Fundings & Exits

Auto Added by WPeMatico

Auto Added by WPeMatico

Flash, the micro-mobility startup from Delivery Hero and Team Europe founder Lukasz Gadowski, is re-branding today and disclosing that the e-scooter rental service has clocked up 1 million rides in just 4.5 months since launch.

This, the company claims, is a milestone passed quicker than any of its competitors, although Voi recently announced that it reached 2 million rides in less than 8 months, while I understand that Tier, which launched later than Voi, is on track to hit that same number any day now, if it hasn’t already. The takeaway: e-scooter rentals in Europe remains a hot and fast-growing market to be in.

Quietly launched in Zurich, Switzerland in mid-January this year, Berlin-based Circ says it has since expanded to 21 cities across 7 countries. The re-brand is in preparation for further international expansion, with Germany up next to coincide with new German regulations permitting e-scooter services.

With regards to the name change, I’m told the decision was both practical and more conceptual. When people think of “flash” they tend to think of lightning or comic book superheroes, while the word itself is intrinsically linked with connotations of speed. While newly named Circ has moved very fast to reach 1 million rides, riding fast is not what the company is about.

“We wanted a name that better reflects who we are and how seriously we take the responsibility of moving people. Circ is all about circles, connections and there is great symmetry with what we do, working with others to help people move around their city in a reliable, safe and enjoyable way,” a company spokesperson tells me.

Reading between the lines, it’s almost certain that the startup is also thinking about its brand beyond e-scooters alone. Gadowski has always described the company as a “micro-mobility” service that isn’t just concerned with scooters and one that wants to play an integral role within a city’s broader transportation system.

On that note, Circ says it has joined the Union Internationale des Transports Publics (UITP), the worldwide association for public transportation. It has also formed a partnership with Swiss public transport operator Swiss Federal Railways (Schweizerische Bundesbahnen, SBB).

“The comprehensive partnership entails the creation of designated parking spaces at key strategic locations in railway stations and explores digital integration as Circ and SBB introduce ways to create seamless mobility for rail and e-scooter users,” says Circ.

Powered by WPeMatico

Twitter has just announced it has picked up London-based Fabula AI. The deep learning startup has been developing technology to try to identify online disinformation by looking at patterns in how fake stuff vs genuine news spreads online — making it an obvious fit for the rumor-riled social network.

Social media giants remain under increasing political pressure to get a handle on online disinformation to ensure that manipulative messages don’t, for example, get a free pass to fiddle with democratic processes.

Twitter says the acquisition of Fabula will help it build out its internal machine learning capabilities — writing that the UK startup’s “world-class team of machine learning researchers” will feed an internal research group it’s building out, led by Sandeep Pandey, its head of ML/AI engineering.

This research group will focus on “a few key strategic areas such as natural language processing, reinforcement learning, ML ethics, recommendation systems, and graph deep learning” — now with Fabula co-founder and chief scientist, Michael Bronstein, as a leading light within it.

Bronstein is chair in machine learning & pattern recognition at Imperial College, London — a position he will remain while leading graph deep learning research at Twitter.

Fabula’s chief technologist, Federico Monti — another co-founder, who began the collaboration that underpin’s the patented technology with Bronstein while at the University of Lugano, Switzerland — is also joining Twitter.

“We are really excited to join the ML research team at Twitter, and work together to grow their team and capabilities. Specifically, we are looking forward to applying our graph deep learning techniques to improving the health of the conversation across the service,” said Bronstein in a statement.

“This strategic investment in graph deep learning research, technology and talent will be a key driver as we work to help people feel safe on Twitter and help them see relevant information,” Twitter added. “Specifically, by studying and understanding the Twitter graph, comprised of the millions of Tweets, Retweets and Likes shared on Twitter every day, we will be able to improve the health of the conversation, as well as products including the timeline, recommendations, the explore tab and the onboarding experience.”

Terms of the acquisition have not been disclosed.

We covered Fabula’s technology and business plan back in February when it announced its “new class” of machine learning algorithms for detecting what it colloquially badged ‘fake news’.

