Fundings & Exits

Auto Added by WPeMatico

Auto Added by WPeMatico

Meet Typology, a new Paris-based startup that designs and sells directly to consumer quality skincare and cosmetics products. The startup has been founded by Made.com co-founder Ning Li and is officially launching today.

“Typology is a relatively ambitious project. We want to challenge FMCG [fast-moving consumer goods] brands with a digital pure player,” Ning Li told me. “I spent all my career working in e-commerce. I’ve seen a lot of industries move from offline to online. But some industries, such as cosmetics, food and do-it-yourself, have been migrating to online channels more slowly.”

And it starts with a list of values. Typology wants to differentiate itself from cosmetics giants with simple lists of ingredients and no dangerous product for your skin or the environment. The company also promises that all its products are vegan, cruelty-free and made in France.

So the startup ticks all the right boxes. But if you’ve been following up-and-coming skincare companies, there are countless brands that make the same promises.

The main difference is that Typology doesn’t want to become yet another small-batch beauty brand. The team wants to create an e-commerce giant with multiple sub-brands, hundreds of products and an aggressive e-commerce strategy.

“Unilever, L’Oréal and P&G represent over 50 percent of the market. And on the other side, you have a ton of independent brands that are quite small and will probably never stand out,” Ning Li said.

Typology plans to launch 10 different product lines over the coming months. Each line will have its own concept and its own sub-brand. Everything has been developed in-house.

