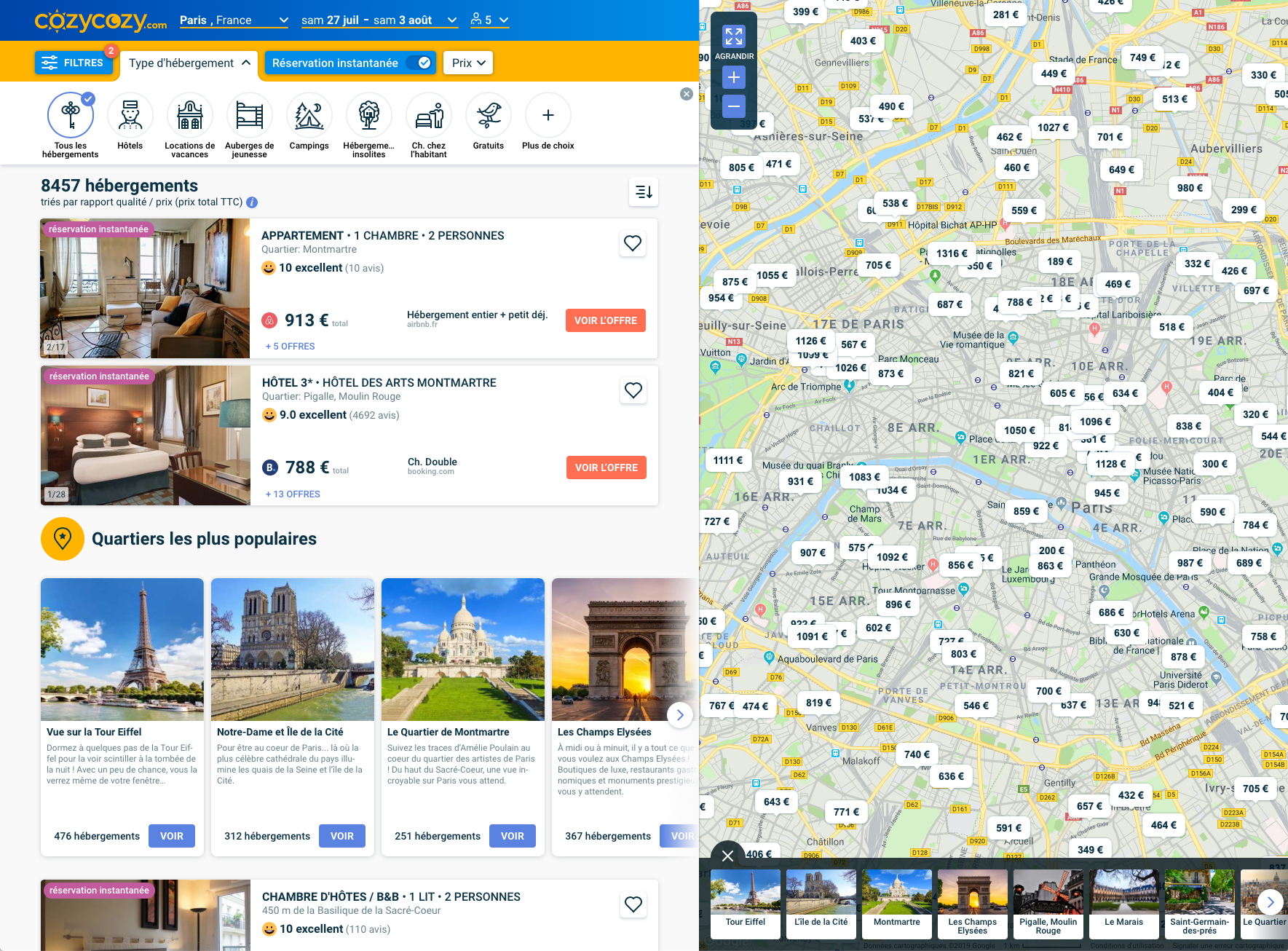

French startup Cozycozy.com wants to make it easier to search for accommodation across a wide range of services. This isn’t the first aggregator in the space and probably not the last one. But this time, it isn’t just about hotels.

When you plan a trip with multiple stops, chances are you end up with a dozen tabs of different services — on Airbnb to look at listings, on a hotel review platform and on a hotel booking platform. Each service displays different prices and has a different inventory.

While there are a ton of services out there, most of them belong to just three companies: Booking Holdings (Booking.com, Priceline, Kayak, Agoda…), Expedia Group (Expedia, Hotels.com, HomeAway, Trivago…) and TripAdvisor (TripAdvisor, HouseTrip, Oyster…). They all operate many different services in order to address as many markets and as many segments as possible.

Cozycozy.com wants to simplify that process by aggregating a ton of services in a single interface — you can find hotels, Airbnb listings, campsites, hostels, boats, home-exchanging apartments… You can filter your results by price or you can exclude some accommodation styles.

