Fundings & Exits

Auto Added by WPeMatico

Auto Added by WPeMatico

The IPO rush of 2021 continued this week with a fresh filing from NoSQL provider Couchbase. The company raised hundreds of millions while private, making its impending debut an important moment for a number of private investors, including venture capitalists.

According to PitchBook data, Couchbase was last valued at a post-money valuation of $580 million when it raised $105 million in May 2020. The company — despite its expansive fundraising history — is not a unicorn heading into its debut to the best of our knowledge.

We’d like to uncover whether it will be one when it prices and starts to trade, so we dug into Couchbase’s business model and its financial performance, hoping to better understand the company and its market comps.

The Couchbase S-1 filing details a company that sells database tech. More specifically, Couchbase offers customers database technology that includes what NoSQL can offer (“schema flexibility,” in the company’s phrasing), as well as the ability to ask questions of their data with SQL queries.

Couchbase’s software can be deployed on clouds, including public clouds, in hybrid environments, and even on-prem setups. The company sells to large companies, attracting 541 customers by the end of its fiscal 2021 that generated $107.8 million in annual recurring revenue, or ARR, by the close of last year.

Couchbase breaks its revenue into two main buckets. The first, subscription, includes software license income and what the company calls “support and other” revenues, which it defines as “post-contract support,” or PCS, which is a package of offerings, including “support, bug fixes and the right to receive unspecified software updates and upgrades” for the length of the contract.

The company’s second revenue bucket is services, which is self-explanatory and lower-margin than its subscription products.

Powered by WPeMatico

Meet Mediflash, a new French startup that wants to improve temp staffing in healthcare facilities, such as nursing homes, clinics and mental health facilities. The company positions itself as an alternative to traditional temp staffing agencies. They claim to offer better terms for both caregivers and institutions.

“It costs a small fortune to health facilities while caregivers are paid poorly,” co-founder Léopold Treppoz told me.

Traditional temp staffing agencies hire caregivers and nurses on their payroll. When a facility doesn’t have enough staff, they ask their usual temp staffing agency. The agency finds someone and charges the facility.

“When we started, we thought we would do a temp staffing agency, but more digital, more tech,” Treppoz said. But the startup realized they would face the same issues as regular temp staffing agencies.

Instead, they looked at other startups working on freelancer marketplaces for developers, project managers, marketing experts and more. In France, a few of them have been quite successful, such as Comet, Malt, StaffMe and Brigad — some of them even run a vertical focused on health professionals. But Mediflash wants to focus specifically on caregivers.

Professionals signing up to Mediflash are freelancers. Mediflash only acts as a marketplace that connects health facilities with caregivers. The company says caregivers can expect more revenue — up to 20% — while facilities end up paying less.

Of course, it’s not a fair comparison as temp staffing agencies hire caregivers. As a freelancer, you don’t have the same benefits as a full-time employee. And in particular, you can’t get unemployment benefits.

“But a lot of caregivers say that this isn’t an issue because there is a lot of demand [from health facilities],” Treppoz said. On the platform, you’ll find students in nursing school who want to earn a bit of money, professionals who already have a part-time job looking for additional work as well as full-time substitute caregivers.

Usually, facilities just want someone for three days because they’re running short on staff. Mediflash is well aware that health facilities usually work with one temp staffing agency and that’s it. That’s why the startup has a sales team that has to talk with each facility one by one. Right now, the startup is mostly focused on Metz, Nancy and Strasbourg.

Mediflash recently raised a $2 million funding round (€1.7 million) led by Firstminute Capital. Several business angels are also participating, such as Alexandre Fretti (Malt), Alexandre Lebrun (Nabla), Simon Dawlat (Batch.com) and Marie Outtier (Aiden.ai, acquired by Twitter).

So far, the company has managed 1,400 substitute days. Mediflash takes a cut on each transaction. The company now plans to expand to other cities all around the country.

Powered by WPeMatico

Databases run the world, but database products are often some of the most mature and venerable software in the modern tech stack. Designers will pixel push, frontend engineers will add clicks to make it more difficult to drop out of a soporific Zoom call, but few companies are ever willing to rip out their database storage engine. Too much risk, and almost no return.