Its approach to the problem of online disinformation looks at how it spreads on social networks — and therefore who is spreading it — rather than focusing on the content itself, as some other approaches do.

Fabula has patented algorithms that use the emergent field of “Geometric Deep Learning” to detect online disinformation — where the datasets in question are so large and complex that traditional machine learning techniques struggle to find purchase. Which does really sound like a patent designed with big tech in mind.

Fabula likens how ‘fake news’ spreads on social media vs real news as akin to “a very simplified model of how a disease spreads on the network”.

One advantage of the approach is it looks to be language agnostic (at least barring any cultural differences which might also impact how fake news spread).

Back in February the startup told us it was aiming to build an open, decentralised “truth-risk scoring platform” — akin to a credit referencing agency, just focused on content not cash.

It’s not clear from Twitter’s blog post whether the core technologies it will be acquiring with Fabula will now stay locked up within its internal research department — or be shared more widely, to help other platforms grappling with online disinformation challenges.

The startup had intended to offer an API for platforms and publishers later this year.

But of course building a platform is a major undertaking. And, in the meanwhile, Twitter — with its pressing need to better understand the stuff its network spreads — came calling.

A source close to the matter told us that Fabula’s founders decided that selling to Twitter instead of pushing for momentum behind a vision of a decentralized, open platform because the exit offered them more opportunity to have “real and deep impact, at scale”.

Though it is also still not certain what Twitter will end up doing with the technology it’s acquiring. And it at least remains possible that Twitter could choose to make it made open across platforms.

“That’ll be for the team to figure out with Twitter down the line,” our source added.

A spokesman for Twitter did not respond directly when we asked about its plans for the patented technology but he told us: “There’s more to come on how we will integrate Fabula’s technology where it makes sense to strengthen our systems and operations in the coming months. It will likely take us some time to be able to integrate their graph deep learning algorithms into our ML platform. We’re bringing Fabula in for the team, tech and mission, which are all aligned with our top priority: Health.”

Powered by WPeMatico

Owlin, a startup we covered all the way back in late 2012, has raised $3.5 million in Series A funding. The fundraise follows the fintech company’s pivot from a real-time news alert service to a more comprehensive “AI-based” text and news analytics platform to help financial institutions assess risk.

The new round is led by fintech investor Velocity Capital. The investment will enable Amsterdam-based Owlin to accelerate its growth internationally, especially in the U.K. and the U.S. The company’s international clients include Fitch Ratings, Adyen, Deutsche Bank, ING, and KPMG.

“We started with delivering news signals to dealing room environments with our platform,” Owlin co-founder and CEO Sjoerd Leemhuis recalls. “These are environments that rely on Bloomberg and Reuters. While doing this we gained a lot of spin-off within risk related departments. With regulatory requirements increasing, and banks being forced to work more efficiently, we’ve been especially successful with augmenting “slow data” (e.g. ratings, annual reports and research reports) for assessing credit risk with real-time actionable data”.

Leemhuis says this makes risk-models more accurate and risk departments “more beloved by the regulators”. “Next to this being our true blue ocean, we can also contribute to a more stable and sustainable financial system,” he says. “It’s great to see that rating agencies and regulators are sharing this vision for more data-driven risk management as is evident from our strategic partnership with Fitch Ratings”.

This is seeing Owlin enable 15,000 counter-party risk managers worldwide to track risk events that are not captured by traditional credit risk metrics. “We are adding news and unstructured data to their risk monitoring. In the end, our clients don’t just gain insights, they also gain time,” adds the Owlin CEO.

Meanwhile, Owlin’s Series A isn’t just a lesson in finding market fit but also in tenacity. In the last few years, two of the startup’s initial founders left after the company found itself in the rare situation of its seed-backer going bankrupt. This left Owlin falling back on a bootstrap strategy and being extremely cautious when choosing a next investor. It seems that not all risk is as easy to assess.

