Fundings & Exits

Auto Added by WPeMatico

Auto Added by WPeMatico

This week Danny and Alex and Chris took to Twitter Spaces to chat about the current state of the crypto economy, and hang out with friends in a live Twitter Space. We’re doing more of these, so make sure that you are following the show on Twitter.

As a small programming note, I forgot to tell the folks who chimed in during the chat that we were recording it, so we had to cut most the Q&A portion of the show. We got Ezra’s permission, thankfully. The mixup was a bummer as we learned a lot. In the future, we’ll not make that mistake and keep all the voices.

So, what did we talk about? The following:

Ok, we’re back Monday with your regularly scheduled programming!

Equity drops every Monday at 7:00 a.m. PST, Wednesday, and Friday morning at 7:00 a.m. PST, so subscribe to us on Apple Podcasts, Overcast, Spotify and all the casts.

iv>

Powered by WPeMatico

Hello and welcome back to Equity, TechCrunch’s venture capital-focused podcast, where we unpack the numbers behind the headlines.

Our beloved Danny was back, joining Natasha and Alex and Grace and Chris to chat through yet another incredibly busy week. As a window into our process, every week we tell one another that the next week we’ll cut the show down to size. Then the week is so interesting that we end up cutting a lot of news, but also keeping a lot of news. The chaotic process is a work in progress, but it means that the end result is always what we decided we can’t not talk about.

Here’s what we got into:

Powered by WPeMatico

Sydney, Australia-based Fable Food is the latest plant-based food startup to announce funding. The company, which uses mushrooms in its meat alternatives, has raised $6.5 million AUD (about $4.8 million USD) in a seed round led by Blackbird Ventures, the Australian venture capital firm whose portfolio also includes Canva, Culture Amp and SafetyCulture. Other participants included agriculture and food tech venture firm AgFunder, sustainability-focused Aera VC and Better Bite Ventures, along with Singapore-based produce importer Ban Choon Marketing and former Sequoia Capital partner Warren Hogarth.

Fable is preparing to launch in the United States by the end of this year. In Australia, its products are available at retailers like Woolworths, Coles and Harris Farm Markets, along with restaurants including Grill’d, which recently started serving its Meaty Mushroom Burger Pattie at 136 locations. Fable’s products are also available at restaurants in Singapore and the United Kingdom.

The startup was founded in 2019 by fine dining chef turned chemical engineer and mycologist (mushroom scientist) Jim Fuller, organic mushroom farmer Chris McLoghlin and Michael Fox, whose previous startup was Shoes of Prey.

Fox, Fable’s chief executive officer, told TechCrunch in an email that after being a vegetarian for six years, he recently became a vegan “for a mix of health, environmental and ethical reasons.”

“Talking to my friends and family, a lot of people want to reduce their meat consumption for the same reasons but they find it challenging because they love the taste and texture of meat and giving it up is hard,” Fox said. He wanted to find a way to make it easier for people to transition to plant-based foods, and spoke to several chefs who suggested using mushrooms as a base ingredient. Then Fox met Fuller and McLoghlin, who were in the process of developing meat alternatives using mushrooms.

“When we met, we realized we shared the same values and goals and had complementary skill sets,” said Fox. “We shared a common desire to help end industrial agriculture and wanted to make our food system more ethical, healthy, sustainable and lower its greenhouse gas emissions.”

Fable’s first products include a substitute for pulled pork, braised beef and beef brisket (Fuller grew up in Texas eating slow-cooked meats and wanted to recreate the experience), along with a line of ready-made meals. The company uses shiitake mushrooms, which Fox explained are “very flavorful with their natural umami flavors, they are a slow-growing mushroom so they naturally have the fleshy fibers that give the meaty bite you typically get from animal proteins, and have the right chemical composition that when cooked allow us to taste flavors that are found in animal products.”

