Fundings & Exits

Auto Added by WPeMatico

Auto Added by WPeMatico

Shares of Luckin Coffee jumped 20% in its first day of trading on the Nasdaq stock market.

After opening at $17.00, shares of the Chinese Starbucks competitor climbed as high as $25.96, or more than 50%, before settling back down to $20.38 at the market’s close. The company has a market cap north of $5 billion after its first day of trading.

The brick-and-mortar coffee chain has achieved major success in China by offering speedy delivery services to Chinese consumers. The company has nearly 2,400 stores compared to Starbucks’ 3,500, but it has plans to more than double that number by the end of the year as it seeks to become the country’s coffee king.

Luckin’s success doesn’t immediately seem to be thwarting the stock market success of Starbucks, which has had a glowing 2019. The company hit another all-time high Friday, closing out the day at $78.91, up more than 35% from a year ago, giving the Seattle company a market cap of nearly $96 billion.

Starbucks and Luckin Coffee may seem like mortal enemies, but their rivalry is more complicated than one might immediately think. Check out our Extra Crunch deep dive from earlier this week on the Xiamen-based company’s financials.

Powered by WPeMatico

Extra Crunch offers members the opportunity to tune into conference calls led and moderated by the TechCrunch writers you read every day. This week, TechCrunch’s Kate Clark sat down with Eric Yuan, the founder and CEO of video communications startup Zoom, to go behind the curtain on the company’s recent IPO process and its path to the public markets.

Since hitting the trading desks just a few weeks ago, Zoom stock is up over 30%. But the Zoom’s path to becoming a Silicon Valley and Wall Street darling was anything but easy. Eric tells Kate how the company’s early focus on profitability, which is now helping drive the stock’s strong performance out of the gate, actually made it difficult to get VC money early on, and the company’s consistent focus on user experience led to organic growth across different customer bases.

Eric: I experienced the year 2000 dot com crash and the 2008 financial crisis, and it almost wiped out the company. I only got seed money from my friends, and also one or two VCs like AME Cloud Ventures and Qualcomm Ventures.

nd all other institutional VCs had no interest to invest in us. I was very paranoid and always thought “wow, we are not going to survive next week because we cannot raise the capital. And on the way, I thought we have to look into our own destiny. We wanted to be cash flow positive. We wanted to be profitable.

nd so by doing that, people thought I wasn’t as wise, because we’d probably be sacrificing growth, right? And a lot of other companies, they did very well and were not profitable because they focused on growth. And in the future they could be very, very profitable.

Eric and Kate also dive deeper into Zoom’s founding and Eric’s initial decision to leave WebEx to work on a better video communication solution. Eric also offers his take on what the future of video conferencing may look like in the next five to 10 years and gives advice to founders looking to build the next great company.

For access to the full transcription and the call audio, and for the opportunity to participate in future conference calls, become a member of Extra Crunch. Learn more and try it for free.

Kate Clark: Well thanks for joining us Eric.

Eric Yuan: No problem, no problem.

Kate: Super excited to chat about Zoom’s historic IPO. Before we jump into questions, I’m just going to review some of the key events leading up to the IPO, just to give some context to any of the listeners on the call.

Powered by WPeMatico

MultiVu, a Tel Aviv-based startup that is developing a new 3D imaging solution that only relies on a single sensor and some deep learning smarts, today announced that it has raised a $7 million seed round. The round was led by crowdfunding platform OurCrowd, Cardumen Capital and Hong Kong’s Junson Capital.

Tel Aviv University’s TAU Technology Innovation Momentum Fund supported some of the earlier development of MultiVu’s core technology, which came out of Prof. David Mendlovic’s lab at the university. Mendlovic previously co-founded smartphone camera startup Corephotonics, which was recently acquired by Samsung.

The promise of MultiVu’s sensor is that it can offer 3D imaging with a single-lens camera instead of the usual two-sensor setup. This single sensor can extract depth and color data in a single shot.

This makes for a more compact setup and, by extension, a more affordable solution as it requires fewer components. All of this is powered by the company’s patented light field technology.

Currently, the team is focusing on using the sensor for face authentication in phones and other small devices. That’s obviously a growing market, but there are also plenty of other applications for small 3D sensors, ranging from other security use cases to sensors for self-driving cars.

