Fundings & Exits

Auto Added by WPeMatico

Auto Added by WPeMatico

French startup Ledger has raised a $380 million Series C funding round led by 10T Holdings. Following today’s funding round, the company has reached a valuation of $1.5 billion.

Other investors in the funding round include existing investors Cathay Innovation, Draper Associates, Draper Dragon, Draper Esprit, DCG, Korelya Capital and Wicklow Capital. Some new investors are joining the round, such as Tekne Capital, Uphold Ventures, Felix Capital, Inherent, Financière Agache and iAngels Technologies.

Ledger’s main product is a hardware wallet to manage your crypto assets. They are shaped like USB keys and feature a tiny screen to confirm transactions on the device. The reason why that screen is important is that your private keys never leave your Ledger device.

In other words, if you want to store a large amount of cryptocurrencies, you don’t want to leave them on an exchange account. If someone manages to sign in, they could withdraw all your crypto assets. With a hardware wallet, you remain in control of your crypto assets.

The company first launched the Ledger Nano S. You have to connect the device to a computer using a USB cable. More recently, with the Ledger Nano X, you can send and receive assets from your phone as the Nano X works over Bluetooth. Ledger also provides an enterprise solution for companies that want to add cryptocurrencies to their balance sheet.

Overall, Ledger has sold over 3 million hardware wallets. Every month, 1.5 million people use Ledger Live, the company’s software solution to manage your crypto assets. The company even says that it currently secures around 15% of all cryptocurrency assets globally.

It hasn’t been a smooth ride as the company has been around for seven years. After the crypto boom of 2018, interest for hardware wallets faded away. Moreover, as the company secures expensive assets, it has also suffered from a serious data breach — 272,000 customers have been affected.

With today’s funding round, the company plans to launch new products, add more DeFi features to Ledger Live and support the growth of the crypto ecosystem in general.

Powered by WPeMatico

BukuWarung, a fintech focused on Indonesia’s micro, small and medium enterprises (MSMEs), announced today it has raised a $60 million Series A. The oversubscribed round was led by Valar Ventures, marking the firm’s first investment in Indonesia, and Goodwater Capital. The Jakarta-based startup claims this is the largest Series A round ever raised by a startup focused on services for MSMEs. BukuWarung did not disclose its valuation, but sources tell TechCrunch it is estimated to be between $225 million to $250 million.

Other participants included returning backers and angel investors like Aldi Haryopratomo, former chief executive officer of payment gateway GoPay, Klarna co-founder Victor Jacobsson and partners from SoftBank and Trihill Capital.

Founded in 2019, BukuWarung’s target market is the more than 60 million MSMEs in Indonesia, according to data from the Ministry of Cooperatives and SMEs. These businesses contribute about 61% of the country’s gross domestic product and employ 97% of its workforce.

BukuWarung’s services, including digital payments, inventory management, bulk transactions and a Shopify-like e-commerce platform called Tokoko, are designed to digitize merchants that previously did most of their business offline (many of its clients started taking online orders during the COVID-19 pandemic). It is building what it describes as an “operating system” for MSMEs and currently claims more than 6.5 million registered merchant in 750 Indonesian cities, with most in Tier 2 and Tier 3 areas. It says it has processed about $1.4 billion in annualized payments so far, and is on track to process over $10 billion in annualized payments by 2022.

BukuWarung’s new round brings its total funding to $80 million. The company says its growth in users and payment volumes has been capital efficient, and that more than 90% of its funds raised have not been spent. It plans to add more MSME-focused financial services, including lending, savings and insurance, to its platform.

BukuWarung’s new funding announcement comes four months after its previous one, and less than a month after competitor BukuKas disclosed it had raised a $50 million Series B. Both started out as digital bookkeeping apps for MSMEs before expanding into financial services and e-commerce tools.

When asked how BukuWarung plans to continue differentiating from BukuKas, co-founder and CEO Abhinay Peddisetty told TechCrunch, “We don’t see this space as a winner takes all, our focus is on building the best products for MSMEs as proven by our execution on our payments and accounting, shown by massive growth in payments TPV as we’re 10x bigger than the nearest player in this space.”

He added, “We have already run successful lending experiments with partners in fintech and banks and are on track to monetize our merchants backed by our deep payments, accounting and other data that we collect.”

BukuWarung’s new funding will be used to double its current workforce of 150, located in Indonesia, Singapore and India, to 300 and develop BukuWarung’s accounting, digital payments and commerce products, including a payments infrastructure that will include QR payments and other services.

