Fundings & Exits

Auto Added by WPeMatico

Auto Added by WPeMatico

Chilean startup Xepelin, which has created a financial services platform for SMEs in Latin America, has secured $30 million in equity and $200 million in credit facilities.

LatAm venture fund Kaszek Ventures led the equity portion of the financing, which also included participation from partners of DST Global and a slew of other firms and founders/angel investors. LatAm- and U.S.-based asset managers and hedge funds — including Chilean pension funds — provided the credit facilities. In total over its lifetime, Xepelin has raised over $36 million in equity and $250 million in asset-backed facilities.

Also participating in the round were Picus Capital; Kayak Ventures; Cathay Innovation; MSA Capital; Amarena; FJ Labs; Gilgamesh Ventures. A group of angels also participated in the financing, including Kavak founder and CEO Carlos Garcia; Jackie Reses, executive chairman of Square Financial Services; Justo founder and CEO Ricardo Weder; Tiger Global Management Partner John Curtius; GGV’s Hans Tung; and Gerry Giacoman, founder and CEO of Clara, among others.

Nicolás de Camino and Sebastian Kreis founded Xepelin in mid-2019 with the mission of changing the fact that “only 5% of companies in all LatAm countries have access to recurring financial services.”

“We want all SMEs in LatAm to have access to financial services and capital in a fair and efficient way,” the pair said.

Xepelin is built on a SaaS model designed to give SMEs a way to organize their financial information in real time. Embedded in its software is a way for companies to apply for short-term working capital loans “with just three clicks, and receive the capital in a matter of hours,” the company claimed.

It has developed an AI-driven underwriting engine, which the execs said gives it the ability to make real-time loan approval decisions.

“Any company in LatAm can onboard in just a few minutes and immediately access a free software that helps them organize their information in real time, including cash flow, revenue, sales, tax, bureau info — sort of a free CFO SaaS,” de Camino said. “The circle is virtuous: SMEs use Xepelin to improve their financial habits, obtain more efficient financing, pay their obligations, and collaborate effectively with clients and suppliers, generating relevant impacts in their industries.”

The fintech currently has over 4,000 clients in Chile and Mexico, which currently has a growth rate “four times faster” than when Xepelin started in Chile. Over the past 22 months, it has loaned more than $400 million to SMBs in the two countries. It currently has a portfolio of active loans for $120 million and an asset-backed facility for more than $250 million.

Overall, the company has been seeing a growth rate of 30% per month, the founders said. It has 110 employees, up from 20 a year ago.

“When we talk about creating the largest digital bank for SMEs in LatAm, we are not saying that our goal is to create a bank; perhaps we will never ask for the license to have one, and to be honest, everything we do, we do it differently from the banks, something like a non-bank, a concept used today to exemplify focus,” the founders said.

Both de Camino and Kreis said they share a passion for making financial services more accessible to SMEs all across Latin America and have backgrounds rooted deep in different areas of finance.

“Our goal is to scale a platform that can solve the true pains of all SMEs in LatAm, all in one place that also connects them with their entire ecosystem, and above all, democratized in such a way that everyone can access it,” Kreis said, “regardless of whether you are a company that sells billions of dollars or just a thousand dollars, getting the same service and conditions.”

For now, the company is nearly exclusively focused on the B2B space, but in the future, it believes several of its services “will be very useful for all SMEs and companies in LatAm.”

“Xepelin has developed technology and data science engines to deliver financing to SMBs in Latin America in a seamless way,” Nicolas Szekasy, co-founder and managing partner at Kaszek Ventures, said in a statement. “The team has deep experience in the sector and has proven a perfect fit of their user-friendly product with the needs of the market.”

Chile was home to another large funding earlier this week. NotCo, a food technology company making plant-based milk and meat replacements, closed on a $235 million Series D round that gives it a $1.5 billion valuation.

Powered by WPeMatico

Hello and welcome back to Equity, TechCrunch’s venture capital-focused podcast, where we unpack the numbers behind the headlines.

We were a smaller team this week, with Natasha and Alex joined by Grace and Chris to sort through a week that brought together both this quarter’s earnings cycle and the Q3 IPO rush. So, it was just a little busy!

