Fundings & Exits

Auto Added by WPeMatico

Auto Added by WPeMatico

Two months ago, we reported that Carbon was set to raise up to $300 million, bringing the 3D printing company’s valuation up to a lofty $2.5 billion. The real numbers released this week by the company aren’t quite so lofty, but are impressive nonetheless. The Series E fetched $260 million, putting its valuation at closer to $2.4 billion.

The latest round follows a $200 million Series D that arrived in late-2017, bringing the company’s total raise to $680 million. What exactly is the bay area-based startup planning to do with that massive sum, in the wake of high profile manufacturing partnerships with companies like Adidas and Riddell?

CEO/co-founder Joseph M. DeSimone and recent addition CMO Dara Treseder (most recently of GE Ventures) stopped by our offices to discuss what the latest round means for the Bay Area-based company.

Asked for a timeline around when Carbon might exit, DeSimon offered a non-committal answer. “As we grow our business, we haven’t made announcements for our IPO or anything like that yet,” he told TechCrunch. But the revenue business is growing nicely. So we’re in pretty good shape.”

It’s hard to say precisely what goals the company is hoping to attain before going public, but at the very least, Carbon presents a good indicator that the 3D printing industry is back on the uptick — in some circles, at least.

Powered by WPeMatico

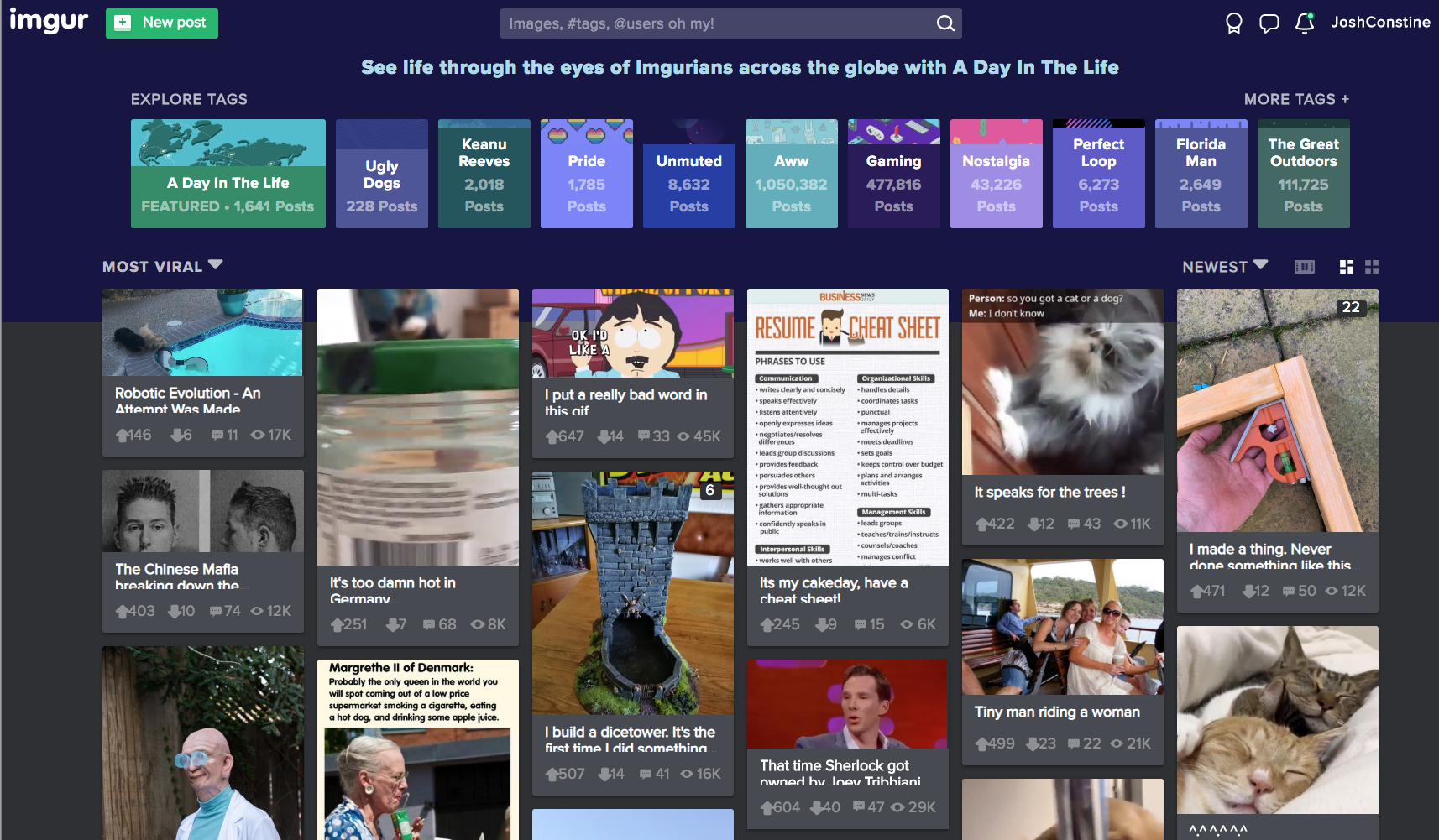

Meme creators have never gotten their fair share. Remixed and reshared across the web, their jokes prop up social networks like Instagram and Twitter that pay back none of their ad revenue to artists and comedians. But 300 million monthly user meme and storytelling app Imgur wants to pioneer a way to pay creators per second that people view their content.

Today Imgur announces that it’s raised a $20 million venture equity round from Coil, a micropayment tool for creators that Imgur has agreed to build into its service. Imgur will eventually launch a premium membership with exclusive features and content reserved for Coil subscribers.

Users pay Coil a fixed monthly fee, install its browser extension, the Interledger protocol is used to route assets around, and then Coil pays creators dollars or XRP tokens per second that the subscriber spends consuming their content at a rate of 36 cents per hour. Imgur and Coil will earn a cut too, diversifying the meme network’s revenue beyond ads.

“Imgur began in 2009 as a gift to the internet. Over the last 10 years we’ve built one of the largest, most positive online communities, based on our core value to ‘give more than we take’” says Alan Schaaf, founder and CEO of Imgur. The startup bootstrapped for its first five years before raising a $40 million Series A from Andreessen Horowitz and Reddit. It’s grown into the premier place to browse ‘meme dumps’ of 50+ funny images and GIFs, as well as art, science, and inspirational tales. With the same unpersonalized homepage for everyone, it’s fostered a positive community unified by esoteric inside jokes.

