Fundings & Exits

Auto Added by WPeMatico

Auto Added by WPeMatico

Three years ago, I met with a founder who had raised a massive seed round at a valuation that was at least five times the market rate. I asked what firm made the investment.

She said it was not a traditional venture firm, but rather a strategic investor that not only had no ties to her space but also had no prior investment experience. The strategic investor, she said, was looking to “get their hands dirty” and “get in on the ground floor.”

Over the next 2 years, I kept a close eye on the founder. Although she had enough capital to pivot her business focus multiple times, she seemed to be at odds, serving the needs of her strategic investor and her customer base.

Ultimately, when the business needed more capital to survive, the strategic investor didn’t agree with the founder’s focus, opted not to prop it up, and the business had to shut down.

Sadly, this is not an uncommon story as examples abound of strategic investors influencing startup direction and management decisions to the point of harm for the startup. Corporate strategics, not to be confused with dedicated funds focused on financial returns like a traditional venture investor like Google Ventures, often care less about return on investment, and more about a startup’s focus, and sector specificity. If corporate imperatives change, the strategic may cease to be the right partner or could push the startup in a challenging direction.

And yet, fortunately, as the disruptive power of technology is being unleashed on nearly every major industry, strategic investors are now getting smarter, both in terms of how they invest and how they partner with entrepreneurs.

From making strong acquisitive plays (i.e. GM’s purchase of Cruise Automation or Toyota’s early-stage investment in Uber) to building dedicated funds, to executing commercial agreements in tandem with capital investment, strategics are getting savvier, and by extension, becoming better partners. In some instances, they may be the best partner.

Negotiating a term sheet with a strategic investor necessitates a different set of considerations. Namely: the preference for a strategic to facilitate commercial milestones for the startup, a cautious approach to avoid the “over-valuation” trap, an acute focus on information rights, and the limitation of non-compete provisions.

Powered by WPeMatico

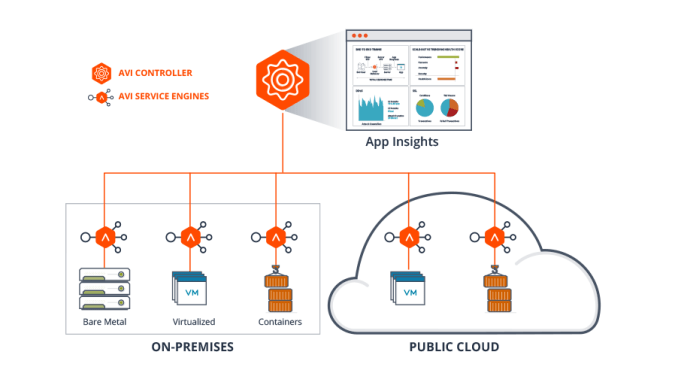

VMware has been trying to reinvent itself from a company that helps you build and manage virtual machines in your data center to one that helps you manage your virtual machines wherever they live, whether that’s on prem or the public cloud. Today, the company announced it was buying Avi Networks, a six-year-old startup that helps companies balance application delivery in the cloud or on prem in an acquisition that sounds like a pretty good match. The companies did not reveal the purchase price.

Avi claims to be the modern alternative to load balancing appliances designed for another age when applications didn’t change much and lived on prem in the company data center. As companies move more workloads to public clouds like AWS, Azure and Google Cloud Platform, Avi is providing a more modern load-balancing tool, that not only balances software resource requirements based on location or need, but also tracks the data behind these requirements.

Diagram: Avi Networks

VMware has been trying to find ways to help companies manage their infrastructure, whether it is in the cloud or on prem, in a consistent way, and Avi is another step in helping them do that on the monitoring and load-balancing side of things, at least.

Tom Gillis, senior vice president and general manager for the networking and security business unit at VMware sees, this acquisition as fitting nicely into that vision. “This acquisition will further advance our Virtual Cloud Network vision, where a software-defined distributed network architecture spans all infrastructure and ties all pieces together with the automation and programmability found in the public cloud. Combining Avi Networks with VMware NSX will further enable organizations to respond to new opportunities and threats, create new business models, and deliver services to all applications and data, wherever they are located,” Gillis explained in a statement.

In a blog post, Avi’s co-founders expressed a similar sentiment, seeing a company where it would fit well moving forward. “The decision to join forces with VMware represents a perfect alignment of vision, products, technology, go-to-market, and culture. We will continue to deliver on our mission to help our customers modernize application services by accelerating multi-cloud deployments with automation and self-service,” they wrote. Whether that’s the case, time will tell.

Among Avi’s customers, which will now become part of VMware, are Deutsche Bank, Telegraph Media Group, Hulu and Cisco. The company was founded in 2012 and raised $115 million, according to Crunchbase data. Investors included Greylock, Lightspeed Venture Partners and Menlo Ventures, among others.

