Fundings & Exits

Auto Added by WPeMatico

Auto Added by WPeMatico

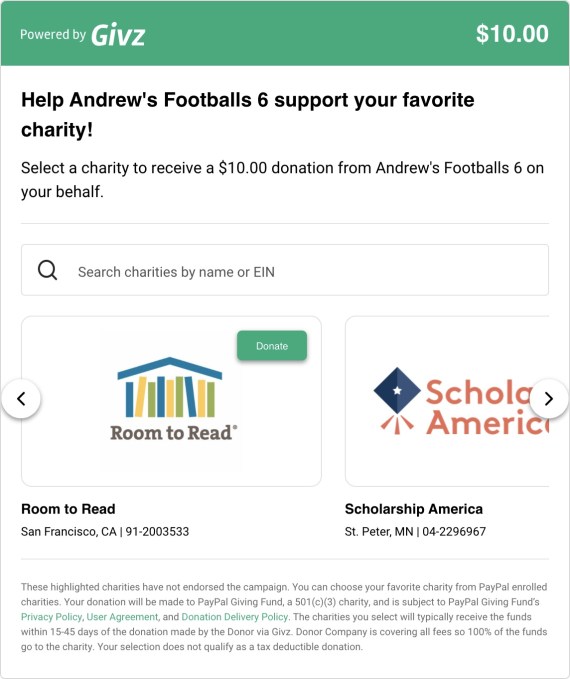

Givz, which has developed an API-powered platform that gives brands a way to convert discounts into donations, has raised $3 million in seed funding.

Eniac and Accomplice co-led the financing for the New York-based startup. Additional investors include Supernode Ventures, Claude Wasserstein of Fine Day, Phoenix Club and Dylan Whitman.

Givz was founded in 2017 to make charitable giving more accessible and convenient for the masses. In March 2020, right before the COVID-19 pandemic hit, the company pivoted from B2C to B2B and used the technology rails it had built to create the e-commerce marketing platform that Givz is today.

The company aims to drive “full-price purchasing behavior” by giving consumers the ability to convert the money they would be saving if getting a discount, and donating it to their favorite charities.

Prior to the funding, Givz had been working with more than 80 enterprise, mid-market and SMB retail and e-commerce clients such as H&M, Tom Brady’s TB12, Seedlip and Terez, and accumulated more than 40,000 individual users. Since the shift last year, the company has helped drive more than $1 million to 1,100 charities, according to CEO and founder Andrew Forman.

It just launched on Shopify, which Forman says will give the startup access to the 1.7 million retailers that use Shopify as their e-commerce platform.

Givz operates under the premise that “donation-driven marketing” consistently outperforms discounts and costs less, “making it an attractive addition” to corporate marketing.

“We are creating a new marketing category and generating the largest sustainable charitable giving platform in the process,” he told TechCrunch.

An example of a company using Givz can be found in Tervis, which offered customers “For every $50 you spend, you’ll receive $15 to give to the charity of your choice.”

“They used Givz technology to allow consumers to choose the charity of their choice and make a turnkey disbursement to hundreds of charities,” Forman explained. “They saw a 20% lift in website conversion and a 17% increase in average order value as a result of this offer.”

Image Credits: Givz

Currently, Givz has eight employees with plans to more than double that number over the next year.

The company plans to use the new capital toward that hiring, and to do some marketing of its own.

“We also want to explore the full potential around the consumer behavior data we collect,” Forman said.

In the short term, Givz is focused on “Shopify growth” with direct to consumer brands.

“But we have successful use cases and huge potential with enterprise retailers and financial institutions,” Forman told TechCrunch. “In the future, we have our sights set on restaurants, the gaming industry and global expansion. I believe that using personalized donations to incentivize consumer behavior has endless application across industries, verticals and continents.”

Eniac partner Vic Singh said that there’s been a trend of brands experimenting with different ways to target the socially conscious consumer.

“We believe Givz’s donation-driven marketing platform offers brands the best way to attract the socially conscious consumer while elevating their brand, moving more inventory and driving increased order value rather than simplistic traditional discounting,” he added.

Accomplice’s TJ Mahony said that both he and Singh believed SMS would emerge as a new marketing category, which led to early investments in Attentive and Postscript, respectively.