So it’s exceptional when a new database offering breaks through the barriers and redefines the enterprise.

Neo4j, which offers a graph-centric database and related products, announced today that it raised $325 million at a more than $2 billion valuation in a Series F deal led by Eurazeo, with additional capital from Alphabet’s venture wing GV. Eurazeo managing director Nathalie Kornhoff-Brüls will join the company’s board of directors.

That funding makes Neo4j among the most well-funded database companies in history, with a collective fundraise haul of more than half a billion dollars. For comparison, MongoDB, which trades on Nasdaq, raised $311 million in total (according to Crunchbase) before its IPO. Meanwhile, Cockroach Labs of CockroachDB fame has now raised $355 million in funding, including a $160 million round earlier this year at a similar $2 billion valuation.

The past decade has seen a whole new crop of next-generation database models, from scale-out SQL to document to key-value stores to time series and on and on and on. What makes graph databases like Neo4j unique is their focus on the connections between individual data entities. Graph-based data models have become central to modern machine learning and artificial intelligence applications, and are now widely used by data analysts in applications as diverse as marketing to fraud detection.

CEO and co-founder Emil Eifrem said that Neo4j, which was founded back in 2007, has hit its growth stride in recent years given the rising popularity of graph-based analysis. “We have a deep developer community of hundreds of thousands of developers actively building applications with Neo4j in any given month, but we also have a really deep data science community,” he said.

In the past, most business analysis was built on relational databases. Yet, inter-connected complexity is creeping in everywhere, and that’s where Eifrem believes Neo4j has a durable edge. As an example, “any company that ships stuff is tapping into this global fine-grain mesh spanning continent to continent,” he suggested. “All of a sudden the ship captain in the Suez Canal … falls asleep, and then they block the Suez Canal for a week, and then you’ve got to figure out how will this affect my enterprise, how does that cascade across my entire supply chain.” With a graph model, that analysis is a cinch.

Neo4j says that 800 enterprises are customers and 75% of the Fortune 100 are users of the company’s products.

We last checked in with the company in 2020 when it launched 4.0, which offered unlimited scaling. Today, Neo4j comes in a couple of different flavors. It’s a database that can be either self-hosted or purchased as a cloud service offering which it dubs Aura. That’s for the data storage folks. For the data scientists, the company offers Neo4j Graph Data Science Library, a set of comprehensive tools for analyzing graph data. The company offers free (or “community” tiers), affordable starting tiers and full-scale enterprise pricing options depending on needs.

Development continues on the database. This morning at its developers conference, Neo4j demonstrated what it dubbed its “super-scaling technology” on a 200 billion node graph with more than a trillion relationships between them, showing how its tools could offer “real-time” queries on such a large scale.

Unsurprisingly, Eifrem said that the new venture funding will be used to continue doubling down on “product, product, product” but emphasized a few major strategic initiatives as critical for the company. First, he wants to continue to deepen the company’s partnerships with public cloud providers. It already has a deep relationship with Google Cloud (GV was an investor in this round after all), and hopes to continue building relationships with other providers.

It’s also seeing a major uptick in interest from the APAC region. Eifrem said that the company recently opened up an office in Singapore to accelerate its sales in the broader IT market there.

Overall, “We think that graphs can be a significant part of the modern data landscape. In fact, we believe it can be the biggest part of the modern data landscape. And this round, I think, sends a clear signal [that] we’re going for it,” he said.

Erik Nordlander and Tom Hulme of GV were the leads for that firm. In addition, DTCP and Lightrock newly invested and previous investors One Peak, Creandum and Greenbridge Partners joined the round.

Powered by WPeMatico

Sunlight is a great source of energy, but it rarely gets hot enough to fry an egg, let alone melt steel. Heliogen aims to change that with its high-tech concentrated solar technique, and has raised more than a hundred million dollars to test its 1,000-degree solar furnace at a few participating mines and refineries.

