Recent Funding

Auto Added by WPeMatico

Auto Added by WPeMatico

Luis Mario Garcia grew up in Mexico making deliveries for the grocery stores in his neighborhood. After honing his startup skills in San Francisco, he returned to Mexico with the idea of building a software company.

That’s when he met his co-founder Javier Gonzalez and the pair started Orchata in 2020, a mobile app enabling consumers to get groceries delivered in 15 minutes, with no substitutes and at supermarket prices. Products delivered include fresh fruit, beverages, bread, medicine and household essentials, Garcia told TechCrunch.

Orchata does this by operating a network of micro fulfillment centers — it is already operating in two cities — with technology for efficient picking and hyperfast delivery.

Online food delivery sales in Latin America are projected to reach $9.8 billion by 2024, with the global pandemic driving demand for faster delivery, according to Statista. Garcia sees three different waves in this market: the first one being traditional supermarkets, where you can spend hours, which led to the second wave of food delivery companies, including some big players in the region — for example Rappi in Colombia, which in July raised $500 million in Series F funding at a $5.25 billion valuation in a round led by T. Rowe Price, and Cornershop in Chile, which was acquired by Uber in 2019.

However, Garcia said many of these services still take more than an hour from order to doorstep and may require phone calls if an item is not available. He wants to be part of a third wave — software that is integrated with inventory and delivery that is super fast, and no substitutions.

“This is similar to what is going on around the world, but there is a huge opportunity to bring convenience, to be the Gopuff for Latin America, and we want to build it first in the region,” Garcia said.

The Monterrey-based company was part of Y Combinator’s summer 2020 cohort and on Friday announced a $4 million seed round from a group of investors, including Y Combinator, JAM Fund, FJ Labs, Venture Friends, Investo and Foundation Capital, and angel investors Ross Lipson, Mike Hennessey, Brian Requarth and Javier Mata.

Jonathan Lewy, co-founder of Grin Scooters and founder of Investo, is also an investor in Rappi. He said Garcia was building a product for the end user, with the key being the building of the infrastructure and inventory. Lewy believes Garcia understands how quick delivery should be done and that it is not just about offering a mobile app, but building the technology behind it.

Meanwhile, Justin Mateen, general partner at JAM Fund, and co-founder of Tinder and an early-stage investor, met Garcia over a year ago and was one of the company’s first investors. He said Garcia’s and Gonzalez’s initial idea for the model of grocery stores was still not solving the problem, but then they pivoted to doing fulfillment and inventory themselves.

“He fits the mold of what I look for in a founder, and he is the type of founder that doesn’t give up,” Mateen said. “Luis finally agreed to let me double down on my investment. The model makes sense now, he is on to something and it is now going to be about execution of capital as he scales.”

Both Mateen and Lewy agree that there will be similar apps coming because food delivery is such a large market, but that Orchata has a clear advantage of owning the customer experience from beginning to end.

Having only launched four months ago, Orchata is already processing thousands of orders and is seeing 100% monthly growth. The new funding will enable Orchata to expand into three new cities in Mexico. Garcia is also eyeing Colombia, Brazil, Peru and Chile for future expansion.

The company is also targeting multiple use cases, including someone noticing a forgotten item while cooking to consumers shopping for the week or teenagers needing food for a party.

“We are going to be super convenient to customers, and we think every use case for food delivery will be this way in the future,” Garcia said. “We will eventually introduce our own brands and foods with the goal of being that app that is there anytime you need it.”

Powered by WPeMatico

Houston-based ThirdAI, a company building tools to speed up deep learning technology without the need for specialized hardware like graphics processing units, brought in $6 million in seed funding.

Neotribe Ventures, Cervin Ventures and Firebolt Ventures co-led the investment, which will be used to hire additional employees and invest in computing resources, Anshumali Shrivastava, Third AI co-founder and CEO, told TechCrunch.

Shrivastava, who has a mathematics background, was always interested in artificial intelligence and machine learning, especially rethinking how AI could be developed in a more efficient manner. It was when he was at Rice University that he looked into how to make that work for deep learning. He started ThirdAI in April with some Rice graduate students.

ThirdAI’s technology is designed to be “a smarter approach to deep learning,” using its algorithm and software innovations to make general-purpose central processing units (CPU) faster than graphics processing units for training large neural networks, Shrivastava said. Companies abandoned CPUs years ago in favor of graphics processing units that could more quickly render high-resolution images and video concurrently. The downside is that there is not much memory in graphics processing units, and users often hit a bottleneck while trying to develop AI, he added.

“When we looked at the landscape of deep learning, we saw that much of the technology was from the 1980s, and a majority of the market, some 80%, were using graphics processing units, but were investing in expensive hardware and expensive engineers and then waiting for the magic of AI to happen,” he said.

