Fundings & Exits

Auto Added by WPeMatico

Auto Added by WPeMatico

Update: Trading of Robinhood shares has been halted due to volatility. The company’s stock paused at $65.60 on Robinhood itself. Yahoo Finance has a higher $77.03 price on the company’s equity, up a stunning 64.59% today. Things are fluid, but Robinhood may have been halted and then rose again when it resumed trading. Stonks indeed.

Shares of Robinhood, an investing-focused consumer fintech company, soared this morning in premarket trading. The stonk phenomenon, which helped propel minor companies like GameStop and AMC earlier this year, appears to be impacting Robinhood’s own stock; that much GameStop and AMC trading took place on Robinhood’s platform during stonk-fever is irony not lost on this publication.

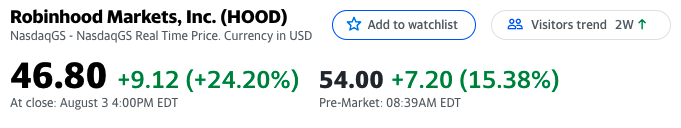

Here’s what things look like this morning, per Yahoo Finance:

Recall that Robinhood went public at $38 per share, the low end of its range, and sank in its early trading sessions to below its IPO price. Now, it’s worth $54 per share.

Cool.

Normally we’d crack a joke and close this small news item here, but with Robinhood’s IPO featuring a unique twist on the traditional public offering, we have to do a bit more work. When it went public, Robinhood reserved a chunk of its equity for purchase by its own users. The impact of this was that more retail investors likely owned Robinhood equity at the start of its trading life than would be normal with a traditional IPO.

One hypothesis regarding Robinhood’s somewhat slack early trading performance was that early retail demand for its shares was sated by its effort to allow its users to buy stock in its shares, leading to a less-skewed supply/demand curve when it debuted.

Things have changed. What’s going on? Last week, an analyst put a $65 per share price target on the stock. And there are a handful of other ratings to chew on. But the wild swing in the price of Robinhood today appears from our vantage point to be another stonk moment. The stock is being traded like a short-squeeze, even if some market participants are skeptical of the idea due to what they view as a limited short interest in the company.

Checking the Robinhood IR page, there’s no news. Robinhood did not recently report earnings. And the company’s recent 606 filings that deal with PFOF incomes seemed to match up with expectations in revenue terms regarding what the company detailed in its Q2 2021 flash numbers. Perhaps there was more crypto in there than expected, but nothing truly wild.

It appears that Robinhood is simply going up because it is. This happens in 2021; we just have to get used to it.

But what matters most for our purposes is that Robinhood’s decision to sell some IPO stock to its users did not manage to create so much float for the now-public unicorn to diminish weird trading. You can go public in an unusual manner and still catch a stonk wave. Now we know.

Powered by WPeMatico

British venture capital firm Draper Esprit recently moved its listing from the AIM to the main board in London, the LSE. The investing group also moved its secondary listing from Dublin’s Euronext Growth Market to its larger sister exchange, Euronext Dublin, which makes sense given its long connection to Irish capital.

Draper has always felt like something of an anomaly from our perspective, a generalist venture capital firm that was itself public. But this July, Forward Partners listed its shares on the AIM, and there are other venture firms in Europe that are also listed.

At first blush, the setup may seem odd; venture capital firms invest in companies that they hope to see go public one day — why would they float themselves? But Draper Esprit co-founder Stuart Chapman told TechCrunch in an interview that he finds it shocking “that venture capital backs some of the most mind-blowing tech advances in our history over the last 70 years, using the same legal structure as a 1958 property vehicle in New York.” It’s a reasonable point.

Perhaps fundraising success is part of why the venture model has not seen much disruption in recent decades, apart from rising fund sizes. But the model is not perfect. It can foist artificial time constraints on investors and force them to focus their deal flow into particular stages for fund-construction reasons. As we found out researching this piece, the public venture model highlights some of these limitations — and may be able to alleviate them in part.

The Exchange explores startups, markets and money.

