Recent Funding

Auto Added by WPeMatico

Auto Added by WPeMatico

The decreasing cost of launch and a slew of other tech innovations have brought about a renaissance in geospatial intelligence, with multiple startups aiming to capture higher-quality and more frequent images of Earth than have ever before been available.

Most of these startups, however, are focused on using satellites to collect data. Not so for Near Space Labs, a four-year-old company that instead aims to gather geospatial intelligence from the stratosphere, using small autonomous wind-powered robots attached to weather balloons. The company has named its platform “Swifty,” and each one is capable of reaching altitudes between 60,000 and 85,000 feet and capturing 400-1,000 square kilometers of imagery per flight.

The company was founded in 2017 by Rema Matevosyan, Ignasi Lluch and Albert Caubet. Matevosyan, who is an applied mathematician by training and previously worked as a programmer, did her masters in Moscow. There, she started doing research in systems engineering for aerospace systems and also flew weather balloons to test aerospace hardware. “It clicked that we can fly balloons commercially and deliver a much better experience to customers than from any other alternative,” she told TechCrunch in a recent interview.

Four years after launch, the company has closed a $13 million Series A round led by Crosslink Capital, with participation from Toyota Ventures and existing investors Leadout Capital and Wireframe Ventures. Near Space Labs also announced that Crosslink partner Phil Boyer has joined its board.

Near Space, which is headquartered in Brooklyn and Barcelona, Spain, is primarily focused on urbanized areas where change happens very rapidly. The robotic devices that attach to the balloons are manufactured at the company’s workshop in Brooklyn, which are then shipped to launch sites across the country. The company’s CTO and chief engineer are both based in Barcelona, so the hardware R&D takes place over there, Matevosyan explained.

The company currently has eight Swifies in operation. It sells the data it collects and has developed an API through which customers can access the data via a subscription model. The company doesn’t need to have specific launch sites — Matevosyan said Swifties can launch from “anywhere at any time” — but the company does work in concert with the Federal Aviation Administration and air traffic control.

The main value proposition of the Swifty as opposed to the satellite, according to Matevosyan, is the resolution: From the stratosphere, the company can collect “resolutions that are 50 times better than what you would get from a satellite,” she said. “We are able to provide persistent and near real-time coverage of areas of interest that change very quickly, including large metro areas.” Plus, she said Near Space can iterate it’s technology quickly using Swifties’ “plug-and-play” model, whereas it’s not so easy to add a new sensor to a satellite fleet that’s already in orbit.

Near Space Labs founders (from left): Ignasi Lluch, Rema Matevosyan and Albert Caubet. Image Credits: Near Space Labs (opens in a new window)

Near Space has booked more than 540 flights through 2022. While customers pay for the flights, the data generated from each trip is non-exclusive, so the data can be sold again and again. Looking ahead, the company will be using the funds to expand its geographical footprint and bring on a bunch of new hires. The goal, according to Matevosyan, is to democratize access to geospatial intelligence — not just for customers, but on the developer side, too. “We believe in diverse, equal and inclusive opportunities in aerospace and Earth imaging,” she said.

Powered by WPeMatico

Fivetran, the data connectivity startup, had a big day today. For starters it announced a $565 million investment on a $5.6 billion valuation, but it didn’t stop there. It also announced its second acquisition this year, snagging HVR, a data integration competitor that had raised more than $50 million, for $700 million in cash and stock.

The company last raised a $100 million Series C on a $1.2 billion valuation, increasing the valuation by over 5x. As with that Series C, Andreessen Horowitz was back leading the round, with participation from other double dippers General Catalyst, CEAS Investments, Matrix Partners and other unnamed firms or individuals. New investors ICONIQ Capital, D1 Capital Partners and YC Continuity also came along for the ride. The company reports it has now raised $730 million.

The HVR acquisition represents a hefty investment for the startup, grabbing a company for a price that is almost equal to all the money it has raised to date, but it provides a way to expand its market quickly by buying a competitor. Earlier this year Fivetran acquired Teleport Data as it continues to add functionality and customers via acquisition.

“The acquisition — a cash and stock deal valued at $700 million — strengthens Fivetran’s market position as one of the data integration leaders for all industries and all customer types,” the company said in a statement.

While that may smack of corporate marketing-speak, there is some truth to it, as pulling data from multiple sources, sometimes in siloed legacy systems, is a huge challenge for companies, and both Fivetran and HVR have developed tools to provide the pipes to connect various data sources and put it to work across a business.