Fable’s ready-made meals. Image Credits: Fable

Fuller serves as Fable’s chief science officer and the startup leverages his experience as a chef/chemical engineer/mycologist to create the right combinations of flavor, aroma and texture while keeping processing and ingredients to a minimum. For example, its braised beef alternative is made with shiitake mushrooms, seven other ingredients and salt and pepper.

Fable also announced today it has appointed Dan Joyce, who was previously safety and compliance software company SafetyCulture’s general manager of Europe, the Middle East and Africa, as chief growth officer to head global sales and marketing. It will launch in the U.S. through a combination of partnerships with restaurants and meal kit companies.

Other startups that use mushrooms as basis for meat alternatives include Meati and AtLast. Fox said a main difference is that those two startups ferment mycelium, or the root structure of fungi, instead of using mushrooms, which are the fruiting body of fungi.

Fable’s new funding will be used for research and development, expanding its production and manufacturing capacity in Australia and other countries. The company is keeping its product pipeline under wraps for now, but Fox said it plans to develop mushroom-based substitutes for pork, chicken, lamb and other animal proteins.

Powered by WPeMatico

Hello and welcome back to Equity, TechCrunch’s venture capital-focused podcast, where we unpack the numbers behind the headlines.

This week we were back to full strength, with Danny, Natasha and Alex joined by Chris to chat through the latest venture capital brouhaha. Namely, whether or not venture capital is about to get shaken to its core, or if we’re really parsing some long-term economic trends that will eventually revert.

Here’s a rundown:

The direction and future of the venture capital world has largely been lost amidst a sea of large numbers. New megarounds. New unicorns. That sort of thing. But inside the rising tide of capital available to private companies has been a mix-shift of sorts. The question is where that goes long-term. We tried to posit a few things that could happen next.

Equity is back on Friday!

Powered by WPeMatico

China’s technology scene has been in the news for all the wrong reasons in recent months. In the wake of the scuttling of Ant Group’s IPO, the Chinese government has gone on a regulatory offensive against a host of technology companies. Edtech got hit. On-demand companies took incoming fire. Ride-hailing? Check. Gaming? You bet.

The result of the government fusillade against some of the best-known companies in China was falling share prices. The damage topped $1 trillion among just public Chinese companies listed abroad.

The Exchange explores startups, markets and money.

Read it every morning on Extra Crunch or get The Exchange newsletter every Saturday.

What about startups in sectors that were reformed overnight? If their public comps are any indication, even more wealth was deleted in the recent wave of crackdowns.

The Exchange was curious about the impact of the Chinese government’s actions on the venture capital market. The Chinese startup economy has produced a number of world-leading companies. Tencent and Alibaba, yes, and even Baidu have become well-known for a reason. Could regulatory changes shake up the venture model that helped grow the country’s largest tech concerns?

After we checked in on the same question this Monday, SoftBank provided a partial answer, noting yesterday that it is pausing investments in China. The Japanese teleco, conglomerate and investing powerhouse has been deploying capital at a rapid pace in recent weeks. That will slow, at least in China. Here’s the WSJ:

The regulatory initiative in China has become so unpredictable and widespread that SoftBank and its funds are planning to hold off on investing much more there until the risks become clearer, [SoftBank CEO Masayoshi Son] said at an earnings press conference in Tokyo.

Is SoftBank early to its decision to shake up its investing strategy, missing Chinese deals for some time? Or is it late? We secured data from PitchBook and Traxcn that paints a somewhat surprising picture of venture capital activity at least thus far in Q3 2021.

But first, a reminder of how well China’s venture capital market was performing as 2020 eased its way into 2021.

But first, a reminder of how well China’s venture capital market was performing as 2020 eased its way into 2021.

China had a reasonably good Q2 2021 despite the turmoil.

Sure, funding flowing into Chinese startups was down 18% compared to Q4 2020, per CB Insights, but that quarter had recorded an all-time high of $27.7 billion. With $22.8 billion raised, Q2 2021 still did better than every other quarter since Q2 2016 with the exception of Q2 2018, Q4 2020 and Q1 2021. Indeed, the ecosystem had started to cool down in late 2018 before picking up pace again at the end of 2020.

