Fundings & Exits

Auto Added by WPeMatico

Auto Added by WPeMatico

What a busy week in the world of media liquidity.

That’s a sentence you don’t get to write often. Regardless, news broke this week that Axel Springer is buying U.S. political journalism outfit POLITICO. The transaction was expected, but the eye-popping roughly $1 billion price tag still has tongues wagging. We even got on the podcast to chat about it.

And Forbes announced that it is going public via a SPAC. The business publication’s news follows BuzzFeed’s journey to the public markets through a blank-check company. Hot media liquidity summer? Something like that.

The Exchange explores startups, markets and money.

Read it every morning on Extra Crunch or get The Exchange newsletter every Saturday.

That TechCrunch is in the process of being sold to private equity, of course, is not something that we should forget. Shoutout to the Verizon bankers who found a way to get rid of us while also deleveraging Verizon’s debt profile. Ten points.

I want to take a quick tour of the Forbes SPAC deck this morning. Our notes on BuzzFeed’s are here, in case you want to run comparisons. This will be easy and fun. Perfect Friday morning fare. Into the data!

I want to take a quick tour of the Forbes SPAC deck this morning. Our notes on BuzzFeed’s are here, in case you want to run comparisons. This will be easy and fun. Perfect Friday morning fare. Into the data!

In corporate-speak, Forbes Global Media Holdings is merging with blank-check company Magnum Opus Acquisition Limited. The transaction will close either Q4 2021 or Q1 2022, Forbes estimates.

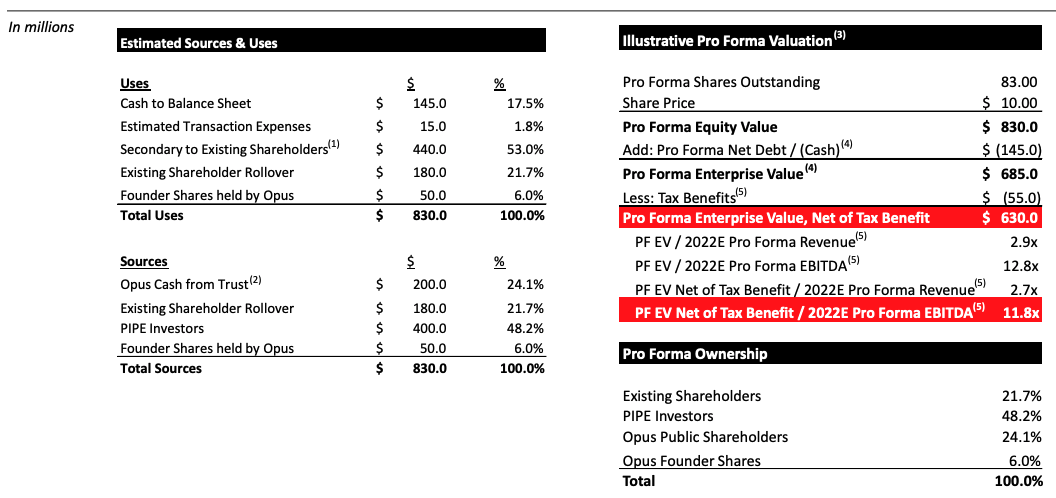

The deal itself is somewhat modest in scale compared with other SPAC deals we’ve recently looked into. Forbes reports that it will sport “an implied pro forma enterprise value of $630 million, net of tax benefits,” after its completion. Some $600 million in gross proceeds will be derived from Magnum Opus funds “and $400 million of additional capital through a private placement of ordinary shares of the combined company,” Forbes writes.

The company will sport an equity valuation of $830 million after the deal closes, per its own calculations. That number will change some depending on redemptions ahead of the combination. The gap between the large dollars going into the deal and the modest final valuation of the public Forbes entity is due to some $440 million in secondary transactions for existing Forbes shareholders.

In case you’d prefer all of that in table form, here’s the Forbes investor deck:

Image Credits: Forbes SPAC deck

Is $830 million a fair price? Let’s dig into Forbes’ results.

Powered by WPeMatico

The Equity crew felt that there was enough media news out recently that we simply had no choice but to fire up a Twitter Space and have a chat. The above episode is a discussion of a few things, in a loose and relaxed manner, so don’t take any of the Verizon jokes too seriously, Verizon, as we still work for you. For a few more days.

Regardless, here’s what Danny and Alex got into:

And there’s more media news to come. Our parent company Verizon Media is expected to close its sale to Apollo on September 1 or sometime soon after, which means we will either be hosting Equity regularly as always, or we’ll be hosting the RUDE (Recently Unemployed Due to (Private) Equity) podcast.

Powered by WPeMatico

Wildfires are burning in countries all around the world. California is dealing with some of the worst wildfires in its history (a superlative that I use essentially every year now) with the Caldor fire and others blazing in the state’s north. Meanwhile, Greece and other Mediterranean nations have been fighting fires for weeks to bring a number of massive blazes under control.

With the climate increasingly warming, millions of homes just in the United States alone are sitting in zones at high risk for wildfires. Insurance companies and governments are putting acute pressure on homeowners to invest more in defending their homes in what is typically dubbed “hardening,” or ensuring that if fires do arrive, a home has the best chance to survive and not spread the disaster further.

SF-based Firemaps has a bold vision for rapidly scaling up and solving the problem of home hardening by making a complicated and time-consuming process as simple as possible.

