Fundings & Exits

Auto Added by WPeMatico

Auto Added by WPeMatico

Daye, a “femcare” startup developing a new type of tampon that uses CBD to help tackle dysmenorrhea, has quietly raised $5.5 million in funding from high-profile investors in the U.S. and Europe, TechCrunch has learned.

Backing the seed round is Silicon Valley’s Khosla Ventures, along with London’s Index Ventures and Kindred Capital. The investment sees Khosla’s chief of staff Kristina Simmons, Khosla venture partner Tim Westergren (who also founded Pandora), and Hannah Seal, principle at Index, join Daye’s board.

Other investors in the London-based company include Sophia Bendz (former global director of Marketing at Spotify and now a partner at VC firm Atomico), Irina Havas (a principle of Atomico), David Schiff (founding partner at United Talent Agency) and Kristin Cardwell (VP of International Business Development at Refinery29).

Founded by 24-year-old Valentina Milanova and launching later this year, Daye has set out to build a new brand for female health products “designed with women in mind.” The startup’s first product is a newly developed tampon that uses CBD to help tackle period cramps (or dysmenorrhea) as an alternative to traditional painkillers (CBD is the extract derived from the flower of the industrial hemp plant, a legal relative to marijuana). Daye also claims its product will be more hygienic and sustainable than legacy tampons, and if successful could be a wake-up call to the incumbent and stagnant tampon industry, which has seen little innovation in decades.

“Our goal is to raise the standards of women’s hygiene products by tackling three primary issues: dysmenorrhea, manufacturing standards and sustainability,” Milanova tells TechCrunch. “Women have largely been left out of medical innovation. In fact, until 1993, researchers banned women from participating in [early] clinical trials, as it was believed female hormone fluctuations polluted medical data. To this day, most medications, including those for pain relief, depression and sleeping aids, have not been tested on women. We’re redefining localised cramp-relief, relying on an ingredient that we’ve tested on women first.”

Milanova says she first had the idea for a cramp-fighting tampon in November 2017 and initially used her salary from a day job and credit cards to fund product development. In September 2018, she quit her job to work on the business full-time and build a team, and to finalise clinical trials for the product.

Describing CBD as “having its 15 minutes of fame,” Milanova says the company doesn’t believe cannabidiol should be added to everything, from dry shampoo to cocktails. However, she says CBD is much safer than over-the-counter painkillers, and that the vaginal canal has the highest concentration of cannabinoid receptors and is also the fastest route of absorption into the bloodstream when it comes to pain relief.

Describing CBD as “having its 15 minutes of fame,” Milanova says the company doesn’t believe cannabidiol should be added to everything, from dry shampoo to cocktails. However, she says CBD is much safer than over-the-counter painkillers, and that the vaginal canal has the highest concentration of cannabinoid receptors and is also the fastest route of absorption into the bloodstream when it comes to pain relief.

“Unlike most CBD products on the market today, our product does not contain any tetrahydrocannabinol (THC),” she explains. “This is why we believe we’re going to be attractive to every consumer who experiences menstrual discomfort.”

Beyond the novel idea of a cramp-fighting CBD tampon, Milanova says Daye wants to raise the bar for tampon production standards and sustainability.

“In Europe, tampons are not classified as medical devices, which means there are no manufacturing guidelines — for context, plasters are more regulated and better sanitised than tampons,” she tells me, to my astonishment. To address this, Daye is introducing pharmaceutical-grade standards and will keep manufacturing in-house.

Period care is also “wreaking havoc” on the environment. “Over the course of her lifetime, the average woman uses enough tampons to fill two double-decker buses. That waste either ends up in our oceans or landfills. We want to relieve the burden period care has on the environment, and offer a product that is equal parts body-safe, effective and as sustainable as possible.”

To begin to answer the question of why something like this hasn’t been done before, Milanova says that menstrual discomfort in general is a massively overlooked problem and that “even the mention of the word tampon makes most people feel uncomfortable.”