“The technology, which passed the proof-of-concept stage, will bring 3D Face Authentication and affordable 3D imaging to the mobile, automotive, industrial and medical markets,” MultiVu CEO Doron Nevo said. “We are excited to be given the opportunity to commercialize this technology.”

Right now, though, the team is mostly focusing on bringing its sensor to market. The company will use the new funding for that, as well as new marketing and business development activities.

“We are pleased to invest in the future of 3D sensor technologies and believe that MultiVu will penetrate markets, which until now could not take advantage of costly 3D imaging solutions,” said OurCrowd Senior Investment Partner Eli Nir. “We are proud to be investing in a third company founded by Prof. David Mendlovic (who just recently sold CorePhotonics to Samsung), managed by CEO Doron Nevo – a serial entrepreneur with proven successes and a superb team they have gathered around them.”

Powered by WPeMatico

SugarCRM announced today that it has acquired Atlanta-based Salesfusion to help build out the marketing automation side of its business. The deal closed last Friday. The companies did not share the purchase price.

CEO Craig Charlton, who joined the company in February, says he recognized that marketing automation was an area of the platform that badly needed enhancing. Faced with a build or buy decision, he decided it would be faster to buy a company and began looking for an acquisition target.

“We spent the last three or four months doing a fairly intensive market scan and dealing with a number of the possible opportunities, and we decided that Salesfusion was head and shoulders above the rest for a variety of reasons,” he told TechCrunch.

Among those was the fact the company was still growing and some of the targets Sugar looked at were actually shrinking in size. The real attraction for him was Salesfusion’s customer focus. “They have a very differentiated on-boarding process, which I hadn’t seen before. I think that’s one of the reasons why they get such a quick time to value for the customers is because they literally hold their hand for 12 weeks until they graduate from the on-boarding process. And when they graduate, they’re actually live with the product,” he said.

Brent Leary, principal at CRM Essentials, who is also based in Atlanta, thinks this firm could help Sugar by giving it a marketing automation story all its own. “Salesfusion gives Sugar a marketing automation piece they can fully bring into their fold and not have to be at the whims of marketing automation vendors, who end up not being the best fit as partners, whether it’s due to acquisition or instability of leadership at chosen partners,” Leary told TechCrunch.

It has been a period of transition for SugarCRM, which has had a hard time keeping up with giants in the industry, particularly Salesforce. The company dipped into the private equity market last summer and took a substantial investment from Accel-KKR, which several reports pegged as a nine-figure deal, and PitchBook characterized as a leveraged buyout.

As part of that investment, the company replaced long-time CEO Larry Augustin with Charlton and began creating a plan to spend some of that money. In March, it bought email integration firm Collabspot, and Charlton says they aren’t finished yet, with possibly two or three more acquisitions on target for this quarter alone.

“We’re looking to make some waves and grow very aggressively and to drive home some really compelling differentiation that we have, and that will be building over the next 12 to 24 months,” he said.

Salesfusion was founded in 2007 and raised $16 million, according to the company. It will continue to operate out of its offices in Atlanta. The company’s 50 employees are now part of Sugar.

Powered by WPeMatico

OpenFin, the company looking to provide the operating system for the financial services industry, has raised $17 million in funding through a Series C round led by Wells Fargo, with participation from Barclays and existing investors including Bain Capital Ventures, J.P. Morgan and Pivot Investment Partners. Previous investors in OpenFin also include DRW Venture Capital, Euclid Opportunities and NYCA Partners.

Likening itself to “the OS of finance,” OpenFin seeks to be the operating layer on which applications used by financial services companies are built and launched, akin to iOS or Android for your smartphone.

OpenFin’s operating system provides three key solutions which, while present on your mobile phone, has previously been absent in the financial services industry: easier deployment of apps to end users, fast security assurances for applications and interoperability.

Traders, analysts and other financial service employees often find themselves using several separate platforms simultaneously, as they try to source information and quickly execute multiple transactions. Yet historically, the desktop applications used by financial services firms — like trading platforms, data solutions or risk analytics — haven’t communicated with one another, with functions performed in one application not recognized or reflected in external applications.

“On my phone, I can be in my calendar app and tap an address, which opens up Google Maps. From Google Maps, maybe I book an Uber . From Uber, I’ll share my real-time location on messages with my friends. That’s four different apps working together on my phone,” OpenFin CEO and co-founder Mazy Dar explained to TechCrunch. That cross-functionality has long been missing in financial services.

