Fundings & Exits

Auto Added by WPeMatico

Auto Added by WPeMatico

Microsoft has never been shy about being acquisitive, and today it announced it’s buying Express Logic, a San Diego company that has developed a real-time operating system (RTOS) aimed at controlling the growing number of IoT devices in the world.

The companies did not share the purchase price.

Express Logic is not some wide-eyed, pie-in-the-sky startup. It has been around for 23 years, building (in its own words) “industrial-grade RTOS and middleware software solutions for embedded and IoT developers.” The company boasts some 6.2 billion (yes, billion) devices running its systems. That number did not escape Sam George, director of Azure IoT at Microsoft, but as he wrote in a blog post announcing the deal, there is a reason for this popularity.

“This widespread popularity is driven by demand for technology to support resource constrained environments, especially those that require safety and security,” George wrote.

Holger Mueller, an analyst with Constellation Research, says that market share also gives Microsoft instant platform credibility. “This is a key acquisition for Microsoft: on the strategy side Microsoft is showing it is serious with investing heavily into IoT, and on the product side it’s a key step to get into the operating system code of the popular RTOS,” Mueller told TechCrunch.

The beauty of Express Logic’s approach is that it can work in low-power and low-resource environments and offers a proven solution for a range or products. “Manufacturers building products across a range of categories — from low-capacity sensors like lightbulbs and temperature gauges to air conditioners, medical devices and network appliances — leverage the size, safety and security benefits of Express Logic solutions to achieve faster time to market,” George wrote.

Writing in a blog post to his customers announcing the deal, Express Logic CEO William E. Lamie, expressed optimism that the company can grow even further as part of the Microsoft family. “Effective immediately, our ThreadX RTOS and supporting software technology, as well as our talented engineering staff join Microsoft. This complements Microsoft’s existing premier security offering in the microcontroller space,” he wrote.

Microsoft is getting an established company with a proven product that can help it scale its Azure IoT business. The acquisition is part of a $5 billion investment in IoT the company announced last April that includes a number of Azure pieces, such as Azure Sphere, Azure Digital Twins, Azure IoT Edge, Azure Maps and Azure IoT Central.

“With this acquisition, we will unlock access to billions of new connected endpoints, grow the number of devices that can seamlessly connect to Azure and enable new intelligent capabilities. Express Logic’s ThreadX RTOS joins Microsoft’s growing support for IoT devices and is complementary with Azure Sphere, our premier security offering in the microcontroller space,” George wrote.

Powered by WPeMatico

Over the past half a decade, the tidal wave of niche brands delivering new kinds of products to consumers and doing so online has changed the retail and CPG landscapes forever.

This shift has in some way caused a shakeout in traditional retail, with once-popular retailers announcing store closures (JCPenney, Sears) or even liquidation (Payless, Toys R Us) and has sent fashion houses and CPG brands on a soul-searching journey. The changing demographics and desires of shoppers have also fueled the decline of traditional brands and their distribution mechanisms.

This bleak scenario of incumbent consumer brands is in stark contrast to the rapid emergence of a host of digitally-native Direct to Consumer (D2C) brands. A few D2C brands have been successful enough to become unicorns! Retailers like Walmart, Nordstrom, and Target have quickly adapted to the D2C era.

Walmart has made a string of acquisitions beginning with Jet.com and Bonobos. Nordstrom has broadened its assortment to include D2C brands, Target has partnered with Harry’s, Quip, and Flamingo – all of which have rolled out their products in Target’s stores across the country. Target has also invested in Casper, which is the latest D2C brand to become a Unicorn.

Venture capital firms have invested over four billion dollars in D2C brands since 2012, with 2018 alone accounting for over a billion. With investment comes pressure to scale and deliver profits. And this pressure is bringing the focus on some pertinent questions – How are these D2C brands going to evolve and how could they sustain as businesses?

Like always, the pioneering companies find their path and we then derive the playbooks out of them. From PipeCandy’s analysis of several D2C brands, we see the following approaches taken by D2C brands.

We discuss the market size and capital availability factors that influence the paths and the outcomes.

Many of these D2C brands that have experienced early success owe their rise largely to an authentic relationship with consumers that is built on the promise of one product. In many ways, focusing on one product line and a small set of SKUs makes total business sense.

Design, Production, Marketing & Customer Support complexities can stay manageable with such deliberate narrowing down of focus.

