Fundings & Exits

Auto Added by WPeMatico

Auto Added by WPeMatico

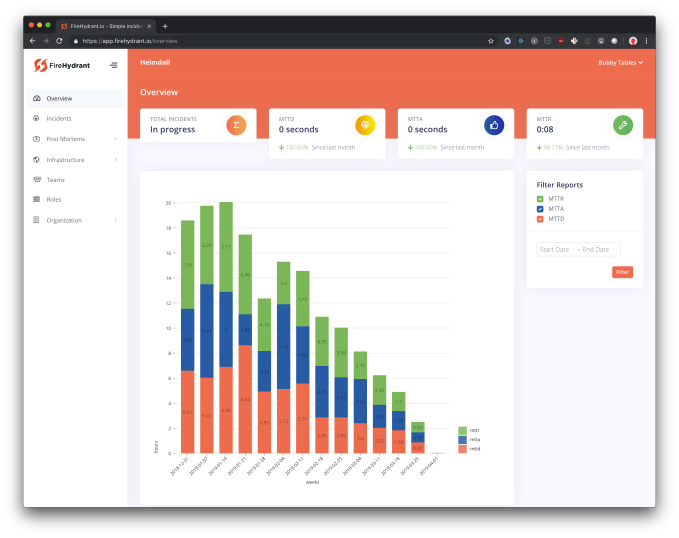

FireHydrant, an NYC startup, wants to help companies recover from IT disasters more quickly, and understand why they happened — with the goal of preventing similar future scenarios from happening again. Today, the fledgling startup announced a $1.5 million seed investment from Work-Bench, a New York City venture capital firm that invests in early-stage enterprise startups.

In addition to the funding, the company announced it was opening registration for its FireHydrant incident management platform. The product has been designed with Google’s Site Reliability Engineering (SRE) methodology in mind, but company co-founder and CEO Bobby Ross says the tool is designed to help anyone understand the cause of a disaster, regardless of what happened, and whether they practice SRE or not.

“I had been involved in several fire fighting scenarios — from production databases being dropped to Kubernetes upgrades gone wrong — and every incident had a common theme: absolute chaos,” Ross wrote in a blog post announcing the new product.

The product has two main purposes, according to Ross. It helps you figure out what’s happening as you attempt to recover from an ongoing disaster scenario, and once you’ve put out the fire, it lets you do a post-mortem to figure out exactly what happened with the hope of making sure that particular disaster doesn’t happen again.

As Ross describes it, a tool like PagerDuty can alert you that there’s a problem, but FireHydrant lets you figure out what specifically is going wrong and how to solve it. He says that the tool works by analyzing change logs, as a change is often the primary culprit of IT incidents. When you have an incident, FireHydrant will surface that suspected change, so you can check it first.

“We’ll say, hey, you had something change recently in this vicinity where you have an alert going off. There is a high likelihood that this change was actually causing your incident. And we actually bubble that up and mark it as a suspect,” Ross explained.

Screenshot: FireHydrant

Like so many startups, the company developed from a pain point the founders were feeling. The three founders were responsible for solving major outages at companies like Namely, DigitalOcean, CoreOS and Paperless Post.

But the actual idea for the company came about almost accidentally. In 2017, Ross was working on a series of videos and needed a way to explain what he was teaching. “I began writing every line of code with live commentary, and soon FireHydrant started to take the shape of what I envisioned as an SRE while at Namely, and I started to want it more than the video series. 40 hours of screencasts recorded later, I decided to stop recording and focus on the product…,” Ross wrote in the blog post.

Today it integrates with PagerDuty, GitHub and Slack, but the company is just getting started with the three founders, all engineers, working on the product and a handful of beta customers. It is planning to hire more engineers to keep building out the product. It’s early days, but if this tool works as described, it could go a long way toward solving the fire-fighting issues that every company faces at some point.

Powered by WPeMatico

After raising $37 million to bring its on-the-spot stock market analytics tools to a wider range of publishers and other internet partners, TradingView today has announced its first acquisition to supercharge the services that it offers to investors, wherever they happen to be online. The startup has acquired TradeIt, which has built an API for on-the-spot trading on any site that uses it.

