Fundings & Exits

Auto Added by WPeMatico

Auto Added by WPeMatico

Most of the buzz about esports focuses on high-profile professional teams and audiences watching live streams of those professionals.

What gets ignored is the entire base of amateurs wanting to compete in esports below the professional tier. This is like talking about the NBA and the value of its sponsorships and broadcast rights as if that is the entirety of the basketball market in the US.

Los Angeles-based PlayVS (pronounced “play versus”) wants to become the dominant platform for amateur esports, starting at the high school level. The company raised $46 million last year—its first year operating—with the vision that owning the infrastructure for competitions and expanding it to encompass other social elements of gaming can make it the largest gaming company in the world.

I recently sat down with Founder & CEO Delane Parnell to talk about his company’s formation and growth strategy. Below is the transcript of our conversation (edited for length and clarity):

Eric P: You have a fascinating background as a serial entrepreneur while you were a teenager.

Delane P.: I grew up on the west side of Detroit and started working at the cell phone store of a family friend when I was 13. When I turned 16 or so, I joined two guys in opening our own Metro PCS franchise. And then two additional franchises. And I was on the founding team of a car rental company called Executive Rental Car.

Eric P: And this segued into tech startups after meeting Jon Triest from Ludlow Ventures?

Delane P: He got me a ticket to the Launch conference in SF, and that experience inspired me to start a Fireside Chat series in Detroit that brought in people like Brian Wong from Kiip and Alexis Ohanian from Reddit to speak. Starting at 21, I worked at a venture capital firm called IncWell based in Birmingham, Michigan then joined a startup called Rocket Fiber.

We were focused on internet infrastructure – this is 2015-ish – and I was appointed to lead our strategy in esports. So I met with many of the publishers, ancillary startups, tournament organizers, and OG players and team owners. Through the process, I became passionate about esports and ended up leaving Rocket Fiber to start a Call of Duty team that I quickly sold to TSM.

Eric P: What then drove you to found PlayVS? Did it seem like an obvious opportunity or did it take you a while to figure it out?

Delane P.: What esports means is playing video games competitively bound to governance and a competitive ruleset. As a player, what that experience means is you play on a team, in a position, with a coach, in a season that culminates in some sort of championship.

Powered by WPeMatico

When FireEye reported its earnings last month, the outlook was a little light, so the security vendor decided to be proactive and make a big purchase. Today, the company announced it has acquired Verodin for $250 million. The deal closed today.

The startup had raised over $33 million since it opened its doors five years ago, according to Crunchbase data, and would appear to have given investors a decent return. With Verodin, FireEye gets a security validation vendor; that is, a company that can run a review against the existing security setup and find gaps in coverage.

That would seem to be a handy kind of tool to have in your security arsenal, and could possibly explain the price tag. Perhaps it could also help set FireEye apart from the broader market, or fill in a gap in its own platform.

FireEye CEO Kevin Mandia certainly sees the potential of his latest purchase. “Verodin gives us the ability to automate security effectiveness testing using the sophisticated attacks we spend hundreds of thousands of hours responding to, and provides a systematic, quantifiable, and continuous approach to security program validation,” he said in a statement.

Chris Key, Verodin co-founder and chief executive officer, sees the purchase through the standard acquisition lens. “By joining FireEye, Verodin extends its ability to help customers take a proactive approach to understanding and mitigating the unique risks, inefficiencies and vulnerabilities in their environments,” he said in a statement. In other words, as part of a bigger company, we’ll do more faster.

While FireEye plans to incorporate Verodin into its on-prem and managed services, it will continue to sell the solution as a standalone product, as well.

Powered by WPeMatico

Venture capitalists aren’t supposed to make their portfolio companies battle to the death. There’s a long-standing but unofficial rule that investors shouldn’t fund multiple competitors in the same space. Conflicts of interest could arise, information about one startup’s strategy could be improperly shared with the other, and the companies could become suspicious of advice provided by their investors. That leads to problems down the line for VCs, as founders may avoid them if they fear the firm might fund their rival down the line.

SoftBank shatters that norm with its juggernaut $100 billion Vision Fund plus its Innovation Fund. The investor hasn’t been shy about funding multiple sides of the same fight.