In some categories, you could stay focused on one product line for a long time and build a successful company.

Powered by WPeMatico

Spotinst, the cloud automation and optimization startup founded in Tel Aviv but now with offices in San Francisco, New York and London, has acquired AWS partner StratCloud. Terms of the deal remain undisclosed, although I’m hearing it combines both cash and stock and was somewhere in the region of $5 million.

As part of the acquisition, StratCloud’s team of 15 people will be joining Spotinst, including founder Patrick Gartlan, who will become VP, Cloud Services at Spotinst. StratCloud hadn’t raised any venture capital but instead was bootstrapped by Gartlan, who was the former CTO of cloud optimization company CloudCheckr.

Founded in 2015, Spotinst enables enterprises to optimize their cloud infrastructure usage by automating the process of using excess — and therefore cheaper — capacity from leading cloud providers.

As TechCrunch’s Ron Miller previously explained, cloud platforms like AWS, Microsoft Azure and Google Cloud Platform, all of which Spotinst supports, have to maintain more resources than they need at any given time. All three companies offer steep discounts to customers who want to access these resources, but they come with a strict condition that the platforms can take those resources back whenever they need them — which is where Spotinst (and today’s acquisition of StratCloud) comes in.

Spotinst’s platform manages the process of acquiring spare capacity, powered by predictive AI, and seamlessly switches providers before it’s withdrawn. This ensures that cloud computing “workloads” keep functioning, while the customer still receives the best possible price.

Meanwhile, StratCloud tech is described as an “optimization platform” that buys, sells and converts reserved capacity, therefore maximizing savings for on-demand infrastructure. “This leads to lower compute payments, without engineers having to change anything in the applications and infrastructure they manage,” explains Spotinst.

Related to this, Spotinst will migrate StratCloud’s several dozen customers to the Spotinst platform, where they’ll continue to receive all of the current functionality.

Overall, the acquisition means Spotinst can now offer a complete solution for cloud users, including offering reserved instances and unused computer power so that enterprises can run any workload and support large-scale migrations on any cloud provider. In addition, Spotinst says the combined technologies give Managed Service Providers (MSPs) a comprehensive tool to optimize cloud workloads for all of their managed customers.

Spotinst claims more than 1,500 enterprise customers in 52 countries, including Samsung, N26, Duolingo, Ticketmaster and Wix. The company currently employs approximately 150 staff across its four offices and has raised $52 million in VC funding to date.

Powered by WPeMatico

Pinterest priced shares of its stock, “PINS,” above its anticipated range on Wednesday evening, CNBC reports. The company will sell 75 million shares of Class A common stock at $19 apiece in an offering that will attract $1.4 billion in new capital for the visual search engine.

The NYSE-listed business had planned to sell its shares at between $15 to $17 and didn’t increase the size of its planned offering prior to Wednesday’s pricing.

Valued at $12.3 billion in 2017, the initial public offering gives Pinterest a fully diluted market cap of $12.6 billion.

The IPO has been a long time coming for the nearly 10-year-old company led by co-founder and chief executive officer Ben Silbermann . Given Wall Street’s lackluster demand for ride-hailing company Lyft, another consumer technology stock that recently made its Nasdaq debut, it’s unclear just how well Pinterest will perform in the days, weeks, months and years to come. Pinterest is unprofitable like its fellow unicorns Lyft and Uber, but its financials, disclosed in its IPO prospectus, illustrate a clear path to profitability. As for Lyft and Uber, Wall Street analysts, among others, still question whether either of the businesses will ever achieve profitability.

Eric Kim of consumer tech investment firm Goodwater Capital says despite the fact that Pinterest and Lyft are very different companies, Lyft’s falling stock has undoubtedly impacted Pinterest’s offering.

“They are so close together, it’s hard for those not to influence one another,” Kim told TechCrunch. “It’s a much different category, but they are still both consumer tech and they will both be trading at a double-digital revenue multiple.

The San Francisco-based company posted revenue of $755.9 million in the year ending December 31, 2018 — 16 times less than its latest decacorn valuation — on losses of $62.9 million. That’s up from $472.8 million in revenue in 2017 on losses of $130 million.

