Fundings & Exits

Auto Added by WPeMatico

Auto Added by WPeMatico

Hello and welcome back to Equity, TechCrunch’s venture capital-focused podcast, where we unpack the numbers behind the headlines.

This week had the whole crew aboard to record: Grace and Chris making us sound good, Danny to provide levity, Natasha to actually recall facts and Alex to divert us from staying on topic. It’s teamwork, people — and our transitions are proof of it.

And it’s good that we had everyone around the virtual table, as there was quite a lot to get through:

Thanks for hanging out this week, Equity is back on Tuesday with our usual weekly kickoff, thanks to the American holiday on Monday. Chat then, unless you want to follow us on Twitter and get a first-look at all of Chris’ meme work.

Equity drops every Monday at 7:00 a.m. PST, Wednesday, and Friday morning at 7:00 a.m. PST, so subscribe to us on Apple Podcasts, Overcast, Spotify and all the casts.

Powered by WPeMatico

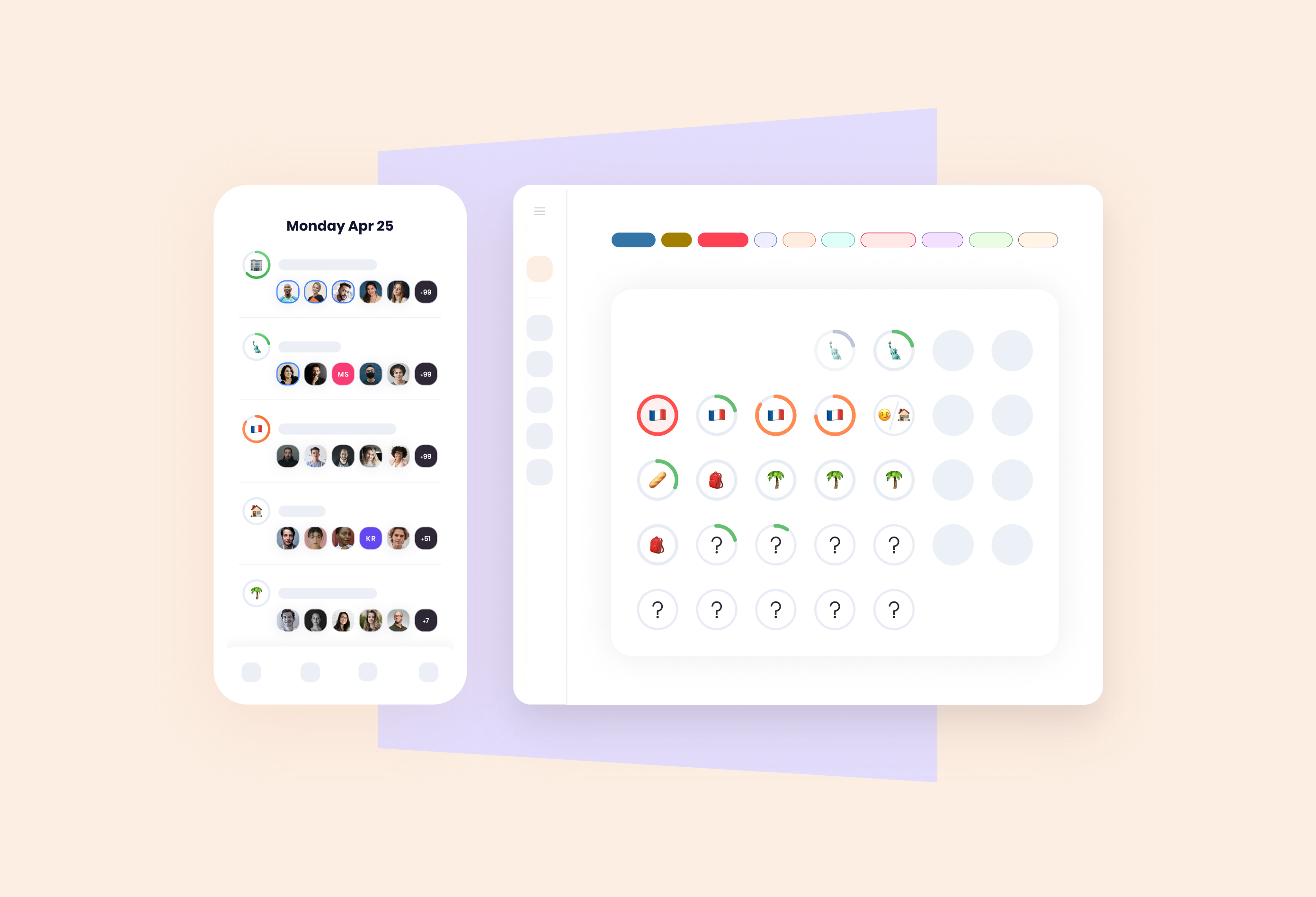

Meet Café, a new French startup founded by two brothers that wants to help companies switch to a hybrid remote-and-office workplace model. Café isn’t a traditional desk-booking tool. Instead, the company helps you see when people in your team are coming to the office so that you can plan when you should go to the office as well.

Instead of focusing on workspace, Café focuses on people first. “We decided that we wouldn’t let you book a desk directly,” co-founder and CTO Arthur Lorotte de Banes told me.

When you open the app, you get a simplified calendar view. For each day, you can see your team members divided by groups — people coming to the office, people working from home, etc.

In just a few taps, you can tell your other co-workers what you plan to do. This way, it becomes much easier to schedule meetings, have in-person conversation and more generally hang out with your co-workers. It also makes it easier to find a common day with a specific co-worker if you’re working on the same project.

“We interviewed 150 companies and we realized companies faced the same issue after interviewing the first five companies. They all use spreadsheets,” co-founder and CEO Tom Nguyen told me.

Image Credits: Café

Using a tool like Café also gives you insights about your office. For instance, you can see the average number of persons in your office depending on the day of the week or the day of the month. Admins can configure a weekly reminder to make sure that everybody fills out information.

