Recent Funding

Auto Added by WPeMatico

Auto Added by WPeMatico

Zeni, a Palo Alto fintech company providing real-time financial services data to venture-backed startups, raised $34 million in Series B funding led by Elevation Capital.

The new investment comes just five months after Zeni announced $13.5 million in a combined seed and Series A round. The company has now raised $47.5 million in total since it was co-founded in 2019 by twin brothers Swapnil Shinde and Snehal Shinde.

Elevation was joined in the new round by new investors Think Investments and Neeraj Arora, as well as existing investors Saama Capital, Amit Singhal, Sierra Ventures, Twin Ventures, Dragon Capital and Liquid 2 Ventures. As part of the investment, Ravi Adusumalli, founder and managing partner at Elevation Capital, will join Zeni’s board.

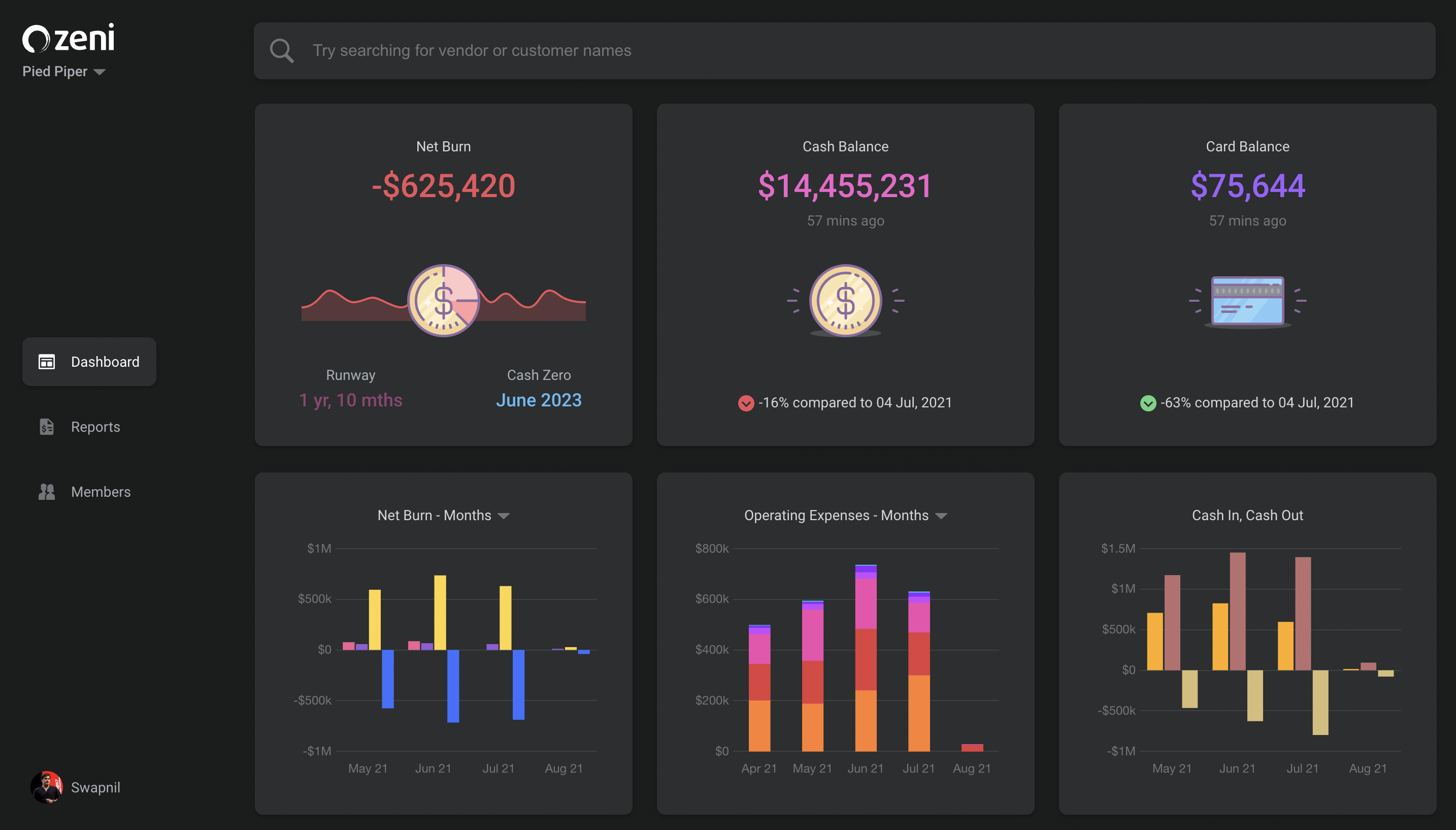

The Shinde siblings started the company after selling their last company, Mezi, a travel concierge, to American Express in 2018. Zeni’s AI-powered finance concierge platform offers bookkeeping, accounting, tax and CFO services, managing these for a flat monthly fee starting at $299 per month. Founders have real-time access to financial insights via the Zeni Dashboard, including cash in and out, operating expenses, yearly taxes and financial projections. They can also download the financial data in the “slice” that they want.

At the time of its seed/Series A round, the company was managing more than $200 million in funds each month, and that has ballooned to more than $500 million, CEO Swapnil Shinde told TechCrunch. Its customers range from pre-revenue startups to businesses generating more than $100 million in annual revenue.

In addition to the cash in and cash out analysis, the company also created a search function for transactions and spend and income trends on every customer and vendor, Snehal Shinde, chief product officer, said.

Zeni’s dashboard

Zeni experienced 550% revenue growth year-over-year, while the company’s customer base grew 375%, driven by referrals and organic growth, Swapnil Shinde said.

Despite the growth, the Series B came as a surprise to the siblings. The company was already “very well capitalized,” with a majority of the previous round still around, Swapnil Shinde said.

However, Zeni began receiving so many inbound inquiries that he said it was too exciting to pass on. Especially with the addition of Elevation Capital as an investor. Shinde said that was appealing because the firm was an investor in Paytm, and “knows how to partner and build unicorns.”