While the new round brings in fewer dollars, Schaaf explains that Imgur raised at a valuation that’s “higher than last time. Our investors are happy with the valuation. This is a really exciting strategic partnership.” Coil founder and CEO Stefan Thomas who was formerly the CTO of cryptocurrency company Ripple Labs will join Imgur’s board. Coil received the money it’s investing in Imgur from Ripple Labs’ Xpring Initiative, which aims to fund proliferation of the Ripple XRP ecosystem, though Imgur received US dollars in the funding deal.

Thomas tells me that “There’s no built in business model” as part of the web. Publishers and platforms “either make money with ads or with subscriptions. The problem is that only works when you have huge scale” that can bring along societal problems as we’ve seen with Facebook. Coil will “hopefully offer a third potential business model for the internet and offer a way for creators to get paid.”

Founded last year, Coil’s $5 per month subscription is now in open beta, and it provides extensions for Chrome and Firefox as it tries to get baked into browsers natively. Unlike Patreon where you pick a few creators and choose how much to pay each every month, Coil lets you browse content from as many creators as you want and it pays them appropriately. Sites like Imgur can code in tags to their pages that tell Coil’s Web Monetization API who to send money to.

The challenge for Imgur will be avoiding the cannibalization of its existing content to the detriment of its non-paying users who’ve always known it to be free. “We’re in the business of making the internet better. We do not plan on taking anything away for the community” Schaaf insists. That means it will have to recruit new creators and add bonus features that are reserved for Coil subscribers without making the rest of its 300 million users feel deprived.

It’s surprising thT meme culture hasn’t spawned more dedicated apps. Decade-old Imgur precedes the explosion in popularity of bite-sized internet content. But rather than just host memes like Instagram, Imgur has built its own meme creation tools. If Imgur and Coil can prove users are willing to pay for quick hits of entertainment and creators can be fairly compensated, they could inspire more apps to help content makers turn their passion into a profession…or at least a nice side hustle.

Powered by WPeMatico

David’s Bridal once owned 50% of the $36 billion wedding gown market before it filed for bankruptcy last year. Brides were growing sick of the lack of styles and sizes plus high prices at expensive brick & mortar shops. The industry was destined for disruption by software that would replace overhead costs and inflexibility with direct-to-consumer personalization.