Read it every morning on Extra Crunch or get The Exchange newsletter every Saturday.

And yet we can’t come up with a single U.S. venture capital firm, for example, that has publicly listed in the same manner as Draper Esprit or Forward Partners.

To better understand why we’re seeing European VCs float, and not their peers in other markets, The Exchange reached out to Draper Esprit, Forward Partners, and fellow listed venture investors Mercia and Augmentum Fintech. From the group, we’ve learned that there are plenty of reasons why the model may be popular in the U.K. and not in the U.S.

But there are also reasons why being a public venture capitalist can make the VC game a rather different, longer-term effort. The firms in question did not go public on a whim.

So let’s talk about the good, the bad, and the regulatory concerning publicly listed venture capital firms. The future? Or just a regional quirk?

Following its move, Draper Esprit is now the largest “purely tech VC” listed on London’s Main Market. Its initial listing had also been a market milestone: “Listing Draper Esprit five years ago was a radical and unusual step for a venture capital business,” Chapman said of Draper’s 2016 dual-listing on London’s AIM and Dublin’s Enterprise Securities Market (ESM) — now Euronext Growth.

Just last month, two tech-related investment funds IPO’d on the London Stock Exchange: space-focused Seraphim Capital and Nic Brisbourne’s Forward Partners. In both cases, Draper Esprit was happy to assist with information, Chapman told us, adding that the firm also invested in Forward via its fund-of-funds effort.

The news adds up to a roster of listed investors that also includes fintech fund Augmentum Fintech, asset manager Mercia Asset Management PLC and intellectual property commercialization company IP Group. “We’re supportive of others following in our footsteps and we will be big fans of having much wider diversity,” Chapman told TechCrunch in an interview, which you can read in full here.

Having recently joined the club, Forward Partners’ founder and CEO Nic Brisbourne gave us a good overview of the three high-level reasons that could lead a fund to list: open opportunities to create more value from new initiatives that sit outside traditional investment capital; breaking the cycle of fundraising; and opening access to the early-stage venture capital asset class. Let’s take a closer look.

Powered by WPeMatico

Marvell announced this morning it has reached an agreement to acquire Innovium for $1.1 billion in an all-stock deal. The startup, which raised over $400 million according to Crunchbase data, makes networking ethernet switches optimized for the cloud.

Marvell president and CEO Matt Murphy sees Innovium as a complementary piece to the $10 billion Inphi acquisition last year, giving the company, which makes copper-based chips, more ways to work across modern cloud data centers.

“Innovium has established itself as a strong cloud data center merchant switch silicon provider with a proven platform, and we look forward to working with their talented team who have a strong track record in the industry for delivering multiple generations of highly successful products,” Marvell CEO Matt Murphy said in a statement.

Innovium founder and CEO Rajiv Khemani, who will remain as an advisor post-close, told a familiar tale from a startup CEO being acquired, seeing the sale as a way to accelerate more quickly as part of a larger organization than it could on its own. “As we engaged with Marvell, it became clear that our data center optimized portfolio combined with Marvell’s scale, leading technology platform and complementary portfolio, can accelerate our growth and vision of delivering breakthrough switch silicon for the cloud and edge,” he wrote in a company blog post announcing the deal.

The company, which was founded in 2014, raised more than $143 million last year on a post-money valuation of $1.3 billion, according to PitchBook data. The question is, was this a reasonable deal for the company given that valuation?

No company wants to sell for less than it was last valued by its investors. In some cases, such deals can still be accretive for early backers of the selling concern, but not always. In this case TechCrunch is not privy to all the details of the Innovium cap table and what its later investors may have built into their deals with the company in the form of downside protection; such measures can tilt the value of the sale of a company more toward its later and final investors. This is usually managed at the expense of its earlier backers and employees.

Still, the Innovium deal should not be seen as a failure. Building a company that sells for north of $1 billion in equity value is impressive. The deal appears to be slightly smaller in enterprise value terms. In the business world, enterprise value is a useful method of valuing the true cost of an acquisition. In the case of Innovium, a large cash position, what was described as “Innovium cash and exercise proceeds expected at closing of approximately $145 million,” lowered the cost of the transaction to a more modest $955 million in net outlays.