We covered Heliogen when it made its debut in 2019, and the details in that article still get at the core of the company’s tech. Computer vision techniques are used to carefully control a large set of mirrors, which reflect and concentrate the sun’s light to the extent that it can reach in excess of 1,000 degrees Celsius, almost twice what previous solar concentrators could do. “It’s like a death ray,” founder Bill Gross explained then.

That lets the system replace fossil fuels and other legacy systems in many applications where such temperatures are required, for example mining and smelting operations. By using a Heliogen concentrator, they could run on sunlight during much of the day and only rely on other sources at night, potentially halving their fuel expenditure and consequently both saving money and stepping toward a greener future.

Both goals hint at why utilities and a major mining and steel-making company are now investors. Heliogen raised a $25 million A-2, led by Prime Movers Lab, but soon also pulled together a much larger “bridge extension round” in their terminology of $83 million that brought in the miner ArcelorMittal, Edison International, Ocgrow Ventures, A.T. Gekko and more.

The money will be used both to continue development of the “Sunlight Refinery,” as Heliogen calls it, and deploy some actual on-site installations that would work in real production workflows at scale. “We are constantly making design and cost improvements to increase efficiency and decrease costs,” a representative of the company told me.

One of those pilot sites will be in Boron, California, where Rio Tinto operates a borates mine and will include Heliogen’s tech as part of its usual on-site processes, according to an MOU signed in March. Another MOU with ArcelorMittal will “evaluate the potential of Heliogen’s products in several of ArcelorMittal’s steel plants.” Facilities are planned in the U.S., MENA and Asia Pacific areas.

Beyond mining and smelting, the technique could be used to generate hydrogen in a zero-carbon way. That would be a big step toward building a working hydrogen infrastructure for next-generation fuel supply, since current methods make it difficult to do without relying on fossil fuels in the first place. And no doubt there are other industrial processes that could benefit from a free and zero-carbon source of high heat.

“We’re being granted the resources to do more projects that address the most carbon-intensive human activities and work toward our goals of lowering the price and emissions of energy for everyone on the planet,” Gross said in a release announcing the round(s). “We thank all of our investors for enabling us to pursue our mission and offer the world technology that will allow it to achieve a post-carbon economy.”

Powered by WPeMatico

Carro, one of the largest automotive marketplaces in Southeast Asia, announced it has hit unicorn valuation after raising a $360 million Series C led by SoftBank Vision Fund 2. Other participants include insurance giant MSIG and Indonesian-based funds like EV Growth, Provident Growth and Indies Capital. About 90% of vehicles sold through Carro are secondhand, and it offers services that cover the entire lifecycle of a car, from maintenance to when it is broken down and recycled for parts.

Founded in 2015, Carro started as an online marketplace for cars, before expanding into more verticals. Co-founder and chief executive officer Aaron Tan told TechCrunch that, roughly speaking, the company’s operations are divided into three sections: wholesale, retail and fintech. Its wholesale business works with car dealers who want to purchase inventory, while its retail side sells to consumers. Its fintech operation offers products for both, including B2C car loans, auto insurance and B2B working capital loans.

Carro’s last funding announcement was in August 2019, when it said it had extended its Series B to $90 million. The company’s latest funding will be used to fund acquisitions, expand its financial services portfolio and develop its AI capabilities, which Carro uses to showcase cars online, develop pricing models and determine how much to charge insurance policyholders.

It also plans to expand retail services in its main markets: Indonesia, Thailand, Malaysia and Singapore. Carro currently employs about 1,000 people across the four countries and claims its revenue grew more than 2.5x during the financial year ending March 2021.

The COVID-19 pandemic helped Carro’s business because people wanted their own vehicles to avoid public transportation and became more receptive to shopping for cars online. Those factors also helped competitors like OLX Autos and Carsome fare well during the pandemic.

The adoption of electric vehicles across Southeast Asia has resulted in a new tailwind for Carro, because people who buy an EV usually want to sell off their combustion engine vehicles. Carro is currently talking to some of the largest electric vehicle countries in the world that want to launch in Southeast Asia.