Powered by WPeMatico

Many of the highest-profile English tutoring platforms focus on children, including VIPKID and Magic Ears. Ringle created a niche for itself by focusing on adults first, with courses like business English and interview preparation. The South Korea-based startup announced today it has raised an $18 million Series A led by returning investor Must Asset Management, at a valuation of $90 million. Ringle is preparing to launch a program for school kids later this year, and also has plans to open offline educational spaces in South Korea and the United States.

Other participants in the round, which brings Ringle’s total raised to $20 million, include returning investors One Asset Management and MoCA Ventures, along with new backer Xolon Invest. Ringle claims its revenue has grown three times every year since it was founded in 2015, and that bookings for lessons have increased by 390% compared to the previous year.

Ringle currently has 700 tutors, who are pre-screened by the company, and 100,000 users. About 30% of its students, who learn through one-on-one live video sessions, are based outside of Korea, including in the U.S., the United Kingdom, Japan, Australia and Singapore.

Ringle’s co-founders are Seunghoon Lee and Sungpah Lee, who both earned MBAs from the Stanford University Graduate School of Business. They developed Ringle based on the challenges they faced as non-native English speakers and graduate students in the U.S. The startup was first created to serve professionals who are already established in their careers or in academia. Its students include people who have worked for companies like Google, Amazon, BCG, McKinsey and Samsung Electronics.

Seunghoon Lee told TechCrunch that Ringle creates proprietary learning materials based on current events to keep its students interested. For example, recent topics have included blockchain NFT tech, how the movie “Parasite” portrayed class conflict and global inequalities in vaccine access.

Ringle’s tutors are recruited from top universities and need to submit proof of education and verify their school emails. The company’s vetting process also includes a mock session with Ringle staff. Lee said applicants are asked to familiarize themselves with some of Ringle’s learning materials and lead a full lesson based on its guidance. Ringle assesses candidates on their teaching skills and ability to lead engaging discussions that also hone their students’ language skills.

Part of Ringle’s new funding is earmarked for its tech platform. It is currently developing a language diagnostics system that tracks the complexity and accuracy of students’ spoken English with researchers at KAIST (Korea Advanced Institute of Science and Technology).

The company already has an AI-based analytics system that uses speech-to-text and measures speech pacing (or words spoken per minute), the amount of filler words and range of words and expressions in lessons. It delivers feedback that allows students to compare their performance with the top 20% of Ringle users in different metrics.

The new language diagnostics system that is currently under development with KAIST will start releasing features over the next few months, including speech fluency scoring, a personalized dictionary and auto-paraphrasing suggestions.

The funding will also be used to create more original learning content, and hire for Ringle’s offices in Seoul and San Mateo, California. Ringle also plans to diversify its revenue sources by providing premium content on a subscription basis, and will launch its junior program for students aged 10 and above later this year.

Powered by WPeMatico

The startup investing market is crowded, expensive and rapid-fire today as venture capitalists work to preempt one another, hoping to deploy funds into hot companies before their competitors. The AI startup market may be even hotter than the average technology niche.

This should not surprise.

In the wake of the Microsoft-Nuance deal, The Exchange reported that it would be reasonable to anticipate an even more active and competitive market for AI-powered startups. Our thesis was that after Redmond dropped nearly $20 billion for the AI company, investors would have a fresh incentive to invest in upstarts with an AI focus or strong AI component; exits, especially large transactions, have a way of spurring investor interest in related companies.

That expectation is coming true. Investors The Exchange reached out to in recent days reported a fierce market for AI startups.

The Exchange explores startups, markets and money.

Read it every morning on Extra Crunch or get The Exchange newsletter every Saturday.

But don’t presume that investors are simply falling over one another to fund companies betting on a future that may or may not arrive. Per a Signal AI survey of 1,000 C-level executives, nearly 92% thought that companies should lean on AI to improve their decision-making processes. And 79% of respondents said that companies are already doing so.

The gap between the two numbers implies that there is space in the market for more corporations to learn to lean on AI-powered software solutions, while the first metric belies a huge total addressable market for startups constructing software built on a foundation of artificial intelligence.

Now deep in the second quarter, we’re diving back into the AI startup market this morning, leaning on notes from Blumberg Capital’s David Blumberg, Glasswing Ventures’ Rudina Seseri, Atomico’s Ben Blume and Jocelyn Goldfein of Zetta Venture Partners. We’ll start by looking at recent venture capital data regarding AI startups and dig into what VCs are seeing in both the U.S. and European markets before chatting about applied AI versus “core” AI — and in which context VCs might still care about the latter.

