Fundings & Exits

Auto Added by WPeMatico

Auto Added by WPeMatico

Iterative, an open-source startup that is building an enterprise AI platform to help companies operationalize their models, today announced that it has raised a $20 million Series A round led by 468 Capital and Mesosphere co-founder Florian Leibert. Previous investors True Ventures and Afore Capital also participated in this round, which brings the company’s total funding to $25 million.

The core idea behind Iterative is to provide data scientists and data engineers with a platform that closely resembles a modern GitOps-driven development stack.

After spending time in academia, Iterative co-founder and CEO Dmitry Petrov joined Microsoft as a data scientist on the Bing team in 2013. He noted that the industry has changed quite a bit since then. While early on, the questions were about how to build machine learning models, today the problem is how to build predictable processes around machine learning, especially in large organizations with sizable teams. “How can we make the team productive, not the person? This is a new challenge for the entire industry,” he said.

Big companies (like Microsoft) were able to build their own proprietary tooling and processes to build their AI operations, Petrov noted, but that’s not an option for smaller companies.

Currently, Iterative’s stack consists of a couple of different components that sit on top of tools like GitLab and GitHub. These include DVC for running experiments and data and model versioning, CML, the company’s CI/CD platform for machine learning, and the company’s newest product, Studio, its SaaS platform for enabling collaboration between teams. Instead of reinventing the wheel, Iterative essentially provides data scientists who already use GitHub or GitLab to collaborate on their source code with a tool like DVC Studio that extends this to help them collaborate on data and metrics, too.

“DVC Studio enables machine learning developers to run hundreds of experiments with full transparency, giving other developers in the organization the ability to collaborate fully in the process,” said Petrov. “The funding today will help us bring more innovative products and services into our ecosystem.”

Petrov stressed that he wants to build an ecosystem of tools, not a monolithic platform. When the company closed this current funding round about three months ago, Iterative had about 30 employees, many of whom were previously active in the open-source community around its projects. Today, that number is already closer to 60.

“Data, ML and AI are becoming an essential part of the industry and IT infrastructure,” said Leibert, general partner at 468 Capital. “Companies with great open-source adoption and bottom-up market strategy, like Iterative, are going to define the standards for AI tools and processes around building ML models.”

Powered by WPeMatico

DealHub.io, an Austin-based platform that helps businesses manage the entire process of their sales engagements, today announced that it has raised a $20 million Series B funding round. The round was led by Israel Growth Partners, with participation from existing investor Cornerstone Venture Partners. This brings DealHub’s total funding to $24.5 million.

The company describes itself as a ‘revenue amplification’ platform (or ‘RevAmp,’ as DealHub likes to call it) that represents the next generation of existing sales and revenue operations tools. It’s meant to give businesses a more complete view of buyers and their intent, and streamline the sales processes from proposal to pricing quotes, subscription management and (electronic) signatures.

“Yesterday’s siloed sales tools no longer cut it in the new Work from Anywhere era,” said Eyal Elbahary, CEO & Co-founder of DealHub.io. “Sales has undergone the largest disruption it has ever seen. Not only have sales teams needed to adapt to more sophisticated and informed buyers, but remote selling and digital transformation have compelled them to evolve the traditional sales process into a unique human-to-human interaction.”

The platform integrates with virtually all of the standard CRM tools, including Salesforce, Microsoft Dynamics and Freshworks, as well as e-signature platforms like DocuSign.

The company didn’t share any revenue data, but it notes that the new funding round follows “continued multi-year hyper-growth.” In part, the company argues, demand for its platform has been driven by sales teams that need new tools, given that they — for the most part — can’t travel to meet their (potential) customers face-to-face.

“Revenue leaders need the agility to keep pace with today’s fast and ever-changing business environment. They cannot afford to be restrained by rigid and costly to implement tools to manage their sales processes,” said Uri Erde, General Partner at Israel Growth Partners. “RevAmp provides a simple to operate, intuitive, no-code solution that makes it possible for sales organizations to continuously adapt to the modern sales ecosystem. Furthermore, it provides sales leaders the visibility and insights they need to manage and consistently accelerate revenue growth. We’re excited to back the innovation DealHub is bringing to the world of revenue operations and help fuel its growth.”

Powered by WPeMatico

Another week, another unicorn IPO. This time, Sprinklr is taking on the public markets.

The New York-based software company works in what it describes as the customer experience market. After attracting over $400 million in capital while private, its impending debut will not only provide key returns to a host of venture capitalists but also more evidence that New York’s startup scene has reached maturity. (More evidence here.)

The Exchange explores startups, markets and money.

Read it every morning on Extra Crunch or get The Exchange newsletter every Saturday.

Sprinklr last raised a $200 million round at a $2.7 billion valuation in September 2020. That round, as TechCrunch reported, also included a host of secondary shares and $150 million in convertible notes. Inclusive of the latter instrument, Sprinklr’s total capital raised to date soars above the $500 million mark.

Temasek Holdings, Battery Ventures, ICONIQ Capital, Intel Capital and others have plugged funds into Sprinklr during its startup days.