That’s why I profiled a new custom wedding dress startup back in 2016 called Anomalie despite little funding or traction. The rise of Instagram meant every bride wanted to look unique on a budget, not pay $5000 for a cookie-cutter $200 dress that happened to be white. Anomalie was willing to embrace software to offer 4 billion design permutations and break the markup cartel by selling gowns starting at $1000.

2.5 years later, Anomalie has begun to prove that cheaper doesn’t have to look cheap and custom doesn’t have to cause a headache. 13% of US brides, 275,000 out of 2.1 million, created an Anomalie account in the last year. With David’s Bridal looking shaky and wedding dresses being a seven-times larger market than bedding and mattresses, investors eagerly proposed to Anomalie. Today the startup announces a $13.6 million Series A led by consumer product VC Goodwater Capital .

“I don’t think I’ll ever get tired of working with brides. Other companies would kill for this costumer. She’s so obsessed with every detail of her wedding dress. it’s just a perfect environment to collect data” says Anomalie co-founder and CEO Leslie Voorhees. “Long lead time, high margin, this industry that’s completely f*cked up — it’s the perfect place to start this mass customization engine beginning with the wedding dress” she tells me, hinting at the startup’s potential to customize other clothing too.

Anomalie is also flexing its tech muscle today with the launch of its new dress sketch visualizer. Choose between a few options on shape, cut, color, pattern, and fabric, and you’ll see an algorithmic sketch of your dream dress appear instantly. Anomalie then pairs you with a squad of its designers to finalize the details, ship swatches, and get you your gown with a 100% refund policy if it’s not right.

The startup’s nest egg will go towards hiring more engineers plus bringing more of production in-house to offer additional features like this. But Voorhees insists that “I don’t think we’ll ever completely automate away the stylists. Customer don’t care about AI or machine learning, but they want to trust us to pull the ideas out of their heads.”

Anomalie co-founder and CEO Leslie Voorhees

Anomalie was woven out of Voorhees’ frustrations picking her own wedding dress. She’d been managing factories and supply chains in Asia for Nike and Apple, and it made no sense why slapping “bridal” on a dress could make it up to ten-times more expensive.

Her investigation uncovered that most brands were outsourcing their manufacturing, so she did an end-run, contacted factories directly, and got her dress made custom for a fraction of the price. So many of her pals demanded help doing the same that the Harvard Business School grad soft-launched Anomalie with her husband Calley Means [Disclosure: who I know from college] in the summer of 2016.

The startup’s gowns now average $1,400. Growth has been swift since weddings are so photographed and shared, with Anomalie reaching an outstanding net promoter score of 91. A friend of mine recently bought her dess through the company and it looked stunning and one-of-a-kind without breaking the bank. And since they’re custom, Anomalie makes inclusivity and advantage by offering larger sizes absent elsewhere

Meanwhile, Anomalie’s incumbent competitors have struggled. Gap and J.Crew abandoned the wedding dress business in the last few years. David’s Bridal emerged from bankruptcy with its 300 retail stores still operating, but it’s slipped to 30 percent US market share. It’s now owned by lenders including Oaktree Capital Group, which is a bad omen given that firm was responsible for driving Toys”R”Us into liquidation instead of keeping it open. No other players have a sizable foot or well-known brand besides super high-end designer Vera Wang.

Anomalie capitalized on David’s troubles by poaching its head of bridal production Angela Ng, who now leads the startup’s Hong Kong team and relieves Voorhees of constant trips to China. It also hired former Sephora VP of digital Marcy Zelmar and former TrueCar VP of engineering Aaron Tavistock. Their goal is to sell more dresses to get Anomalie more data, more factory modularization, and more control over its manufacturing.

Anomalie’s dress visualizer turns a few style selections into a sketch of your potential gown

The new funding round that builds on its $4.5 million seed round was joined by Signia, SoGal Ventures, Lerer Hippeau’s BN Capital Fund, and Fin’s Sam Lessin also includes strategic angels like former Stitch Fix CTO Jeff Barrett and ThirdLove underwear CEO Heidi Zak. At Anomalie’s San Francisco headquarters, mannequins sporting design prototypes stand beside software teams optimizing the new dress visualizer. And when I say the dresses are custom, I mean they can get about as weird as you want. Anomalie is finishing up a dress with lyrics from the couple’s favorite song embroidered in a secret language from their favorite TV show…and it still looks beautiful.

“One of the coolest things about Anomalie is that they’re not just using digital as a distribution strategy, but to also deliver a differentiated product experience” says Goodwater partner Eric Kim. “Anomalie’s sketch-builder is a great expression of this emphasis on product and customer centricity.” Wedding dresses have been largely ignored by startups despite the market being bigger than luggage ($34 billion), or shaving ($21 billion), oral care ($10 billion) and hair loss ($4 billion) combined.

