Fundings & Exits

Auto Added by WPeMatico

Auto Added by WPeMatico

Cytora, a U.K. startup that developed an AI-powered solution for commercial insurance underwriting, has raised £25 million in a Series B round. Leading the investment is EQT Ventures, with participation from existing investors Cambridge Innovation Capital, Parkwalk and a number of unnamed angel investors.

A spin-out of the University of Cambridge, Cytora was founded in 2014 by Richard Hartley, Aeneas Wiener, Joshua Wallace and Andrzej Czapiewski — although both Wallace and Czapiewski have since departed.

Its first product launched in late 2016 to a number of large insurance customers, with the aim of applying AI to commercial insurance supported by various public and proprietary data. This includes property construction features, company financials and local weather, combined with an insurance company’s own internal risk data.

“Commercial insurance underwriting is inaccurate and inefficient,” says Cytora co-founder and CEO Richard Hartley. “It’s inaccurate because underwriting decisions are made using sparse and outdated information. It’s inefficient because the underwriting process is so manual. Unlike buying car or travel insurance, which can be purchased in minutes, buying business insurance can take up to seven days. This means operating costs for insurers are extremely high and customer experience isn’t good leading to a lack of trust.”

To illustrate how inefficient commercial insurance can be, Hartley says that for every £1 of premium that businesses pay to insurers, only 60 pence is set aside to pay total claims. The other 40 pence evaporates as the “frictional cost of delivering insurance.”

Powered by AI, Hartley claims that Cytora is able to distill the seven-day underwriting process down to 30 seconds via its API. This enables insurers to underwrite programmatically and build workflows that provide faster and more accurate decisions.

“Our APIs are powered by a risk engine which learns the subtle patterns of good and bad risks over time,” he explains. “This gives insurers a better understanding of the underlying risk of each business and helps them set a more accurate price. Both customers and insurers benefit.”

Typical Cytora customers are commercial insurers that are digitally transforming their underwriting process. Users of the software are either underwriters within insurance companies who are underwriting large commercial risks (i.e. an average insurance premium ~£500k and above) or business customers of insurance companies who are buying insurance direct online with an average premium of £1,000-£5,000.

“For the latter, our customers have built quotation workflows on top of Cytora’s APIs, enabling business owners to buy policies online in less than a minute without having to fill in a form,” says Hartley. “We require only a business name and postcode to issue a quote, which revolutionises the customer experience.”

To that end, Cytora generates revenue by charging a yearly ARR license fee, which increases based on usage and per line of business. The company says today’s Series B funding will be used to accelerate the expansion of its product suite and for scaling into new geographies.

Powered by WPeMatico

Most work involving computers is highly repetitive, which is why companies regularly have developers write code to automate repetitive tasks. But that process is not very scalable. Ideally, individuals across an entire business would be able to create automated tasks, not just developers. This problem has created a new category called process automation. Startups in this space are all about making companies more efficient.

Most of the existing tools on the market are code-based and complicated, which tends to make it tough for non-technical people to automate anything. Ideally, you would allow them to train software robots to handle repetitive and mundane tasks.

This is the aim of Leapwork, which today announces a Series A investment of $10 million, from London’s DN Capital and e.ventures out of Berlin. The company already has many clients, from tier-one banks and global healthcare firms to aerospace and software companies, and now plans to expand in the U.S. Its customers typically already have a lot of experience with tools such as Tricentis, MicroFocus, UiPath and BluePrism, but employ Leapwork when code-based tools prove limiting.

Founded in 2015 and launched in April 2017, Leapwork has an entirely visual system, backed by a modern tech stack. Instead of using developer time, staff automate tasks themselves, without writing any code, with a simple user interface that is likened to learning PowerPoint or Excel. Leapwork estimates it can save 75 percent of an employee’s time.

Christian Brink Frederiksen, Leapwork’s CEO and co-founder said: “About half of our business comes from the U.S. and this investment will enable us to serve those customers better, as well as reaching new ones.”

Leapwork has found traction in the areas of software testing, data migration and robotic process automation in finance and healthcare. Based in Copenhagen, Denmark, Leapwork has offices in London, U.K., San Francisco, USA, Minsk, Belarus, and Gurugram, India.