“We both saw a similar opportunity with Givz,” he wrote via e-mail. “Discounting is a well worn marketing muscle, but it’s detrimental to the brand, margins and customer expectations. We believe continuous impact marketing becomes the alternative to discounting and marketers will begin to build teams and budget around thoughtful and persistent giving strategies.”

Powered by WPeMatico

Hello and welcome back to Equity, TechCrunch’s venture capital-focused podcast where we unpack the numbers behind the headlines.

This is Equity Monday, our weekly kickoff that tracks the latest private market news, talks about the coming week, digs into some recent funding rounds and mulls over a larger theme or narrative from the private markets. You can follow the show on Twitter here. I also tweet.

Today’s show was good fun to put together. Here’s what we got to:

Woo! And that’s the start to the week. Hugs from here, and we’ll chat you on Wednesday!

Equity drops every Monday at 7:00 a.m. PST, Wednesday, and Friday at 6:00 a.m. PST, so subscribe to us on Apple Podcasts, Overcast, Spotify and all the casts!

Powered by WPeMatico

Covering public companies can be a bit of a drag. They grow some modest amount each year, and their constituent analysts pester them with questions about gross margin expansion and sales rep efficiency. It can be a little dull. Then there are startups, which grow much more quickly — and are more fun to talk about.

That’s the case with Shelf.io. The company announced an impressive set of metrics this morning, including that from July 2020 to July 2021, it grew its annual recurring revenue (ARR) 4x. Shelf also disclosed that it secured a $52.5 million Series B led by Tiger Global and Insight Partners.

That’s quick growth for a post-Series A startup. Crunchbase reckons that the company raised $8.2 million before its Series B, while PitchBook pegs the number at $6.5 million. Regardless, the company was efficiently expanding from a limited capital base before its latest fundraising event.

What does the company’s software do? Shelf plugs into a company’s information systems, learns from the data and then helps employees respond to queries without forcing them to execute searches or otherwise hunt for information.

The company is starting with customer service as its target vertical. According to Shelf CEO Sedarius Perrotta, Shelf can absorb information from, say, Salesforce, SharePoint, legacy knowledge management platforms and Zendesk. Then, after training models and staff, the company’s software can begin to provide support staff with answers to customer questions as they talk to customers in real time.

The company’s tech can also power responses to customer queries not aimed at a human agent and provide a searchable database of company knowledge to help workers more quickly solve customer issues.

Per Perrotta, Shelf is targeting the sales market next, with others to follow. How might Shelf fit into sales? According to the company, its software may be able to offer staff already written proposals for similar-seeming deals and other related content. The gist is that at companies that have lots of workers doing similar tasks — clicking around in Salesforce, or answering support queries, say — Shelf can learn from the activity and get smarter in helping employees with their tasks. I presume that the software’s learning ability will improve over time, as well.

Shelf, around 100 people today, hopes to double in size by the end of the year, and then double again next year.

That’s where the new capital comes in. Hiring folks in the worlds of machine learning and data science is very expensive. And because the company wants to scale those hires quickly, it will need a large bank balance to lean on.

Quick ARR growth was not the only reason Shelf was able to secure such an outsized Series B, at least when compared to how much capital it had raised before. Per Perrotta, Shelf has 130% net dollar retention and no churn to report, meaning its customers are both sticky and expand organically.

While Shelf is interesting today and has certainly found niches it can sell into in its current form, I am more curious about how far the company can take its machine learning system, called MerlinAI. If its tech can get sufficiently smart, its ability to prompt and help employees could reduce onboarding time and the overall cost of employee training. That would be a huge market.

This is the sort of deal that we expect to see Tiger in — an outsized investment (compared to prior rounds) into a high-growth company that has lots of market room. Whatever price Tiger just paid for the company’s stock, a few years of continued growth should de-risk the investment. By our read, Tiger is really just the market-leading bull on software market growth in the long term. Shelf fits into that thesis neatly.

Powered by WPeMatico

Less than three months after announcing a $300 million Series E, Brazilian proptech QuintoAndar has raised an additional $120 million.

New investors Greenoaks Capital and China’s Tencent co-led the round, which included participation from some existing backers as well. São Paulo-based QuintoAndar is now valued at $5.1 billion, up from $4 billion at the time of its last raise in late May. With the extension, the startup has now raised more than $700 million since its 2013 inception. Ribbit Capital led the first tranche of its Series E.