The terms of deal were not disclosed, but we understand from sources close to the deal that it was under $20 million, more specifically in the “high teens.” TradeIt, which used to be called Trading Ticket, had raised about $12 million from investors that included Peter Thiel’s mostly-fintech fund Valar Ventures, Citi Ventures and others. TradingView had raised just over $40 million with investors including Insight Partners, TechStars and others.

The deal is a big move for consolidation: together the two say they will serve more than 10 million monthly active users in 150 countries, covering some $70 billion in linked assets. But also, better economies of scale, and better margins for companies that provide services that touch consumers not necessarily from a “home” of their own.

The latter is a growing trend that has mirrored the rise of social media and other services that aggregate content from multiple sources; and also the bigger trend of instant, on-demand everything, where consumers are happier with the convenience of buying or engaging with something right when they want to, rather than shopping around, delaying or navigating to another place to do it.

That has also seen the rise of commerce APIs to buy things instantly, not to mention the emergence of a wide range of commerce applications that let people easily buy goods and services on the spot. (And in line with that, TradingView says that nearly half of its user base today is millennials, with an additional 13 percent even younger, Gen Z. “The groups are particularly drawn to [our] extensive charting expertise,” the company says.)

In fintech, and in the world of investing specifically, that’s a trend that has also helped the growth of cryptocurrency, which has opened up the world of investing and thinking about investing to a whole new class of consumers who — for better or worse — are hearing about investing opportunities via viral social media campaigns and other new kinds of channels. Whether cryptocurrency speculation bears out longer term, it is depositing a new class of people into the world of thinking about companies and investing in them.

That taps into the sweet spot where TradeIt and TradingView are building their business.

“TradeIt’s secure and compliant relationships with established U.S. retail brokerages, coupled with their robust integrations with top investing apps, allows TradingView to be part of the backbone of the investing ecosystem,” said Denis Globa, TradingView founder and CEO, in a statement.

TradingView’s partners today include Crunchbase, Investopedia, SeekingAlpha, Zacks, Binance, CME Group and Entrepreneur, where users are able to access a premium tier of TradingView tools by way of a subscription in order to do some instant data and price modelling of a company that they might be reading about. The thinking is that now they will also be able to go one step further by trading stocks related to that information. TradingView, meanwhile, can use that extra feature to make a little more money and sell its service to partners as more sticky, to the tune of 80 percent more time spent with publishers as a result of integrating TradingView’s tools.

That’s something that the two companies can already attest to doing well in partnership.

“TradingView’s vision aligns strongly with our view of the distributed financial networks of the future,” said Nathan Richardson, TradeIt CEO, in a statement. “We’ve worked with TradingView for several years now, and always felt our complementary products and shared retail investing users makes us stronger together.”

Richardson and his cofounder Betsy Eisenberg — who are both joining TradingView — had together built Yahoo Finance — so they are already well experienced in how to leverage the potential of bringing together content with utility.

“Nathan Richardson and Betsy Eisenberg are fintech pioneers who led the development of Yahoo! Finance from scratch. With them on board, we’re extremely excited about the growth potential,” Globa said.

Powered by WPeMatico

French startup ManoMano is raising a new funding round of $125 million (€110 million). The company operates an e-commerce website and marketplace focused on home improvement and gardening.

ManoMano is part of the great unbundling of general e-commerce platforms. By focusing on a vertical in particular, the company can provide a large product offering, competitive prices and better customer service.

The platform generated $450 million (€400 million) in gross merchandise value last year. France is still its main market, but the company plans to become the dominant home improvement platform in Europe.

According to an interview in JDN, ManoMano plans to take a page out of Amazon’s playbook and expand its Mano Fulfillment service. As the name suggests, ManoMano plans to manage products from third-party retailers and take care of logistics.

More recently, ManoMano launched a B2B service with a few advantages for professional workers.

Eurazeo Growth, Aglaé Ventures and Bpifrance are participating in today’s funding round, with existing investors CM-CIC, Partech Ventures, Piton and General Atlantic also participating.

Powered by WPeMatico

Mailgun, an email API delivery service, announced today that it was selling a majority stake in the company to private equity firm Thoma Bravo. The companies did not share terms, but this is the second owner in the company’s eight-year history.