However, that’s only one way to look at the numbers. If you compare recent Chinese venture results with other regions, it underperformed. During Q2 2021, U.S. funding reached a new high of $70.4 billion, with places like Latin America, Canada and India also establishing new records.

This also means that China lost ground as to its share of global startup deal-making, and the same goes for unicorn creation. According to Tech Buzz China’s summary of CB Insights data, the U.S. accounted for 132 unicorn births between January 1 and June 16, 2021, compared with just three in China.

Slightly falling quarterly venture capital totals and a notable decline in unicorn formation does not a startup winter make. So let’s look at what’s happened more recently.

The thesis that there would be an instantly obvious slowdown in Chinese venture capital activity is not supported by the data we secured.

Powered by WPeMatico

Reducing global greenhouse gas emissions is an important goal, but another challenge awaits: lowering the levels of CO2 and other substances already in the atmosphere. One promising approach turns the gas into an ordinary mineral through entirely natural processes; 44.01 hopes to perform this process at scale using vast deposits of precursor materials and a $5 million seed round to get the ball rolling.

The process of mineralizing CO2 is well known among geologists and climate scientists. A naturally occurring stone called peridotite reacts with the gas and water to produce calcite, another common and harmless mineral. In fact this has occurred at enormous scales throughout history, as witnessed by large streaks of calcite piercing peridotite deposits.

Peridotite is normally found miles below sea level, but on the easternmost tip of the Arabian peninsula, specifically the northern coast of Oman, tectonic action has raised hundreds of square miles of the stuff to the surface.

Talal Hasan was working in Oman’s sovereign investment arm when he read about the country’s coast having the largest “dead zone” in the world, a major contributor to which was CO2 emissions being absorbed by the sea and gathering there. Hasan, born into a family of environmentalists, looked into it and found that, amazingly, the problem and the solution were literally right next to each other: the country’s mountains of peridotite, which theoretically could hold billions of tons of CO2.

Around that time, in fact, The New York Times ran a photo essay about Oman’s potential miracle mineral, highlighting the research of Peter Kelemen and Juerg Matter into its potential. As the Times’ Henry Fountain wrote at the time:

If this natural process, called carbon mineralization, could be harnessed, accelerated and applied inexpensively on a huge scale — admittedly some very big “ifs” — it could help fight climate change.

That’s broadly speaking the plan proposed by Hasan and, actually, both Kelemen and Matter, who make up the startup’s “scientific committee.” 44.01 (the molecular weight of carbon dioxide, if you were wondering) aims to accomplish mineralization economically and safely with a few novel ideas.

First is the basic process of accelerating the natural reaction of the materials. It normally occurs over years as CO2 and water vapor interact with the rock — no energy needs to be applied to make the change, since the reaction actually results in a lower energy state.

“We’re speeding it up by injecting a higher CO2 content than you would get in the atmosphere,” said Hasan. “We have to drill an engineered borehole that’s targeted for mineralization and injection.”

The holes would maximize surface area, and highly carbonated water would be pumped in cyclically until the drilled peridotite is saturated. Importantly, there’s no catalyst or toxic additive, it’s just fizzy water, and if some were to leak or escape, it’s just a puff of CO2, like what you get when you open a bottle of soda.

Second is achieving this without negating the entire endeavor by having giant trucks and heavy machinery pumping out new CO2 as fast as they can pump in the old stuff. To that end Hasan said the company is working hard at the logistics side to create a biodiesel-based supply line (with Wakud) to truck in the raw material and power the machines at night, while solar would offset that fuel cost at night.

It sounds like a lot to build up, but Hasan points out that a lot of this is already done by the oil industry, which as you might guess is fairly ubiquitous in the region. “It’s similar to how they drill and explore, so there’s a lot of existing infrastructure for this,” he said, “but rather than pulling the hydrocarbon out, we’re pumping it back in.” Other mineralization efforts have broken ground on the concept, so to speak, such as a basalt-injection scheme up in Iceland, so it isn’t without precedent.