He and his team looked at how AI was likely to be developed in the future and wanted to create a cost-saving alternative to graphics processing units. Their algorithm, “sub-linear deep learning engine,” instead uses CPUs that don’t require specialized acceleration hardware.

Swaroop “Kittu” Kolluri, founder and managing partner at Neotribe, said this type of technology is still early. Current methods are laborious, expensive and slow, and for example, if a company is running language models that require more memory, it will run into problems, he added.

“That’s where ThirdAI comes in, where you can have your cake and eat it, too,” Kolluri said. “It is also why we wanted to invest. It is not just the computing, but the memory, and ThirdAI will enable anyone to do it, which is going to be a game changer. As technology around deep learning starts to get more sophisticated, there is no limit to what is possible.”

AI is already at a stage where it has the capability to solve some of the hardest problems, like those in healthcare and seismic processing, but he notes there is also a question about climate implications of running AI models.

“Training deep learning models can be more expensive than having five cars in a lifetime,” Shrivastava said. “As we move on to scale AI, we need to think about those.”

Powered by WPeMatico

Mobile field service startup Youreka Labs Inc. raised an $8.5 million Series A round of funding co-led by Boulder Ventures and Grotech Ventures, with participation from Salesforce Ventures.

The Maryland-based company also officially announced its CEO — Bill Karpovich joined to lead the company after previously general manager at IBM Cloud & Watson Platform.

Youreka Labs spun out into its own company from parent company Synaptic Advisors, a cloud consulting business focused on the customer relationship management transformations using Salesforce and other artificial intelligence and automation technologies.

The company is developing robotic smart mobile assistants that enable frontline workers to perform their jobs more safely and efficiently. This includes things like guided procedures, smart forms and photo or video capture. Youreka is also embedded in existing Salesforce mobile applications like Field Service Mobile so that end-users only have to operate from one mobile app.

Youreka has identified four use cases so far: healthcare, manufacturing, energy and utilities and the public sector. Working with companies like Shell, P&G, Humana and the Transportation Security Administration, the company’s technology makes it possible for someone to share their knowledge and processes with their colleagues in the field, Karpovich told TechCrunch.

“In the case of healthcare, we are taking complex medical assessments from a doctor and pushing them out to nurses out in the field by gathering data into a simple mobile app and making it useful,” he added. “It allows nurses to do a great job without being doctors themselves.”

Karpovich said the company went after Series A dollars because it was “time for it to be on its own.” He was receiving inbound interest from investors, and the capital would enable the company to proceed more rapidly. Today, the company is focused on the Salesforce ecosystem, but that can evolve over time, he added.

The funding will be used to expand the company’s reach and products. He expects to double the team in the next six to 12 months across engineering to be able to expand the platform. Youreka boasts 100 customers today, and Karpovich would also like to invest in marketing to grow that base.

In addition to the use cases already identified, he sees additional potential in financial services and insurance, particularly for those assessing damage. The company is also concentrated in the United States, and Karpovich has plans to expand in the U.K. and Europe.

In 2020, the company grew 300%, which Karpovich attributes to the need of this kind of tool in field service. Youreka has a licensing model with charges per end user per month, along with an administrative license, for the people creating the apps, that also charges per user and per month pricing.

“There are 2.5 million jobs open today because companies can’t find people with the right skills,” he added. “We are making these jobs accessible. Some say that AI is doing away with jobs, but we are using AI to enhance jobs. If we can take 90% of the knowledge and give a digital assistant to less experienced people, you could open up so many opportunities.”

Powered by WPeMatico

Aforza, developing cloud and mobile apps for consumer goods companies, announced a $22 million Series A round led by DN Capital.

The London-based company’s technology is built on the Salesforce and Google Cloud platforms so that consumer goods companies can digitally transform product distribution and customer engagement to combat issues like unprofitable promotions and declining market share, Aforza co-founder and CEO Dominic Dinardo told TechCrunch. Using artificial intelligence, the company recommends products and can predict the order a retailer can make with promotions and pricing based on factors like locations.

The global market for consumer packaged goods apps is forecasted to reach $15 billion by 2024. However, the industry is still using outdated platforms that, in some cases, lead to a loss of 5% of sales when goods are out of stock, Dinardo said.