Our general perspective is that the sale is probably not the outcome that Innovium’s backers had hoped for, but that it may still prove lucrative to early workers and early investors, and still works at that lower figure. It’s also notable how in today’s market of mega-rounds and surfeit unicorns, an exit north of the $1 billion mark in equity terms can be viewed as a disappointment in any terms. Innovium is selling for around the price that Facebook paid for Instagram in 2012, a deal that at the time was so large that it dominated technology headlines around the world.

But with so much capital available today, private valuations are soaring and mega deals abound. And recent rounds north of $100 million, much like Innovium’s 2020-era, $143 million round, can set companies up with rich valuations and a narrow path in front of them to beat those heightened expectations.

What likely happened? Perhaps Innovium found itself with more cash than opportunities to spend it; perhaps it simply needed a large partner to help it better sell into its market. With expected revenues of $150 million in Marvell’s fiscal 2023, its next fiscal period, Innovium did not fail to reach scale. It may have simply grown well as a private, independent company, and stalled out after its last round.

Regardless, a billion-dollar exit is a billion-dollar exit. The deal is expected to close by the end of this year. While both company boards have approved the deal, it still must clear regular closing hurdles, including approval by Innovium’s private stock holders.

Powered by WPeMatico

In “Macbeth,” Shakespeare described sleep as the “chief nourisher in life’s feast.” But like his titular character, many adults aren’t sleeping well. Revery wants to help with an app that combines cognitive behavioral therapy (CBT) for insomnia with mobile gaming concepts.

Founded in March 2021, Revery is currently in beta stealth mode and plans to launch its app in the United States later this year. The company announced today it has raised $2 million, led by Sequoia Capital India’s Surge program. Participants included GGV Capital, Pascal Capital, zVentures (Razer’s corporate venture arm) and angel investors like MyFitnessPal co-founder Albert Lee; gaming entrepreneur Juha Paananen; CRED founder Kunal Shah; Mobile Premier League founder Sai Srinivas; Carolin Krenzer; and Josh Lee.

Lee, a mutual friend, first introduced Revery’s founders, Tammie Siew and Khoa Tran, to one another. Before launching the startup, Siew worked at Sequoia Capital India, Boston Consulting Group and CRED, while Tran was a former product manager at Google.

Revery plans to focus on other mental health issues in the future, but it’s starting with sleep because “it has such a strong correlation with mental health and we’re leveraging protocols, cognitive behavioral therapy for insomnia, that’s robust and have been tried and tested for 30 years,” Siew told TechCrunch. “That is the first indication, but the goal is to build multiple games for other wellness indications as well.”

A study by research firm Infinium found that about 30% to 45% of adults in the world experience insomnia, a problem exacerbated by the COVID-19 pandemic. Chronic lack of sleep is linked to a host of health issues, including high blood pressure, strokes, depression and lowered immunity.

For Revery’s team, which also includes former Zynga and King lead game designer Kriti Sawa and software engineer Stephanie Wong, their focus on sleep is personal.

“Everyone on our team has a deeply personal connection to the mission, because everyone on our team has experienced, or had a family member or friends go through challenges in mental health,” said Siew. “They’ve seen how late intervention creates consequences that could have been avoided if they had gotten help earlier.”

When Tran was 15, he was diagnosed with hypertension and several other health conditions that needed medication. It wasn’t until he was 26 that Tran found out that sleep apnea was at the root of his medical issues. After getting surgery, Tran’s blood pressure became normal and many of his other conditions also improved.

“When I finally got treatment for my sleep disorder, only then did I realize the impact of sleep on mental health,” Tran said. “For me, I was really lucky that a doctor caught my sleep disorder and super lucky to have the time and resources to get treatment. For many people, it’s incredibly inaccessible.”

Revery’s medical advisory team includes the doctor who performed Tran’s surgery, Stanford Sleep Surgery Fellowship director Dr. Stanley Liu; Stanford professor and behavioral sleep medicine expert Dr. Fiona Barwick; and Dr. Ryan Kelly, a clinical psychologist who researches how video games can be used in therapy.