The new funding will be used to continue scaling and building the bookkeeping and accounting functions and to accelerate hiring, particularly in the engineering, sales and finance team verticals. Shinde expects to double or triple the finance team in the next year.

“As our customers scale through to their Series B, the more you can use our solution in real time to see what is happening with your finances, especially with startups and businesses having more of a remote workforce,” Swapnil Shinde added. “Zeni fits with that.”

Ash Lilani, managing partner at Saama Capital, one of Zeni’s earliest and largest investors, said he knew how big the total addressable market was — $200 billion — and how much these kinds of financial services were a giant pain point for startup companies.

“To know where you stand financially in real time is hard to do, usually, you get that information at month-end,” Lilani said. “I believe we have the opportunity to build a large company. Though Zeni is going after startups today, the small and medium markets can be leveraged. As they grow, Zeni will become their controller on the back end, while companies can just hire a CFO for the strategic decisions.”

Powered by WPeMatico

One year after raising $16 million, construction technology company Buildots is back to claim another $30 million, this time in Series B funding.

Lightspeed Venture Partners led the round, with participation from previous investors TLV Partners, Future Energy Ventures, Tidhar Construction Group and Maor Investments. This gives the company $46 million in total funding, Roy Danon, co-founder and CEO of Buildots, told TechCrunch.

The three-year-old company, with headquarters in Tel Aviv and London, is leveraging artificial intelligence computer vision technology to address construction inefficiencies. Danon said though construction accounts for 13% of the world’s GDP and employs hundreds of millions of people, construction productivity continues to lag, only growing 1% in the past two decades.

Danon spent six months on construction sites talking to workers to understand what was happening and learned that control was one of the areas where efficiency was breaking down. While construction processes would seem similar to manufacturing processes, building to the design or specs didn’t happen often due to different rules and reliance on numerous entities to get their jobs done first, he said.

Buildots’ technology is addressing this gap using AI algorithms to automatically validate images captured by hardhat-mounted 360-degree cameras, detecting immediately any gaps between the original design, scheduling and what is actually happening on the construction site. Project managers can then make better decisions to speed up construction.