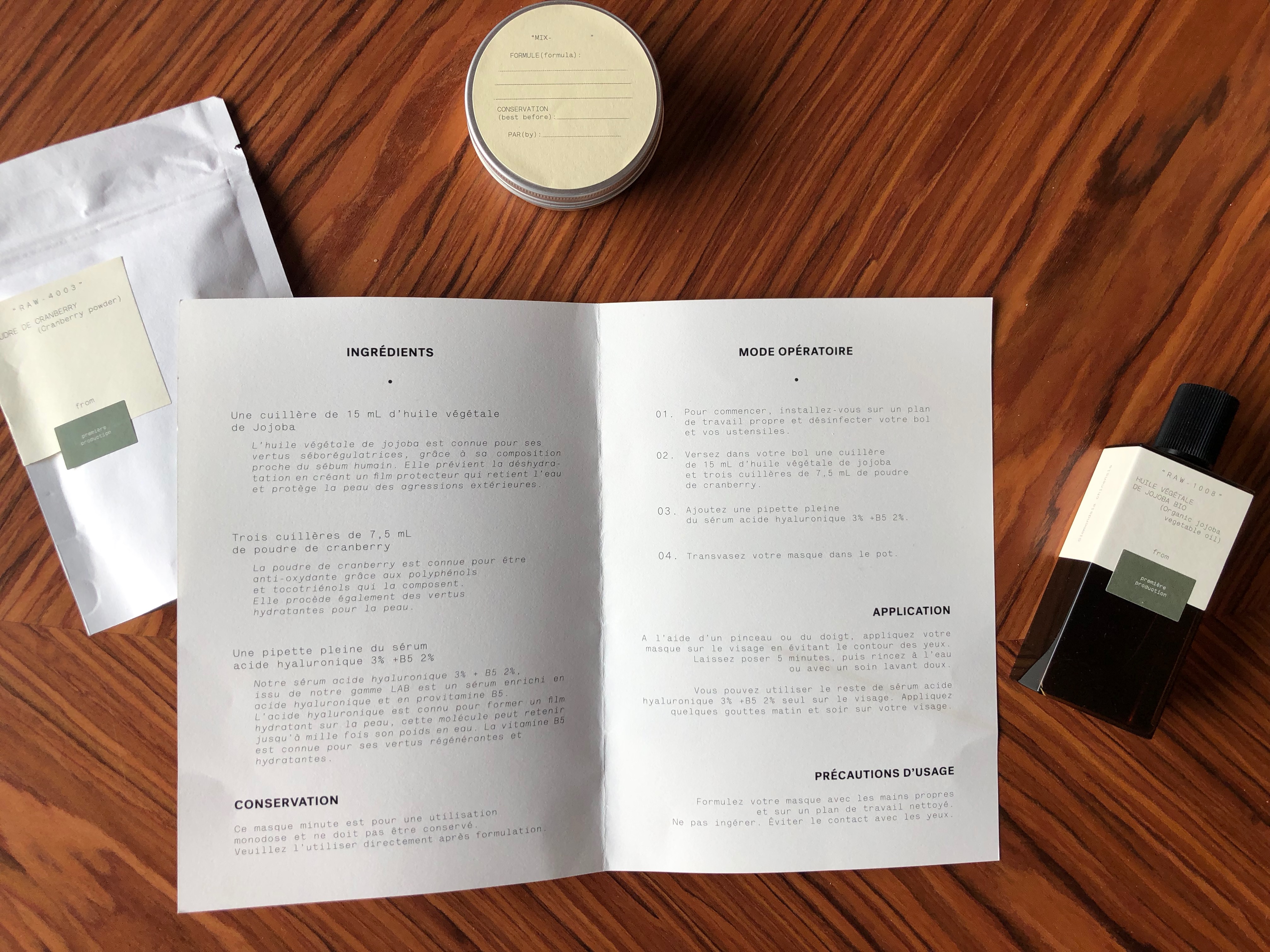

Today, the startup is launching three sub-brands. “Raw” is all about mixing products at home. You can order a kit and you’ll get oils, powders, spoons and a small box to create your own mask, hair oil, beard oil, etc. You can also order each product individually — Raw products are only made using one ingredient.

In the “Lab” product line, you’ll only find cosmetic serums. The company has launched six different tiny bottles for now. Each serum has its own set of properties depending on your needs.

Finally, “Ten” products are basic skincare products with less than 10 ingredients. The company is starting with face, hand and body moisturizers. Soon, the startup will also launch shower gels, shampoos, micellar water and a makeup remover.

When it comes to branding and packaging, Typology is betting everything on a minimalist design. I’m sure branding experts will tell you that clean, white labels mean transparency and simplicity. It’s also worth noting that Typology is a unisex brand.

The company wants to use recyclable packaging as much as possible by relying on glass and aluminum — you’ll get plastic bottles if you order bigger products though.

For now, Typology is only available in France, but the company plans to expand to other European countries very quickly. And they probably mean it as they have raised a significant seed round.

The startup has raised a $10 million funding round from Alven Capital, Marc Simoncini, Xavier Niel and Firstminute Capital. There are now 12 people working for Typology.

Some sub-brands will likely be instant hits while others might not attract that many customers. Typology is taking advantage of its bank account to try many different things and experiment when it comes to positioning. It’s going to be interesting to see how the product lineup evolves over the years.

Powered by WPeMatico

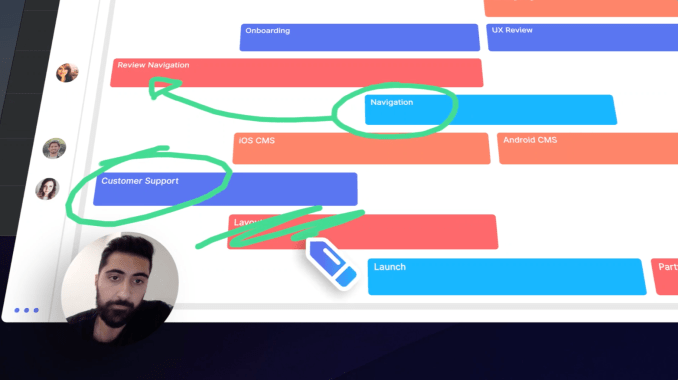

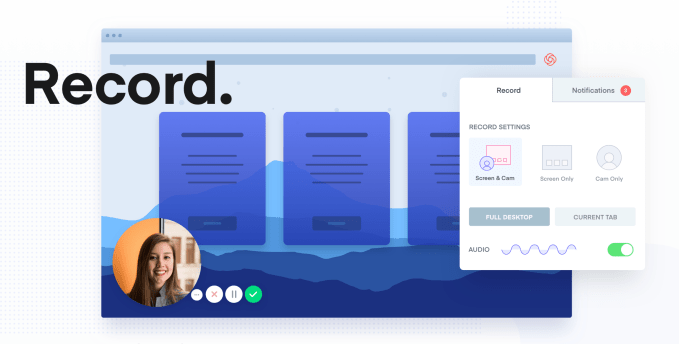

If a picture is worth a thousand words, how many emails can you replace with a video? As offices fragment into remote teams, work becomes more visual and social media makes us more comfortable on camera, it’s time for collaboration to go beyond text. That’s the idea behind Loom, a fast-rising startup that equips enterprises with instant video messaging tools. In a click, you can film yourself or narrate a screenshare to get an idea across in a more vivid, personal way. Instead of scheduling a video call, employees can asynchronously discuss projects or give “stand-up” updates without massive disruptions to their workflow.