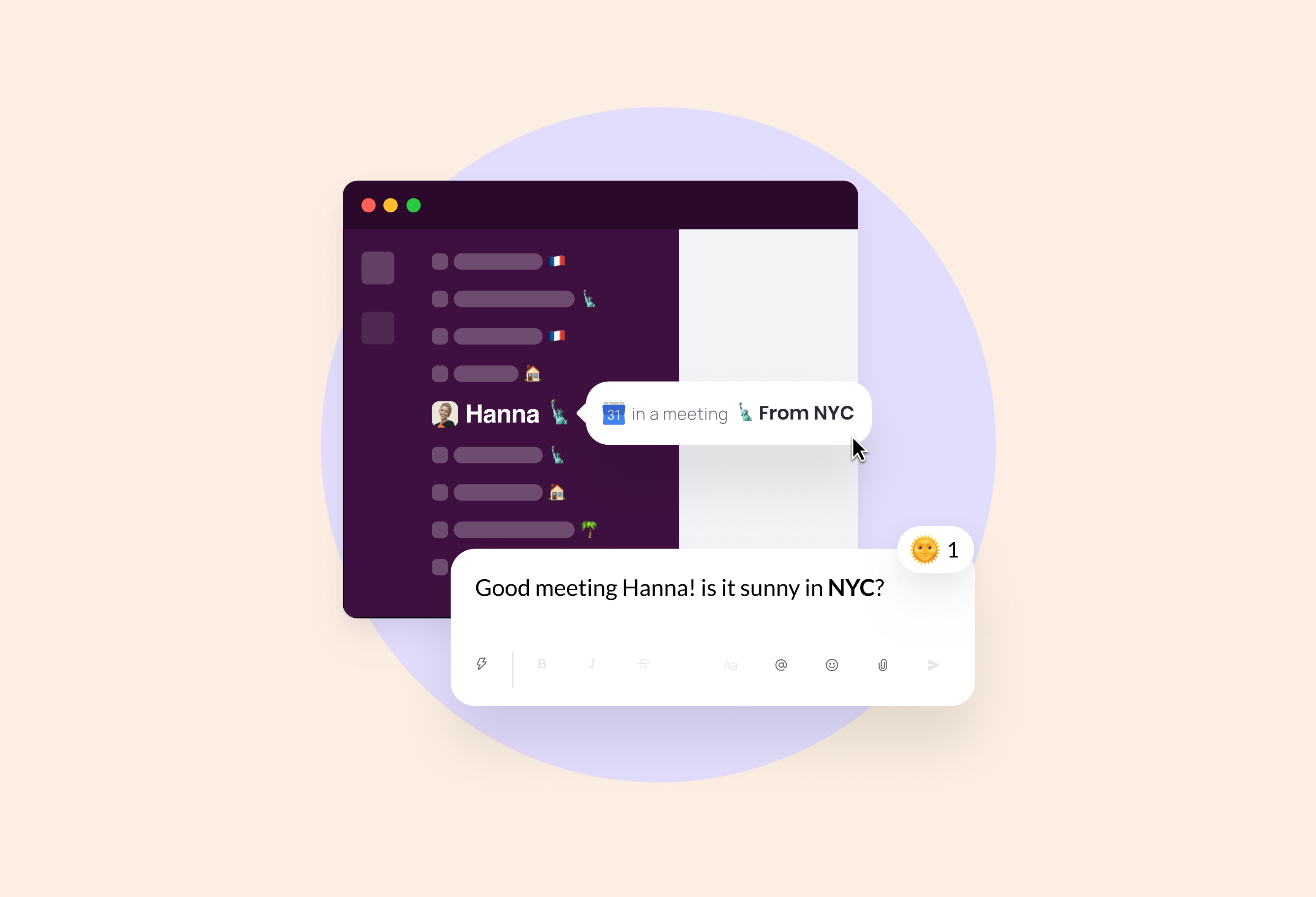

In addition to its mobile app and web app, Café integrates with your existing tools. For instance, you can connect your Café account with Slack so that your status on Slack reflects your status in Café. Teammates can hover over your name to know that you’re in the office or you’re at home.

The company is also working on integrations with human resource information systems, such as PayFit, so that your vacation is automatically synchronized with Café.

Image Credits: Café

As companies start hashing out a plan to return to the office, Café arrives on the market at the right time. Companies can create custom statuses to fit their specific needs. For instance, a Café customer has created a status so that they know who has the office keys to make sure that the office remains open.

The company raised a $1 million seed round from 122West, Kima Ventures, Jonathan Widawski, Guillaume Lestrade, Jacques-Edouard Sabatier and various business angels who work or have worked for WeWork, Dropbox, Github, Snapchat, Intercom, Stripe, Alan and PayFit.