The exit market for AI startups is more than just the big Microsoft-Nuance deal. CB Insights reports that four of the largest five American tech companies have bought a dozen or more AI-focused startups to date, with Apple leading the pack with 29 such transactions.

Powered by WPeMatico

Remote work was the order of the day for the past 16 months, but as we (fingers crossed) move out of the pandemic, it’s looking like a lot of people may move into a new era of hybrid work: less focus being present in offices to feel like you are getting things done, less time commuting and more time to be productive. To help better address that opportunity, a company called 1E, which builds solutions for companies to enable hybrid working along with managing the wider space of endpoint management, has been acquired by Carlyle on the heels of a strong year of business.

The private equity firm has picked up the London-based company in a deal that values the company at $270 million.

The acquisition is coming in the form of a majority stake with CEO and co-founder Sumir Karayi maintaining a significant minority stake, along with employees of the company. The firm is completely bootstrapped — no outside investors, no VCs on the cap table prior to this deal — and profitable, with growth of 28% in the last year.

The birth and now exit of 1E is an interesting counterpoint to that of most of the enterprise startups that you will read about on the pages of TechCrunch, or maybe in tech press overall.

The company was started in 1997 when Karayi and co-founders Phil Wilcock and Mark Blackburn were at Microsoft working as in-house consultants helping enterprises adopt and adapt to Microsoft software. Karayi decided he wanted to start something of his own, rather than, in his words, “working for Microsoft forever.”

Given his background, his business started first as a consultancy, but he said that it didn’t take long to pivot, since “We realized that the problems we were looking to solve we needed to build technology to do that, so we started to write our own software.”

The company got its start as a Microsoft shop, building endpoint technology management, along with tools to help companies manage their computer terminals and networks better. That included products like NightWatchman, a power management tool for PCs and servers that helped save energy consumption for businesses; Nomad, a bandwidth management tool that helps reduce server usage; and Shopping, a platform for companies to build app store-like experiences for internal employees or customer-facing tools.

Over time — years before the COVID-19 pandemic — that also evolved into software to enable hybrid working environments, which were already emerging as a thing and already posing challenges to businesses and users.

“The challenge was that remote working was a second-class experience,” he said, with technical support, software usage, network connectivity, device issues and just about everything harder to sort out when problems arose for workers not working in the office. So 1E — a play on the last two characters of the error message you get on a failing PC, “STOP 0x0000001E” — built software to address that, too.

Overall the company amassed some 40 patents on its technology, which now is used across more than 11 million devices among 500 large enterprise customers, including AT&T, Nestlé and a number of big banks that can’t be named.

It’s been the remote working software that has seen the company through an especially strong year — no surprise there, given the environment many of us have been working in — where businesses have been buying its tools as part of their “digital transformation” efforts, and it was this that got Karayi thinking that the company — which had largely built the business it had today on an employee base of people who just like building new things, and word-of-mouth between end users — could finally do with an outside investment and cash injection to take the business to the next level.

“We’re going through a seismic change right now and we think it’s a big opportunity for 1E,” he noted, adding that while many of us might feel like remote work is everywhere, he believes this is just the beginning of how to enable better remote working. “I think the office boat has sailed,” he said.

1E went with Carlyle among a number of other bidders as it seemed like the right fit: strong support and understanding of the business, combined with a well-recognized name. The plan more generally is to follow the PE playbook if all goes well: four years of growth, with “all later options open.”

“We were attracted to 1E’s fully integrated digital experience technology, which is differentiated by its advanced remediation and automation capabilities, and are delighted to partner with Sumir as we support the company as it enters its next phase of growth,” said Fernando Chueca, a managing director in the Carlyle Europe Technology Partners (CETP) advisory team. “With strong industry tailwinds, we believe 1E has significant growth opportunities and we look forward to supporting another founder-backed business to scale through investments in product innovation, commercial operations, and international expansion.”

Powered by WPeMatico

The continuing saga of Lordstown Motor’s struggles as a public company took a new turn today as the electric truck manufacturer made yet more news. Bad news.

Shares of Lordstown are down sharply today after the company reported in an SEC filing that it does not have enough capital to build and launch its electric truck. Here’s the official verbiage (formatting, bolding: TechCrunch):

Since inception, the Company has been developing its flagship vehicle, the Endurance, an electric full-size pickup truck. The Company’s ability to continue as a going concern is dependent on its ability to complete the development of its electric vehicles, obtain regulatory approval, begin commercial scale production and launch the sale of such vehicles.