Mailgun provides API services for building email functionality into applications. It has more than 150,000 customers using its APIs, according to data provided by the company.

In a blog post announcing the investment, CEO William Conway said the new money should help the company expand its capabilities and accelerate the product roadmap, a common refrain from companies about to be acquired.

“We will be investing millions in the development of products you can use to enhance your deliverability, gain more insights into your emails and deliver an unparalleled experience for your customers. We’re also doubling down on customer success and enablement to ensure our customers have exactly what they need to scale their communications,” Conway wrote in the blog post.

The company, which was founded in 2010 and was a part of the Y Combinator Winter 2011 cohort, has had a complex history. Rackspace acquired it in 2012 and held onto it until 2017, when it spun out into a private company. At that point, Turn/River, another private equity firm, invested $50 million in the company. After today’s deal, Turn/River will maintain a minority ownership stake in Mailgun.

Mailgun typically competes with companies like Mailchimp and SendGrid. Thoma Bravo has a history of buying enterprise software companies. Most recently, it bought a majority stake in enterprise software company Apttus. It also has investments in SolarWinds, SailPoint and Blue Point Systems.

Thoma Bravo did not respond to a request for comment before publishing.

Powered by WPeMatico

Xing, the business networking platform that has been described as Germany’s answer to LinkedIn, has made an acquisition to beef up its recruitment business ahead of a rebrand of the business as “New Work.” The company has acquired Honeypot, a German startup that has built a job-hunting platform for tech people, for up to €57 million ($64 million). Xing tells us that Honeypot is its biggest acquisition to date.

The figure includes the acquisition (€22 million) plus a potential earn-out of up to €35 million if certain targets are met in the next three years.

Xing said that it plans to rebrand as New Work in the second half of 2019, bringing together a number of other assets it has acquired and built over the years.

“This acquisition is an excellent addition to our New Work portfolio,” Thomas Vollmoeller, CEO at Xing, said in a statement. “Honeypot focuses on candidates by helping them to find a job matching their individual preferences… With subsidiaries and brands such as kununu and HalloFreelancer, Xing is far more than just a single network. New Work is the umbrella spanning all our business activities.” Xing said that all the smaller companies will keep their branding.

Xing already offered job listings as part of its platform, with 20,000 businesses as customers; but Honeypot will add a few different things to the mix.

First, it will give Xing more traction specifically in the tech vertical, since Honeypot first started out in 2015 targeting developers although it later expanded to other tech jobs.

Second, Honeypot’s structure is a natural fit for a social recuitment platform: as with a lot of social recruiting, Honeypot lets recruiters use platforms, profile pages and social graphics to find and approach candidates, rather than candidates reaching out in response to specific opportunities.

Honeypot adds additional features to help make this process more accurate and less of a waste of time on both sides. Those doing the recruiting have to provide specific details around salary and, say, programming languages required, as part of their outreach. On the other side, individuals go through a “brief expertise check” to vet them, and they too have to be a bit more specific on what they can and what they want to do, and what they want to earn, to help weed out opportunities that might not be suitable.

Third, the acquisition will help Xing make a bigger push into building its profile outside of Germany into more of Europe, as New Work.

This is no small thing. Xing years ago was considered a would-be rival to LinkedIn. But — and this was perhaps even more true in the past, and Xing was founded in 2003 — scaling startups to be global players out of Europe can be a challenge, even more so when there is a formidable direct competitor growing quickly as well.

In the end, Xing developed as a much more modest operation, relatively speaking. While LinkedIn today has some 600 million users and was acquired by Microsoft in 2016 for $26.2 billion, Xing is publicly traded and currently valued at around $2 billion (€1.81 billion), with some 15 million members.

Xing says that today Honeypot’s current emphasis is German-speaking countries and the Netherlands, which together cover some of the biggest startup hubs in Europe, including Berlin and Amsterdam.

The company is still relatively small but growing, adding 1,000 IT specialists to its books each week, with some 100,000 individuals and 1,500 businesses currently registered. Xing said that it will be investing in the company to expand to more markets in Europe, as well as to grow its business by tapping Xing’s own customer base.

Although there have been some notable exceptions like payments startup Adyen from the Netherlands, Farfetch from the UK and Spotify (originally from Stockholm, grown in London and now increasingly a US company), scaling startups in Europe has proven to be challenging.