“It even finds events where contractors are installing out of place and streamline payments so that information is transparent and clear,” Danon said. “Buildots also creates a collaborative environment and trust by having a single source telling everyone what is going on. There is no more blaming or cutting corners because the system validates that and also makes construction a healthier industry to work in.”

Buildots went after new funding once it was able to show product market fit and was expanding into other countries. The platform is being utilized on major building projects in countries like the U.S., U.K., Germany, Switzerland, Scandinavia and China. To meet demand, Buildots will use the new funding to continue that expansion; double the size of its global team with a focus on sales, marketing and R&D; and grow on the business side. Danon’s aim is “to get to the point where we are the standard for every construction site.” The company is also looking at areas outside construction where its technology would be applicable.

Tal Morgenstern, partner at Lightspeed Venture Partners, said he keeps an eye on graduates of the Israel Defense Forces, where the three Buildots founders came from. However, in the case of this company, Lightspeed actually passed on both the seed and Series A.

Morgenstern admits the decision was a mistake, but at the time, he thought the technology Buildots was trying to build “first, impossible and second, I knew construction was difficult to sell into.” He felt that Buildots, with such a premium product, would have a challenge selling to a low-margin industry that was late to adopt technology in general.

By the time the Series B came round, he said Buildots had solved both of those issues, proving that it works, but also that customers were adopting the technology without much sales and marketing. In addition, other solutions in construction tech were still relying on lasers or people to manually input or tap photos.

“Buildots is seamlessly capturing images and providing a level of insights that is so high, and that is why the company is able to command the price structure they have and are receiving interesting commercial results,” Morgenstern said.

Walking around today’s construction site, Danon said the adoption of technology is enabling Buildots to move quickly to build processes for the industry.

As such, the company saw more than 50% growth quarter over quarter over the past year in three of the countries in which it operates. It is now working with four of the top 10 construction companies in Europe and around the world.

“We did a good job selling remotely, but now we need local offices,” Danon added. “We are also sitting on piles of data from construction sites. We learn from one project to another and want to look for the challenges where data will help make a financial impact. It’s a natural next step for the company.”

Powered by WPeMatico

Even with all the years of work that have been put into improving how screen-based interfaces work, our experiences with websites, mobile apps and any other interactive service you might use still often come up short: we can’t find what we want, we’re bombarded with exactly what we don’t need or the flow is just buggy in one way or another.

Now, FullStory, one of the startups that’s built a platform to identify when all of the above happens and provide suggestions to publishers for fixing it — it’s obsessed enough with the issue that it went so far as to trademark the phrase “Rage Clicks”, the focus of its mission — is announcing a big round of funding, a sign of its success and ambitions to do more.

The Atlanta-based company has closed a Series D round of $103 million, an oversubscribed round that actually was still growing between me interviewing the company and publishing this story (when we talked last week the figure was $100 million). Permira’s growth fund — which has previously invested in other customer experience startups like Klarna and Nexthink — is leading this round, with previous investors Kleiner Perkins, GV, Stripes, Dell Technologies Capital, Salesforce Ventures and Glynn Capital also participating.

FullStory, which has raised close to $170 million to date, has confirmed that the investment values the company at $1.8 billion.

Scott Voigt, FullStory’s founder and CEO, tells me that FullStory currently has some 3,100 paying customers on its books across verticals like retail, SaaS, finance and travel (customers include Peloton, the Financial Times, VMware and JetBlue), which collectively are on course to rack up more than 15 billion user sessions this year — working out to 1 trillion interactions involving clicks, navigations, highlights, scrolls and frustration signals. It says that annual recurring revenue has to date risen by more than 70% year-on-year.

The plan now will be to continue investing in R&D to bring more real-time intelligence into its products, “and pass those insights on to customers,” and also to “move more aggressively into Europe and Asia Pacific,” he added.

FullStory competes with others like Glassbox and Decibel, although it also claims its tools have more presence on websites than its three biggest competitors combined.