In the 2.5 years since launch, Loom has signed up 1.1 million users from 18,000 companies. And that was just as a Chrome extension. Today Loom launches its PC and Mac apps that give it a dedicated presence in your digital work space. Whether you’re communicating across the room or across the globe, “Loom is the next best thing to being there,” co-founder Shahed Khan tells me.

Now Loom is ready to spin up bigger sales and product teams thanks to an $11 million Series A led by Kleiner Perkins . The firm’s partner Ilya Fushman, formally Dropbox’s head of product and corporate development, will join Loom’s board. He’ll shepherd Loom through today’s launch of its $10 per month per user Pro version that offers HD recording, calls-to-action at the end of videos, clip editing, live annotation drawings and analytics to see who actually watched like they’re supposed to.

“We’re ditching the suits and ties and bringing our whole selves to work. We’re emailing and messaging like never before, but though we may be more connected, we’re further apart,” Khan tells me. “We want to make it very easy to bring the humanity back in.”

Loom co-founder Shahed Khan

But back in 2016, Loom was just trying to survive. Khan had worked at Upfront Ventures after a stint as a product designer at website builder Weebly. He and two close friends, Joe Thomas and Vinay Hiremath, started Opentest to let app makers get usability feedback from experts via video. But after six months and going through the NFX accelerator, they were running out of bootstrapped money. That’s when they realized it was the video messaging that could be a business as teams sought to keep in touch with members working from home or remotely.

Together they launched Loom in mid-2016, raising a pre-seed and seed round amounting to $4 million. Part of its secret sauce is that Loom immediately starts uploading bytes of your video while you’re still recording so it’s ready to send the moment you’re finished. That makes sharing your face, voice and screen feel as seamless as firing off a Slack message, but with more emotion and nuance.

“Sales teams use it to close more deals by sending personalized messages to leads. Marketing teams use Loom to walk through internal presentations and social posts. Product teams use Loom to capture bugs, stand ups, etc.,” Khan explains.

Loom has grown to a 16-person team that will expand thanks to the new $11 million Series A from Kleiner, Slack, Cue founder Daniel Gross and actor Jared Leto that brings it to $15 million in funding. They predict the new desktop apps that open Loom to a larger market will see it spread from team to team for both internal collaboration and external discussions from focus groups to customer service.

Loom will have to hope that after becoming popular at a company, managers will pay for the Pro version that shows exactly how long each viewer watched. That could clue them in that they need to be more concise, or that someone is cutting corners on training and cooperation. It’s also a great way to onboard new employees. “Just watch this collection of videos and let us know what you don’t understand.” At $10 per month though, the same cost as Google’s entire GSuite, Loom could be priced too high.

Next Loom will have to figure out a mobile strategy — something that’s surprisingly absent. Khan imagines users being able to record quick clips from their phones to relay updates from travel and client meetings. Loom also plans to build out voice transcription to add automatic subtitles to videos and even divide clips into thematic sections you can fast-forward between. Loom will have to stay ahead of competitors like Vidyard’s GoVideo and Wistia’s Soapbox that have cropped up since its launch. But Khan says Loom looms largest in the space thanks to customers at Uber, Dropbox, Airbnb, Red Bull and 1,100 employees at HubSpot.

“The overall space of collaboration tools is becoming deeper than just email + docs,” says Fushman, citing Slack, Zoom, Dropbox Paper, Coda, Notion, Intercom, Productboard and Figma. To get things done the fastest, businesses are cobbling together B2B software so they can skip building it in-house and focus on their own product.

No piece of enterprise software has to solve everything. But Loom is dependent on apps like Slack, Google Docs, Convo and Asana. Because it lacks a social or identity layer, you’ll need to send the links to your videos through another service. Loom should really build its own video messaging system into its desktop app. But at least Slack is an investor, and Khan says “they’re trying to be the hub of text-based communication,” and the soon-to-be-public unicorn tells him anything it does in video will focus on real-time interaction.