QuintoAndar describes itself as an “end-to-end solution for long-term rentals” that, among other things, connects potential tenants to landlords and vice versa. Last year, it also expanded into connecting home buyers to sellers. Its long-term plan is to evolve into a one-stop real estate shop that also offers mortgage, title insurance and escrow services.

To that end, earlier this month, the startup acquired Atta Franchising, a 7-year-old São Paulo-based independent real estate mortgage broker. Specifically, acquiring Atta is designed to speed up its ability to offer mortgage services to its users. QuintoAndar also plans to explore the possibility of offering a product to perform standalone transactions outside of its marketplace in partnership with other brokers, according to CEO and co-founder Gabriel Braga.

This year, QuintoAndar expanded operations into 14 new cities in Brazil. Eventually, QuintoAndar plans to enter the Mexican market as its first expansion outside of its home country, but it has not yet set a date for that step. Today, the company has more than 120,000 rentals under management and about 10,000 new rentals per month. Its rental platform is live in 40 cities across Brazil, while its home-buying marketplace is live in four (São Paulo, Rio de Janeiro, Belo Horizonte and Porto Alegre) and seeing more than 10,000 sales in annualized terms.

QuintoAndar, he said, is open to acquiring more companies that it believes can either help it accelerate in a particular way or add something it had not yet thought about.

“We’re receptive to the idea but our core strategy is to focus on organic growth and our own innovation and accelerate that,” Braga said.

The Series E was oversubscribed with investors who got in and “some who could not join,” according to Braga.

Greenoaks and Tencent, he said, couldn’t participate because of “timing issues.”

“We kept talking and they came back to us after the round, and wanted to be involved so we found a way to have them on board,” Braga said. “We did not need the money. But we have been constantly overachieving on the forecast that we shared with our investors. And that’s part of the reason why we had this extension.”

Greenoaks’ long-term time horizon was appealing because the firm’s investment was designed to be “perpetual capital with no predefined time frame,” Braga said.

“We’re doing our best to build an enduring company that will be around for many, many years, so it’s good to have investors who share that vision and are technically aligned,” he added.

Greenoaks partner Neil Shah said his firm believes that what QuintoAndar is building will “fundamentally reshape real estate transactions, enhancing transparency, expanding options for Brazilians seeking housing, dramatically simplifying the experience for landlords and driving increased investment into real estate across the country.” He also believes there is big potential for the company to take its offering to other parts of Latin America.

“We look forward to being partners for decades to come,” he added.

Tencent’s experience in China is something QuintoAndar also finds valuable.

“We believe we can learn a lot from them and other Chinese companies doing interesting stuff there,” Braga said.

QuintoAndar isn’t the only Brazilian proptech firm raising big money: In March, São Paulo digital real estate platform Loft announced it had closed on $425 million in Series D funding led by New York-based D1 Capital Partners. Then, about one month later, it revealed a $100 million extension that valued the company at $2.9 billion.

Powered by WPeMatico

Newly reported financial data from Bird, an American scooter sharing service, shows a company with an improving economic model and a multiyear path to profitability. However, that path is fraught unless a number of scenarios all work out in concert and without a glitch.

Bird, well known for its early battles with domestic rival Lime, is pursuing a SPAC-led deal that will see it go public and raise fresh capital. The former startup is merging with Switchback II Corporation in a deal that values it at around $2.3 billion, including a $160 million PIPE (private investment in public equity) component. (Note: The group purchasing TechCrunch’s parent company from its own parent company is part of the Bird PIPE.)

The Exchange explores startups, markets and money.

Read it every morning on Extra Crunch or get The Exchange newsletter every Saturday.

COVID-19 hasn’t been kind to Bird and similar companies around the world. As many around the world stayed home, usage of shared-asset services and ride-hail applications fell sharply. Bird saw rides decline. Airbnb took a temporary hit. Uber and Lyft saw ride demand fall.

Responses to the crisis were varied. Airbnb cut costs and raised external capital. Lyft cut expenses and focused on its core model while Uber grew its food delivery business, which saw transaction volume soar as demand fell for its traditional business.

Responses to the crisis were varied. Airbnb cut costs and raised external capital. Lyft cut expenses and focused on its core model while Uber grew its food delivery business, which saw transaction volume soar as demand fell for its traditional business.

Meanwhile, Bird flipped its entire business model. That decision has helped the scooter outfit improve its economics markedly, giving it a shot at generating profit in the future — provided its forecasts prove achievable.