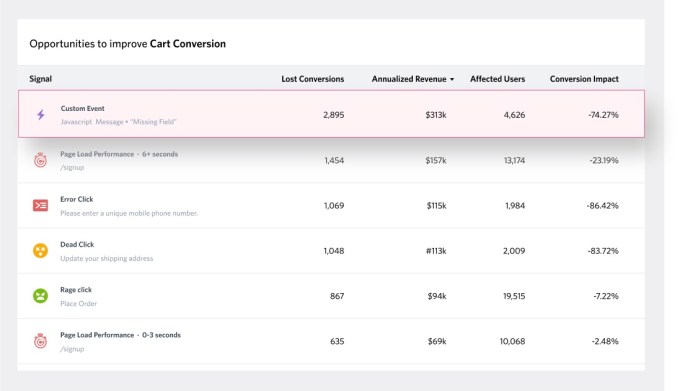

Working across different divisions like product, customer success and marketing, and engineering, FullStory uses machine learning algorithms to analyze how people navigate websites and other digital interfaces.

If approved as part of the “consent gate” you might encounter because of, say, GDPR regulations, it then tracks things like when people are clicking in areas excessively over a short period of time because of delays (the so-called “rage clicks”); or when a click leads nowhere because of, for example, a blip in a piece of JavaScript; or when a person is just scrolling or moving their mouse or cursor or finger in a frustrated (fast) way — again with little or no subsequent activity (or activity from the customer ceasing altogether) resulting from it. It doesn’t use — nor does it have plans to — use eye tracking, or anything like sentiment analysis around data that customers put into, say, customer response windows.

FullStory then packages up the insights that it does collect into data streams that can be used with various visualization tools (having Salesforce as a strategic backer is interesting in this regard, given that it owns Tableau), or spreadsheets, or whatever a customer chooses to put them into. While it doesn’t offer direct remediation (perhaps an area it could tackle in the future), it does offer suggestions for alternative actions to fix whatever problems are arising.

Image Credits: FullStory (opens in a new window)

Part of what has given FullStory a big boost in recent times (this round is by far the biggest fundraise the company has ever done) is the fact that, in today’s world, digital business has become the centerpiece of all business. Because of COVID-19 and the need for social distancing that have taken away some of the traffic of in-person experiences like going to stores, organizations that have natively or built experiences online are seeing unprecedented amounts of traffic; and they are now joined by organizations that have shifted into digital experiences simply to stay in business.

All of that has contributed to a huge amount of content online, and a big shift in mindset to making it better (and in the most urgent of cases, even more basically, simply usable), and that has resulted in the stars aligning for companies like FullStory.

“The category was so nascent to begin with that we had to explain the concept to customers,” Voigt told me of the company’s early days, where selling meant selling would-be customers on to the very idea of digital experience insights. “But digital experience, in the wake of COVID-19, suddenly mattered more than it ever has before, and the continued amount of inbound interest has been afterburner for us.” He noted that demand is increasing among mid-market and enterprise organizations, and something that has also helped FullStory grow is the general movement of talent in the industry.

“Our customers tend to take their tools with them when they change their jobs,” he said. Those tools include FullStory’s analytics.

The evolution of bringing more AI into the world of basically structuring what might otherwise be unstructured data has been a big boost to the world of analytics, and investors are interested in FullStory because of how it’s taken that trend and grown its business on top of it.

“We are very excited to partner with the FullStory team as they continue to expand and build a truly extraordinary technology brand that improves the digital experience for all stakeholders,” said Alex Melamud, who led the transaction on behalf of Permira Growth, in a statement.

“Traditional analytics have been upended by AI- and ML-enabled approaches that can instantly uncover nuanced patterns and anomalies in customer behavior,” said Bruce Chizen, a senior advisor at Permira, in a statement. “Leveraging both structured and unstructured data, FullStory has rapidly established itself as the market and technology leader in DXI and is now the fastest-growing company in the category and the de facto system of record for all digital experience data.” Chizen is joining the FullStory Board with this round.

Powered by WPeMatico

Correlated on Wednesday announced it raised $8.3 million in seed funding to launch its product-led growth platform for sales teams.