Thomas Rubens, of DN Capital, said: “From the outset we were impressed by Leapwork’s product, which we believe will change the automation landscape. Every company has repetitive tasks that could be automated and few have the developer resource to make it happen.”

The founders began in June 2015 in Copenhagen, Denmark, after having worked for almost two decades in enterprise software and business-critical IT. They launched their first pilot in July 2016 and, after working with Global2000 pilot customers in the U.S. and Europe, went live with the Leapwork automation platform in March 2017.

Prior to this funding the company was bootstrapped by the founders, as both had previous successful exits.

Powered by WPeMatico

Airbnb has completed its acquisition of the last-minute hotel booking application, HotelTonight, the company announced on Monday. The deal is Airbnb’s largest M&A transaction yet, and will accelerate the home-sharing giant’s growth as it gears up for an initial public offering.

Airbnb reportedly began talks to acquire HotelTonight months ago, and finally confirmed its intent to acquire the business in early March. Reports indicated a price tag of more than $400 million; Airbnb declined to comment on the size of the deal.

As part of the deal, HotelTonight co-founder and chief executive officer Sam Shank will lead the boutique hotel category at Airbnb, one of the company’s newer units meant to help it scale beyond treehouses and quirky homes.

“When we founded HotelTonight, we sought to reimagine the hotel booking experience to be more simple, fast and fun, and to better connect travelers with the world’s best boutique and independent hotels,” Shank said in a statement. “We are delighted to take this vision to new heights as part of Airbnb.”

Shank launched the San Francisco-based company in 2010. Most recently, it was valued at $463 million with a $37 million Series E funding in 2017, according to PitchBook. HotelTonight raised a total of $131 million in equity funding from venture capital firms including Accel, Battery Ventures, Forerunner Ventures and First Round Capital.

Powered by WPeMatico

Hundreds of billions of dollars in venture capital went into tech startups last year, topping off huge growth this decade. Here at DocSend, we’re seeing the downstream effects in our data: investors who receive DocSend links are reviewing more pitch decks than ever, as more people build companies and try to get a slice of the funding opportunities.

So it stands to reason that making your pitch deck stand out is critical to raising a round. But how do you do that in such a competitive landscape?

After analyzing both successful and failed fundraising pitch decks, we’ve learned that storytelling matters and this hasn’t changed over the last few years. This makes intuitive sense — who doesn’t love a good story?

But does telling a story help founders raise capital successfully? And more importantly, do you fail to fundraise if you don’t tell a story? In this post, I’m going to share some hard evidence.

It follows up on my post over on TechCrunch, looking at three big mistakes we see in failed pitch decks.

Before we start diving into the data, here’s why we know: our document sharing and tracking platform is used every day by thousands of startups to share their decks securely with investors, with visits to pitch decks shared via DocSend having grown 4x from 2017 to 2018. Controlling for DocSend’s growth, we estimate that investors are viewing 35% more decks in 2018 than they did in 2017.

In total, over 100,000 users have shared over 2.2 million links through DocSend since we launched in 2014, and these documents have received over 220 million views; while we’ve grown quickly among sales, business development and customer success teams, startup pitch decks have continued to be a popular use-case. We’ve also been analyzing the pitch data in a collaboration with Harvard Business School since 2015, so we’re experienced at analyzing and interpreting this data.

The old adage “you only get one chance to make a first impression” is true when it comes to pitch decks, and in fact that was the case for our company’s own fundraising process. When I pitched DocSend for our seed round, I knew what we were up against — why will this be a big business? And, why won’t Google build this? Our product was still in private beta, and we had no revenue. However, we had an MVP and those who were using our product, including our potential investors, found the product to be very useful.

Powered by WPeMatico

Fundraising has always been something of a black box. High-flying companies make it seem like a breeze, but most entrepreneurs lose sleep over it. My first startup was called Pursuit.com and although we successfully raised a seed round, it was incredibly tough (we were eventually aqui-hired by Facebook). DocSend is my second startup, and it has taught me a lot about the process — not only because of our own fundraising, but because the product itself reveals big pitching trends in a unique way.

Since 2014, over 100,000 users have shared over 2.2 million links through our document tracking and sharing platform, and these documents have received over 220 million views. Thousands of founders share their funding decks with prospective investors every day, in addition to our product’s other uses for sales, business development and customer success. To get insights about all this activity, we have a long-running partnership with Harvard Business School, where we’ve been analyzing the anonymized fundraising data of startups attempting to raise a Seed or an A round.