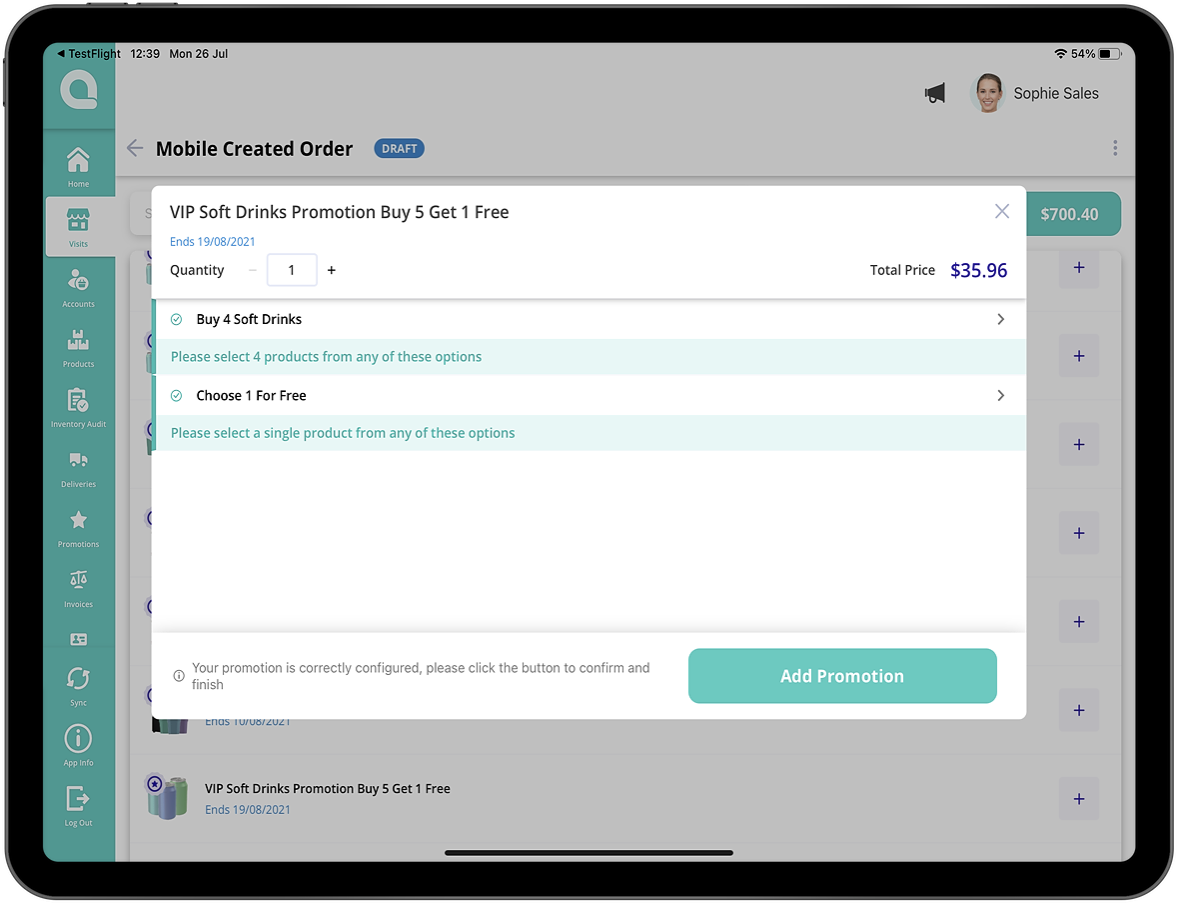

Aforza’s trade promotion designer mobile image. Image Credits: Aforza

Dinardo and his co-founders, Ed Butterworth and Nick Eales, started the company in 2019. All veterans of Salesforce, they saw how underserved the consumer goods industry was in terms of moving to digital.

Aforza is Dinardo’s first time leading a company. However, from his time at Salesforce he feels he got an education like going to “Marc Benioff’s School of SaaS.” The company raised an undisclosed seed round in 2019 from Bonfire Ventures, Daher Capital, DN Capital, Next47 and Salesforce Ventures.

Then the pandemic happened, which had many of the investors leaning in, which was validation of what Aforza was doing, Dinardo said.

“Even before the pandemic, the consumer goods industry was challenged with new market entrants and horrible legacy systems, but then the pandemic turned off pathways to customers,” he added. “Our mission is to improve the lives of consumers by bringing forth more sustainable products and packaging, but also helping companies be more agile and handle changes as the biggest change is happening.”

Joining DN Capital in the round were Bonfire Ventures, Daher Capital and Next47.

Brett Queener, partner at Bonfire Ventures, said he helped incubate Aforza with Dinardo and Eales, something his firm doesn’t typically do, but saw a unique opportunity to get in on the ground floor.

Also working at Salesforce, he saw the consumer goods industry as a major industry with a compelling reason to make a technology shift as customers began expecting instant availability and there were tons of emerging startups coming into the direct-to-consumer space.

Those startups don’t have a year or two to pull together the kind of technology it took to scale. With Aforza, they can build a product that works both online and off on any device, Queener said. And rather than planning promotions on a quarterly basis, companies can make changes to their promotional spend in real time.