Powered by WPeMatico

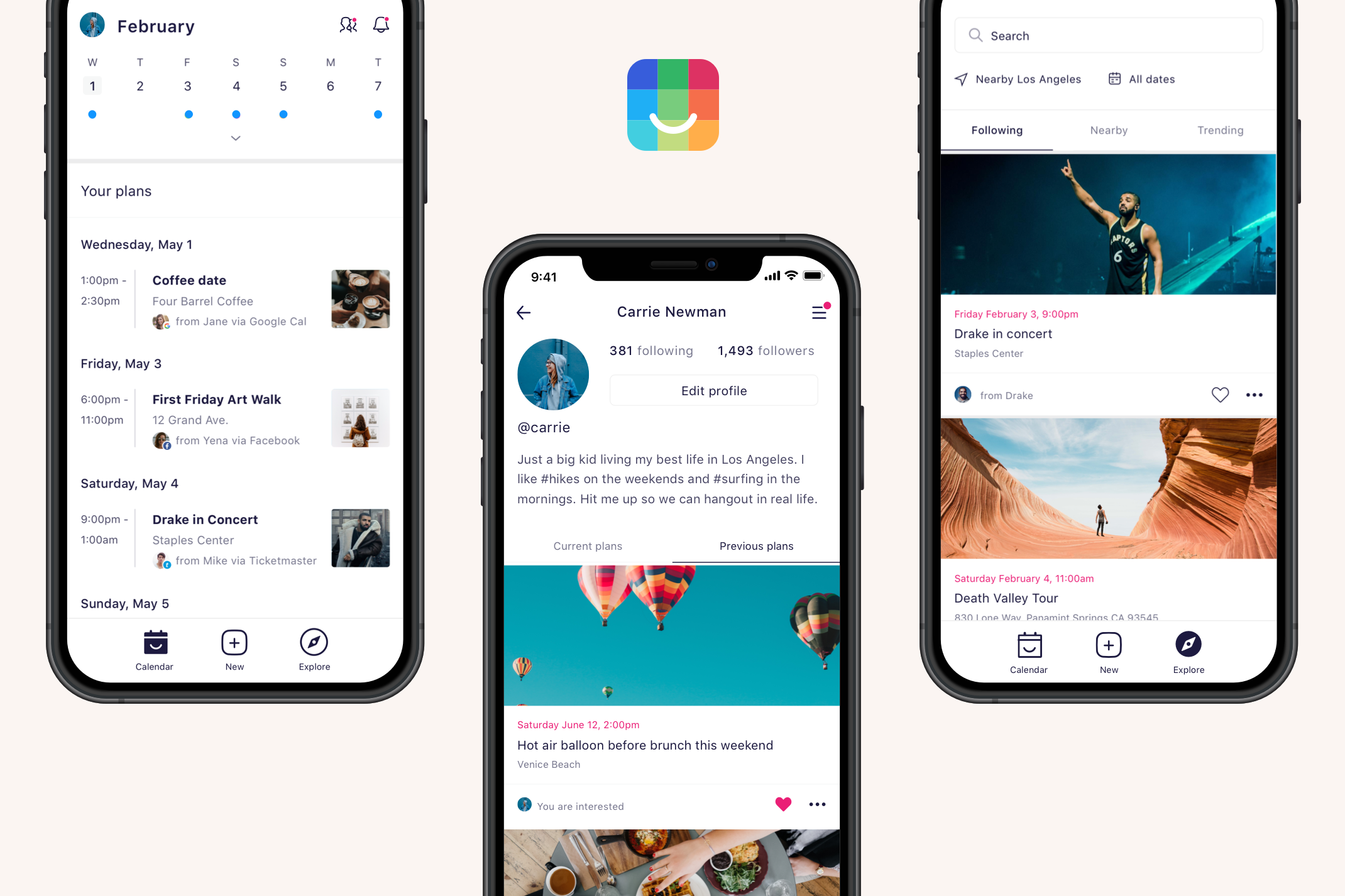

Why is there no app where you can follow party animals, concert snobs or conference butterflies for their curated suggestions of events? That’s the next phase of social calendar app IRL that’s launching today on iOS to help you make and discuss plans with friends or discover nearby happenings to fill out your schedule.

The calendar, a historically dorky utility, seems like a strange way to start the next big social network. Many people, especially teens, either don’t use apps like Google Calendar, keep them professional or merely input plans made elsewhere. But by baking in an Explore tab of event recommendations and the option to follow curators, headliners and venues, IRL could make calendars communal like Instagram did to cameras.

“There’s Twitter for ‘follow my updates,’ there’s SoundCloud for ‘follow my music,’ but there’s no ‘follow my events’ ” IRL CEO Abe Shafi tells me of his plan to turbocharge his calendar app. “They’re arguably the best product that’s been built for organizing what you’re doing, but no one has Superhuman’d or Slack’d the calendar. Let’s build a super f*cking dope calendar!” he says with unbridled excitement. He’ll need that passion to persevere as IRL tries to steal a major use case from SMS, messaging apps and Facebook .

Finding a new opportunity for a social network has attracted a new $8 million Series A funding round for IRL led by Goodwater Capital and joined by Founders Fund and Kleiner Perkins. That builds on its $3 million seed from Founders Fund and Floodgate, whose partner Mike Maples is joining IRL’s board. The startup has also pulled in some entertainment and event CEOs as strategic investors, including Warner Bros. president Greg Silverman, Lionsgate Films president Joe Drake and ClassPass CEO Fritz Lanman to help it recruit calendar influencers users can follow.

In Shafi, investors found a consummate extrovert who can empathize with event-goers. He dropped out of Berkeley to build out his recruitment software startup getTalent before selling it to HR platform Dice, where he became VP of product. He started to become disillusioned by tech’s impact on society and almost left the industry before some time at Burning Man rekindled his fever for events.

IRL CEO Abe Shafi

Shafi teamed up with PayPal’s first board member Scott Banister and early social network founder Greg Tseng. Shafi’s first attempt Gather pissed off a ton of people with spammy invites in 2017. By 2018, he’d restarted as IRL, with a focus on building a minimalist calendar where it was easy to create events and invite friends. Evite and Facebook Events were too heavy for making less formal get-togethers with close friends. He wisely chose to geofence his app and launch state by state to maximize density so people would have more pals to plan with.

IRL is now in 14 states, with a modest 1.3 million monthly active users and 175,000 dailies, plus 3 million people on the waitlist. “Fifty percent of all teens in Texas have downloaded IRL. I wanted to focus on the central states, not Silicon Valley,” Shafi explains. Users log in with a phone number or Google, two-way sync their Google Calendar if they have one, and can then manage their existing schedule and create mini-events. The stickiest feature is the ability to group chat with everyone invited so you can hammer out plans. Even users without the app can chime in via text or email. And unlike Facebook, where your mom or boss are liable to see your RSVPs, your calendar and what you’re doing on IRL is always private unless you explicitly share it.

