Fundings & Exits

Auto Added by WPeMatico

Auto Added by WPeMatico

Flash, the stealthy mobility startup from Delivery Hero and Team Europe founder Lukasz Gadowski, is de-cloaking today, with news that the Berlin-based company has raised a whopping €55 million in Series A funding.

Despite rumours that multiple VC firms would be involved, the bulk of the new funding comes from Target Global via its mobility fund, which led this round and was already an existing backer of Flash. Others participating in Flash’s Series A include Idinvest Partners, Signals Venture Capital and a number of unnamed angel investors.

Notably, Gadowski is listed as an Entrepreneur in Residence at Target Global, and has been broadly working in the mobility space for the past two years. Rather quietly, he is also an investor in Grin, the Mexico City-based electric scooter company backed by Y Combinator.

In a call with Gadowski, he filled in many of the blanks relating to his new venture, including positioning Flash as a “micro-mobility” company that wants to solve the last-mile transportation problem. The startup is initially entering the e-scooter rental space, but this is just the beginning, he says. More broadly, the way he and his team think about Flash is that it is “unbundling” the car, with new forms of transport.

“In a few years time, micro-mobility will look very different from today,” says Gadowski, revealing that before founding Flash last year, he also took a hard look at new forms of aviation.

Even though it is still very early days for Flash, the startup already boasts a current team of more than 50 full-time employees, recruited from the likes of Uber, Amazon, and Airbnb. Alongside Gadowski, the other Flash co-founders are Carlos Bhola (Corp. Development) and Tim Rucquoi-Berger (Supply & Operations).

“This is not a scooter” – Flash branding in stealth mode

Notably — and definitely quietly — Flash is already operating in Switzerland and Portugal, with plans to launch into France, Italy and Spain in spring 2019, and in the rest of Europe in summer 2019.

The existing launches have been soft-launches, to say the least, with Flash e-scooters not initially carrying the company’s branding, instead sporting the label “This is not a scooter,” part in-house word play, part a statement of intent. Not just another scooter company might be an even more apt label if Gadowski’s longer-term ambitions are realised.

Perhaps more of a product-market-fit trial than anything else, Flash has initially used off-the-shelf e-scooters at launch, whilst simultaneously developing its own hardware and technology. The startup is headquartered in Berlin, but Gadowski tells me the team was first posted in China, establishing a supply chain and other partnerships that he believes can help give Flash the edge.

I put to him a common belief amongst some VCs that the e-scooter space in Europe is heading for a bloodbath that will continue to see a huge amount of venture capital pumped into the space, and subsequently many losers and a lot of money lost.

Recent raises by European e-scooter startups include Wind Mobility ($22 million), VOI ($50 million and Tier (€25 million). Meanwhile, Taxify has also announced its entrance into e-scooter rentals, and Bird and Lime have received substantial investment from three of Europe’s top venture capital firms. Index and Accel have backed Bird, and Atomico has backed Lime.

Gadowski appears for the most part unfazed by the swelling of competition coffers, although he does concede that the current “land grab” is forcing Flash to move slightly faster than it might have done otherwise. In some ways, he would have preferred to continue a more staggered, cautious roll-out, describing the startup as “product-first and multi-vehicle,” and says its customers are not just users of the service but local residents more broadly and the authorities with which it needs to coordinate. “Mistakes can be a lot more serious than at Delivery Hero, safety is involved,” he cautions.

The size of recent funding rounds in the space has also surprised him. However, he doesn’t think this is a “Facebook scenario,” where there will only be a single winner. Several micro-mobility companies can happily co-exist, he says, and the early movers are helping to pave the way for others, including Flash.

I suggest that the e-scooter land grab at its current pace also has a high chance of provoking a backlash amongst consumers and/or authorities, perhaps after a more serious safety accident or other source of reputational damage. Gadowski concedes this is definitely a “short-term” risk, but says there is so much determination by governments and local authorities to solve congestion and the last-mile problem, he doesn’t believe it will be a long-term one.

