Fundings & Exits

Auto Added by WPeMatico

Auto Added by WPeMatico

Slack has filed to go public via a direct listing. Similar to what Spotify did last year, this means that the company won’t have a traditional IPO, and will instead allow existing shareholders to sell their stock to investors.

The company’s S-1 filing says it plans to make $100 million worth of shares available, but that’s probably a placeholder figure.

The S-1 offers data about the company’s financial performance, reporting a net loss of $138.9 million and revenue of $400.6 million in the fiscal year ending January 31, 2019. That’s compared to a loss of $140.1 million on revenue of $220.5 million for the year before.

The company attributes these losses to its decision “to invest in growing our business to capitalize on our market opportunity,” and notes that they’re shrinking as a percentage of revenue.

Slack also says that in the three months ending on January 31, it had more than 10 million daily active users across more than 600,000 organizations — 88,000 on the paid plan and 550,000 on the free plan.

In the filing, the company says the Slack team created the product to meet its own collaboration needs.

“Since our public launch in 2014, it has become apparent that organizations worldwide have similar needs, and are now finding the solution with Slack,” it says. “Our growth is largely due to word-of-mouth recommendations. Slack usage inside organizations of all kinds is typically initially driven bottoms-up, by end users. Despite this, we (and the rest of the world) still have a hard time explaining Slack. It’s been called an operating system for teams, a hub for collaboration, a connective tissue across the organization, and much else. Fundamentally, it is a new layer of the business technology stack in a category that is still being defined.”

The company suggests that the total market opportunity for Slack and other makers of workplace collaboration software is $28 billion, and it plans to grow through strategies like expanding its footprint within organizations already using Slack, investing in more enterprise features, expanding internationally and growing the developer ecosystem.

The risk factors mentioned in the filing sound pretty boilerplate and/or similar to other internet companies going public, like the aforementioned net losses and the fact that its current growth rate might not be sustainable, as well as new compliance risks under Europe’s GDPR.

Slack has previously raised a total of $1.2 billion in funding, according to Crunchbase, from investors including Accel, Andreessen Horowitz, Social Capital, SoftBank, Google Ventures and Kleiner Perkins.

Powered by WPeMatico

RosieReality, a startup out of Zürich developing consumer augmented reality experiences, has raised $2.2 million in seed funding led by Redalpine. Other backers include Shasta Ventures, Atomico partners Mattias Ljungman and Siraj Khaliq (both of whom invested in a personal capacity) and Akatsuki Entertainment Fund.

Founded in early 2018, RosieReality’s first AR experience is designed to ignite kids interested in robotics and programming. The smart phone camera-based app is centred around “Rosie,” a cute AR robot that inhabits a “Lego-like” modular AR world within which you and your friends are tasked with building and solving world-size 3D puzzles.

The kicker: to solve these 3D-puzzle games requires “programming” Rosie to move around the augmented reality world.

“By developing Rosie the Robot, we created the first interactive and modular world that exclusively lives in your camera feed,” RosieReality co-founder and CEO Selim Benayat tells TechCrunch. “We use this new computational platform to enable kids to creatively build, solve and share world-sized puzzle games with friends and families – much like modern-day Lego.”

“By developing Rosie the Robot, we created the first interactive and modular world that exclusively lives in your camera feed,” RosieReality co-founder and CEO Selim Benayat tells TechCrunch. “We use this new computational platform to enable kids to creatively build, solve and share world-sized puzzle games with friends and families – much like modern-day Lego.”

Describing Rosie the Robot’s typical users as teens that “like the challenge of intricately crafted puzzles,” Benayat says part of the inspiration behind the AR game was remembering how as a kid he used to love spending time building stuff and then inviting friends over to show them what he’d built.

“Kids today are not that different,” he argues, before adding that AR makes it possible for them to have the same tangible and contextual sensation while giving them a bigger outlet for their creativity.

“We see the camera as a tool to teach and enable [the] next generation of creators. For us gaming is the ultimate creative, social and educational outlet,” says the RosieReality CEO.