Third is sourcing the CO2 itself. The atmosphere is full of it, sure, but it’s not trivial to capture and compress enough to mineralize at industrial scales. So 44.01 is partnering with Climeworks and other carbon capture companies to provide an end point for their CO2 sequestration efforts.

Plenty of companies are working on direct capture of emissions, be they at the point of emission or elsewhere, but once they have a couple million tons of CO2, it’s not obvious what to do next. “We want to facilitate carbon capture companies, so we’re building the CO2 sinks here and operating a plug and play model. They come to our site, plug in, and using power on site, we can start taking it,” said Hasan.

How it would be paid for is a bit of an open question in the exact particulars, but what’s clear is a global corporate appetite for carbon offsetting. There’s a large voluntary market for carbon credits beyond the traditional and rather outdated carbon credits. 44.01 can sell large quantities of verified carbon removal, which is a step up from temporary sequestration or capture — though the financial instruments to do so are still being worked out. (DroneSeed is another company offering a service beyond offsets that hopes to take advantage of a new generation of emissions futures and other systems. It’s an evolving and highly complex overlapping area of international regulations, taxes and corporate policy.)

For now, however, the goal is simply to prove that the system works as expected at the scales hoped for. The seed money is nowhere near what would be needed to build the operation necessary, just a step in that direction to get the permits, studies and equipment necessary to properly perform demonstrations.

“We tried to get like-minded investors on board, people genuinely doing this for climate change,” said Hasan. “It makes things a lot easier on us when we’re measured on impact rather than financials.” (No doubt all startups hope for such understanding backers.)

Apollo Projects, a early-stage investment fund from Max and Sam Altman, led the round, and Breakthrough Energy Ventures participated. (Not listed in the press release but important to note, Hasan said, were small investments from families in Oman and environmental organizations in Europe.)

Oman may be the starting point, but Hasan hinted that another location would host the first commercial operations. While he declined to be specific, one glance at a map shows that the peridotite deposits spill over the northern border of Oman and into the eastern tip of the UAE, which no doubt is also interested in this budding industry and, of course, has more than enough money to finance it. We’ll know more once 44.01 completes its pilot work.

Powered by WPeMatico

Just months after raising $28 million, Jerry announced today that it has raised $75 million in a Series C round that values the company at $450 million.

Existing backer Goodwater Capital doubled down on its investment in Jerry, leading the “oversubscribed” round. Bow Capital, Kamerra, Highland Capital Partners and Park West Asset Management also participated in the financing, which brings Jerry’s total raised to $132 million since its 2017 inception. Goodwater Capital also led the startup’s Series B earlier this year. Jerry’s new valuation is about “4x” that of the company at its Series B round, according to co-founder and CEO Art Agrawal.

“What factored into the current valuation is our annual recurring revenue, growing customer base and total addressable market,” he told TechCrunch, declining to be more specific about ARR other than to say it is growing “at a very fast rate.” He also said the company “continues to meet and exceed growth and revenue targets” with its first product, a service for comparing and buying car insurance. At the time of the company’s last raise, Agrawal said Jerry saw its revenue surge by “10x” in 2020 compared to 2019.