Still, the biggest threat to Loom is apathy. People already feel overwhelmed with Slack and email, and if recording videos comes off as more of a chore than an efficiency, workers will stick to text. And without the skimability of an email, you can imagine a big queue of videos piling up that staffers don’t want to watch. But Khan thinks the ubiquity of Instagram Stories is making it seem natural to jump on camera briefly. And the advantage is that you don’t need a bunch of time-wasting pleasantries to ensure no one misinterprets your message as sarcastic or pissed off.

Khan concludes, “We believe instantly sharable video can foster more authentic communication between people at work, and convey complex scenarios and ideas with empathy.”

Powered by WPeMatico

Some interesting M&A is afoot in the world of hardware and software that’s aiming to improve the quality of audio and video communications over digital networks.

GN Group — the Danish company that broke new ground in mobile when it inked deals first with Apple and then Google to stream audio from their phones directly to smart, connected hearing aids — is expanding from audio to video, and from Europe to Silicon Valley.

Today, the company announced that it would acquire Altia Systems, a startup out of Cupertino that makes a “surround” videoconferencing device and software called the PanaCast (we reviewed it once) designed to replicate the panoramic, immersive experience of vision that we have as humans.

GN is paying $125 million for the startup. For some context, this price represents a decent return: according to PitchBook, Altia was last valued at around $78 million with investors including Intel Capital and others.

Intel’s investment was one of several strategic partnerships that Altia had inked over the years. (Another was with Zoom to provide a new video solution for Uber.)

The Intel partnership, for one, will continue post-acquisition. “Intel invested in Altia Systems to bring an industry leading immersive, Panoramic-4K camera experience to business video collaboration,” said Dave Flanagan, Vice President of Intel Corporation and Senior Managing Director of Intel Capital, in a statement. “Over the past few years, Altia Systems has collaborated with Intel to use AI and to deliver more intelligent conference rooms and business meetings. This helps customers make better decisions, automate workflows and improve business efficiency. We are excited to work with GN to further scale this technology on a global basis.”

We have seen a lot of applications of AI in just about every area of technology, but one of the less talked about, but very interesting, areas has been in how it’s being used to enhance audio in digital network. Pindrop, as one example, is creating and tracking “audio fingerprints” for security applications, specifically fraud prevention (to authenticate users and to help weed out imposters based not just on the actual voice but on all the other aural cues we may not pick up as humans but can help build a picture of a caller’s location and so on).

GN, meanwhile, has been building AI-based algorithms to help those who cannot hear as well, or who simply needs to hear better, be able to listen to calls on digital networks and make out what’s being said. This not only requires technology to optimise the audio quality, but also algorithms that can help tailor that quality to the specific person’s own unique hearing needs.

One of the more obvious applications of services like these are for those who are hard of hearing and use hearing aids (which can be awful or impossible to use with mobile phones), another is in call centers, and this appears to be the area where GN is hoping to address with the Altia acquisition.

GN already offers two products for call centre workers, Jabra and BlueParrot — headsets and speakerphones with their own proprietary software that it claims makes workers more efficient and productive just by making it easier to understand what callers are saying.

Altia will be integrated into that solution to expand it to include videoconferencing around unified communications solutions, creating more natural experiences for those who are not actually in physical rooms together.

“Combining GN Audio’s sound expertise, partner eco-system and global channel access with the video technology from Altia Systems, we will take the experience of conference calls to a completely new level,” said René Svendsen-Tune, President and CEO of GN Audio, in a statement.

What’s notable is that GN is a vertically-integrated company, building not just hardware but software to run on it. The AI engine underpinning some of its software development will be getting a vast new trove of data fed into it now by way of the PanaCast solution: not jut in terms of video, but the large amount of audio that will naturally come along with it.

“Combining PanaCast’s immersive, intelligent video with GN Audio’s intelligent audio solutions will enable us to deliver a whole new class of collaboration products for our customers,” said Aurangzeb Khan, President and CEO of Altia Systems, in a statement. “PanaCast’s solutions enable companies to improve meeting participants’ experience, automate workflows, and enhance business efficiency and real estate utilization with data lakes of valid information.”

Given GN’s work with Android and iOS devices, it will be interesting to see how and if these video solutions make their way to those platforms as well, either by way of solutions that work on their phones or perhaps more native integrations down the line.

Regardless of how that develops, what’s clear is that there remains a market not just for basic tools to get work done, but technology to improve the quality of those tools, and that’s where GN hopes it will resonate with this deal.