“It is time for Aforza to tell the world about its technology, time to build out its footprint in the U.S. and in Europe, invest more in R&D and execute the Salesforce playbook,” he said. “That is what this round is about.”

Dinardo intends on using the new funding to continue R&D and to double its employee headcount over the next six months as it establishes its new U.S. headquarters in the Northeast. It is already working with customers in 20 countries.

As to growth, Dinardo said he is using his past experiences at startups like Veeva and Vlocity, which was acquired by Salesforce in 2020, as benchmarks for Aforza’s success.

“We have the money and the expertise — now we need to take a moment to breathe, hire people with the passion to do this and invest in new product tiers, digital assets and even payments,” he said.

Powered by WPeMatico

Doxel, which has developed software that uses computer vision to help track and monitor progress on construction job sites, announced today that it has raised $40 million in Series B funding.

Insight Partners led the round, which included participation from existing backers Andreessen Horowitz (a16z) and Amplo and brings the startup’s total raised to $56.5 million since its December 2015 inception. A16z has participated in each of Doxel’s rounds — from seed to Series B. In addition to its institutional investors, Robinhood CEO Vladimir Tenev also put money in Doxel’s Series A round as an angel.

Co-founder and CEO Saurabh Ladha said he could not disclose the valuation at which the capital was raised, but that it was “over a 4x multiple” from its $12 million Series A in early 2020. He described the Series B as an “opportunistic raise.”

“We raised because we could, at a phenomenal valuation. The full series A is still in the bank. We didn’t touch it even,” he told TechCrunch. “Our growth and bookings traction has actually been so high that we’ve been cash flow neutral in that period of time.

Ladha was inspired to start Doxel after his family nearly suffered from financial catastrophe after a two-year delay on a major construction project in India in which his father was involved.

“I almost thought we’d lose our house. It was the first time I was made aware of the impact construction can have on livelihoods,” Ladha told TechCrunch. “Even as a child, I realized that predictability is what keeps projects on time and on budget.”

Twenty years later, when Ladha graduated from Stanford University, he learned that 90% of projects are delayed and delivered over budget.

Ladha then teamed up with Robin Singh, Doxel’s CTO, in 2015 to found Doxel to build a “computer-vision-powered predictive analytics platform” designed to help owners and contractors “navigate problems before they happen.” Or put more simply, Doxel is building what it describes as the “Waze for Construction” platform.

The company’s biggest differentiator from competitors, according to Ladha, is that it provides forward-looking insight on the construction field.

“A lot of companies offer backward-looking analytics,” he told TechCrunch. “We’re the only player offering a forward-looking solution that’s predictive…In much the same way drivers have come to rely on satellite technology to avoid traffic accidents and slow-downs ahead of them, Doxel’s customers have come to rely on our AI-powered Project Controls platform.”

Doxel, Ladha added, does monitoring for project teams, so they can focus on solving problems rather than on finding them.

“Our predictive analytics gives building owners and general contractors a way to identify critical risk factors that threaten to derail their project before they even know the risks exist,” he said. “So they are not finding out about problems when it’s too late to actually solve them.”

The premise is that by the time potential risk factors are discovered, it’s too late and cost overruns and project delays are unavoidable. Over the years, with all the data it has gathered, Doxel has built out what it describes as a “Construction Encyclopedia” that helps it in identifying those potential risk factors.

Image Credits: Co-founders Saurabh Ladha (CEO) and Robin Singh (CTO) / Doxel

The company claims that its technology has helped its customers come in up to 11% below budget on projects and see an average 38% increase in productivity, according to Ladha.

Doxel’s platform works by tapping into multiple real-time data sources on a project, such as 360-degree images, Building Information Models (BIM) — also known as 3D designs — as well as budget and schedule in an effort to provide both predictability and control to building owners and contractors. The goal is to help prevent a domino effect of delays and heightened costs, so that building owners and contractors are better able to stay on time and on budget.

“Other companies don’t bridge all silos across field, accounting and schedule management,” Ladha said. “These are three disparate entities that operate separately and without the knowledge silos being bridged.”

Besides cost overruns, the loss of revenue associated with projects not being available for use per plan is exponentially disastrous, Ladha noted. For example, a multifamily developer expecting to make money by selling or renting condo units will lose income the longer it takes for project completion.

Over time, Doxel says it has tracked tens of billions of capital expenditures for “a diverse group” of Fortune 500 companies, including Kaiser Permanente and Royal Dutch Shell. Doxel claims to have saved companies “tens of millions” of dollars with its predictive technology.

“Our users are senior execs tasked with making multibillion-dollar decisions with little information on a week to week basis,” Ladha said. “They need to know if they are on cost and on time.”