Finally, I asked Gadowski if he is considering acquiring smaller e-scooter startups in Europe (or perhaps elsewhere), as part of a roll-up strategy that would help the company leapfrog competitors. He declined to rule out acquisitions entirely — Delivery Hero was very effective in this regard — but said it doesn’t make much sense right now as hype in the space has pushed valuations way up. A more likely scenario, he says, is investing in or acquiring startups that can help with other aspects of the business, such as in the supply chain.

Powered by WPeMatico

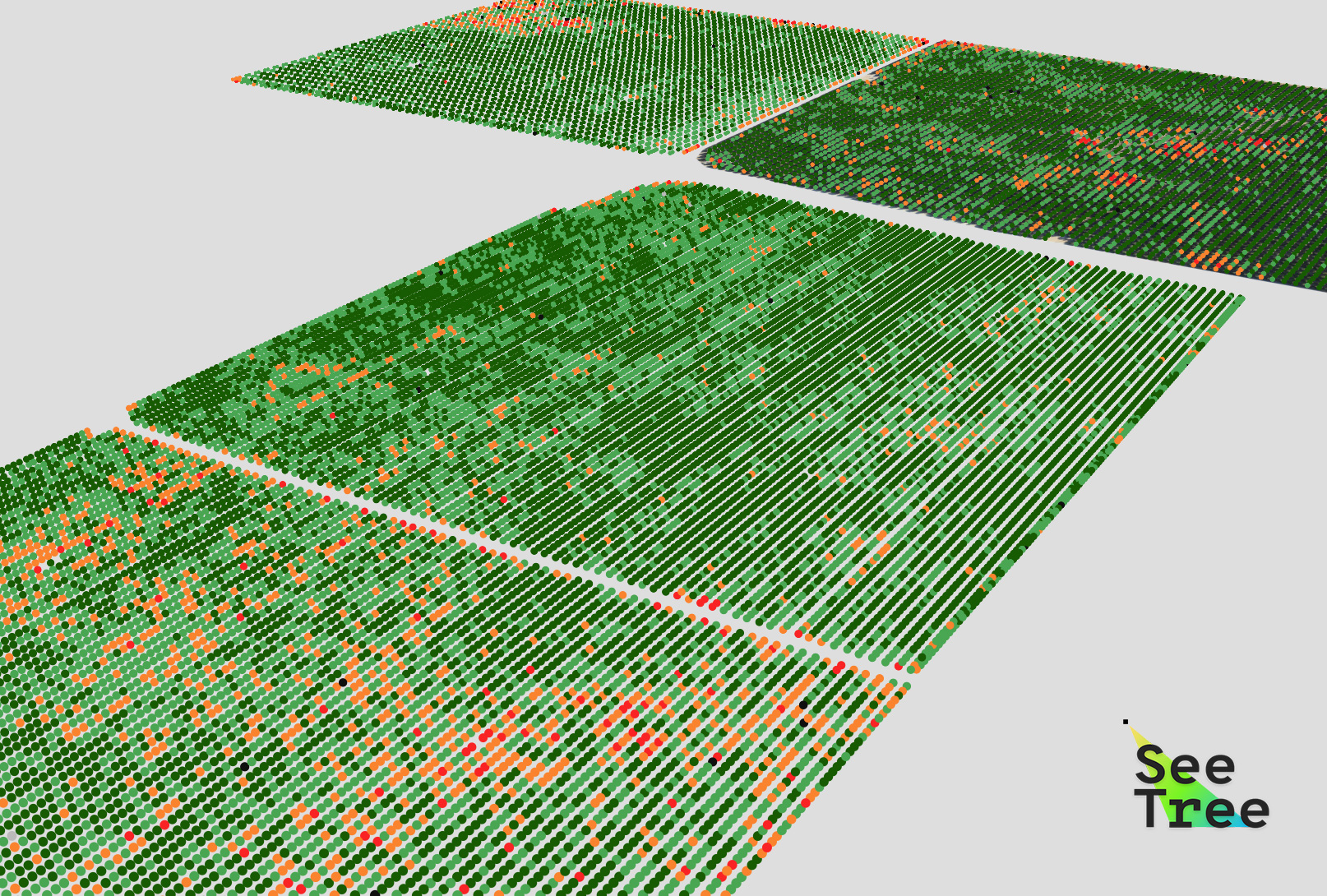

SeeTree, a Tel Aviv-based startup that uses drones and artificial intelligence to bring precision agriculture to their groves, today announced that it has raised an $11.5 million Series A funding round led by Hanaco Ventures, with participation from previous investors Canaan Partners Israel, Uri Levine and his investors group, iAngel and Mindset. This brings the company’s total funding to $15 million.