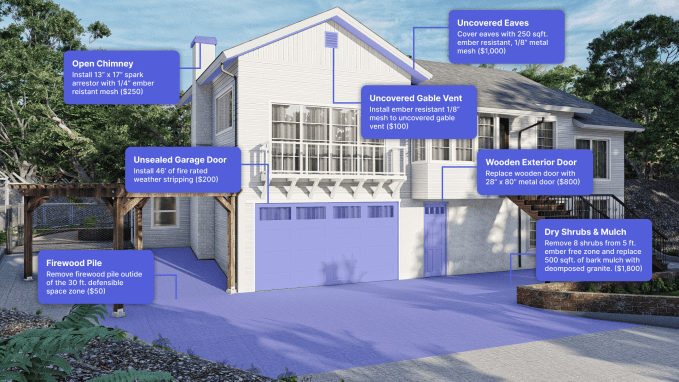

The company, which was founded just a few months ago (in March), sends out a crew with a drone to survey a homeowner’s house and property if it is in a high-risk fire zone. Within 20 minutes, the team will have generated a high-resolution 3D model of the property down to the centimeter. From there, hardening options are identified and bids are sent out to trade contractors to perform the work on the company’s marketplace.

Once the drone scans a house, Firemaps can create a full CAD model of the structure and the nearby property. Image Credits: Firemaps.

While early, it’s already gotten traction. In addition to hundreds of homeowners who have signed up on its website and a few dozen that have been scanned, Andrew Chen of a16z has led a $5.5 million seed round into the business (the Form D places the round sometime around April). Uber CEO Dara Khosrowshahi and Addition’s Lee Fixel also participated.

Firemaps is led by Jahan Khanna, who co-founded it along with his brother, who has a long-time background in civil engineering, and Rob Moran. Khanna was co-founder and CTO of early ridesharing startup Sidecar, where Moran joined as one of the company’s first employees. The trio spent cycles exploring how to work on climate problems, while staying focused on helping people in the here and now. “We have crossed certain thresholds [with the climate] and we need to get this problem under control,” Khanna said. “We are one part of the solution.”

Over the past few years Khanna and his brother explored opening a solar farm or a solar-powered home in California. “What was wild, whenever we talked to someone, is they said you cannot build anything in California since it will burn down,” Khanna said. “What is kind of the endgame of this?” As they explored fire hardening, they realized that millions of homeowners needed faster and cheaper options, and they needed them sooner rather than later.

While there are dozens of options to harden a home to fire, some popular options include constructing an ember-free zone within a few feet of a home, often by placing gravel made of granite on the ground, as well as ensuring that attic vents, gutters and siding are fireproof and can withstand high temperatures. These options can vary widely in cost, although some local and state governments have created reimbursement programs to allow homeowners to recoup at least some of the expenses of these improvements.

A Firemaps house in 3D model form with typical hardening options and associated prices. Image Credits: Firemaps.

The company’s business model is simple: vetted contractors pay Firemaps to be listed as an option on its platform. Khanna believes that because its drone offers a comprehensive model of a home, contractors will be able to bid for contracts without doing their own site visits. “These contractors are getting these shovel-ready projects, and their acquisition costs are basically zero,” Khanna said.

Long-term, “our operating hypothesis is that building a platform and building these models of homes is inherently valuable,” Khanna said. Right now, the company is launched in California, and the goal for the next year is to “get this model repeatable and scalable and that means doing hundreds of homes per week,” he said.

Powered by WPeMatico

Copenhagen-based process automation platform Leapwork has snagged Denmark’s largest-ever Series B funding round, announcing a $62 million raise co-led by KKR and Salesforce Ventures, with existing investors DN Capital and Headline also participating.

Also today it’s disclosing that its post-money valuation now stands at $312 million.

The “no-code” 2015-founded startup last raised back in 2019, when it snagged a $10 million Series A. The business was bootstrapped through earlier years — with the founders putting in their own money, garnered from prior successful exits. Their follow-on bet on no-code already looks to have paid off in spades: Since launching the platform in 2017, Leapwork has seen its customer base more than double year on year and it now has a roster of 300+ customers around the world paying it to speed up their routine business processes.

Software testing is a particular focus for the tools, which Leapwork pitches at enterprises’ quality assurance and test teams.

It claims that by using its no-code tech — a label for the trend which refers to software that’s designed to be accessible to non-technical staff, greatly increasing its utility and applicability — businesses can achieve a 10x faster time to market, 97% productivity gains and a 90% reduction in application errors. So the wider pitch is that it can support enterprises to achieve faster digital transformations with only their existing mix of in-house skills.

Customers include the likes of PayPal, Mercedes-Benz and BNP Paribas.

Leapwork’s own business, meanwhile, has grown to a team of 170 people — working across nine offices throughout Europe, North America and Asia.

The Series B funding will be used to accelerate its global expansion, with the startup telling us it plans to expand the size of its local teams in key markets and open a series of tech hubs to support further product development.

Expanding in North America is a big priority now, with Leapwork noting it recently opened a New York office — where it plans to “significantly” increase headcount.

“In terms of our global presence, we want to ensure we are as close to our customers as possible, by continuing to build up local teams and expertise across each of our key markets, especially Europe and North America,” CEO and co-founder Christian Brink Frederiksen tells TechCrunch. “For example, we will build up more expertise and plan to really scale up the size of the team based out of our New York office over the next 12 months.