Powered by WPeMatico

Last week, at TechCrunch’s robotics event at UC Berkeley, we sat down with four VCs who are making a range of bets on robotics companies, from drone technologies to robots whose immediate applications aren’t yet clear. Featuring Peter Barrett of Playground Global, Helen Liang of FoundersX Ventures, Eric Migicovsky of Y Combinator and Andy Wheeler of GV (pictured above), we covered a lot of terrain (no pun intended), including whether last-mile delivery robots make sense and how much robots should be expected to do without human intervention.

We also discussed climate change and how it factors into their bets, and why the many private enterprises focused on creating fully automated vehicles may need to do much more to empower the cities in which they plan to operate. You can find excerpts of our talk below. And for access to the full transcript, become a member of Extra Crunch. Learn more and try it for free.

TC: How do you think about investing in the here and now, versus the future (which is complicated for VCs, given that venture funds need to produce returns within a ten-year window, typically):

PB: One of the challenges with investing in robotics is that robotics companies do tend to take a lot longer to mature than your average enterprise SaaS company. There are some classes of investments that we know the technology works; it’s just a question of commercializing it and bringing it to market, and Canvas [a Playground-backed company that makes autonomous warehouse carts and was just acquired by Amazon] did an extraordinary job of finding a market that existed and had technology in hand that would solve that problem.

There’s other stuff like the amazing work that the folks are doing at Agility [Robotics] with a biped that can operate for many hours in unstructured human environments that today is really, candidly, a research robot, and to reach its long-term aspirations, there’s a whole other set of technologies that we’ll need to develop as the company matures.

We think about blending the stuff that’s very impactful but is going to take a long time because it’s fundamentally a new science and technology that needs to be created, [with] immediate applications of technologies that are proven today, that we’re deploying against real markets.

AW: As for whether we try to build a portfolio where there are exits at different stages, generally, when I’m looking to invest in a robotics thing, I understand that the timeframes can be fairly long, and so what we’re looking for are things that really are going to be very large opportunities — that can generate billion-dollar-plus exits.

TC: A growing number of small last-mile delivery robots has attracted funding. Helen, your firm is an investor in one of these startups, Robby. What’s the appeal?

HL: We look at where we see a pain point in the market. During our team meetings on Fridays, we always use DoorDash. It feels awkward when we order a $100 meal, and the delivery person has driven a long way. We’ll give him a $15, but it’s still [tricky for that person] in terms of economics. If you have a central station for the food delivery, and robots can handle that last-mile delivery, we think that’s a more cost-effective approach.

Robby has partnered with PepsiCo [to delivering snacks to students attending the University of the Pacific in Stockton, Ca.] that makes it more like a vending machine, and we think that’s an interesting market, too. We’ll see how fast adoption will happen.

EM: YC is an investor in Robby as well, and we think of this as kind of the perfect example of how hackers can get into a fairly complex industry. When you look at some robotics and specifically autonomous vehicles, you see extremely large investments going into some of the some of the big players, but then at the same time, you see groups and hackers that are able to use off-the-shelf technology to solve real problems that affect businesses or people, and build services or products that that are valuable. We’ve seen this over and over.

You don’t have to be looking for a large VC investment to compete in the space. It is possible to stay frugal stay nimble and build something on a small scale to demonstrate that you found a problem that people are willing to pay money to solve. Then, if you’re interested, [you can] pursue larger VC investment or not. It’s kind of open right now.

TC: VCs we’ve talked with in the past have suggested that in robotics, they often see cool ideas for which there isn’t necessarily a market or big market need. Is this also your experience?

PB: This is a common pattern where there was some mechanism, some capability of the robot, some feat of dexterity or something [and founders think, ‘That’s really cool, I’m going to make a company out of it.’ But we think about it in terms of, what do you want from the robots? What’s the outcome that everybody agrees is worthwhile? And then, how do you find and build companies to achieve those goals?

One thing we’re struggling with right now is that there’s no real hardware or software platforms. You think about 10 years hence [and] the kinds of things we’ll be investing in, [and it’s] robotics applications that are aggregates of neural networks and some explicit software bound together in some form that can be delivered, so a large enterprise can use an application and not have everybody start from first principles. Because right now, when you built a robotics application, you make all the hardware, you make all the software. All the intellectual and actual capital [money] gets dissipated, building and rebuilding those same things. So robotics applications over time will be investable, much more like the way we invest in software, and that will allow smaller units of creativity to produce useful products.