Powered by WPeMatico

Hot on the heels of being acquired by company builder Finleap, German SME banking upstart Penta has appointed a new CEO.

Marko Wenthin, who previously co-founded solarisBank (the banking-as-a-service used by Penta), is now heading up the company, having replaced outgoing CEO and Penta co-founder Lav Odorović.

I understand Odorović left Penta last month after it was mutually agreed with new owner Finleap that a CEO with more experience scaling should be brought in. The Penta co-founder remains a shareholder in the SME banking fintech and is thought to be eyeing up his next venture.

Wenthin stepped down from solarisBank’s executive team in late 2018 citing “health reasons” and saying that he needed to focus on his recovery. It’s not known what those health issues were, although, regardless, it’s good to see that he’s well-enough to take up a new role as Penta CEO.

Asked to comment on Odorović’s departure, Penta issued the following statement:

“Lav is still part of the shareholders at Penta. His step back from the operational management team was a decision taken by mutual agreement. Lav was the right fit during the building phase of Penta, but by entering a new step of growth, the company faces bigger challenges and needs therefore to position itself differently”.

Penta says that in his new leadership role, Wenthin, who previously spent 16 years at Deutsche Bank, will lead international expansion — next stop Italy — and begin to market the fintech to larger SMEs in addition to its original focus on early-stage startups and other small digital companies. “In the future, the focus will be also on traditional medium-sized companies,” says Penta.

Adds Wenthin in a statement: “I am very much looking forward to my new role at Penta. On the one hand, digital banking for small and medium-sized companies is very important to me, as they are the driver of the economy and I have spent most of my career in this segment. On the other hand, I have known Penta and the team for a long time as successful partners of solarisBank. Penta is the best example of how a very focused banking provider can create real, digital added value for an entire customer segment in cooperation with a banking-as-a-service platform”.

Meanwhile, TechCrunch understands that Odorović’s departure and the appointment of Wenthin isn’t the only recent personnel change within Penta’s leadership team. According to LinkedIn, Aleksandar Orlic, who held the position of CTO, departed the company last month. “We are searching for a new CTO,” said a Penta spokesperson.

Alongside Wenthin, that leaves Penta’s current management team as Jessica Holzbach (Chief Customer Officer), Luka Ivicevic (Chief of Staff), Lukas Zörner (Chief Product Officer (CPO) and Matteo Concas (Chief Marketing Officer).

Powered by WPeMatico

Jumia may be the first startup you’ve heard of from Africa. But the e-commerce venture that recently listed on the NYSE is definitely not the first or last word in African tech.

The continent has an expansive digital innovation scene, the components of which are intersecting rapidly across Africa’s 54 countries and 1.2 billion people.

When measured by monetary values, Africa’s tech ecosystem is tiny by Shenzen or Silicon Valley standards.

But when you look at volumes and year over year expansion in VC, startup formation, and tech hubs, it’s one of the fastest growing tech markets in the world. In 2017, the continent also saw the largest global increase in internet users—20 percent.

If you’re a VC or founder in London, Bangalore, or San Francisco, you’ll likely interact with some part of Africa’s tech landscape for the first time—or more—in the near future.

That’s why TechCrunch put together this Extra-Crunch deep-dive on Africa’s technology sector.