The problem is that most of this could be handled with SMS and a more popular calendar. That’s why IRL is doubling-down on event discovery through influencers, which you can’t do anywhere else at scale. With the new version of the app launching today, you’ll be recommended performers, locations and curators to follow. You’ll see their suggestions in the Explore tab that also includes sub-tabs of Nearby and Trending happenings. There’s also a college-specific feed for users that auth in with their school email address. Curators and event companies like TechCrunch can get their own IRL.com/… URL people can follow more easily than some janky list of events of gallery of flyers on their website. Since pretty much every promoter wants more attendees, IRL’s had little resistance to it indexing all the events from Meetup.com and whatever it can find.

IRL is concentrating on growth for now, but Shafi believes all the intent data about what people want to do could be valuable for directing people to certain restaurants, bars, theaters or festivals, though he vows that “we’re never going to sell your data to advertisers.” For now, IRL is earning money from affiliate fees when people buy tickets or make reservations. Event affiliate margins are infamously slim, but Shafi says IRL can bargain for higher fees as it gains sway over more people’s calendars.

Unfortunately, without reams of personal data and leading artificial intelligence that Facebook owns, IRL’s in-house suggestions via the Explore tab can feel pretty haphazard. I saw lots of mediocre happy hours, crafting nights and community talks that weren’t quite the hip nightlife recommendations I was hoping for, and for now there’s no sorting by category. That’s where Shafi hopes influencers will fill in. And he’s confident that Facebook’s business model discourages it moving deeper into events. “Facebook’s revenue driver is time spent on the app. While meaningful to society, events as a feature is not a primary revenue driver so they don’t get the resources that other features on Facebook get.”

Unfortunately, without reams of personal data and leading artificial intelligence that Facebook owns, IRL’s in-house suggestions via the Explore tab can feel pretty haphazard. I saw lots of mediocre happy hours, crafting nights and community talks that weren’t quite the hip nightlife recommendations I was hoping for, and for now there’s no sorting by category. That’s where Shafi hopes influencers will fill in. And he’s confident that Facebook’s business model discourages it moving deeper into events. “Facebook’s revenue driver is time spent on the app. While meaningful to society, events as a feature is not a primary revenue driver so they don’t get the resources that other features on Facebook get.”

Yet the biggest challenge will be rearranging how people organize their lives. A lot of us are too scatterbrained, lazy or instinctive to make all our plans days or weeks ahead of time and put them on a calendar. The beauty of mobile is that we can communicate on the fly to meet up. “Solving for spontaneity isn’t our focus so far,” Shafi admits. But that’s how so much of our social lives come together.

My biggest problem isn’t finding events to fill my calendar, but knowing which friends are free now to hang out and attend one with me. There are plenty of calendar, event discovery and offline hangout apps. IRL will have to prove they deserve to be united. At least Shafi says it’s a problem worth trying to solve. “I know for a fact that the product of a calendar will outlive me.” He just wants to make it more social first.

Powered by WPeMatico

Target Circle and TapHeaven announced they’re merging into a single company under the Target Circle brand.

TapHeaven co-founder and CEO Chris Hoyt, who is becoming chief growth officer at the combined organization, said the two companies have been “trying to solve the same problem” — namely, eliminating many of the inefficiencies in the mobile advertising business.

Hoyt said that for Target Circle, that meant trying to “unify this fragmented ecosystem into a single dashboard for contracts, invoices and offers.” And for TapHeaven, that meant a focus on automation, resulting in the launch of what the company calls a “command center” for user acquisition, where advertisers can optimize their ad campaigns “at the source level, by country” while getting high-quality traffic without fraud.

The companies also complement each other geographically — Target Circle is headquartered in Oslo, Norway, while TapHeaven is headquartered in San Francisco.

According to Hoyt, they first came across each other because they were talking to the same mobile studio about supporting the launch of a new game, and it became clear they “both had the same vision for our businesses, the same future with a unified dashboard wrapped in automation and machine learning to simplify and help the ecosystem perform for these advertisers.”

Target Circle founder and CEO Heiko Hildebrandt will continue to serve as chief executive for the combined companies — in the announcement, he said TapHeaven allows the company to “strengthen and expand its technology in the automation of advertising and fraud prevention and resolution.” Meanwhile, TapHeaven executives Brian Krebs and Jeremy Jones will become CIO and chief of user experience, respectively.

The financial terms of the deal were not disclosed. Moving forward, Hoyt said Target Circle will continue to support its existing products while focusing on the new UA Command Center as “the future of our business.” He also suggested that the platform could help advertisers move away from Facebook and Google, allowing them to get the performance they need from other ad networks.

“What impact this is going to have on the market is really lifting up the rest of the ecosystem,” he said. “I feel like Facebook and Google have had their day, a little bit … With the serious things that are going on with these companies, advertisers are desperate for the answers to where [else] can they spend their money and diversify their portfolio.”