One of the big reasons why has to do with a shortage of talent to build these companies: in Germany alone — home to the buzzy startup city of Berlin — there are 82,000 unfilled tech jobs. In other words, there is an opportunity for more user-friendly platforms to help connect those dots.

“XING and Honeypot both have the vision of helping people to further their career. We want Honeypot to offer the world’s largest work-life community for IT specialists by giving candidates the power to decide on their next career step,” said Kaya Taner, CEO who founded Honeypot with Emma Tracey. “We will continue to pursue this vision with XING. Going forward, around 100,000 IT specialists from all over the world who are registered on Honeypot will be able to connect with the many first-rate employers in German-speaking countries. This will enable Honeypot to continue developing its domestic market, while also further expanding its international community.”

Powered by WPeMatico

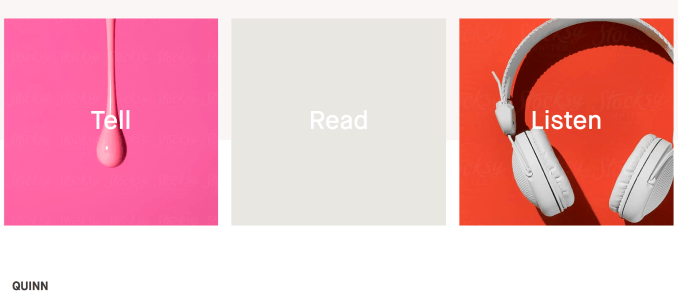

If you took the photos and videos out of pornography, could it appeal to a new audience? Caroline Spiegel’s first startup Quinn aims to bring some imagination to adult entertainment. Her older brother, Snapchat CEO Evan Spiegel, spent years trying to convince people his app wasn’t just for sexy texting. Now Caroline is building a website dedicated to sexy text and audio. The 22-year-old college senior tells TechCrunch that on April 13th she’ll launch Quinn, which she describes as “a much less gross, more fun Pornhub for women.”

TechCrunch checked out Quinn’s private beta site, which is pretty bare bones right now. Caroline tells us she’s already raised less than a million dollars for the project. But given her brother’s success spotting the next generation’s behavior patterns and turning them into beloved products, Caroline might find investors are eager to throw cash at Quinn. That’s especially true given she’s taking a contrarian approach. There will be no imagery on Quinn.

Caroline explains that “There’s no visual content on the site — just audio and written stories. And the whole thing is open source, so people can submit content and fantasies, etc. Everything is vetted by us before it goes on the site.” The computer science major is building Quinn with a three-woman team of her best friends she met while at Stanford, including Greta Meyer, though they plan to relocate to LA after graduation.

The idea for Quinn sprung from a deeply personal need. “I came up with it because I had to leave Stanford my junior year because I was struggling with anorexia and sexual dysfunction that came along with that,” Caroline tells me. “I started to do a lot of research into sexual dysfunction cures. There are about 30 FDA-approved drugs for sexual dysfunction for men but zero for women, and that’s a big bummer.”

She believes there’s still a stigma around women pleasuring themselves, leading to a lack of products offering assistance. Sure, there are plenty of porn sites, but few are explicitly designed for women, and fewer stray outside of visual content. Caroline says photos and videos can create body image pressure, but with text and audio, anyone can imagine themselves in a scene. “Most visual media perpetuates the male gaze … all mainstream porn tells one story … You don’t have to fit one idea of what a woman should look like.”

That concept fits with the startup’s name “Quinn,” which Caroline says one of her best guy friends thought up. “He said this girl he met — his dream girl — was named ‘Quinn.’ ”

Caroline took to Reddit and Tumblr to find Quinn’s first creators. Reddit stuck to text and links for much of its history, fostering the kinky literature and audio communities. And when Tumblr banned porn in December, it left a legion of adult content makers looking for a new home. “Our audio ranges from guided masturbation to overheard sex, and there’s also narrated stories. It’s literally everything. Different strokes for different for folks, know what I mean?” Caroline says with a cheeky laugh.

To establish its brand, Quinn is running social media influencer campaigns where “The basic idea is to make people feel like it’s okay to experience pleasure. It’s hard to make something like masturbation cool, so that’s a little bit of a lofty goal. We’re just trying to make it feel okay, and even more okay than it is for men.”