Nikhil Sachdev, managing director at Insight Partners, said his firm was really excited about the size of the problem Doxel is going after in addition to the traction the company has “with some of the world’s largest enterprises, and their highly defensible AI-first software.”

Conversations with customers revealed that prior to using Doxel’s technology, they did not have a way to accurately predict the future state of their construction projects.

“Most construction management software tools are still dependent on manual data entry or photos tagged to blueprints, which requires weeks of manual mining to extract insights on a project’s cost & schedule performance,” Sachdev wrote via email. “Doxel is the only tool we’ve found that can ingest all of the relevant data, process it using their AI, and make the leap to what the project will look like in the future.”

Looking ahead, Redwood City, California-based Doxel plans to use its new capital to scale its platform and hire across its engineering, sales, marketing and product staff. Currently, Doxel has 75 employees across offices in the U.S. and Bangalore. It’s looking to roughly double the size of its team over the next year.

Powered by WPeMatico

The link-in-bio business is heating up as more mobile website builders compete for a coveted slice of real estate on a creator’s TikTok, Instagram or Twitter. Linktree leads the space, securing a recent $45 million Series B raise to build out e-commerce features, but Beacons boasts competitive creator monetization tools with just a $6 million seed round in May. Now, Snipfeed enters the ring with its own $5.5 million seed round, including investments from CRV, Abstract Ventures, Crossbeam (Ali Hamed), id8, Michael Ovitz (founder of CAA), Michael Bosstick, Diaspora Ventures and others.

Linktree has been around since 2016 and has more funding than its up-and-coming competitors. But for creators seeking to monetize their following, these newer platforms may be more attractive to some creators, since they already have built-in tools to help them monetize their followings. Linktree currently supports tipping on the platform for users subscribed to its $6 Linktree Pro platform, but Snipfeed offers a wider range of monetization options; some creators are making more than $20,000 per month on the platform, according to CEO and co-founder Rédouane Ramdani.

Snipfeed started as a content discovery platform with 44,000 weekly active users — but when Snipfeed added a creator monetization tool to its platform, it became its most popular feature. So, in February 2020, with little to no funding left, the company completely pivoted to its current link-in-bio business. Since then, Snipfeed has amassed 50,000 registered users, with the user base growing 500% in the last six months (Linktree, for comparison, has more than 12 million users).

Based in Paris and Los Angeles, Snipfeed’s 15-person staff is particularly interested in the “long tail” of creators, which it says encompasses more than 46 million people.

“Content creator doesn’t necessarily mean you’re going to be the next Addison Rae or a TikTok star,” explained Ramdani. “It means that you might be a doctor or lawyer, and on top of that, you’re going to have a TikTok where you explain how to file your taxes and that kind of stuff. They have this expertise, and they’re wondering, ‘How can I turn that into a side-hustle?’ ”

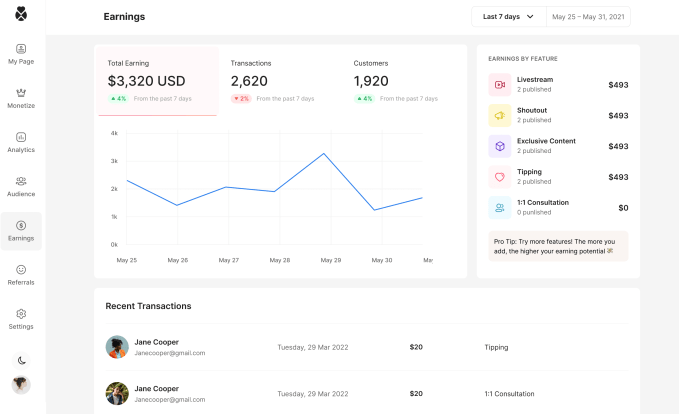

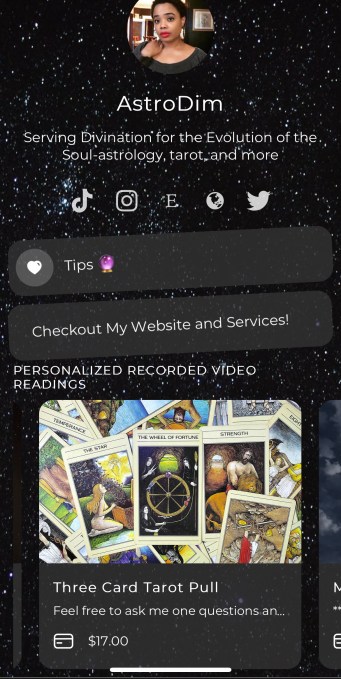

Image Credits: Snipfeed

In addition to a standard tipping tool, Snipfeed allows users to sell digital goods, like on-demand video, e-books, access to livestreams and one-on-one consultations. But Snipfeed’s biggest differentiator is its Cameo-like system for selling personalized content. For example, TikToker maylikethemonthh uses Snipfeed to sell asynchronous, video-recorded tarot readings. While asking a single, personalized astrology question costs $5, a more in-depth reading can cost up to $20 or $40.