“For every car someone typically buys in Southeast Asia, there’s always a trade-in. Where do cars go, right? We are a marketplace, but on a very high level, what we’re doing is reusing and recycling. That’s a big part in the environmental sustainability of the business, and something that sets us apart of other players in the region,” Tan said.

Cars typically stay in Carro’s inventory for less than 60 days. Its platform uses computer vision and sound technology to replicate the experience of inspecting a vehicle in-person. When someone clicks on a Carro listing, an AI bot automatically engages with them, providing more details about the cost of the car and answering questions. They also see a 360-degree view of the vehicle, its interior and can virtually start the engine to see how it sounds. Listings also provide information about defects and inspection reports.

Since many customers still want to get an in-person look before finalizing a purchase, Carro recently launched a beta product called Showroom Anywhere. Currently available in Singapore, it allows people to unlock Carro cars parked throughout the city, using QR codes, so they can inspect it at any time of the day, without a salesperson around. The company plans to add test driving to Showroom Anywhere.

“As a tech company, our job is to make sure we automate everything we can,” said Tan. “That’s the goal of the company and you can only assume that our cost structure and our revenue structure will get better along the years. We expect greater margin improvement and a lot more in cost reduction.”

Pricing is fixed, so shoppers don’t have to engage in haggling. Carro determines prices by using machine-learning models that look at details about a vehicle, including its make, model and mileage, and data from Carro’s transactions as well as market information (for example, how much of a particular vehicle is currently available for sale). Carro’s prices are typically in the middle of the market’s range.

Cars come with a three or seven-day moneyback guarantee and 30-day warranty. Once a customer decides to buy a car, they can opt to apply for loans and insurance through Carro’s fintech platform. Tan said Carro’s loan book is about five years old, almost as old as the startup itself, and is currently about $200 million.

Carro’s insurance is priced based on the policyholders driving behavior as tracked by sensors placed in their cars. This allows Carro to build a profile of how someone drives and the likelihood that they have an accident or other incident. For example, someone will get better pricing if they typically stick to speed limits.

“It sounds a bit futuristic,” said Tan. “But it’s something that’s been done in the United States for many years, like GEICO and a whole bunch of other insurers,” including Root Insurance, which recently went public.

Tan said MSIG’s investment in Carro is a “statement that we are really trying to triple down in insurance, because an insurer has so much linkage with what we do. The reason that MSIG is a good partner is that, like ourselves, they believe a lot in data and the difference in what we call ‘new age’ insurance, or data-driven insurance.”

Carro is also expanding its after-sale services, including Carro Care, in all four of its markets. Its after-sale services reach to the very end of a vehicle’s lifecycle and its customers include workshops around the world. For example, if a Toyota Corolla breaks down in Singapore, but its engine is still usable, it might be extracted and shipped to a repair shop in Nairobi, and the rest of its parts recycled.

“One thing I always ask in management meetings, is tell me where do cars go to die in Indonesia? Where do cars go to die in Thailand? There has to be a way, so if there is no way, we’re going to find a way,” said Tan.

In a statement, SoftBank Investment Advisers managing partner Greg Moon said, “Powered by AI, Carro’s technology platform provides consumers with full-stack services and transparency throughout the car ownership process. We are delighted to partner with Aaron and the Carro team to support their ambition to expand into new markets and use AI-powered technology to make the car buying process smarter, simpler and safer.”

Powered by WPeMatico

Andrea Campos has struggled with depression since she was eight years old. Over the years, she’s tried all sorts of therapies — from behavioral to pharmacotherapy.

In 2017, when Campos was in her early 20s, she learned to program and created a system to help manage her mental health. It started as a personal project, but as she talked to more people, Campos realized that many others might benefit from the system as well.

So she built an application to provide access to mental health tools for Spanish-speaking people and began testing it with a small group. At first, Campos herself was her own chatbot, texting with users who were tired of dealing with depression.

“During the month, I was pretending I was an app, and would send these people a list of activities they had to complete during the day, such as writing in a gratitude journal, and then asking them how those activities made them feel,” Campos recalls.

Her thinking was that sometimes with depression and anxiety comes “a lot of avoidance,” where people resist potential treatment out of fear.