We shared our early learnings in a TechCrunch article in 2015, Lessons from a study of perfect pitch decks. In this post, I’ll update our findings based on the last four years of data (and a lot of user growth on our side).

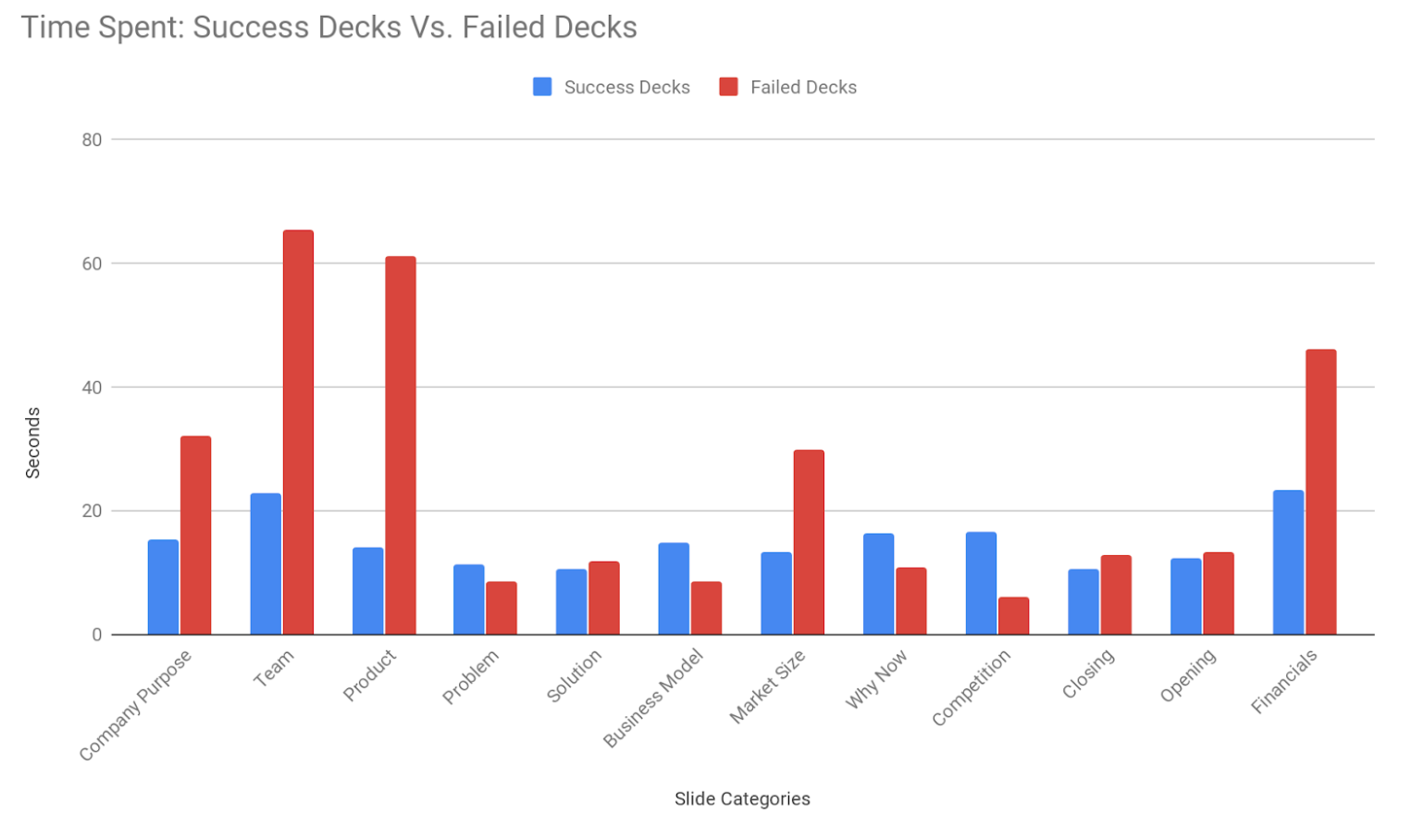

So what differentiates a winning seed round pitch deck from those that fail to raise capital? While both successful and failed pitch decks are about the same length, an average of 18 pages, how the content is structured is vastly different. And while investors spend the same amount of time on both, 3.7 minutes on average, where they spend time tells us a lot about what successful pitches and failed pitches have in common. Below, I detail three mistakes that you want to avoid.