Temasek Holdings, Battery Ventures, ICONIQ Capital, Intel Capital and others have plugged funds into Sprinklr during its startup days.

Sure, Robinhood didn’t file last week as many folks hoped, but the Sprinklr IPO ensures that we’ll have more than just SPACs to chat about in the coming days. But one thing at a time. Let’s discuss what Sprinklr does for a living.

Sprinklr’s IPO filing and corporate website suffer from a slight case of corporate speak, so we have some work to do this morning to determine what the company does. Here’s what the company says about itself in its filing:

Sprinklr empowers the world’s largest and most loved brands to make their customers happier.

We do this with a new category of enterprise software — Unified Customer Experience Management, or Unified-CXM — that enables every customer-facing function across the front office, from Customer Care to Marketing, to collaborate across internal silos, communicate across digital channels, and leverage a complete suite of modern capabilities to deliver better, more human customer experiences at scale — all on one unified, AI-powered platform.

Not very clear, yeah? Don’t worry, I’ve got you. Here’s what the company actually does:

Powered by WPeMatico

Just about every week there’s a blockbuster round coming out of South America, but in certain countries such as Ecuador, things have been more hush-hush. However, Kushki, a Quito-based fintech, is bringing attention to the region with today’s announcement of an $86 million Series B and a $600 million valuation.

“We never thought that we would return home [from the U.S.] and build a company that was more valuable in Ecuador than we had built in the U.S.,” said Aron Schwarzkopf, CEO and co-founder of Kushki.

Schwarzkopf and his business partner, Sebastián Castro, previously built and sold a fintech called Leaf in the U.S. in 2014. The two are originally from Ecuador but moved to Boston for college, where they met watching soccer.

Unlike many other fintechs in LatAm that are out to help the unbanked, Kushki works behind the scenes building the tech infrastructure that companies like Nubank use to transfer money. Some of the functionalities they build enable both local and cross-border payment players in credit and debit cards, bank transfers, digital cash, mobile wallets and other alternative payment methods.

“We realized there was a gigantic opportunity to democratize and create infrastructure to move money,” Schwarzkopf told TechCrunch.

The company, which was founded in 2017, already has operations in Mexico, Colombia, Ecuador, Peru and Chile. The Series B will be used to accelerate growth and expand to Brazil and nine other markets in Central America.

Generally, expanding to Brazil is an expensive proposition, and therefore not a path that all companies can take, even though it can be an extremely profitable move if done right. Some of the challenges include the need to translate everything into Portuguese followed by the varying financial regulations.

That’s why Kushki’s approach has to be somewhat custom in each country.

“We focus on going into the markets and we basically rebuild an entire infrastructure, so we put everything into one API,” said Schwarzkopf.

Products similar to Kushki have been successful in other regions around the world, such as in India with Pine Labs, Africa with Flutterwave and Checkout.com, which now has 15 international offices.

To build all this infrastructure, Kushki, which means “cash” in a native Andes dialect, has raised a total of $100 million from SoftBank and an undisclosed global growth equity firm, as well as previous investors including DILA Capital, Kaszek Ventures, Clocktower Ventures and Magma Partners.

“From now until 2060, people will need servers and ways to move money, and we knew that the existing payment infrastructure couldn’t support that,” said Schwarzkopf.

Powered by WPeMatico

Zenyum, a startup that wants to make cosmetic dentistry more affordable, announced today it has raised a $40 million Series B. This includes $25 million from L Catterton, a private equity firm focused on consumer brands. The round’s other participants were Sequoia Capital India (Zenyum is an alum of its Surge accelerator program), RTP Global, Partech, TNB Aura, Seeds Capital and FEBE Ventures. L Catteron Asia’s head of growth investments, Anjana Sasidharan, will join Zenyum’s board.

This brings Zenyum’s total raised so far to $56 million, including a $13.6 million Series A announced in November 2019. In a press statement, Sasidharan said, “Zenyum’s differentiated business model gives it a strong competitive advantage, and we are excited to partner with the founder management team to help them realize their growth ambitions.” Other dental-related investments in L Catteron’s portfolio include Ideal Image, ClearChoice, dentalcorp, OdontoCompany, Espaçolaser and 98point6.

Founded in 2018, the company’s products now include ZenyumSonic electric toothbrushes; Zenyum Clear, or transparent 3D-printed aligners; and ZenyumClear Plus for more complex teeth realignment cases.

Founder and chief executive officer Julian Artopé told TechCrunch that ZenyumClear aligners can be up to 70% cheaper than other braces, including traditional metal braces, lingual braces and other clear aligners like Invisalign, depending on the condition of a patients’ teeth and what they want to achieve. Zenyum Clear costs $2,400 SGD (about $1,816 USD), while ZenyumClear Plus ranges from $3,300 to $3,900 SGD (about $2,497 to $2,951 USD).

The company is able to reduce the cost of its invisible braces by combining a network of dental partners with a technology stack that allows providers to monitor patients’ progress while reducing the number of clinic visits they need to make.