Data is central to a number of modern enterprise practices, including customer experience management, which takes advantage of customer data to deliver customized experiences based on what you know about them, and data is the main fuel for machine learning models, which use it to understand and learn how a process works. Fivetran and HVR provide the nuts and bolts infrastructure to move the data around to where it’s needed, connecting to various applications like Salesforce, Box or Airtable, databases like Postgres SQL or data repositories like Snowflake or Databricks.

Whether bigger is better remains to be seen, but Fivetran is betting that it will be in this case as it makes its way along the startup journey. The transaction has been approved by both companies’ boards. The deal is still subject to standard regulatory approval, but Fivetran is expecting it to close in October.

Powered by WPeMatico

Small businesses in the U.S. now have a new way to source home and lifestyle goods from new manufacturers. Bzaar, a business-to-business cross-border marketplace, is connecting retailers with over 50 export-ready manufacturers in India.

The U.S.-based company announced Monday that it raised $4 million in seed funding, led by Canaan Partners, and including angel investors Flipkart co-founder Binny Bansal, PhonePe founders Sameer Nigam and Rahul Chari, Addition founder Lee Fixel and Helion Ventures co-founder Ashish Gupta.

Nishant Verman and Prasanth Nair co-founded Bzaar in 2020 and consider their company to be like a “fair without borders,” Verman put it. Prior to founding Bzaar, Verman was at Bangalore-based Flipkart until it was acquired by Walmart in 2018. He then was at Canaan Partners in the U.S.

“We think the next 10 years of global trade will be different from the last 100 years,” he added. “That’s why we think this business needs to exist.”

Traditionally, small U.S. buyers did not have feet on the ground in manufacturing hubs, like China, to manage shipments of goods in the same way that large retailers did. Then Alibaba came along in the late 1990s and began acting as a gatekeeper for cross-border purchases, Verman said. U.S. goods imports from China totaled $451.7 billion in 2019, while U.S. goods imports from India in 2019 were $87.4 billion.

Bzaar screenshot. Image Credits: Bzaar

Small buyers could buy home and lifestyle goods, but it was typically through the same sellers, and there was not often a unique selection, nor were goods available handmade or using organic materials, he added.

With Bzaar, small buyers can purchase over 10,000 wholesale goods on its marketplace from other countries like India and Southeast Asia. The company guarantees products arrive within two weeks and manage all of the packaging logistics and buyer protection.

Verman and Nair launched the marketplace in April and had thousands users in three continents purchasing from the platform within six months. Meanwhile, products on Bzaar are up to 50% cheaper than domestic U.S. platforms, while SKU selection is growing doubling every month, Verman said.

The new funding will enable the company to invest in marketing to get in front of buyers and invest on its technology to advance its cataloging feature so that goods pass through customs seamlessly. Wanting to provide new features for its small business customers, Verman also intends to create a credit feature to enable buyers to pay in installments or up to 90 days later.

“We feel this is a once-in-a-lifetime shift in how global trade works,” he added. “You need the right team in place to do this because the problem is quite complex to take products from a small town in Vietnam to Nashville. With our infrastructure in place, the good news is there are already shops and buyers, and we are stitching them together to give buyers a seamless experience.”

Powered by WPeMatico

Facetune developer Lightricks, which operates more than a dozen subscription-based photo- and video-editing apps across iOS and Android, now has $130 million in new funding to further grow its business. The company’s newly announced Series D round includes $100 million in primary and $30 million in secondary funding, and now values the company at $1.8 billion. To date, Lightricks has raised $335 million.

The new round was co-led by New York-based VC firm Insight Partners and Hanaco Venture Capital and includes new investors Migdal Insurance, Altshuler Shaham and Shavit Capital. Existing investors Goldman Sachs Asset Management, Claltech, Harel Insurance and Finance, and Greycroft, also participated.

The company’s last round of funding was its pre-pandemic raise of $135 million, which minted the company as a unicorn.

Based in Jerusalem, Lightricks has been best known for its photo-editing app Facetune, which puts Photoshop-like retouching tools into the hands of consumers. The app quickly gained traction as online influencers tweaked their Instagram photos to look more polished, perfected and blemish-free. This growth wasn’t without controversy, however, as some argued how image-editing apps like Facetune took airbrushing too far, contributing to body image issues that now, Facebook’s internal research indicates, could have a negative effect on teenagers’ mental health.

