Fundings & Exits

Auto Added by WPeMatico

Auto Added by WPeMatico

Wefox Group, the Berlin-based insurtech startup behind the consumer-facing insurance app and carrier One and the insurance platform Wefox, has raised $125 million in Series B funding. Notably, the round is led by Abu Dhabi government-owned Mubadala Ventures (which is also an LP in SoftBank’s Vision Fund) and is the first investment from Mubadala’s newly created European Investment Fund. Chinese investor Creditease also participated.

The investment, which Wefox Group says is the first tranche in the Series B round, will be used for expansion into the European broker market. The German company will also grow its product and engineering teams, specifically in relation to applying “advanced data analytics” to realise Wefox’s vision for an all-in-one insurance platform that places personalisation at the heart of how various insurance coverage is sold and delivered.

Wefox’s existing investors include Target Global, Salesforce Ventures, Seedcamp, Idinvest and Hollywood actor Ashton Kutcher’s investment vehicle Sound Ventures. The startup raised $28 million in Series A funding in late 2016.

In a call with Wefox Group co-founder and CEO Julian Teicke, he disclosed that Wefox has grown its revenues to around $40 million since being founded in 2014. The company now serves more than 1,500 brokers and more than 400,000 customers, making it “Europe’s number one insurtech platform.”

As it exists today, Wefox Group consists of two main products and subsidiaries: Wefox, and One.

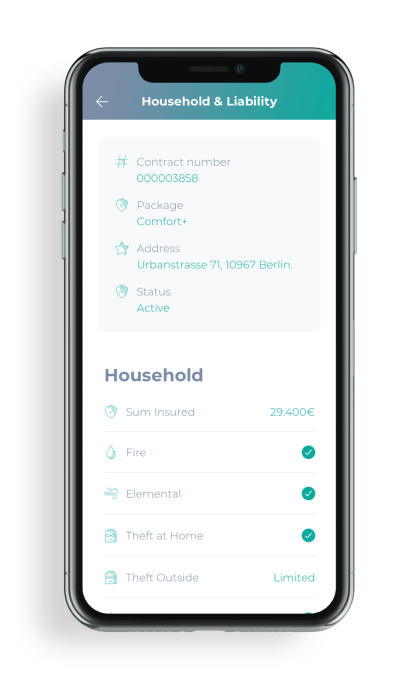

Wefox is a platform that connects insurance providers, brokers and customers in an attempt to drag the insurance industry into the digital age. Rather than bypass human brokers entirely, Wefox lets independent brokers on-board their existing customers onto the platform to help deliver a better experience and more easily manage their clients’ coverage.

Efficiencies are achieved through a degree of automation, helping a broker scale the admin side of their business while also ensuring customers get the most appropriate coverage. From a consumer’s perspective, the Wefox app and website also acts as a “digital” wallet, where they can store details of the various insurance coverage to which they have subscribed.

Teicke says that about 80 percent of customers on the Wefox platform come via brokers. The remaining 20 percent sees customers sign-up direct. In this scenario, Wefox effectively acts as a lead generation or matching service for local brokers.

One is a direct-to-consumer fully digital insurance provider, offering various personal insurance coverage — and is only one of multiple insurance providers that reside on the Wefox platform and can be recommended by brokers. Teicke says it is also modular in design, letting customers select areas of coverage and essentially plugging in additional coverage based on their needs and appetite for risk at any given time. This includes pioneering the use of IoT and other data, customer permitting, to make insurance coverage proactive rather than reactive.

One is a direct-to-consumer fully digital insurance provider, offering various personal insurance coverage — and is only one of multiple insurance providers that reside on the Wefox platform and can be recommended by brokers. Teicke says it is also modular in design, letting customers select areas of coverage and essentially plugging in additional coverage based on their needs and appetite for risk at any given time. This includes pioneering the use of IoT and other data, customer permitting, to make insurance coverage proactive rather than reactive.