The existing market is also monopolised “to the point where innovation suffers.” All tampons on the market today perform and look the same, using the same materials and the same manufacturing processes. Yet, because there’s barely any product differentiation, the Daye founder says most women remain loyal to the first tampon brand they ever tried.

“What we’re bringing to market is a completely novel product, and we’re operating in a very sensitive, intimate area of consumer goods. As a newcomer, we have to gain consumer trust by ensuring we’re in constant contact with our users, taking note of their feedback and iterating on our proposition fast.”

Powered by WPeMatico

OneDegree, an insurance technology startup based in Hong Kong, announced today it has extended its Series A round to $30 million, up from the $25.5 million it announced in September. Its extension, which the company is calling its “A2” round, was led by BitRock Capital, an investment firm that focuses on financial tech. Cyberport Macro Fund, Cathay Venture and investors from its initial Series A also participated.

The company is preparing to launch its online insurance platform, designed to make buying insurance plans easier for both consumers and providers by using data analytics to automate the most tedious parts of the process. The company will start with medical insurance for pets after its license is approved by the Hong Kong Insurance Authority before expanding into other products, including travel, cyber and human medical insurance.

In a press statement, OneDegree co-founder Alvin Kwock said its strategy is “not to compete head-on with traditional insurers, but rather to work together, steering the whole industry towards a fully digital ecosystem.”

Powered by WPeMatico

Slack, the ubiquitous workplace messaging tool, will make its pitch to prospective shareholders on Monday at an invite-only event in New York City, the company confirmed in a blog post on Wednesday. Slack stock is expected to begin trading on the New York Stock Exchange as soon as next month.

Slack, which is pursuing a direct listing, will live stream Monday’s Investor Day on its website.

An alternative to an initial public offering, direct listings allow businesses to forgo issuing new shares and instead sell directly to the market existing shares held by insiders, employees and investors. Slack, like Spotify, has been able to bypass the traditional roadshow process expected of an IPO-ready business, as well as some of the exorbitant Wall Street fees.

Spotify, if you remember, similarly live streamed an event that is typically for investors eyes only. If Slack’s event is anything like the music streaming giant’s, Slack co-founder and chief executive officer Stewart Butterfield will speak to the company’s greater mission alongside several other executives.

Slack unveiled documents for a public listing two weeks ago. In its SEC filing, the company disclosed a net loss of $138.9 million and revenue of $400.6 million in the fiscal year ending January 31, 2019. That’s compared to a loss of $140.1 million on revenue of $220.5 million for the year before.

Additionally, the company said it reached 10 million daily active users earlier this year across more than 600,000 organizations.

Slack has previously raised a total of $1.2 billion in funding from investors, including Accel, Andreessen Horowitz, Social Capital, SoftBank, Google Ventures and Kleiner Perkins.

Powered by WPeMatico

HeyJobs, a three-year-old Berlin startup that helps large employers scale recruitment, has raised $12 million in Series A funding.

The round is led by Notion Capital, with participation from existing investors Creathor Ventures, Rocket Internet’s GFC and newly re-branded Heartcore Capital.

Founded in 2016 and launched the following year, HeyJobs aims to tackle the recruitment problem European employers are facing due to steep declines in available workforce as the so-called the “boomer” generation nears retirement (this is seeing Germany alone losing 500,000 workers annually, apparently).

The HeyJobs platform leverages machine learning in an attempt to make high-skilled recruitment more scalable. It promises to match talent with job profiles and draw in the best candidates via targeted marketing and a “personalized application and assessment flow.”

“We use a fully automated technological approach to help candidates find jobs and companies find employees,” says HeyJobs co-founder and CEO Marius Luther.

“For example, we deploy multiple machine learning algorithms to find the right potential candidates for a specific role (asking ‘who are the most likely candidates for an intensive care nurse role in East London?’). Our technology then makes sure candidates see the job proposal on channels such as Facebook, Instagram, job platforms and across the web.”