Before we get to topics, however, a note that we are having a lot of fun recording these live on Twitter Spaces. We’ve found a hacky way to capture local audio and also share the chats live. So, hit us up on Twitter so you can hang out with us. It’s fun — and we may even bring you up on stage to play guest host.

OK, now, to the Great List of Subjects:

Powered by WPeMatico

INKR is a digital comics platform that crosses cultural and language divides, enabling creators to reach global audiences with its proprietary localization technology. Previously bootstrapped, the company announced today that it has raised $3.1 million in pre-Series A funding led by Monk’s Hill Ventures, with participation from manga distributor TokyoPop founder and chief executive Stu Levy and VI Management managing director David Do.

Headquartered in Singapore with an office in Ho Chi Minh City, INKR was founded in 2019 by Ken Luong, Khoa Nguyen and Hieu Tran. The company says that since it launched in October 2020, its monthly average users have grown 200%. It currently partners with more than 70 content creators and publishers, including FanFan, Image Comics, Kodansha USA, Kuaikan, Mr. Blue, SB Creative, TokyoPop and Toons Family, and has more than 800 titles so far, including manga, webtoons and graphic novels.

Luong, INKR’s CEO, told TechCrunch that the platform will focus first on translated comics from top global publishers, but plans to open to small and indie creators in 2022.

At the heart of INKR’s platform is its localization technology, which the company says reduces the time spent on preparing comics for different markets from days to just hours.

“Comics localization is more than just translation. It is a time-consuming process with many steps involving many people—file handling, transcription, translation, typesetting, sound effects, quality control, etc,” Luong said.

In addition to language, publishers also have to take into account the differences between comic styles around the world, including Japanese manga, Chinese manhua, Korean manhwa, American comics. For example, comics can be laid out page-by-page or use vertical scrolling. Some languages read from left to right, while others go from right to left.

Luong says INKR’s proprietary AI engine, called INKR Comics Vision, is able to recognize different formats and elements on a comic page, including text, dialogue, characters, facial expressions, backgrounds and panels. INKR Localize, its tool for human translators, helps them deliver accurate translations more quickly by automating tasks like text transcription, vocabulary suggestions and typesetting.

Since localization is performed by teams, including people in different locations, INKR provides them with browser-based collaboration software. The platform supports Japanese-English, Korean-English and Chinese-English translations, with plans to add more languages. Some publishers, like Kuaikan Manhua and Mr. Blue, have used INKR to translate thousands of comic chapters from Chinese and Korean into English.

INKR provides content creators with a choice of monetization models, including ad-supported, subscription fees or pay-per-chapter. Luong says the platform analyzes content to tell publishers which model will maximize their earnings, and shares a percentage of the revenue generated.

INKR is vying for attention with other digital comics platforms like Amazon-owned Comixology and Webtoon, the publishing portal operated by Naver Corporation.

Luong said INKR’s competitive advantages include the the diversity of comics is offers and the affordability of its pricing. Before launching, it also invested in data and AI-based technology for both readers and publishers. For example, users get personalized recommendation based on their reading activity, while publishers can access analytics to track title performance based on consumption trends.

In a statement, Monk’s Hill Ventures general partner Justin Nguyen said INKR’s “proprietary AI-driven platform is addressing pain points for creators and publishers who need to go digital and global—localizing for many languages quickly and cost-effectively while also helping them improve reach and readership through analytics and intelligent personalized feeds. We look forward to partnering with them to quench the huge demand for translated comics globally.”

Powered by WPeMatico

Among Silicon Valley circles, a fun parlor game is to ask to what extent world GDP levels are held back by a lack of computer science and technical training. How many startups could be built if hundreds of thousands or even millions more people could code and bring their entrepreneurial ideas to fruition? How many bureaucratic processes could be eliminated if developers were more latent in every business?

The answer, of course, is on the order of “a lot,” but the barriers to reaching this world remain formidable. Computer science is a challenging field, and despite proactive attempts by legislatures to add more coding skills into school curriculums, the reality is that the demand for software engineering vastly outstrips the supply available in the market.