Powered by WPeMatico

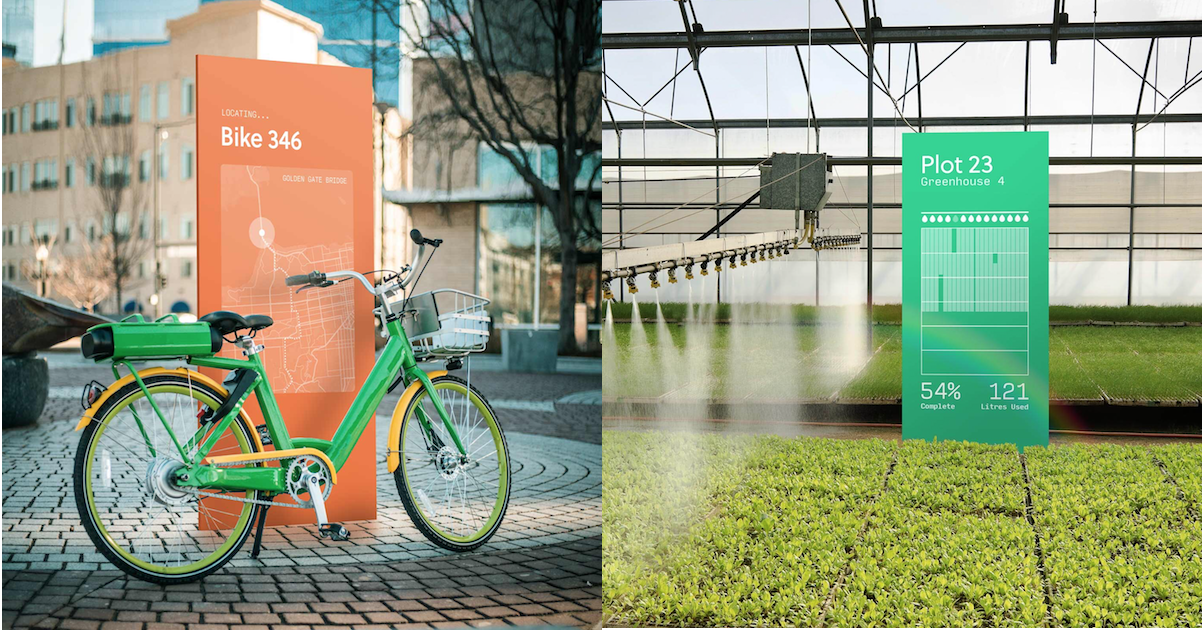

With 200X the range of Wi-Fi at 1/1000th of the cost of a cellular modem, Helium’s “LongFi” wireless network debuts today. Its transmitters can help track stolen scooters, find missing dogs via IoT collars and collect data from infrastructure sensors. The catch is that Helium’s tiny, extremely low-power, low-data transmission chips rely on connecting to P2P Helium Hotspots people can now buy for $495. Operating those hotspots earns owners a cryptocurrency token Helium promises will be valuable in the future…

The potential of a new wireless standard has allowed Helium to raise $51 million over the past few years from GV, Khosla Ventures and Marc Benioff, including a new $15 million Series C round co-led by Union Square Ventures and Multicoin Capital. That’s in part because one of Helium’s co-founders is Napster inventor Shawn Fanning. Investors are betting that he can change the tech world again, this time with a wireless protocol that like Wi-Fi and Bluetooth before it could unlock unique business opportunities.

Helium already has some big partners lined up, including Lime, which will test it for tracking its lost and stolen scooters and bikes when they’re brought indoors, obscuring other connectivity, or their battery is pulled, out deactivating GPS. “It’s an ultra low-cost version of a LoJack” Helium CEO Amir Haleem says.

InvisiLeash will partner with it to build more trackable pet collars. Agulus will pull data from irrigation valves and pumps for its agriculture tech business. Nestle will track when it’s time to refill water in its ReadyRefresh coolers at offices, and Stay Alfred will use it to track occupancy status and air quality in buildings. Haleem also imagines the tech being useful for tracking wildfires or radiation.

Haleem met Fanning playing video games in the 2000s. They teamed up with Fanning and Sproutling baby monitor (sold to Mattel) founder Chris Bruce in 2013 to start work on Helium. They foresaw a version of Tile’s trackers that could function anywhere while replacing expensive cell connections for devices that don’t need high bandwith. Helium’s 5 kilobit per second connections will compete with SigFox, another lower-power IoT protocol, though Haleem claims its more centralized infrastructure costs are prohibitive. It’s also facing off against Nodle, which piggybacks on devices’ Bluetooth hardware. Lucky for Helium, on-demand rental bikes and scooters that are perfect for its network have reached mainstream popularity just as Helium launches six years after its start.

Helium says it already pre-sold 80% of its Helium Hotspots for its first market in Austin, Texas. People connect them to their Wi-Fi and put it in their window so the devices can pull in data from Helium’s IoT sensors over its open-source LongFi protocol. The hotspots then encrypt and send the data to the company’s cloud that clients can plug into to track and collect info from their devices. The Helium Hotspots only require as much energy as a 12-watt LED light bulb to run, but that $495 price tag is steep. The lack of a concrete return on investment could deter later adopters from buying the expensive device.

Only 150-200 hotspots are necessary to blanket a city in connectivity, Haleem tells me. But because they need to be distributed across the landscape, so a client can’t just fill their warehouse with the hotspots, and the upfront price is expensive for individuals, Helium might need to sign up some retail chains as partners for deployment. As Haleem admits, “The hard part is the education.” Making hotspot buyers understand the potential (and risks) while demonstrating the opportunities for clients will require a ton of outreach and slick marketing.

Without enough Helium Hotspots, the Helium network won’t function. That means this startup will have to simultaneously win at telecom technology, enterprise sales and cryptocurrency for the network to pan out. As if one of those wasn’t hard enough.

Powered by WPeMatico

When you’re talking about 16 billion smackeroos, it’s easy to get lost in the big number. When Salesforce acquired Tableau this morning for $15.7 billion, while it was among the biggest enterprise deals ever, it certainly wasn’t the largest.

There was widespread speculation that when the new tax laws went into effect in 2017, and large tech companies could repatriate large sums of their money stored offshore, we would start to see a wave of M&A activity, and sure enough that’s happened.