“The modular, timestamp and IoT triggered product design will be the role model for all insurance incumbents,” says Teicke. Related to this, Wefox Group plans to make the underlying technology of One available to other insurance providers so they too can plug proactive insurance provision into the Wefox platform, based on specific cohorts, scenarios and specialist coverage.

Ultimately, the grand vision and big bet — and no doubt what attracted such large amounts of capital into this Series B round — is that insurance will transition to a platform play, fueled by responsibly harnessing various types of data. The will see a platform exist to deliver the right coverage at the right time from a multitude of providers rather than the outdated and disparate model that exists today.

“Our hypothesis is that insurance will be massively impacted by the IoT data revolution,” says Teicke. “Insurers will have access to an exponentially grown number of real-time variables in order to price insurance products in real time. This trend will change insurance from a pure financial service to a service that offers proactive advice to reduce risk and consists of a financial service component only as an add-on to the core business model.”

Meanwhile, the new round of funding draws a line under a particularly tough period for Wefox Group after it was threatened with a lawsuit by New York-based insurance platform Lemon. The complaint, filed in the U.S. District Court Southern District of NY, alleged that Wefox reverse-engineered Lemonade to create One, and infringed Lemonade’s intellectual property. Ultimately, however, the dispute panned out to be a “much ado about nothing,” with Lemonade quietly dropping the lawsuit a few months later.

Powered by WPeMatico

Blueground, the startup providing turnkey flexible rental apartments, has raised $20 million in a round led by Athens-based VentureFriends, with participation from Endeavor Catalyst, Dubai’s Jabbar Internet Group and serial entrepreneur Kevin Ryan. Ryan — who helped found MongoDB, Gilt Groupe, Zola and others — will also join Blueground’s board of directors.

It’s no secret that remote work and frequent business travel are becoming more and more commonplace. As a result, a growing number of people are shying away from lengthy rental or lease commitments and are instead turning to companies like Blueground for more flexible short-term solutions.

Blueground is trying to be the go-to option for individuals moving or traveling to a city for as little as a month, or any duration longer. Similar to flexible office space providers, Blueground partners with major property owners to sign long-term leases for units it then furnishes and rents out with more flexible terms.

Users can rent listings for anywhere between one month to five years, and rates are set on a monthly basis, which can often lead to more favorable prices over medium-to-long-term stays relative to the short-term pricing structures commonly used by hospitality companies.

CEO Alex Chatzieleftheriou is intimately familiar with the value flexible leasing can unlock. Before founding Blueground, Chatzieleftheriou worked as a consultant for McKinsey, where he was frequently sent off to projects in far-off cities for months at a time — living in 15 cities over just seven years.

However, no matter how much time Alex logged in hotels, he constantly felt the frustration and mental strain of not having a stable personal living arrangement.

“I spent so much time in hotels but they never really resembled a home. They didn’t have enough space or enough privacy,” Chatzieleftheriou told TechCrunch. “But renting an apartment can be a huge pain in these cities. They can be hard to find, they usually have a minimum rental term of a year or more, and you usually have to deal with filling out paperwork and buying furniture.”

Knowing there were thousands of people at his company alone dealing with the same frustrations, Alex launched what would become Blueground, beginning with a handful of apartments in his home city of Athens, Greece.

Chatzieleftheriou and his team structured the platform to make the rental process as seamless as possible for the needs of flexible renters like himself. Through a quick plug-and-play checkout flow — more similar to the booking process for a hotel or Airbnb — renters can lock down an apartment without having to deal with the painful, costly and time-consuming traditional rental process. Tenants are also able to switch to any other Blueground listing during their rental period if their preferences change or if they want to explore different locations during their stay.

Every Blueground listing also comes completely furnished by the company’s design team, so renters don’t have to deal with buying, transporting — and eventually selling — furniture. And each apartment comes outfitted with digital and connected infrastructure so that tenants can monitor their apartment and arrange maintenance, housekeeping and other services directly through Blueground’s mobile app.