When people think of sleeping apps, ones that focus on meditation (Calm and Headspace, for example) or soothing noises usually come to mind. The Revery team isn’t sharing a lot of details about its app before launch, but says it draws from casual mobile games, which are designed to get people to return for short play sessions over a long period of time. The goal is to use gamification to make CBT practices interactive and fun, so it becomes part of users’ daily routines.

“That’s the same kind of gameplay that Zynga and King have used, which is why Kriti’s experience is super helpful,” said Siew. Casual games revolve around rewarding people for small actions, and for the Revery app, that means positive reinforcement for habits that contribute to better sleep. For example, it will reward people for putting down their phones.

“I think a lot of people have the misconception that solving sleep is only at the time you fall asleep. They don’t realize that sleep is impacted by what you do throughout the day,” Siew said. “A big part is also what are your thoughts, behavior and the other things that you do, so in order to effectively and sustainably improve sleep, we also have to change your thoughts and behaviors outside of the time you’re trying to fall asleep.”

In a statement, GGV Capital managing director Jenny Lee said, “We are excited about the growing mental wellness market, and believe that Revery’s unique mobile game-based approach has the opportunity to create immense impact. We are happy to back such a mission-driven team in this space.”

Powered by WPeMatico

Swiss alternative protein company Planted has raised its second round of the year, a CHF 19 million (about $21 million at present) “pre-B” fundraise that will help it continue its growth and debut new products. A U.S. launch is in the cards eventually, but for now Planted’s exclusively European customers will be able to give its new veggie schnitzel a shot.

Planted appeared in 2019 as a spinoff from Swiss research university ETH Zurich, where the founders developed the original technique of extruding plant proteins and water into fibrous structures similar to real meat’s. Since then the company has diversified its protein sources, adding oat and sunflower to the mix, and developed pulled pork and kebab alternative products as well.

Over time the process has improved as well. “We added fermentation/biotech technologies to enhance taste and texture,” wrote CEO and co-founder Christoph Jenny in an email to TechCrunch. “Meaning 1) we can create structures without form limitation and 2) can add a broader taste profile.”

The latest advance is schnitzel, which is of course a breaded and fried piece of pounded-thin meat style popular around the world, but especially in the company’s core markets of Germany, Austria and Switzerland. Jenny noted that Planted’s schnitzel is produced as one piece, not pressed together from smaller bits. “The taste and texture benefit from fermentation approach, that makes the flavor profile mouth watering and the texture super juicy,” he said, though of course we will have to test it to be sure. Expect schnitzel to debut in Q3.

It’s the first of several planned “whole” or “prime” cuts, larger pieces that can be prepared like any other piece of meat — the team says their products require no special preparation or additives and can be dropped in as 1:1 replacements in most recipes. Right now the big cuts are leaving the lab and entering consumer testing for taste tuning and eventually scaling.

The funding round came from “Vorwerk Ventures, Gullspång Re:food, Movendo Capital, Good Seed Ventures, Joyance, ACE & Company (SFG strategy) and Be8 Ventures,” and was described as a follow-on to March’s CHF 17M series A. No doubt the exploding demand for alternative proteins and growing competition in the space has spurred Planted’s investors to opt for more aggressive growth and development strategies.

The company plans to enter several new markets over Q3 and Q4, but the U.S. is still a question mark due to COVID-19 restrictions on travel. Jenny said they are preparing so that they can make that move whenever it becomes possible, but for now Planted is focused on the European market.

(Update: This article originally misstated the new round as also being CHF 17M — entirely my mistake. This has been corrected.)

Powered by WPeMatico

MGA Thermal wants to help utility companies transition from fossil fuels to renewable energy sources with shoebox-sized thermal energy storage blocks. The company says a stack of 1,000 blocks is about the size of a small car and can store enough energy to power 27 homes for 24 hours. This gives utility providers the ability to store large amounts of energy and have it ready to dispatch even when weather conditions aren’t ideal for generating solar or wind power. The modular blocks also make it easier to convert infrastructure, like coal-fired power plants, into grid-scale energy storage.