The problem is that SoftBank’s power distorts the market dynamics. Startups might take exploitative deals from the firm under the threat that they’ll be outspent whoever is willing to take the term sheet. That can hurt employees, especially ones joining later, who might have a reduced chance for a meaningful exit. SoftBank could advocate for mergers, acquisitions, or product differentiation that boost its odds of reaping a fortune at the expense of the startups’ potential.

Powered by WPeMatico

PlanetScale’s founders invented the technology called Vitess that scaled YouTube. Now they’re selling it to any enterprise that wants their data both secure and consistently accessible. And thanks to its ability to re-shard databases while they’re operating, it can solve businesses’ troubles with GDPR, which demands they store some data in the same locality as the user to whom it belongs.

The potential to be a computing backbone that both competes with and complements Amazon’s AWS has now attracted a mammoth $22 million Series A for PlanetScale. Led by Andreessen Horowitz and joined by the firm’s Cultural Leadership Fund, head of the US Digital Service Matt Cutts, plus existing investor SignalFire, the round is a tall step up from the startup’s $3 million seed it raised a year ago. Andreessen general partner Peter Levine will join the PlanetScale board, bringing his enterprise launch expertise.

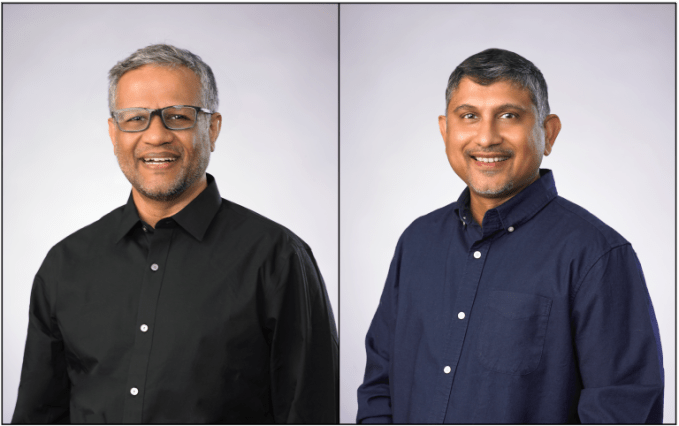

PlanetScale co-founders (from left): Jitendra Vaidya and Sugu Sougoumarane

“What we’re discovering is that people we thought were at one point competitors, like AWS and hosted relational databases — we’re discovering they may be our partners instead since we’re seeing a reasonable demand for our services in front of AWS’ hosted databases,” says CEO Jitendra Vaidya. “We are growing quite well.” Competing database startups were raising big rounds, so PlanetScale connected with Andreessen in search of more firepower.

Vitess is a horizontal scaling sharding middleware engineered for MySQ that was built to run on “Borg” the predecessor to Kubernetes at Google. It lets businesses segment their database to boost memory efficiency without sacrificing reliable access speeds. PlanetScale sells Vitess in four ways: hosting on its database-as-a-service, licensing of the tech that can be run on-premises for clients or through another cloud provider, professional training for using Vitess and on-demand support for users of the open-source version of Vitess. PlanetScale now has 18 customers paying for licenses and services, and plans to release its own multi-cloud hosting to a general audience soon.

With data becoming so valuable and security concerns rising, many companies want cross-data center durability so one failure doesn’t break their app or delete information. But often the trade-off is unevenness in how long data takes to access. “If you take 100 queries, 99 might return results in 10 milliseconds, but one will take 10 seconds. That unpredictability is not something that apps can live with,” Vaidya tells me. PlanetScale’s Vitess gives enterprises the protection of redundancy but consistent speeds. It also allows businesses to continually update their replication logs so they’re only seconds behind what’s in production rather than doing periodic exports that can make it tough to track transactions and other data in real-time.

Now equipped with a ton of cash for a 20-person team, PlanetScale plans to double its staff by adding more sales, marketing and support. “We don’t have any concerns about the engineering side of things, but we need to figure out a go-to-market strategy for enterprises,” Vaidya explains. “As we’re both technical co-founders, about half of our funding is going towards hiring those functions [outside of engineering], and making that part of our organization work well and get results.”

But while a $22 million round from Andreessen Horowitz would be exciting for almost any startup, the funding for PlanetScale could assist the whole startup ecosystem. GDPR was designed to reign in tech giants. In reality, it applied compliance costs to all companies — yet the rich giants have more money to pay for those efforts. For a smaller startup, figuring out how to obey GDPR’s data localization mandate could be a huge engineering detour they can hardly afford. PlanetScale offers them not only databases but compliance-as-a-service too. It shards their data to where it has to be, and the startup can focus on their actual product.