“Equally we have opened new offices across Europe, so we want to ensure our teams have the scope to work closely with customers. We also plan to invest heavily in the product and the technology that underpins it. For example, we’ll be doubling the size of our tech hubs in Copenhagen and India over the next 12 months.”

Product development set to be accelerated with the chunky Series B will focus on enhancements and functionality aimed at “breaking down the language barrier between humans and computers,” as Brink Frederiksen puts it

“Europe and the U.S. are our two main markets. Half of our customers are U.S. companies,” he also tells us, adding: “We are extremely popular among enterprise customers, especially those with complex compliance setups — 40% of our customers come from enterprises banking, insurance and financial services.

“Having said that, because our solution is no-code, it is heavily used across industries, including healthcare and life sciences, logistics and transportation, retail, manufacturing and more.”

Asked about competitors — given that the no-code space has become a seething hotbed of activity over a number of years — Leapwork’s initial response is coy, trying the line that its business is a “truly special snowflake.” (“We truly believe we are the only solution that allows non-technical everyday business users to automate repetitive computer processes, without needing to understand how to code. Our no-code, visual language is what really sets us apart,” is how Brink Frederiksen actually phrases that.)

But on being pressed Leapwork names a raft of what it calls “legacy players” — such as Tricentis, Smartbear, Ranorex, MicroFocus, Eggplant Software, Mabl and Selenium — as (also) having “great products,” while continuing to claim they “speak to a different audience than we do.”

Certainly Leapwork’s Series B raise speaks loudly of how much value investors are seeing here.

Commenting in a statement, Patrick Devine, director at KKR, said:

Test automation has historically been very challenging at scale, and it has become a growing pain point as the pace of software development continues to accelerate. Leapwork’s primary mission since its founding has been to solve this problem, and it has impressively done so with its powerful no-code automation platform.

“The team at Leapwork has done a fantastic job building a best-in-class corporate culture which has allowed them to continuously innovate, execute and push the boundaries of their automation platform,” added Stephen Shanley, managing director at KKR, in another statement.

In a third supporting statement, Nowi Kallen, principal at Salesforce Ventures, added:

Leapwork has tapped into a significant market opportunity with its no-code test automation software. With Christian and Claus [Rosenkrantz Topholt] at the helm and increased acceleration to digital adoption, we look forward to seeing Leapwork grow in the coming years and a successful partnership.

The proof of the no-code “pudding” is in adoption and usage — getting non-developers to take to and stick with a new way of interfacing with and manipulating information. And so far, for Leapwork, the signs are looking good.

Powered by WPeMatico

Earlier today, spend management startup Ramp said it has raised a $300 million Series C that valued it at $3.9 billion. It also said it was acquiring Buyer, a “negotiation-as-a-service” platform that it believes will help customers save money on purchases and SaaS products.

The round and deal were announced just a week after competitor Brex shared news of its own acquisition — the $50 million purchase of Israeli fintech startup Weav. That deal was made after Brex’s founders invested in Weav, which offers a “universal API for commerce platforms.”

From a high level, all of the recent deal-making in corporate cards and spend management shows that it’s not enough to just help companies track what employees are expensing these days. As the market matures and feature sets begin to converge, the players are seeking to differentiate themselves from the competition.

But the point of interest here is these deals can tell us where both companies think they can provide and extract the most value from the market.

These differences come atop another layer of divergence between the two companies: While Brex has instituted a paid software tier of its service, Ramp has not.

Let’s start with Ramp. Launched in 2019, the company is a relative newcomer in the spend management category. But by all accounts, it’s producing some impressive growth numbers. As our colleague Mary Ann Azevedo wrote:

Since the beginning of 2021, the company says it has seen its number of cardholders on its platform increase by 5x, with more than 2,000 businesses currently using Ramp as their “primary spend management solution.” The transaction volume on its corporate cards has tripled since April, when its last raise was announced. And, impressively, Ramp has seen its transaction volume increase year over year by 1,000%, according to CEO and co-founder Eric Glyman.

Ramp’s focus has always been on helping its customers save money: It touts a 1.5% cash back reward for all purchases made through its cards, and says its dashboard helps businesses identify duplicitous subscriptions and license redundancies. Ramp also alerts customers when they can save money on annual versus monthly subscriptions, which it says has led many customers to do away with established T&E platforms like Concur or Expensify.

All told, the company claims that the average customer saves 3.3% per year on expenses after switching to its platform — and all that is before it brings Buyer into the fold.

Powered by WPeMatico

Creating single-family homes for the homeless using 3D printing robotics. Developing construction systems to create infrastructure and habitats on the moon, and eventually Mars, with NASA. Delivering what is believed to be the largest 3D-printed structure in North America — a barracks for Texas Military Department.

These are just some of the things that Austin, Texas-based construction tech startup ICON has been working on.

And today, the company is adding a massive $207 million Series B raise to its list of accomplishments.

I’ve been covering ICON since its $9 million seed round in October of 2018, so seeing the company reach this milestone less than three years later is kind of cool.

Norwest Venture Partners led the startup’s Series B round, which also included participation from 8VC, Bjarke Ingels Group (BIG), BOND, Citi Crosstimbers, Ensemble, Fifth Wall, LENx, Moderne Ventures and Oakhouse Partners. The financing brings ICON’s total equity raised to $266 million. The company declined to reveal its valuation.