Like Typeform, Doodle or Slido, Café has chosen a freemium strategy. Teams can sign up for free and start using the product with their immediate co-workers. You don’t need to enter card information to sign up.

If you want to roll it out across the organization with more users, you have to start paying — existing clients include Livestorm, Jellysmack and Yubo. The startup believes employees will become product advocates for the entire organization. And it seems like the right strategy for a product that is supposed to make employees happier at work.

Powered by WPeMatico

Fintech and proptech are two sectors that are seeing exploding growth in Latin America, as financial services and real estate are two categories in particular dire need of innovation in a region.

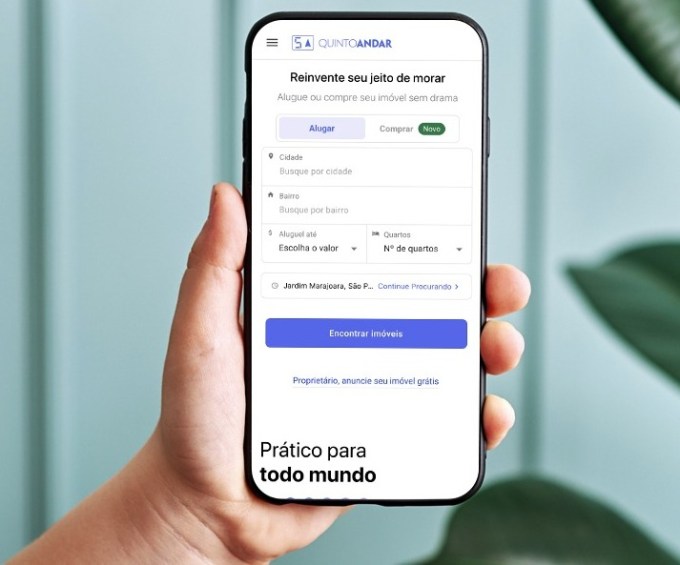

Brazil’s QuintoAndar, which has developed a real estate marketplace focused on rentals and sales, has seen impressive growth in recent years. Today, the São Paulo-based proptech has announced it has closed on $300 million in a Series E round of funding that values it at an impressive $4 billion.