As for the business model, Caroline’s research found younger women were embarrassed to pay for porn. Instead, Quinn plans to run ads, though there could be commerce opportunities too. And because the site doesn’t bombard users with nude photos or hardcore videos, it might be able to attract sponsors that most porn sites can’t.

Until monetization spins up, Quinn has the sub-$1 million in funding that Caroline won’t reveal the source of, though she confirms it’s not from her brother. “I wouldn’t say that he’s particularly involved other than he’s one of the most important people in my life and I talk to him all the time. He gives me the best advice I can imagine,” the younger sibling says. “He doesn’t have any qualms, he’s very supportive.”

Quinn will need all the morale it can get, as Caroline bluntly admits, “We have a lot of competitors.” There’s the traditional stuff like Pornhub, user-generated content sites like Make Love Not Porn and spontaneous communities like on Reddit. She calls $5 million-funded audio porn startup Dipsea “an exciting competitor,” though she notes that “we sway a little more erotic than they do, but we’re so supportive of their mission.” How friendly.

Quinn’s biggest rival will likely be outdated but institutionalized site Literotica, which SimilarWeb ranks as the 60th most popular adult website, 631st most visited site overall, showing it gets 53 million hits per month. But the fact that Literotica looks like a web 1.0 forum yet has so much traffic signals a massive opportunity for Quinn. With rules prohibiting Quinn from launching native mobile apps, it will have to put all its effort into making its website stand out if it’s going to survive.

But more than competition, Caroline fears that Quinn will have to convince women to give its style of porn a try. “Basically, there’s this idea that for men, masturbation is an innate drive and for women it’s a ‘could do without it, could do with it.’ Quinn is going to have to make a market alongside a product and that terrifies me,” Caroline says, her voice building with enthusiasm. “But that’s what excites me the most about it, because what I’m banking on is if you’ve never had chocolate before, you don’t know. But once you have it, you start craving it. A lot of women haven’t experienced raw, visceral pleasure before, [but once we help them find it] we’ll have momentum.”

Most importantly, Quinn wants all women to feel they have rightful access to whatever they fancy. “It’s not about deserving to feel great. You don’t have to do Pilates to use this. You don’t have to always eat right. There’s no deserving with our product. Our mission is for women to be more in touch with themselves and feel fucking great. It’s all about pleasure and good vibes.”

Powered by WPeMatico

Lyft raised more than $2 billion Thursday afternoon after pricing its shares at $72 apiece, the top of the expected range of $70 to $72 per share. This gives Lyft a fully diluted market value of $24 billion.

The company will debut on the Nasdaq stock exchange Friday morning, trading under the ticker symbol “LYFT.”

The initial public offering is the first-ever for a ride-hailing business and represents a landmark liquidity event for private market investors, which had invested billions of dollars in the San Francisco-based company. In total, Lyft had raised $5.1 billion in debt and equity funding, reaching a valuation of $15.1 billion last year.

Lyft’s blockbuster IPO is unique for a number of reasons, in addition to being amongst transportation-as-a-service companies to transition from private to public. Lyft has the largest net losses of any pre-IPO business, posting losses of $911 million on revenues of $2.2 billion in 2018. However, the company is also raking in the largest revenues, behind only Google and Facebook, for a pre-IPO company. The latter has made it popular on Wall Street, garnering buy ratings from analysts prior to pricing.

Uber is the next tech unicorn, or company valued north of $1 billion, expected out of the IPO gate. It will trade on the New York Stock Exchange in what is one of the most anticipated IPOs in history. The company, which reported $3 billion in Q4 2018 revenues with net losses of $865 million, is reportedly planning to unveil its IPO prospectus next month.

Next in the pipeline is Pinterest, which dropped its S-1 last week and revealed a path to profitability that is sure to garner support from Wall Street investors. The visual search engine will trade on the NYSE under the symbol “PINS.” It posted revenue of $755.9 million last year, up from $472.8 million in 2017. The company’s net loss, meanwhile, shrank to $62.9 million last year from $130 million in 2017.