ICON was founded in late 2017 and launched during SXSW in March 2018 with the first permitted 3D-printed home in the U.S. That 350-square-foot house took about 48 hours (at 25% speed) to print. ICON purposely chose concrete as a material because, as co-founder and CEO Jason Ballard put it, “It’s one of the most resilient materials on Earth.”

Since then, the startup says it has delivered more than two dozen 3D-printed homes and structures across the U.S. and Mexico. More than half of those homes have been for the homeless or those in chronic poverty. For example, in 2020, ICON delivered 3D-printed homes in Mexico with nonprofit partner New Story. It also completed a series of homes serving the chronically homeless in Austin, Texas, with nonprofit Mobile Loaves & Fishes.

The startup broke into the mainstream housing market in early 2021 with what it said were the first 3D-printed homes for sale in the U.S. for developer 3Strands in Austin, Texas. Two of the four homes are under contract. The remaining two homes will hit the market on August 31.

And recently, ICON revealed its “next generation” Vulcan construction system and debuted its new Exploration Series of homes. The first home in the series, “House Zero,” was optimized and designed specifically for 3D printing.

For some context, ICON says its proprietary Vulcan technology produces “resilient, energy-efficient” homes faster than conventional construction methods and with less waste and more design freedom. The company’s new Vulcan construction system, according to Ballard, can 3D print homes and structures up to 3,000 square feet, is 1.5x larger and 2x faster than its previous Vulcan 3D printers.

From the company’s early days, Ballard has maintained ICON is motivated by the global housing crisis and lack of solutions to address it. Using 3D printers, robotics and advanced materials, he believes, is one way to tackle the lack of affordable housing, a problem that is only getting worse across the country and in Austin.

ICON’s list of future plans include the delivery of social, disaster relief and more mainstream housing, Ballard said, in addition to developing construction systems to create infrastructure and habitats on the moon, and eventually Mars, with NASA.

ICON also has two ongoing projects with NASA. Recently, Mars Dune Alpha was just announced by NASA, ICON and BIG – and ICON so far has finished printing the wall system and is onto the roof now. Also, NASA is recruiting for crewed missions to begin nextfFall to live in the first simulated Martian habitat 3D printed by ICON.

When asked, Ballard said the most significant thing that has happened since the company’s $35 million Series A last August has been the “the radical increase in demand for 3D-printed homes and structures.”

“That single metric represents a lot for us,” Ballard told TechCrunch. “People have to want these houses.”

To tackle the housing shortage, the world needs to increase supply, decrease cost, increase speed, increase resiliency, increase sustainability… all without compromising quality and beauty, he added.

“Perhaps there are a few approaches that can do some of those things, but only construction scale 3D printing holds the potential to do all of those things,” he said.

ICON has seen impressive financial growth, with 400% revenue growth nearly every year since inception, according to Ballard. It’s also tripled its team in the past, year and now has more than 100 employees. It expects to double in size within the next year.

Image Credits: Co-founders with next-gen Vulcan Construction System / ICON

The series B funds will go toward more construction of 3D-printed homes, “rapid scaling and R&D,” further space-based tech advancements and creating “a lasting societal impact on housing issues,” Ballard said.

“We have already stood up early-stage manufacturing and are in the process of upgrading and accelerating those efforts in order to meet demand for more 3D-printed houses even as we close the round,” Ballard said. “In the next five years, we believe we will be delivering thousands of homes per year and on our way to tens of thousands of homes per year.”

Norwest Venture Partners Managing Partner Jeff Crowe, who is joining ICON’s board as part of the financing, said his firm believes that ICON’s 3D printing construction technology will “massively impact the housing shortage in the U.S. and around the globe.”

It is “enormously difficult” to bring together the advanced robotics, materials science and software to develop a robust 3D printing construction technology in the first place, Crowe said.

“It is still harder to develop the technology in a way that can produce hundreds and thousands of beautiful, affordable, comfortable, energy efficient homes in varying geographies with reliability and predictability — not just one or two demonstration units in a controlled setting,” he wrote via e-mail. “ICON has done all that, and…has all the elements to be a breakout, generational success.”

Powered by WPeMatico

Inflation may or may not prove transitory when it comes to consumer prices, but startup valuations are definitely rising — and noticeably so — in recent quarters.

That’s the obvious takeaway from a recent PitchBook report digging into valuation data from a host of startup funding events in the United States. While the data covers the U.S. startup market, the general trends included are likely global, given that the same venture rush that has pushed record capital into startups in the U.S. is also occurring in markets like India, Latin America, Europe and Africa.

The rapidly appreciating startup price chart is interesting, and we’ll unpack it. But the data also implies a high bar for future IPOs to not only preserve startup equity valuations at their point of exit, but exceed their private-market prices. A changing regulatory environment regarding antitrust could limit large future deals, leaving a host of startups with rich price tags and only one real path to liquidity.

Investors appear to be implicitly betting that the future IPO market will accelerate for a multiyear period at attractive prices.

That situation should be familiar: It’s the unicorn traffic jam that we’ve covered for years, in which the global startup markets create far more startups worth $1 billion and up than the public markets have historically accepted across the transom.

Let’s talk about some big numbers.