The value proposition is also fairly straightforward for the landlords Blueground partners with, as they avoid costs related to marketing and coordinating with fragmented brokers to fill open units, while also benefiting from steady rental payments, tenant vetting and free property management.

The offering certainly seems to be compelling for renters — while Chatzieleftheriou initially focused on serving business travelers and those moving for work, he quickly realized the market for flexible leasing was in fact much bigger. Blueground’s sales have tripled over the past three years and after its expansion in the U.S. last year, Blueground now hosts 1,700 listings in 10 cities across three continents.

“The trend of flexible and seamless real estate is bigger and is happening everywhere,” Chatzieleftheriou said. “A lot of people throughout the real estate sector really want this seamless, turnkey, furnished solution.”

To date, Blueground has raised a total of $28 million and plans to use funds from the latest round for additional hiring and to help the company reach its goal of growing its portfolio to 50,000 units over the next five years.

Powered by WPeMatico

SurveyMonkey announced today that it has acquired Usabilla, an Amsterdam-based website and app survey company, for $80 million in cash and stock.

Zander Lurie, CEO at SurveyMonkey, said Usabilla filled in a missing piece in its survey toolkit. “A key product that we identified that we really wanted to add to the portfolio, which is really adjacent to our VOC (voice of the customer) solution is a website feedback collector helping people on the web or on mobile apps really understand what users are doing on their site,” Lurie told TechCrunch.

Usabilla CEO Marc van Agteren says his company is adding a complementary product to SurveyMonkey. “If you compare us to the SurveyMonkey enterprise solution where you create surveys that you need to send out via social media or email, our software sits on a website and instantly provides feedback,” he said. For example, if there is a bug on the page, the user can click the Usabilla tool, capture the area of the page that’s problematic as a screenshot and send it with a comment to the website or app owner for review.

Conversely the website or app owner could display a question for the visitor to answer before he or she exits. This provides a way to get immediate feedback about design or why they are leaving without finishing a transaction, as examples.

Qualtrics, another survey company, was about to go public last fall when it was acquired by SAP for $8 billion, but Lurie doesn’t necessarily see this move as a reaction to that. He said that today’s acquisition was really related to enhancing the company’s enterprise product.

As for Qualtrics, he says that with the acquisition, it is more aligned with SAP now, and therefore really being marketed to SAP customers. He sees plenty of room in the survey market with customers of Adobe, Salesforce and Microsoft and others, whom he says probably aren’t looking for an SAP solution.

With Usabilla, SurveyMonkey gains a stronger foothold in the EU as the company’s headquarters in Amsterdam will become the SurveyMonkey’s largest EU office. The transaction also adds 130 new employees to the SurveyMonkey family, bringing the total number to more than 1,000. In addition, it can now access Usabilla’s 450 customers, which include Lufthansa, Philips and Vodafone. Lurie said there is some customer overlap, but given that the majority of Usabilla’s customers are outside the U.S., there would likely be a net customer gain from the purchase.

SurveyMonkey was founded in 1999 and went public last September. This is the company’s sixth acquisition and the first in three years, according to Lurie. Usabilla was founded in 2009 and raised a modest $1 million along the way.

The deal is subject to the normal regulatory approval process and is expected to close some time in the second quarter this year.

Powered by WPeMatico

The Nordic Web Ventures, the “pre-seed” investment firm founded by Neil Murray in late 2017, has raised a second fund to continue backing very early-stage startups within the Nordic ecosystem.

The remit of the new “Fund II” is largely unchanged from the first fund, promising to write the first cheque of between $50,000 and $75,000 for the most promising founders in the region.

In total, the size of The Nordic Web Ventures’ second fund is $1.5 million, which should see it have enough capital to make another 20 or more investments across the next 18-24 months, making the firm one of the most active investors in the region. Existing portfolio startups from Fund I include Engaging Care, TPH, Uizard, Meeshkan, SafetyWing and Confrere.