The round is notable for a few reasons. For one, the valuation — high by any standards but especially for a LatAm company — represents an increase of four times from when QuintoAndar raised a $250 million Series D in September 2019.

It’s also noteworthy who is backing the company. Silicon Valley-based Ribbit Capital led its Series E financing, which also included participation from SoftBank’s LatAm-focused Innovation Fund, LTS, Maverik, Alta Park, an undisclosed U.S.-based asset manager fund with over $2 trillion in AUM, Kaszek Ventures, Dragoneer and Accel partner Kevin Efrusy.

Having backed the likes of Coinbase, Robinhood and CreditKarma, Ribbit Capital has historically focused on early-stage investments in the fintech space. Its bet on QuintoAndar represents clear faith in what the company is building, as well as its confidence in the startup’s plans to branch out from its current model into a one-stop real estate shop that also offers mortgage, title, insurance and escrow services.

The latest round brings QuintoAndar’s total raised since its 2013 inception to $635 million.

Ribbit Capital Partner Nick Huber said QuintoAndar has over the years built “a unique and trusted brand in Brazil” for those looking for a place to call home.

“Whether you are looking to buy or to rent, QuintoAndar can support customers through the entire transaction process: from browsing verified inventory to signing the final contracts,” Huber told TechCrunch. “The ability to serve customers’ needs through each phase of life and to do so from start to finish is a unique capability, both in Brazil and around the world.”

QuintoAndar describes itself as an “end-to-end solution for long-term rentals” that, among other things, connects potential tenants to landlords and vice versa. Last year, it expanded also into connecting a home buyers to sellers.

Image Credits: QuintoAndar

TechCrunch spoke with co-founder and CEO Gabriel Braga and he shared details around the growth that has attracted such a bevy of high-profile investors.

Like most other businesses around the world, QuintoAndar braced itself for the worst when the COVID-19 pandemic hit last year — especially considering one core piece of its business is to guarantee rents to the landlords on its platform.

“In the beginning, we were afraid of the implications of the crisis but we were able to honor our commitments,” Braga said. “In retrospect, the pandemic was a big test for our business model and it has validated the strength and defensibility of our business on the credit side and reinforced our value proposition to tenants and landlords. So after the initial scary moments, we actually felt even more confident in the business that we are building.”

QuintoAndar describes itself as “a distant market leader” with more than 100,000 rentals under management and about 10,000 new rentals per month. Its rental platform is live in 40 cities across Brazil, while its home-buying marketplace is live in four. Part of its plans with the new capital is to expand into new markets within Brazil, as well as in Latin America as a whole.

The startup claims that, in less than a year, QuintoAndar managed to aggregate the largest inventory among digital transactional platforms. It now offers more than 60,000 properties for sale across Sao Paulo, Rio de Janeiro, Belho Horizonte and Porto Alegre. To give greater context around the company’s growth of that side of its platform: In its first year of operation, QuintoAndar closed more than 1,000 transactions. It has now surpassed the mark of 8,000 transactions in annualized terms, growing between 50% and 100% quarter over quarter.

As for the rentals side of its business, Braga said QuintoAndar has more than 100,000 rentals under management and is closing about 10,000 new rentals per month. The company is not profitable as it’s focused on growth, although it’s unit economics are particularly favorable in certain markets such as Sao Paulo, which is financing some of its growth in other cities, according to Braga.

Now, the 2,000-person company is looking to begin its global expansion with plans to enter the Mexican market later this year. With that, Braga said QuintoAndar is looking to hire “top-tier” talent from all over.

“We want to invest a lot in our product and tech core,” he said. “So we’re trying to bring in more senior people from abroad, on a global basis.”

CEO Braga and CTO André Penha came up with the idea for QuintoAndar after receiving their MBAs at Stanford University. As many startups do, the company was founded out of Braga’s personal “nightmare” of an experience — in this case, of trying to rent an apartment in Sao Paulo.

The search process, he recalls, was difficult as there was not enough information available online and renters were forced to provide a guarantor, or co-signer, from the same city or pay rent insurance, which Braga described as “very expensive.”

“Overall, I felt it was a very inefficient and fragmented process with no transparency or tech,” Braga told me at the time of the company’s last raise. “There was all this friction and high cost involved, just real tangible problems to solve.”