NextView Ventures and Harrison Metal co-led the round and were joined by Apollo Projects, Attentive co-founders Brian Long and Andrew Jones, Cockroach Labs co-founder Ben Darnell and Atrium’s Pete Kazanjy. The round includes funding raised last year and more recent follow-on funding from both NextView and Harrison, co-founder and CEO Tim Geisenheimer told TechCrunch.

The New York-based company was founded in 2020 by Geisenheimer and Diana Hsieh, who overlapped at TimescaleDB, and John Pena, who Geisenheimer met at Facet. In their previous roles, they saw a need to connect product data to sales tools.

While at Timescale, Geisenheimer said there were thousands of free users to talk to, and he and Hsieh built a similar version of a product-led growth platform there, but secretly wished there was something more like Correlated available.

What they saw was data across multiple tools being stored manually on spreadsheets so that actionable insights could be generated. The data would quickly become outdated. Add in that the way customers use products now is different. Traditionally, customers would not be able to use a product until they talked to the sales team. Today, customers start using products for free and either get value from it or not, but sales teams don’t have real-time data on their experience.

“Sales needs to know how customers are using the product and the right time for sales to engage based on maturity of the experience,” Geisenheimer said. “That was the missing piece of it and sales teams ended up talking to the wrong people. With Correlated, they can close more deals efficiently.”

Correlated’s technology pulls in product usage data from tools and data warehouses and connects to a management platform like Salesforce or HubSpot, stitching it together into a data graph to show how customers are using a product. For example, within a company of 200 to 500 employees, a salesperson can see the frequency employees logged in and be alerted of when the best opportunity is to make the sale.

The company has a SaaS pricing model and is already working with mid-market companies like Ally, Pulumi, ReadMe and LaunchNotes. To support its launch out of beta, Geisenheimer intends to use the new funding for hiring across functions like engineering and go-to-market. The company has 11 employees currently.

There are other product-led growth platforms out there that raised venture capital funding recently, for example, Endgame, and similarly Geisenheimer said the competition is often in-house product teams building their own systems. Correlated’s differentiator is that it has taken on that task itself and enables customers to quickly see value once they are up-and-running, he added.

David Beisel, co-founder and partner at NextView Ventures, said his firm invests in category stage companies and is currently operating out of its fourth fund, infusing business-to-business SaaS and e-commerce companies. Beisel has known Geisenheimer for nearly a decade now, having met him when NextView invested in one of Geisenheimer’s previous companies, TapCommerce.

“At the end of the day with Tim, he knows sales and the company is selling a product that has a strong founder market fit,” Beisel said. “We are moving toward a world where end-user adoption of software — not the initial engagement — is growing over time. Instead, Correlated empowers that initial sale and account expansion and that will align with where the industry is going.”

Powered by WPeMatico

Indian fintech startup BharatPe has raised $370 million in a new round of financing as it looks to aggressively scale its business in the next two years. It’s the nineteenth Indian startup to become a unicorn this year (up from 11 last year) as several high-profile global investors double down in the South Asian market.

The new round — a Series E — was led by Tiger Global and valued the New Delhi-based startup at $2.85 billion (post-money), it said in a statement Tuesday evening. Dragoneer Investor Group and Steadfast Capital also participated in the new round, which brings the startup’s to-date raise to over $580 million against equity.

Tuesday’s news confirms a TechCrunch scoop from June in which we reported that the four-year-old startup was looking to raise about $250 million at a pre-money valuation of $2.5 billion. BharatPe was valued at about $900 million in its Series D round in February this year, and $425 million last year.

BharatPe co-founder Ashneer Grover confirmed that the startup was indeed looking to raise $250 million until inbound requests from investors prompted an oversubscription. The new investment also includes some secondary transactions.