First, potential customers send a photo of their teeth to Zenyum to determine if ZenyumClear or ZenyumClear Plus will work for them. If so, they have an in-person consultation with a dentists, including an X-ray and 3D scan. This costs between $120 to $170 SGD, which is paid to the clinic. After their invisible braces are ready, the patient returns to the dentist for a fitting. Then dentists can monitor the progress of their patient’s teeth through Zenyum’s app, only asking them to make another in-person visit if necessary.

ZenyumClear is currently available in Singapore, Malaysia, Indonesia, Hong Kong, Macau, Vietnam, Thailand and Taiwan, with more markets planned.

Sequoia India principal Pieter Kemps told TechCrunch, “There are 300M customers in Zenyum’s core markets—Southeast Asia, Hong Kong, Taiwan—who have increased disposable income for beauty. We believe spend on invisible braces will grow significantly from the current penetration, but what it requires is strong execution on a complex product to become the preferred choice for consumers. That is where Zenyum shines: excellent execution, leading to new products, best-in-class NPS, fast growth, and strong economics. This Series B is a testament to that, and of the belief in the large opportunity down the road.”

Powered by WPeMatico

Meet June, a new startup that wants to make it easier to create analytics dashboards and generate reports even if you’re not a product analytics expert. June is built on top of your Segment data. Like many no-code startups, it uses templates and a graphical interface so that non-technical profiles can start using it.

“What we do today is instant analytics and that’s why we’re building it on top of Segment,” co-founder and CEO Enzo Avigo told me. “It lets you access data much more quickly.”

Segment acts as the data collection and data repository for your analytics. After that, you can start playing with your data in June. Eventually, June plans to diversify its data sources.

“Our long-term vision is to become the Airtable of analytics,” Avigo said.

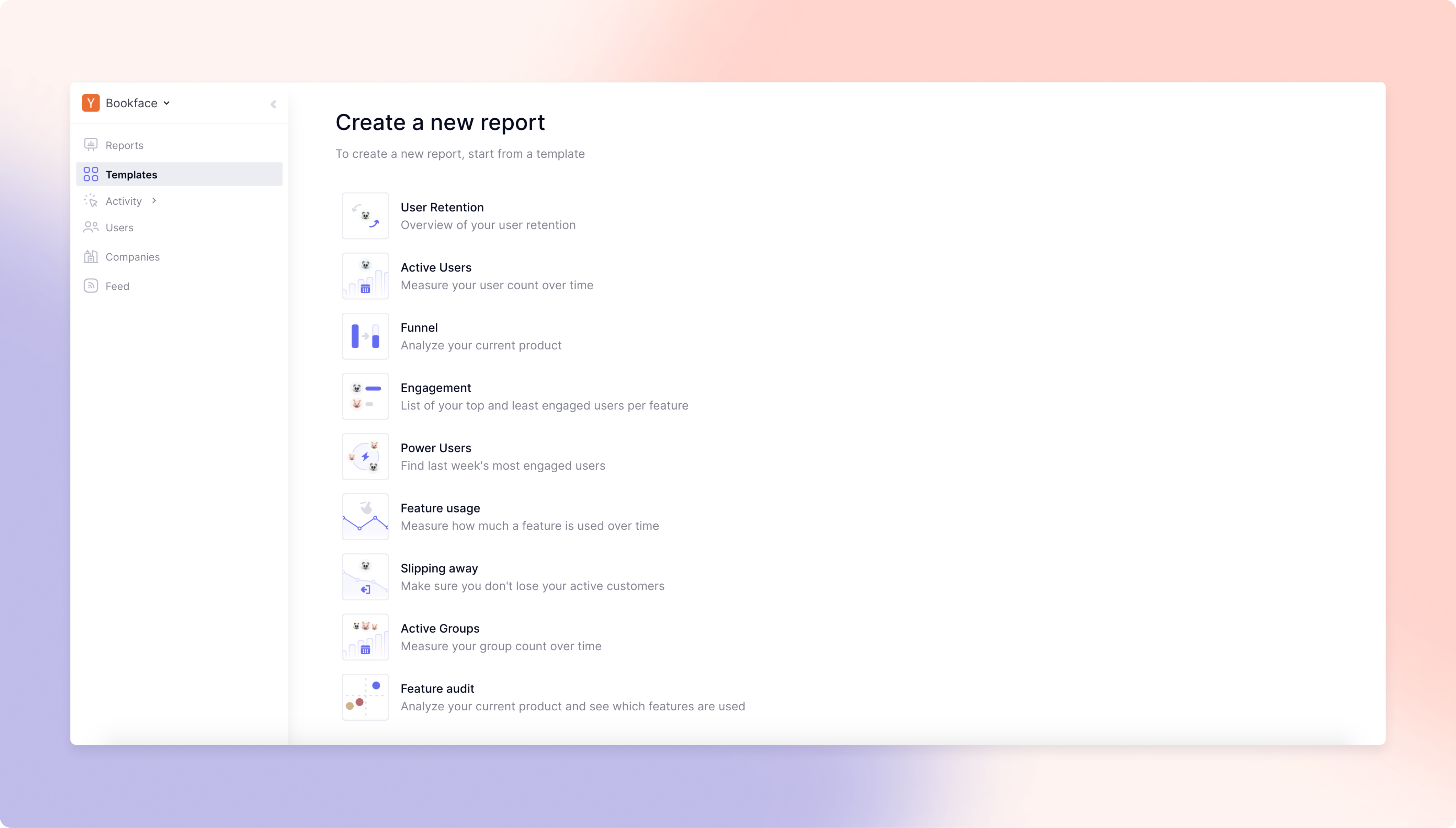

If you’re familiar with Airtable, June may look familiar. The company has built a template library to help you get started. For instance, June helps you track user retention, active users, your acquisition funnel, engagement, feature usage, etc.