But Facetune was only the beginning for what’s since become a mobile editing empire for Lightricks, at a time when everyone is trying to look their best online and create compelling content. Over the years, the company has rolled out the more powerful Facetune 2, along with other creativity and mobile photo apps that weren’t focused on selfies. It also expanded its product lineup beyond the creator crowd to bring a suite of tools to online marketers and small businesses. And last year, Lightricks more directly responded to the growth in online video as a form of self-expression with a new selfie retouching tool called Facetune Video — essentially Facetune for the TikTok era.

Image Credits: Lightricks

The company benefitted from COVID-19 lockdowns, as well, as more people participated online and creators, as a group, became more well-established as a way for brands to reach consumers. During peak lockdowns, the company saw a 90% increase in usage across its apps in the U.S. Meanwhile, downloads for its popular Videoleap video editing apps jumped 70% since the start of the pandemic, as TikTok adoption also grew.

Across its suite of apps, the company now touts 29 million monthly active users, where over 5 million are paid subscribers. Its users average around 78 million monthly exports, indicating Lightricks’ sizable impact on the creator economy. In 2021, Lightricks is on track for over $200 million in revenue and plans to grow that figure by 40% in the year ahead.

To do so, the company’s strategy will change. Instead of just developing its own apps, it’s now on the hunt for potential acquisitions.

“Our plan is to grow into a one-stop shop creator platform, supporting creators throughout their journey, from content creation to monetization,” says Zeev Farbman, CEO and co-founder of Lightricks. “To do so, we are broadening our acquisition activity, while developing other services in-house — our overall M&A objective is advancing our shift into the creator’s platform. To begin, we are planning between three to five acquisitions, each with a budget of tens of millions of dollars. However, we are also on the lookout for larger ticket size deals if there is enough conviction on both sides,” he notes.

Image Credits: Lightricks

The company will also enhance its own technology to develop tools and services that will help all creators with content production and monetization, and it will grow its team.

Currently, Lightricks has 460 employees and plans to add 60 more by the end of 2021. The longer-term goal is to grow the team to 1,000 employees by the end of 2023, across roles that include developers, designers and marketing. While most of this growth to date has taken place in Jerusalem, over the next two years, the company plans to grow its teams locally in Haifa, as well as internationally in London and Shenzhen. It may add other locations through M&As, as well.

The U.K. office is now the largest outside of Lightricks’ headquarters, with 23 people. This number is expected to climb to 35 by year-end and be closer to 50 or 60 by the end of 2022, with growth focused on the production of the company’s new photography app plus customer experience and marketing teams, which were previously only in Israel.

In the U.S., Lightricks is focused on content.

“Our U.S.-based activity will focus mostly on our content efforts that will provide a vast array of original, acquired and co-produced content to inspire, educate and entertain creators across the entirety of their careers,” notes Farbman. “This includes written, video, audio, short and long-form, fun and informative content,” he says.

Investors say they see the potential for Lightricks to continue to grow as the creator economy booms.

“The creator economy has changed the way we, as a society, experience social networks,” said Pasha Romanovski, co-founding partner of Hanaco Ventures, in a statement. “Audiences constantly consume information through the different content channels daily. Lightricks’ platform enables creators to have a broader, more professional, and higher-quality set of tools to optimize content. At a time when we are seeing content creators monetize content on social media at new levels, it is clear that Lightricks’ platform has the ability to create a one-stop shop that will be meaningful to its users,” he added.

Powered by WPeMatico

Business, now more than ever before, is going digital, and today a startup that’s building a vertically integrated solution to meet business banking needs is announcing a big round of funding to tap into the opportunity. Airwallex — which provides business banking services directly to businesses themselves as well as via a set of APIs that power other companies’ fintech products — has raised $200 million, a Series E round of funding that values the Australian startup at $4 billion.

Lone Pine Capital is leading the round, with new backers G Squared and Vetamer Capital Management, and previous backers 1835i Ventures (formerly ANZi), DST Global, Salesforce Ventures and Sequoia Capital China also participating.

The funding brings the total raised by Airwallex — which has head offices in Hong Kong and Melbourne, Australia — to $700 million, including a $100 million injection that closed out its Series D just six months ago.