The idea behind the company, which also has offices in California and Brazil, is that in the past, drone-based precision agriculture hasn’t really lived up to its promise and didn’t work all that well for permanent crops like fruit trees. “In the past two decades, since the concept was born, the application of it, as well as measuring techniques, has seen limited success — especially in the permanent-crop sector,” said SeeTree CEO Israel Talpaz. “They failed to reach the full potential of precision agriculture as it is meant to be.”

He argues that the future of precision agriculture has to take a more holistic view of the entire farm. He also believes that past efforts didn’t quite offer the quality of data necessary to give permanent crop farmers the actionable recommendations they need to manage their groves.

SeeTree is obviously trying to tackle these issues and it does so by offering granular per-tree data based on the imagery gathered from drones and the company’s machine learning algorithms that then analyze this imagery. Using this data, farmers can then decide to replace trees that underperform, for example, or map out a plan to selectively harvest based on the size of a tree’s fruits and its development stages. They can then also correlate all of this data with their irrigation and fertilization infrastructure to determine the ROI of those efforts.

“Traditionally, farmers made large-scale business decisions based on intuitions that would come from limited (and often unreliable) small-scale testing done by the naked eye,” said Talpaz. “With SeeTree, farmers can now make critical decisions based on accurate and consistent small and large-scale data, connecting their actions to actual results in the field.”

SeeTree was founded by Talpaz, who like so many Israeli entrepreneurs previously worked for the country’s intelligence services, as well as Barak Hachamov (who you may remember from his early personalized news startup my6sense) and Guy Morgenstern, who has extensive experience as an R&D executive with a background in image processing and communications systems.

Powered by WPeMatico

Pro.com is basically a general contractor for the age of Uber and Prime Now. While the company started as a marketplace for hiring home improvement professionals, it has now morphed into a general contractor and serves Denver, Phoenix, San Francisco, San Jose and Seattle. Today, Pro.com announced that it has raised a $33 million Series B round led by WestRiver Group, Goldman Sachs and Redfin. Previous investors DFJ, Madrona Venture Group, Maveron and Two Sigma Ventures also participated.

WestRiver founder Erik Anderson, Redfin CEO Glenn Kelman and former Microsoft exec Charlotte Guyman are joining the Pro.com board.

“Many of Redfin’s customers struggle to get professional renovation services, so we know firsthand that Pro.com’s market opportunity is massive,” writes Redfin’s Kelman. “Pro.com and Redfin share a commitment to combining technology and local, direct services to best take care of customers.”

The company tells me that the round caps off a successful 2018, where Pro.com saw its job bookings grow by 275 percent over 2017, a number that was also driven by its expansion beyond the Seattle market (as well as the good economic climate that surely helped in driving homeowners to tackle more home improvement projects). The company now has 125 employees.

With this funding round, Pro.com has now raised a total of $60 million. It’ll use the funding to enter more markets, with Portland, Oregon being next on the list, and expand its team as it goes along.

It’s no secret that the home improvement market could use a bit of a jolt. The market is extremely local and fragmented — and finding the right contractor for any major project is a long and difficult process, where the outcome is never quite guaranteed. The process has enough vagaries that many people never get around to actually commissioning their projects. Pro.com wants to change that with a focus on transparency and technology. That’s a startup that’s harder to scale than the marketplace the company started out with, but it also gives the company a chance to establish itself as one of the few well-known brands in this space.