The concept for QuintoAndar (which can be translated literally to “Fifth Floor” in Portuguese) was born.

“Little by little, we created a platform that consolidated supply and inventory in a uniform way,” Braga said.

The company took the search phase online for the first time, according to Braga. It also eliminated the need for tenants to provide a guarantor, thereby saving them money. On the other side, QuintoAndar also works to help protect the landlord with the guarantee that they will get their rent “on time every month,” Braga said.

It’s been interesting watching the company evolve and grow over time, just as it’s been fascinating seeing the region’s startup scene mature and shine in recent years.

Powered by WPeMatico

Drug discovery is a large and growing field, encompassing both ambitious startups and billion-dollar Big Pharma incumbents. Engine Biosciences is one of the former, a Singaporean outfit with an expert founding crew and a different approach to the business of finding new therapeutics, and it just raised $43 million to keep growing.

Digital drug discovery in general means large-scale analysis of biological data like genes, gene expression, protein structures, binding sites, things like that. Where it has hit a wall in the past is not on the digital side, where any number of likely molecules or processes can be generated, but on the next step, when those notions need to be tested in vitro. So a new crop of biotech companies have worked to integrate these aspects.

Engine does so with a pair of tools it has dubbed NetMAPPR and CombiGEM. NetMAPPR is a huge sort of search engine for genes and gene interactions, taking special note of “errors” that could provide a foothold for a molecule or treatment. CombiGEM is like a mass genetic testing process that can look into thousands of gene combinations and edits on diseased cells simultaneously, providing quick experimental confirmation of the targets and effects proposed by the digital side. The company is focused on anti-cancer drugs but is looking into other fields as they become viable.

The focus on gene interactions sets their approach apart, said co-founder and CEO Jeffrey Lu.

“Gene interactions are relevant to all diseases, and in cancers, where we focus, a proven approach for effective precision medicines,” he explained. “For example, there are four approved drugs targeting the PARP enzyme in the context of mutation in the BRCA gene that is changing cancer treatment for millions of people. The fundamental principle of this precision medicine is based on understanding the gene interaction between BRCA and PARP.”

The company raised a $10 million seed in 2018 and has been doing its thing ever since — but it needs more money if it’s going to bring some of these things to market.

“We already have chemical compounds directed toward the novel biology we have uncovered,” said Lu. “These are effectively prototype drugs, which are showing anti-cancer effects in diseased cells. We need to refine and optimize these prototypes to a suitable candidate to enter the clinic for testing in humans.”

Right now they’re working with other companies to do the next step up from automated testing, which is to say animal testing, to clear the way for human trials.

The CombiGEM experiments — hundreds of thousands of them — produce a large amount of data as well, and they’re sharing and collaborating on that front with several medical centers throughout Asia. “We have built what we believe to be the largest data compendium related to gene interactions in the context of cancer disease relevance,” said Lu, adding that this is crucial to the success of the machine learning algorithms they employ to predict biological processes.

The $43 million round was led by Polaris Partners, with participation by newcomers Invus and a long list of existing investors. The money will go toward the requisite testing and paperwork involved in bringing a new drug to market based on promising leads.

“We have small molecule compounds for our lead cancer programs with data from in vitro (in cancer cells) experiments. We are refining the chemistry and expanding studies this year,” said Lu. “Next year, we anticipate having our first drug candidate enter the late preclinical phase of development and regulatory work for an IND (investigational new drug) filing with the FDA, and starting the clinical trials in 2023.”

It’s a long road to human trials, let alone widespread use, but that’s the risk any drug discovery startup takes. The carrot dangling in front of them is not just the possibility of a product that could generate billions in income, but perhaps save the lives of countless cancer patients awaiting novel therapies.

Powered by WPeMatico

The spinout of video platform Vimeo from IAC completed today, with the smaller company now trading as an independent entity under the ticker symbol VMEO.

If you missed the news that the internet conglomerate was spinning out the video service, don’t feel bad; it slipped past many radars. But with the company now trading, with our access to its historical results, and with our minds still enthralled by YouTube’s recent financial performance for Alphabet, it’s worth taking a moment to digest the company’s health.