Airwallex will be using the funding both to continue investing in its product and technology as well as to continue its geographical expansion and to focus on some larger business targets. The company has started to make some headway into Europe and the U.K. and that will be one big focus, along with the U.S.

The quick succession of funding and rising valuation underscore Airwallex’s traction to date around what CEO and co-founder Jack Zhang describes as a vertically integrated strategy.

That involves two parts. First, Airwallex has built all the infrastructure for the business banking services that it provides directly to businesses with a focus on small and medium enterprise customers. Second, it has packaged up that infrastructure into a set of APIs that a variety of other companies use to provide financial services directly to their customers without needing to build those services themselves — the so-called “embedded finance” approach.

“We want to own the whole ecosystem,” Zhang said to me. “We want to be like the Apple of business finance.”

That seems to be working out so far for Airwallex. Revenues were up almost 150% for the first half of 2021 compared to a year before, with the company processing more than US$20 billion for a global client portfolio that has quadrupled in size. In addition to tens of thousands of SMEs, it also, via APIs, powers financial services for other companies like GOAT, Papaya Global and Stake.

Airwallex got its start like many of the strongest startups do: It was built to solve a problem that the founders encountered themselves. In the case of Airwallex, Zhang tells me he had actually been working on a previous startup idea. He wanted to build the “Blue Bottle Coffee” of Asia Pacific out of Australia, and it involved buying and importing a lot of different materials, packaging and, of course, coffee from all around the world.

“We found that making payments as a small business was slow and expensive,” he said, since it involved banks in different countries and different banking systems, manual efforts to transfer money between them and many days to clear the payments. “But that was also my background — payments and trading — and so I decided that it was a much more fascinating problem for me to work on and resolve.”

Eventually one of his co-founders in the coffee effort came along, with the four co-founders of Airwallex ultimately including Zhang, along with Xijing Dai, Lucy Liu and Max Li.

It was 2014, and Airwallex got attention from VCs early on in part for being in the right place at the right time. A wave of startups building financial services for SMBs were definitely gaining ground in North America and Europe, filling a long-neglected hole in the technology universe, but there was almost nothing of the sort in the Asia Pacific region, and in those earlier days solutions were highly regionalized.

From there it was a no-brainer that starting with cross-border payments, the first thing Airwallex tackled, would soon grow into a wider suite of banking services involving payments and other cross-border banking services.

“In the last six years, we’ve built more than 50 bank integrations and now offer payments across 95 countries, payments through a partner network,” he added, with 43 of those offering real-time transactions. From that, it moved on to bank accounts and “other primitive stuff” with card issuance and more, he said, eventually building an end-to-end payment stack.

Airwallex has tens of thousands of customers using its financial services directly, and they make up about 40% of its revenues today. The rest is the interesting turn the company decided to take to expand its business.

Airwallex had built all of its technology from the ground up itself, and it found that — given the wave of new companies looking for more ways to engage customers and become their one-stop shop — there was an opportunity to package that tech up in a set of APIs and sell that on to a different set of customers, those who also provided services for small businesses. That part of the business now accounts for 60% of Airwallex’s business, Zhang said, and is growing faster in terms of revenues. (The SMB business is growing faster in terms of customers, he said.)

A lot of embedded finance startups that base their business around building tech to power other businesses tend to stay at arm’s length from offering financial services directly to consumers. The explanation I have heard is that they do not wish to compete against their customers. Zhang said that Airwallex takes a different approach, by being selective about the customers they partner with, so that the financial services they offer would not be in direct competition with those of its customers. The GOAT marketplace for sneakers, or Papaya Global’s HR platform are classic examples of this.

However, as Airwallex continues to grow, you can’t help but wonder whether one of those partners might like to gobble up all of Airwallex and take on some of that service provision role itself. In that context, it’s very interesting to see Salesforce Ventures returning to invest even more in the company in this round, given how widely the company has expanded from its early roots in software for salespeople into a massive platform providing a huge range of cloud services to help people run their businesses.

For now, it’s been the combination of its unique roots in Asia Pacific, plus its vertical approach of building its tech from the ground up, plus its retail acumen that has impressed investors and may well see Airwallex stay independent and grow for some time to come.

“Airwallex has a clear competitive advantage in the digital payments market,” said David Craver, MD at Lone Pine Capital, in a statement. “Its unique Asia-Pacific roots, coupled with its innovative infrastructure, products and services, speak volumes about the business’ global growth opportunities and its impressive expansion in the competitive payment providers space. We are excited to invest in Airwallex at this dynamic time, and look forward to helping drive the company’s expansion and success worldwide.”