The Company believes that its current level of cash and cash equivalents are not sufficient to fund commercial scale production and the launch of sale of such vehicles. These conditions raise substantial doubt regarding our ability to continue as a going concern for a period of at least one year from the date of issuance of these unaudited condensed consolidated financial statements.

Now, companies that are trying to invent the future are more risky than, say, established banking concerns that are generating stable GAAP net income. I’m sure that SpaceX looked dicey at times when it was busy crashing rockets on its way to learning how to land them on drone ships.

But in the case of Lordstown’s admission that it cannot “fund commercial scale production and the launch of sale” of its Endurance pickup are fucking galling.

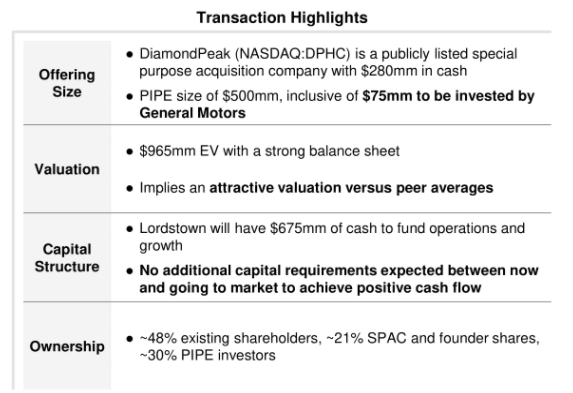

Why? Because when the company pitched its SPAC-led combination and public debut, it was pretty freaking confident that it would have enough cash to do so.

Don’t take my word for it. Here’s an excerpt from Lordstown’s investor deck:

You will note in the “Capital Structure” section that the company claimed that it would not need more funding to go to market.

Now Lordstown is pretty sure it’s going to need more money. If it’s putting the possible need in a filing, it means it.

Here’s what the company may do to solve its problems (formatting, bolding: TechCrunch):

To alleviate these conditions, management is currently evaluating various funding alternatives and may seek to raise additional funds through the issuance of equity, mezzanine or debt securities, through arrangements with strategic partners or through obtaining credit from government or financial institutions.

As we seek additional sources of financing, there can be no assurance that such financing would be available to us on favorable terms or at all. Our ability to obtain additional financing in the debt and equity capital markets is subject to several factors, including market and economic conditions, our performance and investor sentiment with respect to us and our industry.

In other words, the company is going to have to lever itself using debt, or dilute existing shareholders through the sale of equity, and Lordstown can’t promise that it will be able to do either “on favorable terms or at all.”

What we’re seeing here is the difference between SEC filings, which are no-bullshit zones, and SPAC decks, which are business propaganda. Shares of Lordstown fell more than 16% during regular trading, and another 6.9% in after-hours trading, as of the time of writing.

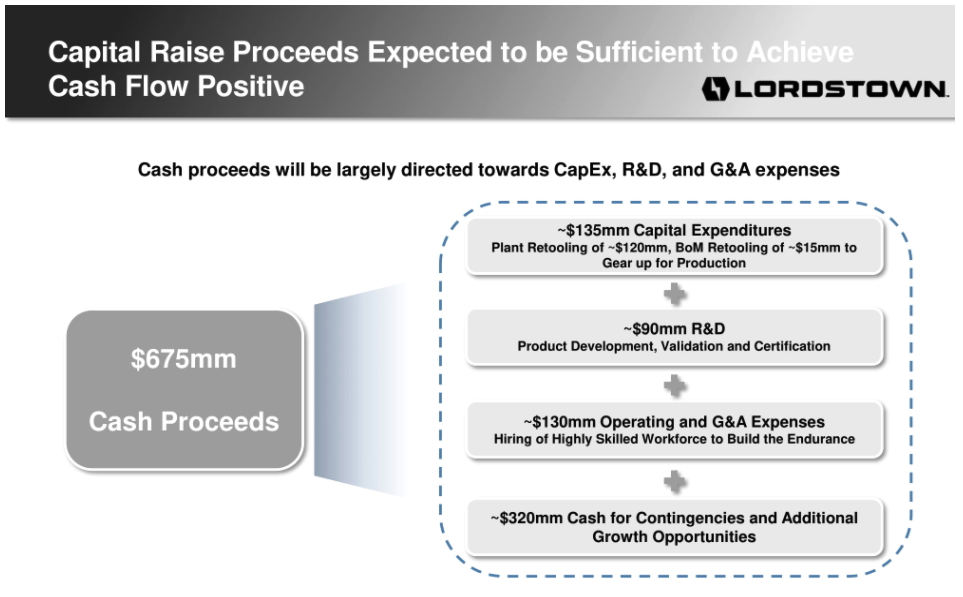

This mess from the company that put out this diagram in its investor deck:

In separate news, TechCrunch received an invite to a media availability to visit Lordstown’s operations in May, which included a note that the company “look[s] forward to opening [its] doors and showing you the latest progress from Lordstown Motors as [it] prepare[s] for the beginning of production in late September.” In a new missive sent today concerning the same event, the production timeline was not present.

So, yeah, maybe don’t trust SPAC decks much, if at all.

Powered by WPeMatico

Last year, Seattle-based network security startup ExtraHop was riding high, quickly approaching $100 million in ARR and even making noises about a possible IPO in 2021. But there will be no IPO, at least for now, as the company announced this morning it has been acquired by a pair of private equity firms for $900 million.

The firms, Bain Capital Private Equity and Crosspoint Capital Partners, are buying a security solution that provides controls across a hybrid environment, something that could be useful as more companies find themselves in a position where they have some assets on-site and some in the cloud.

The company is part of the narrower Network Detection and Response (NDR) market. According to Jesse Rothstein, ExtraHop’s chief technology officer and co-founder, it’s a technology that is suited to today’s threat landscape, “I will say that ExtraHop’s north star has always really remained the same, and that has been around extracting intelligence from all of the network traffic in the wire data. This is where I think the network detection and response space is particularly well suited to protecting against advanced threats,” he told TechCrunch.

The company uses analytics and machine learning to figure out if there are threats and where they are coming from, regardless of how customers are deploying infrastructure. Rothstein said he envisions a world where environments have become more distributed with less defined perimeters and more porous networks.

“So the ability to have this high-quality detection and response capability utilizing next generation machine learning technology and behavioral analytics is so very important,” he said.

Max de Groen, managing director at Bain, says his company was attracted to the NDR space, and saw ExtraHop as a key player. “As we looked at the NDR market, ExtraHop, which [ … ] has spent 14 years building the product, really stood out as the best individual technology in the space,” de Groen told us.

Security remains a frothy market with lots of growth potential. We continue to see a mix of startups and established platform players jockeying for position, and private equity firms often try to establish a package of services. Last week, Symphony Technology Group bought FireEye’s product group for $1.2 billion, just a couple of months after snagging McAfee’s enterprise business for $4 billion as it tries to cobble together a comprehensive enterprise security solution.

Powered by WPeMatico

Briq, which has developed a fintech platform used by the construction industry, has raised $30 million in a Series B funding round led by Tiger Global Management.

The financing is among the largest Series B fundraises by a construction software startup, according to the company, and brings Briq’s total raised to $43 million since its January 2018 inception. Existing backers Eniac Ventures and Blackhorn Ventures also participated in the round.

Briq CEO and co-founder Bassem Hamdy is a former executive at construction tech giant Procore (which recently went public and has a market cap of $10.4 billion) and Canadian software giant CMiC. Wall Street veteran Ron Goldshmidt is co-founder and COO.

Briq describes its offering as a financial planning and workflow automation platform that “drastically reduces” the time to run critical financial processes, while increasing the accuracy of forecasts and financial plans.

Briq has developed a toolbox of proprietary technology that it says allows it to extract and manipulate financial data without the use of APIs. It also has developed construction-specific data models that allows it to build out projections and create models of how much a project might cost, and how much could conceivably be made. Currently, Briq manages or forecasts about $30 billion in construction volume.

Specifically, Briq has two main offerings: Briq’s Corporate Performance Management (CPM) platform, which models financial outcomes at the project and corporate level, and BriqCash, a construction-specific banking platform for managing invoices and payments.

Put simply, Briq aims to allow contractors “to go from plan to pay” in one platform with the goal of solving the age-old problem of construction projects (very often) going over budget. Its longer-term, ambitious mission is to “manage 80% of the money workflows in construction within 10 years.”

The company’s strategy, so far, seems to be working.

From January 2020 to today, ARR has climbed by 200%, according to Hamdy. Briq currently has about 100 employees, compared to 35 a year ago.