Powered by WPeMatico

Continuing a trend that VCs here in London tell me is seeing an increasing amount of deal-flow in Europe attract the interest of top-tier Silicon Valley venture capital firms, TechCrunch has learned that email security provider Tessian is the latest to raise from across the pond.

According to multiple sources, the London-based company has closed a Series B round led by Sequoia Capital. I understand that the deal could be announced within a matter of weeks, and that the round size is in the region of $40 million. Tessian declined to comment.

Founded in 2013 by three engineering graduates from Imperial College — Tim Sadler, Tom Adams and Ed Bishop — Tessian is deploying machine learning to improve email security. Once installed on a company’s email systems, the machine learning tech analyses an enterprise’s email networks to understand normal and abnormal email sending patterns and behaviours.

Tessian then attempts to detect anomalies in outgoing emails and warns users about potential mistakes, such as a wrongly intended recipient, or nefarious employee activity, before an email is sent. More recently, the startup has begun addressing in-bound email, too. This includes preventing phishing attempts or spotting when emails have been spoofed.

Meanwhile, Tessian (formerly called CheckRecipient) raised $13 million in Series A funding just 7 months ago in a round led by London’s Balderton Capital. The company’s other investors include Accel, Amadeus Capital Partners, Crane, LocalGlobe, Winton Ventures, and Walking Ventures.

Powered by WPeMatico

Immersive Labs, a cybersecurity skills platform founded by former GCHQ researcher James Hadley, has raised $8 million in Series A funding. Leading the round is Goldman Sachs, with participation from a number of unnamed private investors.

Operating in the cybersecurity training space, Immersive Labs helps enterprise IT and other cybersecurity teams acquire the latest security skills by combining up to date threat data with what is described as “gamified” learning. This sees the startup use real-time feeds of the latest attack techniques, hacker psychology and technological vulnerabilities to quickly create “cyber war games” for IT and security teams to learn from.

The idea is that the platform can up-skill people within hours of a threat emerging, in addition to being used more generally to help identify and remedy less immediate weaknesses in a company’s cybersecurity team.

“First, there is a big picture problem that the world is crying out for cybersecurity talent and is currently struggling to fill that gap,” Immersive Labs founder and CEO James Hadley tells me. “Secondly, the way that cyber skills are being taught is massively obsolete and puts the companies they work for at risk. On many occasions, what is taught is out of date before people leave the classroom.”

The inspiration for Immersive Labs was born out of Hadley’s experience running a summer school at GCHQ. It was while running the course that he came to the realisation that “passive classroom-based learning doesn’t suit the people, or pace, of cybersecurity.”

“Not only does the content date quickly, but the lack of challenge is just not enough for the curious and creative minds required to be good in cyber. You can’t dictate, they have to teach themselves through exploration,” he says.

“We let technical and security teams learn cyber skills like an attacker, allowing them to keep pace by combining breaking threat data with short browser-based war games. This takes the form of a series of stories that encourage people to research, analyse and build their own attacks and solutions. Whilst doing this, they learn in a fun and compelling way.”

To that end, Immersive Labs says its Series A funding will be used to grow its offering for enterprise IT and cybersecurity teams. This will include investing in headcount and infrastructure to develop the platform further, and to support the company’s go-to-market strategy. Current clients include global corporates with complex cybersecurity needs, such as BAE Systems, Sophos and Grant Thornton.

Powered by WPeMatico

The Daily Crunch is TechCrunch’s roundup of our biggest and most important stories. If you’d like to get this delivered to your inbox every day at around 9am Pacific, you can subscribe here:

1. Microsoft Bing not only shows child pornography, it suggests it

A TechCrunch-commissioned report has found damning evidence on Microsoft’s search engine. Our findings show a massive failure on Microsoft’s part to adequately police its Bing search engine and to prevent its suggested searches and images from assisting pedophiles.

2. Unity pulls nuclear option on cloud gaming startup Improbable, terminating game engine license

Unity, the widely popular gaming engine, has pulled the rug out from underneath U.K.-based cloud gaming startup Improbable and revoked its license — effectively shutting them out from a top customer source. The conflict arose after Unity claimed Improbable broke the company’s Terms of Service and distributed Unity software on the cloud.