Image Credits: June

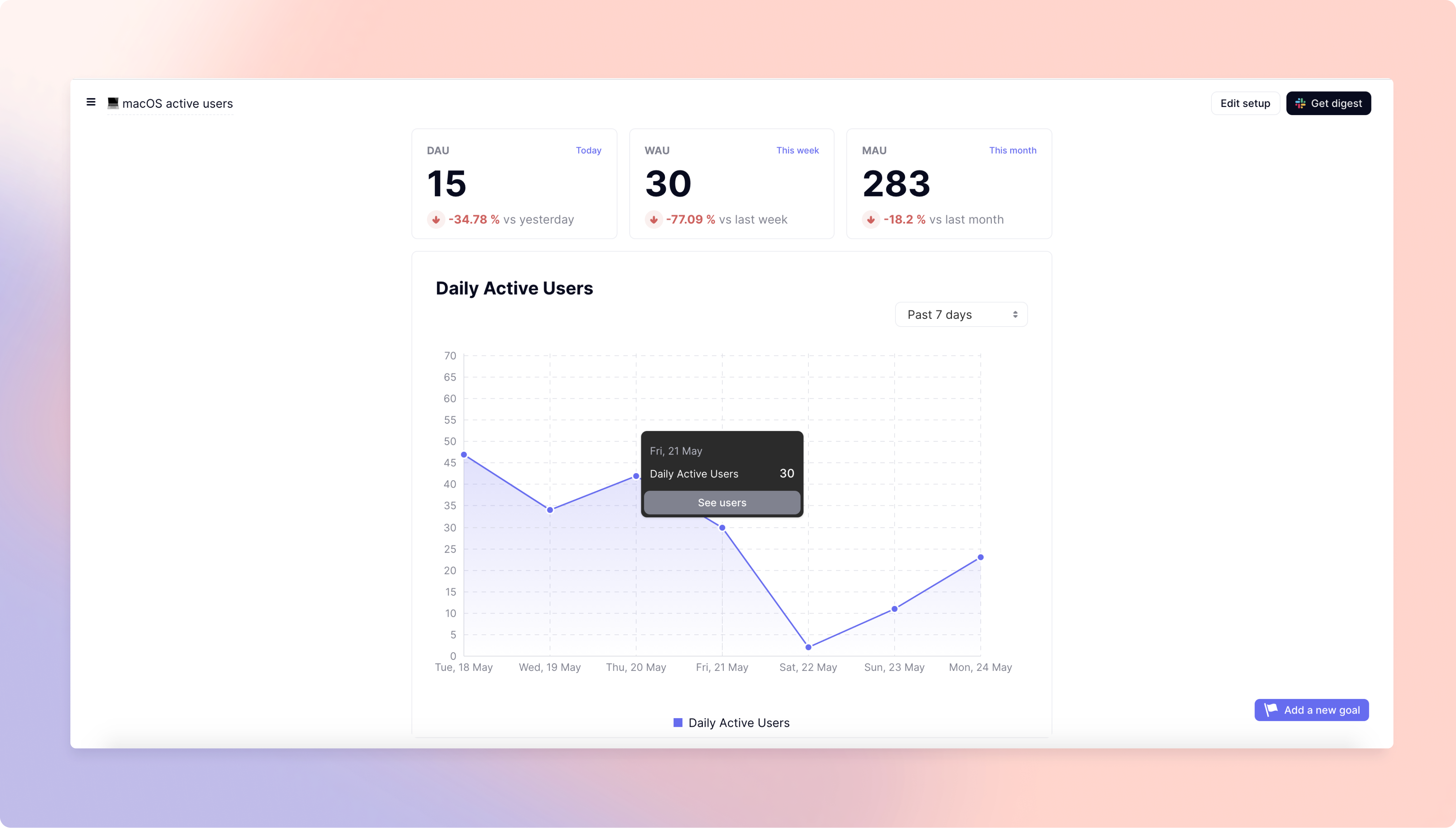

Once you pick a template, you can start building a report by matching data sources with templates. June automatically generates charts, sorts your user base into cohorts and shows you important metrics. You can create goals so that you receive alerts in Slack whenever something good or bad is happening.

Advanced users can also use June so that everyone in the team is using the same tool. They can create custom SQL queries and build a template based on those queries.

The company raised a seed round of $1.85 million led by Point Nine. Y Combinator, Speedinvest, Kima Ventures, eFounders and Base Case also participated, as well as several business angels.