Briq has 150 customers, and serves general and specialty contractors from $10 million to $1 billion in revenue. They include Cafco Construction Management, WestCor Companies and Choate Construction and Harper Construction. The company is currently focused on contractors in North America but does have long-term plans to address larger international markets, Hamdy told TechCrunch.

Hamdy came up with the idea for Santa Barbara, California-based Briq after realizing the vast amount of inefficiencies on the financial side of the construction industry. His goal was to do for construction financials what Procore did to document management, and PlanGrid to construction drawing. He started Briq with his own cash, amassed through secondary sales as Procore climbed the ranks of startups to become a construction industry unicorn.

Briq CEO and co-founder Bassem Hamdy. Image Credits: Briq

“I wanted to figure out how to bring the best of fintech into a construction industry that really guesses every month what the financial outcomes are for projects,” Hamdy told me at the time of the company’s last raise — a $10 million Series A led by Blackhorn Ventures announced in May of 2020. “Getting a handle on financial outcomes is really hard. The vast majority of the time, the forecasted cost to completion is plain wrong. By a lot.”

In fact, according to McKinsey, an astounding 80% of projects run over budget, resulting in significant waste and profit loss.

So at the end of a project, contractors often find themselves having doled out more money and resources than originally planned. This can lead to negative cash flow and profit loss. Briq’s platform aims to help contractors identify outliers, and which projects are more at risk.

Throughout the COVID-19 pandemic, Briq has proven to be “extremely valuable” to contractors, Hamdy said.

“In an industry where margins are so thin, we have given contractors the ability to truly understand where they stand on cash, profit and labor,” he added.

Powered by WPeMatico

Welcome back to the week, and welcome back to The Exchange. Robinhood has yet to file its IPO, so we’re looking at other companies in the meantime. Today it’s Babylon Health, a British health tech company that is pursuing a U.S. listing via a blank-check company, or SPAC.

You have questions. I have questions. We’ll get to some answers.

But before we do, we wanted to note that Anna and I are looking into the AI startup market tomorrow morning. If you are a VC with notes regarding the current pace of investment into the sector or thoughts on where customer traction is highest, let us know. If you are a founder building an AI-powered startup, we’d also like to hear from you about what you are seeing. Use the subject line “AI startups,” please.

The Exchange explores startups, markets and money.

Read it every morning on Extra Crunch or get The Exchange newsletter every Saturday.

With that out of the way, let’s get into Babylon Health. We’ll kick off with a short riff on its fundraising history, talk about its product, and then dive into its numbers and, bracing ourselves for impact, its projections.

The larger context this morning is that we’re doing legwork ahead of what could be a super active Q3 2021 IPO cycle. Kanzhun, a Chinese company, has also filed for a U.S. listing. Toss in Robinhood whenever it gets off its duff and gives us its own filing, and we’re being promised a good time.

Per Crunchbase data, Babylon has raised north of $600 million as a private company. Its funding, however, has not come from sources that we tend to discuss here at TechCrunch. Instead, the company raised some money from more traditional investors like Hoxton Ventures and Kinnevik, but the bulk of its capital was raised from the Saudi Arabian “Public Investment Fund,” or PIF. The PIF led a $550 million round into the British health tech company back in August 2019.

PitchBook has the round cut into two parts, the larger, first portion of which valued the company at $1.9 billion on a post-money basis.

That figure brings us to the SPAC deal that Babylon is now pursuing. The company’s new equity value after its SPAC deal will land around $4.2 billion, with Babylon sitting on around $540 million in cash after the deal is completed. The company will sport a lower, $3.6 billion enterprise valuation after its merger with SPAC Alkuri.

Powered by WPeMatico

Hello and welcome back to Equity, TechCrunch’s venture capital-focused podcast where we unpack the numbers behind the headlines.

This is Equity Monday, our weekly kickoff that tracks the latest private market news, talks about the coming week, digs into some recent funding rounds and mulls over a larger theme or narrative from the private markets. You can follow the show on Twitter here and myself here.

It’s WWDC week, so expect a deluge of Apple news to overtake your Twitter feed here and there over the next few days. But there’s a lot more going on, so let’s dig in:

And that’s your start to the week. More to come from your friends here on Wednesday, and Friday. Chat soon!

Equity drops every Monday at 7:00 a.m. PST, Wednesday, and Friday at 6:00 AM PST, so subscribe to us on Apple Podcasts, Overcast, Spotify and all the casts!

Powered by WPeMatico