TC: Andy, how long do you think it’s going to take until we get there?

AW: I think I think we’re making we’re making steady progress on that front. To your earlier question, this space has a lot of folks that are building technology a bit in search of a problem. That’s a common thing in startups generally. I would encourage everybody who’s looking to build a startup in the space is to really find a burning business problem. In the course of solving those [problems], people will build these platforms that Peter was talking about, and we’ll eventually get there in terms of [founders] just having to focus on the application layer.

TC: There are so many buckets: delivery robots, self-driving trucks. Both relate in ways to the overarching problem for our age, which is climate change. How much do you factor climate change into the investing decisions that you make?

PB: When we look at applications and robotics in agricultural, a lot of [our questions are] around how do you deal with a minimum carbon footprint, [and] how you replace workers who are missing. And dealing with climate change will be increasingly be a central thought in what we want from our robots. [After all] what we want from them is the ability to maintain or improve the lifestyles we have without further unwinding the environment.

TC: We talked backstage, and you think we are over-indexing on autonomy as the answer.

PB: When we think about autonomy, it’s not clear how autonomy helps cities. . . There are absolutely applications for autonomy, [including] on a farm or in a logistics environment. I think we still really don’t know how to do Level 5 [which is complete automation, requiring zero human assistance]. And I don’t think we know whether it’s exponentially hard or asymptotically. I think it’s decades before there’s any significant Level 5.

[In the meantime, if] we cared about safety, we’d install roundabouts or lower the blood alcohol limit and not try and make a sentient vehicle that drives on the road the way we do, right?

I’d much rather see having the city collaborate with the vehicles and instrument the city to collaborate with clever vehicles for the benefit of everybody who lives there. But that’s not Level 5 autonomy as the way we think of it

EM: It’s slightly interesting that autonomous vehicles, specifically the individual passenger car, evolved in America, because it’s one of the countries that has the least public transport per capita. And that that’s one of the things that the industry has to acknowledge — that there are other options that can be blended into the transport solutions for cities.

It seems like it might be happening because it’s something that an individual can take somewhat control over. You can’t own a bus, but you can own or [rent] a self-driving car.

PB: Or [an electric] scooter or a bike, right. The future of mobility is going to be a blending of all of these things. But not taking advantage of a logistics platform in a city means you’re kind of doing it the hard way, trying to make a robot to have all the human priors required to drive safely. And it’s just not clear that we know how to do that yet.

TC: Andy, GV is a big investor in Uber. What what’s your thinking? Does the city need to be a kind of central brain in order for these private enterprises to work effectively?

AW: I don’t think it’s a strict requirement at all. We’ve seen success with with self-driving trials where the city is not super involved from an infrastructure perspective, I do think it makes it a lot easier if that’s the case, though.

Powered by WPeMatico

Pinterest is a great place to find digital art but a terrible place to sell it. The fact that anything online is infinitely copyable makes it tough for artists to establish a sense of scarcity necessary for their work to be perceived as valuable. Yash Nelapati saw this struggle up close as Pinterest’s first employee. Now he has started MakersPlace, where creators can generate a blockchain fingerprint for each of their artworks that proves who made it and lets it be sold as part of a limited edition.

Similar to Etsy, MakersPlace allows artists to sell their creations while the startup takes a 15 percent cut. Collectors receive a non-fungible cryptocurrency token connoting ownership of a limited-edition digital print of the artwork that they can store in their own crypto wallet or in one on MakersPlace. The MakersPlace site officially launches today after a year of beta testing.

“At Pinterest, we noticed that there are millions of digital creators that are spending countless hours creating digital artwork, but they struggle with basic things like attribution,” says MakersPlace co-founder Dannie Chu, who spent six years leading growth engineering at Pinterest. “Their work is getting printed, copied, shared and ultimately they make very little money from it being put online. If you can’t create a sustainable model for digital creators to create, you’re not going to have art.”