Prior to June, the startup’s two co-founders worked for Intercom. They noticed that the analytics tool was too hard to use for many people. They didn’t rely on analytics to make educated decisions.

There are hundreds of companies using June every week and that number is growing by 10% per week. Right now, the product is free but the company plans to charge based on usage.

Image Credits: June

Powered by WPeMatico

Scotland is slowly but surely drawing attention in the UK’s startup space. In 2020, Scottish startups collectively raised £345 million, according to Tech Nation, and with nearly 2,500 startups, it has the highest number of budding tech companies outside London. Venture capital fundraises are also consistently on the rise every year.

Scotland’s capital Edinburgh boasts a beautiful, hilly landscape, a robust education system and good access to grant funding, public and private investment. It’s also one of the top financial centers in the U.K., making it a great place to begin a business.

So to find out what the startup scene in Edinburgh looks like, we spoke to six founders, executives and investors. The city’s tech ecosystem appears to have a robust space for machine learning, artificial intelligence, biomedicine, fintech, travel tech, oil, renewables, e-commerce, gaming, health tech, deep tech, space tech and insurtech.

Use discount code SCOTLANDSURVEY to save 25% off an annual or two-year Extra Crunch membership.

This offer is only available to readers in the UK Europe and expires on June 30, 2021.

However, the city’s tech scene is apparently lackluster when it comes to legal tech, blockchain and consumer-facing technology.

Breakout companies that were founded in Edinburgh include Skyscanner and FanDuel. Notable among the current crop are Desana, Continuum Industries, Parsley Box, Current Health, Boundary, Zumo, Appointedd, Criton, Mallzee, TravelNest, TVSquared, Care Sourcer, Stampede, For-Sight, Vistalworks, Reath, InfraCost, Speech Graphics and Cyan Forensics.

The Edinburgh business-angel community appears to be quite strong, but it seems local founders find it difficult to get London-based investors to take an interest. Scottish investors are said to be “pretty conservative and risk-adverse” with some notable exceptions.

We surveyed:

Which sectors is your tech ecosystem strong in? What are you most excited by? What does it lack?

It’s strong in space, biomedicine, fintech/insurtech, AI.

What are the tech investors like in Edinburgh? What’s their focus?

The Scottish business-angel community is said to be the largest in Europe. It’s difficult to get London-based investors take an interest in Scotland — investors can tend to look at where companies are based. It is hard for “underrepresented founders” to get investments in Scotland and beyond.

With the shift to remote working, do you think people will stay in Edinburgh or will they move out? Will others move in?

Stay. Not always easy to get people to come and live in Scotland. Edinburgh, there are lots of prejudices, despite it being one of the best cities to live in in the whole of the U.K.

Who are the key startup people in the city (e.g., investors, founders, lawyers, designers)?

Good to see more focus on impact investing. Par Equity is one of Edinburgh’s biggest investors, whereas Archangels is one of the biggest angel investors. Poonam Malik is great for diversity and female entrepreneurs, and she is on the board of Scottish Enterprise, and is a social entrepreneur and investor. Garry Bernstein is also an investor — he leads the Scottish chapter of Tech London Advocates and Global Tech Advocates, and as such is the founder of Tech Scot Advocates.

Where do you think the city’s tech scene will be in five years?

Thriving. The government is doing its best for the tech sector. Education in tech is currently an issue, though. Hope Brexit won’t be too much of an issue.

Which sectors is your tech ecosystem strong in? What are you most excited by? What does it lack?

Strong in fintech, health tech, data science, deep tech. Excited by quantum computing, advanced materials, AI in Edinburgh. Weak in blockchain and consumer.

Which are the most interesting startups in Edinburgh?

Current Health, InfraCost, Speech Graphics and Cyan Forensics.

What are the tech investors like in Edinburgh? What’s their focus?

Good at seed stage up to £1 million, okay for pre-series A (£1 million to £3 million) and non-existent for Series A (£3 million-£10 million). Quality of investors is improving. Par Equity is leading the way.

With the shift to remote working, do you think people will stay in Edinburgh, or will they move out? Will others move in?

Experiencing influx of new talent due to COVID-19. Edinburgh is a highly desirable city to live in. Recent new residents include Aaron Ross (Predictable Revenue) and Jules Pursuad (early employee at Airbnb and now VP at Omio).

Who are the key startup people in the city (e.g., investors, founders, lawyers, designers)?

Par Equity (investor), Paul Atkinson, Alistair Forbes, Mark Logan, Lesley Eccles, Chris McCann, CodeBase.

Where do you think the city’s tech scene will be in five years?

One to two new unicorns. Promising number of high-growth tech companies. A much more sophisticated investor scene in the Series A space.

Which sectors is your tech ecosystem strong in? What are you most excited by? What does it lack?

Edinburgh is strong in fintech because of our proximity to so many financial services companies and banks. Also, there are some exciting games tech companies because of our history of games companies. We’re pretty weak in law tech, Valla’s area.

Which are the most interesting startups in Edinburgh?

Vistalworks for consumer tech; Sustainably for fintech; Reath for sustainable tech.

What are the tech investors like in Edinburgh? What’s their focus?