In addition, Luther says that HeyJobs’ personalized assessment ensures that the company only delivers to employers high-quality, hireable candidates, something he dubs as “predictable hiring” at scale.

“Our clients are typically the talent acquisition teams of employers with high-volume recruitment needs,” he explains. “In Germany, 8/10 largest employers (by headcount) are our clients. Typical industries would be logistics (i.e. DPD, UPS), retail (i.e. Vodafone) and hospitality (i.e. h-hotels, Five Guys). However our real customer is the non-academic job seeker who is looking for a job that will help him/her live a more fulfilling life — be it by being paid more, switching to better employment conditions or finding a job closer to home.”

To that end, HeyJobs says it is now serving more than 500 enterprise clients, including United Parcel Service, PayPal, Five Guys, Vodafone and Securitas. The company generates revenue via a range of business models, from subscription to per-hire success fees.

“The cost per hire is typically a fraction of what clients would pay job boards on a per-post basis or what they would pay to staffing firms on a per-hire basis,” adds the HeyJobs CEO.

Powered by WPeMatico

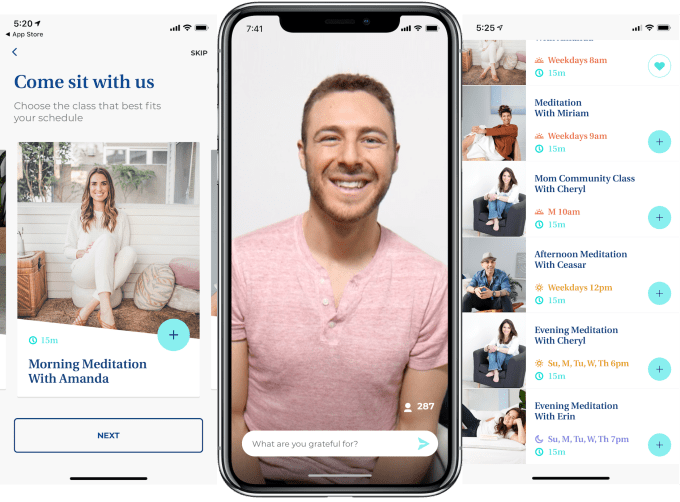

Sitting silently with your eyes closed isn’t fun, but it’s good for you… so you probably don’t meditate as often as you’d like. In that sense, it’s quite similar to exercise. But people do show up when prodded by the urgency and peer pressure of scheduled group cycling or aerobics classes. What’s still in the way is actually hauling your lazy butt to the gym, hence the rise of Peloton’s in-home stationary bike with attached screen streaming live and on-demand classes. My butt is particularly lazy, but I’ve done 80 Peloton rides in four months. The model works.

Now that model is coming to mindfulness with the launch of Journey LIVE, a subscription iOS app offering live 15-minute group meditation classes. With sessions starting most waking hours, instructors that interact with you directly and a sense of herd mentality, you feel compelled to dedicate the time to clearing your thoughts. By video and voice, the teachers introduce different meditation theories and practices, guide you through and answer questions you can type in. Each day, Journey also provides a newly recorded on-demand session in case you need a class on your own schedule.

” ‘I tried Headspace’ or ‘I tried Calm .’ With a lot of the current meditation apps, people go on but they drop off very quickly,” says Journey founder and CEO Stephen Sokoler. “It means that there’s an interest in meditating and having a better life but people fall off because meditating alone is hard, it’s confusing, it’s boring. Meditating with a live teacher who can connect with you and say your name, who makes you feel seen and heard makes a huge difference.”

Journey subscriptions start at $19.99 per month after a week-long free trial. That feels a bit steep, but prices drop to $7.99 if paid annually with the launch discount, or you can dive in with a $399 lifetime pass. The challenge will be keeping users from abandoning meditation and then their subscription without resorting to growth hacking and annoying notifications that are antithetical to the whole concept. Journey has now raised a $2.4 million seed round led by Canaan and joined by Brooklyn Bridge Ventures, Betaworks and more to get the company rolling.