If you want to check out more details on what you should do in your deck, read my follow-up article “Data tells us that investors love a good story“ over on Extra Crunch.

It’s very tempting, especially for technical founders, to start pitch decks with how incredible their product is, how much time they’ve spent building it, their unique tech stack, and how convinced they are that they have just the right MVP for launch. But guess what?

You might think that’s a good thing. More time on my product slides, right? No. Data tells us that they are probably digging into the details trying to map your product‘s value to the current market needs and they are not coming away with a clear connection between the two.

Your target investors are also not your target customer. Showing screenshots and product details are just confusing for them. What are they looking at? Why does this matter? Most products are capable of being built; the question they are trying to answer is why is this product going to create a big business?

Image via DocSend

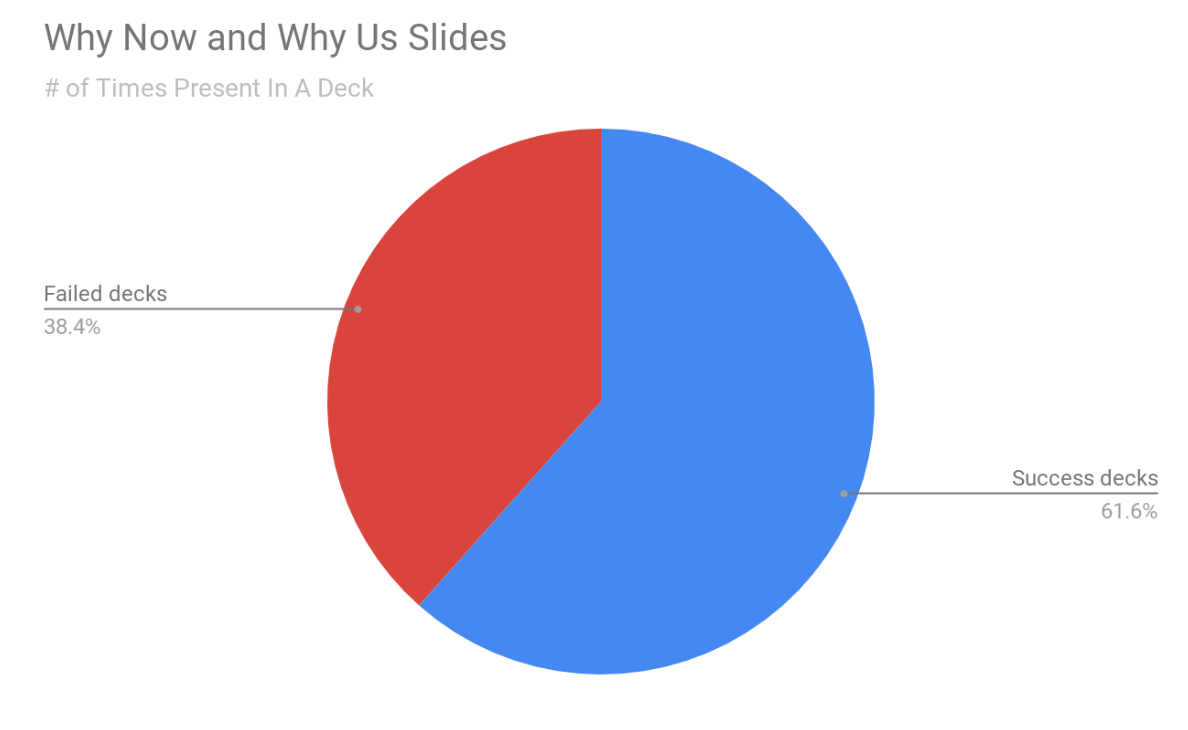

By now Simon Sinek has beaten this one into our collective brains with his start with the why Ted Talk and yet what we see in our data is that in failed decks, the “why now” and “why you” question has been left to the end. Successful pitches start with their company purpose, followed by why this team, and why the timing is right for this particular product.