Just when you thought things were going south for Improbable the company inked a late-night deal with Unity competitor Epic Games to establish a fund geared toward open gaming engines. This begs the question of how Unity and Improbable’s relationship managed to sour so quickly after this public debacle.

WeChat boasts more than 1 billion daily active users, but user growth is starting to hit a plateau. That’s been expected for some time, but it is forcing the Chinese juggernaut to build new features to generate more time spent on the app to maintain growth.

5. Bungie takes back its Destiny and departs from Activision

The creator behind games like Halo and Destiny is splitting from its publisher Activision to go its own way. This is good news for gamers, as Bungie will no longer be under the strict deadlines of a big gaming studio that plagued the launch of Destiny and its sequel.

6. Another server security lapse at NASA exposed staff and project data

The leaking server was — ironically — a bug-reporting server, running the popular Jira bug triaging and tracking software. In NASA’s case, the software wasn’t properly configured, allowing anyone to access the server without a password.

7. Is Samsung getting serious about robotics?

This week Samsung made a surprise announcement during its CES press conference and unveiled three new consumer and retail robots and a wearable exoskeleton. It was a pretty massive reveal, but the company’s look-but-don’t-touch approach raised far more questions than it answered.

Powered by WPeMatico

The Daily Crunch is TechCrunch’s roundup of our biggest and most important stories. If you’d like to get this delivered to your inbox every day at around 9am Pacific, you can subscribe here:

1. How Trump’s government shutdown is harming cyber and national security

The government has been shut down for nearly three weeks, and there’s no end in sight. While most of the core government departments — State, Treasury, Justice and Defense — are still operational, others like Homeland Security, which takes the bulk of the government’s cybersecurity responsibilities, are suffering the most.

2. With SEC workers offline, the government shutdown could screw IPO-ready companies

The SEC has been shut down since December 27 and only has 285 of its 4,436 employees on the clock for emergency situations. While tech’s most buzz-worthy unicorns like Uber and Lyft won’t suffer too much from the shutdown, smaller businesses, particularly those in need of an infusion of capital to continue operating, will bear the brunt of any IPO delays.

In 2018, seed activity as a percentage of all deals shrank from 31 percent to 25 percent — a decade low — while the share and size of late-stage deals swelled to record highs.

4. Banking startup N26 raises $300 million at $2.7 billion valuation

N26 is building a retail bank from scratch. The company prides itself on the speed and simplicity of setting up an account and managing assets. In the past year, N26’s valuation has exploded as its user base has tripled, with nearly a third of customers paying for a premium account.

5. E-scooter startup Bird is raising another $300M

Bird is reportedly nearing a deal to extend its Series C round with a $300 million infusion led by Fidelity. The funding, however, comes at a time when scooter companies are losing steam and struggling to prove that its product is the clear solution to last-mile transportation.

6. AWS gives open source the middle finger

It’s no secret that AWS has long been accused of taking the best open-source projects and re-using and re-branding them without always giving back to those communities.

7. The Galaxy S10 is coming on February 20

Looks like Samsung is giving Mobile World Congress the cold shoulder and has decided to announce its latest flagship phone a week earlier in San Francisco.

Powered by WPeMatico

The Daily Crunch is TechCrunch’s roundup of our biggest and most important stories. If you’d like to get this delivered to your inbox every day at around 9am Pacific, you can subscribe here:

1. Facebook is the new crapware

Well Facebook, you did it again. Fresh off its latest privacy scandal, the troubled social media giant has inked a deal with Android to pre-install its app on an undisclosed number of phones and make the software permanent. This means you won’t be able to delete Facebook from those phones. Thanks, Facebook.

2. The world’s first foldable phone is real

Chinese company Royole has beaten Samsung to the market and has been showing off a foldable phone/tablet this week at CES. While it’s not the most fluid experience, the device definitely works at adapting to your needs.

3. CES revokes award from female-founded sex tech company

Outcries of a double-standard are pouring out of CES after the Consumer Tech Association revoked an award from a company geared toward women’s sexual health.