This morning, let’s talk about how Bird has changed its business, their impacts on its operating results and how long the company thinks its climb to profitability is.

In their initial forms, Bird and Lime bought and deployed large fleets of electric scooters. Not only was this capital intensive, the companies also wound up with costs that were more than sticky — charging wasn’t simple or cheap, moving scooters around to balance demand took both human capital and vehicles, and the list went on.

Throw in vehicle depreciation — the pace at which scooters in the wild degraded from use or abuse — and the businesses proved excellent vehicles for raising capital and throwing that money at more scooters, costs, and, as it turned out, losses.

Results improved somewhat over time, though. As scooter-share companies increasingly built their own hardware, their economics improved. Sturdier scooters meant lower depreciation, and better battery tech could allow for more rides per charge. That sort of thing.

But the model wasn’t incredibly lucrative even before COVID-19 hit. Costs were high, and the model did not break-even, even on a gross margin basis, let alone when considering all corporate expenses. You can see the financial mess from that period of operations in historical Bird results.

Powered by WPeMatico

Hello and welcome back to Equity, TechCrunch’s venture capital-focused podcast, where we unpack the numbers behind the headlines.

Danny was back, joining Natasha and Alex and Grace and Chris to chat through the week’s coming and goings. But, before we get to the official news, here’s some personal news: Danny is stepping back from his role as co-host of the Friday show! Yes, Mr. Crichton will still take part in our mid-week, deep-dive episodes, but this is the conclusion of his run as part of the news roundup. We will miss him, glad that his transitions and wit will continue to be part of the Equity universe.

Who will take the third chair? Well, stay tuned. We have some neat things planned.

Now, the rundown:

Powered by WPeMatico

Poland-based health tech AI startup Cardiomatics has announced a $3.2 million seed raise to expand use of its electrocardiogram (ECG) reading automation technology.

The round is led by Central and Eastern European VC Kaya, with Nina Capital, Nova Capital and Innovation Nest also participating.

The seed raise also includes a $1 million non-equity grant from the Polish National Centre of Research and Development.

The 2017-founded startup sells a cloud tool to speed up diagnosis and drive efficiency for cardiologists, clinicians and other healthcare professionals to interpret ECGs — automating the detection and analysis of some 20 heart abnormalities and disorders with the software generating reports on scans in minutes, faster than a trained human specialist would be able to work.

Cardiomatics touts its tech as helping to democratize access to healthcare — saying the tool enables cardiologists to optimise their workflow so they can see and treat more patients. It also says it allows GPs and smaller practices to offer ECG analysis to patients without needing to refer them to specialist hospitals.

The AI tool has analyzed more than 3 million hours of ECG signals commercially to date, per the startup, which says its software is being used by more than 700 customers in 10+ countries, including Switzerland, Denmark, Germany and Poland.

The software is able to integrate with more than 25 ECG monitoring devices at this stage, and it touts offering a modern cloud software interface as a differentiator versus legacy medical software.

Asked how the accuracy of its AI’s ECG readings has been validated, the startup told us: “The data set that we use to develop algorithms contains more than 10 billion heartbeats from approximately 100,000 patients and is systematically growing. The majority of the data-sets we have built ourselves, the rest are publicly available databases.

“Ninety percent of the data is used as a training set, and 10% for algorithm validation and testing. According to the data-centric AI we attach great importance to the test sets to be sure that they contain the best possible representation of signals from our clients. We check the accuracy of the algorithms in experimental work during the continuous development of both algorithms and data with a frequency of once a month. Our clients check it everyday in clinical practice.”

Cardiomatics said it will use the seed funding to invest in product development, expand its business activities in existing markets and gear up to launch into new markets.

“Proceeds from the round will be used to support fast-paced expansion plans across Europe, including scaling up our market-leading AI technology and ensuring physicians have the best experience. We prepare the product to launch into new markets too. Our future plans include obtaining FDA certification and entering the US market,” it added.

The AI tool received European medical device certification in 2018 — although it’s worth noting that the European Union’s regulatory regime for medical devices and AI is continuing to evolve, with an update to the bloc’s Medical Devices Directive (now known as the EU Medical Device Regulation) coming into application earlier this year (May).

A new risk-based framework for applications of AI — aka the Artificial Intelligence Act — is also incoming and will likely expand compliance demands on AI health tech tools like Cardiomatics, introducing requirements such as demonstrating safety, reliability and a lack of bias in automated results.