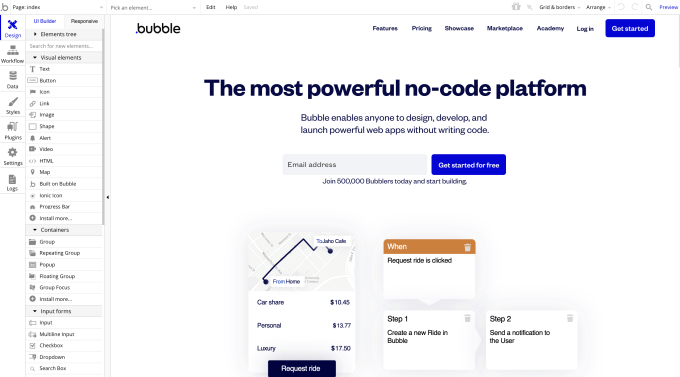

Coding is not a bubble, and Bubble wants to empower the democratization of software development and the creation of new startups. Through its platform, Bubble enables anyone — coder or not — to begin building modern web applications using a click-and-drag interface that can connect data sources and other software together in one fluid interface.

It’s a bold bet — and it’s just received a bold bet as well. Bubble announced today that Ryan Hinkle of Insight Partners has led a $100 million Series A round into the company. Hinkle, a longtime managing director at the firm, specializes in growth buyout deals as well as growth SaaS companies.

If that round size seems huge, it’s because Bubble has had a long history as a bootstrapped company before reaching its current scale. Co-founders Emmanuel Straschnov and Josh Haas spent seven years bootstrapping and tinkering with the product before securing a $6.5 million seed round in June 2019 led by SignalFire. Interestingly, according to Straschnov, Insight was the first venture firm to reach out to Bubble all the way back in 2014. Seven years on, the two have now signed and closed a deal.

Since the seed round, Bubble has been expanding its functionality. As a no-code tool, any missing feature could potentially block an application from being built. “In our business, it’s a features game,” Straschnov said. “[Our users] are not technical, but they have high standards.” He noted that the company introduced a plugins system that allows the Bubble community to build their own additions to the platform.

Image Credits: Bubble. Its editor offers a clickable interface for designing dynamic web applications.

As the platform matured, it happened to nail the timing of the COVID-19 pandemic last year, which saw people scrambling for new skills and improving their prospects amid a gloomy job market. Straschnov says that Bubble saw an immediate bump in usage in March and April 2020, and the company has tripled revenue over the past 12 months.

Bubble’s focus for the past eight years has been on helping people turn their ideas into startups. The company’s proposition is that a large number of even venture-backed companies could be built using Bubble without the expense of a large engineering team writing code from scratch.

Unlike other no-code tools, which focus on building internal corporate apps, Straschnov says that the company remains as focused today on these new companies as it has always been. “[We’re] not trying to move upmarket just yet — we are trying to do the same thing that AWS and Stripe did five years ago,” he said. Instead of trying to dominate the enterprise, Bubble wants to grow with its nascent customers as they expand in scale.

The company today charges a range of prices depending on the performance and scale requirements of an application. There’s a free tier, and then professional pricing starts at $25/month all the way to $475/month for its top-listed offering. Enterprise pricing is also available, as is special pricing for students.

On the latter point, Bubble is looking to invest heavily in education using its newly raised capital. While the platform is easy to use, the reality is that any design of a web application can be intimidating for a new user, particularly one who isn’t technical. So the company wants to create more videos and documentation while also heavily investing in partnerships with universities to get more students using the platform.

While the no-code space has seen prodigious investment, Straschnov said that “I don’t look at all the no-code players as competition … the true competition we have is code.” He noted that while the no-code label has been assumed by more and more startups, very few companies are focused on his company’s specific niche, and he believes he offers a compelling value proposition in that category.

The company has doubled headcount since the beginning of the pandemic, growing from around 21 employees to about 45 today. They are lightly concentrated in New York City, but the company operates remotely and has folks in 15 states as well as in France. Straschnov says that the company is looking to aggressively hire technical talent to build out the product using its new funds.

Powered by WPeMatico

U.S. edtech company Duolingo released a revised IPO price range this morning, boosting its potential per-share value to $100 after initially targeting a range that topped out at $95 per share.

Per the unicorn’s SEC filings, Duolingo is now targeting a $95 to $100 per share IPO price range, up from $85 to $95 per share, or a gain of around 12% at the bottom and 5% at the top.