4. Everything Google announced at CES 2019

Google went all in on the Assistant this year at CES. The company boasted that the voice-enabled AI will make its way onto a billion devices by the end of the month — up from 400 million last year. But what’s most exciting is the expanded capabilities of Google’s Assistant. Soon you’ll be able to check into flights and translate conversations on the fly with a simple “Hey Google.”

5. Rebranding WeWork won’t work

The company formerly known as WeWork has rebranded to the We Company, but its new strategy has the potential to plunge the company further into debt.

6. Despite promises to stop, US cell carriers are still selling your real-time phone location data

Last year a little-known company called LocationSmart came under fire after leaking location data from AT&T, Verizon, T-Mobile and Sprint users to shady customers. LocationSmart quickly buckled under public scrutiny and promised to stop selling user data, but few focused on another big player in the location tracking business: Zumigo.

7. The best and worst of CES 2019

From monster displays to VR in cars, we’re breaking down the good, the bad and the ugly from CES 2019.

Powered by WPeMatico

Amazon has reportedly acquired Israeli disaster recovery startup CloudEndure. Neither company has responded to our request for confirmation, but we have heard from multiple sources that the deal has happened. While some outlets have been reporting the deal was worth $250 million, we are hearing it’s closer to $200 million.

The company provides disaster recovery for cloud customers. You may be thinking that disaster recovery is precisely why we put our trust in cloud vendors. If something goes wrong, it’s the vendor’s problem — and you would be right to make this assumption, but nothing is simple. If you have a hybrid or multi-cloud scenario, you need to have ways to recover your data in the event of a disaster like weather, a cyberattack or political issue.

That’s where a company like CloudEndure comes into play. It can help you recover and get back and running in another place, no matter where your data lives, by providing a continuous backup and migration between clouds and private data centers. While CloudEndure currently works with AWS, Azure and Google Cloud Platform, it’s not clear if Amazon would continue to support these other vendors.

The company was backed by Dell Technologies Capital, Infosys and Magma Venture Partners, among others. Ray Wang, founder and principal analyst at Constellation Research, says Infosys recently divested its part of the deal and that might have precipitated the sale. “So much information is sitting in the cloud that you need backups and regions to make sure you have seamless recovery in the event of a disaster,” Wang told TechCrunch.

While he isn’t clear what Amazon will do with the company, he says it will test just how open it is. “If you have multi-cloud and want your on-prem data backed up, or if you have backup on one cloud like AWS and want it on Google or Azure, you could do this today with CloudEndure,” he said. “That’s why I’m curious if they’ll keep supporting Azure or GCP,” he added.

CloudEndure was founded in 2012 and has raised just over $18 million. Its most recent investment came in 2016 when it raised $6 million, led by Infosys and Magma.

Powered by WPeMatico

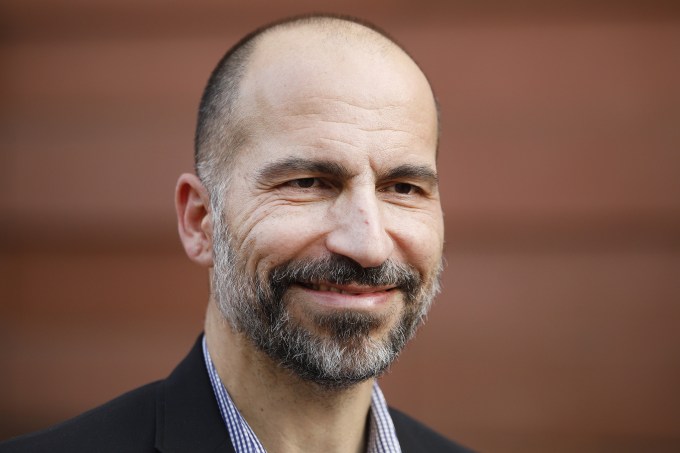

Uber is expected to raise $10 billion later this year in one of the largest U.S. initial public offerings in history. The float will value the ride-hailing giant somewhere between $76 billion — the valuation it garnered with its last private financing — and $120 billion — a sky-high figure assigned by Wall Street bankers that’s had even early Uber investors scratching their heads.