Updated to note that the coffee business was in Australia, not Hong Kong.

Powered by WPeMatico

Flippa, an online marketplace to buy and sell online businesses and digital assets, announced its first venture-backed round, an $11 million Series A, as it sees over 600,000 monthly searches from investors looking to connect with business owners.

OneVentures led the round and was joined by existing investors Andrew Walsh (former Hitwise CEO), Flippa co-founders Mark Harbottle and Matt Mickiewicz, 99designs, as well as new investors Catch.com.au founders Gabby and Hezi Leibovich; RetailMeNot.com founders Guy King and Bevan Clarke; and Reactive Media founders Tim O’Neill and Tim Fouhy.

The company, with bases in both Austin and Australia, was started in 2009 and facilitates exits for millions of online business owners, some that operate on e-commerce marketplaces, blogs, SaaS and apps, the newest data integration being for Shopify, Blake Hutchison, CEO of Flippa, told TechCrunch.

He considers Flippa to be “the investment bank for the 99%,” of small businesses, providing an end-to end platform that includes a proprietary valuation product for businesses — processing over 4,000 valuations each month — and a matching algorithm to connect with qualified buyers.

Business owners can sell their companies directly through the platform and have the option to bring in a business broker or advisor. The company also offers due diligence and acquisition financing from Thrasio-owned Yardline Capital and a new service called Flippa Legal.

“Our strategy is verification at the source, i.e. data,” Hutchison said. “Users can currently connect to Stripe, QuickBooks Online, WooCommerce, Google Analytics and Admob for apps, which means they can expose their online business performance with one-click, and buyers can seamlessly assess financial and operational performance.”

Online retail, as a share of total retail sales, grew to 19.6% in 2020, up from 15.8% in 2019, driven largely by the global pandemic as sales shifted online while brick-and-mortar stores closed.

Meanwhile, Amazon has 6 million sellers, and Shopify sellers run over 1 million businesses. This has led to an emergence of e-commerce aggregators, backed by venture capital dollars, that are scooping up successful businesses to grow, finding many through Flippa’s marketplace, Hutchison said.

Flippa has over 3 million registered users and added 300,000 new registered users in the past 12 months. Overall transaction volume grows 100% year over year. Though being bootstrapped for over a decade, the company’s growth and opportunity drove Hutchison to go after venture capital dollars.

“There is a huge movement toward this being recognized as an asset class,” he said. “At the moment, the asset class is undervalued and driving a massive swarm as investors snap up businesses and aggregate them together. We see the future of these aggregators becoming ‘X company for apps’ or ‘X for blogs.’ ”

As such, the new funding will be used to double the company’s headcount to more than 100 people as it builds out its offices globally, as well as establishing outposts in Melbourne, San Francisco and Austin. The company will also invest in marketing and product development to scale its business valuation tool that Hutchison likens to the “Zillow Zestimate,” but for online businesses.

Nigel Dews, operating partner at OneVentures, has been following Flippa since it started. His firm is one of the oldest venture capital firms in Australia and has 30 companies in its portfolio focused on healthcare and technology.

He believes the company will create meaningful change for small businesses. The team combined with Flippa’s ability to connect buyers and sellers puts the company in a strong leadership position to take advantage of the marketplace effect.

“Flippa is an incredible opportunity for us,” he added. “You don’t often get a world-leading business in a brand new category with incredible tailwinds. We also liked that the company is based in Australia, but half of its revenue comes from the U.S.”

Powered by WPeMatico

Taha Ahmed and Rooshan Aziz left their jobs in strategy consulting and investment banking in London earlier this year in order to found a mobile-only education platform startup, Maqsad, in Pakistan, with a goal “to make education more accessible to 100 million Pakistani students.”

Having grown up in Karachi, childhood friends Ahmed and Aziz are aware of the challenges about the Pakistani education system, which is notably worse for those not living in large urban areas (the nation’s student-teacher ratio is 44:1). Pakistani children are less likely to go to school for each kilometer of distance between school and their home — with girls being four times affected, Maqsad co-founder Aziz said.

Maqsad announced today its $2.1 million pre-seed round to enhance its content platform growth and invest in R&D.

The pre-seed round, which was completed in just three weeks via virtual meetings, was led by Indus Valley Capital, with participation from Alter Global, Fatima Gobi Ventures and several angel investors from Pakistan, the Middle East and Europe.