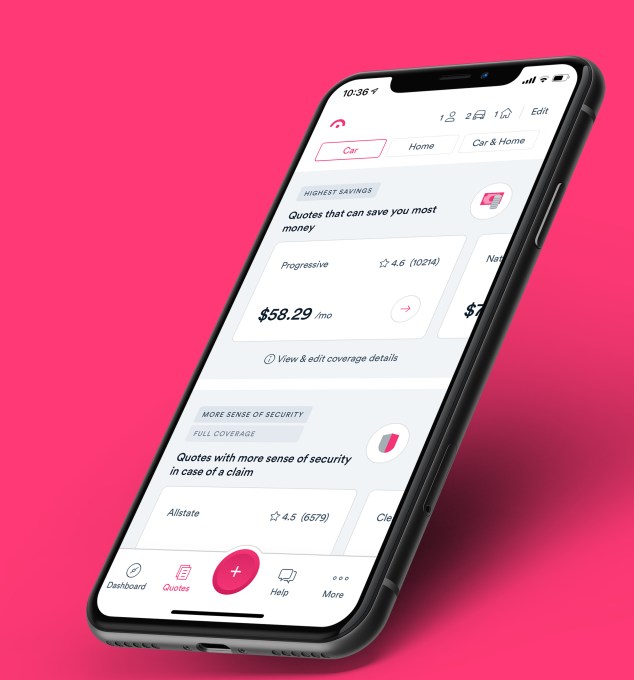

Jerry, which says it has evolved its model to a mobile-first car ownership “super app,” aims to save its customers time and money on car expenses. The Palo Alto-based startup launched its car insurance comparison service using artificial intelligence and machine learning in January 2019. It has quietly since amassed nearly 1 million customers across the United States as a licensed insurance broker.

“Today as a consumer, you have to go to multiple different places to deal with different things,” Agrawal said at the time of the company’s last raise. “Jerry is out to change that.”

The new funding round fuels the launch of the company’s “compare-and-buy” marketplaces in new verticals, including financing, repair, warranties, parking, maintenance and “additional money-saving services.” Although Jerry also offers a similar product for home insurance, its focus is on car ownership.

Image Credits: Jerry

“Access to reliable and affordable transportation is critical to economic empowerment,” said Rafi Syed, Jerry board member and general partner at Bow Capital, which also doubled down on its investment in the company. “Jerry is helping car owners make the most of every dollar they earn. While we see Jerry as an excellent technology investment showcasing the power of data in financial services, it’s also a high-performing investment in terms of the financial inclusion it supports.”

Goodwater Capital Partner Chi-Hua Chien said the firm’s recurring revenue model makes it stand out from lead generation-based car insurance comparison sites.

CEO Agrawal agrees, noting that Jerry’s high-performing annual recurring revenue model has made the company “attractive to investors” in addition to the fact that the startup “straddles” the auto, e-commerce, fintech and insurtech industries.

“We recognized those investment opportunities could drive our business faster and led to raising the round earlier than expected,” he told TechCrunch. “We’re eager to launch new categories to save customers time and money on auto expenses and the new investment shortens our time to market.”

Agrawal also believes Jerry is different from other auto-related marketplaces out there in that it aims to help consumers with various aspects of car ownership (from repair to maintenance to insurance to warranties), rather than just one. The company also believes it is set apart from competitors in that it doesn’t refer a consumer to an insurance carrier’s site so that they still have to do the work of signing up with them separately, for example. Rather, Jerry uses automation to give consumers customized quotes from more than 45 insurance carriers “in 45 seconds.” The consumers can then sign on to the new carrier via Jerry, which can then cancel former policies on their behalf.

Jerry makes recurring revenue from earning a percentage of the premium when a consumer purchases a policy on its site from carriers such as Progressive.

Powered by WPeMatico

Trendyol, an e-commerce platform based in Turkey, has raised $1.5 billion in a massive funding round that values the company at $16.5 billion. General Atlantic, SoftBank Vision Fund 2, Princeville Capital and sovereign wealth funds, ADQ (UAE) and Qatar Investment Authority co-led the round.

The deal marks SoftBank’s first in the country.

The new financing also makes Trendyol Turkey’s first decacorn, and among the highest-valued private tech companies in Europe. It comes just months after strategic — and majority — backer Alibaba invested $350 million in the company at a $9.4 billion valuation.

Founded in 2010, Trendyol ranks as Turkey’s largest e-commerce company, serving more than 30 million shoppers and delivering more than 1 million packages per day. It claims to have evolved from marketplace to “superapp” by combining its marketplace platform (which is powered by Trendyol Express, its own last-mile delivery solution) with instant grocery and food delivery through its own courier network (Trendyol Go), its digital wallet (Trendyol Pay), consumer-to-consumer channel (Dolap) and other services.