As Box CEO Aaron Levie pointed out on Twitter, it also shows that if you can develop a best-of-breed tool that knocks off the existing dominant tool set, you can build a multibillion-dollar company. We have seen this over and over, maybe not $15 billion companies, but substantial companies with multibillion-dollar price tags.

Tableau is a perfect example of best-of-breed winning. 15 years ago the BI market was destined to be owned by incumbents, then simpler, better, more democratized software came along, and a $15B company was built.

— Aaron Levie (@levie) June 10, 2019

Last year alone we saw 10 deals that equaled $87 billion, with the biggest prize going to IBM when it bought Red Hat for a cool $34 billion, but even that wasn’t the biggest enterprise deal we could track down. In fact, we decided to compile a list of the biggest enterprise deals ever, so you could get a sense of where today’s deal fits.

At the time, this was the biggest deal Salesforce had ever done — until today. While the company has been highly acquisitive over the years, it had tended to keep the deals fairly compact for the most part, but it wanted MuleSoft to give it access to enterprise data wherever, it lived and it was willing to pay for it.

Not to be outdone by its rival, Microsoft opened its wallet almost exactly a year ago and bought GitHub for a hefty $7.5 billion. There was some hand-wringing in the developer community at the time, but so far, Microsoft has allowed the company to operate as an independent subsidiary.

SAP swooped in right before Qualtrics was about to IPO and gave it an offer it couldn’t refuse. Qualtrics gave SAP a tool for measuring customer satisfaction, something it had been lacking and was willing to pay big bucks for.

It wasn’t really a surprise when Oracle acquired NetSuite. It had been an investor and Oracle needed a good SaaS tool at the time, as it was transitioning to the cloud. NetSuite gave it a ready-to-go packaged cloud service with a built-in set of customers it desperately needed.

That brings us to today’s deal. Salesforce swooped in again and paid an enormous sum of money for the Seattle software company, giving it a data visualization tool that would enable customers to create views of data wherever it lives, whether it’s part of Salesforce or not. What’s more, it was a great complement to last year’s MuleSoft acquisition.

A huge deal in dollars from a year of big deals. Broadcom surprised a few people when a chip vendor paid this kind of money for a legacy enterprise software vendor and IT services company. The $18.9 billion represented a 20% premium for shareholders.

This was a company that Salesforce reportedly wanted badly at the time, but Microsoft was able to flex its financial muscles and come away the winner. The big prize was all of that data, and Microsoft has been working to turn that into products ever since.

Near the end of last year, IBM made a huge move, acquiring Red Hat for $34 billion. IBM has been preaching a hybrid cloud approach for a number of years, and buying Red Hat gives it a much more compelling hybrid story.

This was the biggest of all, by far surpassing today’s deal. A deal this large was in the news for months as it passed various hurdles on the way to closing. Among the jewels that were included in this deal were VMware and Pivotal, the latter of which has since gone public. After this deal, Dell itself went public again last year.

Powered by WPeMatico

Financial troubles have forced Maker Media, the company behind crafting publication MAKE: magazine as well as the science and art festival Maker Faire, to lay off its entire staff of 22 and pause all operations. TechCrunch was tipped off to Maker Media’s unfortunate situation which was then confirmed by the company’s founder and CEO Dale Dougherty.

For 15 years, MAKE: guided adults and children through step-by-step do-it-yourself crafting and science projects, and it was central to the maker movement. Since 2006, Maker Faire’s 200 owned and licensed events per year in over 40 countries let attendees wander amidst giant, inspiring art and engineering installations.

“Maker Media Inc ceased operations this week and let go of all of its employees — about 22 employees” Dougherty tells TechCrunch. “I started this 15 years ago and it’s always been a struggle as a business to make this work. Print publishing is not a great business for anybody, but it works…barely. Events are hard . . . there was a drop off in corporate sponsorship.” Microsoft and Autodesk failed to sponsor this year’s flagship Bay Area Maker Faire.

But Dougherty is still desperately trying to resuscitate the company in some capacity, if only to keep MAKE:’s online archive running and continue allowing third-party organizers to license the Maker Faire name to throw affiliated events. Rather than bankruptcy, Maker Media is working through an alternative Assignment for Benefit of Creditors process.

“We’re trying to keep the servers running” Dougherty tells me. “I hope to be able to get control of the assets of the company and restart it. We’re not necessarily going to do everything we did in the past but I’m committed to keeping the print magazine going and the Maker Faire licensing program.” The fate of those hopes will depend on negotiations with banks and financiers over the next few weeks. For now the sites remain online.

The CEO says staffers understood the challenges facing the company following layoffs in 2016, and then at least 8 more employees being let go in March according to the SF Chronicle. They’ve been paid their owed wages and PTO, but did not receive any severance or two-week notice.

“It started as a venture-backed company but we realized it wasn’t a venture-backed opportunity” Dougherty admits, as his company had raised $10 million from Obvious Ventures, Raine Ventures, and Floodgate. “The company wasn’t that interesting to its investors anymore. It was failing as a business but not as a mission. Should it be a non-profit or something like that? Some of our best successes for instance are in education.”

The situation is especially sad because the public was still enthusiastic about Maker Media’s products Dougherty said that despite rain, Maker Faire’s big Bay Area event last week met its ticket sales target. 1.45 million people attended its events in 2016. MAKE: magazine had 125,000 paid subscribers and the company had racked up over one million YouTube subscribers. But high production costs in expensive cities and a proliferation of free DIY project content online had strained Maker Media.

“It works for people but it doesn’t necessarily work as a business today, at least under my oversight” Dougherty concluded. For now the company is stuck in limbo.

Regardless of the outcome of revival efforts, Maker Media has helped inspire a generation of engineers and artists, brought families together around crafting, and given shape to a culture of tinkerers. The memory of its events and weekends spent building will live on as inspiration for tomorrow’s inventors.