MGA Thermal announced today it has raised $8 million AUD (about $5.9 million USD), bring its total funding so far to $9 million AUD. The round was led by Main Sequence, a venture firm founded by Australia’s national science agency that recently launched a new $250 million AUD fund. Alberts Impact Capital, New Zealand’s Climate Venture Capital Fund, The Melt and returning investor CP Ventures participated, along with angel investors like Chris Sang, Emlyn Scott and Glenn Butcher.

Based in Newcastle, Australia, MGA Thermal was founded in April 2019 by Erich Kisi and Alexander Post after nearly a decade spent researching and developing miscibility gap alloys technology at the University of Newcastle. When asked to explain MGA tech in layperson’s terms, Kisi used a delicious analogy.

MGA Thermal’s blocks “essentially comprise metal particles that melt when heated embedded in an inert matrix material. Think of a block as being like a choc-chip muffin heated in a microwave. The muffin consists of a cake component, which holds everything in shape when heated, and the choc chips, which melt,” he told TechCrunch.

“The energy that goes into melting the choc chips is stored and can burn your mouth when you bite into the muffin,” he added. “Melting energy is more intense than merely heating something up and that melting energy is concentrated near the melting temperature so energy can be released in a consistent way.”

Energy stored in MGA Thermal’s blocks can be used to heat water to power steam turbines and generators. In this scenario, blocks are designed with internal tubing for pumping and boiling water, or interact with a heat exchanger. Kisi said MGA Thermal’s blocks enable aging thermal power plans to continue running on renewable energy that would usually be switched off in situations like overheating caused by too much sun or high winds.

Other thermal energy solutions include heating low-cost solid materials in blocks or granules to high temperatures in an insulated container. But many of these materials aren’t good at moving thermal energy around and have temperature limitations, Kisi said. This means thermal energy decreases in temperature as it is discharged, making it less effective.

Another method for storing thermal energy involves molten salts that are heated by a renewable energy source and stored in a hot tank. The hot salt is then pumped through a heat exchanger to make steam, while colder (but still molten) salt is returned to a “cold” tank.

“These systems are widely used in concentrating solar thermal energy but have found little use elsewhere,” Kisi said. “That’s mostly because there is a large infrastructure cost for piping pumps and heaters, and a large amount of power is wasted keeping the salt from freezing.”

MGA Thermal is establishing a manufacturing plant in New South Wales to scale to commercial levels production of its blocks, and plans to double its team over the next 12 months so it can make hundreds of thousands of blocks each month. It is also currently working with partners like Swiss company E2S Power ASG and U.S.-based Peregrine Turbine Technologies to deploy its tech in Australia, Europe and North America. For example, E2S Power AG will use MGA Thermal’s tech to repurpose retired and active coal-fired thermal plants in Europe.

While MGA Thermal’s tech has many industrial use cases, like converting power stations, building off-grid storage and supplying power to remote communities and commercial spaces, it can also help consumers consume less fossil fuel. For example, MGA blocks can be used by households to store excess energy generated from rooftop solar panels or small wind turbines. Then that energy can be used to heat homes.

“Around the world an estimated three billion people heat their homes by burning fuel,” said Kisi. “That’s a lot of CO2, especially in very cold climates.”

In a statement, Main Sequence partner Martin Duursma said, “A core focus of our new fund is uncovering the scientific discoveries, and helping to turn them into real, tangible technologies so we can reverse our climate impact. Erich Kisi and Alexander Post’s impressive deep research backgrounds, their expert team and innovative technology are paving the way for grid-scale energy storage and boosting the capability of a renewable energy future globally.”

Powered by WPeMatico

Over the last couple of years, robotic process automation or RPA has been red hot with tons of investor activity and M&A from companies like SAP, IBM and ServiceNow. UIPath had a major IPO in April and has a market cap over $30 billion. I wondered when Salesforce would get involved and today the company dipped its toe into the RPA pool, announcing its intent to buy German RPA company Servicetrace.