In successful decks, investors spend 27 seconds on an average on “why now” and “why you” slides but in failed decks, they spend 62 seconds on these slides. We read this as investors are spending more time researching your team and your capabilities than they do with successful pitch decks. More time spent on these pages means that investors are not as convinced about this venture as the entrepreneur would like them to be. Entrepreneurs should focus on making their “why” slides part of a seamless narrative that leaves the investors wondering why this isn’t already a huge business.

Image via DocSend

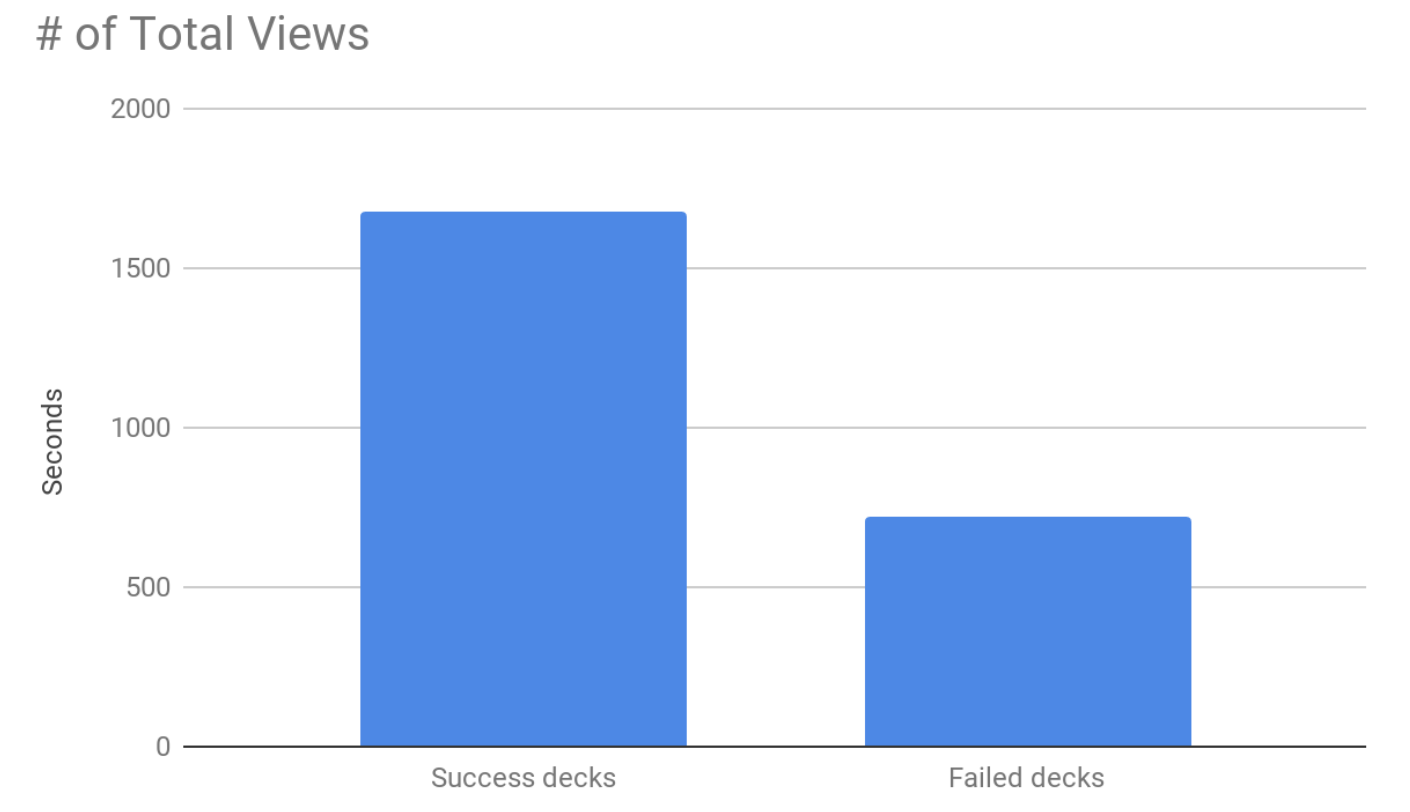

Everyone loves a good story and investors are no exception to this rule. All successful pitch decks tell a compelling story and follow a similar narrative thread. They start with the company purpose, the big problem they are trying to solve, why now is the right time, and why they are the right team to solve it. Failed pitch decks start with the product, followed by business model, and competitive landscape. Successful decks cover these too but they invariably follow a narrative that makes intuitive sense while in failed decks there is no compelling narrative.