Powered by WPeMatico

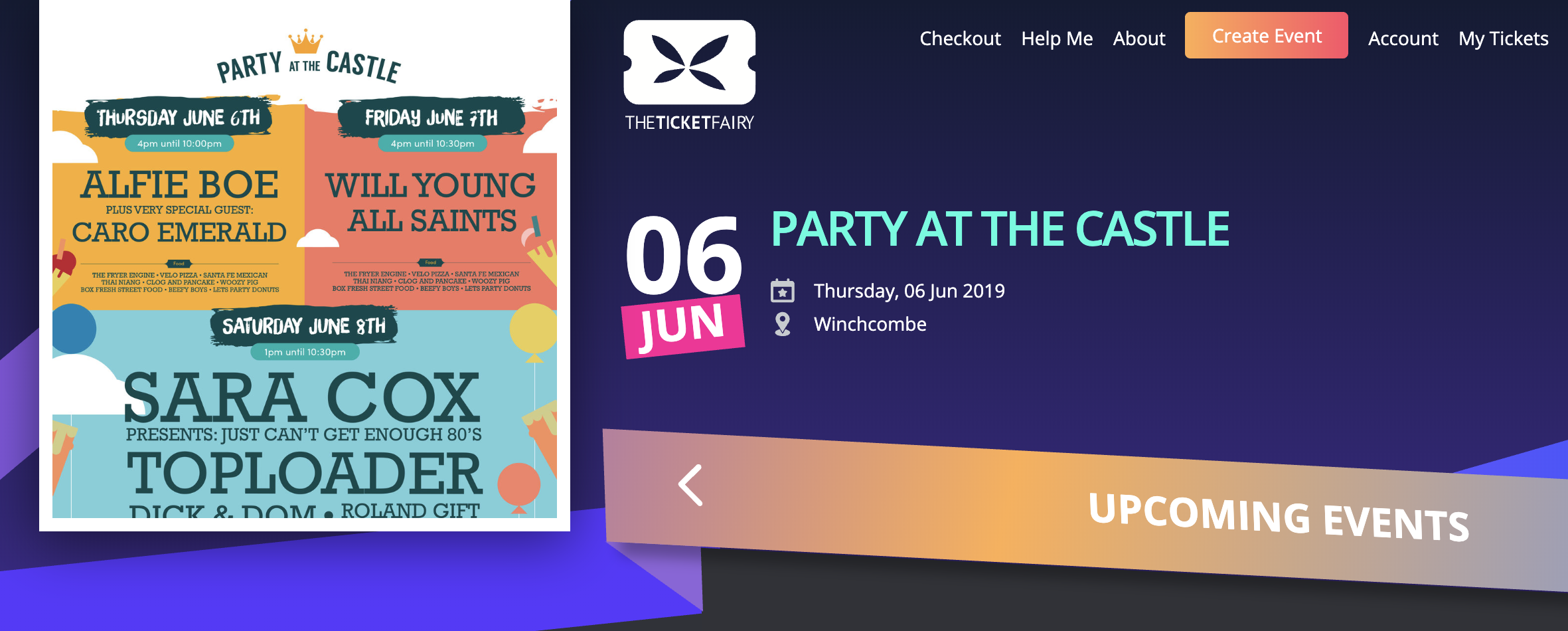

Ticketmaster’s dominance has led to ridiculous service fees, scalpers galore and exclusive contracts that exploit venues and artists. The moronic approval of venue operator and artist management giant Live Nation’s merger with Ticketmaster in 2010 produced an anti-competitive juggernaut. It pressures venues to sign ticketing contracts under veiled threat that artists would otherwise be routed to different concert halls. Now it’s become difficult for venues, artists and fans to avoid Ticketmaster, which charges fees as high as 50% that many see as a ripoff.

The Ticket Fairy wants to wrestle away from Ticketmaster control of venues while giving fans ways to earn tickets for referring their friends. The startup is doing that by offering the most technologically advanced ticketing platform that not only handles sales and check-ins, but acts as a full-stack Salesforce for concerts that can analyze buyers and run ad campaigns while thwarting scalpers. Co-founder Ritesh Patel says The Ticket Fairy has increased revenue for event organizers by 15% to 25% during its private beta focused on dance music festivals.

Now after 850,000 tickets sold, it’s officially launching its ticketing suite and actively poaching venues from Eventbrite as it moves deeper into esports and conventions. With a little more scale, it will be ready to challenge Ticketmaster for lucrative clients.

Ritesh’s combination of product and engineering skills, rapid progress and charismatic passion for live events after throwing 400 of his own has attracted an impressive cadre of angel investors. They’ve delivered a $2.5 million seed round for Ticket Fairy, adding to its $485,000 pre-seed from angels like Twitch/Atrium founder Justin Kan, Twitch COO Kevin Lin and Reddit CEO Steve Huffman.

The new round includes YouTube founder Steve Chen, former Kleiner Perkins partner (and Mark’s sister) Arielle Zuckerberg and funds like 500 Startups, ex-Uber angels Fantastic Ventures, G2 Ventures, Tempo Ventures and WeFunder. It’s also scored music industry angels like Serato DJ hardware CEO AJ Bertenshaw, Spotify’s head of label licensing Niklas Lundberg, and celebrity lawyer Ken Hertz, who reps Will Smith and Gwen Stefani.

“The purpose of starting The Ticket Fairy was not to be another Eventbrite, but to reduce the risk of the person running the event so they can be profitable. We’re not just another shopping cart,” Patel says. The Ticket Fairy charges a comparable rate to Eventbrite’s $1.59 + 3.5% per ticket plus payment processing that brings it closer to 6%, but Patel insists it offers far stronger functionality.