As a rule, Scottish investors are pretty conservative and risk-averse. The only real exception is Techstart Ventures, in my experience.

With the shift to remote working, do you think people will stay in Edinburgh, or will they move out? Will others move in?

I think more people will come to Edinburgh from London because the quality of life and cost of living are both so much better here.

Who are the key startup people in the city (e.g., investors, founders, lawyers, designers)?

Calum Forsyth and Mark Hogarth at Techstart Ventures; Janine Matheson at CodeBase; Jackie Waring from the Investing Women angel syndicate; Jim Newbury is a very well-respected developer and coach, and my co-founder Kate Ho is also well known. Also Danny Helson who runs the EIE event with the Bayes Centre.

Where do you think the city’s tech scene will be in five years?

We’ve had a few exits in the past few years (Skyscanner, FreeAgent), which means that talent is spreading out across the ecosystem here and we’re getting some fantastic new startups kicking off. In five years, that first crop should be coming into the Series A stage so we could see a lot of super exciting businesses!

Which sectors is your tech ecosystem strong in? What are you most excited by? What does it lack?

Strong in fintech, travel tech, health, oil, renewables, e-commerce, gaming (both video game and gambling tech). Excited by all bar oil (great driver of revenue, but not the future).

Which are the most interesting startups in Edinburgh?

Boundary, Parsley Box, Appointedd, Criton, Mallzee, TravelNest, TVSquared, Care Sourcer, Stampede, For-Sight.

What are the tech investors like in Edinburgh? What’s their focus?

Big fintech scene here. Travel tech is growing too, with Skyscanner’s influence strong.

With the shift to remote working, do you think people will stay in Edinburgh, or will they move out? Will others move in?

Most will stay, as it’s a very attractive city to live and work in. It’s a globally recognized and unique city. Very international flavor as evidenced by the makeup of our team.

Who are the key startup people in the city (e.g., investors, founders, lawyers, designers)?

Ex-Skyscanner people including Gareth Williams, Mark Logan, etc. Ian Ritchie, Alistair Forbes, the FanDuel’s founders and the CodeBase founders.

Where do you think the city’s tech scene will be in five years?

A lot bigger, as tech is a key growth target of the Scottish government and is underpinned/influenced/inspired by Skyscanner and FanDuel.

Which sectors is your tech ecosystem strong in? What are you most excited by? What does it lack?

Strong in machine learning/AI/digital. Weak in deep tech discovery, especially in biotech/therapeutics. Excited by the rise in adoption of AI in drug discovery — all these ideas that were sci-fi 20 years ago are now adopted in £B deals.

Which are the most interesting startups in Edinburgh?

Pheno Therapeutics.

What are the tech investors like in Edinburgh? What’s their focus?

Conservative angels and a few tech seed VCs.

With the shift to remote working, do you think people will stay in Edinburgh, or will they move out? Will others move in?

Move in.

Who are the key startup people in the city (e.g., investors, founders, lawyers, designers)?

Investors: Archangels, Techstart Ventures and Epidarex.

Where do you think the city’s tech scene will be in five years?

Growing.

Which sectors is your tech ecosystem strong in? What are you most excited by? What does it lack?

I don’t think there are any sectors that stand out — it’s fairly evenly split. A good strength of the city is the talent that comes from the universities. There are some really good engineers that come from Edinburgh, Heriot Watt and Edinburgh Napier. The main weakness is that the ecosystem doesn’t favor the most ambitious founders. Most investors in the region are angels and aren’t interested in finding outliers that could grow 1000x and are more interested in backing companies that are less risky but might 5x their money. If you want to find investors that will back risky (but very ambitious) plans, it’s easier to find that elsewhere.

Which are the most interesting startups in Edinburgh?

Desana, Continuum Industries, Parsley Box, Current Health, Boundary, Zumo.

What are the tech investors like in Edinburgh? What’s their focus?

I would say it’s getting better, but there are still a lot of issues with the ecosystem. It is being helped in Scotland by the likes of Techstart investing at the earliest stages with high conviction and term sheets that are more similar to London VCs. Outside of this, though, it’s easy for founders to end up with a messy cap table due to the number of angels and lack of VCs looking for VC-type returns — the messiness of these cap tables can then make it hard to raise venture funding down the line. This is fine for a lot of companies that aren’t aiming for a venture-scale return (which admittedly is a lot), but it can hurt those that are.

With the shift to remote working, do you think people will stay in Edinburgh, or will they move out? Will others move in?

I imagine and hope others will move in. It is a great place to live with a very high quality of life, and this should be a natural attraction for people who want a good standard of living but want to remain in a city.

Who are the key startup people in the city (e.g., investors, founders, lawyers, designers)?

SEP (investor), Techstart Ventures (investor), Gareth Williams (founder/investor), MBM Commercial (lawyers), Pentech, Bill Dobbie (investor), Jamie Coleman.

Where do you think the city’s tech scene will be in five years?

Optimistically, I hope that there will be a good number of companies that are at the Series B/Series C stage, which will invite a lot more interest from investors outside of Edinburgh (London, Berlin, Paris, New York, San Francisco, etc.) to start investing more actively in the city at the earliest stages as well as these stages.