The stock offering represents a big liquidity event for a handful of investors. Pinterest had raised a modest $1.47 billion in equity funding from Bessemer Venture Partners, which holds a 13.1 percent pre-IPO stake, FirstMark Capital (9.8 percent), Andreessen Horowitz (9.6 percent), Fidelity Investments (7.1 percent) and Valiant Capital Partners (6 percent). Bessemer’s stake is worth upwards of $1 billion. FirstMark and a16z’s shares will be worth more than $700 million each.

Zoom — another tech company going public on Thursday that, unlike its peers, is actually profitable — priced its shares on Wednesday too after increasing the price range of its IPO earlier this week. The price values Zoom at roughly $9 billion, nearly surpassing Pinterest, an impressive feat considering Zoom was last valued at $1 billion in 2017 around when Pinterest’s Series H valued it at a whopping $12.3 billion.

Profitability, as it turns out, may mean more to Wall Street than Silicon Valley thinks.

Powered by WPeMatico

Salesforce announced today it’s buying another company built on its platform. This time it’s MapAnything, which, as the name implies, helps companies build location-based workflows, something that could come in handy for sales or service calls.

The companies did not reveal the selling price, and Salesforce didn’t have anything to add beyond a brief press release announcing the deal.

“The addition of MapAnything to Salesforce will help the world’s leading brands accurately plan: how many people they need, where to put them, how to make them as productive as possible, how to track what’s being done in real time and what they can learn to improve going forward,” Salesforce wrote in the statement announcing the deal.

It was a logical acquisition on many levels. In addition to being built on the Salesforce platform, the product was sold through the Salesforce AppExchange, and over the years MapAnything has been a Salesforce SI Partner, an ISV Premier Partner, according the company.

“Salesforce’s pending acquisition of MapAnything comes at a critical time for brands. Customer Experience is rapidly overtaking price as the leading reason companies win in the market. Leading companies like MillerCoors, Michelin, Unilever, Synchrony Financial and Mohawk Industries have all seen how location-enabled field sales and service professionals can focus on the right activities against the right customers, improving their productivity, and allowing them to provide value in every interaction,” company co-founder and CEO John Stewart wrote in a blog post announcing the deal.

MapAnything boasts 1,900 customers in total, and that is likely to grow substantially once it officially becomes part of the Salesforce family later this year.

MapAnything was founded in 2009, so it’s been around long enough to raise more than $84 million, according to Crunchbase. Last year, we covered the company’s $33.1 million Series B round, which was led by Columbus Nova.

At the time of the funding CEO John Stewart told me that his company’s products present location data more logically on a map instead of in a table. “Our Core product helps users (most often field-based sales or service workers) visualize their data on a map, interact with it to drive productivity, and then use geolocation services like our mobile app or complex routing to determine the right cadence to meet them,” Stewart told me last year.

It raised an additional $42.5 million last November. Investors included General Motors Ventures and (unsurprisingly) Salesforce Ventures.

Powered by WPeMatico

Zoom, a relatively under-the-radar tech unicorn, has defied expectations with its initial public offering. The video conferencing business priced its IPO above its planned range on Wednesday, confirming plans to sell shares of its Nasdaq stock, titled “ZM,” at $36 apiece, CNBC reports.

The company initially planned to price its shares at between $28 and $32 per share, but following big demand for a piece of a profitable tech business, Zoom increased expectations, announcing plans to sell shares at between $33 and $35 apiece.

The offering gives Zoom an initial market cap of roughly $9 billion, or nine times that of its most recent private market valuation.

Zoom plans to sell 9,911,434 shares of Class A common stock in the listing, to bring in about $350 million in new capital.

If you haven’t had the chance to dive into Zoom’s IPO prospectus, here’s a quick run-down of its financials:

Zoom is backed by Emergence Capital, which owns a 12.2 percent pre-IPO stake; Sequoia Capital (11.1 percent); Digital Mobile Venture, a fund affiliated with former Zoom board member Samuel Chen (8.5 percent); and Bucantini Enterprises Limited (5.9 percent), a fund owned by Chinese billionaire Li Ka-shing.

Zoom will debut on the Nasdaq the same day Pinterest will go public on the NYSE. Pinterest, for its part, has priced its shares above its planned range, per The Wall Street Journal.