The company doesn’t work with hotels and doesn’t handle bookings directly. Instead, the service searches across all the usual suspects. When you want to book, you get redirected to the original listing on Airbnb, Booking.com, Hostelworld, etc.

The startup recently raised a $4.5 million funding round (€4 million) from Daphni, CapDecisif, Raise and many different business angels, such as Xavier Niel, Thibaud Elzière and Eduardo Ronzano.

Cozycozy.com co-founder and chairman Pierre Bonelli also previously founded Liligo.com. It is one of the most popular flight comparison website in France. It was acquired by SNCF in 2010 and then eDreams ODIGEO in 2013.

Powered by WPeMatico

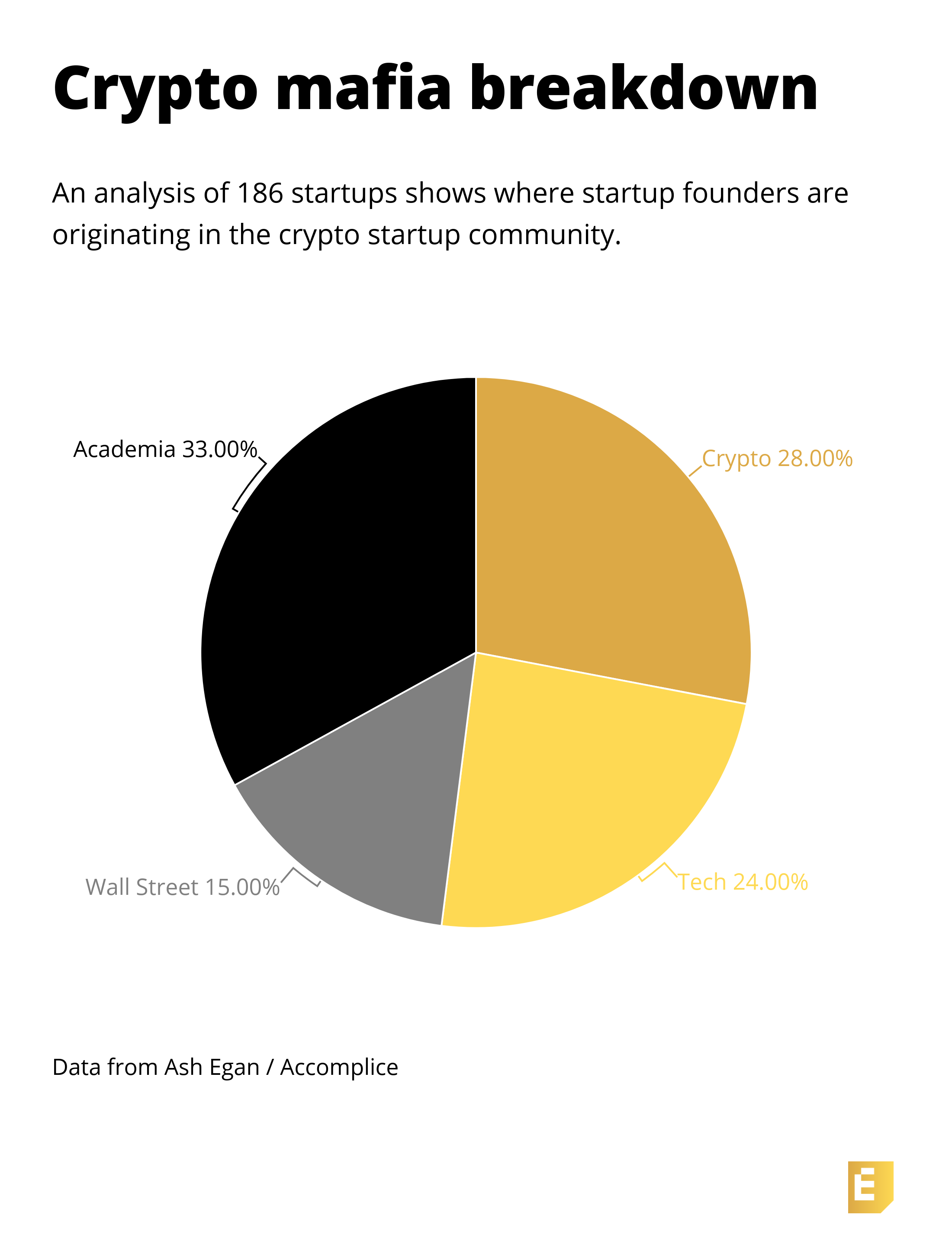

In the early 2000s, journalists popularized the term “PayPal mafia” to describe the PayPal founders and employees who left to start their own wildly successful tech companies, including Peter Thiel, Reid Hoffman, and Elon Musk. Drawing from that idea, this article seeks to cover the formation and flow of talent within the crypto landscape today.

I’m fascinated by the concept of tech mafias, popularized by Paypal in the early 00s.

Early signs of crypto mafias:

Coinbase

@0xProject @dydxprotocol

Ethereum/ConsenSys@Cardano @polkadotnetwork @metamask_io

MIT@EnigmaMPC @Algorand Unit-e

IC3Avalanche

Others?