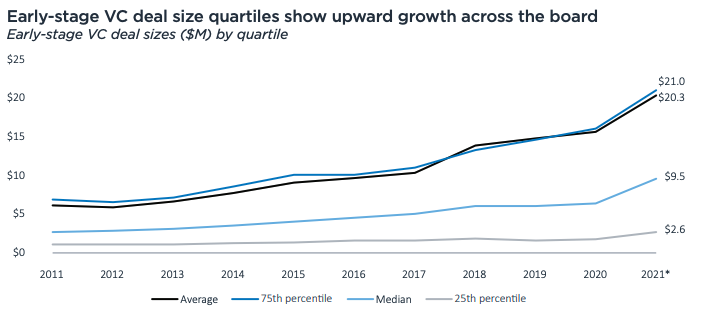

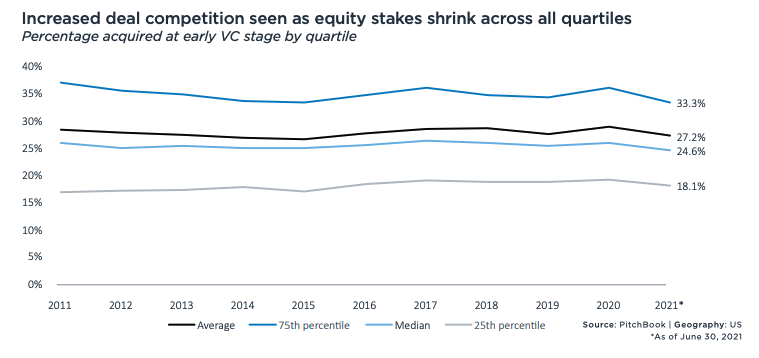

To summarize what PitchBook published: Round sizes are going up as valuations go up, and with the latter rising faster than the former, we’re not seeing investors get more ownership despite them having to spend more for deal access.

In the early-stage market, deal sizes are rising as follows:

Image Credits: PitchBook

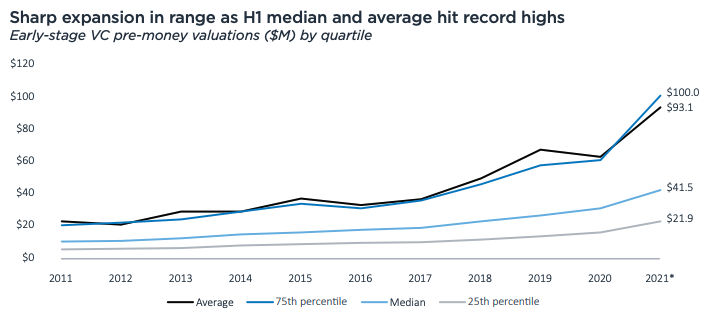

Prices are going up as well, as the following chart shows:

Image Credits: PitchBook

Which leads to the following decline in equity take rates:

Image Credits: PitchBook

Those charts belie somewhat how quickly venture capital is changing. For example, in 2020, the median early-stage value created between rounds was $16 million (or a 54% relative velocity, if you prefer). In 2021 thus far, it’s $39.4 million (120% relative velocity). And that 2020 figure was a prior record. It just got smashed.

The PitchBook dataset has other superlatives worth noting. Enterprise-focused seed pre-money valuations hit an average of $11 million in the first half of 2021, an all-time high. Early-stage valuations for enterprise-focused startups also hit fresh records — $92.7 million on average, $43 million median — this year after rising consistently since 2011.

And late-stage valuations for enterprise tech startups have gone vertical (chart on the right):

Powered by WPeMatico

Pry Financials wants to make startup finances approachable for its entire team, not just the people in charge of its accounting spreadsheets. The Y Combinator alum announced today it has raised $4.2 million from Global Founders Capital, Pioneer Fund, NOMO VC, Liquid2 and Hyphen Capital.

Launched in March, Pry now has more than 200 customers and claims it has grown 35% month-over-month since YC’s Demo Day. It was founded by Alex Sailer, Tiffany Wong, Hayden Jensen and Andy Su.

Before starting Pry, Su was co-founder of InDinero, another YC alum that started as a “Mint for small businesses” before pivoting to a full-service accounting company. InDinero launched while he was still a student at UC Berkeley, and Su eventually became responsible for its financial planning.