Powered by WPeMatico

French startup Yousign is partnering with startup studio eFounders. While eFounders usually builds software-as-a-service startups from scratch, the company is trying something new with this partnership.

Indeed, eFounders wants to create all the tools you need to make your work more efficient. The startup studio is behind many respectable SaaS successes, such as Front, Aircall and Spendesk. And electronic signatures are a must if you want to speed up your workflow.

Sure, there are a ton of well-established players in the space — DocuSign, SignNow, Adobe Sign, HelloSign, etc. But nobody has really cracked the European market in a similar way.

Yousign has been around for a while in France. When it comes to features, it has everything you’d expect. You can upload a document and set up automated emails and notifications so that everybody signs the document.

Signatures are legally binding and Yousign archives your documents. You also can create document templates and send contract proposals using an API.

The main challenge for Yousign is that Europe is still quite fragmented. The company will need to convince users in different countries that they need to switch to an e-signature solution. Starting today, Yousign is now available in France, Germany, the U.K. and Spain.

Yousign had only raised some money; eFounders is cleaning the cap table by buying out existing investors and replacing them.

“We can’t really communicate on the details of the investment, but what I can tell you is that we bought out existing funds for several millions of euros in order to replace them — founders still have the majority of shares,” eFounders co-founder and CEO Thibaud Elzière told me.

In a blog post, Elzière writes that eFounders has acquired around 50% of the company through an SPV (Single Purpose Vehicle) that it controls. The startup studio holds 25% directly, and investors in the eFounders eClub hold 25%.

Yousign now looks pretty much like any other eFounders company when they start. Of course, founders and eFounders might get diluted further down the road if Yousign ends up raising more money.

Powered by WPeMatico

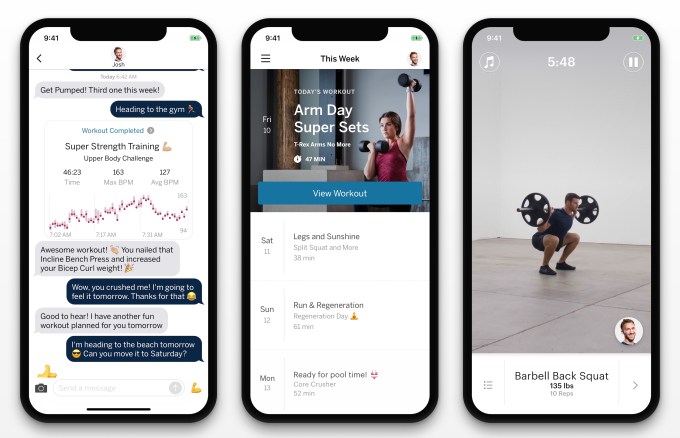

The only way to beat laziness is with guilt, so that’s what Future sells. It assigns you an actual human trainer who builds personalized workout plans and messages you throughout the day to make sure you’re doing them. It even gives you an Apple Watch to track your activity and ensure you’re not lying. Future actually got me to the gym where my coach kicked my ass remotely with a 30-minute lifting routine I’d never have stuck to by myself.

The catch? It’s probably the most expensive app you’ve ever seen, charging $150 per month.

Future officially launches today. Luckily it comes with a one-month money-back guarantee that CEO Rishi Mandal says has only been redeemed once. It’s produced some stunning stats from its beta tests: 95% of users stuck with it for three months, and 85% kept training for six months. That’s unheard of in fitness tech.

Future’s welcome kit includes a water bottle and Apple Watch

The remarkable retention and Future’s potential to become a gateway for your exercise and nutrition spending have roped in some big-name investors. Today it’s announcing an $8.5 million Series A led by Kleiner Perkins with partner Mamoon Hamid joining the board, building on its $3 million seed. Other backers include Instagram co-founder Mike Krieger, Khosla Ventures, Founders Fund and Caffeinated Capital. Athletes are betting on Future’s promise of democratizing the personal training they get, including Golden State Warrior Sean Livingston, and NFL stars Ndamukong Suh and Kelvin Beachum.

“Future manages to be both deeply personalized (and personable!) while being super convenient,” says Krieger of one of his first investments since leaving Instagram. Future’s Mandal built his old startup Sosh while sitting next to Krieger at incubator Dogpatch Labs, where Instagram was getting its start. “The always-available nature of it means travel or a shifting schedule is no longer an excuse to not work out.”