Constantly clad in his golden disco hoodie over a Ticket Fairy t-shirt, Patel lives his product, spending late nights dancing and taking feedback at the events his clients host. He’s been a savior of SXSW the past two years, injecting the aging festival that shuts down at 2am with multi-night after-hours raves. Featuring top DJs like Pretty Lights in creative locations cab drivers don’t believe are real, The Ticket Fairy’s parties have won the hearts of music industry folks.

The Ticket Fairy co-founders. Center and inset left: Ritesh Patel. Inset right: Jigar Patel

Now the Y Combinator startup hopes its ticketing platform will do the same thanks to a slew of savvy features:

Still, the biggest barrier to adoption remains the long exclusive contracts Ticketmaster and other giants like AEG coerce venues into in the U.S. Abroad, venues typically work with multiple ticket promoters who sell from the same pool, which is why 80% of The Ticket Fairy’s business is international right now. In the U.S., ticketing is often handled by a single company, except for the 8% of tickets artists can sell however they want. That’s why The Ticket Fairy has focused on signing up non-traditional venues for festivals, trade convention halls, newly built esports arenas, as well as concert halls.

“Coming from the event promotion background, we understand the risk event organizers take in creating these experiences,” The Ticket Fairy’s co-founder and Ritesh’s brother Jigar Patel explains. “The odds of breaking even are poor and many are unable to overcome those challenges, but it is sheer passion that keeps them going in the face of financial uncertainty and multi-year losses.” As competitors’ contracts expire, The Ticket Fairy hopes to swoop in by dangling its sales-boosting tech. “We get locked out of certain things because people are locked in a contract, not because they don’t want to use our system.”

The live music industry can be brutal, though. Events can have slim margins, organizers are loathe to change their process and it’s a sales-heavy process convincing them to try new software. But while the record business has been redefined by streaming, ticketing looks a lot like it did a decade ago. That makes it ripe for disruption.

“The events industry is more important than ever, with artists making the bulk of their income from touring instead of record sales, and demand from fans for live experiences is increasing at a global level,” Jigar concludes. “When events go out of business, everybody loses, including artists and fans. Everything we do at The Ticket Fairy has that firmly in mind – we are here to keep the ecosystem alive.”

Powered by WPeMatico

When starting a tech company, there seems to be a playbook that most entrepreneurs follow. While some may start with a bit of bootstrapping, most will dive straight into raising seed money through investors. In many cases, this is a great path. It’s a path I’ve taken twice myself, first with GroupMe, and then again with Fundera.

Ironically, though, my second venture-backed company is a business focused on helping entrepreneurs find debt financing—a process I’ve gone through only once myself. But after five years of building and scaling this business, it’s made me take a step back and consider the question of when and where debt financing might be a better option for a business than equity financing, and vice versa.

I view these financing vehicles differently now than I did half a decade ago, and think it’s time we start to think a bit wider and diversely about how we finance our growing endeavors.

After all, when entrepreneurs take venture capital, they usually sign up to provide a 10x return on an investor’s capital. This expectation ultimately influences how they operate their business in the short-term. Maybe they’re not always ready for that expectation.

Or maybe they know they need to focus on building a good business before a great one. In this case, debt may be the better vehicle, where the only expectation is to pay it back.

Whether it’s money to get your business off the ground, capital to fuel additional growth, or cash to cover a gap, and whether you’re guiding the growth of a burgeoning startup, a smaller business, or even consulting firm helping other entrepreneurs, you should think critically about how you finance your business.

Here’s what to consider.

Powered by WPeMatico

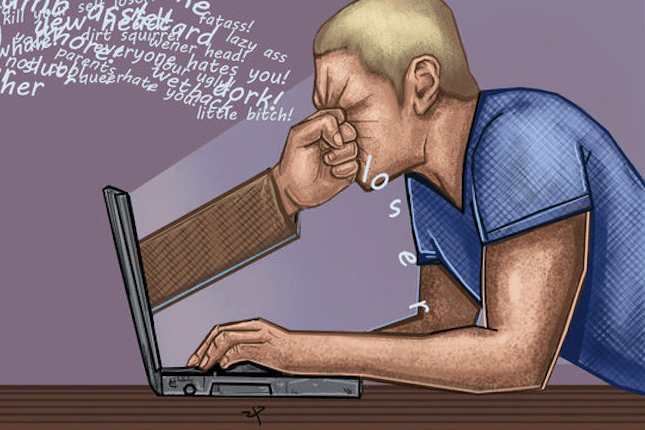

The big social networks and video games have failed to prioritize user well-being over their own growth. As a result, society is losing the battle against bullying, predators, hate speech, misinformation and scammers. Typically when a whole class of tech companies have a dire problem they can’t cost-effectively solve themselves, a software-as-a-service emerges to fill the gap in web hosting, payment processing, etc. So along comes AntiToxin Technologies, a new startup that wants to help web giants fix their abuse troubles with its safety-as-a-service.

It all started on Minecraft. AntiToxin co-founder Ron Porat is cybersecurity expert who’d started ad blocker Shine. Yet right under his nose, one of his kids was being mercilessly bullied on the hit children’s game. If even those most internet-savvy parents were being surprised by online abuse, Porat realized the issue was bigger than could be addressed by victims trying to protect themselves. The platforms had to do more, research confirmed.

A recent Ofcom study found almost 80% of children had a potentially harmful online experience in the past year. Indeed, 23% said they’d been cyberbullied, and 28% of 12 to 15-year-olds said they’d received unwelcome friend or follow requests from strangers. A Ditch The Label study found of 12 to 20-year-olds who’d been bullied online, 42% were bullied on Instagram.