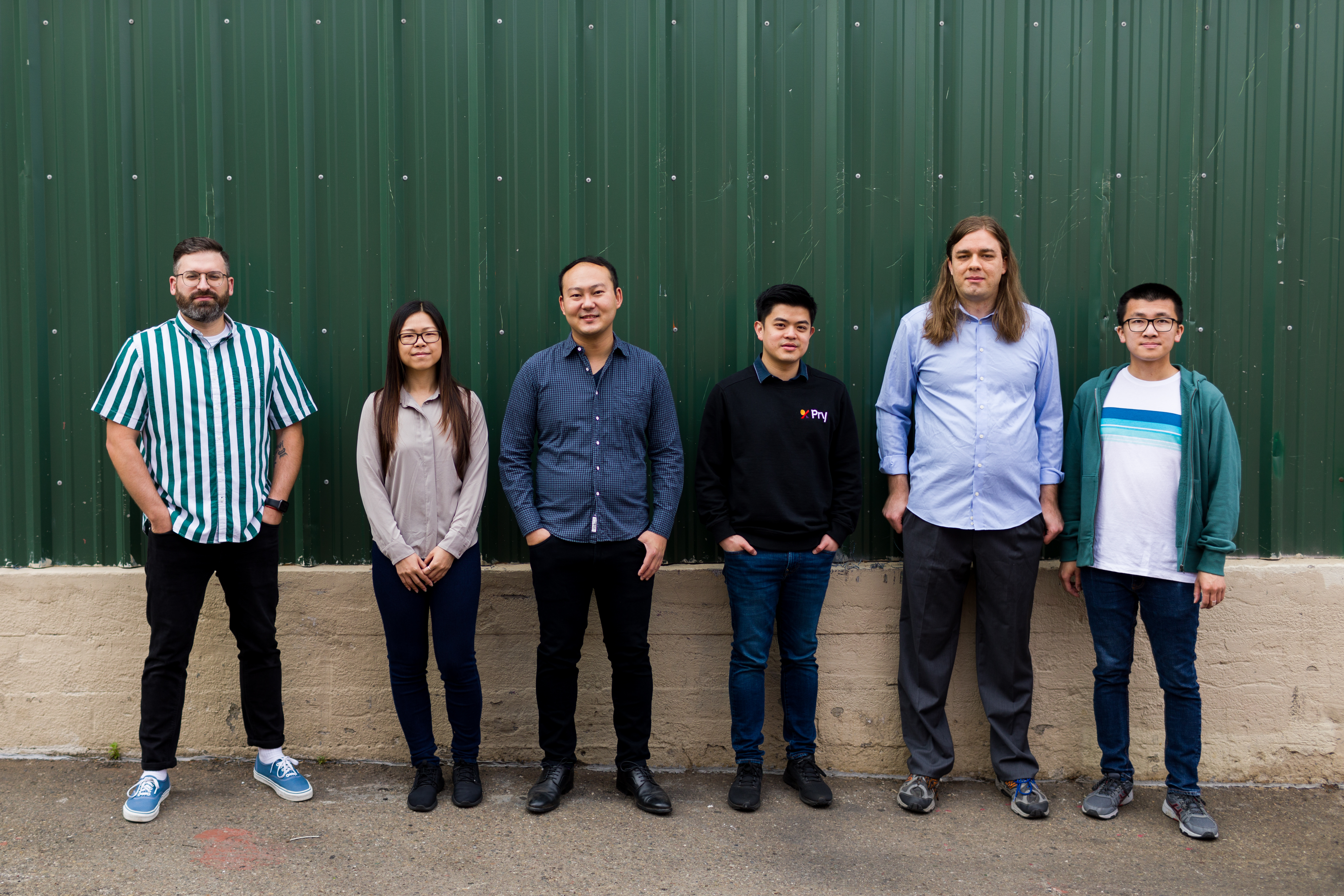

Pry Financials’ team. Image Credits: Pry Financials

He told TechCrunch that most startups can’t afford accounting software like Workday Adaptive Planning. Instead, they sometimes work with outsourced CFO services, but mostly rely on spreadsheets for everything: three-way forecasts, predicting runway, hiring and contractor budgets and investor updates.

“I was the chief technical officer and over the years, I also took on the finance function, so it was kind of a dual CTO/CFO role. This was 2010 through 2020 and as technology grew, the engineering and product teams got all sorts of new tools every six months or so, whereas the finance team was just stuck in Excel,” he said.