A new report from The Information pegs Uber’s initial market cap at $90 billion. To develop the estimate, the site analyzed undisclosed documents Uber provided creditors in 2017 “in which the company projected it would double net revenue to $14.2 billion by 2019,” ran revenue multiples and compared Uber to GrubHub, which investors say is the business’s closest comparison.

Uber declined to comment on The Information’s analysis.

Uber confidentially filed for its long-awaited IPO last month, marking the beginning of a race to the stock markets between it and U.S. competitor Lyft, which filed just hours before, according to a source with knowledge of the situation. Founded in 2009 by Travis Kalanick, Uber has brought in about $20 billion in a combination of debt and equity funding. It counts SoftBank as its largest shareholder in a cap table that also lists Toyota, T. Rowe Price, Fidelity, TPG Growth and many more. As for the skepticism surrounding Uber’s lofty $120 billion valuation, the eye-popping figure seems unachievable considering the company isn’t profitable and has and continues to burn through cash.

An IPO that large would certainly make its investors happy. First Round Capital, for example, seeded Uber with $1.6 million in the company’s first two funding rounds in 2010 and 2011, according to The Wall Street Journal. At a $120 billion valuation, First Round’s shares would be worth some $5 billion. The venture capital firm, however, sold some of its shares to SoftBank alongside Benchmark, which itself would otherwise own shares worth about $14 billion.

Bradley Tusk, an early Uber investor who signed on to help the company surmount political and regulatory barriers in 2011, own shares said to be worth $100 million, though he too gave up 42 percent of his equity in a secondary sale to SoftBank, he recently told TechCrunch.

“I’m quite happy with the 120 number,” Tusk said. “But … I am a little surprised by [it], it does seem to be a really aggressive number.”

“Any investment in Uber is obviously a long-term bet on the future, like someone who invested in Amazon in the early days,” Tusk added. “One thing [Uber chief executive officer Dara Khosrowshahi] is doing well is really expanding Uber into a mobility company as opposed to just a ride-hailing company.”

Dara Kowsrowshahi, chief executive officer of Uber, looks on following an event in New Delhi, India, on Thursday, Feb. 22, 2018. Photographer: Anindito Mukherjee/Bloomberg via Getty Images

Uber has opted to go public in a year poised to see the most high-flying unicorn IPOs in history. As we’ve reported in great detail on this site, both Lyft and Uber are planning to float, as are Slack and Pinterest . Many of these companies, however, made the call to make their public markets debut before the stock market took a quick turn south. Poor performing stocks may discourage unicorns from emerging from their cozy VC-protected stalls.

Uber will garner increased scrutiny from Wall Street investors as they begin to parse out its true value. Fortunately the company, which like Amazon has long prioritized growth over profit, has “’clear levers’ it could pull in order to turn on the cash spigots if it wanted to, by reducing its marketing spending both in the U.S. and developing markets and by finding partners to help finance its self-driving car development,” according to The Information. “Pulling those levers would slow revenue growth by a third—from a 33% growth in net revenue to 22 percent growth in net revenue in 2019 [but] it would save Uber $2 billion annually.”

In its third quarter 2018 financial results, Uber posted a net loss of $939 million on a pro forma basis and an adjusted EBITDA loss of $527 million, up about 21 percent quarter-over-quarter. Revenue for Q3 was up five percent QoQ at $2.95 billion and up 38 percent year-over-year.

“We had another strong quarter for a business of our size and global scope,” Uber chief financial officer Nelson Chai said in a statement. “As we look ahead to an IPO and beyond, we are investing in future growth across our platform, including in food, freight, electric bikes and scooters, and high-potential markets in India and the Middle East where we continue to solidify our leadership position.”

We can speculate on Uber’s valuation for days but ultimately Wall Street will determine just how high Uber will go. For now, all we can do is sit and wait for the company to relinquish its S-1 to the masses.

Powered by WPeMatico