Other notable companies planning 2019 stock offerings include Slack, Zoom — a rare, profitable pre-IPO unicorn — and, potentially, Airbnb.

Updating.

Powered by WPeMatico

Kong, the open core API management and life cycle management company previously known as Mashape, today announced that it has raised a $43 million Series C round led by Index Ventures. Previous investors Andreessen Horowitz and Charles River Ventures (CRV), as well as new investors GGV Capital and World Innovation Lab, also participated. With this round, Kong has now raised a total of $71 million.

The company’s CEO and co-founder Augusto Marietti tells me the company plans to use the funds to build out its service control platform. He likened this service to the “nervous system for an organization’s software architecture.”

Right now, Kong is just offering the first pieces of this, though. One area the company plans to especially focus on is security, in addition to its existing management tools, where Kong plans to add more machine learning capabilities over time, too. “It’s obviously a 10-year journey, but those two things — immunity with security and machine learning with [Kong] Brain — are really a 10-year journey of building an intelligent platform that can manage all the traffic in and out of an organization,” he said.

In addition, the company also plans to invest heavily in its expansion in both Europe and the Asia Pacific market. This also explains the addition of World Innovation Lab as an investor. The firm, after all, focuses heavily on connecting companies in the U.S. with partners in Asia — and especially Japan. As Marietti told me, the company is seeing a lot of demand in Japan and China right now, so it makes sense to capitalize on this, especially as the Chinese market is about to become more easily accessible for foreign companies.

Kong notes that it doubled its headcount in 2018 and now has more than 100 enterprise customers, including Yahoo! Japan, Ferrari, SoulCycle and WeWork.

It’s worth noting that while this is officially a Series C investment, Marietti is thinking of it more like a Series B round, given that the company went through a major pivot when it moved from being Mashape to its focus on Kong, which was already its most popular open-source tool.

“Modern software is now built in the cloud, with applications consuming other applications, service to service,” said Martin Casado, general partner at Andreessen Horowitz . “We’re at the tipping point of enterprise adoption of microservices architectures, and companies are turning to new open-source-based developer tools and platforms to fuel their next wave of innovation. Kong is uniquely suited to help enterprises as they make this shift by supporting an organization’s entire service architecture, from centralized or decentralized, monolith or microservices.”

Powered by WPeMatico

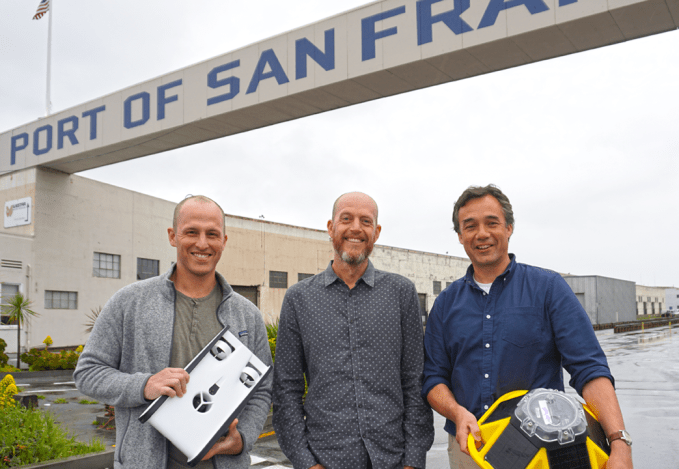

What lies beneath the murky depths? SolarCity co-founder Peter Rive wants to help you and the scientific community find out. He’s just led a $7 million Series A for Sofar Ocean Technologies, a new startup formed from a merger he orchestrated between underwater drone maker OpenROV and sea sensor developer Spoondrift. Together, they’re teaming up their 1080p Trident drone and solar-powered Spotter sensor to let you collect data above and below the surface. They can help you shoot awesome video footage, track waves and weather, spot fishing and diving spots, inspect boats or infrastructure for damage, monitor acquaculture sites or catch smugglers.

Sofar’s Trident drone (left) and Spotter sensor (right)

“Aerial drones give us a different perspective of something we know pretty well. Ocean drones give us a view at something we don’t really know at all,” former Spoondrift and now Sofar CEO Tim Janssen tells me. “The Trident drone was created for field usage by scientists and is now usable by anyone. This is pushing the barrier towards the unknown.”