Throughout the onboarding, Future flexes the money you spend to offer what feels like a luxury app experience.

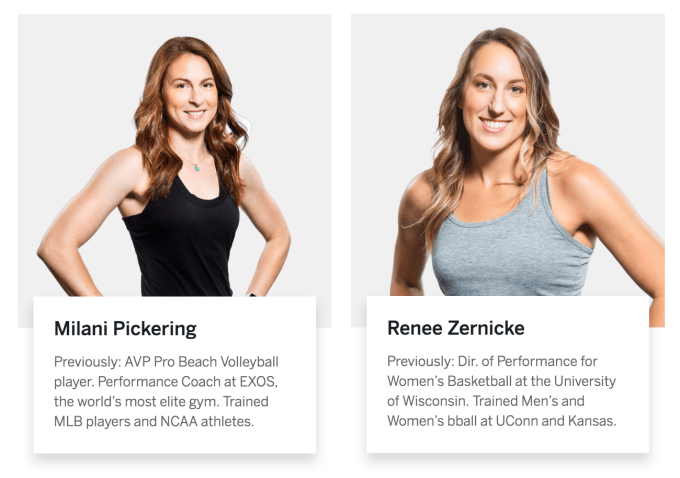

Upon signup, you’ll answer some questions about your goals like slimming down or beefing up, and pick from a few expert trainers matched to your needs. You’ll do a 15-minute video chat with your trainer to get friendly, describe your schedule and hammer out details of your workout plan. After you get your welcome kit with some swag and an Apple Watch, your trainer delivers your week’s worth of personalized daily routines that come with video instructions for each exercise. The Future app provides audio cues (and optional music) to guide you through the workouts while your trainer chimes in with personalized pointers and motivation via pre-recorded voice clips.

Future’s app guides you through workouts with instructional video clips and audio cues

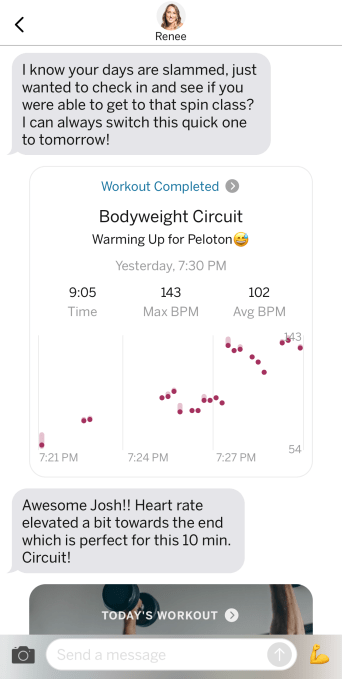

But what’s unique about Future is that your trainer proactively checks in with you throughout your day to make sure you’re actually going to the gym or doing those pushups. Because you don’t switch between trainers with each workout like some apps, and because they have your activity and heart-rate data from the Apple Watch, they can spot patterns of procrastination or flaking out. You’re prompted to give feedback after each sweat session that the trainer uses to tweak your plan. That personalization and prodding go a long way to making sure Future always fits your day and actually stays part of it.

For example, I wanted to burn a few pounds without burning too much time by adding a gym day or two plus some warmup strength training before my home Peloton rides. My trainer Renee Zernicke, a former University of Wisconsin director of Sports Performance for basketball, designed a 30-minute weight-lifting circuit and some 10-minute bodyweight exercise plans for me. When I messaged her that I was doing a more intense spin class today, she remixed my warmup exercises to avoid legs so I wouldn’t be tired during my ride. So far she’s always responded within a few minutes, and been cheerful yet forceful. “I know your days are slammed, just wanted to check in and see if you were able to get to that spin class?” she messaged me at 6:30pm. That’s something even most in-person trainers don’t do.

Future matches you with several trainer options

I found most of the workout instructions easy to understand, and the audio cues make it easy to do routines without constantly staring at your phone. But the one thing you really lose with a text message trainer instead of an in-person coach is warnings when you’re doing something wrong. Bad posture or jerky motions could get you injured. It’s all a lot smoother if you know your way around a gym. Future could do more to gauge your familiarity with proper form for riskier exercises, and then either teach you or steer you away from them. I hope I’m so sore today because I’m getting built, not getting hurt.