In addition to an all-star investor lineup of Fund I LPs returning for a second bite — such as Index’s Martin Mignot, Point Nine’s Christoph Janz and Philipp Moehring and Andy Chung of AngelList — Fund II sees a number of new LPs join. Most notably, perhaps, Skype and Atomico founder Niklas Zennström has invested, in addition to Atomico partner Sophia Bendz, who was previously an exec at Spotify and is already a very active angel investor in the Nordics and beyond.

Revealing that The Nordic Web Ventures plans to raise a much larger fund in the future, Murray tells me the plan for Fund II is to “fundamentally change” the early-stage landscape in one of Europe’s most interesting regions. He says the fund is also a great example of how Europe’s investment landscape is changing, with individuals from major European venture capital firms invested, as well as receiving backing “from some of the Nordic’s most successful entrepreneurs.”

Cue a statement from Atomico’s Sophia Bendz: “Neil and I share the same passion for entrepreneurship and both care a lot about the early stage ecosystem… The Nordic Web Ventures can, through their LP networks and expertise, provide dealflow, hands-on support and advice for Nordic pre-seed and seed companies, something that is super helpful for the founders and that’s what it’s all about in the end, being valuable to the entrepreneurs in a meaningful and relevant way.”

To that end, I’m also told that having raised Fund II, The Nordic Web publication and The Nordic Web Ventures will merge into a single entity, with The Nordic Web’s core focus moving forward “to support and strengthen the Nordic ecosystem through investment, analysis and community.”

Powered by WPeMatico

Customer experience management platform Medallia has filed to raise up to $70 million in Series F funding, according to regulatory documents obtained by the Prime Unicorn Index. The new shares were priced at $15 apiece, valuing the nearly two-decades-old business at $2.4 billion.

Medallia confirmed the funding. A previous version of this report pinpointed Medallia’s valuation at $1.7 billion.

Medallia is expected to finally transition to the public markets in 2019, a year chock-full of high-profile unicorn IPOs. The downsized round, which is less than half of its Series E funding, will likely be Medallia’s final infusion of private investment.

San Mateo-headquartered Medallia, led by newly appointed chief executive officer Leslie Stretch, operates a platform meant to help businesses better provide for their customers. Its core product, the Medallia Experience Cloud, provides employees real-time data on customers collected from online review sites and social media. The service leverages that data to provide insights and tools to improve customer experiences.

Leslie Stretch, president and CEO of Medallia (PRNewsfoto/Medallia)

According to PitchBook, Medallia boasts a particularly clean cap table, especially for a roughly 18-year-old business. It’s backed by four venture capital firms: Sequoia Capital, Saints Capital, TriplePoint Venture Growth and Grotmol Solutions, the latter which invested a small amount of capital in 2010. Medallia has raised a total of $268 million in equity funding, including a $150 million round in 2015 that valued the company at $1.25 billion.

Prior to hiring Stretch to lead the company to IPO, Medallia co-founder Borge Hald ran the company as CEO since its 2001 launch. Hald is now executive chairman and chief strategy officer.

Powered by WPeMatico

French startup Mirakl raised a $70 million funding round. Bain Capital is leading the round, with existing investors 83North, Felix Capital and Elaia Partners also participating.

If you’ve bought a few products from a third-party seller on an e-commerce website that isn’t Amazon or Alibaba, chances are you’ve used Mirakl in the past. The company has built a solution to manage the marketplace of your e-commerce platform.

While Mirakl doesn’t have a ton of customers, each customer is very valuable. The company has worked with some of the biggest names in e-commerce so that they could add a new revenue stream with a marketplace. Examples include Best Buy in Canada, Walmart in Mexico, Office Depot and Darty.

The startup also lets you create B2B marketplaces for bulk selling and other complicated transactions. Sellers can set minimum and maximum quantities and customize their listings.