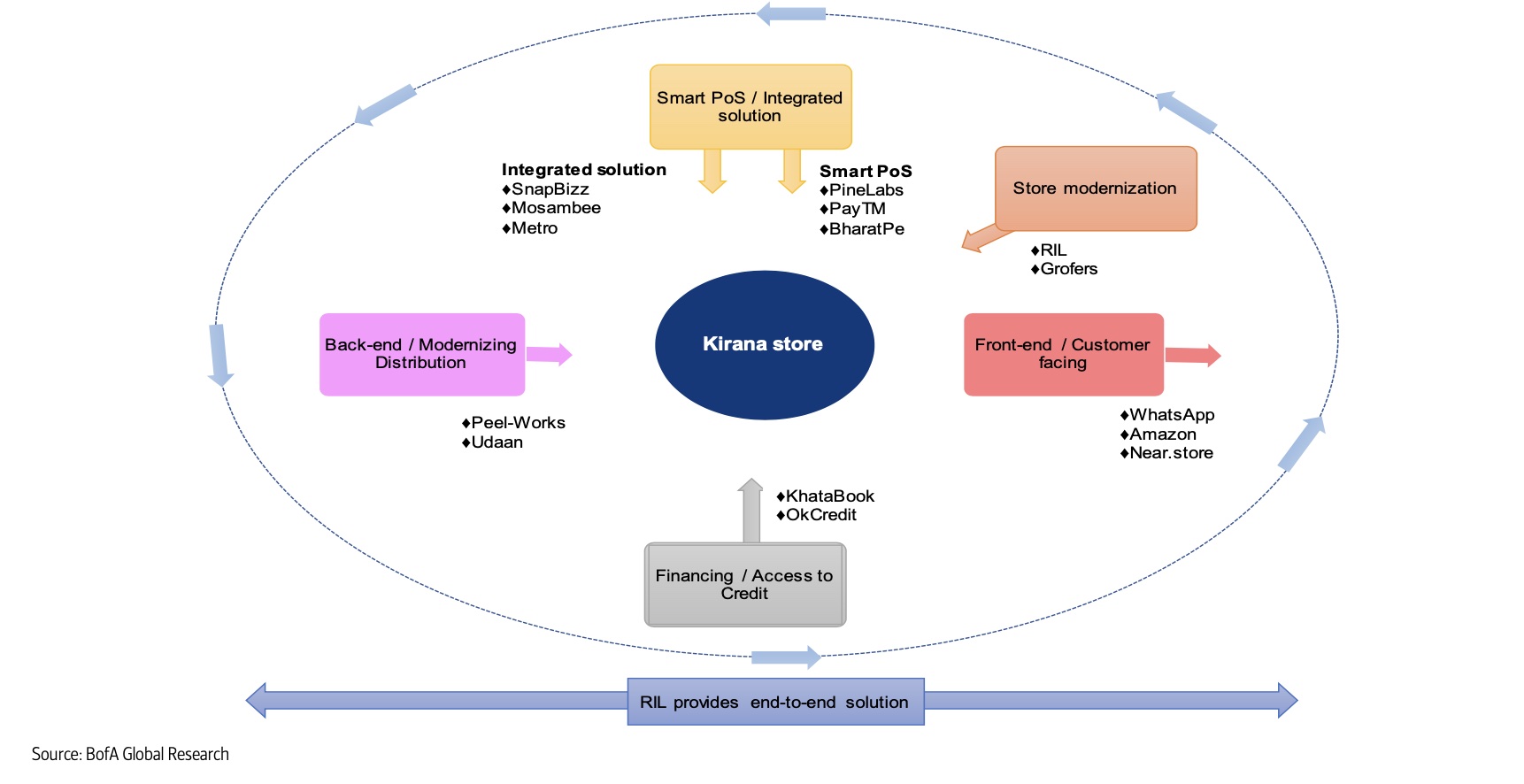

BharatPe, which counts Coatue, Ribbit Capital and Sequoia Capital India among its existing investors, operates an eponymous service to help offline merchants accept digital payments and secure working capital.

Even as India has already emerged as the second-largest internet market, with more than 650 million users, much of the country remains offline.

Among those outside of the reach of the internet are merchants running small businesses, such as roadside tea stalls and neighborhood stores. To make these merchants comfortable with accepting digital payments, BharatPe relies on QR codes and point of sale machines that support government-backed UPI payments infrastructure.

Scores of giants and startups are attempting to serve neighborhood stores in India. Image Credits: Bank of America Research

The startup, which serves more than 7 million merchants in over 130 Indian cities, said it has disbursed close to $300 million to merchant partners. It does not charge merchants for universal QR code access, but is looking to make money by lending.