If software is eating art, Uncork Capital wants a seat at the dinner table. It has led a $2 million seed round for MakersPlace, joined by Draper Dragon Fund and Abstract Ventures, plus angels from Pinterest, Facebook, Zillow and Coinbase. They see the crypto-tokenized digital photo of a rose that sold for $1 million last year as just the start of a thriving blockchain art market. “That was a light-bulb moment for us. People are actually valuing digital creations like physical creations,” says Chu.

Hiscox estimates there were $4.64 billion in online art sales (though mostly of traditional offline art) in 2018, compared to Art Basel‘s estimate of $67.4 billion in total art sales for the year. MakersPlace could be well-positioned as more art is sold online and more of it becomes truly digital. “MakersPlace has already partnered with thousands of incredible digital artists selling their unique artwork, a testament to the easy-to-use platform they’ve built,” said Uncork Managing Partner Jeff Clavier. “They’ve also created a seamless and fun, one-stop-shop for discovering and collecting digital artwork.”

The startup’s technology is designed so artists fingerprinting their work don’t need extensive blockchain experience. They just upload it to MakersPlace before sharing it elsewhere, verify their identity through an integration with Civic where they take a photo holding their driver’s license, and an Ethereum-based token is generated with the creator’s name, the art’s name, its impression and edition number and the date. An Ethereum token name, ID, contract ID and creator’s ID are all assigned so there’s a permanent record of authorship.

Art collectors can browse MakersPlace’s categories for animation, photography, drawings, pixel art and 3D creations; explore recent and popular uploads; or search by specific artist or art piece. They can buy art with a credit card or with Ether; use, display or distribute it for non-commercial purchases; or resell it on the secondary market. MakersPlace assumes no ownership of the art it hosts.

One major concern is that artists unaware of MakersPlace might have their works fraudulently fingerprinted and attributed to a thief. Chu says that “We use a mix of website, email and identity verification services to do this (we use civic.com). This is a strong deterrent to uploading and establishing attribution for stolen digital creations.” But you could still imagine the headache for less-tech-savvy artists if their creative identity gets hijacked.

One major concern is that artists unaware of MakersPlace might have their works fraudulently fingerprinted and attributed to a thief. Chu says that “We use a mix of website, email and identity verification services to do this (we use civic.com). This is a strong deterrent to uploading and establishing attribution for stolen digital creations.” But you could still imagine the headache for less-tech-savvy artists if their creative identity gets hijacked.

There’s plenty of other blockchain entrants into the art world, from Blockchain Art Collective‘s NFC stickers for registering physical art to artist tipping platform ArtByte. Many startups are trying to solve the art attribution problem, including Monegraph, KnownOrigin, Bitmark, CodexProtocol, Artory and more. MakersPlace will have to hope its talent, Silicon Valley funding and focus on digital works will differentiate it from the pack.

As we move to a culture where so many of the things that represent our identity, from photographs to music, have become endlessly replicable, the concept of possession has lost its meaning. Yet we’re still hoarders deep down, scared of not having enough. “Collecting is an innate human behavior, but as people become more urban, mobile and minimalist, physical keepsakes have become less appealing,” Nelapati concludes. “Our mission is to create a platform that incentivizes creators by giving them ownership over the work they produce.”

[Featured Image: bunny style by Chocotoy]

Powered by WPeMatico

Embrace, an LA-based startup that offers a mobile-first application performance management platform, today announced that it has raised a $4.5 million funding round led by Pritzker Group Venture Capital. This brings the company’s total funding to $7 million. New investors Greycroft, Miramar Ventures and Vy Captial also participated in this round, as did previous investors Eniac Ventures, The Chernin Group, Techstars Ventures, Tikhon Bernstam of Parse and others.

Current Embrace customers include the likes of Home Depot, Headspace, OkCupid, Boxed, Thrive Market and TuneIn. These companies use the service to get a better view of how their apps perform on their users’ devices.

As Embrace CEO and co-founder Eric Futoran, who also co-founded entertainment company Scopely, argues, too many similar services mostly focus on crashes, yet those only constitute a small number of the actual user experience issues in most apps. “To a large extent, crashes are solved,” he told me. “The crash percentages are often 99.8 percent crash-free and yet users are still complaining.”