Powered by WPeMatico

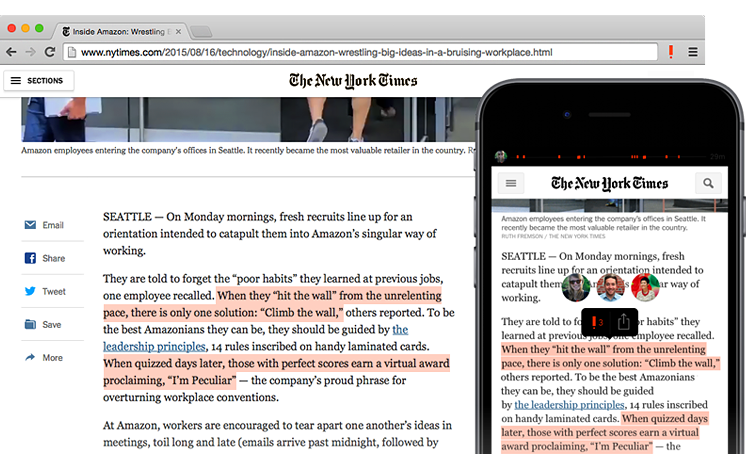

Quotes from articles are much more eye-catching than links on Twitter, so the social giant is scooping up the team behind highlight-sharing app Highly. This talent could help Twitter build its own version of Highly or develop other ways to excerpt the best content from websites and get it into the timeline.

Twitter confirmed to TechCrunch that the deal was an acqui-hire, and a spokesperson provided this statement: “We are excited to welcome the Highly team to Twitter. Their expertise will accelerate our product and design thinking around making Twitter more conversational.” We’ve asked about what data portability options Highly will offer.

Highly will shut down its iOS and Slack app on April 26th, though it promises that “No highlights will be harmed.” It’s also making its paid “Crowd Control” for private highlight sharing plus Highly For Teams free in the meantime.

“Social highlights can make sharing stories online feel personal, efficient and alive — like retelling a story to a friend, over coffee. They give people shared context and spark meaningful conversations,” the Highly team writes.

Quotes can make the difference between someone breezing past a link they don’t want to leave Twitter to explore, and getting a peek at what’s smart about an article so they know if it’s worth diving deeper. Many people use OneShot to generate Twitter-formatted screenshots of posts. But Highly lets you just rub your finger over text to turn it into an image with a link back to the article for easy tweeting. You could also search an archive of your past highlights, and follow curators who spot the best quotes. Its browser extensions and native app let you highlight from wherever you read.

Get Highly before Twitter shuts down its appshttps://t.co/3yLbfWW25l pic.twitter.com/xAEMG7oJai

— Josh Constine (@JoshConstine) April 17, 2019

“Sharing highlights, not headlines — sharing thinking instead of lazily linking — helps spark the kind of conversation that leaves participants and observers alike a bit better off than they started. We’d like to see more of this,” the Highly teams writes. That’s why it’s joining Twitter to work on improving conversation health. Founded in 2014, Highly had raised a seed round in 2017.

Twitter’s shift to algorithmic ranking of the timeline means every tweet has to compete to be seen. Blasting out links that are a chore to open and read can lead to low engagement, causing Twitter to show it to fewer people. Tools like Highly can give tweeters a leg up. And if Twitter can build these tools right into its service, it could allow more people to create appealing tweets so they actually feel heard.