Let’s answer a few questions: How quickly is Vimeo growing, how profitable is its business, and what can its spinout tell us about the larger video market? Recall that Kaltura, another video-powering company, recently put its IPO back into the pipeline after a small delay during what felt like a snap-freeze of the public markets toward the start of the second quarter.

So the Vimeo debut could impact a possible forthcoming unicorn IPO. With that in mind, let’s dig into the numbers.

From Q1 2020 to Q1 2021, Vimeo’s revenues expanded from $57 million to $89.4 million, a gain of around 57%. That’s a solid pace of expansion, but not a surprising one considering how much digital video the world consumed during the COVID-19 pandemic, a fact that could have bolstered the company’s recent performance.

Over the same time frame, Vimeo’s gross profit grew from $38.6 million to $64.5 million, a gain of around 67%. As you can infer from faster-rising gross profit than revenue, Vimeo’s gross margins improved during Q1 2021 compared to the first quarter of 2020, from 68% to 72%.

Powered by WPeMatico

Welcome back to the working week. Are you ready to get our hands a little dirty this morning?

Good. We have an IPO to catch up on, one I should have kept up with in the past few weeks. Regardless, today we’re looking at Zeta Global’s latest IPO filing ahead of its eventual pricing.

The Exchange explores startups, markets and money.

Read it every morning on Extra Crunch or get The Exchange newsletter every Saturday.

Zeta Global is not a firm that I am very familiar with, but because Crunchbase notes that the New York-based startup has raised north of $600 million in private capital in the form of both equity financing and debt, it’s a unicorn worth understanding.

The gist is that Zeta ingests and crunches lots of data, helping its users market to their customers on a targeted basis throughout their individual buying lifecycles. In simpler terms, Zeta helps companies pitch customers in varied manners depending on their own characteristics.

You can imagine that, as the digital economy has grown, the sort of work Zeta Global supports has only expanded. So, has Zeta itself grown quickly? And does it have an attractive business profile? We want to know. We’ll also poke around its final private valuation so that we can see how much that number matches up — or doesn’t — to its recent financial results.

You can imagine that, as the digital economy has grown, the sort of work Zeta Global supports has only expanded. So, has Zeta itself grown quickly? And does it have an attractive business profile? We want to know. We’ll also poke around its final private valuation so that we can see how much that number matches up — or doesn’t — to its recent financial results.

Sound good? Let’s find out why Staley Capital, GCP Capital Partners, Franklin Square Group, GPI Capital and others backed the firm.

It can be useful to dissect a company’s marketing materials not just to see how well they describe themselves, but also to grok how they want to be perceived in the marketplace. Zeta is one such case.

Via its S-1 filings, here’s how it wants you to understand its business:

Zeta is a leading omnichannel data-driven cloud platform that provides enterprises with consumer intelligence and marketing automation software. We empower our customers to target, connect and engage consumers through software that delivers personalized marketing across all addressable channels, including email, social media, web, chat, connected TV (“CTV”) and video, among others.

If that didn’t make a lot of sense, it’s OK.

Powered by WPeMatico

You might have thought that with more than 300 companies joining this year’s winter batch of Y Combinator, the investor interest might have thinned. Well, it’s 2021 and investors are hopping around like crazy to invest in ideas that push the boundaries in fields far-flung from enterprise SaaS.

Case in point today: Gridware. It’s a startup I profiled earlier this year when it had just started up in its YC batch. As I wrote, it wants to save our power grids from the ravages of climate change:

Its approach is to use a small, sensor-laden box that can be installed to a power pole with just four screws. Gridware’s package contains microphones and other sensors to sense the ambient environment around a power pole, and it uses on-board AI/ML processing to listen for anomalies and report them to the relevant managers as appropriate.

Hardware, IoT, infrastructure, utilities and government are five keywords you probably most would have wanted to avoid when pitching investors even a few years ago. But with power disappearing in states like California and Texas for stretches of time, investors have perhaps finally realized there is an opportunity to save the planet and make a bit of money here.

Gridware today announced that it has raised $5.3 million in a seed round led by Priscilla Tyler of True Ventures and Seth Bannon and Shuo Yang of Fifty Years. CEO and co-founder Tim Barat said fundraising was quite fierce. “We had 130 investors reach out to us, and I wasn’t even able to get back to some of them yet … [I’m] still going back through the emails,” he said. “Even before Demo Day, we had raised a significant portion of our round.”