In 2018, the startup managed to add 60 customers and launch 37 marketplaces — it doubled the gross merchandise volume compared to 2017. And it’s true that marketplaces are attractive. You can greatly increase your sales without any physical infrastructure investment as third-party sellers handle logistics.

Behind the scene, Mirakl has developed connectors that work with multiple e-commerce platforms. After setting up Mirakl, your third-party sellers will also get their own on-boarding back end. And Mirakl continuously helps you when it comes to maintaining a certain level of quality and handling orders.

More recently, Mirakl has developed a catalog manager so that you can more easily manage product listings. It lets you get product information, merge product listings and moderate your platform in general. Any e-commerce website can use it, not just websites that operate a Mirakl marketplace.

The company has also launched a services marketplace so you can upsell your customers with extended warranties and insurance products from third-party companies before they check out.

Mirakl works with global B2B platforms as well as retail websites that usually operate in a country or a handful of countries. Thirty percent of retail clients are French, 30 percent are American and 40 percent are from the rest of the world. The startup charges an upfront fee as well as a monthly subscription that varies according to the success of your marketplace.

With today’s funding round, the company plans to do more of the same, at a bigger scale. Mirakl will expand the team, expand to new countries and improve its product offering.

Powered by WPeMatico

Compass, the real estate tech platform that is now worth $4.4 billion, has made an acquisition to give its agents a boost when it comes to looking for good leads on properties to sell. It is acquiring Contactually, an AI-based CRM platform designed specifically for the industry, which includes features like linking up a list of homes sold by a brokerage with records of sales in the area and other property indexes to determine which properties might be good targets to tap for future listings.

Contactually had already been powering Compass’s own CRM service that it launched last year, so there is already a degree of integration between the two.

Terms of the deal are not being disclosed. Crunchbase notes that Contactually had raised around $18 million from VCs that included Rally Ventures, Grotech and Point Nine Capital, and it was last valued at around $30 million in 2016, according to PitchBook. From what I understand, the startup had strong penetration in the market, so it’s likely that the price was a bit higher than this previous valuation.

The plan is to bring over all of Contactually’s team of 32 employees, led by Zvi Band, the co-founder and CEO, to integrate the company’s product into Compass’s platform completely. They will report to CTO Joseph Sirosh and head of product Eytan Seidman. It will also mean a bigger operation for Compass in Washington, DC, which is where Contactually had been based.

“The Contactually team has worked for the past 8 years to build a best-in-class CRM that aggregates relationships and automatically documents every touchpoint,” said Band in a statement “We are proud that our investment into machine learning has resulted in new features like Best Time to Email and other data-driven, follow-up recommendations which help agents be more effective in their day-to-day. After working extensively with the Compass team, it was apparent that joining forces would accelerate our missions of building the future of the industry.”

For the time being, customers who are already using the product — and a large number of real estate brokers and agents in the U.S. already were, at prices that ranged from $59/month to $399/month depending on the level of service — will continue their contracts as before.

I suspect that the longer-term plan, however, will be a little different: You have to wonder if agents who compete against Compass would be happy to use a service where their data is being processed by it, and for Compass itself. I would suspect that having this tech for itself would give it an edge over the others.

Compass, I understand from sources, is on track to make $2 billion in revenues in 2019 (its 2018 targets were $1 billion on $34 billion in property sales, and it had previously said it would be doubling that this year). Now in 100 cities, it’s come a long way from its founding in 2012 by Ori Allon and Robert Reffkin.

The bigger picture beyond real estate is that, as with many other analog industries, those who are tackling them with tech-first approaches are sweeping up not only existing business, but in many cases helping the whole market to expand. Contactually, as a tool that can help source potential properties for sale that owners hadn’t previously considered putting on the market, could end up serving that very end for Compass.