Image Credits: Founder Demet Mutlu / Trendyol

Trendyol founder Demet Suzan Mutlu said the new capital will go toward expansion within Turkey and globally. Specifically, the company plans to continue investing in nationwide infrastructure, technology and logistics and toward accelerating digitalization of Turkish SMEs. She said the company was founded to create positive impact and that it intends to continue on that mission.

Evren Ucok, Trendyol’s chairman, added that part of the company’s goal is to create new export channels for Turkish merchants and manufacturers.

Melis Kahya Akar, managing director and head of consumer for EMEA at General Atlantic, said that Trendyol’s marketplace model — ranging from grocery delivery to mobile wallets — “brings convenience and ease to consumers” in Turkey and internationally.

“Turkey is one of the fastest growing economies in the world and benefits from attractive demographics, with a young population that is very active online,” wrote General Atlantic’s Kahya Akar via e-mail. “We expect its already sizable e-commerce market –$17 billion in 2020 – to continue to grow meaningfully on the back of growing online penetration. We think Trendyol is ideally positioned to meet the needs of consumers in Turkey and around the world as the company expands.”

A 2020 report by JPMorgan found that e-commerce represented only 5.3% of the overall Turkish retail market at the time but that Turkish e-commerce had notched impressive leaps in revenues in recent years: 2018 alone saw the market jump by 42%, followed by 31% in 2019. As of 2020, 67% of the Turkish population were making purchases online.

Powered by WPeMatico

We’ve all been there. (Or at least I have.)

You’re getting ready to vacate a property you’ve rented, only to be told by the landlord that you won’t be getting your security deposit back.

This happened to me the first time I ever rented a place in the late 90s. I was shocked, but more than anything, I was angry at the injustice because I knew that what the landlord claimed was not true. It was her word against mine and my roommate’s. Still, we took her to small claims court, not so much over the $800 she was trying to keep but more to prove her wrong. In the end, we won.

But it was a lot of work, and a lot of time spent. If only there was some kind of technology available to have helped us make our case.

Well, today there is. RentCheck, a startup that is out to help solve the “he said, she said” challenge in these situations with an automated property inspection platform, has recently raised $2.6 million in seed money.

Lydia Winkler and Marco Nelson started the company in mid-2019 after Winkler experienced a similar situation to mine and ended up suing her landlord in small claims court. She was working on getting her JD/MBA at Tulane University at the time.

“It was an injustice for me not to pursue it,” she told TechCrunch. “I took meticulous photos of the move-out condition of my apartment. The process took 18 months. But not everyone has the time or knowledge to fight in court.”

She then met Nelson, who had bought several properties that he ended up renting out. He had issues with security deposits too, but the opposite ones. He had to settle disputes over deposits, and found himself documenting properties’ condition at the time of move-out.

“I met Lydia and we realized we were passionate about the same problem,” Nelson recalled.

And so New Orleans-based RentCheck was born.

Image Credits: RentCheck; Co-founders Marco Nelson and Lydia Winkler

There are an estimated 48 million rental units in the U.S., with an average deposit of $1,000.

“A good chunk of that is being fought after on aggregate,” Winkler said. “And so many need that money to put down a deposit on another unit.”

To address the problem, RentCheck built a web app for property managers that they believe also benefits tenants. The company’s digital platform works by providing a way for property managers to facilitate and conduct remote, guided property inspections. For obvious reasons, the company saw increased demand upon the onset of the COVID-19 pandemic, considering that the platform was automated and contactless. It saw 1,000% — mostly organic — growth in terms of the number of properties on the platform.

“What we do is, using a guided inspection process, prompt users and guide them room by room, telling them exactly what to take photos of so that floors, ceilings, windows and walls are all accounted for,” Winkler said.

Everything is done within the app so that users can’t upload photos that were previously on their camera roll “to ensure the integrity of the inspection” and that everything is time stamped. Once the inspection is complete, whoever does it signs off on it that they completed it accurately and honestly. Then the property manager can also sign off on it so both parties can agree on the move-out condition.