Salesforce intends to make Servicetrace part of Mulesoft, the company it bought in 2018 for $6.5 billion. The companies aren’t divulging the purchase price, suggesting it’s a much smaller deal. When Servicetrace is in the fold, it should fit in well with Mulesoft’s API integration, helping to add an automation layer to Mulesoft’s tool kit.

“With the addition of Servicetrace, MuleSoft will be able to deliver a leading unified integration, API management and RPA platform, which will further enrich the Salesforce Customer 360 — empowering organizations to deliver connected experiences from anywhere. The new RPA capabilities will enhance Salesforce’s Einstein Automate solution, enabling end-to-end workflow automation across any system for service, sales, industries, and more,” Mulesoft CEO Brent Hayward wrote in a blog post announcing the deal.

While Einstein, Salesforce’s artificial intelligence layer, gives companies with more modern tooling the ability to automate certain tasks, RPA is suited to more legacy operations, and this acquisition could be another step in helping Salesforce bridge the gap between older on-prem tools and more modern cloud software.

Brent Leary, founder and principal analyst at CRM Essentials says that it brings another dimension to Salesforce’s digital transformation tools. “It didn’t take Salesforce long to move to the next acquisition after closing their biggest purchase with Slack. But automation of processes and workflows fueled by real-time data coming from a growing variety of sources is becoming a key to finding success with digital transformation. And this adds a critical piece to that puzzle for Salesforce/MuleSoft,” he said.

While it feels like Salesforce is joining the market late, in an investor survey we published in May, Laela Sturdy, general partner at CapitalG, told us that we are just skimming the surface so far when it comes to RPA’s potential.

“We’re a long way from needing to think about the space maturing. In fact, RPA adoption is still in its early infancy when you consider its immense potential. Most companies are only now just beginning to explore the numerous use cases that exist across industries. The more enterprises dip their toes into RPA, the more use cases they envision,” Sturdy responded in the survey.

Servicetrace was founded in 2004, long before the notion of RPA even existed. Neither Crunchbase nor PitchBook shows any money raised, but the website suggests a mature company with a rich product set. Customers include Fujitsu, Siemens, Merck and Deutsche Telekom.

Powered by WPeMatico

Shares of Square are up this morning after the company announced its second-quarter earnings and that it will buy Afterpay, an Australian buy now, pay later (BNPL) player in a $29 billion deal. As TechCrunch reported this morning, Afterpay shareholders will receive 0.375 shares of Square in exchange for their existing equity.

Shares of Afterpay are sharply higher after the deal was announced thanks to its implied premium, while shares of Square are up 7% in early-morning trading.

The Exchange explores startups, markets and money.

Read it every morning on Extra Crunch or get The Exchange newsletter every Saturday.

Over the past year, we’ve written extensively about the BNPL market, usually from the perspective of earnings from companies in the space. Afterpay has been a key data source, along with the yet-private Klarna and U.S. public BNPL outfit Affirm. Recall that each company has posted strong growth in recent periods, with the United States arising as a prime competitive market.

Most recently, consumer hardware and services giant Apple is reportedly preparing a move into the BNPL space. Our read at the time was that any such movement by Cupertino would impact mass-market BNPL players more than niche-focused companies. Apple has a fintech base and broad IRL payment acceptance, making it a potentially strong competitor for BNPL services aimed at consumers; BNPL services targeted at particular industries or niches would likely see less competition from Apple.

Most recently, consumer hardware and services giant Apple is reportedly preparing a move into the BNPL space. Our read at the time was that any such movement by Cupertino would impact mass-market BNPL players more than niche-focused companies. Apple has a fintech base and broad IRL payment acceptance, making it a potentially strong competitor for BNPL services aimed at consumers; BNPL services targeted at particular industries or niches would likely see less competition from Apple.

From that landscape, let’s explore the Square-Afterpay deal. We want to know what Afterpay brings to Square in terms of revenue, growth and reach. We also want to do some math on the price Square is willing to pay for the company — and what that might tell us about the value of BNPL and fintech revenues more broadly. Then we’ll eyeball the numbers and try to decide if Square is overpaying for Afterpay.