The results from her small experiment were encouraging. So, Campos set out to conduct a bigger sample of experiments, and raised about $10,000 via a crowdfunding campaign. With that money, she hired a developer to build a chatbot for her app, which was mostly being used via Facebook Messenger.

Then an earthquake hit Mexico City and that developer lost everything — including his home and computer — and had to relocate.

“I was left with nothing,” Campos says. But that developer introduced her to another, who disappeared with his payment, and again, left Campos, “with nothing.”

“I realized at the beginning of 2019, I was going to have to do this by myself,” Campos said. So she used a site that she described as a “Wix for chatbots,” and created one herself.

After experimenting with the app with a sample of 700 people, Campos was even more encouraged and raised an angel round of funding for Yana, the startup behind her app. (Yana is an acronym for “You Are Not Alone.”) By early 2020, with just three months of runway left, she pivoted to create an app with chatbot integration that wasn’t just limited to use via Facebook Messenger.

Campos ended up launching the app more broadly during the same week that her city in Mexico went into quarantine.

Image Credits: Yana

At first, she said, she saw “normal, steady growth.” But then on October 10, 2020, Apple’s App Store highlighted Yana for International Mental Health Day, and the response was overwhelming.

“It was also my birthday so I was at a spa in a nearby town, relaxing, when I started hearing my cell phone go crazy,” Campos recalls. “Everything went nuts. I had to go back to Mexico City because our servers were exploding since they were not used to having that kind of volume.”

As a result of that exposure, Yana went from having around 80,000 users to reaching 1 million users two weeks later. Soon after that, Google highlighted the app as one of best for personal growth in 2020, and that too led to another spike in users. Today, Yana is about to hit the 5 million-user mark and is also announcing it has raised $1.5 million in funding led by Mexico’s ALLVP, which has also invested in the likes of Cornershop, Flink and Nuvocargo.

When the pandemic hit last year, six of Yana’s nine-person team decided to quarantine together in a “startup house” in Cancun to focus on building the company. Earlier this year, the company had raised $315,000 from investors such as 500 Startups, Magma and Hustle Fund. The company had pitched ALLVP, which was intrigued but wanted to wait until it could write a bigger check.

That time is now, and Yana is now among the top three downloaded apps in Mexico and 12 countries, including Spain, Chile, Ecuador and Venezuela.

With its new capital, Yana is planning to “move away from the depression/anxiety narrative,” according to Campos.

“We want to compete in the wellness space,” she told TechCrunch. “A lot of people were looking for us to deal with crises such as a breakup or a loss but then they didn’t always see a necessity to keep using Yana for longer than the crisis lasted.”

Some of those people would download the app again months later when hit with another crisis.

“We don’t want to be that app anymore,” Campos said. “We want to focus on whole wellness and mental health and transmit something that needs to be built every single day, just like we do with exercise.”

Moving forward, Yana aims to help people with their mental health not just during a crisis but with activities they can do on a daily basis, including a gratitude journal, a mood tracker and meditation — “things that prevent depression and anxiety,” Campos said.

“We want to be a vitamin for our soul, and keeping people mentally healthy on an ongoing basis,” she said. “We also want to include a community inside our application.”

ALLVP’s Federico Antoni is enthusiastic about the startup’s potential. He first met Campos when she was participating in an accelerator program in 2017, and then again recently.

The firm led Yana’s latest round because it “wanted to be on her team.”

“She [Campos] has turned into an amazing leader, and we realized her potential and strength,” he said. “Plus, Yana is an amazing product. When you download it, it’s almost like you can see a soul in there.”

Powered by WPeMatico

It’s easier than ever to build a product and sell it around the United States, or the world. But if you want to do so without incurring the wrath of any particular state, or nation-state, you’d best have your tax matters in order. This is why Stripe’s news last week that it has built tax-focused tooling to help its customers manage their state bills mattered.

But for SaaS companies, things can be more complicated from a tax perspective. That’s what Anrok, a startup working to build sales tax software for SaaS firms, told TechCrunch.