Successful decks also get more repeat visits, they are visited 2.3 times more than failed decks and are forwarded along more often than failed pitch decks.

Image via DocSend

In the early days, entrepreneurs spend most of their time conceiving and building their minimum viable product (MVP). Naturally, they feel compelled to pitch this to investors. Although unintuitive, data suggests that you should restrain yourself from talking about your product before you have painted a narrative about the business opportunity: why now and why you. Once investors are convinced of those key points, by all means, go through all the product details and roadmaps. Just don’t lead with your product.

This is the first of a series of articles about fundraising. My followup article now available on Extra Crunch reveals what our data shows you should do with your deck. In future installments, I’ll be sharing more about the difference between Seed, Series A, and Series B rounds as well as how fundraising challenges change as your company grows. For the next post, I’ll be writing about why some pitch decks raise way more money than others. In the meantime, have questions about the best way to raise money? Check out our blog or reach out to us on Twitter at: @rheddleston or @docsend.

Powered by WPeMatico

The SoftBank Vision Fund has been screaming from the venture headlines the last few months, driven by eye-popping rounds (and valuations!) into some of the most notable startups around the world. Yet, SoftBank isn’t the only player rapidly buying up the cap tables of top startups. Indeed, another firm, more than a century old, has been fighting for that late-stage equity crown.

… Who the what?

When our fintech contributor Gregg Schoenberg interviewed Charles Plowden, the firm’s joint senior partner, about the firm’s prodigious investing, we realized that we have never gone in-depth on one of the most influential investors in Silicon Valley. So here goes.

Baillie Gifford is a 110-year-old asset management firm based out of Edinburgh, Scotland, and has long had a penchant for pre-IPO tech companies. The firm was an early investor into some of the world’s most valuable private and public tech companies, boasting a roster of portfolio companies that includes unicorns from nearly all generations in modern tech, including everything from Amazon, Google and Salesforce to Tesla, Airbnb, Spotify, newly public Lyft, Palantir and even SpaceX.

Baillie Gifford’s reach stretches way beyond the 280/101 corridor. The firm has an extensive history of investing across geographies, with one of its first and most successful investments coming from an early entry into Chinese e-commerce titan Alibaba. More recently, Baillie Gifford even held a stake in recently IPO’d Chinese electric autonomous vehicle manufacturer NIO, and one the firm’s largest current holdings is South African internet conglomerate Naspers — which itself is an active investor and developer of emerging market tech infrastructure.

The firm’s low profile belies its aggressive capital deployment strategy. According to data from PitchBook, Baillie Gifford was involved in roughly 20 deals in 2018 and was involved as a lead or participant in transactions worth over $21 billion in aggregate total deal size — beating out behemoth Tiger Global, which tallied roughly $13.25 billion on the same metric.

The firm has about $2 billion focused on private companies, so while it is aggressive in getting into later-stage rounds, it is not nearly operating at the scale of say the Vision Fund or Tiger Global. While the asset manager primarily focuses on public-equity investing, the firm has participated in investment rounds as early as Series A, according to PitchBook and Crunchbase data.

Overall, the firm manages $221 billion in assets under management as of January 2019.

As one of the earliest asset managers to invest in pre-IPO tech companies, Baillie Gifford has sourced investments through its longstanding reputation as an investor. The firm first began really diving into private tech investing in the wake of the dot-com bubble. The firm doubled down on the tech sector at a time when few others were investing and sifted through the blood bath to find cheap entryways into companies that are now amongst the world’s largest.

Today, however, the landscape is undoubtedly much different. Tech companies now make up four of the top five largest companies in the world by market cap, and seven out of the top 10. Now, everyone wants a piece of the pie and there seem to be more checks being thrown at founders than most can even fit in their wallets.

With more capital at their fingertips than ever before, founders are opting to keep their startups private for longer in order to avoid the stress of having to deal with short-term public market investors who are more often than not looking for the first opportunity to cash out. So why, amongst so much choice, do companies continue to partner with Baillie Gifford?