TechCrunch previously called the Duolingo debut a bellwether of sorts for the larger U.S. edtech ecosystem; if Duolingo can price and trade well, investors in private companies may be more willing to invest, given a more proven and attractive exit market. On the other hand, if Duolingo prices weakly or trades poorly, the company could place a wet blanket atop the startup edtech world.

The fact that Duolingo is raising its IPO price range indicates that we are more likely on the path for a strong offering than a weak one.

For edtech companies that have hit unicorn status — like Masterclass, Course Hero, Quizlet and Outschool — it’s good news. For reference, those companies have raised $461.4 million, $97.4 million, $62 million and $130 million, respectively, per Crunchbase data.

The terms of the company’s IPO have not changed, aside from its proposed price. So, Duolingo is still selling 3.7 million shares in its debut, and some 1.41 million shares will be sold by existing equity holders. The company’s underwriters also reserved their right to buy 765,916 shares of the company’s stock at IPO price in the 30 days following its debut.

At the upper and lower bands of the company’s IPO price, its simple valuation excluding underwriter shares now lands between $3.41 billion and $3.59 billion. Inclusive of its greenshoe offering, those numbers rise to $3.48 billion and $3.67 billion.

Recall that when private, Duolingo’s November 2020 Series H valued the company at just over $2.4 billion. So long as Duolingo prices in its range, it will provide investors with a nice bump in the value of their investment. Duolingo was valued at just $1.6 billion in mid-2020, indicating that it has more than doubled in value since that investment.

Powered by WPeMatico

Despite the plentiful headlines about mega billion-dollar M&A transactions, record IPOs and the rapid growth of SPACs, small deals will continue to be the most likely exit for the vast majority of tech startups. In the over 30 years I’ve worked on M&A at White & Case, Barclays and my current firm Ascento Capital, I have seen too many startups that are not prepared for an exit via a merger or sale. This article will provide specific recommendations on how to prepare your startup for M&A.

While it is good to strive for a billion-dollar-plus sale, a successful IPO or a SPAC deal, it is practical to prepare your startup for a smaller transaction.

Global M&A hit record highs in the second quarter with a total deal value of $1.5 trillion, but smaller transactions vastly outnumber mega billion-dollar deals. The U.S. saw a total of 16,672 deals in the year ended June 31, but only 583, or 3% of that number, were valued at more than a billion dollars (FactSet). The IPO market is healthy again, but M&A still represents 88% of exits: So far this year, there were 503 IPOs and 5,203 deals, according to the CB Insights Q2 2021 State of Venture Report. After the SEC announced in early April that it was considering new guidance on SPAC IPOs, the rate of new SPAC issuances fell by around 90%.

While it is good to strive for a billion-dollar-plus sale, a successful IPO or a SPAC deal, it is practical to prepare your startup for a smaller transaction.

Here are a few recommendations that will prepare your startup for an M&A exit:

Set up an alert on Google News for M&A activity in your subsector. For example, if your startup is in the IoT subsector, search for “IoT acqui” and this will pick up news stories on acquisitions in the IoT space. Save the search so you can go to Google News on a regular basis. Also track your closest competitors on Google News, particularly to see who is selling their company.

Prepare a list of the companies or firms most likely to buy your startup. This list should include domestic and international companies, businesses in non-tech industries, private equity firms and their portfolio companies, as well as VC-backed companies. Track these likely acquirers on Google News as well.

Consider approaching the top 10 likely acquirers when you are raising the next round of capital. If your startup gets M&A offers and VC term sheets at the same time, this will provide your board of directors choices on the path ahead. Knowing the M&A activity in your startup’s subsector and the 10 most likely acquirers will impress VCs and increase the chances of being funded.

Powered by WPeMatico

The whole human proteome may be free to browse thanks to DeepMind, but at the bleeding edge of biotech new proteins are made and tested every day, a complex and time-consuming process. Glyphic Biotechnologies accelerates the critical but slow sequencing step, potentially cutting drug development times down by a huge amount, and the startup just raised a $6 million seed to bring its clever solution to market.

Proteins are at the heart of many new treatments and products; the ubiquitous and infinitely varied chains of amino acids twist into shapes that interact with cells, substances in the body, and other proteins, doing everything from interpreting DNA to controlling access to secure areas (“sorry, no potassium allowed”).