Powered by WPeMatico

Redis Labs, a startup that offers commercial services around the Redis in-memory data store (and which counts Redis creator and lead developer Salvatore Sanfilippo among its employees), today announced that it has raised a $60 million Series E funding round led by private equity firm Francisco Partners.

The firm didn’t participate in any of Redis Labs’ previous rounds, but existing investors Goldman Sachs Private Capital Investing, Bain Capital Ventures, Viola Ventures and Dell Technologies Capital all participated in this round.

In total, Redis Labs has now raised $146 million and the company plans to use the new funding to accelerate its go-to-market strategy and continue to invest in the Redis community and product development.

Current Redis Labs users include the likes of American Express, Staples, Microsoft, Mastercard and Atlassian . In total, the company now has more than 8,500 customers. Because it’s pretty flexible, these customers use the service as a database, cache and message broker, depending on their needs. The company’s flagship product is Redis Enterprise, which extends the open-source Redis platform with additional tools and services for enterprises. The company offers managed cloud services, which give businesses the choice between hosting on public clouds like AWS, GCP and Azure, as well as their private clouds, in addition to traditional software downloads and licenses for self-managed installs.

Redis Labs CEO Ofer Bengal told me the company’s isn’t cash positive yet. He also noted that the company didn’t need to raise this round but that he decided to do so in order to accelerate growth. “In this competitive environment, you have to spend a lot and push hard on product development,” he said.

It’s worth noting that he stressed that Francisco Partners has a reputation for taking companies forward and the logical next step for Redis Labs would be an IPO. “We think that we have a very unique opportunity to build a very large company that deserves an IPO,” he said.

Part of this new competitive environment also involves competitors that use other companies’ open-source projects to build their own products without contributing back. Redis Labs was one of the first of a number of open-source companies that decided to offer its newest releases under a new license that still allows developers to modify the code but that forces competitors that want to essentially resell it to buy a commercial license. Ofer specifically notes AWS in this context. It’s worth noting that this isn’t about the Redis database itself but about the additional modules that Redis Labs built. Redis Enterprise itself is closed-source.

“When we came out with this new license, there were many different views,” he acknowledged. “Some people condemned that. But after the initial noise calmed down — and especially after some other companies came out with a similar concept — the community now understands that the original concept of open source has to be fixed because it isn’t suitable anymore to the modern era where cloud companies use their monopoly power to adopt any successful open source project without contributing anything to it.”

Powered by WPeMatico

Compared to startups born into the frothy London fintech space as it exists today, 2011-founded GoCardless could well be considered a slow burner. However, in more recent years, the nearly 300-person company — headed by co-founder and CEO Hiroki Takeuchi — has undoubtedly stepped on the gas in a bid to become the one-stop shop globally for businesses that want to let customers pay via recurring bank payments.

A little over a year ago, GoCardless announced that it had raised $22.5 million in further funding, off the back of record annual growth in the U.K. and strong early traction in new markets. And today the fintech is disclosing another fresh injection of capital: $75 million in Series E funding, in part to fund new offices across EMEA, APAC and North America. In addition to its London HQ, the company already has sites in France, Australia and Germany, from which it says it processes transactions for 40,000 businesses worldwide.

Leading the round are new investors Adams Street Partners, Google Ventures and Salesforce Ventures. Previous backers Accel Partners, Balderton Capital, Notion Capital and Passion Capital also followed on.

In a call with Takeuchi late last week, he picked up on a familiar theme, describing the collection of recurring payments for many business as “broken.” Accessing the various bank to bank payments schemes has traditionally been difficult from a commercial, compliance and technical point of view. Instead, businesses have typically relied on payment methods, such as card payments or cheques, which aren’t up to the job of recurring payments.

That’s because these payment options are designed for one-off transactions (cards, for example, expire, breaking the payment flow). Meanwhile, there’s been a rise in subscription business models and an expanding B2B market in which contractors and partners need to make regular variable payments. According to Takeuchi, this means an international recurring payments network like the one GoCardless is building is needed more than ever.

“A global network for bank debit is an absolute necessity in allowing businesses to easily collect recurring payments anywhere, in any currency,” he says. “Thanks to the support of our investors we can now open up our global network and payments platform to more businesses across the world, delivering on our mission to take the pain out of getting paid, so that businesses can focus on what they do best.”