The challenge is that unlike those products, bridal gowns are “a zero failure game. This is like airplane engines and heart rate monitors” Voorhees stresses. Anomalie must maintain perfect quality, times, and customer experience to avoid ruining someone’s big day. “Never messing up a dress or losing a dress — we take this really, really seriously.” She knows a few viral disasters could sink the ship. It also has to stay ahead of fresh entrants like COUTURME, a new Y Combinator startup making custom evening gowns as well as wedding dresses.

Anomalie’s SF headquarters. Photo by Summer Wilson

Anomalie sees global demand for a better experience, and thinks it can apply its data set to wedding dresses for more cultures as well as additional types of clothing. “We are building up a large repository of female measurements and creating tech plus operational processes around ‘mass customization’ that can be applied to other garments” Voorhees reveals. “Our aspirations are around bringing more body inclusivity + customization to women’s fashion, not just bridal.”

And while Anomalie could always find a retail partner to get more exposure, it’s tough for brick & mortar brands to operate online without cannibalizing their sales. “We think the women’s closet of the future contains staples from Stitch Fix, rotating dresses from Rent the Runway, and signature custom garments from Anomalie.”

The Anomalie just needs to educate brides that they can actually have the dress of their dreams, and now it wants to inspire that dream on-site too. Full of ambition and verve, Voorhees concludes, “What’s Pinterest valued at when it’s basically a wedding dress search engine?”

Powered by WPeMatico

Monzo, the fast-growing U.K.-based challenger bank with more than two million account holders, has raised £113 million (~$144m) in additional funding.

Confirming TechCrunch’s scoop in April, the Series F round is led by Y Combinator’s “Continuity” growth fund, and gives the company a new £2 billion (~$2.5b) post-money valuation. That’s double the £1 billion valuation it garnered in October last year.

A number of other new and existing investors have also participated in the Series F. They include Latitude, General Catalyst, Stripe, Passion Capital, Thrive, Goodwater, Accel, and Orange Digital Ventures.

The investment by London-based Latitude, the growth fund from prolific seed investor LocalGlobe, is particularly noteworthy given that LocalGlobe itself didn’t previously back Monzo. The same might be said of YC’s Continuity, considering that Monzo isn’t a YC alumni (although GoCardless, Monzo co-founder Tom Blomfield’s previous startup, did take part in the Silicon Valley accelerator).

The take-away: a growth fund attached to an early-stage fund can be a great antidote to the anti-portfolio (the list of successful companies a VC firm either missed, were unable or chose not to invest in).

Meanwhile, Monzo’s new funding round and YC’s backing should be viewed within the context of not only fast growth and increasingly convincing product-market fit in the U.K. — the challenger bank is currently adding 200,000 new sign-ups for its current account each month — but also recently unveiled plans to tentatively launch across the pond.

We first reported that Monzo was busy assembling a U.S.-based team over five months ago, and the U.K. company made its U.S. plans official last week. This will see a U.S. Monzo app and connected Mastercard debit card available via in-person signups at events to be held soon. The rollout will initially consist of a few thousand cards, supported by a waitlist in preparation for a wider launch.

The U.S. launch is being done in partnership with a local bank, but in the longer term Monzo plans to apply for its own U.S. bank license, similar to the strategy it employed in the U.K. so as to own and operate as much of its technical, product and regulatory infrastructure as possible.

In the U.K., this has helped Monzo achieve an NPS score of 80, which Blomfield previously told me is unusually high for a bank. This is seeing 60% of U.K. signups remain long-term active, transacting at once per week. As a counterpoint, however, the percentage of Monzo users that pay a salary into their Monzo account sits at between about 27% and 30% of active users, suggesting that a significant number of Monzo customers aren’t yet using it as their main account (Monzo’s definition of salaried is anyone who deposits at least £1,000 per month by bank transfer).

Success in the U.S., therefore, isn’t a given, conceded Blomfield when I had a call with him earlier this month. Instead, he argued that the key to cracking North America will be creating a fully localised version of Monzo based on carefully listening to U.S. users and once again finding product-market fit. He says there are obvious and less obvious cultural and technical differences in the way Brits and Americans save, spend and manage their finances, and this will require significant product divergence from the U.K. version of Monzo. Today’s new £113 million injection of capital is clearly designed to provide some of the breathing space required to achieve that.