Powered by WPeMatico

Here in the U.S. the concept of using a driver’s data to decide the cost of auto insurance premiums is not a new one.

But in markets like Brazil, the idea is still considered relatively novel. A new startup called Justos claims it will be the first Brazilian insurer to use drivers’ data to reward those who drive safely by offering “fairer” prices.

And now Justos has raised about $2.8 million in a seed round led by Kaszek, one of the largest and most active VC firms in Latin America. Big Bets also participated in the round, along with the CEOs of seven unicorns, including Assaf Wand, CEO and co-founder of Hippo Insurance; David Vélez, founder and CEO of Nubank; Carlos Garcia, founder and CEO of Kavak; Sergio Furio, founder and CEO of Creditas; Patrick Sigrist, founder of iFood and Fritz Lanman, CEO of ClassPass. (There’s a seventh CEO who wishes to remain anonymous). Senior executives from Robinhood, Stripe, Wise, Carta and Capital One also put money in the round.

Serial entrepreneurs Dhaval Chadha, Jorge Soto Moreno and Antonio Molins co-founded Justos, having most recently worked at various Silicon Valley-based companies including ClassPass, Netflix and Airbnb.

“While we have been friends for a while, it was a coincidence that all three of us were thinking about building something new in Latin America,” Chadha said. “We spent two months studying possible paths, talking to people and investors in the United States, Brazil and Mexico, until we came up with the idea of creating an insurance company that can modernize the sector, starting with auto insurance.”

Ultimately, the trio decided that the auto insurance market would be an ideal sector considering that in Brazil, an estimated more than 70% of cars are not insured.

The process to get insurance in the country, by any accounts, is a slow one. It takes up to 72 hours to receive initial coverage and two weeks to receive the final insurance policy. Insurers also take their time in resolving claims related to car damages and loss due to accidents, the entrepreneurs say. They also charge that pricing is often not fair or transparent.

Justos aims to improve the whole auto insurance process in Brazil by measuring the way people drive to help price their insurance policies. Similar to Root here in the U.S., Justos intends to collect users’ data through their mobile phones so that it can “more accurately and assertively price different types of risk.” This way, the startup claims it can offer plans that are up to 30% cheaper than traditional plans, and grant discounts each month, according to the driving patterns of the previous month of each customer.

“We measure how safely people drive using the sensors on their cell phones,” Chadha said. “This allows us to offer cheaper insurance to users who drive well, thereby reducing biases that are inherent in the pricing models used by traditional insurance companies.”

Justos also plans to use artificial intelligence and computerized vision to analyze and process claims more quickly and machine learning for image analysis and to create bots that help accelerate claims processing.

“We are building a design-driven, mobile first and customer experience that aims to revolutionize insurance in Brazil, similar to what Nubank did with banking,” Chadha told TechCrunch. “We will be eliminating any hidden fees, a lot of the small text and insurance-specific jargon that is very confusing for customers.”

Justos will offer its product directly to its customers as well as through distribution channels like banks and brokers.

“By going direct to consumer, we are able to acquire users cheaper than our competitors and give back the savings to our users in the form of cheaper prices,” Chadha said.

Customers will be able to buy insurance through Justos’ app, website or even WhatsApp. For now, the company is only adding potential customers to a waitlist but plans to begin selling policies later this year..

During the pandemic, the auto insurance sector in Brazil declined by 1%, according to Chadha, who believes that indicates “there is latent demand raring to go once things open up again.”

Justos has a social good component as well. Justos intends to cap its profits and give any leftover revenue back to nonprofit organizations.

The company also has an ambitious goal: to help make insurance become universally accessible around the world and the roads safer in general.

“People will face everyday risks with a greater sense of safety and adventure. Road accidents will reduce drastically as a result of incentives for safer driving, and the streets will be safer,” Chadha said. “People, rather than profits, will become the focus of the insurance industry.”

Justos plans to use its new capital to set up operations, such as forming partnerships with reinsurers and an insurance company for fronting, since it is starting as an MGA (managing general agent).

It’s also working on building out its products such as apps, its back end and internal operations tools, as well as designing all its processes for underwriting, claims and finance. Justos’ data science team is also building out its own pricing model.

The startup will be focused on Brazil, with plans to eventually expand within Latin America, then Iberia and Asia.

Kaszek’s Andy Young said his firm was impressed by the team’s previous experience and passion for what they’re building.

“It’s a huge space, ripe for innovation and this is the type of team that can take it to the next level,” Young told TechCrunch. “The team has taken an approach to building an insurance platform that blends being consumer-centric and data-driven to produce something that is not only cheaper and rewards safety but as the brand implies in Portuguese, is fairer.”

Powered by WPeMatico

As AI has grown from a menagerie of research projects to include a handful of titanic, industry-powering models like GPT-3, there is a need for the sector to evolve — or so thinks Dario Amodei, former VP of research at OpenAI, who struck out on his own to create a new company a few months ago. Anthropic, as it’s called, was founded with his sister Daniela and its goal is to create “large-scale AI systems that are steerable, interpretable, and robust.”