My trainer Renee encouraging me to get to the gym

Future was inspired by some scary facts. “Seventy percent of Americans are obese and overweight,” Mandal tells me. “We spend $3.5 trillion per year on healthcare, yet we have pretty mediocre outcomes.” Mandal had gone through Stanford, worked at NASA and been at Slide when it was acquired by Google. After selling his local experience app Sosh to Postmates, he became an entrepreneur-in-residence at Khosla Ventures, which does many medtech investments. There, Mandal realized health is largely determined by how you eat, sleep, deal with stress, take your medicine and exercise.

Thanks to smart watches, that last one had become the easiest to measure while remaining the toughest to do right on your own. Mandal set out to learn what the fittest people, professional athletes, do for exercise. They all said they relied on personal trainers to make all the workout plans and force them to do them. Home gyms or apps full of pre-made exercises weren’t enough. They needed someone to keep them accountable.

The trouble is that’s pretty expensive one-on-one. So Mandal teamed up with Justin Santamaria, a 10-year Apple veteran from the first iOS team who’d been working on iMessage and FaceTime. Together they designed Future in 2017 to make personal trainers cheap enough to be more accessible while retaining the personal connection that keeps trainees on track.

If you won’t shell out $150 per month to be nagged, there are plenty of apps like Sweat that let you choose between guided workouts. Hell, if you’ve got that much will power you could get any gym membership or just go running. But the closest thing to Future, called Fit.net, folded. AI trainers like Freeletics can’t make you feel guilty or inspired the same way. Lose It and MyFitnessPal can get fellow trainees to badger you, but Mandal found people don’t obey peers like a respected trainer.

The constant communication and sense of trust users develop with their coaches could give Future potential beyond subscription fitness. The app becomes a hub for your healthy behavior. Future already offers an in-app Shop where it recommends workout clothes, headphones and water bottles. It’s easy to imagine it partnering with fitness equipment makers, health food lines or other brands to score a cut of referred sales. “We become your most important relationship regarding your health. You only talk to your doctor two times to three times per year,” says Mandal. But you might tell your trainer you’re looking for ways to eat healthier or sleep better. “Over time, that’s the opportunity.”

Still, the biggest hurdle is convincing people to pay more than 10X their Netflix fee for a personal trainer they don’t see in person. Compared to the $1 apps we’re used to, Future can induce sticker shock. But compared to unused gym memberships, pricey private coaching and potential health problems, Future could look affordable if well-to-do professionals squint right. Humans are sluggish. Most healthy habits lapse. But Future is building the closest thing to “press button, pay money, get fitter” — which in the end looks like getting someone to enthusiastically shame/support us from afar.

Powered by WPeMatico

Bars lose 20% of their alcohol to overpours and “free” drinks for friends. That amounts to $50 billion per year in booze that mysteriously disappears, making life tough for every pub and restaurant. Nectar wants to solve that mystery with its ultrasound depth-sensing bottle caps that measure how much liquid is left in a bottle by measuring how long it takes a sonar pulse to bounce back. And now it’s bringing real-time pour tracking to beer with its gyroscopic taps. The result is that bar managers can determine who’s pouring too much or giving away drink, which promotions are working and when to reorder bottles without keeping too much stock on hand — and avoid wasting hours weighing or eyeballing the liquor level of their inventory.

Nectar’s solution to alcohol shrinkage has now attracted a $10 million Series A led by DragonCapital.vc and joined by former Campari chairman Gerry Ruvo, who will join the board. “Not a lot of technology has come to the bottle,” Nectar CEO Aayush Phumbhra says of ill-equipped bars and restaurants. “Liquor is their highest margin and highest cost item. If you don’t manage it efficiently, you go out of business.” Other solutions can look ugly to customers, forcibly restrict bartenders or take time and money to install and maintain. In contrast, Phumbhra tells me, “I care about solving deep problems by building a solution that doesn’t change behavior.”

Investors were eager to back the CEO, since he previously co-founded text book rental giant Chegg — another startup disrupting an aged market with tech. “I come from a pretty entrepreneurial family. No one in my family has ever worked for anyone else before,” Phumbhra says with a laugh. He saw an opportunity in the stunning revelation that the half-trillion-dollar on-premises alcohol business was plagued by missing booze and inconsistent ways to track it.