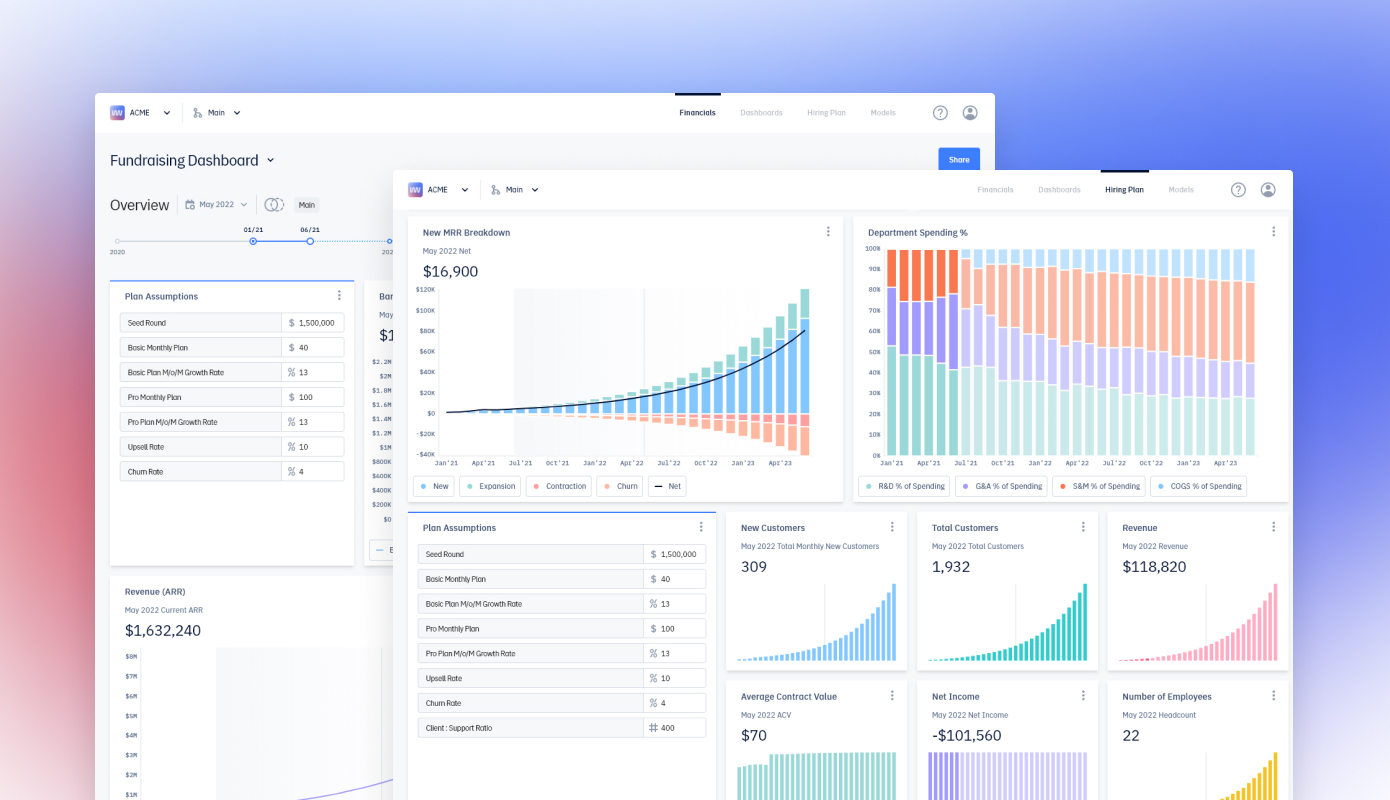

Started as a side project while Su was still at InDinero, Pry starts at just $50 a month and replaces those spreadsheets with easy-to-understand dashboards for accounting, financial planning and scenario modeling. The dashboards connect to QuickBooks, Xero or bank accounts, so numbers are continuously updated.

Pry’s clients typically start using it after they raise seed funding, because “for most first-time founders, that’s the most amount of money you have ever received, so you need to spend more time managing it and reviewing it every month. And you’re spending a lot of time on payroll each month,” Su said. Second-time founders, meanwhile, sign up for Pry because they are sick of Excel spreadsheets.

“Reviewing a spreadsheet is mind-numbingly hard,” said Su. “If you see a number that’s off, you get this weird formula if you didn’t do it yourself. Then you basically have to write a long email to the financial analyst who wrote it and hope that they get back to you before closing time.” For founders who need to update lenders or investors every month, this means a lot of work.

Pry makes the process more efficient by turning three-way reports — combinations of balance sheets, profit and loss statements and cashflow — into Financial Report dashboards, and then adding features like hiring plans, financial modeling and scenario planning.

The scenario planning feature serves as a sandbox, giving startup teams and their investors a way to predict how different situations will impact finances: for example, how much runway they have if they raise a certain amount of funding or adjust product pricing.

Fundraising dashboards created with Pry Financials. Image credits: Pry Financials

“We’re improving upon and trying to make decisions about the company in a collaborative way. The analogy we have is Git branching, where you have your main plan, and want to try something like a new revenue model or acquiring a business, but don’t want to mess with your current strategy,” said Su. “What you can do is create a completely new branch with, say, a new pricing strategy. You can make all the changes you want and then switch back to your old branch without worrying about overriding or conflicting with it.”

Those speculative branches are also continuously updated with the company’s most recent bank account and payroll information, so founders don’t need to recreate them from scratch if they want to revisit a potential scenario later.

Pry plans to build more complex predictive tools and also integrate industry standards, like statistic and benchmarks, into templates to help founders understand what targets they should set.

Because Pry is easier to manage than a set of Excel spreadsheets, Su said it’s helped startups spot important things. For example, one founder was able to find a way to save $15,000 by catching a tax issue. Pry also helps everyone at a startup understand its finances’ even if they haven’t worked with accounting spreadsheets before. The platform will add roles and permissions soon, so founders can give or restrict access to different people, like leaders of specific departments.

Su said Pry does not compete with the accounting services many startups rely on until they can hire a head of finance, but makes it easier for startups to collaborate with them since they can share their dashboards.

“Usually early on, you can outsource to a CFO firm. That’s the norm in the business and it works pretty well for most companies. You get a part-time CFO to work really hard for a month and get your fundraising structure done,” said Su, adding “we fit into that ecosystem well.”

Powered by WPeMatico

Silicon Valley was once one of the most productive regions in the country for the defense industry, churning out chips and technologies that helped the United States overtake the Soviet Union during the Cold War. Since then, the region has been known far less for silicon and defense than for the consumer internet products of Google, Facebook and Netflix.

A small number of startups, though, are attempting to revitalize that important government-industry nexus as the rise of China pushes more defense planners in Washington to double down on America’s technical edge. Vannevar Labs is one of this new crop, and it has hit some new milestones in its quest to displace traditional defense contractors with Silicon Valley entrepreneurial acumen.

I last chatted with the company just as it was debuting in late 2019, having raised a $4.5 million seed. The company has been quiet and heads down the past two years as it developed a product and traction within the defense establishment. Now it’s ready to reveal a bit more of what all that work has culminated in.

First, the company officially launched its Vannevar Decrypt product in January of this year. It’s focused on foreign language natural language processing, organizing overseas data and resources that are collected by the intelligence community and then immediately translating and interpreting those documents for foreign policy decisionmakers. CEO and co-founder Brett Granberg said that the product “went from one deployment to a dozen adoptions.”

Second, the company raised a $12 million Series A investment in May from Costanoa Ventures and Point72, with General Catalyst participating. Costanoa and GC co-led the startup’s seed round.

Finally, the company has been on a hiring spree. The team has grown into a crew of 20 employees, and the firm last week brought on Scott Sanders to lead business development. Sanders was one of the earliest employees at Anduril, and had spent several years at the company. Vannevar also added to its board John Doyle, a long-time Palantir employee who was head of its national security business, according to Granberg. Today, the team is equally split between national security folks and technologists, and he says that the team is set to double this year.