The company’s CEO, Michelle Valentine, said that modern software companies need specialized help. And her startup is announcing a $4.3 million fundraise today to back its efforts. The capital event was led by Sequoia and Index, the latter firm a place where Valentine used to work.

Anrok delivers its service via an API, and charges based on the total dollar value of sales that it helps a customer manage. Its percentage-fee falls with volume, and you can’t pay more than 0.19% of managed revenue, so it’s pretty cheap regardless, given how strong software gross margins tend to be.

The Anrok founding team: Michelle Valentine, and Kannan Goundan. Via the company.

Valentine said that there are three things that make SaaS tax issues more complex than other products. The first deals with addresses. Software companies have to pay sales tax where customers are located, and often only have partial information. Anrok will help with that problem. The CEO also said that variable SaaS billing makes charging the right amount of tax an interesting issue, and that states have tax laws specifically aimed at the software market that must be navigated.

So, a more mass-market solution might not be the best fit for SaaS companies looking to avoid both trouble with states and the work of handling tax matters themselves.

It’s not hard to see why Anrok was able to raise capital. The company is early-stage with its first customers onboarded, so it’s not posting the sort of revenue growth that investors covet at the later stages. What then were its more fetching attributes? From our perspective, on-demand pricing and a simply gigantic market.

Sure, Anrok is serving SaaS businesses, but it’s doing so using what could be described as a post-SaaS business model; on-demand, or usage-based pricing is an increasingly popular way to charge for software products today, putting Anrok closer to the cutting edge in business-model terms. And the company’s market is essentially every software business out there. That’s a lot of TAM to carve into, something that investors love to see.

Powered by WPeMatico

Didi filed to go public in the United States last night, providing a look into the Chinese ride-hailing company’s business. This morning, we’re extending our earlier reporting on the company to dive into its numerical performance, economic health and possible valuation.

Recall that Didi has raised tens of billions worth of private capital from venture capitalists, private equity firms, corporations and other sources. The size of the bet riding on Didi is simply massive.

Didi is approaching the American public markets at a fortuitous moment. While the late-2020 IPO fervor, which sent offerings from DoorDash and others skyrocketing after their debuts, has cooled, valuations for public companies remain high compared to historical norms. And Uber and Lyft, two American ride-hailing companies, have been posting numbers that point to at least a modest recovery in the ride-hailing industry as COVID-19 abates in many parts of the world.

As further grounding, recall that Didi has raised tens of billions worth of private capital from venture capitalists, private equity firms, corporations and other sources. The size of the bet riding on Didi is simply massive. As we explore the company’s finances, then, we’re more than vetting a single company’s performance; we’re examining what sort of returns an ocean of capital may be able to derive from its exit.

In that vein, we’ll consider GMV results, revenue growth, historical profitability, present-day profitability and what Didi may be worth on the American markets, given current comps. Sound good? Into the breach!

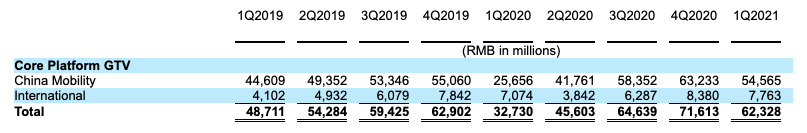

Starting at the highest level, how quickly has gross transaction volume (GTV) scaled at the company?

Didi is historically a business that operates in China but has operations today in more than a dozen countries. The impact and recovery of China’s bout with COVID-19 is therefore not the whole picture of the company’s GTV results.

COVID-19 began to affect the company starting in the first quarter of 2020. From the Didi F-1 filing:

Core Platform GTV fell by 32.8% in the first quarter of 2020 as compared to the first quarter of 2019, and then by 16.0% in the second quarter of 2020 as compared to the second quarter of 2019.

The dips were short-lived, however, with Didi quickly returning to growth in the second half of the year:

Our businesses resumed growth in the second half of 2020, which moderated the impact on a year-on-year basis. Our Core Platform GTV for the full year 2020 decreased by 4.8% as compared to the full year 2019. Both our China Mobility and International segments were impacted, but whereas the GTV for our China Mobility segment decreased by 6.6% from 2019 to 2020, the GTV for our International segment increased by 11.4% from 2019 to 2020.