Maqsad will use the proceeds for developing in-house content, such as production studio, academics and animators, as well as bolstering R&D and engineering, Aziz told TechCrunch. The company will focus on the K-12 education in Pakistan, including 11th and 12th grade math, with plans to expand into other STEM subjects for the next one-two years, Aziz said.

Maqsad’s platform, which provides a one-stop shop for after-school academic content in a mix of English and Urdu, will be supplemented by quizzes and other gamified features that will come together to offer a personalized education to individuals. Its platform features include adaptive testing that alter a question’s level of difficulty depending on users’ responses, Aziz explained.

The word “maqsad” means purpose in Urdu.

“We believe everyone has a purpose. Maqsad’s mission is to enable Pakistani students to realize this purpose; whether you are a student from an urban centre, such as Lahore, or from a remote village in Sindh: Maqsad believes in equal opportunity for all,” Aziz said.

“We are building a mobile-first platform, given that 95% of broadband users in Pakistan are via mobile. Most other platforms are not mobile optimized,” Aziz added.

“It’s about more than just getting students to pass their exams. We want to start a revolution in the way Pakistani students learn, moving beyond rote memorization to a place of real comprehension,” said co-founder Taha Ahmed, who was a former strategy consultant at LEK.

The company ran small pilots in April and May and started full-scale operations on 26 July, Aziz said, adding that Maqsad will launch its mobile app, currently under development, in the coming months in Q4 2021 and has a waitlist for early access.

“Struggles of students during the early days of the pandemic motivated us to run a pilot. With promising initial traction and user feedback, the size of the opportunity to digitize the education sector became very clear,” Aziz said.

The COVID-19 pandemic reshaped the education industry, heating up the global edtech startups that made online education more accessible for a wider population, for example in countries like India and Indonesia, Aziz mentioned.

The education market size in Pakistan is estimated at $12 billion and is projected to increase to $30 billion by 2030, according to Aziz.

It plans to build the company as a hybrid center offering online and offline courses like Byju’s and Aakash, and expand classes for adults such as MasterClass, the U.S.-based online classes for adults, as its long-term plans, Aziz said.

“Maqsad founders’ deep understanding of the problem, unique approach to solving it and passion for impact persuaded us quickly,” the founder and managing partner of Indus Valley Capital, Aatif Awan, said.

“Pakistan’s edtech opportunity is one of the largest in the world and we are excited to back Maqsad in delivering tech-powered education that levels access, quality and across Pakistan’s youth and creates lasting social change,” Ali Mukhtar, general partner of Fatima Gobi Ventures said.

Powered by WPeMatico

More spacecraft will be sent to orbit this year than ever before in human history, and the number of satellite launches is only anticipated to increase through the rest of the decade. Under these crowded conditions, being able to maneuver satellites in space and deorbit them when they reach the end of their useful life will be key.

Enter Aurora Propulsion Technologies. It’s one of a handful of startups that has emerged in the past few years to help simplify the problem of spacecraft propulsion. Since its founding in 2018, the Finnish company has developed two products — a tiny thruster engine and a plasma braking system — and will be testing both in an in-orbit demonstration in the fourth quarter of this year. Aurora’s activities have caught the eye of investors: the company just closed a €1.7 million ($2 million) seed round to bring its technology to market.

The round was led by Lithuanian VC firm Practica Capital, with additional participation from the state-owned private equity company TESI (Finnish Industry Investment Ltd.) and The Flying Object, a fund from Kluz Ventures. Individual investors also participated.

Aurora’s first in-orbit demonstration, Aurora Sat-1, will be heading to space on a Rocket Lab rideshare mission, the company announced last month. On that satellite will be two modules. The first module will contain six Aurora “resistojet” engines, designed to help small spacecraft adjust their attitude (the satellite’s orientation, not its mood) and de-tumble. Aurora will also test its Plasma Brake technology, which could be used to de-orbit satellites or even to conduct deep space missions.

Each resistojet thruster comes in at just around one centimeter long, and it moves the spacecraft using microliters of water and propellant. The six thrusters are distributed around the satellite in such a way to facilitate movement in virtually any direction, and the thruster can also modulate the temperature of the water and the strength of the puff of steam that’s discharged to generate movement.