Journey subscriptions start at $19.99 per month after a week-long free trial. That feels a bit steep, but prices drop to $7.99 if paid annually with the launch discount, or you can dive in with a $399 lifetime pass. The challenge will be keeping users from abandoning meditation and then their subscription without resorting to growth hacking and annoying notifications that are antithetical to the whole concept. Journey has now raised a $2.4 million seed round led by Canaan and joined by Brooklyn Bridge Ventures, Betaworks and more to get the company rolling.

Sokoler’s own journey could set an example of the possibilities of sticking with it. “Meditation changed my life. I was fortunate enough to move to Australia, find a book on Buddhism, and then I had the willpower to start practicing meditation every day,” he tells me. “I lost 85 pounds. People ask me how I lost the weight and they expect me to say a diet like keto or Atkins, but it was because of the program I was in.” Suddenly able to sit quietly with himself, Sokoler didn’t need food to stay occupied or feel at ease.

The founder saw the need for new sources of happiness while working in employee rewards and recognition for 12 years. He built up a company that makes mementos for commemorating big business deals. Meditation proved to him the value of developing inner quiet, whether to inspire happiness, calm, focus or deeper connections to other people and the world. Yet the popular meditation apps ignored thousands of years of tradition when meditation would be taught in groups that give a naturally ethereal activity more structure. He founded Journey in 2015 to bring meditation to corporate environments, but now is hoping to democratize access with the launch of Journey LIVE.

“You could think of it as a real-life meditation community or studio in the palm of your hand,” Sokoler explains. Instructors greet you when you join a session in the Journey app and can give you a shout-out for practicing multiple days in a row. They help you concentrate on your breath while giving enough instruction to keep you from falling asleep. You can see or hide a list of screen names of other participants that make you feel less isolated and encourage you not to quit.

Finding a market amidst the popular on-demand meditation apps will be an uphill climb for Journey LIVE. While classes recorded a long time ago might not be as engaging, they’re convenient and can dig deep into certain styles and intentions. Calm and Headspace run around $12.99 per month, making them cheaper than Journey LIVE and potentially easier to scale.

But Sokoler says his app’s beta testing saw better retention than competitors. “If you’ve ever been to the New York Public Library, there’s so many books versus going to a local curated bookstore where something is right there for you. This is much more approachable, much more accessible,” Sokoler tells me. “There’s a paradox of choice, and having so many options makes it hard for people to stick with it and come back every single day.”

With our phones and Netflix erasing the downtime we used to rely on to give our brain a break or reflect on our day, life is starting to feel claustrophobic. We’re tense, anxious and easily overwhelmed. Meditation could be the antidote. Unlike with cycling or weightlifting, you don’t need some expensive Peloton bike or Tonal home gym. What you need is consistency, and an impetus to slow down for 15 minutes you could easily squander. We’re a tribal species, and Journey LIVE group classes could use camaraderie to lure us into the satisfying void of nirvana.

Powered by WPeMatico

Most of the strategy discussions and news coverage in the media and entertainment industry is concerned with the unfolding corporate mega-mergers and the political implications of social media platforms.

These are important conversations, but they’re largely a story of twentieth-century media (and broader society) finally responding to the dominance Web 2.0 companies have achieved.

To entrepreneurs and VCs, the more pressing focus is on what the next generation of companies to transform entertainment will look like. Like other sectors, the underlying force is advances in artificial intelligence and computing power.

In this context, that results in a merging of gaming and linear storytelling into new interactive media. To highlight the opportunities here, I asked nine top VCs to share where they are putting their money.

Here are the media investment theses of: Cyan Banister (Founders Fund), Alex Taussig (Lightspeed), Matt Hartman (betaworks), Stephanie Zhan (Sequoia), Jordan Fudge (Sinai), Christian Dorffer (Sweet Capital), Charles Hudson (Precursor), MG Siegler (GV), and Eric Hippeau (Lerer Hippeau).