— Ash Egan (@AshAEgan) April 3, 2019

The crypto world is in a constant state of flux, with new startups entrants joining the industry every single day. These new startups have the potential either to be superstars within a portfolio company or to start the next Coinbase. Additionally, there are already impressive spin-outs from some of the more established crypto companies.

For ease of framing, I’ve separated these early-forming mafias into four categories: Crypto, Tech, Wall Street, and Academia. Since 2009, there have been 186 spinout companies originating from those four categories (33% from Academia, 28% from Crypto, 24% from Tech, and 15% from Wall Street).

Obvious but important disclaimer: this article does not intend to promote organized crime within crypto.

Powered by WPeMatico

French startup Ornikar is raising a $40 million Series B round (€35 million) from Idinvest and Bpifrance. The company competes with traditional driving schools in Europe with an online marketplace of students and teachers.

And Ornikar has been a massive success in France. Overall, 35 percent of driving school registrations in 2019 are handled by Ornikar.

There are many advantages in choosing Ornikar. For driver students, Ornikar is much more flexible than a traditional driving school. Driving schools in France are usually pretty small with only a handful of employees. It’s sometimes hard to book lessons, especially if you have a full-time work.

When you sign up to Ornikar, you can connect to your Ornikar account and book an hour or two from there. Ornikar works with a pool of 650 instructors so that you get to study at your own pace.

Ornikar is also cheaper than a traditional driving school. By automating the administration work as much as possible, the startup says that it is 35 percent cheaper than a traditional driving school. It currently costs €750 for 20 hours of lessons.

“We’ve been profitable in 2018 and very profitable in 2019 for the French market,” Ornikar co-founder and CEO Benjamin Gaignault told me.

Here are some numbers. Every month, 30,000 people sign up to Ornikar in France. The startup manages 70,000 hours of lessons per month on its marketplace.

Ornikar works with qualified instructors who got a license to work in a driving school. They get paid €15 per hour, which is theoretically more than in a normal driving school.

With today’s funding round, the startup wants to expand to more countries. Ornikar is already live in Germany and Spain, but the company wants to grow the product there. Eventually, the company will also expand to Italy and the U.K.

In addition to new countries, Ornikar wants to sell other car-related products. The company is partnering with third-party companies for car insurance products, and there will be more products down the road.

Ornikar had previously raised an $11.3 million Series A (€10 million) and a $1.3 million seed round (€1 million). Existing investors include Brighteye, Partech, Elaia, Xavier Niel, Jacques-Antoine Granjon and Marc Simoncini.

Powered by WPeMatico

Fungible, a startup that wants to help data centers cope with the increasingly massive amounts of data produced by new technologies, has raised a $200 million Series C led by SoftBank Vision Fund, with participation from Norwest Venture Partners and its existing investors. As part of the round, SoftBank Investment Advisers senior managing partner Deep Nishar will join Fungible’s board of directors.

Founded in 2015, Fungible now counts about 200 employees and has raised more than $300 million in total funding. Its other investors include Battery Ventures, Mayfield Fund, Redline Capital and Walden Riverwood Ventures. Its new capital will be used to speed up product development. The company’s founders, CEO Pradeep Sindhu and Bertrand Serlet, say Fungible will release more information later this year about when its data processing units will be available and their on-boarding process, which they say will not require clients to change their existing applications, networking or server design.

Sindu previously founded Juniper Networks, where he held roles as chief scientist and CEO. Serlet was senior vice president of software engineering at Apple before leaving in 2011 and founding Upthere, a storage startup that was acquired by Western Digital in 2017. Sindu and Serlet describe Fungible’s objective as pivoting data centers from a “compute-centric” model to a data-centric one. While the company is often asked if they consider Intel and Nvidia competitors, they say Fungible Data Processing Units (DPU) complement tech, including central and graphics processing units, from other chip makers.

Sindhu describes Fungible’s DPUs as a new building block in data center infrastructure, allowing them to handle larger amounts of data more efficiently and also potentially enabling new kinds of applications. Its DPUs are fully programmable and connect with standard IPs over Ethernet local area networks and local buses, like the PCI Express, that in turn connect to CPUs, GPUs and storage. Placed between the two, the DPUs act like a “super-charged data traffic controller,” performing computations offloaded by the CPUs and GPUs, as well as converting the IP connection into high-speed data center fabric.

This better prepares data centers for the enormous amounts of data generated by new technology, including self-driving cars, and industries such as personalized healthcare, financial services, cloud gaming, agriculture, call centers and manufacturing, says Sindu.

In a press statement, Nishar said “As the global data explosion and AI revolution unfold, global computing, storage and networking infrastructure are undergoing a fundamental transformation. Fungible’s products enable data centers to leverage their existing hardware infrastructure and benefit from these new technology paradigms. We look forward to partnering with the company’s visionary and accomplished management team as they power the next generation of data centers.”

Powered by WPeMatico