Snipfeed is free to set up, but if you make sales, the company takes 15% — this percentage is inclusive of any transaction fees. Through Snipfeed’s referral program, creators can make 5% of sales from anyone they onboard to the platform (this comes out of Snipfeed’s commission).

“We decided to go with this model because we really want to have a relationship where we help the creators really make money. We only make money if they make money,” Ramdani said.

If a creator or celebrity were to sell personalized videos on Cameo, they’d lose 25% to the platform. Meanwhile, Beacons takes 9% of sales from its free version, and 5% from its $10 per month version, which offers more customization, integrations and analytics.

Image Credits: Snipfeed

Still, depending on the type of creator, the features that each link-in-bio startup offers might matter more than the cost. Beacons allows users to share a shopping-enabled TikTok feed, which could be a huge money-maker for creators that often share product recommendations with affiliate links, which give them a commission from sales. Ramdani said that astrologers have been particularly successful on Snipfeed, since fans can book a variety of asynchronous services at a wide range of prices. But these features could benefit any creator who can profit from answering followers’ specific questions — a chef could offer recipe ideas based on what’s in a fan’s fridge, or a life coach could make a personalized video if a follower requests advice.

With its $5.5 million in seed funding, Snipfeed plans to build out its e-commerce tools so that creators can sell physical products on their link-in-bio (Beacons and Linktree are also working on this with their recent funding rounds — but Beacons’ and Snipfeed’s seed rounds are small compared to Linktree’s Series B). The company also wants to develop educational content to show its users how to best monetize their platform — if Snipfeed can help its creators make money, then it’ll make more money too.

Powered by WPeMatico

Trust wants to give smaller businesses the same advantages that large enterprises have when marketing on digital and social media platforms. It came out of beta with $9 million in seed funding from Lerer Hippeau, Lightspeed Venture Partners, Upfront Ventures and Upper90.

The Los Angeles-based company was started in 2019 by a group of five Snap alums working in various roles within Snap’s revenue product strategy business. They were building tools for businesses to fund success with digital marketing, but kept hearing from customers about the advantage big advertisers had over smaller ones — the ability to receive good payment terms, credit lines, as well as data and advice.

Aiming to flip the script on that, the group created Trust, which is a card and business community to help digital businesses navigate the ever-changing pricing models to market online, receive the same incentives larger advertisers get and make the best decision of where their marketing dollars will reach the furthest.

Trust dashboard

Trust does this in a few ways: Its card, built in partnership with Stripe, enables businesses to increase their buying power by up to 20 times and have 45 days to make payments on their marketing investments, CEO James Borow told TechCrunch. Then as part of its community, companies share knowledge of marketing buys and data insights typically reserved for larger advertisers. Users even receive news via their dashboard around their specific marketing strategy, he added.

“The ad platforms are walled gardens, and most people don’t know what is going on inside, so our customers work together to see what is going on,” Borow said.

The growth of e-commerce is pushing more digital marketing investments, providing opportunity for Trust to be a huge business, Borow said. E-commerce sales in the U.S. grew by 39% in the first quarter, while digital advertising spend is forecasted to increase 25% this year to $191 billion. Meanwhile, Google, Facebook, Snapchat and Twitter all recently reported rapid growth in their year-over-year advertising revenues, Borow said.

The new funding will go toward increasing the company’s headcount.

“We have active customers on the platform, so we wanted to ramp up hiring as soon as we went into general release,” he added. “We are leaving beta with 25 businesses and a few hundred on our waitlist.”

That list will soon grow. In addition to the funding round, Trust announced a strategic partnership with social shopping e-commerce platform Verishop. The company’s 3,500 merchants will receive priority access to the Trust card and community, Borow said.

Andrea Hippeau, partner at Lerer Hippeau, said she knew Borow from being an investor in his previous advertising company Shift, which was acquired by Brand Networks in 2015.

When Borow contacted Lerer about Trust, Hippeau said this was the kind of offering that would be applicable to the firm’s portfolio, which has many direct-to-consumer brands, and knew marketing was a huge pain point for them.

“Digital marketing is important to all brands, but it is also a black box that you put marketing dollars into, but don’t know what you get,” she said. “We hear this across our portfolio — they spend a lot of money on ad platforms, yet are treated like mom-and-pop companies in terms of credit. When in reality Casper is outspending other companies by five times. Trust understands how important marketing dollars are and gives them terms that are financially better.”

Powered by WPeMatico

Cart.com, a Houston-based company providing end-to-end e-commerce services, brought in its third funding round this year, this time a $98 million Series B round to bring its total funding to $143 million.