Powered by WPeMatico

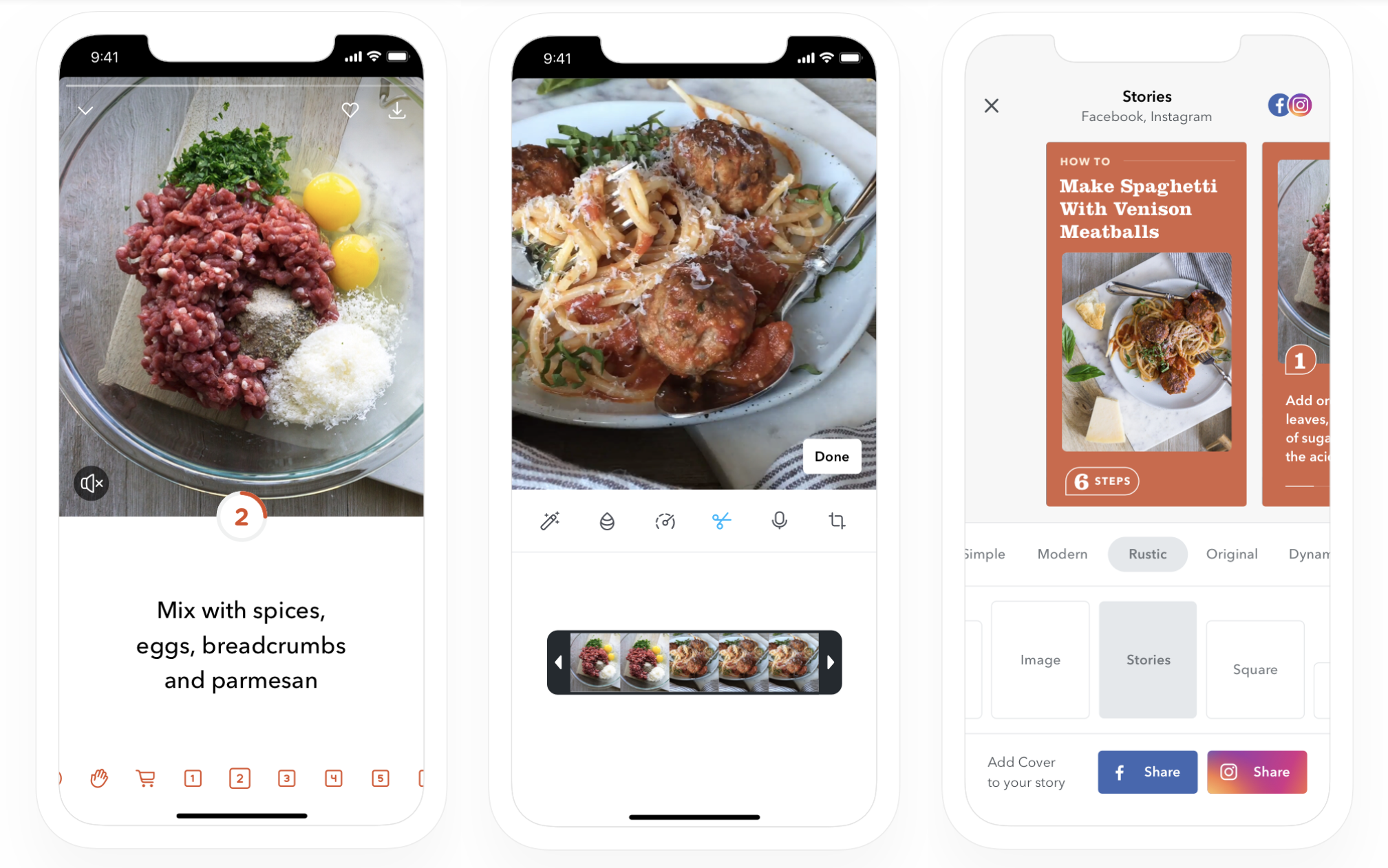

Sick of pausing and rewinding YouTube tutorials to replay that tricky part? Jumprope is a new instructional social network offering a powerful how-to video slideshow creation tool. Jumprope helps people make step-by-step guides to cooking, beauty, crafts, parenting and more using voice-overed looping GIFs for each phase. And creators can export their whole lesson for sharing on Instagram, YouTube or wherever.

Jumprope officially launches its iOS app today with plenty of how-tos for making chocolate chip bars, Easter eggs, flower boxes or fierce eyebrows. “By switching from free-form linear video to something much more structured, we can make it much easier for people to share their knowledge and hacks,” says Jumprope co-founder and CEO Jake Poses.

The rise of Snapchat Stories and Pinterest have made people comfortable jumping on camera and showing off their niche interests. By building a new medium, Jumprope could become the home for rapid-fire learning. And because viewers will have tons of purchase intent for the makeup, art supplies or equipment they’ll need to follow along, Jumprope could make serious cash off ads or affiliate commerce.

The opportunity to bring instruction manuals into the mobile video era has attracted a $4.5 million seed round led by Lightspeed Venture Partners and joined by strategic angels like Adobe Chief Product Officer Scott Belsky and Thumbtack co-founders Marco Zappacosta and Jonathan Swanson. People are already devouring casual education content on HGTV and the Food Network, but Jumprope democratizes its creation.

Jumprope co-founders (from left): CTO Travis Johnson and CEO Jake Poses

The idea came from a deeply personal place for Poses. “My brother has pretty severe learning differences, and so growing up with him gave me this appreciation for figuring out how to break things down and explain them to people,” Poses reveals. “I think that attached me to this problem of ‘how do you organize information so it’s simple and easy to understand?’ Lots and lots of people have this information trapped in their heads because there isn’t a way to easily share that.”