Typically at the end of a week or month, a bar manager will have staff painstakingly look at each bottle, try to guess what percent remains and mark it on a clipboard to be loaded into a spreadsheet later. While a little quicker, that’s very subjective and inaccurate. More advanced systems see every bottled weighed to see exactly how much is left. If they’re lucky, the scale connects to a computer, but they still have to punch in what brand of booze they’re sizing up. But the process can take many hours, which amounts to costly labor and infrequent data. None of these methods eliminate the manual measurement process or give real-time pour info.

Typically at the end of a week or month, a bar manager will have staff painstakingly look at each bottle, try to guess what percent remains and mark it on a clipboard to be loaded into a spreadsheet later. While a little quicker, that’s very subjective and inaccurate. More advanced systems see every bottled weighed to see exactly how much is left. If they’re lucky, the scale connects to a computer, but they still have to punch in what brand of booze they’re sizing up. But the process can take many hours, which amounts to costly labor and infrequent data. None of these methods eliminate the manual measurement process or give real-time pour info.

So with $6 million in funding, Nectar launched in 2017 with its sonar bottle caps that look and operate like old-school pourers. When bars order them, they come pre-synced and labeled for certain bottle shapes like Patron or Jack Daniels. Their Bluetooth devices stay charged for a year and connect wirelessly to a base hub in the bar. With each pour, the sonar pulse determines how much is in the bottle and subtracts it from the previous measurement to record how much was doled out. And the startup’s new gyroscopic beer system is calibrated to deduce pour volume from the angle and time the tap is depressed without the need for a sensor to be installed (and repaired) inside the beer hose.

Bar managers can keep any eye on everything throughout the night with desktop, iOS and Android apps. They could instantly tell if a martini special is working based on how much gin across brands is being poured, ask bartenders to slow their pours if they’re creeping upwards in volume or give the green light to strong pours on weeknights to reward regular customers. “Some bars encourage overpours to get people to keep coming back,” says local San Francisco celebrity bartender Broke-Ass Stuart, who tells me pre-measured pourers can save owners money but cost servers tips.

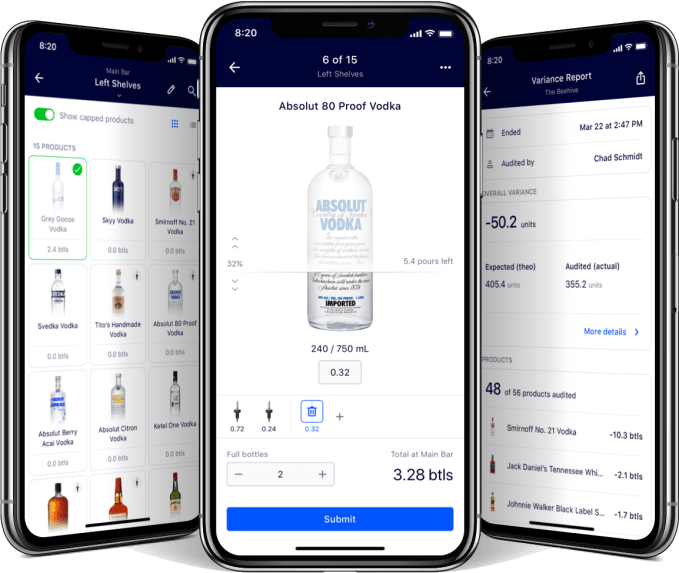

Nectar now sells self-serve subscriptions to its hardware and software, with a 20-cap package costing $99 per month billed annually with free yearly replacements. It’s also got a free two-tap trial package, or a $399 per month enterprise subscription for 100 taps. Nectar is designed to complement bar point of sale systems. And if a bar just wants the software, Nectar just launched its PrecisionAudit app, where staff tap the current liquid level on a photo of each different bottle for more accurate eyeballing. It’s giving a discount rate of $29.99 per month on the first 1,000 orders.

After 2 million pours measured, the business is growing 200% quarter-over-quarter as bowling alley chains and stadiums sign up for pilots. The potential to change the booze business seduced investors like Tinder co-founders Sean Rad and Justin Mateen, Palantir co-founder Joe Lonsdale and the founding family of the Modelo beer company. Next, Nectar is trying to invent a system for wine. That’s trickier, as its taps would need to be able to suck the air out of the bottles each night.

The big challenge will be convincing bars to change after tracking inventory the same way for decades. No one wants to deal with technical difficulties in a jam-packed bar. That’s partly why Nectar’s subscription doesn’t force owners to buy its hardware up front.