Oak HC/FT led the new round of funding and was joined by PayPal Ventures, Clearco, G9 Ventures, Mercury Fund, Valedor Partners and Arsenal Growth. Strategic investors in the Series B include Heyday CEO Sebastian Rymarz and Casper CEO Philip Krim. This new round follows a $25 million Series A round, led by Mercury and Arsenal in July, and a $20 million seed round from Bearing Ventures.

Cart.com CEO Omair Tariq, who was previously an executive at Home Depot and COO of Blinds.com, co-founded the company in September 2020 with Jim Jacobson, former CEO of RTIC Outdoors.

Tariq told TechCrunch that the company provides software, services and infrastructure to businesses so they can scale online. Cart.com is taking the best parts of selling direct-to-consumer on marketplaces like Amazon and Shopify to create value for brands. Tariq said he is pioneering the term “e-commerce-as-a-service” to bring together under one platform a suite of business tools like storefront software, marketing, fulfillment, payments and customer service.

“We see the power of having an interconnected platform,” Tariq said. “There also needs to be a hybrid between selling direct-to-consumer and on Amazon and Shopify for companies that don’t have the money to pay for a percentage of their sales and receive no access to customers or data, and needing 20 different plug-ins that are not connected.”

Cart.com went after the new funding after seeing validation of its idea: brands coming to them wanting more products and services, which led to acquisitions. The company has acquired seven companies so far, including — AmeriCommerce, Spacecraft Brands and, more recently, DuMont Project and Sauceda Industries. Tariq is planning for another three or four by the end of the year.

In addition, it received inbound interest from strategic investors, like Oak and PayPal, which Tariq said was going to enable the company “to be more successful faster.”

Allen Miller, principal at Oak HC/FT, said after spending time with Tariq to understand his vision about Cart.com’s software, payments and services, he felt that the company was doing something that didn’t exist in today’s commerce infrastructure.

He said that Cart.com is well positioned to help companies, like those with $1 million in sales, stay focused on growing the business while Cart.com stitches together all of the tools for them to operate in the background.

“It’s a unique offering to merchants that has a high value proposition,” Miller said. “The vision and drive that Omair and Jim have, along with an inspiring mission they want to achieve — to be brand-centric and help the next generation of merchants. These guys also have a good playbook on finding companies and teams to acquire, as well as handling the post M&A to have everyone on one platform.”

The new financing will enable Cart.com to further invest in technology development and to increase headcount by at least 15 times, with plans to go from fewer than two dozen employees to more than 300 team members by the end of the year. The company has nearly 70 jobs posted on its website for positions in engineering, technology, digital marketing and e-commerce. Tariq also expects half of the funds to go toward more acquisitions.

Cart.com currently serves over 2,000 e-commerce brands, including GNC, Haymaker Coffee and KeHE, and processes more than $700 million in gross merchandise value per year. The company saw revenue increase 400% since the platform’s launch in November.

In addition, the company has nine fulfillment centers across the country, and is increasing its access to reach 80% of the U.S. population with two-day shipping, Tariq added.

“We are giving the power back to brands by giving them what they need to operate e-commerce,” he said. “There are still a few pieces to fill in so brands have a unified experience, but with us, they can add fulfilment, marketing or customer conversion tools with the click of a couple of buttons.”

Powered by WPeMatico

Will Clem knows all too well about restaurant workers not showing up for a shift. At least one person would have car trouble or need to stay home with sick children, and it became a common occurrence on the weekends for the co-founder of Memphis Meats and owner of Baby Jacks BBQ in Memphis.

Needing to fill a shift one Friday night, Clem decided to prop his laptop in the drive-thru lane of one of his restaurants and took orders from home by remoting into the system. No one noticed that he wasn’t actually taking orders from the kitchen itself. Thus came the idea for Bite Ninja, a remote hiring technology platform for restaurants.

Clem connected with Orin Wilson to start the company in 2020 and worked for a year on the technology before launching it in March. Today, the company announced $675,000 in pre-seed funding led by Y Combinator, AgFunder and Manta Ray.

With many restaurants unable to find workers as a result of the global pandemic, Clem and Wilson wanted to build a technology that would enable restaurants to go back to normal operating hours, or even reopen their stores. At the same time, the workers, or “Ninjas” as they are referred to, can work the drive-thru or counter for a lunch or dinner rush shift from home, but appear on-screen to customers via menu boards, Wilson said.

Bite Ninja drive-thru. Image Credits: Bite Ninja

“When a restaurant is slammed, you need an army of people to work the rush, but it is not reasonable to ask them to get in their uniform and get in their cars, last-minute, to clock in for just an hour or two,” he added. “They have control of their schedule and can pick the right shift for them. It is so popular that we typically have five to 10 people bidding on each shift.”