Poses was formerly the VP of Product at Thumbtack where he helped grow the company from 8 to 500 people and a $1.25 billion valuation. He teamed up with AppNexus’ VP of engineering Travis Johnson, who’d been leading a 50-person team of coders. “The product takes people who have knowledge and passion but not the skill to make video [and gives them] guard rails that make it easy to communicate,” Poses explains.

Disrupting incumbents like YouTube’s grip on viewers might take years, but Jumprope sees its guide creation and export tool as a way to infiltrate and steal their users. That strategy mirrors how TikTok’s watermarked exports colonized the web.

Jumprope lays out everything you’ll need to upload, including a cover image, introduction video, supplies list and all your steps. For each, you’ll record a video that you can then enhance with voice-over, increased speed, music and filters.

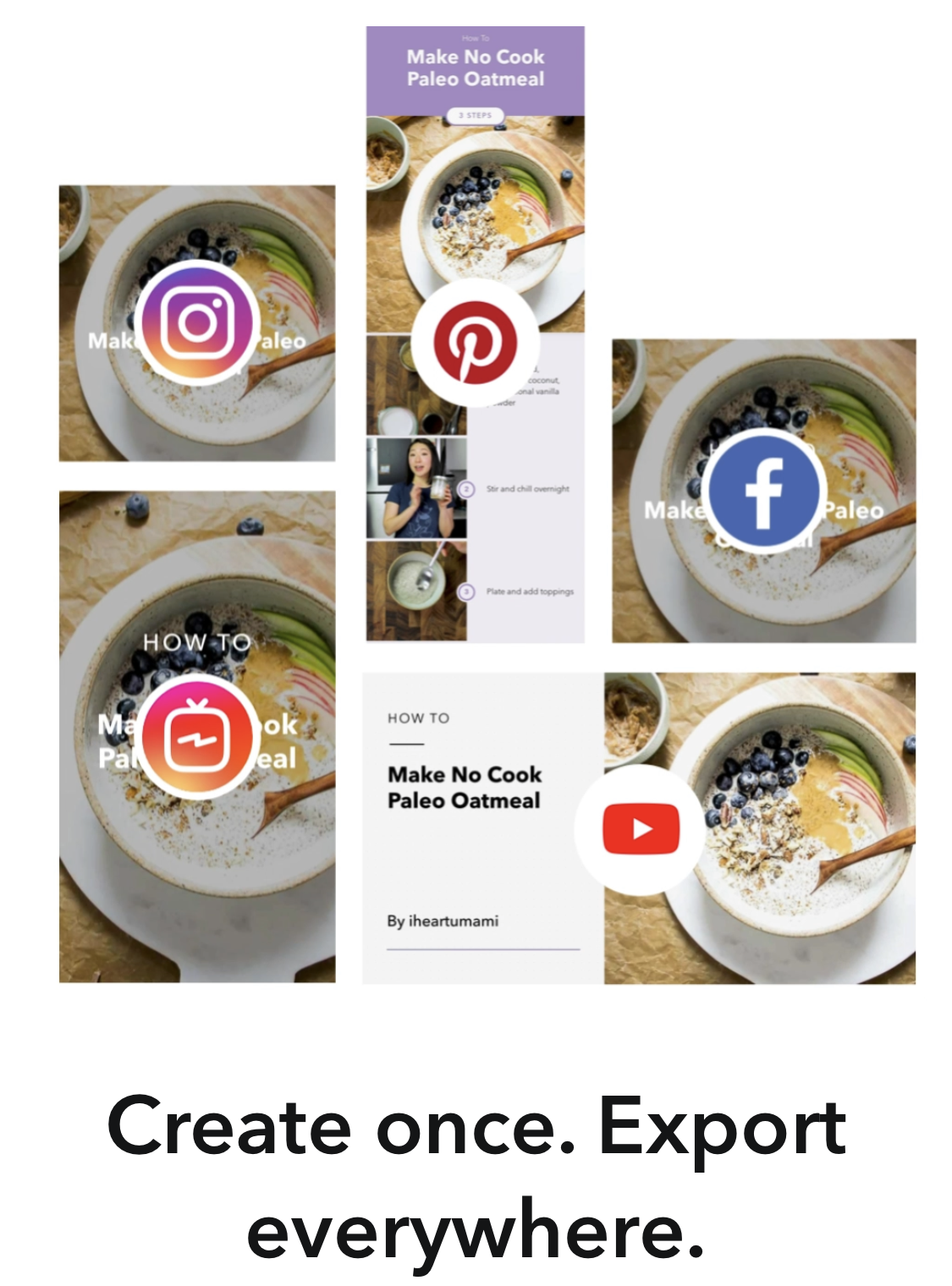

Creators are free to suggest their own products or enter affiliate links to monetize their videos. Once it has enough viewers, Jumprope plans to introduce advertising, but it could also add tipping, subscriptions, paid how-tos or brand sponsorship options down the line. Creators can export their lessons with five different border themes and seven different aspect ratios for posting to Instagram’s feed, IGTV, Snapchat Stories, YouTube or embedding on their blog.

Creators are free to suggest their own products or enter affiliate links to monetize their videos. Once it has enough viewers, Jumprope plans to introduce advertising, but it could also add tipping, subscriptions, paid how-tos or brand sponsorship options down the line. Creators can export their lessons with five different border themes and seven different aspect ratios for posting to Instagram’s feed, IGTV, Snapchat Stories, YouTube or embedding on their blog.

“Like with Stories, you basically tap through at your own pace,” Poses says of the viewing experience. Jumprope offers some rudimentary discovery through categories, themed collections or what’s new and popular. The startup has done extensive legwork to sign up featured creators in all its top categories. That means Jumprope’s catalog is already extensive, with food guides ranging from cinnabuns to pot roasts to how to perfectly chop an onion.

“You’re not constantly dealing with the frustration of cooking something and trying to start and stop the video with greasy hands. And if you don’t want all the details, you can tap through it much faster” than trying to skim a YouTube video or blog post, Poses tells me. Next the company wants to build a commenting feature where you can leave notes, substitution suggestions and more on each step of a guide.

Poses claims there’s no one building a direct competitor to its mobile video how-to editor. But he admits it will be an uphill climb to displace viewership on Instagram and YouTube. One challenge facing Jumprope is that most people aren’t hunting down how-to videos every day. The app will have to work to remind users it exists and that they shouldn’t just go with the lazy default of letting Google recommend the videos it hosts.