That’s because there are plenty of other issues beyond code exceptions, which many tools focus on almost exclusively, that can force an app to close (think memory issues or the OS shutting down the app because it uses too many CPU cycles). “To users, that looks like a crash. Your app closed. But in no way, that’s a crash from a technical perspective,” Futoran noted.

Raising this new round, Futoran told me, was pretty easy. Indeed, Pritzker approached the company. “It was not fundraising,” he said. “They sat us down and said, ‘we want to fund you guys,’ which I find pretty unusual. So I’ve been calling it a pre-emptive round.” He also noted that having Pritzker involved should help open up the mid-west market for Embrace, which is mostly focusing on enterprise customers (though Futoran’s definition of “enterprise” includes the likes of digital-first companies like Headspace).

“We saw many organizations trust Embrace’s seamless and innovative optimization platform to quickly identify and resolve any user-impacting issues within their apps, and we’re optimistic about the future of the company in this growing market,” said Gabe Greenbaum, an LA-based partner for Pritzker Group Venture Capital. “We look forward to this next stage in the company’s growth journey and are honored to partner with Eric and Fredric to help them achieve their vision.”

The company plans to use the new funding to increase its go-to-market capabilities, and grow its team to build out its technology.

Powered by WPeMatico

Extra Crunch offers members the opportunity to tune into conference calls led and moderated by the TechCrunch writers you read every day. This week, TechCrunch’s Brian Heater and Lucas Matney shared their key takeaways from our Robotics + AI Sessions event at UC Berkeley last week.

The event was filled with panels, demos and intimate discussions with key robotics and deep learning founders, executives and technologists. Brian and Lucas discuss which companies excited them most, as well as which verticals have the most exciting growth prospects in the robotics world.

“This is the second [robotics event] in a row that was done at Berkeley where people really know the events; they respect it, they trust it and we’re able to get really, I would say far and away the top names in robotics. It was honestly a room full of all-stars.

I think our Disrupt events are definitely skewed towards investors and entrepreneurs that may be fresh off getting some seed or Series A cash so they can drop some money on a big-ticket item. But here it’s cool because there are so many students. robotics founders and a lot of wide-eyed people wandering from the student union grabbing a pass and coming in. So it’s a cool different level of energy that I think we’re used to.

And I’ll say that this is the key way in which we’ve been able to recruit some of the really big people like why we keep getting Boston Dynamics back to the event, who generally are very secretive.”

Brian and Lucas dive deeper into how several of the major robotics companies and technologies have evolved over time, and also dig into the key patterns and best practices seen in successful robotics startups.

For access to the full transcription and the call audio, and for the opportunity to participate in future conference calls, become a member of Extra Crunch. Learn more and try it for free.

Powered by WPeMatico

Mfine, an India-based startup aiming to broaden access to doctors and healthcare by using the internet, has pulled in a $17.2 million Series B funding round for growth.

The company is led by four co-founders from Myntra, the fashion commerce startup acquired by Flipkart in 2014. They include CEO Prasad Kompalli and Ashutosh Lawania who started the business in 2017 and were later joined by Ajit Narayanan and Arjun Choudhary, Myntra’s former CTO and head of growth, respectively.

The round is led by Japan’s SBI Investment with participation from sibling fund SBI Ven Capital and another Japanese investor, Beenext. Existing Mfine backers Stellaris Venture Partners and Prime Venture Partners also returned to follow-on. Mfine has now raised nearly $23 million to date.

“In India, at a macro-level, good doctors are far and few and distributed very unevenly,” Kompalli said in an interview with TechCrunch. “We asked ‘Can we build a platform that is a very large hospital on the cloud?,’ that’s the fundamental premise.”

There’s already plenty of money in Indian healthtech platforms — Practo, for one, has raised more than $180 million from investors like Tencent — but Mfine differentiates itself with a focus on partnerships with hospitals and clinics, while others have offered more daily health communities that include remote sessions with doctors and healthcare professionals who are recruited independently of their day job.

“We are entering a different phase of what is called healthtech… the problems that are going to be solved will be much deeper in nature,” Kompalli said in an interview with TechCrunch.