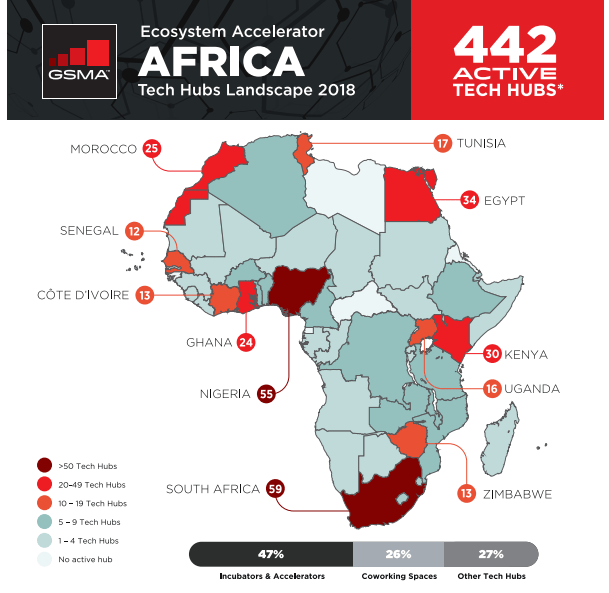

A foundation for African tech is the continent’s 442 active hubs, accelerators, and incubators (as tallied by GSMA). These spaces have become focal points for startup formation, digital skills building, events, and IT activity on the continent.

Prominent tech hubs in Africa include CcHub in Nigeria, Pan-African incubator MEST, and Kenya’s iHub, with over 200 resident members. More of these organizations are receiving funds from DFIs, such as the World Bank, and aid agencies, including France’s $76 million African tech fund.

Prominent tech hubs in Africa include CcHub in Nigeria, Pan-African incubator MEST, and Kenya’s iHub, with over 200 resident members. More of these organizations are receiving funds from DFIs, such as the World Bank, and aid agencies, including France’s $76 million African tech fund.

Blue-chip companies such as Google and Microsoft are also providing money and support. In 2018 Facebook opened its own Hub_NG in Lagos with partner CcHub, to foster startups using AI and machine learning.

Powered by WPeMatico

After a decade in the peculiar world of venture capital, Andreessen Horowitz managing director Scott Kupor has seen it all when it comes to the dos and don’ts for dealing with Valley VCs and company building. In his new book Secrets of Sand Hill Road (available on June 3), Scott offers up an updated guide on what VCs actually do, how they think and how founders should engage with them.

TechCrunch’s Silicon Valley editor Connie Loizos will be sitting down with Scott for an exclusive conversation on Tuesday, June 4 at 11:00 am PT. Scott, Connie and Extra Crunch members will be digging into the key takeaways from Scott’s book, his experience in the Valley and the opportunities that excite him most today.

Tune in to join the conversation and for the opportunity to ask Scott and Connie any and all things venture.

To listen to this and all future conference calls, become a member of Extra Crunch. Learn more and try it for free.

Powered by WPeMatico

Let’s rewind a decade. It’s 2009. Vancouver, Canada.

Stewart Butterfield, known already for his part in building Flickr, a photo-sharing service acquired by Yahoo in 2005, decided to try his hand — again — at building a game. Flickr had been a failed attempt at a game called Game Neverending followed by a big pivot. This time, Butterfield would make it work.

To make his dreams a reality, he joined forces with Flickr’s original chief software architect Cal Henderson, as well as former Flickr employees Eric Costello and Serguei Mourachov, who like himself, had served some time at Yahoo after the acquisition. Together, they would build Tiny Speck, the company behind an artful, non-combat massively multiplayer online game.

Years later, Butterfield would pull off a pivot more massive than his last. Slack, born from the ashes of his fantastical game, would lead a shift toward online productivity tools that fundamentally change the way people work.

In mid-2009, former TechCrunch reporter-turned-venture-capitalist M.G. Siegler wrote one of the first stories on Butterfield’s mysterious startup plans.

“So what is Tiny Speck all about?” Siegler wrote. “That is still not entirely clear. The word on the street has been that it’s some kind of new social gaming endeavor, but all they’ll say on the site is ‘we are working on something huge and fun and we need help.’”

Maybe I make a terrible boss, but at least I know it. Work with me: http://tinyspeck.com/jobs/cptl/

— Stewart Butterfield (@stewart) July 10, 2009

Siegler would go on to invest in Slack as a general partner at GV, the venture capital arm of Alphabet .

“Clearly this is a creative project,” Siegler added. “It almost sounds like they’re making an animated movie. As awesome as that would be, with people like Henderson on board, you can bet there’s impressive engineering going on to turn this all into a game of some sort (if that is in fact what this is all about).”