“In 2018 I was obsessed with the idea of how you can bring AI and entertainment together. Having made early investments in Brud, A.I. Foundation, Artie and Fable, it became clear that the missing piece behind most AR experiences was a lack of memory.

Powered by WPeMatico

Health coaching app developer Noom announced today that it has raised $58 million led by Sequoia Capital.

Other participants include Aglaé Ventures, the tech investment arm of French holding company Groupe Arnault, WhatsApp co-founder and former CEO Jan Koum, DoorDash co-founder and CEO Tony Xu, Oscar Health co-founder Josh Kushner, SB Project co-founder Scooter Braun and returning investor Samsung Ventures.

Headquartered in New York City with offices in Seoul and Tokyo, Noom is best known for its direct-to-consumer weight loss app, but it also develops enterprise products, including an app focused on diabetes and hypertension. Noom’s consumer app competes for users with Under Armour’s MyFitnessPal and Weight Watchers, but its closest rival is probably nutrition and weight loss app Rise because both offer personalized programs and coaching for a subscription fee.

Noom aims to set itself apart by focusing on long-term lifestyle and behavior changes, in addition to calorie, nutrition and exercise tracking. Users get access to 1:1 coaching and fitness programs personalized by an algorithm based on how they answer a questionnaire.

The company will use its new funding to hire more people for product development. In a press statement, Koum said he invested in Noom because it “has many of the same traits that helped WhatsApp disrupt the communications industry. Noom is so far ahead of the competition when it comes to technology, execution and brand recognition that it will be difficult for any company to catch up.”

Powered by WPeMatico

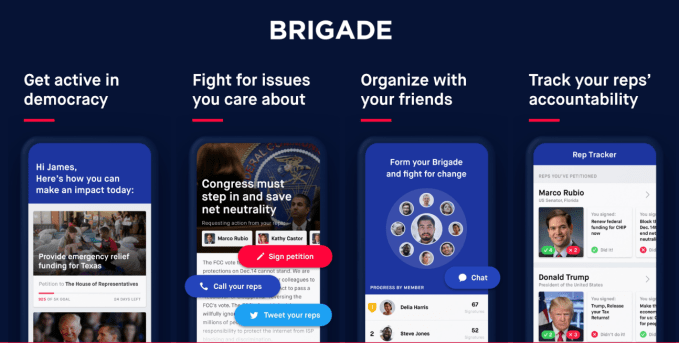

Causes grew to a jaw-dropping 200 million users as one of the first 10 Facebook platform apps. Started by Facebook co-founder Sean Parker, it was meant to turn a generation into activists and philanthropists. Causes acquired Votizen to augment shallow clicktivism with a way to remind friends to vote. But after Facebook went mobile and the web platform waned, Parker arranged Causes’ sale to his newer civic tech effort Brigade, for which he’d led a $9.3 million Series A and later fed more money. Brigade’s ballot guide was used by 250,000 people in the 2016 election, leading to 5 million Get Out The Vote messages sent, but the startup’s apps for connecting with campaigns or debating political issues never went viral like Causes.

Now both Causes’ and Brigade’s stories are coming to an end. In February, we caught wind of Brigade selling off its high-grade engineering team to Pinterest in an acqui-hire while it sought a home for its IP. Today, Brigade announces its technology and data have been acquired by politician-tracking service Countable. Terms of the deal were not disclosed, but it’s unlikely that Brigade’s Series A investors earned a return.

“While we didn’t reach the ultimate mountaintop, I think we moved the entire civic tech space forward,” Brigade CEO Matt Mahan tells me. “Countable offers a unique opportunity to bring greater scale to some of our best ideas, and our previous work will in turn accelerate their already impressive progress.”