As a result, employees can find themselves losing precious time — which in the world of financial services can often mean losing money — as they juggle multiple screens and perform repetitive processes across different applications.

Additionally, major banks, institutional investors and other financial firms have traditionally deployed natively installed applications in lengthy processes that can often take months, going through long vendor packaging and security reviews that ultimately don’t prevent the software from actually accessing the local system.

OpenFin CEO and co-founder Mazy Dar (Image via OpenFin)

As former analysts and traders at major financial institutions, Dar and his co-founder Chuck Doerr (now president & COO of OpenFin) recognized these major pain points and decided to build a common platform that would enable cross-functionality and instant deployment. And since apps on OpenFin are unable to access local file systems, banks can better ensure security and avoid prolonged yet ineffective security review processes.

And the value proposition offered by OpenFin seems to be quite compelling. OpenFin boasts an impressive roster of customers using its platform, including more than 1,500 major financial firms, almost 40 leading vendors and 15 of the world’s 20 largest banks.

More than 1,000 applications have been built on the OS, with OpenFin now deployed on more than 200,000 desktops — a noteworthy milestone given that the ever-popular Bloomberg Terminal, which is ubiquitously used across financial institutions and investment firms, is deployed on roughly 300,000 desktops.

Since raising their Series B in February 2017, OpenFin’s deployments have more than doubled. The company’s headcount has also doubled and its European presence has tripled. Earlier this year, OpenFin also launched it’s OpenFin Cloud Services platform, which allows financial firms to launch their own private local app stores for employees and customers without writing a single line of code.

To date, OpenFin has raised a total of $40 million in venture funding and plans to use the capital from its latest round for additional hiring and to expand its footprint onto more desktops around the world. In the long run, OpenFin hopes to become the vital operating infrastructure upon which all developers of financial applications are innovating.

“Apple and Google’s mobile operating systems and app stores have enabled more than a million apps that have fundamentally changed how we live,” said Dar. “OpenFin OS and our new app store services enable the next generation of desktop apps that are transforming how we work in financial services.”

Powered by WPeMatico

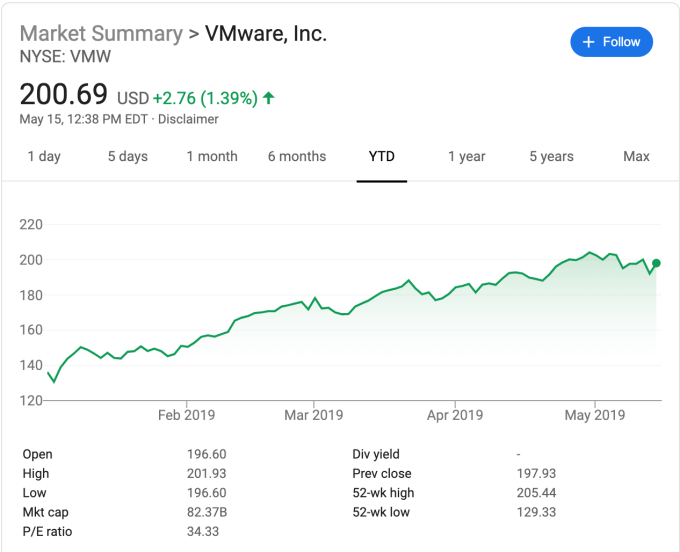

VMware announced today that it’s acquiring Bitnami, the package application company that was a member of the Y Combinator Winter 2013 class. The companies didn’t share the purchase price.

With Bitnami, the company can now deliver more than 130 popular software packages in a variety of formats, such as Docker containers or virtual machine, an approach that should be attractive for VMware as it makes its transformation to be more of a cloud services company.

“Upon close, Bitnami will enable our customers to easily deploy application packages on any cloud — public or hybrid — and in the most optimal format — virtual machine (VM), containers and Kubernetes helm charts. Further, Bitnami will be able to augment our existing efforts to deliver a curated marketplace to VMware customers that offers a rich set of applications and development environments in addition to infrastructure software,” the company wrote in a blog post announcing the deal.