Takeuchi also tells me GoCardless is investing heavily in its product, with a product team of around 100 members. He declined to go into much detail with regards to GoCardless’ immediate or more long-term roadmap, although currency conversion is one area the company is developing new products for. It’s not clear if that will be via an FX partner, such as London neighbour TransferWise, or a more homegrown solution, although the former seems more likely. Takeuchi wouldn’t be drawn on any specifics.

Other areas of development include products to help businesses boost cash flow via “instant settlement,” and smarter payment features to increase transaction success rates. The latter could include using open banking to check if funds are available before trying to process a bank debit, or to automatically set the most appropriate payment date.

Powered by WPeMatico

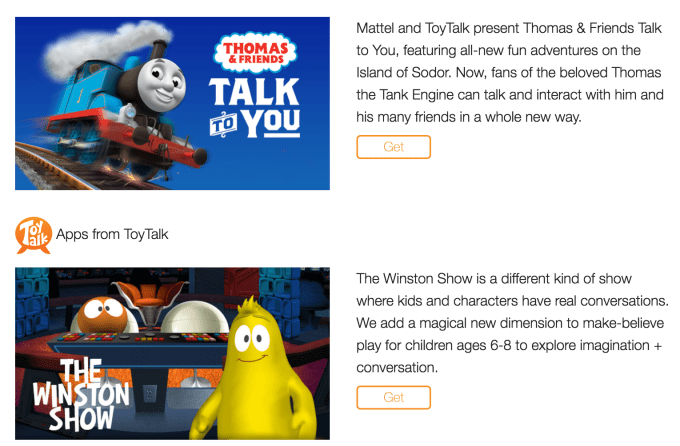

Apple has just bought up the talent it needs to make talking toys a part of Siri, HomePod, and its voice strategy. Apple has reportedly acquired PullString, also known as ToyTalk, according to Axios’ Dan Primack and Ina Fried. The company makes voice experience design tools, artificial intelligence to power those experiences, and toys like talking Barbie and Thomas The Tank Engine toys in partnership with Mattel. Founded in 2011 by former Pixar executives, PullString went on to raise $44 million.

Apple’s Siri is seen as lagging far behind Amazon Alexa and Google Assistant, not only in voice recognition and utility, but also in terms of developer ecosystem. Google and Amazon has built platforms to distribute Skills from tons of voice app makers, including storytelling, quizzes, and other games for kids. If Apple wants to take a real shot at becoming the center of your connected living room with Siri and HomePod, it will need to play nice with the children who spend their time there. Buying PullString could jumpstart Apple’s in-house catalog of speech-activated toys for kids as well as beef up its tools for voice developers.

PullString did catch some flack for being a “child surveillance device” back in 2015, but countered by detailing the security built intoHello Barbie product and saying it’d never been hacked to steal childrens’ voice recordings or other sensitive info. Privacy norms have changed since with so many people readily buying always-listening Echos and Google Homes.

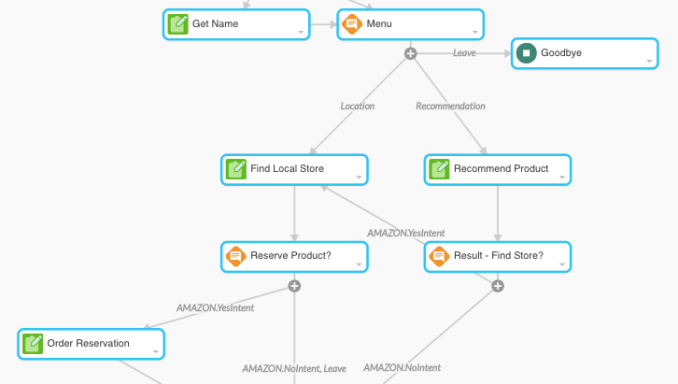

In 2016 it rebranded as PullString with a focus on developers tools that allow for visually mapping out conversations and publishing finished products to the Google and Amazon platforms. Given SiriKit’s complexity and lack of features, PullString’s Converse platform could pave the way for a lot more developers to jump into building voice products for Apple’s devices.

We’ve reached out to Apple and PullString for more details about whether PullString and ToyTalk’s products will remain available.