But while Rive has a soft spot for the ecological potential of DIY ocean exploration, the sea is crowded with competing drones. There are more expensive professional research-focused devices like the Saildrone, DeepTrekker and SeaOtter-2, as well as plenty of consumer-level devices like the $800 Robosea Biki, $1,000 Fathom ONE and $5,000 iBubble. The $1,700 Sofar Trident, which requires a cord to a surface buoy to power its three hours of dive time and two meters per second speed, sits in the middle of the pack, but Sofar co-founder David Lang things Trident can win with simplicity, robustness and durability. The question is whether Sofar can become the DJI of the water, leading the space, or if it will become just another commoditized hardware maker drowning in knock-offs.

From left: Peter Rive (chairman of Sofar), David Lang (co-founder of OpenROV) and Tim Janssen (co-founder and CEO of Sofar)

Spoondrift launched in 2016 and raised $350,000 to build affordable ocean sensors that can produce climate-tracking data. “These buoys (Spotters) are surprisingly easy to deploy, very light and easy to handle, and can be lowered in the water by hand using a line. As a result, you can deploy them in almost any kind of conditions,” says Dr. Aitana Forcén-Vázquez of MetOcean Solutions.

OpenROV (it stands for Remotely Operated Vehicle) started seven years ago and raised $1.3 million in funding from True Ventures and National Geographic, which was also one of its biggest Trident buyers. “Everyone who has a boat should have an underwater drone for hull inspection. Any dock should have its own weather station with wind and weather sensors,” Sofar’s new chairman Rive declares.

Spotter could unlock data about the ocean at scale

Sofar will need to scale to accomplish Rive’s mission to get enough sensors in the sea to give us more data on the progress of climate change and other ecological issues. “We know very little about our oceans since we have so little data, because putting systems in the ocean is extremely expensive. It can cost millions for sensors and for boats,” he tells me. We gave everyone GPS sensors and cameras and got better maps. The ability to put low-cost sensors on citizens’ rooftops unlocked tons of weather forecasting data. That’s more feasible with Spotter, which costs $4,900 compared to $100,000 for some sea sensors.

Sofar hardware owners do not have to share data back to the startup, but Rive says many customers are eager to. They’ve requested better data portability so they can share with fellow researchers. The startup believes it can find ways to monetize that data in the future, which is partly what attracted the funding from Rive and fellow investors True Ventures and David Sacks’ Craft Ventures. The funding will build up that data business and also help Sofar develop safeguards to make sure its Trident drones don’t go where they shouldn’t. That’s obviously important, given London’s Gatwick airport shutdown due to a trespassing drone.

Spotter can relay weather conditions and other climate data to your phone

“The ultimate mission of the company is to connect humanity to the ocean as we’re mostly conservationists at heart,” Rive concludes. “As more commercialization and business opportunities arise, we’ll have to have conversations about whether those are directly benefiting the ocean. It will be important to have our moral compass facing in the right direction to protect the earth.”

Powered by WPeMatico

You know how kings used to have trumpeters heralding their arrival wherever they went? Proxy wants to do that with Bluetooth. The startup lets you instantly unlock office doors and reserve meeting rooms using Bluetooth Low Energy signal. You never even have to pull out your phone or open an app. But Proxy is gearing up to build an entire Bluetooth identity layer for the world that could invisibly hover around its users. That could allow devices around the workplace and beyond to instantly recognize your credentials and preferences to sign you into teleconferences, pay for public transit or ask the barista for your usual.

Today, Proxy emerges from stealth after piloting its keyless, badgeless office entry tech with 50 companies. It’s raised a $13.6 million Series A round led by Kleiner Perkins to turn your phone into your skeleton key. “The door is a forcing function to solve all the hard problems — everything from safety to reliability to the experience to privacy,” says Proxy co-founder and CEO Denis Mars. “If you’re gonna do this, it’s gonna have to work right, and especially if you’re going to do this in the workplace with enterprises where there’s no room to fix it.”

But rather than creepily trying to capitalize on your data, Proxy believes you should own and control it. Each interaction is powered by an encrypted one-time token so you’re not just beaming your unprotected information out into the universe. “I’ve been really worried about how the internet world spills over to the physical world. Cookies are everywhere with no control. What’s the future going to be like? Are we going to be tracked everywhere or is there a better way?” He figured the best path to the destiny he wanted was to build it himself.