As with most major deals these days, Square and Afterpay released an investor presentation detailing their argument in favor of their combination. Let’s dig through it.

Square is a two-part company. It has a large consumer business via Cash App, and it has a large business division that offers payments tech and other fintech services to corporate customers. Recall that Square is also building out banking services for its business customers and that Cash App also serves some banking and investing functionality for consumers.

Powered by WPeMatico

Duolingo landed onto the public markets this week, rallying excitement and attention for the edtech sector and its founder cohort. The language learning business’ stock price soared when it began to trade, even after the unicorn raised its IPO price range, and priced above the raised interval.

Duolingo’s IPO proves that public market investors can see the long-term value in a mission-driven, technology-powered education concern; the company’s IPO carries extra weight considering the historically few edtech companies that have listed.

Duolingo’s IPO proves that public market investors can see the long-term value in a mission-driven, technology-powered education concern; the company’s IPO carries extra weight considering the historically few edtech companies that have listed.

For those that want the entire story of Duolingo, from origin to messy monetization to historical IPO, check out our EC-1. It has dozens of interviews from executives, investors, linguists and competitors.

For today, though, we have fresh additions. We sat down with Duolingo CEO Luis von Ahn earlier in the week to discuss not only his company’s IPO, but also what impact the listing may have on startups. Duolingo’s IPO can be looked at as a case study into consumer startups, mission-driven companies that monetize a small base of users, or education companies that recently hit scale. Paraphrasing from von Ahn, Duolingo doesn’t see itself as just an edtech company with fresh branding. Instead, it believes its growth comes from being an engineering-first startup.

Selling motivation, it seems, versus selling the fluency in a language is a proposition that international consumers are willing to pay for, and an idea that investors think can continue to scale to software-like margins.

Duolingo has gone through three distinct phases: Growth, in which it prioritized getting as many users as it could to its app; monetization, in which it introduced a subscription tier for survival; and now, education, in which it is focusing on tacking on more sophisticated, smarter technology to its service.

Powered by WPeMatico

Robinhood priced at $38 per share this week, opened flat and closed its first day’s trading yesterday worth $34.82 per share, or a bit more than 8% underwater. The company posted a mixed picture today, falling early before recovering to breakeven in late-morning trading.

It wasn’t the debut that some expected Robinhood to have.

The Exchange explores startups, markets and money.

Read it every morning on Extra Crunch or get The Exchange newsletter every Saturday.

To close out the week, we’re not going to noodle on banned Chinese IPOs or do a full-week mega-round discussion. Instead, let’s parse some notes from a chat The Exchange had with Robinhood’s CFO about his company’s IPO and go over a few reasonable guesses as to why we’re not wondering how much money Robinhood left on the table by pricing its public offering lower than it closed on its first day.

Let’s not be dicks about it. The time for Twitter jokes was yesterday. We’ll put our thinking caps on this morning.

Let’s not be dicks about it. The time for Twitter jokes was yesterday. We’ll put our thinking caps on this morning.

Chatting with Robinhood CFO Jason Warnick earlier this week, we wanted to know why this was the right time for Robinhood to go public.

Now, no public company CEO or CFO will come out and directly say that they are going public because they think that they can defend — or extend — their most recent private valuation thanks to current market conditions.

Instead, execs on IPO day tend to deflect the question, pivoting to a well-oiled bon mot about how their public offering is a mere milestone on their company’s long-term trajectory. For some reason in our capitalist society, during an arch-capitalist event, by a for-profit company, leaders find it critical to downplay their IPO’s importance.1

With that in mind, Warnick did not say Robinhood went public because the IPO market has recently rewarded big-brand consumer tech companies like Airbnb and DoorDash with strong debuts. And he didn’t say that with tech shares near all-time highs and a taste for high-growth concerns, the company was likely set to enter a market that would be willing to price it at a valuation that it found attractive.

Powered by WPeMatico