Per usual, Bitnami’s founders see the exit through the prism of being able to build out the platform faster with the help of a much larger company. “Joining forces with VMware means that we will be able to both double-down on the breadth and depth of our current offering and bring Bitnami to even more clouds as well as accelerating our push into the enterprise,” the founders wrote in a blog post on the company website.

Holger Mueller, an analyst at Constellation Research says the deal fits well with VMware’s overall strategy. “Enterprises want easy, fast ways to deploy packaged applications and providers like Bitnami take the complexity out of this process. So this is a key investment for VMware that wants to position itselfy not only as the trusted vendor for virtualizaton across the hybrid cloud, but also as a trusted application delivery vendor,” he said.

The company has raised a modest $1.1 million since its founding in 2011 and says that it has been profitable since early days when it took the funding. In the blog post, the company states that nothing will change for customers from their perspective.

“In a way, nothing is changing. We will continue to develop and maintain our application catalog across all the platforms we support and even expand to additional ones. Additionally, if you are a company using Bitnami in production, a lot of new opportunities just opened up.”

Time will tell whether that is the case, but it is likely that Bitnami will be able to expand its offerings as part of a larger organization like VMware. The deal is expected to close by the end of this quarter (which is fiscal Q2 2020 for VMware).

VMware is a member of the Dell federation of products and came over as part of the massive $67 billion EMC deal in 2016. The company operates independently, is sold as a separate company on the stock market and makes its own acquisitions.

Powered by WPeMatico

Sisense announced today that it has acquired Periscope Data to create what it is calling a complete data science and analytics platform for customers. The companies did not disclose the purchase price.

The two companies’ CEOs met about 18 months ago at a conference, and running similar kinds of companies, hit it off. They began talking and, after a time, realized it might make sense to combine the two startups because each one was attacking the data problem from a different angle.

Sisense, which has raised $174 million, tends to serve business intelligence requirements either for internal use or externally with customers. Periscope, which has raised more than $34 million, looks at the data science end of the business.

Both CEOs say they could have eventually built these capabilities into their respective platforms, but after meeting they decided to bring the two companies together instead, and they made a deal.

Harry Glaser from Periscope Data and Amir Orad of Sisense

“I realized over the last 18 months [as we spoke] that we’re actually building leadership positions into two unique areas of the market that will slowly become one as industries and technologies evolve,” Sisense CEO Amir Orad told TechCrunch.

Periscope CEO Harry Glaser says that as his company built a company around advanced analytics and predictive modeling, he saw a growing opportunity around operationalizing these insights across an organization, something he could do much more quickly in combination with Sisense.

“[We have been] pulled into this broader business intelligence conversation, and it has put us in a place where as we do this merger, we are able to instantly leapfrog the three years it would have taken us to deliver that to our customers, and deliver operationalized insights on integration day on day one,” Glaser explained.

The two executives say this is part of a larger trend about companies becoming more data-driven, a phrase that seems trite by now, but as a recent Harvard Business School study found, it’s still a big challenge for companies to achieve.

Orad says that you can debate the pace of change, but that overall, companies are going to operate better when they use data to drive decisions. “I think it’s an interesting intellectual debate, but the direction is one direction. People who deploy this technology will provide better care, better service, hire better, promote employees and grow them better, have better marketing, better sales and be more cost effective,” he said.

Orad and Glaser recognize that many acquisitions don’t succeed, but they believe they are bringing together two like-minded companies that will have a combined ARR of $100 million and 700 employees.

“That’s the icing on the cake, knowing that the cultures are so compatible, knowing that they work so well together, but it starts from a conviction that this advanced analytics can be operationalized throughout enterprises and [with] their customers. This is going to drive transformation inside our customers that’s really great for them and turns them into data-driven companies,” Glaser said.