Mars and his co-founder Simon Ratner, both Australian, have been best buddies for 10 years. Ratner co-founded a video annotation startup called Omnisio that was acquired by YouTube, while Mars co-founded teleconferencing company Bitplay, which was bought by Jive Software. Ratner ended up joining Jive where the pair began plotting a new startup. “We asked ourselves what we wanted to do with the next 10 or 20 years of our lives. We both had kids and it changed our perspective. What’s meaningful that’s worth working on for a long time?”

They decided to fix a real problem while also addressing their privacy concerns. As he experimented with Internet of Things devices, Mars found every fridge and light bulb wanted you to download an app, set up a profile, enter your password and then hit a button to make something happen. He became convinced this couldn’t scale and we’d need a hands-free way to tell computers who we are. The idea for Proxy emerged. Mars wanted to know, “Can we create this universal signal that anything can pick up?”

Most offices already have infrastructure for badge-based RFID entry. The problem is that employees often forget their badges, waste time fumbling to scan them and don’t get additional value from the system elsewhere.

So rather than re-invent the wheel, Proxy integrates with existing access control systems at offices. It just replaces your cards with an app authorized to constantly emit a Bluetooth Low Energy signal with an encrypted identifier of your identity. The signal is picked up by readers that fit onto the existing fixtures. Employees can then just walk up to a door with their phone within about six feet of the sensor and the door pops open. Meanwhile, their bosses can define who can go where using the same software as before, but the user still owns their credentials.

“Data is valuable, but how does the end user benefit? How do we change all that value being stuck with these big tech companies and instead give it to the user?” Mars asks. “We need to make privacy a thing that’s not exploited.”

Mars believes now’s the time for Proxy because phone battery life is finally getting good enough that people aren’t constantly worried about running out of juice. Proxy’s Bluetooth Low Energy signal doesn’t suck up much, and geofencing can wake up the app in case it shuts down while on a long stint away from the office. Proxy has even considered putting inductive charging into its sensors so you could top up until your phone turns back on and you can unlock the door.

Opening office doors isn’t super exciting, though. What comes next is. Proxy is polishing its features that auto-reserve conference rooms when you walk inside, that sign you into your teleconferencing system when you approach the screen and that personalize workstations when you arrive. It’s also working on better office guest check-in to eliminate the annoying iPad sign-in process in the lobby. Next, Mars is eyeing “Your car, your home, all your devices. All these things are going to ask ‘can I sense you and do something useful for you?’ ”

After demoing at Y Combinator, thousands of companies reached out to Proxy, from hotel chains to corporate conglomerates to theme parks. Proxy charges for its hardware, plus a monthly subscription fee per reader. Employees are eager to ditch their keycards, so Proxy sees 90 percent adoption across all its deployments. Customers only churn if something breaks, and it hasn’t lost a customer in two years, Mars claims.

The status quo of keycards, competitors like Openpath and long-standing incumbents all typically only handle doors, while Proxy wants to build an omni-device identity system. Now Proxy has the cash to challenge them, thanks to the $13.6 million from Kleiner, Y Combinator, Coatue Management and strategic investor WeWork. In fact, Proxy now counts WeWork’s headquarters and Dropbox as clients. “With Proxy, we can give our employees, contractors and visitors a seamless smartphone-enabled access experience they love, while actually bolstering security,” says Christopher Bauer, Dropbox’s physical security systems architect.

The cash will help answer the question of “How do we turn this into a protocol so we don’t have to build the other side for everyone?,” Mars explains. Proxy will build out SDKs that can be integrated into any device, like a smoke detector that could recognize which people are in the vicinity and report that to first responders. Mars thinks hotel rooms that learn your climate, wake-up call and housekeeping preferences would be a no-brainer. Amazon Go-style autonomous retail could also benefit from the tech.

When asked what keeps him up at night, Mars concludes that “the biggest thing that scares me is that this requires us to be the most trustworthy company on the planet. There is no ‘move fast, break things’ here. It’s ‘move fast, do it right, don’t screw it up.’ “

Powered by WPeMatico