Bite Ninja is providing a better experience and reaches potential workers that would not necessarily have an interest in performing fast food work. Many of the 3,000 Ninjas already working with the company are stay-at-home moms and retirees with customer service experience, but who can’t physically come into a store, Clem said. In addition, the company is working with the Nurse-Family Partnership to help women get back into the workforce.

The company initially ran three pilot programs and has expanded services to curbside and front cashier stations. The funding will enable Bite Ninja to scale initiatives, hire additional software engineers and prepare for a rollout at national food chains.

Since launching earlier this year, Bite Ninja is already being used in a few thousand stores.

Manuel Gonzalez, partner at AgFunder, said restaurants are a big part of entrepreneurship, but the pandemic forced more than 110,000 of them out of business.

“Bite Ninja’s solution is one that decreases costs to restaurant owners, but increases the income of the worker,” he said. “It also helps entrepreneurs and the community because restaurants are important for economic, cultural, community and social points of view.”

Powered by WPeMatico

Pave, a San Francisco-based startup that helps companies benchmark, plan and communicate compensation to their employees, has raised a $46 million Series B. YC Continuity led the round, which also saw participation from Andreessen Horowitz and Bessemer Venture Partners. The round comes eight months after Pave closed a $16 million Series A round. Today’s financing puts Pave’s valuation at $400 million, up from $75 million one year ago.

Pave launched with an ambitious goal: Can it measure pay across venture-backed tech companies in real time, and help startups move their comp table off of spreadsheets? AngelList and Glassdoor have already tried to build a similar benchmark-worthy data set, but Pave may have a built-in advantage over the companies that tried to fix the same problem before. Y Combinator, which helped incubate Pave and is now leading its most recent round through its later-stage capital vehicle, is one of the largest startup accelerators in the world. Of Pave’s 900 customers to date, one-third come from Y Combinator, and CEO Matthew Schulman only sees that number growing.

“Having YC’s deep support of Pave as the YC-stamped leader in the burgeoning [compensation technology] industry is and will continue to be game changing for our distribution and ability to have ample data coverage in our benchmarking product,” Schulman said. He compared Pave’s distribution trajectory as similar to what fintech company Brex, also backed by Y Combinator Continuity, managed. The founder estimates that 60% of YC companies are active Brex customers.

The reliance on YC could engender platform risk, considering how often the accelerator invests in competitors — often within the same batch. That said, an investment from Y Combinator Continuity, which does Series B rounds and higher, may be a signal that YC has found the comptech player it wants to back. Ali Rowghani, the managing director of the fund and former COO of Twitter, is joining Pave’s board.

Data is everything for the startup, supporting each of Pave’s three main services that it offers to companies. First, Pave uses market and partner data to help companies benchmark salaries for their employees. Second, the startup integrates with HR tools such as Workday, Carta and Greenhouse to give its customers a holistic picture on how employees are currently being compensated, and what makes sense for promotion cycles and salary bumps. And third, the data work culminates into formal offers and compensation packages that employers can then offer to new and old employees.

Pave’s current customers account for data on over 65,000 employee records. The first product serves as a free top of funnel service, while the last two are paid services offered up like any ol’ enterprise software contract.

The world of compensation is rife with inequity, leading to the gender wage gap, and the gaps we can see in the market regarding minority pay disparity.

Schulman views one of Pave’s goals as getting companies to go from doing their D&I analysis from once a year, to doing it consistently. The company plans to build diversity and inclusion-specific dashboards that allow companies to see inequities and access ways or suggestions to improve their breakdown.

“What gets measured, gets improved,” Schulman said. Pave has begun to track its own compensation and diversity metrics, in an effort to be more transparent with its employees and maybe inspire some companies to do the same. About 33% of Pave’s workforce identify as women, compared to an industry average of 28.8%. Half of Pave’s executives, and half of Pave’s board members, identify as women. The company has committed to having 50% of its client-facing roles, which include customer success managers and sales members, “to be female or persons from underrepresented groups.”

While Pave is starting to disclose its own internal benchmarks, transparency around diversity isn’t yet a standard within tech companies — it’s far easier to get valuations than to get specifics around the makeup of historically overlooked individuals within organizations. Pave recently launched the Pave Data Lab, which uses its data set to showcase compensation trends and inequities within how tech workers are paid. That said, Pave doesn’t currently require the companies it works with to upload gender and race information into their benchmarking tool, and didn’t disclose what specific percentage of companies on its platform share that data.

It is hoping noise will make a difference. Pave’s compensation benchmarking data is now free for all companies to use, which will bring more data underneath its umbrella, and more standards to the confusing world of compensation.

Powered by WPeMatico