Powered by WPeMatico

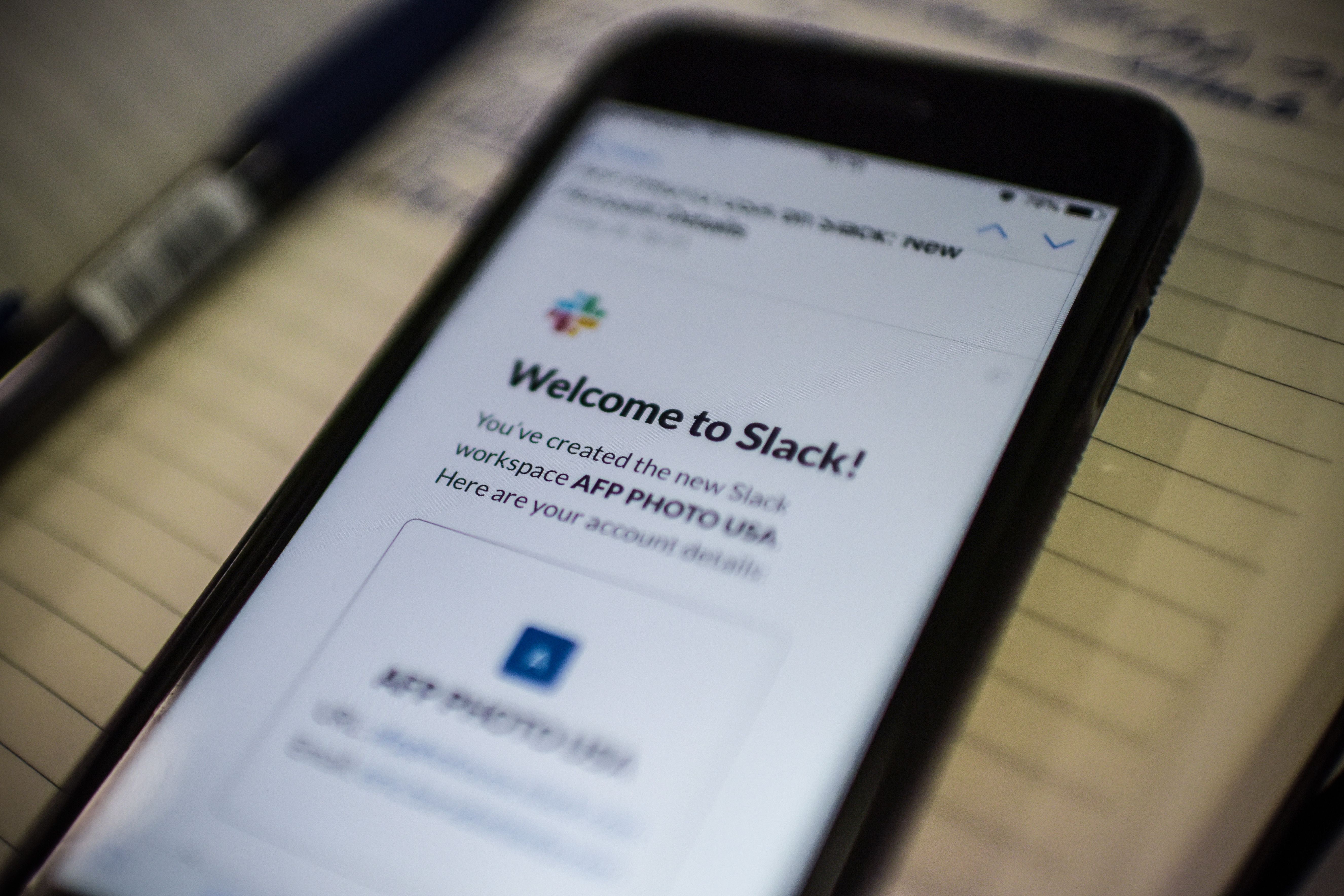

Slack this morning disclosed estimated preliminary financial results for the first quarter of 2019 ahead of a direct listing planned for June 20.

Citing an addition of paid customers, the workplace messaging service posted revenues of about $134 million, up 66% from $81 million in the first quarter of 2018. Losses from operations increased from $26 million in Q1 2018 to roughly $39 million this year.

In addition to filing updated paperwork, the Slack executive team gathered on Monday to make a final pitch to potential shareholders, emphasizing its goal of replacing email within enterprises across the world.

“People deserve to do the best work of their lives,” Slack co-founder and chief executive officer Stewart Butterfield said in a video released alongside a live stream of its investor day event. “This desire of feeling aligned with your team, of removing confusion, of getting clarity; the desire for support in doing the best work of your life, that’s universal, that’s deeply human. It appeals to people with all kinds of roles, in all kinds of industries, at all scales of organization and all cultures.”

“We believe that whoever is able to unlock that potential for people … is going to be the most important software company in the world. We aim to be that company,” he added.”