After months of speculation, Tiny Speck unveiled its project: Glitch, an online game set inside the brains of 11 giants. It would be free with in-game purchases available and eventually, a paid subscription for power users.

Powered by WPeMatico

Entering into the world of Anthemis is a bit like stepping into the frame of a Wes Anderson film. Eclectic, offbeat people situated in colorful interiors? Check. A muse in the form of a renowned British-Venezuelan economist? Check. A design-forward media platform to provoke deep thought? Check. An annual summer retreat ensconced in the French Alps? Bien sûr.

Sitting atop this most unusual fintech(ish) VC is its ponytailed founder and chairman Sean Park, whose difficult-to-place accent and Philosophy professor aura belie his extensive fixed income capital markets experience. He’s joined by founder and CEO Amy Nauiokas, who in addition to being one of Fintech’s most prominent female investors also owns a high-minded film and television production company.

When Arman Tabatabai and I recently sat down with Park and Nauiokas in their New York office, the firm’s leaders were in an upbeat mood, having blown past the temporary perception-setback associated with the abrupt resignation last year of Anthemis’ former CEO Nadeem Shaikh (for more on this, read TechCrunch writer Steve O’Hear’s coverage of the situation).

And as the conversation below demonstrates, Park and Nauiokas are well poised to bring the quirk into everything they touch, which these days runs the gamut from backing companies involved in sustainable finance, advancing their home-grown media platform and preparing a soon-to-be-announced initiative elevating female entrepreneurs.

Gregg Schoenberg: With the two of you now at the helm, how does Anthemis present itself today?

Sean Park: I’ll step back and say that when Amy and I were working at big financial institutions in the noughties, we saw that the industry was going to change and that existing business models were running into their natural diminishing returns.

We tried to bring some new ideas to the organizations we were working in, but we each had epiphany moments when we realized that big organizations weren’t built to do disruptive transformation — for bad reasons, but also good reasons, too.

GS: Let’s fast forward to today, where you have several strong Fintech VCs out there. But unlike others, Anthemis puts weirdness at the heart of its model.

Yes, you’ve backed some big names like Betterment and eToro, but you’ve done other things that are farther afield. What’s the underlying thesis that supports that?

Amy Nauiokas: Whatever we do at Anthemis has to be a non-zero-sum game. It has to be for good, not for evil. So that means that we aren’t looking in any place where you see predatory opportunities to make money.

Powered by WPeMatico

The Valley’s rocky history with cleantech investing has been well-documented.

Startups focused on non-emitting-generation resources were once lauded as the next big cash cow, but the sector’s hype quickly got away from reality.

Complex underlying science, severe capital intensity, slow-moving customers and high-cost business models outside the comfort zones of typical venture capital ultimately caused a swath of venture-backed companies and investors in the cleantech boom to fall flat.

Yet, decarbonization and sustainability are issues that only seem to grow more dire and more galvanizing for founders and investors by the day, and more company builders are searching for new ways to promote environmental resilience.

While funding for cleantech startups can be hard to find nowadays, over time we’ve seen cleantech startups shift down the stack away from hardware-focused generation plays toward vertical-focused downstream software.

A far cry from past waves of venture-backed energy startups, the downstream cleantech companies offered more familiar technology with more familiar business models, geared toward more recognizable verticals and end users. Now, investors from less traditional cleantech backgrounds are coming out of the woodwork to take a swing at the energy space.

An emerging group of non-traditional investors getting involved in the clean energy space are those traditionally focused on fintech, such as New York and Europe-based venture firm Anthemis — a financial services-focused team that recently sat down with our fintech contributor Gregg Schoenberg and I (check out the full meat of the conversation on Extra Crunch).

The tie between cleantech startups and fintech investors may seem tenuous at first thought. However, financial services have long played a significant role in the energy sector and is now becoming a more common end customer for energy startups focused on operations, management and analytics platforms, thus creating real opportunity for fintech investors to offer differentiated value.