Barat and the Gridware team were looking for investors who were mission-driven and really understood the timeline it would take to build the company. “You see a lot of investors say they are mission-driven … but when it comes time to put their money where their mouth is, it often goes to consumer technology where it is safer,” he said. Tyler at True leads climate investing for the firm, and True has made a variety of bets in the space. Fifty Years focuses on startups tackling the UN’s list of 17 Sustainable Development Goals.

Gridware co-founders Abdulrahman Bin Omar, Tim Barat, and Hall Chen. Image Credits: Gridware

You can read more about the company’s product and market in my profile from three months ago, but with the new funding, Gridware wants to double down on building a very intentional team capable of tackling this tough market. “Dealing with this multi-stakeholder business model is very challenging, so bringing on people with the experience, knowledge and wits to deal with this kind of environment is key,” Barat said.

As I explored recently, the disaster response space is probably one of the toughest markets in the world to sell into. Barat acknowledged the intrinsic difficulty, but sees huge potential in the long run. “One of the things that I have observed with the companies being successful — they really spend the time to meet as many stakeholders as possible,” he said. “With consumer, you can stand in front of a shopping mall and talk to 100 customers in a day [but] in govtech, getting 100 meetings even within a year is a huge accomplishment.”

The company will be re-opening its Bay Area office in Walnut Creek on June 1.

Powered by WPeMatico

Hello and welcome back to Equity, TechCrunch’s venture capital-focused podcast where we unpack the numbers behind the headlines.

This is Equity Monday, our weekly kickoff that tracks the latest private market news, talks about the coming week, digs into some recent funding rounds and mulls over a larger theme or narrative from the private markets. You can follow the show on Twitter here and myself here.

After a somewhat quiet weekend, things are kicking off in rapid-fire fashion this week. Here’s what you need to know:

With a busy funding market and a yet-busy IPO cycle, it should be yet another busy week. Strap in!

Equity drops every Monday at 7:00 a.m. PST, Wednesday, and Friday at 6:00 AM PST, so subscribe to us on Apple Podcasts, Overcast, Spotify and all the casts!

Powered by WPeMatico

Commonwealth Bank group executive Angus Sullivan and Jon Beros, co-founder and CEO of Little Birdie. Image Credits: Little Birdie

Melbourne-based Little Birdie, an e-commerce startup that wants to become the “new homepage of online shopping,” won’t launch until next month, but it’s already scored a major investor. Commonwealth Bank of Australia (CBA), the largest of Australia’s “Big Four” banks, has poured $30 million AUD (about $23.2 million USD) in prelaunch funding into Little Birdie, and will also integrate its shopping content, including exclusive offers, into its consumer banking app, which reaches 11 million retail customers in Australia.

Little Birdie says this brings its valuation to $130 million AUD (about $100 million USD). Compared to the United States, where Amazon is the largest e-commerce retailer by far, Australian shoppers spend more time choosing between several platforms, including large marketplaces like eBay, Gumtree, Amazon, Woolworths and a host of smaller players.

Set to launch in mid-June, Little Birdie will aggregate more than 70 million products from different online brands and stores, with the goal of being the first place shoppers look when they want to buy something. Users can use Little Birdie to track and compare products, and look for price drops, sales and offers. The SKUs come from a combination of brand partnerships and scraping e-commerce sites, with the majority from retailers’ product feeds.

Co-founder and chief executive officer Jon Beros told TechCrunch that “Australia’s e-commerce market is very competitive and quite fragmented with a lot of retailers fighting for market share. The pandemic accelerated online adoption and saw many retailers switch on an online presence, or shift their focus online. With so many players fighting for the attention of shoppers and driving up the cost of acquisition, Little Birdie can genuinely help retailers by providing a new marketing channel that delivers qualified customers leads.”

Commonwealth Bank will be able to access Little Birdie’s catalog of shopping content to create targeted offers for customers, including features that link savings goals to specific items through its money management tools. Beros said that Little Birdie will also seek two different types of brand partnerships: “Firstly with retailers who come on board to promote their exclusive offers and products on Little Birdie and secondly with major brands and media companies that look to integrate our shopping content into their apps or websites. These integration partners ultimately deepen the value Little Birdie offers its retail partners by helping to amplify the reach of their offers to a wider audience.”