In the drug discovery and biotech world, proteins represent unlimited possibility — the right one could clamp onto cancer cells, facilitate natural healing processes, or prompt the creation of helpful substances. But finding and testing novel molecules is not easy — and a big part of that is sequencing, which confirms the exact makeup of the protein you’re trying to test.

Right now there are several large companies doing good business in the protein discovery world, and generally the process involves identifying the amino acid at the end of the protein chain, then snipping it off, identifying the next one, and so on until you’ve done the whole thing.

The trouble with this approach is that the protein’s shape or the molecular properties of the next amino acid in line can interfere with the process of binding to and identifying the one on the very end. As a result there’s a certain amount of uncertainty and a lack of unreliability inherent to the process.

Glyphic Biotechnologies changes that by adding a step where the target amino acid is detached first and then tethered nearby using a novel molecule called ClickP developed by one of the co-founders. A single stationary amino acid attached to a known molecule is much, much easier to identify, and when it’s done, the process repeats as before.

It’s briefly stated but the advance is significant. Current techniques in the antibody discovery space produce and inspect on the order of tens of thousands of proteins per week per (very expensive) machine. It sounds like a lot but with proteins essentially innumerable, it’s just a drop in the bucket. Even running 24/7 this rate doesn’t come close to satisfying demand.

Glyphic’s approach, utilizing ClickP and single-molecule microscopy (like that used by DNA sequencing giant Illumina), should be capable of millions to tens of millions per week, possibly climbing to billions in time. Even at the most conservative estimate you’re talking about orders of magnitude in improvement — those tens of thousands in the other techniques include lots of (perhaps mostly) repeat or junk information due to their use of B cell cultivation to produce the antibodies in question.

Not only that, but because the ClickP process avoids the problem of interference from the next amino acid in the chain, it has way, way higher specificity and confidence. So you wouldn’t just be sequencing a hundred or a thousand times as many proteins, you’d be far more sure about the results.

At first Glyphic would be processing samples sent to them, but ultimately their tech could live in other labs as their competitors do now. Going from service to hardware sales and support is the current roadmap.

If everything works as advertised, Glyphic could be the new standard in protein sequencing just as demand skyrockets in the biotech world. To do so, though, it needs just a bit more time in the incubator.

The process they pioneered was the result of work done by co-founders Joshua Yang (CEO) and Daniel Estandian (CTO) at the lab of MIT’s Ed Boyden (on the team as “scientific founder”).

Yang explained that what stands between them and potential industry dominance is a mere matter of chemical engineering.

“My co-founder [Estandian] developed ClickP himself. The chemistry works,” he told me. “But as a spinout of an academic lab, we didn’t develop all 20 binders, because it would have bankrupted the lab. This isn’t an ‘off-the-shelf’ molecule.”

These binders are a bit like adapters that make the process work for each of the 20 amino acids. It takes time and money to engineer them, so they decided to show the system off with a handful first in order to get the cash to make the rest. “It’s really just about putting the time into getting them out there,” said Yang.

The $6.025 million seed round should finance the company through this early stage as it builds its platform. It was led by OMX ventures (which previously invested in 10X Genomics and Twist Bioscience), with participation from Osage University Partners, Wing VC, Artis Ventures, Cantos Ventures, Civilization Ventures, and Axial VC, and has an angel investor in Mammoth Biosciences CEO Trevor Martin.

Glyphic will be making its first home at Bakar Labs, the freshly inaugurated new Berkeley biotech incubator. There it will stay until it’s ready to take the next big step, likely hardware manufacturing next year on the back of an A round to be raised then. 2022 should then also see the company’s first paid services. And the antibody market, as large as it is, is only the beginning.

“Antibodies are just a starting point, as numerous applications can benefit from protein sequencing,” Josh explained in an email after we spoke. “Another high value area is in industrial biotechnology, where protein-sequencing-based screening of evolved enzymes can help identify enhanced or novel functions (e.g., better laundry detergents, waste-water treatment). Development of diagnostic tests would also benefit because, the more proteins you can sequence and identify in a sample set, the increased likelihood you can identify rare yet important biomarkers and/or develop a robust panel of biomarkers that together can detect or predict disease.”