Slack, valued at more than $7 billion with its last round of venture capital funding, plans to list on the NYSE under the ticker symbol “SK.”

The business filed to go public in April as other well-known tech companies were finalizing their initial public offerings. Following Uber’s disastrous IPO last week, public and private market investors alike will be keeping a close-eye on Slack’s stock market performance, which may determine Wall Street’s future appetite for Silicon Valley’s unicorns.

Though some of the recent tech IPOs performed famously, like Zoom, Uber and Lyft’s performance has served as a cautionary tale for going out in poor market conditions with lofty valuations. Uber began trading last week at below its IPO price of $45 and is today down significantly at just $36 per share. Lyft, for its part, is selling for $47.5 apiece today after pricing at $72 per share in March.

Slack isn’t losing billions per year like Uber, but it’s also not as close to profitability as expected. In the year ending January 31, 2019, Slack posted a net loss of $138.9 million and revenue of $400.6 million. That’s compared to a loss of $140.1 million on revenue of $220.5 million for the year ending January 31, 2018. In its S-1, the company attributed its losses to scaling the business and capitalizing on its market opportunity.

Workplace messaging startup Slack said Monday, February 4, 2019 it had filed a confidential registration for an initial public offering, becoming the latest of a group of richly valued tech enterprises to look to Wall Street. (Photo by Eric BARADAT / AFP) (Photo credit should read ERIC BARADAT/AFP/Getty Images)

Slack currently boasts more than 10 million daily active users across more than 600,000 organizations — 88,000 on the paid plan and 550,000 on the free plan.

Slack has been able to bypass the traditional roadshow process expected of an IPO-ready business, opting for a path to Wall Street popularized by Spotify in 2018. The company plans to complete in mid-June a direct listing, which allows companies to forgo issuing new shares and instead sell directly to the market existing shares held by insiders, employees and investors. The date, however, is subject to change.

Slack has previously raised a total of $1.2 billion in funding from investors, including Accel, Andreessen Horowitz, Social Capital, SoftBank, Google Ventures and Kleiner Perkins.

Powered by WPeMatico

In a carefully framed deal, ServiceNow announced this morning that it has acquired the intellectual property and key personnel of mobile analytics company Appsee for an undisclosed price. Under the terms of the deal, the co-founders and R&D team will be joining ServiceNow after the deal closes.

It’s worth noting that ServiceNow did not acquire Appsee’s customers, and the company is expected to wind down its existing business over the next 12 months.

Appsee provides more than pure numerical analytics. As the name it implies, it lets developers see what the user is seeing by recording an interaction and seeing what went right or wrong as the person used the program.

GIF courtesy of Appsee

ServiceNow wants to take that functionality and incorporate it into its Now Platform, which enables customers to create customized service applications for their businesses, or use mobile applications it has created out of the box.

The company sees this as a way to improve the UI and build more usable apps. “We’ll be able to use Appsee for our mobile app and browser analytics. This can be used across all three of our workflows, and with this level of visibility our customers will be able to see how customers or employees are engaging [with the application]. With these analytics, ServiceNow will be able to provide insights on user behavior. In turn, this will help us provide an improved UI for customers,” a company spokesperson told TechCrunch.

Just last week at its Knowledge 19 customer conference in Las Vegas, the company announced Now Mobile, a new tool for performing tasks like ordering a new laptop or searching for the holiday calendar, and a mobile on-boarding tool for new employees. Both of these will be available in the company’s next release and could benefit from the Appsee functionality to improve the overall design of these products after it releases them to users.

Appsee has always been focused on capturing user activity. Over the years it has layered on more traditional analytics like DAUs (daily active users) and crash rates, the kind of metrics that can give companies insight into their user experience, but they combine that with the visual record to help see more detail about exactly what was happening, along with myriad other features, all of which will be incorporated into the ServiceNow platform moving forward.

The deal is expected to close by the end of Q2 2019.

Powered by WPeMatico

At long last, it’s lift-off for Uber. After pricing its initial public offering at $45 per share, at the bottom end of the range it set previously, to raise $8.1 billion, the transportation startup began trading today on the New York Stock Exchange, and the shares opened at $42, down from the IPO price.

Ahead of Uber finally making its debut, the company had an indication price that went as low as $42 ahead of live trading. With the overall market in a slump this week over trade woes with China, it’s a challenging time to list, to say the least.