The internet has gathered communities around every conceivable interest. But greater access to creation and consumption necessitates better tools for production and curation. As we move from a material to an experiential culture, people crave skills that will help them forge memories and contribute to the world around them. Jumprope makes it a lot less work to leap into the life of a guru.

You can watch my first Jumprope here or below to learn how to tie up headphones without knots:

Powered by WPeMatico

Five years ago, Dynamic Yield was courting an investment from The New York Times as it looked to shift how publishers paywalled their content. Last month, Chicago-based fast food king McDonald’s bought the Israeli company for $300 million, a source told TechCrunch, with the purpose of rethinking how people order drive-thru chicken nuggets.

The pivot from courting the grey lady to the golden arches isn’t as drastic as it sounds. In a lot of ways, it’s the result of the company learning to say “no” to certain customers. At least, that’s what Bessemer’s Adam Fisher tells us.

The Exit is a new series at TechCrunch. It’s an exit interview of sorts with a VC who was in the right place at the right time but made the right call on an investment that paid off.

Fisher

Fisher was Dynamic Yield founder Liad Agmon’s first call when he started looking for funds from institutional investors. Bessemer bankrolled the bulk of a $1.7 million funding round which valued the startup at $5 million pre-money back in 2013. The firm ended up putting about $15 million into Dynamic Yield, which raised ~$85 million in total from backers including Marker Capital, Union Tech Ventures, Baidu and The New York Times.

Fisher and I chatted at length about the company’s challenging rise and how Israel’s tech scene is still being underestimated. Fisher has 11 years at Bessemer under his belt and 14 exits including Wix, Intucell, Ravello and Leaba.

The interview has been edited for length and clarity.

Lucas Matney: So, right off the bat, how exactly did this tool initially built for publishers end up becoming something that McDonalds wanted?

Adam Fisher: I mean, the story of Dynamic Yield is unique. Liad, the founder and CEO, he was an entrepreneur in residence in our Herzliya office back in 2011. I’d identified him earlier from his previous company, and I just said, ‘Well, that’s the kind of guy I’d love to work with.’ I didn’t like his previous company, but there was something about his charisma, his technology background, his youth, which I just felt like “Wow, he’s going to do something interesting.” And so when he sold his previous company, coincidentally to another Chicago based company called Sears, I invited him and I think he found it very flattering, so he joined us as an EIR.