Brigade’s features

Countable lets people view summaries of upcoming legislation, contact their representatives about their opinion and track the officials’ votes. “Brigade was founded with the non-partisan mission to reinvent how Americans participate in politics. When they decided to bring their journey to a close, Matt and Brigade’s leadership team sought a mission-aligned company to acquire their technology, and a responsible place to point any members of their community who were eager to remain civically active and engaged,” says Countable CEO Bart Myers, whose tech has powered 35 million civic actions. “They approached Countable — an obvious fit for our commitment to lowering barriers to civic entry and empowering meaningful action, and we’re excited to provide a home for their technology moving forward.”

Brigade CEO Matt Mahan

Mahan admits that a potentially fatal wrong turn for Brigade was pivoting its product to “debates” in 2016. “We quickly learned that this level of openness resulted in less substantive discussion, more personal attacks and fewer participants willing to add their voices: the opposite of our goals. By removing too many barriers, debates empowered the loudest and most aggressive voices in the room,” he tells me. The startup course-corrected to focus on making real political impact with petitions and tools for contacting representatives.

By 2018, Mahan realized that “after two election cycles Brigade had not achieved the user scale we know is required to fundamentally transform our politics . . . For a company set up to be a civic moonshot, this was simply not good enough.” Parker’s team did not provide TechCrunch a statement or commentary on Brigade’s decline. The startup’s San Francisco-based engineering team was too pricey for civic tech companies to afford, but those that could pay the steep price didn’t need Brigade’s IP. So after approaching a half-dozen potential acquirers, Mahan split the company, selling the team to Pinterest and the tech to Countable. The cash and stock deal will make Brigade investors shareholders in Countable, and Mahan is taking an advisory role.

To further their contribution to the democracy innovation community, Countable has agreed to open-source Brigade’s voter matching software. This allows apps to tie a user to their official voting record to offer personalized features, like reminders of upcoming elections, petitions for local issues and ways to contact their elected officials. Seth Flaxman, the CEO of civic tech software developer Democracy Works, which built TurboVote, says, “This is extremely difficult technology to build and can help TurboVote determine which of our 6 million users needs more help registering to vote. They are passing the baton, making it possible for nonprofits like ours to build off their progress.”

Countable

But there was one more loose end to tie up. Causes sucked in a ton of Facebook user data in the early days of the platform before restrictions were put in place (too late to stop Cambridge Analytica). So Mahan tells me, “Brigade proactively reached out to Facebook and worked with them and a third-party consultant to conduct a comprehensive review to identify and delete user data that was not essential for providing the existing app experience. In all, we deleted billions of rows of data that ethically we felt should not be transferred.”

As one of the most well-funded civic tech startups, Brigade’s breakup could cast a shadow on the space that includes MoveOn and Change.org. Consumer-focused apps for improving democracy are tough to monetize. It may fall to more sustainable democracy-focused startups like grassroots mass-texting app Hustle or nonprofits like Avaaz to arm the public with the equipment and knowledge necessary to participate in the political process. Given the deep polarization and animosity between nations’ political parties around the world, we need all the tools to amplify truth and civility we can get.

Powered by WPeMatico

With news that the We Company (formerly known as WeWork) has officially filed to go public confidentially with the SEC today, there’s a big question on everyone’s mind: Is this the next massive startup win or a house of cards waiting to be toppled by the glare of the public markets?

No company I follow has as much polarized opinion as the We Company. And while the company will have to reveal at least some of its hand in its official S-1, my guess is that the polarization around the company will not be alleviated until well after it goes public, if ever.

The challenge with understanding its business is how much the details of each of its leases, real estate markets and tenants matter to its bottom line. We already know the top line numbers: the company had revenue of $1.8 billion in 2018, and a net loss of $1.9 billion that year. That led to the received opinion that the company has an extraordinarily weak business. As Crunchbase News editor Alex Wilhelm put it:

Powered by WPeMatico

Edtech and recruitment continue to converge. London-based online degree platform, FutureLearn, is taking £50 million (~$64.6M) from Australian-based online job matching group, Seek, in exchange for a 50 per cent stake in the business — just days after the same group led a massive Series E in U.S. online learning giant Coursera.