Co-founders Nini Moorhead and Brett Granberg of Vannevar Labs. Photo via Vannevar Labs.

With a few years of hindsight, Granberg says that he has refined what he considers the best model for defense tech startups to break into the hardscrabble market at the Pentagon and across Northern Virginia.

First, there needs to be incredible focus on getting access to actual end users and learning their work. The functions that defense and intelligence personnel perform are completely different from operations in the commercial economy, and trying to translate what works at a large corporation into defense is a fool’s errand. “You need to have both the DNA of understanding new technology and the DNA of deeply understanding a lot of different use cases within DoD,” Granberg said, referencing the Department of Defense.

That has directly informed how Decrypt has developed over time. “We started focusing on the counter-terrorism space, and as the government moved away from counter-terrorism, we started moving to the foreign actors that were important,” he said. “Once we have our first couple of deployments, we are able to iterate very, very quickly.”

He also strongly eschews a popular view in defense procurement circles that there are “dual-use” technologies that can be used equally well in commercial and defense applications. “Some of the most important mission problems where the government spends the most money and has the most interest,” he explained, are also contexts where commercial off-the-shelf products (dubbed COTS in the industry parlance) are least useful. He says startups targeting defense simply cannot split their bandwidth by also trying to learn commercial use cases.

In fact, he went so far to predict that “you are going to see a lot of companies that have raised a lot of money that will fizzle out in the coming years” because they just can’t nail the dual-use model well.

Second, he argues that defense tech startups need to move beyond the model that each company should work on one platform, and instead move to an organizational model where a company offers multiple products to reach scale. Each product has the potential to reach “a couple of hundred million in revenue,” according to Granberg, but it is hard to expand a company’s size if it doesn’t parallelize product development.

To that end, Granberg said that he pushes Vannevar Labs to always be exploring new product lines for growth. “Decrypt is our first product [but]10% of our energy is in new product efforts,” he said. “I can imagine when we are three to four years down the line… it might be nine-10 products.” He said that the one platform approach might have worked for Palantir, which ironically, is the major winner in the defense tech space the last few years. But newer companies like Anduril and Shield AI have been designed around product line expansion.

Finally, noting those other companies, Granberg believes there is something of a collective benefit as each startup makes headway in the defense sector. “There is this theory in our space that we don’t view ourselves as competitors — if one of us does well, we all do well,” he said. Given the varied mission requirements of different agencies and the absolute massive scale of budgets in this field, startups actually have a lot of independent terrain to explore, even if they come up against the big legacy defense contractors on a regular basis.

As for Vannevar Labs, its next goal is to turn its Decrypt product into a program of record, which would guarantee it a certain level of sales and revenue for potentially years into the future. That’s a huge bar to leap, but would be a turning point in the company’s long-term trajectory.

Powered by WPeMatico

On October 27, we’re taking on the ferociously competitive field of software as a service (SaaS), and we’re thrilled to announce our packed agenda, overflowing with some of the biggest names and most exciting startups in the industry. And you’re in luck, because $75 early-bird tickets are still on sale — make sure you book yours so you can enjoy all the agenda has to offer and save $100 bucks before prices go up!

Throughout the day, you can expect to hear from industry experts, and take part in discussions about the potential of new advances in data, open source, how to deal with the onslaught of security threats, investing in early-stage startups and plenty more.

We’ll be joined by some of the biggest names and the smartest and most prescient people in the industry, including Javier Soltero at Google, Kathy Baxter at Salesforce, Jared Spataro at Microsoft, Jay Kreps at Confluent, Sarah Guo at Greylock and Daniel Dines at UiPath.

You’ll be able to find and engage with people from all around the world through world-class networking on our virtual platform — all for $75 and under for a limited time, with even deeper discounts for nonprofits and government agencies, students and up-and-coming founders!

Our agenda showcases some of the powerhouses in the space, but also plenty of smaller teams that are building and debunking fundamental technologies in the industry. We still have a few tricks up our sleeves and will be adding some new names to the agenda over the next month, so keep your eyes open.

In the meantime, check out these agenda highlights:

We’ll have more sessions and names shortly, so stay tuned. But get excited in the meantime, we certainly are.

Pro tip: Keep your finger on the pulse of TC Sessions: SaaS. Get updates when we announce new speakers, add events and offer ticket discounts.

Why should you carve a day out of your hectic schedule to attend TC Sessions: SaaS? This may be the first year we’ve focused on SaaS, but this ain’t our first rodeo. Here’s what other attendees have to say about their TC Sessions experience.

“TC Sessions: Mobility offers several big benefits. First, networking opportunities that result in concrete partnerships. Second, the chance to learn the latest trends and how mobility will evolve. Third, the opportunity for unknown startups to connect with other mobility companies and build brand awareness.” — Karin Maake, senior director of communications at FlashParking.

“People want to be around what’s interesting and learn what trends and issues they need to pay attention to. Even large companies like GM and Ford were there, because they’re starting to see the trend move toward mobility. They want to learn from the experts, and TC Sessions: Mobility has all the experts.” — Melika Jahangiri, vice president at Wunder Mobility.

TC Sessions: SaaS 2021 takes place on October 27. Grab your team, join your community and create opportunity. Don’t wait — jump on the early bird ticket sale right now.

Powered by WPeMatico