Uber had raised $28.5 billion as a private company from no less than 166 different backers, with its last valuation in the region of $75 billion. The $82.4 billion valuation that it finally settled on for the IPO (selling 180 million shares at $45/share) is definitely up from that, but far from the lofty projections of $120 billion that banks and analysts that floated in the months leading up to today.

The figures nevertheless cement Uber, alongside Alibaba and Facebook, as one of the most valuable tech IPOs in history, and a major beacon for breaking ground in a new area of tech, transportation.

But if it is the sheer scale and potential of Uber that catapulted it to such financial heights (real and imaginary), it’s the bare financials that have tempered some of those notions.

On one side, Uber essentially created and currently dominates the market for on-demand transportation, which started with the premise of connecting drivers with passengers by way of an app that tracked the location of both, but eventually evolved into a wider two-sided marketplace ambition that brings together different modes of transportation — including bikes, public buses and more — with human passengers, as well as the movement of other goods like food, all on a global scale.

That model has propelled Uber to 93 million active platform consumers (from 70 million a year ago) and 17 million trips per day across 700 cities on six continents, along with a lot of high hopes from others like PayPal — which are making very late-stage, strategic investments to bank on what it believes could shape up to be a lucrative e-commerce empire in the years to come.

But Uber’s prospects are not without competition — which includes a host of more regional players like Lyft, Gett, Heetch, MyTaxi, Bolt and more — and not without controversy. Even as it goes public, the company is dealing with high-profile driver protests, lawsuits and ongoing regulatory pressures, not to mention a bigger cloud over its business practices that has hovered for years that the company has worked to dispel.

Even today, during the iconic bell ringing, there was a notable absence: former CEO and co-founder Travis Kalanick, who was ousted over the controversies around business practices but still sits on the board, was not up there — although he did show up at the NYSE for the event.

$UBER The Uber drama Continues: Travis Kalanick — who built @Uber in his image and still sits on the board with an 8.6% stake in the company after being ousted almost two years ago — was not on the balcony to ring the Opening… https://t.co/aUKNKSkFd2 pic.twitter.com/R1h6kOli3d

— Silentmax (@silentmax) May 10, 2019

Outside, meanwhile, protesters against the company were also making their voices heard.

Two drivers hold up a protest sign as the Uber banner hangs on the front of the New York Stock Exchange May 10, 2019 in New York. – Uber is set for its Wall Street debut Friday with a massive share offering that is a milestone for the ride-hailing industry, but which comes with simmering concerns about its business model. Shares will be priced at $45 for the initial public offering (IPO). (Photo: DON EMMERT/AFP/Getty Images)

On the pure metric of profit and loss, Uber’s been firmly in the latter column, most recently posting a loss of some $1 billion in the last quarter on revenues of $3 billion-$3.1 billion, versus $2.6 billion a year ago.

Today’s listing is a small pause on the bigger question of how and if Uber will ever turn that boat around. It has made some significant shifts, such as divesting certain regional assets and reducing some of the incentive payments and discounts it made to drivers around the world to lure them to its platform; and under current CEO Dara Khosrowshahi, it has made a concerted effort to play nice on a number of fronts. Khosrowshahi acknowledged the new set of challenges that staff would be facing as of today in a memo he sent out this morning:

As we move from a private to a public company, our jobs will no doubt become harder and all eyes will be on us. We’ll have an even deeper responsibility to our customers, to our shareholders, to our cities, and to each other. With every share purchased, someone else will join us as a co-owner of Uber — and we’ll gain another person to whom we owe a duty to always ‘do the right thing, period.’

Remember: while the public markets will keep their version of the ‘score’ and the value of what we build, our true north will be determined over the long term. We will go through periods when we will be misunderstood, as well as periods when we will be hailed as heroes. It’s during those days, regardless of the ups and downs, that we should focus on our work: on creating opportunity, on moving the world, and relentlessly innovating and executing.

But the big question will still remain of whether all these changes and the recast approach will be enough, and whether — now that it’s listed — public investors will be patient enough. At least in the short term, the performance of its smaller rival, Lyft, which largely operates on similar metrics and business model to Uber, might give some pause: it is currently trading at around $55, well below its debut of $78.29 on March 29.

Powered by WPeMatico