U.K. distance learning veteran, the Open University — which had wholly owned the FutureLearn platform up til now — retains a 50 per cent stake in the business following the Seek Group investment.

In a press release announcing the news, FutureLearn said the investment values it at £100M ($129M) — some six years after the initiative was first announced, with the OU bringing together a consortium of U.K. universities to attack the MOOCs/online learning space which was then being rapidly expanded by U.S. edtech startups.

“Our partnership with Seek and the investment in FutureLearn will take our unique mission to make education open for all into new parts of the world. Education improves lives, communities and economies and is a truly global product, with no tariffs on ideas,” said OU vice chancellor Mary Kellett in a statement on the investment.

The joint venture will have “contractual arrangements” to protect its academic independence, teaching methods and curriculum, the OU added — in an attempt to assuage concerns about an (overly) commercially minded takeover of its fledgling digital education platform.

The first FutureLearn courses launched in fall 2013. Since then a cumulative total of nine million+ people have signed up to learn via its platform — which now offers around 2,000 courses in all.

This includes short courses; postgraduate diplomas and certificates; all the way up to fully online degrees. (FutureLearn partners with six U.K. universities on the full degree courses at this stage.)

FutureLearn also has partnerships with management consultancy firm Accenture; the British Council; the Chartered Institute of Personnel and Development; learn-to-code foundation Raspberry Pi; and Health Education England (part of the UK’s National Health Service); and is involved in U.K. government-backed initiatives to address skills gaps — including The Institute of Coding and the National Centre for Computing Education.

Last fall the Financial Times reported that the OU was looking for a £40M capital injection for FutureLearn to fund more courses and better compete with the scale of U.S. edtech giants — like Coursera and Lynda.com.

It’s not clear how many more courses FutureLearn plans to add with its new partner on board; a spokesperson told us it is not able to provide a figure at this stage.

For a little comparative context, some 40M people have taken online classes via Coursera to date — with that platform currently offering some 3,200 courses, and partnering with the likes of Columbia University, Johns Hopkins and the University of Michigan. While Coursera’s $103M in Series E reportedly valued its business at well over a $1BN, with Seek coming on board as a strategic investor.

The shared investor is an interesting but perhaps not surprising development given the different markets involved, and the challenge of monetizing free-to-access courses without having massive scale — suggesting the Seek group, which is already well established across Australia, New Zealand, China, South East Asia, Brazil and Mexico — sees more opportunities from strengthening regional online learning platform plays, in Europe and the U.S., to grow the overall online learning pipe and expand adjacent cross-marketing options in employment/job matching.

Last week, when its strategic investment in Coursera was announced, the Seek group talked effusively about how edtech platforms enabling up-skilling and re-skilling are “aligned” with its employment-focused business mission. (Or “our purpose of helping people live fulfilling working lives”, as it put it.)

The FutureLearn partnership provides Seek with access to another pool of potential job seekers — including actively engaged learners in the UK/Europe — to further grow the geographical reach of its recruitment platform.

Commenting on the investment in a statement, Seek co-founder and CEO Andrew Bassat said: “Technology is increasing the accessibility of quality education and can help millions of people up-skill and re-skill to adapt to rapidly changing labour markets. We see FutureLearn as a key enabler for education at scale.”

“FutureLearn’s reputation is strong and it has attracted leading education providers onto its platform. We are excited to come on as a partner with The Open University,” he added.

FutureLearn’s CEO Simon Nelson said the joint venture will allow the learning platform to extend its global reach and impact.

“This investment allows us to focus on developing more great courses and qualifications that both learners and employers will value,” he said in a statement. “This includes building a portfolio of micro-credentials and broadening our range of flexible, fully online degrees and being able to enhance support for our growing number of international partners to empower them to build credible digital strategies, and in doing so, transform access to education.”

Powered by WPeMatico