Though the conversation around energy resources and decarbonization often focuses on politics, a significant portion of decisions made in the energy generation business is driven by pure economics — is it cheaper to run X resource relative to resources Y and Z at a given point in time? Based on bid prices for request for proposals (RFPs) in a specific market and the cost-competitiveness of certain resources, will a developer be able to hit their targeted rate of return if they build, buy or operate a certain type of generation asset?

Alternative generation sources like wind, solid oxide fuel cells or large-scale or even rooftop solar have reached more competitive cost levels — in many parts of the U.S., wind and solar are in fact often the cheapest form of generation for power providers to run.

Thus as renewable resources have grown more cost competitive, more infrastructure developers and other new entrants have been emptying their wallets to buy up or build renewable assets like large-scale solar or wind farms, with the American Council on Renewable Energy even forecasting cumulative private investment in renewable energy possibly reaching up to $1 trillion in the U.S. by 2030.

A major and swelling set of renewable energy sources are now led by financial types looking for tools and platforms to better understand the operating and financial performance of their assets, in order to better maximize their return profile in an increasingly competitive marketplace.

Therefore, fintech-focused venture firms with financial service pedigrees, like Anthemis, now find themselves in pole position when it comes to understanding cleantech startup customers, how they make purchase decisions, and what they’re looking for in a product.

In certain cases, fintech firms can even offer significant insight into shaping the efficacy of a product offering. For example, Anthemis portfolio company kWh Analytics provides a risk management and analytics platform for solar investors and operators that helps break down production, financial analysis and portfolio performance.

For platforms like kWh analytics, fintech-focused firms can better understand the value proposition offered and help platforms understand how their technology can mechanically influence rates of return or otherwise.

The financial service customers for clean energy-related platforms extends past just private equity firms. Platforms have been and are being built around energy trading, renewable energy financing (think financing for rooftop solar) or the surrounding insurance market for assets.

When speaking with several of Anthemis’ cleantech portfolio companies, founders emphasized the value of having a fintech investor on board that not only knows the customer in these cases, but that also has a deep understanding of the broader financial ecosystem that surrounds energy assets.

Founders and firms seem to be realizing that various arms of financial services are playing growing roles when it comes to the development and access to clean energy resources.

By offering platforms and surrounding infrastructure that can improve the ease of operations for the growing number of finance-driven operators or can improve the actual financial performance of energy resources, companies can influence the fight for environmental sustainability by accelerating the development and adoption of cleaner resources.

Ultimately, a massive number of energy decisions are made by financial services firms and fintech firms may often know the customers and products of downstream cleantech startups more than most. And while the financial services sector has often been labeled as dirty by some, the vital role it can play in the future of sustainable energy offers the industry a real chance to clean up its image.

Powered by WPeMatico

Let’s go beyond the high-level fundraising advice that fills VC blogs. If you have a compelling business and have educated yourself on crafting a pitch deck and getting warm intros to VCs, there are still specific questions about the strategy to follow for your fundraise.

How can you make your round “hot” and trigger a fear of missing out (FOMO) among investors? How can you fundraise faster to reduce the distraction it has on running your business?

“You’re trying to make a market for your equity. In order to make a market you need multiple people lining up at the same time.”

Unsurprisingly, I’ve noticed that experienced founders tend to be more systematic in the tactics they employ to raise capital. So I asked several who have raised tens (or hundreds) of millions in VC funding to share specific strategies for raising money on their terms. Here’s their advice.

(The three high-profile CEOs who agreed to share their specific playbooks requested anonymity so VCs don’t know which is theirs. I’ve nicknamed them Founder A, Founder B, and Founder C.)

Have additional fundraising tactics to share? Email me at eric.peckham@techcrunch.com.

“You’re trying to make a market for your equity. In order to make a market, you need multiple people lining up at the same time.”

That advice from Atrium CEO Justin Kan (a co-founder of companies like Twitch and former partner at Y Combinator) was reiterated by all the entrepreneurs I interviewed. Fundraising should be a sprint, not a marathon, otherwise the loss of momentum will make it more difficult.

Powered by WPeMatico