Asked about the regulatory landscape it said: “When we launched in 2018 we were one of the first AI-based solutions approved as medical device in Europe. To stay in front of the pace we carefully observe the situation in Europe and the process of legislating a risk-based framework for regulating applications of AI. We also monitor draft regulations and requirements that may be introduced soon. In case of introducing new standards and requirements for artificial intelligence, we will immediately undertake their implementation in the company’s and product operations, as well as extending the documentation and algorithms validation with the necessary evidence for the reliability and safety of our product.”

However it also conceded that objectively measuring efficacy of ECG reading algorithms is a challenge.

“An objective assessment of the effectiveness of algorithms can be very challenging,” it told TechCrunch. “Most often it is performed on a narrow set of data from a specific group of patients, registered with only one device. We receive signals from various groups of patients, coming from different recorders. We are working on this method of assessing effectiveness. Our algorithms, which would allow them to reliably evaluate their performance regardless of various factors accompanying the study, including the recording device or the social group on which it would be tested.”

“When analysis is performed by a physician, ECG interpretation is a function of experience, rules and art. When a human interprets an ECG, they see a curve. It works on a visual layer. An algorithm sees a stream of numbers instead of a picture, so the task becomes a mathematical problem. But, ultimately, you cannot build effective algorithms without knowledge of the domain,” it added. “This knowledge and the experience of our medical team are a piece of art in Cardiomatics. We shouldn’t forget that algorithms are also trained on the data generated by cardiologists. There is a strong correlation between the experience of medical professionals and machine learning.”

Powered by WPeMatico

Choosing an insurance policy is one of the most complicated financial decisions a person can make. Jakarta-based Lifepal wants to simplify the process for Indonesians with a marketplace that lets users compare policies from more than 50 providers, get help from licensed agents and file claims. The startup, which says it is the country’s largest direct-to-consumer insurance marketplace, announced today it has raised a $9 million Series A. The round was led by ProBatus Capital, a venture firm backed by Prudential Financial, with participation from Cathay Innovation and returning investors Insignia Venture Partners, ATM Capital and Hustle Fund.

Lifepal was founded in 2019 by former Lazada executives Giacomo Ficari and Nicolo Robba, along with Benny Fajarai and Reza Muhammed. The new funding brings its total raised to $12 million.

The marketplace’s partners currently offer about 300 policies for life, health, automotive, property and travel coverage. Ficari, who also co-founded neobank Aspire, told TechCrunch that Lifepal was created to make comparing, buying and claiming insurance as simple as shopping online.

“The same kind of experience a customer has today on a marketplace like Lazada—the convenience, all digital, fast delivery—we saw was lacking in insurance, which is still operating with offline, face-to-face agents like 20 to 30 years ago,” he said.

Indonesia’s insurance penetration rate is only about 3%, but the market is growing along with the country’s gross domestic product thanks to a larger middle-class. “We are really at a tipping point for GDP per capita and a lot of insurance carriers are focusing more on Indonesia,” said Ficari.

Other venture-backed insurtech startups tapping into this demand include Fuse, PasarPolis and Qoala. Both Qoala and PasarPolis focus on “micro-policies,” or inexpensive coverage for things like damaged devices. PasarPolis also partners with Gojek to offer health and accident insurance to drivers. Fuse, meanwhile, insurance specialists an online platform to run their businesses.

Lifepal takes a different approach because it doesn’t sell micro-policies, and its marketplace is for customers to purchase directly from providers, not through agents.

Based on Lifepal’s data, about 60% of its health and life insurance customers are buying coverage for the first time. On the other hand, many automotive insurance shoppers had policies before, but their coverage expired and they decided to shop online instead of going to an agent to get a new one.

Ficari said Lifepal’s target customers overlap with the investment apps that are gaining traction among Indonesia’s growing middle class (like Ajaib, Pluang and Pintu). Many of these apps provide educational content, since their customers are usually millennials investing for the first time, and Lifepal takes a similar approach. Its content side, called Lifepal Media, focuses on articles for people who are researching insurance policies and related topics like personal financial planning. The company says its site, including its blog, now has about 4 million monthly visitors, creating a funnel for its marketplace.

While one of Lifepal’s benefits is enabling people to compare policies on their own, many also rely on its customer support line, which is staffed by licensed insurance agents. In fact, Ficari said about 90% of its customers use it.