And really only at the very end of his residence did he come up with this idea that would become Dynamic Yield. He came about it very much focused on the problem he saw with publishers being outwitted by ad buyers. He felt like all the big publishers really didn’t understand their digital businesses, didn’t understand their users, didn’t understand how performance ad buying was working, and he began to build a product that could dynamically optimize a publisher’s website to maximize revenue, hence the yield … the dynamic yield.

But very quickly, we told him, ‘That’s interesting, but we’re not sure how big that market is. And, you know it’s not always great to sell to those kind of weak customers. Sometimes they’re weak for a reason.’

Powered by WPeMatico

I’m excited to announce that The Europas Awards for European Tech Startups is really shaping up! The awards will be held on 27 June 2019, in London, U.K. on the front lawn of the Geffrye Museum in Hoxton, London — creating a fantastic and fun garden party atmosphere in the heart of London’s tech startup scene.

TechCrunch is once more the exclusive media sponsor of the awards and conference, alongside new “tech, culture & society” event creator The Pathfounder.

Here’s how to enter and be considered for the awards.

You can nominate a startup, accelerator or venture investor that you think deserves to be recognized for their achievements in the last 12 months.

*** The deadline for nominations is 1 May 2019 ***

For the 2019 awards, we’ve overhauled the categories to a set that we believe better reflects the range of innovation, diversity and ambition we see in the European startups being built and launched today. There are now 20 categories, including new additions to cover AgTech / FoodTech, SpaceTech, GovTech and Mobility Tech.

Attendees, nominees and winners will get discounts to TechCrunch Disrupt in Berlin, later this year.

The Europas “Diversity Pass”

We’d like to encourage more diversity in tech! That’s why, for the upcoming invitation-only “Pathfounder” event held on the afternoon before The Europas Awards, we’ve reserved a tranche of free tickets to ensure that we include more women and people of colour who are “pre-seed” or “seed-stage” tech startup founders. If you are a women founder or person of colour founder, apply here for a chance to be considered for one of the limited free diversity passes to the event.

The Pathfounder event will feature premium content and invitees, designed be a “fast download” into the London tech scene for European founders looking to raise money or re-locate to London.

The Europas Awards

The Europas Awards results are based on voting by expert judges and the industry itself.

But key to it is that there are no “off-limits areas” at The Europas, so attendees can mingle easily with VIPs.

The complete list of categories is here:

Timeline of The Europas Awards deadlines:

* 6 March 2019 – Submissions open

* 1 May 2019 – Submissions close

* 10 May 2019 – Public voting begins

* 18 June 2019 – Public voting ends

* 27 June 2019 – Awards Bash

Amazing networking

We’re also shaking up the awards dinner itself. Instead of a sit-down gala dinner, we’ve taken feedback for more opportunities to network. Our awards ceremony this year will be in the setting of a garden lawn party, where you’ll be able to meet and mingle more easily, with free-flowing drinks and a wide-selection of street food (including vegetarian/vegan). The ceremony itself will last approximately 75 minutes, with the rest of the time dedicated to networking. If you’d like to talk about sponsoring or exhibiting, please contact dianne@thepathfounder.com

Instead of thousands and thousands of people, think of a great summer event with the most interesting and useful people in the industry, including key investors and leading entrepreneurs.

The Europas Awards have been going for the last 10 years, and we’re the only independent and editorially driven event to recognise the European tech startup scene. The winners have been featured in Reuters, Bloomberg, VentureBeat, Forbes, Tech.eu, The Memo, Smart Company, CNET, many others — and of course, TechCrunch.

• No secret VIP rooms, which means you get to interact with the speakers

• Key founders and investors attending

• Journalists from major tech titles, newspapers and business broadcasters

Meet the first set of our 20 judges:

Brent Hoberman

Executive Chairman and Co-Founder

Founders Factory

Videesha Böckle

Founding Partner

signals Venture Capital

Bindi Karia

Innovation Expert + Advisor, Investor

Bindi Ventures

Christian Hernandez Gallardo

Co-Founder and Venture Partner at White Star Capital

Powered by WPeMatico