The focus on using tech to storm into a legacy industry is also coming at an interesting time. As we’ve pointed out before, the housing market is predicted to cool this year, and that will put the squeeze on agents who do not have strong networks of clients and the tools to maximise whatever opportunities there are out there to list and sell properties.

The likes of Opendoor — which appears to be raising money and inching closer to Compass in terms of valuation — is also trying out a different model, which essentially involves becoming a middle part in the chain, buying properties from sellers and selling them on to buyers, to speed up the process and cut out some of the expenses for the end users. That approach underscores the fact that, while the infusion of technology is an inevitable trend, there will be multiple ways of applying that.

This appears to be Compass’s first full acquisition of a tech startup, although it has made partial acqui-hires in the past.

Powered by WPeMatico

Accurx, the U.K. startup and Entrepreneur First alumni that has developed a messaging service for doctor surgeries, has raised £8.8 million in Series A funding, TechCrunch has learned.

According to multiple sources, London venture capital firm Atomico has led the round, with participation from LocalGlobe and EF. We first heard a term sheet had been put on the table as far back as mid-January, while it is thought the investment only closed last week.

I also understand the round was highly contested, potentially pushing up Accurx’s valuation. One source tells me that Accel was in the running but didn’t end up investing.

Both Atomico and Accurx declined to comment.

Co-founded by Jacob Haddad and Laurence Bargery, who met and subsequently founded the company at Entrepreneur First in 2016, Accurx initially set out to develop a data-set and tools to help tackle the problem of inappropriate use of antibiotics, which is a major contributor to the diminishing effectiveness of antibiotics. Since then the startup has pivoted to focus on creating a broader communication platform to bring medical teams and patients closer together.

(Given Haddad and Bargery’s backgrounds, I dare say that the use of data and machine learning to help improve healthcare delivery is still very much front of mind for the company).

As it exists today, Accurx’s main product is Chain SMS, a messaging app for use by doctor surgeries to communicate with patients. It has been designed to support nurses, administration staff and practice managers etc., as well as GPs. Typical use-cases for Chain SMS includes sending advice to patients, notifying a patient of normal results, and reminding them to book appointments. All communication is saved back to a patient’s medical record to ensure a more joined up approach than might otherwise happen using arcane communication methods such as telephone calls and sending letters in the post.

(Somewhat related: this weekend, British Health Secretary Matt Hancock has called for the use of pagers for communications within the NHS to be phased out by 2021. The outdated technology costs the U.K. taxpayer-funded health service £6.6m per year, apparently).

To that end — and no doubt not gone unnoticed by investors — I gather that Chain SMS is already in use by 20 percent of GP practices in England, from close to zero when it launched in February 2018. The conventional wisdom is that startups find it difficult to penetrate the NHS, when in practice this is starting to change, whilst GP surgeries, although funded through the NHS, are actually run as independent businesses so arguably easier to sell into.

A fun fact: A quick spelunking of Companies House records reveals that prominent Conservative Party politician and former Army officer Tom Tugendhat — who is also the current chairman of the Foreign Affairs Committee and tipped by some to be a possible future PM — is an early investor in Accurx.

Separately, I’m told that Wendy Tan White, the former EF General Partner who recently joined Alphabet’s X (formerly Google X) as Vice President, has also invested as part of this latest round. Meanwhile, I understand that recently recruited Principal Irina Haivas led on behalf of Atomico. Haivas is a former surgeon and former surgical fellow at Harvard Medical School (yes, you read that correctly!) and has previously worked at healthcare investor GHO Capital Partners.

Powered by WPeMatico

Visual search engine Pinterest has joined a long list of high-flying technology companies planning to go public in 2019. The business has confidentially submitted paperwork to the Securities and Exchange Commission for an initial public offering slated for later this year, according to a report from The Wall Street Journal.

Pinterest declined to comment.

Founded in 2008 by Ben Silbermann, earlier reports indicated the company was planning to debut on the stock market in April. In late January, Pinterest took its first official step toward a 2019 IPO, hiring Goldman Sachs and JPMorgan Chase as lead underwriters for its offering.