Unfortunately, the massive scale of the threat combined with a late start on policing by top apps makes progress tough without tremendous spending. Facebook tripled the headcount of its content moderation and security team, taking a noticeable hit to its profits, yet toxicity persists. Other mainstays like YouTube and Twitter have yet to make concrete commitments to safety spending or staffing, and the result is non-stop scandals of child exploitation and targeted harassment. Smaller companies like Snap or Fortnite-maker Epic Games may not have the money to develop sufficient safeguards in-house.

“The tech giants have proven time and time again we can’t rely on them. They’ve abdicated their responsibility. Parents need to realize this problem won’t be solved by these companies” says AntiToxin co-founder and CEO Zohar Levkovitz, who previously sold his mobile ad company Amobee to Singtel for $321 million. “You need new players, new thinking, new technology. A company where ‘Safety’ is the product, not an after-thought. And that’s where we come-in.” The startup recently raised a multimillion-dollar seed round from Mangrove Capital Partners and is allegedly prepping for a double-digit millions Series A.

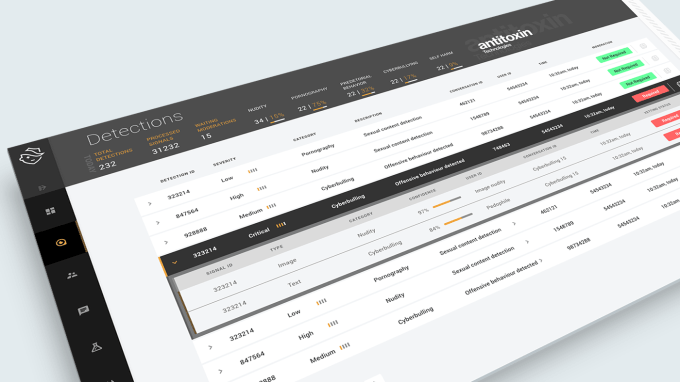

AntiToxin’s technology plugs into the backends of apps with social communities that either broadcast or message with each other and are thereby exposed to abuse. AntiToxin’s systems privately and securely crunch all the available signals regarding user behavior and policy violation reports, from text to videos to blocking. It then can flag a wide range of toxic actions and let the client decide whether to delete the activity, suspend the user responsible or how else to proceed based on their terms and local laws.

Through the use of artificial intelligence, including natural language processing, machine learning and computer vision, AntiToxin can identify the intent of behavior to determine if it’s malicious. For example, the company tells me it can distinguish between a married couple consensually exchanging nude photos on a messaging app versus an adult sending inappropriate imagery to a child. It also can determine if two teens are swearing at each other playfully as they compete in a video game or if one is verbally harassing the other. The company says that beats using static dictionary blacklists of forbidden words.

AntiToxin is under NDA, so it can’t reveal its client list, but claims recent media attention and looming regulation regarding online abuse has ramped up inbound interest. Eventually the company hopes to build better predictive software to identify users who’ve shown signs of increasingly worrisome behavior so their activity can be more closely moderated before they lash out. And it’s trying to build a “safety graph” that will help it identify bad actors across services so they can be broadly deplatformed similar to the way Facebook uses data on Instagram abuse to police connected WhatsApp accounts.

“We’re approaching this very human problem like a cybersecurity company, that is, everything is a Zero-Day for us” says Levkowitz, discussing how AntiToxin indexes new patterns of abuse it can then search for across its clients. “We’ve got intelligence unit alums, PhDs and data scientists creating anti-toxicity detection algorithms that the world is yearning for.” AntiToxin is already having an impact. TechCrunch commissioned it to investigate a tip about child sexual imagery on Microsoft’s Bing search engine. We discovered Bing was actually recommending child abuse image results to people who’d conducted innocent searches, leading Bing to make changes to clean up its act.

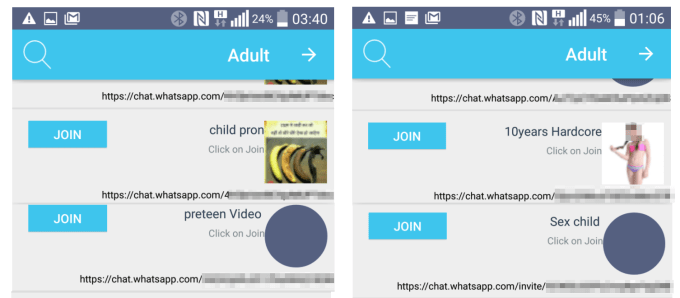

AntiToxin identified publicly listed WhatsApp Groups where child sexual abuse imagery was exchanged

One major threat to AntiToxin’s business is what’s often seen as boosting online safety: end-to-end encryption. AntiToxin claims that when companies like Facebook expand encryption, they’re purposefully hiding problematic content from themselves so they don’t have to police it.

Facebook claims it still can use metadata about connections on its already encrypted WhatApp network to suspend those who violate its policy. But AntiToxin provided research to TechCrunch for an investigation that found child sexual abuse imagery sharing groups were openly accessible and discoverable on WhatsApp — in part because encryption made them hard to hunt down for WhatsApp’s automated systems.

AntiToxin believes abuse would proliferate if encryption becomes a wider trend, and it claims the harm that it causes outweighs fears about companies or governments surveiling unencrypted transmissions. It’s a tough call. Political dissidents, whistleblowers and perhaps the whole concept of civil liberty rely on encryption. But parents may see sex offenders and bullies as a more dire concern that’s reinforced by platforms having no idea what people are saying inside chat threads.

What seems clear is that the status quo has got to go. Shaming, exclusion, sexism, grooming, impersonation and threats of violence have started to feel commonplace. A culture of cruelty breeds more cruelty. Tech’s success stories are being marred by horror stories from their users. Paying to pick up new weapons in the fight against toxicity seems like a reasonable investment to demand.

Powered by WPeMatico