The company operates as a SaaS business, and charges property management companies a subscription fee based on the number of properties that they have on the RentCheck platform. They can then conduct “as many inspections as they want,” Nelson says, “whether the residents are doing them, their internal teams are doing them, or a third-party vendor, or a hybrid of the three.”

Image Credits: RentCheck/Bryce Ell Photography

The startup has attracted some large-name investors since its inception, first catching the attention of James “Jim” Coulter, the founder of TPG Capital, when the company won New Orleans Entrepreneurship Week. Coulter subsequently became one of the company’s first investors in its $1 million pre-seed round.

The company’s seed round included participation from Cox Enterprises, for its operations in the multifamily housing space, and angels such as Jim Payne, who previously sold MoPub to Twitter, and MAX to AppLovin; Ken Goldman, the former CFO of Yahoo, and who currently runs Hillspire, Eric and Wendy Schmidt’s family office; Mark Zaleski and John Kuolt of BCG Digital Ventures, and Brian Long, the founder of Attentive, who previously sold TapCommerce to Twitter. It also included institutional investors such as Irongrey, Context Ventures and Techstars.

“What we love about RentCheck is that it’s using very clever technology to automate and solve arguably the industry’s biggest problem in terms of money and time for both property managers and tenants,” said Kuolt, former managing director at BCG Digital Ventures and an early RentCheck investor. “The deposit deduction issue needs a technology-based solution, and almost everyone, at some time, has felt like they’ve been screwed over on their deposit by a landlord. When you see and use RentCheck’s solution, it makes you think: ‘Why didn’t I think of this?’ ”

Powered by WPeMatico

The Chinese government’s crackdown on its domestic technology industry continues, with Tencent under fresh pressure despite the company’s efforts to follow changing regulatory expectations.

News broke over the weekend that Beijing filed a civil suit against Tencent “over claims its messaging-app WeChat’s Youth Mode does not comply with laws protecting minors,” per the BBC. And NetEase, a major Chinese technology company, will delay the IPO of its music arm in Hong Kong. Why? Uncertain regulations, per Reuters.

The Exchange explores startups, markets and money.

Read it every morning on Extra Crunch or get The Exchange newsletter every Saturday.

The latest spate of bad news for China’s technology industry follows a raft of regulatory changes and actions by the nation’s government that have deleted an enormous quantity of equity value. After a period of relatively light-touch regulatory oversight, domestic Chinese technology companies have found themselves on defense after the Chinese Communist Party (CCP) came after their market power in antitrust terms — and some of their business operations from other perspectives. Sectors hit the hardest include fintech and edtech.

Gaming is also in the CCP crosshairs.

After state media criticized the gaming industry as providing the digital equivalent of drugs to the nation’s youth last week, shares of companies like Tencent and NetEase fell. Tencent owns Riot Games, makers of the popular League of Legends title. NetEase generated $2.3 billion in gaming revenue out of total revenues of $3.1 billion in its most recent quarter.

After state media criticized the gaming industry as providing the digital equivalent of drugs to the nation’s youth last week, shares of companies like Tencent and NetEase fell. Tencent owns Riot Games, makers of the popular League of Legends title. NetEase generated $2.3 billion in gaming revenue out of total revenues of $3.1 billion in its most recent quarter.

NetEase stock traded around $110 per share in late July. It’s now worth around $90 per share after expectations shifted in light of the gaming news, indicating that investors are concerned about its future performance. Tencent’s Hong Kong-listed stock has also fallen, from HK$775.50 to HK$461.60 this morning.

Tencent tried to head off regulatory pressure, announcing changes to how it controls access to its games after the government’s shot across the bow. The effort doesn’t appear to have worked. That Tencent is being sued by the government despite its publicly announced changes implies that its proposed curbs to youth gaming were either insufficient or perhaps moot from the beginning.

Powered by WPeMatico