“What we realize is that insurance is complicated and it’s expensive,” said Ficari. “People want to take their time to think and they have a lot of questions, so we introduced good customer support.” He added Lifepal’s combination of enabling self-research while providing support is similar to the approach taken by PolicyBazaar in India, one of the country’s largest insurance aggregators.

To keep its business model scalable, Lifepal uses a recommendation engine that matches potential customers with policies and customer support representatives. It considers data points like budget (based on Lifepal’s research, its customers usually spend about 3% to 5% of their yearly income on insurance), age, gender, family composition and if they have purchased insurance before.

Lifepal’s investment from ProBatus will allow it to work with Assurance IQ, the insurance sales automation platform acquired by Prudential Financial two years ago.

In a statement, ProBatus Capital founder and managing partner Ramneek Gupta said Lifepal’s “three-pronged approach” (its educational content, online marketplace and live agents for customer support) has the “potential to change the way the Indonesian consumer buys insurance.”

Part of Lifepal’s funding will be used to build products to make it easier to claim policies. Upcoming products include Insurance Wallet, which will include an application process with support on how to claim a policy—for example, what car repair shop or hospital a customer should go to—and escalation if a claim is rejected. Another product, called Easy Claim, will automate the claim process.

“The goal is to stay end-to-end with the customer, from reading content, comparing policies, buying and then renewing and using them, so you really see people sticking around,” said Ficari.

Lifepal is Cathay Innovation’s third insurtech investment in the past 12 months. Investment director Rajive Keshup told TechCrunch in an email that it backed Lifepal because “the company grew phenomenally last year (12X) and is poised to beat its aggressive 2021 plan despite the proliferation of the COVID delta variant, accentuating the fact that Lifepal is very much on track to replicate the success of similar global models such as Assurance IQ (US) and PolicyBazaar (India).”

Powered by WPeMatico

Danggeun Market, the publisher of South Korea’s hyperlocal community app Karrot, announced it has raised $162 million in a Series D round of funding with a valuation of $2.7 billion. (By the way, Danggeun means carrot in Korean.)

This round of funding was led by DST Global, with additional participation from Aspex Management, Reverent Partners and existing investors such as Goodwater Capital, Altos Ventures, SoftBank Ventures Asia, Kakao Ventures, Strong Ventures and Capstone Partners.

The latest funding officially makes Danggeun Market a unicorn, with $205 million total raised.

The company plan to strengthen its capabilities in local commerce with Danggeun Pay, or Karrot Pay, which is set to launch this year, and Danggeun’s platform Karrot enables approximately 300,000 local SMB partners to go digitalized by offering offline to online (O2O) service. Danggeun Market’s consumers access everything from fresh local produce delivery to essential services, including cleaning, education, real estate brokerage and used cars in their local communities.

The funding proceeds from the new round will be used for further global expansion, business diversification, R&D, investment in advanced artificial intelligence and machine learning technology and recruiting team talent.

“Danggeun Market plans to focus on accelerating further overseas market expansion for the next two years after closing Series D funding, and in South Korea, we will diversify our business, aiming to be a super app,” co-founder and co-CEO Gary Kim said in an exclusive conversation with TechCrunch.

Danggeun Market, which is short for “the market in your neighborhood,” was founded by Gary Kim and Paul Kim in 2015.

Danggeun Market also plans to launch its payment service Karrot Pay, expand offline to online (O2O) service for South Korean SMEs that use its platform Karrot and invest to develop advanced artificial intelligence and machine learning in its platform for suggesting personalized feeds for users to stay longer, Kim continued.

Danggeun Market is expected to get approval from South Korea’s financial supervisory service (FSS) as early as September for two licenses, such as payment gateway operator (PG) and prepaid payment means operator, to launch Danggeun Market’s payment service, Karrot Pay, this year, Kim said.

Danggeun Market, which already launched its global version of hyperlocal community app Karrot in the U.K. in November 2019, currently operates the Karrot app in 72 local communities in four countries: the U.K., the U.S., Canada and Japan.

“We see some active transactions in Manchester, Birmingham and Toronto,” Kim said. Danggeun Market launched Karrot in Canada and the U.S. in September and October 2020, respectively. In February 2021, it opened in Japan, Kim said.