A company like Glyphic may seem like a perfect target to get snapped up by one of the more deep-pocketed competitors out there, but Yang said they’re confident enough to ride it out.

“The activity in this space is insane. My co-founder and I really want to be the next Illumina or 10X Genomics — we really want to be that leader in proteomics.” And unless the competition has a few cards hidden up their sleeves, Yang’s ambition seems like a distinct possibility.

Powered by WPeMatico

The Exchange spent a little time on Friday ruminating on the impact of then-rumored regulation in China targeting its edtech sector. News that the Chinese government intended to crack down further on the education technology market hit shares of public, China-based edtech companies. It was a mess.

Then over the weekend, the rumors became reality, and the impact is still being felt today in the global markets.

But there’s more. China is also bringing new regulatory pressure on food-delivery companies and Tencent Music. More precisely, we’ve seen successive market-dynamic-changing moves from the Chinese government in the last few days, coming as 2021 had already proved to be a turbulent environment for China-based technology companies.

The Exchange explores startups, markets and money.

Read it every morning on Extra Crunch or get The Exchange newsletter every Saturday.

Today we have to do a little bit of work to understand precisely what is going on with the various regulatory changes. Why? Because the Chinese venture capital market is a key player in the global venture scene. And Chinese startups have gone public on both Chinese, Hong Kong and U.S. exchanges; there’s a lot of capital tied up in companies impacted today — and possibly tomorrow.

For startups, the regulatory changes aren’t a death blow; indeed, many Chinese tech startups won’t be affected by what we’ve seen thus far. And upstart tech companies in sectors less likely to be targeted by central authorities may become more attractive to investors than they were before the regulatory onslaught kicked off. But on the whole, it feels like the risk profile of doing business in China has risen. That could curb the pace at which capital is invested, cut valuations and lower interest in the Chinese startup market from private-market investors able to invest globally.

Let’s parse what’s changed, examine market reactions and then consider what could be next. We want to better understand today’s Chinese startup market and what its new form could mean for existing players and future performance.

Let’s parse what’s changed, examine market reactions and then consider what could be next. We want to better understand today’s Chinese startup market and what its new form could mean for existing players and future performance.

The edtech clampdown did not start last week. China’s edtech sector started to rack up penalties and fines in June, which led to what the Asia Times called “warning bells” in the sector. From there, things went from penalties to punishing regulatory changes.

Powered by WPeMatico

Hello and welcome back to Equity, TechCrunch’s venture capital-focused podcast where we unpack the numbers behind the headlines.

This is Equity Monday, our weekly kickoff that tracks the latest private market news, talks about the coming week, digs into some recent funding rounds and mulls over a larger theme or narrative from the private markets. You can follow the show on Twitter here and me here.

Ever wake up to just a massive wall of news? That was us this morning, so we had to pick and choose. But since this show is about getting you caught up, we decided to focus on the largest, broadest new information that we could:

All that, and we had a good time! Hugs and love from the Equity crew — chat Wednesday!

Equity drops every Monday at 7:00 a.m. PST, Wednesday, and Friday at 6:00 a.m. PST, so subscribe to us on Apple Podcasts, Overcast, Spotify and all the casts!

Powered by WPeMatico

The loss of a loved one is perhaps one of the most traumatic things a person can experience.

When it comes to memorializing someone after their death, most people think of planning funerals and/or picking out caskets or tombstones. And those things are typically done with the help of a funeral home.

Enter Austin-based Eterneva, which is building a rare direct-to-consumer brand in the end-of life space. The four-year-old startup creates diamonds from the cremated ashes or hair of people and pets. It’s a highly unusual business but one that seems to be resonating with people seeking a way to keep a piece of their loved ones close to them after their death.

Since its inception, Eterneva has seen triple-digit growth in sales — including in 2020, when it more than doubled its revenue, according to CEO and co-founder Adelle Archer. And today, the company is announcing an “oversubscribed” $10. million Series A funding round led by Tiger Management with participation from Goodwater Capital, Capstar Ventures, NextCoast Ventures and Dallas billionaire Mark Cuban. (For the unacquainted, Tiger Management is the hedge fund and family office of Julian Robertson from which Tiger Global Management descended.)