If Nectar can nail not only the tech but the bartender experience, it could pave a smoother path to hospitality entrepreneurship. Alcohol shrinkage is one factor leading to the rapid demise of many bars and restaurants. Plus, it could liberate bartenders from measuring bottles into the wee hours. As Phumbhra noted, “They’re coming in on weekends and working late. We want them to spend that time with their families and on customer service.”

Powered by WPeMatico

While Android and iOS have locked up the market for smartphone operating systems, a feature phone platform that has the distinction of being the world’s third biggest mobile OS is announcing a hefty round of funding to continue its expansion. KaiOS, which makes the OS that powers devices like Nokia’s feature phones and Jio’s devices out of India, has raised $50 million from Cathay Innovation (which led the round) and previous investors Google and TCL Holdings.

The funding takes the total raised by KaiOS — which has now shipped 100 million devices across 100 countries — to $72 million. It comes less than a year after Google invested $22 million in the business — a strategic round that also marked KaiOS beginning the process of creating native integrations of different Google services like Maps and (more recently) Assistant into the platform.

KaiOS is not disclosing its valuation, but Sebastien Codeville, its CEO, confirmed it is “definitely up.” (PitchBook put it at a very modest $43.75 million last year on the back of Google’s earlier round.)

We actually knew a little about this round back in February, at MWC in Barcelona, when KaiOS announced new handset partners and a raft of new features. A spokesperson for KaiOS told TechCrunch the delay in closing the deal and making it public was due to a need to coordinate with different stakeholders.

As it turned out, KaiOS’s timing for this announcement turned out to be pretty interesting. The big news this week in mobile is what kind of an impact Huawei will face in the wake of a U.S. regulation barring it from doing business in the U.S. One development in that story has been just how serious Huawei is about building its own operating system to replace Google’s Android and its related services.

This is big news because while Huawei is currently the world’s second-biggest mobile phone maker, we haven’t seen any platform gain reasonable mobile phone traction against the hegemony of iOS and Android outside of China — including the failure of Firefox OS, which retreated from the market only to reemerge, phoenix-like, as KaiOS two years ago — in part because of the extensive ecosystems that have coalesced around these two.

But while all eyes are on smartphones, KaiOS’s funding and general growth represents an interesting alternative for markets, carriers and consumers that might be in the market for what KaiOS refers to as “smart feature phones.”

Today, the company counts companies like Reliance Jio, Google, Facebook, Twitter, Orange, MTN and Qualcomm among its partners, and it’s been building an interesting, two-pronged strategy for targeting people both in developed and developing markets.

As Codeville describes it, in emerging markets (which are KaiOS’s primary target), its devices are being purchased by first-time phone users, or those that have had very basic, non-data mobile phones and are upgrading without the big step and expense of smartphones. “We are bringing people to internet usage with a device they are familiar with,” he said of the form factor. “Other key characteristics are a long battery life, a keyboard and a more resistant touch panel.”

The developed market, he added, was an interesting opportunity because of the amount of professionals and others who want pared-down devices for weekend use to unplug from their daily grind.

Many had left feature phones for dead with the growth in popularity of devices like the iPhone, app stores and, of course, apps themselves. But research from Counterpoint found that feature phones still accounted for almost 25% of all handset shipments in Q3 of last year, working out to a $28 billion market opportunity in the years ahead. Today there are some 1.5 billion feature phone users, an interesting number to consider as smartphone sales continue to feel the crunch.

Powered by WPeMatico

One of the bigger developments in customer services has been the impact of social media — both as a place to vent frustration or praise (mostly frustration) and — especially over messaging apps — as a place for businesses to connect with their users.

Now, customer support specialist Zendesk has made an acquisition so that it can make a bigger move into how it works within social media platforms, and specifically messaging apps: it has acquired Smooch, a startup that describes itself as an “omnichannel messaging platform,” which companies’ customer care teams can use to interact with people over messaging platforms like WhatsApp, WeChat, Line and Messenger, as well as SMS and email.

Smooch was in fact one of the first partners for the WhatsApp Business API, alongside VoiceSage, Nexmo, Infobip, Twilio, MessageBird and others already advertising their services in this area.