When asked regarding the next foreign market location, “Danggeun Market will not designate a particular country this time. We will change our overseas penetration strategy slightly by opening the app Karrot globally and monitor the countries that show organic growth and then we will narrow down specific countries and cities to focus on more,” Kim said.

The company will still seek the high population density areas in foreign markets and keep the distance limit set, Danggeun’s unique feature that only shows people listings from sellers located within 6 km radius in South Korea and 10 miles (about 15 km) maximum for the U.K. for providing hyperlocalized community service.

For the next round, Gary Kim said it depends on its global expansion growth. If its global business works well and Karrot draws more global users and reaches active MAU and transactions the company has set, Danggeun Market will definitely raise another funding in two years, Kim said. “We are not in a hurry for an IPO at this stage since we can raise enough capital in the private market now. We want to consider going public after we make stable profits,” Kim said.

Danggeun Market now claims its total registered users exceed 21 million (South Korea has a total of 20.92 million households) and has consistently experienced over 300 % year-on-year growth since 2018.

The company reached 1.8 million monthly active users (MAUs) in 2019, 4.8 million MAUs in 2020 and finally increased to 14.2 million MAUs in 2021, growing 3x every year over the past three years. According to global app analytics platform App Annie, Danggeun Market users spend an average of two hours and two minutes per month on the app.

“Over the past few years, Danggeun Market has demonstrated overwhelming dominance in the Korean C2C market… with unique user behavior from location-based communities, Danggeun Market continues to showcase its potential as the hyperlocal super app,” managing partner at DST Investment Management John Lindfors said.

“COVID-19 highlighted the importance of people wanting to connect to their neighbors and community. When meeting a friend for a simple coffee can no longer be taken for granted, we realize all the more importance of our relationships and community. Danggeun Market’s service bridges the offline and online world, enhancing both in-person interactions as well as purely digital ones. The core of Danggeun Market’s growth is its digital end-to-end platform that allows consumers to feel both genuinely part of their communities as well as have the comfort and safety of being part of a larger network that can grow together,” co-founder and managing partner at Goodwater Capital Eric Kim said.

Powered by WPeMatico

Cisco announced on Friday that it’s acquiring Israeli applications-monitoring startup Epsagon at a price pegged at $500 million. The purchase gives Cisco a more modern microservices-focused component for its growing applications-monitoring portfolio.

The Israeli business publication Globes reported it had gotten confirmation from Cisco that the deal was for $500 million, but Cisco would not confirm that price with TechCrunch.

The acquisition comes on top of a couple of other high-profile app-monitoring deals, including AppDynamics, which the company bought in 2018 for $3.7 billion, and ThousandEyes, which it nabbed last year for $1 billion.

With Epsagon, the company is getting a way to monitor more modern applications built with containers and Kubernetes. Epsagon’s value proposition is a solution built from the ground up to monitor these kinds of workloads, giving users tracing and metrics, something that’s not always easy to do given the ephemeral nature of containers.

As Cisco’s Liz Centoni wrote in a blog post announcing the deal, Epsagon adds to the company’s concept of a full-stack offering in their applications-monitoring portfolio. Instead of having a bunch of different applications monitoring tools for different tasks, the company envisions one that works together.

“Cisco’s approach to full-stack observability gives our customers the ability to move beyond just monitoring to a paradigm that delivers shared context across teams and enables our customers to deliver exceptional digital experiences, optimize for cost, security and performance and maximize digital business revenue,” Centoni wrote.

That experience point is particularly important because when an application isn’t working, it isn’t happening in a vacuum. It has a cascading impact across the company, possibly affecting the core business itself and certainly causing customer distress, which could put pressure on customer service to field complaints, and the site reliability team to fix it. In the worst case, it could result in customer loss and an injured reputation.

If the application-monitoring system can act as an early warning system, it could help prevent the site or application from going down in the first place, and when it does go down, help track the root cause to get it up and running more quickly.

The challenge here for Cisco is incorporating Epsagon into the existing components of the application-monitoring portfolio and delivering that unified monitoring experience without making it feel like a Frankenstein’s monster of a solution globbed together from the various pieces.

Epsagon launched in 2018 and has raised $30 million. According to a report in the Israeli publication, Calcalist, the company was on the verge of a big Series B round with a valuation in the range of $200 million when it accepted this offer. It certainly seems to have given its early investors a good return. The deal is expected to close later this year.

Powered by WPeMatico