The startup plans to expand its product offerings as well as work with Centrum Financial Services, with which it was recently granted the license by India’s central bank (Reserve Bank of India) to set up a small finance bank. (Centrum Financial Services has collaborated with BharatPe for the license, and the Indian startup says the two are “equal” partners.)

Tuesday’s development further illustrates the growing interest of Tiger Global in India. The New York-headquartered firm has backed dozens of Indian startups, including social commerce startup DealShare, edtech Classplus, Apna (an app that helps blue-collar workers connect with recruiters) and home services platform Urban Company in recent months.

On Tuesday, Infra.Market, an Indian startup that helps construction and real estate companies procure materials and handle logistics for their projects, said it had raised $125 million in a round led also by Tiger Global.

Powered by WPeMatico

With the pandemic wreaking havoc amongst early years education amid school lockdowns, it’s no wonder edtech startups have piled into the space. But it has also served to highlight the abysmal nature of early years teaching: Some 40 million teachers across the globe are leaving the sector, according to the World Bank. Of the 1.5 billion primary-age children, only a few can access high-quality education, and approximately 58 million primary-age children are out of education, most of whom are girls.

So the opportunity to make a difference, using online teaching, in these very young years, is great, because classes sizes can be reduced online, and the quality of teaching improved.

This is the idea behind bina, which bills itself as a “digital primary education ecosystem”. It has now raised $1.4 million to aim at the education of 4- to 12-year-olds.

The funding round was led by Taizo Son, one of Japan’s billionaires. Other investors and advisors include Jutta Steiner, founder at Parity Technologies, the company behind Polkadot decentralized protocol, and Lord Jim Knight, ex-Minister of Education (U.K.).

Bina’s “schtick” is that it has very small online class sizes of six students (3x smaller than the OECD average).

It also boasts of “adaptive learning paths” that cover international standards; teachers with a minimum of eight years of digital teaching experience; and data-driven decision making for its pedagogical approach.

Noam Gerstein, bina’s CEO and founder said: “I’ve interviewed students, teachers and parents globally for years, and it is clear a new systemic design is needed. With our founding families, we are building a world in which every child has access to quality education, educators’ skills are valued and continuously developed, and parents don’t need to choose between their work and family life.”

He says it also grants pupils company shares (RSUs) as they grow with the school. Currently available to English-speaking students in the CET time zone, the bina School is planning a SaaS product for governments, NGOs and school systems.

“We right now compete against companies like Outschool, Pearson’s online Academy, Primer and Prisma,” he told me over a call. “So these are the big names of the last year for the first phase. But the strategy is that we’re building it in two phases. The first phase is actually building a school that we operate as a ‘lab’ school. And the second phase is what we call ‘bina as a service’. So it’s a SaaS ‘school as a service’. The idea is that we offer collaboration with NGOs and governments, doing accreditation and training and licencing of the product. So for that second part we’re actually competing against the big accreditation system.”

Powered by WPeMatico

In “Macbeth,” Shakespeare described sleep as the “chief nourisher in life’s feast.” But like his titular character, many adults aren’t sleeping well. Revery wants to help with an app that combines cognitive behavioral therapy (CBT) for insomnia with mobile gaming concepts.

Founded in March 2021, Revery is currently in beta stealth mode and plans to launch its app in the United States later this year. The company announced today it has raised $2 million, led by Sequoia Capital India’s Surge program. Participants included GGV Capital, Pascal Capital, zVentures (Razer’s corporate venture arm) and angel investors like MyFitnessPal co-founder Albert Lee; gaming entrepreneur Juha Paananen; CRED founder Kunal Shah; Mobile Premier League founder Sai Srinivas; Carolin Krenzer; and Josh Lee.

Lee, a mutual friend, first introduced Revery’s founders, Tammie Siew and Khoa Tran, to one another. Before launching the startup, Siew worked at Sequoia Capital India, Boston Consulting Group and CRED, while Tran was a former product manager at Google.