It had also been a longtime partner of Zendesk’s, powering the company’s own WhatsApp Business integration and other features. The two already have some customers in common, including Uber. Other Smooch customers include Four Seasons, SXSW, Betterment, Clarabridge, Harry’s, LVMH, Delivery Hero and BarkBox.

Terms of the deal are not being disclosed, but Zendesk SVP class=”il”>Shawna Wolverton said in an interview that the startup’s entire team of 48, led by co-founder and CEO Warren Levitan, are being offered positions with Zendesk. Smooch is based out of Montreal, Canada — so this represents an expansion for Zendesk into building an office in Canada.

Its backers included iNovia, TA Associates and Real Ventures, who collectively had backed it with less than $10 million (when you leave the inflated hills surrounding Silicon Valley, numbers magically decline). As Zendesk is publicly traded, we may get more of a picture of the price in future quarterly reports. This is the company’s fifth acquisition to date.

The deal underscores the big impact that messaging apps are making in customer service. While phone and internet are massive points of contact, messaging apps is one of the most-requested features Zendesk’s customers are requesting, “because they want to be where their customers are,” with WhatsApp — now at 1.5 billion users — currently at the top of the pile, Wolverton said. (More than half of Zendesk’s revenues are from outside the U.S., which speaks to why WhatsApp — which is bigger outside the U..S than it is in it — is a popular request.)

That’s partly a by-product of how popular messaging apps are full-stop, with more than 75% of all smartphone users having at least one messaging app in use on their devices.

“We live in a messaging-centric world, and customers expect the convenience and interactivity of messaging to be part of their experiences,” said Mikkel Svane, Zendesk founder, CEO and chairman, in a statement. “As long-time partners with Smooch, we know first hand how much they have advanced the conversational experience to bring together all forms of messaging and create a continuous conversation between customers and businesses.”

While the two companies were already working together, the acquisition will mean a closer integration.

That will be in multiple areas. Last year, Zendesk launched a new CRM play called Sunshine, going head to head with the likes of Salesforce in helping businesses better organise and make use of customer data. Smooch will build on that strategy to bring in data to Sunshine from messaging apps and the interactions that take place on them. Also last year, Zendesk launched an omnichannel play, a platform called The Suite, which it says “has become one of our most successful products ever,” with a 400% rise in its customers taking an omnichannel approach. Smooch already forms a key part of that, and it will be even more tightly so.

On the outbound side, for now, there will be two areas where Smooch will be used, Wolverton said. First will be on the basic level of giving Zendesk users the ability to see and create messaging app discussions within a dashboard where they are able to monitor and handle all customer relationship contacts: a conversation that was initiated now on, say, Twitter, can be easily moved into WhatsApp or whatever more direct channel someone wants to use.

Second, Wolverton said that customer care workers can use Smooch to send on “micro apps” to users to handle routine service enquiries, for example sending them links to make or change seat assignments on a flight.

Over time, the plan will be to bring more automated options into the experience, which opens the door for using more AI and potentially bots down the line.

Powered by WPeMatico

In August of last year, Getaround scored $300 million from Softbank. Eight months later they handed that same amount to Drivy, a Parisian peer-to-peer car rental service that was Getaround’s ticket to tapping into European markets.

Alven Capital’s Jeremy Uzan

Both companies shared similar visions for the future of car ownership, they were about the same size, both were flirting with expanding beyond their home market, but only one had the power of the Vision Fund behind it.

The Exit is a new series at TechCrunch. It’s an exit interview of sorts with a VC who was in the right place at the right time but made the right call on an investment that paid off. [Have feedback? Shoot me an email at lucas@techcrunch.com]

Alven Capital partner Jeremy Uzan first invested in Drivy’s seed round in 2013. Uzan joined Index Ventures co-leading a $2 million round that valued the company at less than $10 million. The firms would later join forces again for the company’s $8.3 million Series A.

I chatted at length with Uzan about what lies ahead for the Drive team, what Paris’s startup scene is still in desperate need of, and how Softbank’s power is becoming even more impossible to ignore.

The interview has been edited for length and clarity.

Lucas Matney: So before we dive into this acquisition, tell me a little bit about how you got to the point where you were writing these checks in the first place.

Jeremy Uzan: So, I studied computer science and business and then spent three years as a tech banker. I was actually in a very small investment banking boutique in Paris helping young startups to raise their Series A rounds. They were all French companies, my first deal was with the YouTube competitor DailyMotion.

Powered by WPeMatico