As a side note, there are encouraging signs from other London-based fintechs that have ventured across the pond. One recent example is the financial “digital assistant” chatbot Cleo, which entered the U.S. around a year ago and has been more successful than the company anticipated, seeing Cleo add 650,000 active U.S. users to date. In fact, the U.S. currently makes up more than 90% of new Cleo users, prompting one source to describe the U.K. startup as effectively a U.S. company now.

Powered by WPeMatico

Welcome back to this week’s transcribed edition of Equity.

This week, TechCrunch’s Danny Crichton filled in for co-host Alex Wilhelm – who was out in preparation for his wedding this weekend – joining Kate to cover the big news of the week.

Kate and Danny dive straight into Slack’s IPO and the implications of its direct listing strategy, before shifting gears to discuss the launch of Facebook’s new ‘Libra’ cryptocurrency and the VCs backing the initiative.

The duo then took a look at Lime’s latest fundraising efforts and the potential headwinds facing scooter companies with an appetite for capital. Lastly, Kate and Danny talk about underappreciated tensions for founders, including getting pushed out of their own companies and handling their own salaries.

Crichton: Talking about founders and compensation, our correspondent, Ron Miller, talked to a bunch of VCs to ask how are founders paying themselves today? Obviously, the cost of living in the Bay Area, in New York and other startup hubs has increased dramatically. So VCs have had to become acutely aware of their founders’ financial means.

One of the things that really came out of this survey though, from my perspective, was just how high the numbers are. We surveyed small number. We put it out in the interviews. It came out to post-Series A people are starting to get paid around 200K. But the numbers, even a couple of years ago, I seem to recall was like $120 was the magic number around the Series A, $90K if you had a serious seed fund and like $60 to $80 if you are just getting started.

But the numbers that we saw out of this were significantly higher. I think that shows a lot about how the cost of living has just continued to creep up in San Francisco and in New York.

Clark: Yeah. I think the point is made in the story. If you live in San Francisco and you’re paying a mortgage and you have kids, of course, you need to make six figures really to get by, which is just an unfortunate reality. I can’t say I was surprised by how those salaries looked. Seeing $125K for a founder, if anything, I thought was maybe a little low.

But it reminded me of, nearly a year ago at this point, when I wrote something on how much VCs are paid. I had written it based off data that was provided to me from a consulting firm. People were just up in arms at what I had written because, and I understand looking back, I think it grouped VCs together as VCs who work at really big funds who are getting the 2% carry out of a multi-billion dollar fund and who are paid a lot more.

And there are of course VCs who run seed funds or any kind of fund. There are many different sizes of VC funds. Some VCs actually don’t have a salary at all and are up against the same challenges, if not even more difficult challenges, of a startup founder.

Want more Extra Crunch? Need to read this entire transcript? Then become a member. You can learn more and try it for free.

Kate Clark: Hello, and welcome back to Equity, TechCrunch’s venture capital-focused podcast. My co-host, Alex, is getting married this weekend so he’s not with us today, unfortunately. But we’ve got TechCrunch editor, Danny Crichton on the line. Danny, how are you?

Powered by WPeMatico

The Daily Crunch is TechCrunch’s roundup of our biggest and most important stories. If you’d like to get this delivered to your inbox every day at around 9am Pacific, you can subscribe here.

1. Slack prices IPO at $26 per share

Slack is debuting on the New York Stock Exchange today. Trading hasn’t opened yet as I write this, but The Wall Street Journal reports that the company has set a price of $26 per share.

The enterprise communication company is pursuing a direct listing, eschewing the typical IPO process in favor of putting its current stock on to the NYSE without doing an additional raise or bringing on underwriter banking partners.

2. Waymo takes its self-driving car ambitions global in partnership with Renault-Nissan

Waymo has locked in an exclusive partnership with Renault and Nissan to research how commercial autonomous vehicles might work for passengers and packages in France and Japan.

3. UK age checks for online porn delayed after bureaucratic cock-up

Digital minister Jeremy Wright said the government failed to notify the European Commission of age verification standards it expects companies to meet. Without this notification, the government can’t legally implement the policy.

4. iRobot acquires education startup Root Robotics

Root Robotics is the creator of an eponymous coding robot, a two-wheeled device designed to draw on whiteboards and other surfaces, scanning colors, playing music and otherwise playing out coding instructions.

5. SaaS data protection provider Druva nabs $130M, now at a $1B+ valuation, acquiring CloudLanes

Druva has made a name for itself as a provider of cloud-based solutions to protect and manage IT assets.