The startup raised its cash from investors including Khosla Ventures, CRV, Greylock, First Round, and True Ventures, with a Series D in 2016 as its last raise that PitchBook says valued the startup at $160 million. While the voicetech space has since exploded, it can still be difficult for voice experience developers to earn money without accompanying physical products, and many enterprises still aren’t sure what to build with tools like those offered by PullString. That might have led the startup to see a brighter future with Apple, strengthening one of the most ubiquitous though also most detested voice assistants.

Powered by WPeMatico

ChargedUp, a U.K. startup that offers a mobile charging network that takes inspiration from bike sharing, has closed £1.2 million in seed investment. Leading the round is Sir John Hegarty’s fund The Garage, and the ex-Innocent Smoothie founders fund JamJar. The funding will be used to grow the offering across the U.K. and for international expansion.

Founded by Hugo Tilmouth, Charlie Baron, Hakeem Buge and Forrest Skerman Stevenson, ChargedUp has set out to solve the dead mobile phone battery problem with a charging network. However, rather than offer fixed charging points, the team has developed a solution that lets you rent a mobile charging pack from one destination and return it at a different location if needed. That way, mobile phone use remains mobile.

“It’s annoying and inconvenient to be out and about with a dying phone battery,” says CEO Hugo Tilmouth. We’ve all been there and I was inspired to do something about it through my own experiences. I was at a cricket match at London’s Lord’s Cricket Ground and waiting for a call for a last round interview with a large tech firm, and was running very low on charge! I ended up having to leave the cricket ground, buy a power bank and then rode a Boris Bike home and the light bulb went off in my head! Why not combine the flexibility of the sharing economy with the need of a ‘ChargedUp’ phone!”

The solution was to create multiple distribution points across a city, located in the venues where people spend most of their time. This includes cafes, bars and restaurants. “Our solution uses an app to enable users to find the nearest stations, unlock a sharable power bank and then return it to any station in the network and only pay for the time they use. Our goal is to be never five minutes from a charge,” adds Tilmouth.

In the next six months, ChargedUp says it will expand its network of over 250 vending stations in London’s bars, cafes and restaurants across to other large metropolitan areas in the U.K. Last month, the young startup partnered with Marks & Spencer to trial the platform in its central London stores. If the trial is successful, ChargedUp says it could lead to providing its phone-charging solution to all M&S customers by the end of 2019.

“Since launch we have delivered over 1 million minutes of charge across the network, and our customers love the service,” says Tilmouth. “Like the sharing scooter and bike companies, we operate a time-based model. We simply charge our users a simple price of 50p per 30 mins to charge their phones. We also make revenue from the advertising space both on our batteries and within our app.”

With regards to competition, Tilmouth says ChargedUp’s most direct competitor is the charging lockers found in some public spaces, such as ChargeBox. “We do not see this as a viable alternative to ChargedUp as users are forced to lock their phones away preventing them from using them while it charges. They are also prone to theft and damage. We are also differentiated by our use of green energy offsetting throughout the network,” he says.

Meanwhile, in a statement, investor Sir John Hegarty talks up the revenue opportunities beyond rentals, which includes advertising, rewards and loyalty. “At its simplest, ChargedUp addresses a massive need in the market, mobile devices running out of power. But more than that, ChargedUp provides advertisers with a powerful medium that connects directly with their audience at point of purchase,” he says.

Prior to today’s seed round, ChargedUp received investment from Telefonica via the Wayra accelerator and Brent Hoberman’s Founders Factory.

Powered by WPeMatico

As autonomous driving eventually transforms cars from transportation devices to mobile theaters or conference rooms we will need better audio inside them. And we’ve already seen that VCs like Andreessen Horowitz say “audio is the future.”

So it’s interesting that Swedish sound pioneer Dirac has completed a new $13.2 million round of financing led by current investors. Previous investors included Swedish Angel network Club Network Investments, Erik Ejerhed and Staffan Persson.

Dirac makes sophisticated audio technology for customers including BMW, OnePlus, Rolls Royce, Volvo and Xiaomi .

Its platform is used by those firms for everything from capture to playback — regardless of device size or form factor.

“As consumer devices decrease in size and expand in complexity, digital signal processing is the key to unlocking their full audio potential and creating premium sound experiences,” says Dirac CEO Mathias Johansson. “With this new funding, we can take our approach to digitizing sound systems even further — creating more intelligent and adaptive audio processing solutions that establish new standards in both audio playback and capture across a variety of applications.”