The challenge the siblings Amodei are tackling is simply that these AI models, while incredibly powerful, are not well understood. GPT-3, which they worked on, is an astonishingly versatile language system that can produce extremely convincing text in practically any style, and on any topic.

But say you had it generate rhyming couplets with Shakespeare and Pope as examples. How does it do it? What is it “thinking”? Which knob would you tweak, which dial would you turn, to make it more melancholy, less romantic, or limit its diction and lexicon in specific ways? Certainly there are parameters to change here and there, but really no one knows exactly how this extremely convincing language sausage is being made.

It’s one thing to not know when an AI model is generating poetry, quite another when the model is watching a department store for suspicious behavior, or fetching legal precedents for a judge about to pass down a sentence. Today the general rule is: the more powerful the system, the harder it is to explain its actions. That’s not exactly a good trend.

“Large, general systems of today can have significant benefits, but can also be unpredictable, unreliable, and opaque: our goal is to make progress on these issues,” reads the company’s self-description. “For now, we’re primarily focused on research towards these goals; down the road, we foresee many opportunities for our work to create value commercially and for public benefit.”

The goal seems to be to integrate safety principles into the existing priority system of AI development that generally favors efficiency and power. Like any other industry, it’s easier and more effective to incorporate something from the beginning than to bolt it on at the end. Attempting to make some of the biggest models out there able to be picked apart and understood may be more work than building them in the first place. Anthropic seems to be starting fresh.

“Anthropic’s goal is to make the fundamental research advances that will let us build more capable, general, and reliable AI systems, then deploy these systems in a way that benefits people,” said Dario Amodei, CEO of the new venture, in a short post announcing the company and its $124 million in funding.

That funding, by the way, is as star-studded as you might expect. It was led by Skype co-founder Jaan Tallinn, and included James McClave, Dustin Moskovitz, Eric Schmidt and the Center for Emerging Risk Research, among others.

The company is a public benefit corporation, and the plan for now, as the limited information on the site suggests, is to remain heads-down on researching these fundamental questions of how to make large models more tractable and interpretable. We can expect more information later this year, perhaps, as the mission and team coalesces and initial results pan out.

The name, incidentally, is adjacent to anthropocentric, and concerns relevancy to human experience or existence. Perhaps it derives from the “Anthropic principle,” the notion that intelligent life is possible in the universe because… well, we’re here. If intelligence is inevitable under the right conditions, the company just has to create those conditions.

Powered by WPeMatico

There was a time when this column was more than a never-ending run of IPO coverage. Then the unicorn liquidity cycle kicked off and it’s been a long run of public offerings ever since. This morning is no exception.

Doximity filed to go public earlier today. You likely haven’t heard of the company because it exists in the modestly obscure world of telehealth. But it’s a venture-backed startup all the same that raised more than $80 million from investors like Emergence, InterWest Partners, Morgenthaler Ventures and Threshold, according to Crunchbase data.

Notably, Doximity has not fundraised since 2014, a year in which it attracted just under $82 million at a valuation of $355 million, per PitchBook data. How has it managed to not raise for so long? By generating lots of cash and profit over the years. Health tech communications, it turns out, can be a lucrative endeavor.

The Exchange explores startups, markets and money.

Read it every morning on Extra Crunch or get The Exchange newsletter every Saturday.

Doximity is a social network that allows doctors to speak to each other while complying with HIPAA, a federal law that promotes medical privacy. The network, originally defined as a LinkedIn for medical professionals, gives doctors a Rolodex for specialists, a newsfeed for healthcare updates, a communication tool to talk to patients and a job search tool.

In 2017, Doximity claimed that it reached 70% of all U.S. doctors, more than 800,000 licensed professionals.

This is CEO Jeff Tangney’s second time bringing a health tech company public after his previous medical software startup, Epocrates, debuted in 2011.

This is CEO Jeff Tangney’s second time bringing a health tech company public after his previous medical software startup, Epocrates, debuted in 2011.

Let’s chat briefly about the larger health tech exit market and then dig into Doximity’s IPO filing and get our heads around how the company managed to avoid private-market dilution for seven years — and what the company may be worth.

The global digital health market is estimated to hit $221 billion by 2026, underscoring how large an opportunity the sector may present to venture capitalists. But investors aren’t merely just paying attention to estimates; they are seeing a number of exits in digital health (read: liquidity) that are warming up their checkbooks.

CB Insights estimates that there were 79 healthcare IPOs and M&A transactions in Q1 2021 alone, a 60% increase from the quarter prior. Another report says that there were 145 acquisitions of digital health companies in 2020, up from a solid 113 in 2019.

While still growing, it’s fair to say that those figures describe a healthy exit environment.

The list of deals in the market is straight fire. Earlier this year, Everlywell, founded in 2015, acquired two healthcare companies to expand its digital health service and distribution. Last week, Modern Fertility was bought by Ro for north of $225 million in a majority-equity deal. Before you start complaining that it’s not an IPO, consider this: A less than four-year-old company just got bought for a quarter of a billion dollars by another company that is less than four years old.

Powered by WPeMatico