6. Why all standard black Tesla cars are about to cost $1,000 more

Tesla will start charging $1,000 for its once-standard black paint color next month, according to a tweet by CEO Elon Musk.

7. Tally’s Jason Brown on fintech’s first debt roboadvisor and an automated financial future

We sat down with Tally’s founder and CEO Jason Brown to discuss a new funding round, Tally’s growth strategy and the company’s vision for an automated financial future. (Extra Crunch membership required.)

Powered by WPeMatico

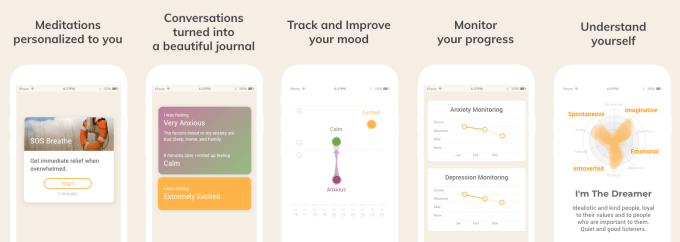

Youper, a mental health app with a chatbot it calls an “emotional health assistant,” has raised $3 million in seed funding from Goodwater Capital. The funds will be used to accelerate development of Youper’s artificial intelligence-based capabilities and grow its user base.

Based in San Francisco, Youper was co-founded in 2016 by Dr. Jose Hamilton. For a decade, Hamilton worked as a psychiatrist in clinical settings, seeing more than 3,000 patients. While talking to them, he realized that a handful of barriers kept many people from seeking help earlier, even if they had dealt with anxiety or depression for years.

“The first one is fear, taking care of yourself, talking about your mental health, understanding your mental health,” he tells TechCrunch. “Seeing a therapist or psychiatrist is super intimidating. That’s why all of my patients used to say the same things. The second barrier is cost, of course. Psychiatrists and therapists are super expensive.”

Hamilton teamed up with co-founders Diego Couto, the startup’s chief product and growth officer, and Thiago Marafon, its CTO, to create an app that would make mental healthcare less intimidating and more accessible. They originally created an app that did not have a conversational interface. Instead, Hamilton says it took a similar approach to Calm and Headspace. But that resulted in a very low user engagement rate and, after a year, the team realized Youper needed to provide a more personalized experience, matching users to the right psychological techniques, including cognitive behavioral techniques and mindfulness, for their needs.

Youper is part of a growing roster of apps that use AI-based chatbots to help users improve their emotional health, including Woebot, Wysa and X2’s Tess. Hamilton says Youper wants to differentiate with its focus on personalization, combining mental health research and user data to match the right psychological techniques with users.

Screenshots from Youper, an app for emotional well-being.

The startup claims Youper has been downloaded more than one million times so far. Most of its users are young adults, and there are more women than men who use Youper.

“I think that’s because women are facing new challenges in our society by conquering new spaces and assuming new roles, and that poses an emotional toll. Another reason is that women are more tuned into self-care than men,” he says. “Sometimes I feel that we men wait for too long suffering in silence.”

For users who have never consulted with a provider, Youper provides a gentle introduction to the types of questions and exercises they might experience in therapy. The questions and exercises given by Youper’s chatbot are meant to help users achieve a better understanding of their emotions, thoughts and behavior.

Youper’s chatbot asks users to focus on their thoughts and identify how they are feeling from a menu of descriptive words. Then a scale lets them rate the strength of that emotion from “slightly” to “extremely.” More questions help them narrow down what is causing those feelings and track their mood. Users are also given options for mindfulness exercises and journaling prompts.

Hamilton says that the average time users spend during each session with its chatbot is about seven minutes, with 80% reporting a reduction in negative moods after one conversation. The startup also claims that after 30 days, a quarter of people who signed up for Youper are still active users.

Youper is currently free, though the company may test a freemium model in the future with premium features. It uses anonymized user data in its own research to improve Youper, but keeps it private and does not share or sell user data or information.

Of course, an app is not a replacement for seeing a therapist or psychiatrist, but Youper presents a much lower barrier to entry for people who worried about the stigma of seeing a professional. Hamilton says he hopes using Youper will encourage more people to seek medical treatment sooner if they need it by making them more comfortable with the idea of discussing their emotional health.

“On average, it takes 10 years for someone to finally talk to a health provider. This could become 10 minutes with an app like Youper,” Hamilton says. “Having an app with a super low barrier to entry, no stigma, something that is about emotional health and taking care of yourself, shows that you don’t need to be afraid.”