Dirac has now appointed former Harman International executive Armin Prommersberger as CTO and opened a Copenhagen Research Development Center.

Johansson says new 5G networks are set to create new use-cases for current and emerging technologies, including audio.

Powered by WPeMatico

Last week TechCrunch reported that Reddit was raising $150 million from Chinese tech giant Tencent and up to $150 million more in a Series D that would value the company at $2.7 billion pre-money or $3 billion post-money. After no-commenting on our scoop, today Reddit confirmed it has raised $300 million at $3 billion post-money, with $150 million from Tencent.

The deal makes for an odd pairing between one of the architects of China’s Great Firewall of censorship and one of America’s most lawless free-speech forums. Some Redditors are already protesting the funding by trying to post content that would rile Chinese’s internet watchdogs, like imagery from Tiananmen Square and Winnie the Pooh memes mocking Chinese President Xi Jinping’s appearance.

The round brings the Conde Nast-majority owned Reddit to $550 million in total funding. Beyond Tencent, the rest of the round came from previous investors potentially including Andreessen Horowitz, Sequoia and Fidelity. Apparently frustrated that we had disrupted its PR plan, Reddit today handed confirmation of the round to CNBC, which re-reported our scoop without citation. While CNBC reported in June 2018 that Reddit would top $100 million in revenue, a reliable source tells us Reddit only brought in $85 million in 2018 revenue.

Reddit’s CEO Steve Huffman has had his own problems with attribution after the exec was caught editing users’ comments to mislead viewers into thinking they were insulting their Subreddit’s moderators. Huffman managed to get off with just an apology and vow not to do it again, though he seemed to laugh off and excuse the abuse of power by saying “I spent my formative years as a young troll on the Internet.”

Reddit will have to compete for ad dollars with the Google-Facebook duopoly despite having less information about its users, who are often anonymous. Reddit sees 330 million users per month across its Subreddit forums for discussing everything from news and entertainment to niche types of pornography, conspiracy theories and other highly brand-unsafe content. Meanwhile, users may be concerned that Reddit’s policy views could be tightened as it cosies up to Tencent.

Reddit has struggled with staff departures and user revolts over the years as it tries to balance freedom of expression with civility. The hope is the cash could help it pay for experienced leaders and more moderation staff to maintain that balance. But without proper oversight, the cash could simply scale up Reddit and its problems along with it.

Powered by WPeMatico

Lunar Way, the Nordic banking app that’s riding new EU regulation to help inject more competition into the region, has raised €13 million in new funding. The round is led by SEED Capital, with participation from Greyhound Capital, Socii Capital and a number of individual investors from the financial services industry.

It also comes shortly after Lunar Way announced it had attained a PISP payments license, meaning that the fintech can offer a more comprehensive banking feature-set, including making payments out of third-party bank accounts on a user’s behalf.

This, says Lunar Way founder Ken Villum Klausen, also paves the way for the startup to crack open the “Nordic clearing system monopoly,” which has traditionally made it difficult for new banking entrants.

“The new payment license grants us the option to instruct underlying banks to do payments, pay bills or even pay in a retail environment from their accounts,” explains Klausen. “So when you sign up, you’re able to connect to an existing bank-account in the sign up flow. And after that control all your finances through our platform.”

In addition, Lunar Way has a PSD2 AISP license, so that it is regulated to “co-own the transaction data,” which Klausen says Lunar Way can use in the company’s PFM features and for new products.

“The [Lunar Way] product offers all the fundamentals from a banking app. You can pay bills, transfer money, set a budget, do saving-goals, manage your card etc. We also have a few subscription-based credit lines, where you pay a monthly fee [for credit],” he says.

In Denmark, Lunar Way also acts as a “NemKonto” — or national Danish account — a type of bank account that the Danish government stipulates by law that all citizens and businesses must have.

Adds Klausen: “It has taken a few years to build our app to suit the different demands of the Nordic countries, but now we are a serious competitor to traditional banks. Our aim is — and have always been — to fundamentally change the status quo of banking. We’re now welcoming more than 10,000 new users a month and counting, which is substantial considering the fact that the Nordics’ total addressable market is 27 million people.”

Meanwhile, Lunar Way says it will use the funding to help accelerate the banking app’s growth, in a bid to reach further scale across the Nordics. I also understand the fintech is already gearing up for a new funding round pegged for later this summer.

Powered by WPeMatico