The company is looking at expansion into Southeast Asia and the United States, but Beros said there is not a firm timeline for its international growth yet, since it depends on the COVID-19 pandemic situation and when borders start to reopen.

In a press statement, Commonwealth Bank group executive Angus Sullivan said, “We believe customers should have access to the world’s best digital experience and our partnership with Little Birdie will give customers access to exclusive industry leading deals via the CommBank app.”

Powered by WPeMatico

Aurora Solar had one of those pitches that seemed obvious in retrospect. Instead of going to a house and measuring its roof manually for a solar panel installation, why not use aerial scans and imagery of the whole region? That smart play earned them a $20 million A round, a $50 million B round and now, only six months later, a massive $250 million C round as they aim to become the software platform on which the coming solar power expansion will be run.

The idea is simple enough to explain, but difficult to pull off. There’s lots of data out there about the topography, physical and infrastructural, of most cities. Satellite imagery, aerial lidar scans, light and power lines and usage data and, of course, where and how the sun hits a given location — this information is readily available. Aurora’s innovation wasn’t just using it, but assembling it into a cohesive system that’s simple and effective enough to be used widely by solar installers.

“Aurora’s core value proposition is the fact that you can do things remotely much faster and more accurately than if you traveled to the site,” explained co-founder and COO Sam Adeyemo.

Having developed algorithms that ingest the aforementioned data, the service they offer is a very quick turnaround on the tricky question of whether a solar installation makes sense for a potential customer, and if so what it might cost and look like, down to the size and angle of the panels.

“It’s not uncommon for the acquisition cost for a customer to be thousands of dollars,” said Adeyemo’s co-founder, CEO Chris Hopper. That’s partly because every installation is custom. He estimated that half the price tag of any setup is “soft cost” — that is, over and above the actual price of the hardware.

“If the quote is for $30K, what actually goes on your roof might be $15K, the rest is overhead, design, acquisition cost, yada yada yada,” he explained. “That’s the next frontier to make solar cost-competitive, and that’s where Aurora comes in. Every time we shave a few dollars off the price of an installation, it opens it up for new consumers.”

The company doesn’t do its own lidar flights or solar installations, so the $250 million in funding may strike some as rather high for a company making software. Though I did my best to tease out any secret skunkworks projects under way at Aurora, Adeyemo and Hopper patiently explained that enterprise-scale software isn’t cheap, and the funding is proportional to their ambitions.

“The amount we raised speaks to the opportunity ahead of us,” said Hopper. “There’s a lot more solar to put on roofs.”

Aurora has been used for evaluating about 5 million solar projects so far, about a fifth of which end up being built, Adeyemo estimated. And that’s just a fraction of a fraction. Solar makes up about 2% of the U.S.’s power infrastructure, right now, but that’s on track to increase by an order of magnitude in the next 20 years.

The new administration has thrown fuel on the fire of the industry’s optimism, and whether or not something like the Green New Deal comes to fruition, the fundamentally different approach to environmental and energy policy means there are more eyeballs directed at clean energy and consequently a lot of checks being written.

“It counts for a lot. With heightened awareness about climate change there will be more interest in ways to mitigate it,” said Adeyemo. He gave the example of Texas, which after the recent storms and blackouts had more inquiries per capita than anywhere else in the country. Renewables may be a charged issue in some ways, but solar power is bipartisan and broadly popular across the political spectrum.

The $250 million round, led by Coatue and with participation from previous investors ICONIQ, Energize Ventures and Fifth Wall, allows the company to go both broad and deep with their product.

“Historically we’ve been more of a design solution; the next phase is to broaden that into a platform that covers more of the process of going solar,” said Hopper. “We don’t believe this is going to be a niche market — going from 2 to 20% and beyond, that’s a huge endeavor.”

The co-founders would not be more specific than that scaling a SaaS company requires significant cash up front, and during the push to come they can’t be worried about whether or when they’ll need to get more capital.

“The first five years of the company were quasi-bootstrapped… we’d raised like a million bucks. So we know what it’s like to grow a company from that perspective, and now we know what it’s like to really need the capital to scale the business,” said Adeyemo. “If you want to be the platform for a significant percentage of the energy capacity of the country… you gotta tool up.”

What exactly tooling up comprises we will soon find out — the company is planning to announce more news at its upcoming summit in June.

Powered by WPeMatico