Powered by WPeMatico

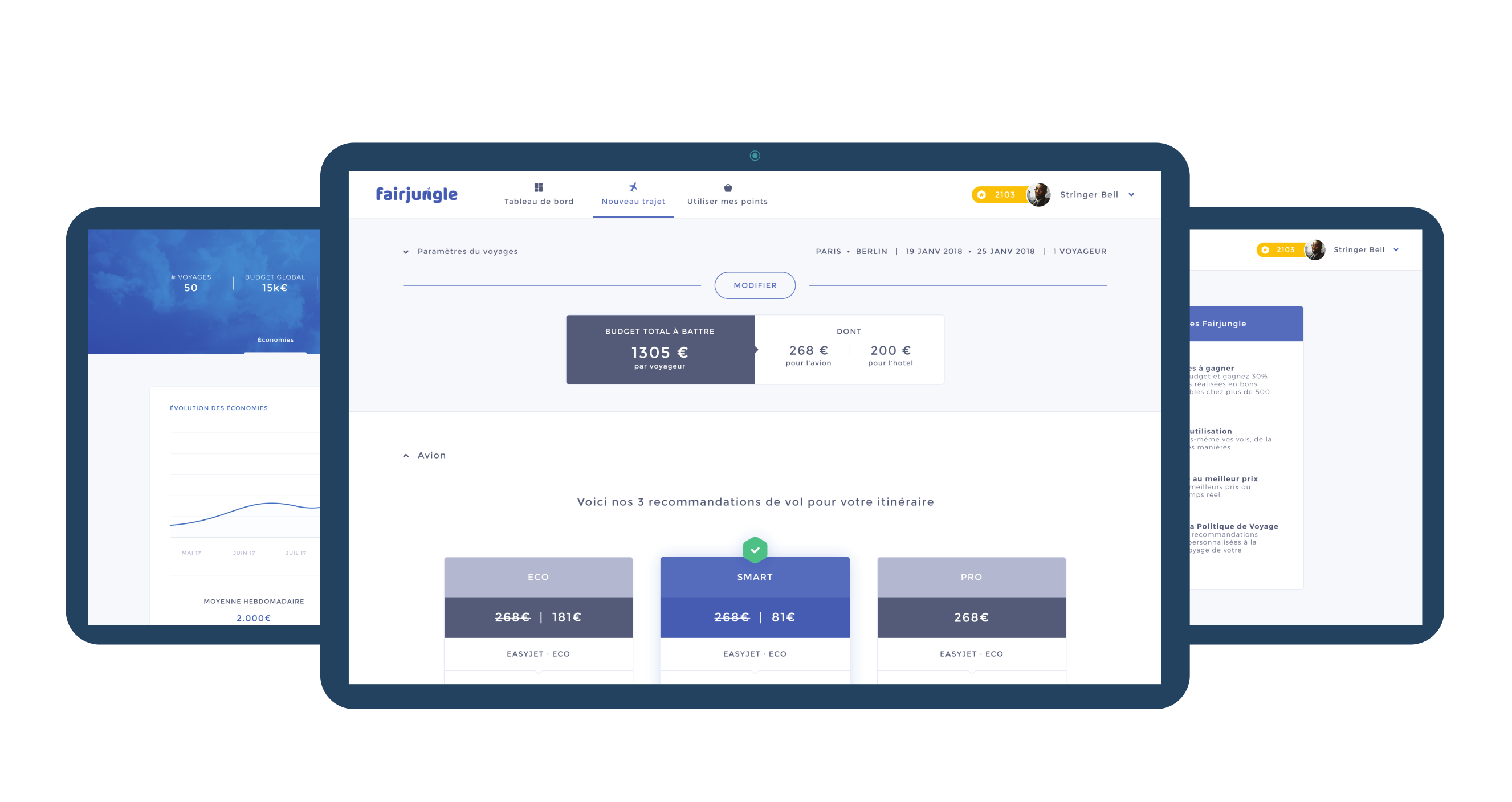

French startup Fairjungle wants to make it easier to book a flight or a hotel room for corporate purposes. The company just raised a $2 million funding round (€1.8 million) from Thibaud Elzière, Eduardo Ronzano, Bertrand Mabille and Whitestones Ventures.

If you work for a big company, chances are you book corporate flights through GBT, CWT or BCD Travel. And let’s be honest, the web interface usually sucks. It’s often hard to compare flights, change dates or even get a fair price.