Image Credits: Aurora Propulsion Technologies (opens in a new window)

Aurora CEO Roope Takala, who previously worked for Nokia, likened the innovations in weight and size in the space industry — which we see in the resistojet — to what happened to cell phones and computers 20 years ago. “The industry moves very slow,” he said in a recent interview with TechCrunch. “In the old space era, it took a quarter to develop a rocket engine — that would be a quarter of a century. Now, it takes two quarters of a year. That’s what we did.”

The Plasma Brake uses an electrically charged microtether to generate a lump of protons to generate drag. That’s ideal for de-orbiting a spacecraft, but interestingly (and counterintuitively), the Plasma Brake could also be used for traveling away from the planet, Takala said. That’s because when you go outside the Earth’s magnetosphere, the Plasma Brake becomes unstable and moves with solar wind (which is also plasma). “The same product can jump onto that flow of plasma from the sun and extract energy from that,” Takala explained. “In that context we can use it as an interplanetary traveling tool.”

Theoretically, if a spacecraft was equipped with multiple tethers extending different directions, it could be used to rotate and guide the spacecraft, like a sailboat, he added. This technology is only scalable to a certain degree, however, so don’t expect it to be sending a crewed spacecraft into deep space anytime soon. That’s mostly due to limitations in the material strength of the Plasma Brake tethers, but the tech can be used for satellites up to around 1,000 kilograms.

“That’s our future. That’s where we’re aiming,” Takala said. “We’re focused now for the short term on low Earth orbit with the Plasma Brake and the attitude control [resistojet], and later on when the moon businesses kick off as they are slowly starting to do, then we’ll probably be looking at that way.”

The Plasma Brake and resistojet thruster would need to be put on spacecraft before they launch to orbit, but Aurora is in conversation with other companies of the potential of in-orbit installation of Plasma Brakes for existing space junk. Looking to the short term, the company is going to use the funding to productize the technology for low Earth orbit and to serialize its production, as well as to add features to the products to equip them for satellites larger than CubeSats.

In the longer term, Aurora has a vision of conducting missions in deep space. “We started off from the idea that we want to make a technology that fits into a really small spacecraft, [and] travels really fast so that we can catch up with the Voyager probes,” Takala said.

“First to the moon and then to Mars, Venus, and then one day we may be able to catch up with the Voyagers and take a big trip.”

Powered by WPeMatico

Aircover raised $3 million in seed funding to continue developing its real-time sales intelligence platform.

Defy Partners led the round with participation from Firebolt Ventures, Flex Capital, Ridge Ventures and a group of angel investors.

The company, headquartered in the Bay Area, aims to give sales teams insights relevant to closing the sale as they are meeting with customers. Aircover’s conversational AI software integrates with Zoom and automates parts of the sales process to lead to more effective conversations.

“One of the goals of launching the Zoom SDK was to provide developers with the tools they need to create valuable and engaging experiences for our mutual customers and integrations ecosystem,” said Zoom’s CTO Brendan Ittelson via email. “Aircover’s focus on building sales intelligence directly into the meeting, to guide customer-facing teams through the entire sales cycle, is the type of innovation we had envisioned when we set out to create a broader platform.”

Aircover’s founding team of Andrew Levy, Alex Young and Andrew’s brother David Levy worked together at Apteligent, a company co-founded and led by Andrew Levy, that was sold to VMware in 2017.

Chatting about pain points on the sales process over the years, Levy said it felt like the solution was always training the sales team more. However, by the time everyone was trained, that information would largely be out-of-date.

Instead, they created Aircover to be a software tool on top of video conferencing that performs real-time transcription of the conversation and then analysis to put the right content in front of the sales person at the right time based on customer issues and questions. This means that another sales expert doesn’t need to be pulled in or an additional call scheduled to provide answers to questions.

“We are anticipating that knowledge and parsing it out at key moments to provide more leverage to subject matter experts,” Andrew Levy told TechCrunch. “It’s like a sales assistant coming in to handle any issue.”

He considers Aircover in a similar realm with other sales team solutions, like Chorus.ai, which was recently scooped up by ZoomInfo, and Gong, but sees his company carving out space in real-time meeting experiences. Other tools also record the meetings, but to be reviewed after the call is completed.

“That can’t change the outcome of the sale, which is what we are trying to do,” Levy added.

The new funding will be used for product development. Levy intends to double his small engineering team by the end of the month.