Mfine makes its money as a digital extension of its healthcare partners, essentially. That means it takes a cut of spending from consumers. The company claims to work with more than 500 doctors from 100 “top” hospitals, while there’s a big focus on tech. In particular, it says that an AI-powered “virtual doctor” can help in areas that include summarising diagnostic reports, narrowing down symptoms, providing care advice and helping with preventative care. There are also other services, including medicine delivery from partner pharmacies.

To date, Mfine said that its platform has helped with more than 100,000 consultations across 800 towns in India during the last 15 months. It claims it is seeing around 20,000 consultations per month. Beyond helping increase the utilization of GPs — Mfine claims it can boost their productivity 3 to 4X — the service can also help hospitals and centers increase their revenue, a precious commodity for many.

Going forward, Kompalli said the company is increasing its efforts with corporate companies, where it can help cover employee healthcare needs, and developing its insurance-style subscription service. Over the coming few years, that channel should account for around half of all revenue, he added.

A more immediate goal is to expand its offline work beyond Hyderabad and Bangalore, the two cities where it currently operates.

“This round is a real endorsement from global investors that the model is working,” he added.

Powered by WPeMatico

Blueshift is a startup founded by tech industry veterans who saw first-hand how difficult cross-channel marketing was. They decided to launch a company and build a cross-channel marketing platform from the ground up that uses AI and machine learning to make sense of the growing amount of customer data. Today, the startup announced a $15 million Series B round to keep it going.

The round was led by SoftBank Ventures Asia, a fund focused on AI startups like Blueshift . Previous investors Storm Ventures and Nexus Venture Partners also participated. Today’s investment brings the total raised to $30 million, according to the company.

Company co-founder and CEO Vijay Chittoor says the marketing landscape is changing, and he believes that requires a new approach to allow marketers to take advantage of the multiple channels where they could be engaging with customers from a single tool.

“If you thought about the world of customer engagement at Walmart or Groupon [or any other retailer] 10 years ago, it was primarily an email problem. Today, we as customers, we’re interacting with these brands on not just email, but also on mobile notifications, Facebook custom audiences and WeChat [and across multiple other channels],” he explained.

He says that this has created a lot more data, which it turns out is a double-edged sword for marketing pros. “I think on one end, it’s exciting for a marketer or a CMO to have more data and more channels. It gives them more ways to connect. But at the same time, it’s also more challenging because now you have to make sense of a thousand times more data. And you have to use it intelligently on not just one channel like email, but you’re now trying to make sense of data across 15 different channels,” Chittoor said.

This a crowded field, with big players like Adobe, Salesforce and Oracle, among others, offering similar cross-channel, AI-fueled solutions. In addition, startups are attracting huge chunks of money to attack this problem, including Klayvio pulling in $150 million a couple of weeks ago and Iterable, which landed $50 million last month.

He says his company’s differentiator is the AI piece, and it is this piece that the company’s lead investor in this round has been focusing on in its investments. The company plans to use this round to continue building out its marketing platform and show marketers how to communicate intelligently across channels wherever the consumer happens to be. Customers include LendingTree, Udacity and BBC.

Powered by WPeMatico

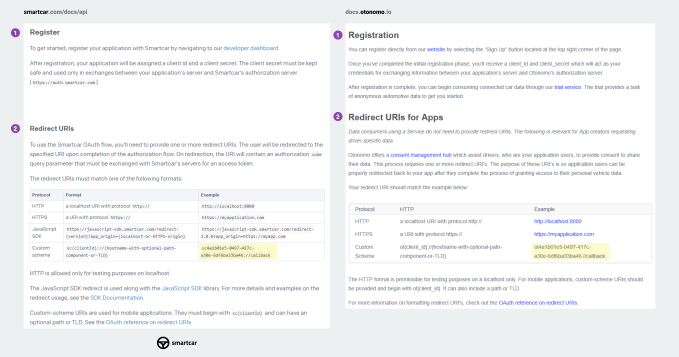

Ruthless copying is common in tech. Just ask Snapchat. However, it’s typically more conceptual than literal. But car API startup Smartcar claims that its competitor Otonomo copy-and-pasted Smartcar’s API documentation, allegedly plagiarizing it extensively to the point of including the original’s typos and randomly generated strings of code. It’s published a series of side-by-side screenshots detailing the supposed theft of its intellectual property.