The company garnered a $12.3 billion valuation in 2017 with a $150 million financing.

Touting 250 million monthly active users, Pinterest has raised nearly $1.5 billion in venture capital funding from key stakeholders Bessemer Venture Partners, Andreessen Horowitz, FirstMark Capital, Fidelity and SV Angel. The business brought in some $700 million in ad revenue in 2018, per reports, a 50 percent increase year-over-year.

Pinterest employs 1,600 people across 13 cities, including Chicago, London, Paris, São Paulo, Berlin and Tokyo. The company says half its users live outside the U.S.

Pinterest will likely follow Lyft, Uber and Slack to the public markets, which have all filed confidential paperwork for IPOs or, in Slack’s case, a reported direct listing, expected in the coming months.

Powered by WPeMatico

JFrog, the popular DevOps startup now valued at more than $1 billion after raising $165 million last October, is making a move to expand the tools and services it provides to developers on its software operations platform: it has acquired Shippable, a cloud-based continuous integration and delivery platform (CI/CD) that developers use to ship code and deliver app and microservices updates, and plans to integrate it into its Enterprise+ platform.

Terms of the deal — JFrog’s fifth acquisition — are not being disclosed, said Shlomi Ben Haim, JFrog’s co-founder and CEO, in an interview. From what I understand, though, it was in the ballpark of Shippable’s most recent valuation, which was $42.6 million back in 2014 when it raised $8 million, according to PitchBook data. (And that was the last time it raised money.)

Shippable employees are joining JFrog and plan to release the first integrations with Enterprise+ this coming summer, and a full integration by Q3 of this year.

Shippable, founded in 2013, made its name early on as a provider of a containerized continuous integration and delivery platform based on Docker containers, but as Kubernetes has overtaken Docker in containerized deployments, the startup had also shifted its focus beyond Docker containers.

The acquisition speaks to the consolidation that is afoot in the world of DevOps, where developers and organizations are looking for more end-to-end toolkits, not just to help develop, update and run their apps and microservices, but to provide security and more — or at least, makers of DevOps tools hope they will be, as they themselves look to grow their margins and business.

As more organizations run ever more of their operations as apps and microservices, DevOps have risen in prominence and are offered both toolkits from standalone businesses as well as those whose infrastructure is touched and used by DevOps tools. That means a company like JFrog has an expanding pool of competitors that include not just the likes of Docker, Sonatype and GitLab, but also AWS, Google Cloud Platform and Azure and “the Red Hats of the world,” in the words of Ben Haim.

For Shippable customers, the integration will give them access to security, binary management and other enterprise development tools.

“We’re thrilled to join the JFrog family and further the vision around Liquid Software,” said Avi Cavale, founder and CEO of Shippable, in a statement. “Shippable users and customers have long enjoyed our next-generation technology, but now will have access to leading security, binary management and other high-powered enterprise tools in the end-to-end JFrog Platform. This is truly exciting, as the combined forces of JFrog and Shippable can make full DevOps automation from code to production a reality.”

On the part of JFrog, the company will be using Shippable to provide a native CI/CD tool directly within JFrog.

“Before most of our users would use Jenkins, Circle CI and other CI/CD automation tools,” Ben Haim said. “But what you are starting to see in the wider market is a gradual consolidation of CI tools into code repository.”

He emphasized that this will not mean any changes for developers who are already happy using Jenkins or other integrations: just that it will now be offering a native solution that will be offered alongside these (presumably both with easier functionality and with competitive pricing).

JFrog today has 5,000 paying customers, up from 4,500 in October, including “most of the Fortune 500,” with marquee customers including the likes of Apple and Adobe, but also banks, healthcare organizations and insurance companies — “conservative businesses,” said Ben Haim, that are also now realizing the importance of using DevOps.

Powered by WPeMatico