He calls what Aircover is doing a “large interesting problem we are solving that requires some difficult technology because it is real time,” which is why the company was eager to partner with Bob Rosin, partner at Defy Partners, who joins Aircover’s board of directors as part of the investment.

Rosin joined Defy in 2020 after working on the leadership teams of Stripe, LinkedIn and Skype. He said sales and customer teams need tools in the moment, and while some are useful in retrospect, people want them to be live, in front of the customer.

“In the early days, tools helped before and after, but in the moment when they need the most help, we are not seeing many doing it,” Rosin added. “Aircover has come up with the complete solution.”

Powered by WPeMatico

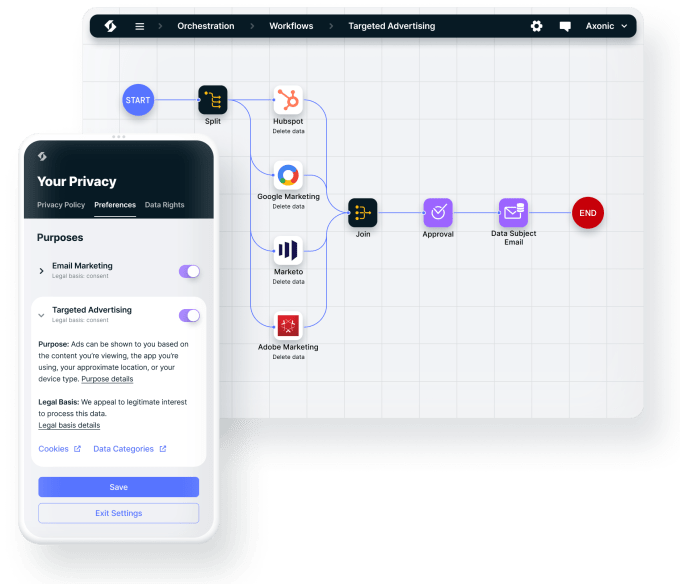

Six months after securing a $23 million Series A round, Ketch, a startup providing online privacy regulation and data compliance, brought in an additional $20 million in A1 funding, this time led by Acrew Capital.

Returning with Acrew for the second round are CRV, super{set} (the startup studio founded by Ketch’s co-founders CEO Tom Chavez and CTO Vivek Vaidya), Ridge Ventures and Silicon Valley Bank. The new investment gives Ketch a total of $43 million raised since the company came out of stealth earlier this year.

In 2020, Ketch introduced its data control platform for programmatic privacy, governance and security. The platform automates data control and consent management so that consumers’ privacy preferences are honored and implemented.

Enterprises are looking for a way to meet consumer needs and accommodate their rights and consents. At the same time, companies want data to fuel their growth and gain the trust of consumers, Chavez told TechCrunch.

There is also a matter of security, with much effort going into ransomware and malware, but Chavez feels a big opportunity is to bring security to the data wherever it lies. Once the infrastructure is in place for data control it needs to be at the level of individual cells and rows, he said.

“If someone wants to be deleted, there is a challenge in finding your specific row of data,” he added. “That is an exercise in data control.”

Ketch’s customer base grew by more than 300% since its March Series A announcement, and the new funding will go toward expanding its sales and go-to-market teams, Chavez said.

Ketch app. Image Credits: Ketch

This year, the company launched Ketch OTC, a free-to-use privacy tool that streamlines all aspects of privacy so that enterprise compliance programs build trust and reduce friction. Customer growth through OTC increased five times in six months. More recently, Qonsent, which developing a consent user experience, is using Ketch’s APIs and infrastructure, Chavez said.

When looking for strategic partners, Chavez and Vaidya wanted to have people around the table who have a deep context on what they were doing and could provide advice as they built out their products. They found that in Acrew founding partner Theresia Gouw, whom Chavez referred to as “the OG of privacy and security.”

Gouw has been investing in security and privacy for over 20 years and says Ketch is flipping the data privacy and security model on its head by putting it in the hands of developers. When she saw more people working from home and more data breaches, she saw an opportunity to increase and double down on Acrew’s initial investment.

She explained that Ketch is differentiating itself from competitors by taking data privacy and security and tying it to the data itself to empower software developers. With the OTC tool, similar to putting locks and cameras on a home, developers can download the API and attach rules to all of a user’s data.

“The magic of Ketch is that you can take the security and governance rules and embed them with the software and the piece of data,” Gouw added.

Powered by WPeMatico