“It was an extremely competitive round,” Archer told TechCrunch. “We received three term sheets and were able to put together an all-star investment group.” That investment group included Capstar Managing DIrector Kathryn Cavanaugh, who also joined Eterneva’s board; Lydia Jett — one of the top female partners at Softbank overseeing their $100 billion Vision Fund and Kara Nortman, managing partner at Upfront Capital, one of the first women to make managing partner at a VC fund and co-founder of Angel City with actress Natalie Portman.

Archer and co-founder Garrett Ozar launched Eterneva in the first quarter of 2017 after working together at BigCommerce. The company’s origin story is a very personal one for Archer. Her close friend and business mentor, Tracey Kaufman, was diagnosed with pancreatic cancer and ended up passing away at the age of 47. With no next of kin, Kaufman left her cremated ashes to her aunt, best friend and Archer.

“We started looking into different options but all the websites we landed on were so lackluster, somber and overwhelming,” Archer recalls. “Tracey was the most amazing person, and I felt like when you lose remarkable people, you needed better options to honor and memorialize them.”

At the time, Archer was working on a lab-grown diamond startup. Over dinner with a diamond scientist during which she was discussing her mentor’s death, the scientist said, “Well, you know Adele, there is carbon in ashes, so we could get the carbon out of Tracey’s ashes and make a diamond.”

The thought blew Archer’s mind.

“I knew that I had to do that, 100%. Tracy was such a vibrant person, it suited her so perfectly,” she said. “And I’d have a part of her with me all the time.”

Eterneva co-founders Garrett Ozar and Adelle Archer. Image Credits: Eterneva

It was the first diamond ever created by Eterneva, and it gave Archer a chance to be a customer of her own product, which she believes has helped in building an experience for her other customers. Soon, she became “fully focused” on the idea, which she viewed as a way to give grieving people “brightness and healing and a beautiful way to honor their loved ones.”

Since inception, Eterneva has created nearly 1,500 diamonds for over 1,000 customers. It can do colorless or nearly any color including black, yellow, blue, orange and green. The entry price for an Eterneva diamond is $2,999 and that goes up based on the size and color. Pets make up about 40% of Eterneva’s business.

“We view ourselves as the complete opposite tone of everything else in this space,” Archer said. “A lot of people are trying to solve planning and logistics around the end of life. We’re about helping people move forward, and building a platform for the celebration of life.”

The process to create the diamond is intricate, according to Archer, taking 7 to 9 months. The intent is to bring the customer along the journey by sharing the process with them at each stage through videos and pictures.

“We do it in parallel with their processing grief, which is super isolating,” Archer said. “They are usually in a different place with their grief than when they first started.”

One of the plans with the new capital is to enable more people to participate in person with the process, such as starting the machine work, or telling the jeweler stories about their loved one and coming up with a custom design that might have little details that represent aspects of their loved one’s life.

The company also plans to use the money to scale their funeral home channel program nationwide via Enterprise partnerships and scaling its operations and capacity in Austin so it can keep up with demand.

Eterneva is banking on the fact that more and more “people don’t want traditional funerals anymore.”

“They want personalization and meaning,” said Archer. “We plan to evolve the platform with different products and services down the road.”

The startup also wants to continue to build awareness around its brand. Recently, it’s seen more than a dozen videos on TikTok about its diamonds go viral, according to Archer.

Prior to the Series A, Eterneva had raised a total of $6.7 million from angels and institutions. Its seed round was a $3 million financing led by Austin-based Springdale Ventures in 2020. Mark Cuban first became an investor in the company when Archer and Ozar appeared on “Shark Tank.” Cuban took a 9% stake in the company in exchange for a $600,000 investment. Despite claims that the company was a scam, Cuban has stood by the science behind it and put money in the latest round as well.

Via email, he told TechCrunch he views an Eterneva diamond as “a unique, socially responsible way to stay connected to loved ones.”

“There is still so much upside and growth in their future,” Cuban wrote. “So I doubled down.”

He went on to describe the creation of diamond from the hair or ashes of a loved one as “such an intense personal commitment.”

“Eternava takes a very emotional and difficult [time] and helps people walk through their journey in a trusted way that I don’t think anyone else can come close to,” Cuban added.

Powered by WPeMatico