Plowden has some insights on that front in our interview, but the summary is that Baillie Gifford just sees itself as a partner. Unlike its peers and most investment managers, Baillie Gifford has no outside shareholder owners to report to. As a partnership, wholly owned and run by just 44 partners, the firm doesn’t face the organizational constraints that beset most firms that manage billions and billions in assets.

The result? In short, Baillie Gifford has quietly been making a killing, and probably drinking some good Scotch along the way, as well.

Powered by WPeMatico

“It is our contention that the investment industry may be experiencing a peak of its own, in this case the point of the maximum rate at which it extracts value from its clients’ assets. Let’s call it Peak Gravy.” That’s a recent quote from Tom Coutts, who is one of a few dozen partners at Baillie Gifford (See Arman Tabatabai’s profile here). It’s also typical of the provocative sentiments offered by this band of fund managers who are based in Edinburgh, but scour the world looking for opportunities.

In an effort to distinguish its world view, the firm has introduced the somewhat eyebrow-raising tagline, “We’re actual investors.” For many US technology observers, though, Baillie Gifford is known for its investments in unicorns. But as Extra Crunch’s executive editor Danny Crichton and I found out in a recent conversation with Charles Plowden (one of two senior partners and the overseer of the firm’s investment departments), there’s a lot more to the story and motivations behind this unique 110-year-old partnership that’s still going strong.

Powered by WPeMatico

French startup ReachFive wants to become Stripe for account management. The company just raised a $10 million Series A funding round led by CapHorn Invest, with Dawn Capital and Ventech also participating — investment bank Avolta Partners handled the fundraising process.

When you buy something on an e-commerce website or app, chances are those companies asked you to create an account before entering your address and payment information. ReachFive creates the login module for dozens of e-commerce and transactional companies.

This isn’t just about storing an email and password. ReachFive lets you do interesting things with your customer database. For instance, ReachFive works across different channels.

If you shop on L’Occitane’s website and then purchase cosmetics in a store, they can find your account. This way, you get accurate information about your customers. ReachFive complies with GDPR.

ReachFive also supports social logins, such as Facebook Connect or “Sign in with Google.” The company also supports two-factor authentication. And, of course, you can integrate ReachFive with other services, such as a CRM, a CMS, a recommendation engine, etc.

If you’re creating a brand from scratch, you might rely heavily on newsletters and content. You can let people sign up to the newsletter without creating a full-fledged account. They can create an account when they make their first purchase later down the road — ReachFive will reconcile profiles.

Forty companies are using ReachFive, including Boulanger, Etam Group, L’Occitane, Hachette Group, Engie and La Redoute. The startup manages 40 million user accounts overall. The company uses a software-as-a-service pricing model, and you can be sure that each contract must be quite valuable.

ReachFive proves that an omnichannel strategy doesn’t just mean that you should merge your inventories and catalogs across your online and offline platforms. It also means that you should be able to provide a unified customer experience by understanding a customer from start to finish.

Big retail companies have already unified their user accounts — when you buy an Apple product in an Apple store, you can see the receipt in your online account. But ReachFive could become an essential widget for all mid-tier e-commerce platforms.

Powered by WPeMatico

CleverTap, an India-based startup that lets companies track and improve engagement with users across the web, has pulled in $26 million in new funding thanks to a round led by Sequoia India.

Existing investor Accel and new backer Tiger Global also took part in the deal, which values CleverTap at $150-$160 million, the startup disclosed. The deal takes CleverTap to around $40 million from investors to date.

Founded in 2015 and based in Mumbai, CleverTap competes with a range of customer experience services, including Oracle Cloud. Its service covers a range of touchpoints with consumers, including email, in-app activity, push notifications, Facebook, WhatsApp (for business) and Viber. Its service helps companies map out how their users are engaging across those vectors, and develop “re-engagement” programs to help reactive dormant users or increase engagement among others.

The company says its SDK is installed in more than 8,000 apps and its customers include Southeast Asia-based startups Go-Jek and Zilingo, Hotstar in India and U.S.-based Fandango . With a considerable customer base in Asia, CleverTap puts a particular focus on mobile because many of these markets are all about personal devices.

“Asia is mobile-first and massively growing,” CleverTap CEO and co-founder Sunil Thomas told TechCrunch in an interview. “A lot of engagement in this [part of the] world is timely… we were sort of born physically on the east side of the world, so we got to scale with all these diverse set of devices.”