Smartcar CEO Sahas Katta says “We do have evidence of several of their employees systemically using our product with behavior indicating they wanted to copy our product in both form and function.” Now a spokesperson for the startup tells me “We’ve filed a cease-and-desist letter, delivered to Otonomo this morning, that contains documented aspects of different breaches and violations.”

The accusations are troubling given Otonomo is not some inconsequential upstart. The Israel-based company has raised over $50 million since its founding in 2015, and its investors include auto parts giant Aptiv (formerly Delphi) and prestigious VC firm Bessemer Ventures Partners. Otonomo CMO Lisa Joy provided this statement in response to the allegations, noting it will investigate but is confident it acted with integrity:

Otonomo prides itself on providing a completely unique offering backed by our own intellectual property and patents. We take Smartcar’s questions seriously and are conducting an investigation, but we remain confident that our rigorous standards of integrity remain uncompromised. If our investigation reveals any issues, we will immediately take the necessary steps to address them.

Both startups are trying to build an API layer that connects data from cars with app developers so they can build products that can locate, unlock, or harness data from vehicles. The 20-person Mountain View-based Smartcar has raised $12 million from Andreessen Horowitz and NEA. A major deciding factor in who’ll win this market is which platform offers the best documentation that makes it easiest for developers to integrate the APIs.

“A few days ago, we came across Otonomo’s publicly available API documentation. As we read through it, we quickly realized that something was off. It looked familiar. Oddly familiar. That’s because we wrote it” Smartcar explains in its blog post. “We didn’t just find a few vague similarities to Smartcar’s documentation. Otonomo’s docs are a systematically written rip-off of ours – from the overall structure, right down to code samples and even typos.”

The screenshot above comparing API documentation from Smartcar on the left and Otonomo on the right appears to show Otonomo used nearly identical formatting and the exact same randomly generated sample identifier (highlighted) as Smartcar. Further examples flag seemingly identical code strings and snippets.

Smartcar founder and CEO Sahas Katta

Otonomo has pulled down their docs.otonomo.io documentation website, but TechCrunch has reviewed an Archive.org Wayback Machine showing this Otonomo site as of April 5, 2019 featured sections that are identical to the documentation Smartcar published in August 2018. That includes Smartcar’s typo “it will returned here”, and its randomly generated sample code placeholder “”4a1b01e5-0497-417c-a30e-6df6ba33ba46” which both appear in the Wayback Machine copy of Otonomo’s docs. The typo was fixed in this version of Otonomo’s docs that’s still publicly available, but that code string remains.

“It would be a one in a quintillion chance of them happening to land on the same randomly generated string” Smartcar’s Katta tells TechCrunch.

Yet curiously, Otonomo’s CMO told TechCrunch that “The materials that [Smartcar] put on their post are all publicly accessible documentation, It’s all public domain content.” But that’s not true, Katta argues, given the definition of ‘public domain’ is content belonging to the public that’s uncopyrightable. “I would sure hope not, considering . . . we have proper copyright notices at the bottom. Our product is our intellectual property. Just like Twilio’s API documentation or Stripe’s, it is published and publicly available — and it is proprietary.”

Otonomo’s Lisa Joy noted that her startup is currently fundraising for its Series C, which reportedly already includes $10 million from South Korean energy and telecom holdings giant SK. “We’re in the middle of raising a round right now. That round is not done” she told me. But if Otonomo gets a reputation for allegedly copying its API docs, that could hurt its standing with developers and potentially endanger that funding round.

Powered by WPeMatico

Africa has made its global IPO debut. Pan-African e-commerce company Jumia—a $1 billion-valued company—began trading live on the NYSE last week.

The stock offering made Jumia the first upstart operating in Africa to list on a major global exchange.

This raises expectations for unicorns and IPOs to create the continent’s first wave of startup moguls. But unlike other markets, big public listings and nine-figure valuations could remain rare in Africa.

The rise of venture arms and startup acquisitions will factor more prominently than IPOs in creating Africa’s early startup successes.

I’ll break down why. First, a quick briefer.

Not everyone may be aware, but yes, Africa has a booming tech scene. When measured by monetary values, it’s minuscule by Shenzen or Silicon Valley standards.

Powered by WPeMatico