Fairjungle is betting on a modern user experience and a software-as-a-service business model to change this industry. The idea is to make it feel more like you’re using a flight comparison service instead of a travel agency with a website.

“The value proposition [of legacy competitors] was historically around finding the best travel options for the business traveler, which has become obsolete today when you have tools like Skyscanner and Google Flights,” co-founder and CEO Saad Berrada told me.

In order to modernize that industry, the startup is leveraging the inventory of Skyscanner, Booking.com, Amadeus, Travelfusion and Hotelbeds. This way, you can book flights on 400 airlines and reserve hotel rooms in one million hotels.

After searching for a flight or a hotel room, you can book directly from Fairjungle. This way, employees don’t have to download invoices and file expense reports on a separate platform every time they travel. Companies can set up different rules to keep costs down. For instance, a flight that is unusually expensive requires approval from a manager.

Instead of charging per transaction, Fairjungle has opted for a SaaS model with a subscription of €5 per monthly active user.

Fairjungle currently focuses on small and mid-sized companies. The company has attracted 20 clients so far, including OVH. And it expects to generate $3.4 million (€3 million) in gross bookings by the end of the year.

Powered by WPeMatico

Cleo, the London-based “digital assistant” that wants to replace your banking apps, has quietly taken venture debt from U.S.-based TriplePoint Capital, according to a regulatory filing.

The amount remains undisclosed, though I understand from sources that the figure is somewhere in the region of mid-“single-digit” millions and will bridge the gap before a larger Series B round later this year. Cleo declined to comment on the fundraising.

However, sources tell me the need to raise debt financing is partly related to Cleo Plus, the startup’s stealthy premium offering that is currently being tested and set to launch more widely soon. The new product offers Cleo users a range of perks, including rewards and an optional £100 cash advance as an alternative to using your bank’s overdraft facility. The credit facility is, for the time bring at least, being financed from the startup’s own balance sheet, hence the need for additional capital.

The new funding also relates to Cleo’s U.S. launch, which began tentatively around a year ago. This has been more successful than was expected, seeing Cleo add 650,000 active U.S. users to date. The U.S. currently makes up more than 90% of new users now, too. Overall, the fintech claims 1.3 million users have signed up to the Cleo chatbot and app, with 350,000 active in the U.K.

Accessible via Facebook Messenger and the company’s iOS app, Cleo is an AI-powered chatbot that gives you insights into your spending across multiple accounts and credit cards, broken down by transaction, category or merchant. In addition, Cleo lets you take a number of actions based on the financial data it has gleaned. This includes choosing to put money aside for a rainy day or specific goal, sending money to your Facebook Messenger contacts, donating to charity and setting spending alerts and more.

Meanwhile, alongside TriplePoint, Cleo is backed by some of the biggest VC names in the London tech scene — including Balderton Capital, Entrepreneur First, Moonfruit co-founders Wendy Tan White and Joe White, Skype founder Niklas Zennström, Wonga founder Errol Damelin, TransferWise founder Taavet Hinrikus and LocalGlobe.

Powered by WPeMatico

French startup PayFit is raising a new $79 million funding round (€70 million) from Eurazeo and Bpifrance. The company first started with a payroll service for small and medium companies in France. It has evolved into a full-fledged HR solution for multiple European countries.

PayFit uses a software-as-a-service approach so that small companies can easily manage payroll and HR information from a web browser. Everything stays up-to-date and compliant with labor regulation.

After you enter information about your employees, PayFit automatically generates pay slips every month. Your employees receive an email when their pay slips are ready. If somebody is getting a raise, you can connect to your PayFit account and modify an amount for all pay slips going forward.

When it comes to payroll taxes, the service automatically reminds you when you have to pay them and how much you’re supposed to pay. You also can generate exports for your accountant, see reports about your staff, etc.

And PayFit doesn’t want to stop at payrolls. You also can manage absences and leaves, expense reports and shifts. It makes sense to build those tools in-house as they have a direct effect on your payroll.

In order to approve expense reports and vacation days, you also can build an organizational chart in PayFit and decide who’s managing who.

While it’s easy to build an HR giant in the U.S., it’s a bit more complicated in Europe, as labor laws vary so much from one country to another. But the startup has managed to launch its service in France, Spain, Germany and the U.K. — Italy is coming soon.

The company says that it has developed its own programming language called Jetlang in order to transform labor code into computer code.

There are 3,000 companies relying on PayFit and 300 people working for the company. With today’s funding round, PayFit plans to double its workforce by 2020.

Powered by WPeMatico