That stands to benefit CleverTap as it seeks to grow market share outside of Asia, and in markets like the U.S. and Europe where mobile is — right now — just one part of the marketing and customer engagement process. The company believes that engagement by mobile has a long way to develop there.

“Engagement [in the West] is still email-heavy and not really timely,” Thomas said. “Whereas the East thinks of it as ‘Hey, let’s be proactive… instead of a user coming in to hunt for information, can I provide it when I think he or she will need it?’ ”

Of course, mobile push and in-app notifications can be easily abused.

Most people will know of an app on their phone that falls into that category. So, how does a company know what is too much or what isn’t enough?

“As long as you use push or in-app as an extension of your brand, then I think it’s extremely useful,” explained Thomas. “After all, this is a really competitive world; it isn’t just your app out there — if you can make your brand count when this person isn’t in your app, that’ll help you.”

More broadly, Thomas argued that CleverTap brings data to the table which, ultimately, “changes the whole context in real time.” So a customer can really look holistically at their online presence and figure out what is working, and with which users. In real terms, when used to acquire new users online, he said he believes that CleverTap typically doubles registration conversions and triples the buying rate.

“The cost of acquisition to first purchase is what we really effect,” said Thomas. “It’s that moment you get a new person into your house.”

CleverTap has an office in Sunnyvale and it has just landed in Singapore. Now it plans to add a location in Indonesia before the end of the year. Those expansions are centered around business development, with some customer support, since tech and other teams are in India. Already, according to Thomas, the company is looking to grow in Europe while it is weighing the potential to enter Latin America in a move that could include a local partnership.

The CleverTap CEO is also considering raising more money toward the end of the year, when he believes that the company can push its valuation as high as $400 million.

“That’s very doable based on revenue growth,” he said. “We think that the revenue will demand that valuation.”

Powered by WPeMatico

Madrid-based micromobility startup Movo has closed a €20 million (~$22.5M) Series A funding round to accelerate international expansion.

The 2017-founded Spanish startup targets cities in its home market and in markets across LatAm, offering last-mile mobility via rentable electric scooters (e-mopeds and e-scooters) plotted on an app map. It’s a subsidiary of local ride-hailing firm Cabify, which provided the seed funding for the startup.

Movo’s Series A round is led by two new investors: Insurance firm Mutua Madrileña, doubtless spying strategic investment potential in helping diversify its business by growing the market for humans to scoot around cities on two wheels — and VC fund Seaya Ventures, an early investor in Cabify.

Both Mutua Madrileña and Seaya Ventures are now taking a seat on Movo’s board.

Commenting on the Series A in a statement, Javier Mira, general director of Mutua Madrileña, said: “The equity investment in Movo reflects Mutua Madrileña’s aspiration to respond to the new mobility needs that are emerging, and to the economic and social changes that are occurring and that are transforming our life habits.”

Movo currently operates in six cities across five countries — Spain, México, Colombia, Perú and Chile.

It first launched an e-moped service in Madrid a year ago, according to a spokeswoman, and has since expanded domestic operations to the southern Spanish coastal city of Malaga, as well as riding into Latin America.

The new funding is mostly pegged for further international expansion, with a plan to expand into new markets in LatAm, including Argentina, Brazil and Uruguay. Movo is targeting operating in a total of 10 countries by the end of 2019.

The Series A will also be used to grow its vehicle fleet in existing markets, it said.

“We are very excited to be able to offer a solution to the problems of mobility in cities, particularly for short distances in areas with high population density,” said CEO Pedro Rivas in a statement. “We are committed to working together with governments to complement mass public transport with these new micromobility alternatives, so that people can get around in a more sustainable and efficient way.”

Commenting on its investment in the Cabify subsidiary, Seaya Ventures’ Beatriz Gonzalez, founder and managing partner, said the fund is “committed to the evolution of mobility towards sustainable alternatives in the world’s major cities.”

“We want to be part of the transport revolution by promoting projects like Cabify and, of course, Movo,” she said in a statement, which seeks to paint micromobility as a solution for urban congestion and poor air quality. “We are motivated to continue to promote companies with which we share this sense of responsibility towards the development and improvement of people’s quality of life.”

Powered by WPeMatico