Holding to just the Chinese market, we can see how rapidly Didi managed to pick itself up over the last year. Chinese GTV at Didi grew from 25.7 billion RMB to 54.6 billion RMB from the first quarter of 2020 to the first quarter of 2021; naturally, we’re comparing a more pandemic-impacted quarter at the company to a less-affected period, but the comparison is still useful for showing how the company recovered from early-2020 lows.

The number of transactions that Didi recorded in China during the first quarter of this year was also up more than 2x year over year.

On a whole-company basis, Didi’s “core platform GTV,” or the “sum of GTV for our China Mobility and International segments,” posted numbers that are less impressive in growth terms:

Image Credits: Didi F-1 filing

You can see how quickly and painfully COVID-19 blunted Didi’s global operations. But seeing the company settle back to late-2019 GTV numbers in 2021 is not super bullish.

Takeaway: While Didi managed an impressive GTV recovery in China, its aggregate numbers are flatter, and recent quarterly trends are not incredibly attractive.

Powered by WPeMatico

The U.S. insurance technology market is hot and has been for years now. Back in early 2020, to pick an example, TechCrunch reported on a wave of funding events among domestic insurtech marketplaces. Those companies have since gone on to raise hundreds of millions of dollars more.

And after a long period of incubation, we’ve seen neoinsurance players from the U.S. like Root and Metromile go public. Hippo is working to join the cohort.

The Exchange explores startups, markets and money.

Read it every morning on Extra Crunch or get The Exchange newsletter every Saturday.

So from the perspective of venture capital activity, startup growth and exits, insurtech is proving itself in the States. Even if growth remains the name of the game in insurance tech and profits are often scarce.

What about other markets? The recent Wefox round caught The Exchange’s eye. A $650 million insurtech round would have commanded our attention regardless of its location. But to see a European insurance technology startup raise that amount of cash made us wonder if there’s as much money present for the EU market’s insurtech startups as we’ve seen here in the U.S.

After all, with business-focused neoinsurance provider Embroker raising a big round this week in the United States, to pick an example, it seems that attacking the massive and antiquated insurance market is good startup sport. Why wouldn’t that concept apply to Europe?

After all, with business-focused neoinsurance provider Embroker raising a big round this week in the United States, to pick an example, it seems that attacking the massive and antiquated insurance market is good startup sport. Why wouldn’t that concept apply to Europe?

To find out more, we got in touch with a number of VCs from Europe to hear their perspectives on what’s happening on the ground, including folks from Accel, Astorya.vc and Insurtech Gateway. To ground us, we collated the biggest recent rounds from the EU insurance technology market. Let’s go!

Venture capitalists and startup founders get paid when they generate an exit. Lately, exits in the space have featured a number of IPOs.

The older a startup gets, the more it has to deal with public-market investors. Crossover funds and the like make their appearance before unicorns go public. And then former startups have to pitch not the venture capital market, but the public markets. It’s a different game.

That’s the impression that The Exchange got chatting with the CEO of Root, Alex Timm, this earnings cycle. He noted that public tech-focused investors don’t always grok the insurance elements of his business, while insurance investors don’t always grok the tech side of Root.

Powered by WPeMatico

Hello and welcome back to Equity, TechCrunch’s venture capital-focused podcast, where we unpack the numbers behind the headlines.

We’re closing our survey soon, so this is your last chance (probably) to get your voice heard!

Despite it being a short week, as always, it was a busy, busy time. We had Grace on the dials today, and Danny, Natasha and Alex making chit-chat about the tech world. As with every week this year, we had to cut and cut and cut to get the show down to size. Here’s what made it in in the end:

Thanks for hopping along with us this week and every week. Quick programming note: Natasha will take Alex’s spot on the Monday show for next week since he’s out, so be nice, and send her stuff to mention.

Equity drops every Monday at 7:00 a.m. PST, Wednesday, and Friday morning at 7:00 a.m. PST, so subscribe to us on Apple Podcasts, Overcast, Spotify and all the casts.

Powered by WPeMatico