Revery plans to focus on other mental health issues in the future, but it’s starting with sleep because “it has such a strong correlation with mental health and we’re leveraging protocols, cognitive behavioral therapy for insomnia, that’s robust and have been tried and tested for 30 years,” Siew told TechCrunch. “That is the first indication, but the goal is to build multiple games for other wellness indications as well.”

A study by research firm Infinium found that about 30% to 45% of adults in the world experience insomnia, a problem exacerbated by the COVID-19 pandemic. Chronic lack of sleep is linked to a host of health issues, including high blood pressure, strokes, depression and lowered immunity.

For Revery’s team, which also includes former Zynga and King lead game designer Kriti Sawa and software engineer Stephanie Wong, their focus on sleep is personal.

“Everyone on our team has a deeply personal connection to the mission, because everyone on our team has experienced, or had a family member or friends go through challenges in mental health,” said Siew. “They’ve seen how late intervention creates consequences that could have been avoided if they had gotten help earlier.”

When Tran was 15, he was diagnosed with hypertension and several other health conditions that needed medication. It wasn’t until he was 26 that Tran found out that sleep apnea was at the root of his medical issues. After getting surgery, Tran’s blood pressure became normal and many of his other conditions also improved.

“When I finally got treatment for my sleep disorder, only then did I realize the impact of sleep on mental health,” Tran said. “For me, I was really lucky that a doctor caught my sleep disorder and super lucky to have the time and resources to get treatment. For many people, it’s incredibly inaccessible.”

Revery’s medical advisory team includes the doctor who performed Tran’s surgery, Stanford Sleep Surgery Fellowship director Dr. Stanley Liu; Stanford professor and behavioral sleep medicine expert Dr. Fiona Barwick; and Dr. Ryan Kelly, a clinical psychologist who researches how video games can be used in therapy.

When people think of sleeping apps, ones that focus on meditation (Calm and Headspace, for example) or soothing noises usually come to mind. The Revery team isn’t sharing a lot of details about its app before launch, but says it draws from casual mobile games, which are designed to get people to return for short play sessions over a long period of time. The goal is to use gamification to make CBT practices interactive and fun, so it becomes part of users’ daily routines.

“That’s the same kind of gameplay that Zynga and King have used, which is why Kriti’s experience is super helpful,” said Siew. Casual games revolve around rewarding people for small actions, and for the Revery app, that means positive reinforcement for habits that contribute to better sleep. For example, it will reward people for putting down their phones.

“I think a lot of people have the misconception that solving sleep is only at the time you fall asleep. They don’t realize that sleep is impacted by what you do throughout the day,” Siew said. “A big part is also what are your thoughts, behavior and the other things that you do, so in order to effectively and sustainably improve sleep, we also have to change your thoughts and behaviors outside of the time you’re trying to fall asleep.”

In a statement, GGV Capital managing director Jenny Lee said, “We are excited about the growing mental wellness market, and believe that Revery’s unique mobile game-based approach has the opportunity to create immense impact. We are happy to back such a mission-driven team in this space.”

Powered by WPeMatico

If you’re trying to develop fluency in a non-native tongue, language immersion is a crucial part of the learning process. Surrounding yourself with native speakers helps with pronunciation, context building, and most of all, confidence.

But what if you’re an eight-year-old kid in Spain learning English and can’t swing a solo trip to the United States for the summer?

Novakid, founded by Maxim Azarov, wants to be your next best option. The San Francisco-based edtech startup offers virtual-only, English language immersion for kids between the ages of four through 12, by combining a mix of different services from live tutors to gamification.

After closing its $4.25 million Series A round last December, Novakid announced today that it is back with a $35 million Series B financing, led by Owl Ventures and Goodwater Capital. Existing investors also participated in the round, including PortfoLion, LearnStart, TMT Investments, Xploration Capital, LETA Capital and BonAngels.

The startup is raising capital in response to an active start to its year. The company’s active client base grew 350% year over year, currently at over 50,000 paying students. The money will be used to get more students into its universe of tools, as well as help Novakid expand into international markets with high populations of speakers who want to learn English.

The company’s suite of services are built around two principles: First, that it can immerse early-age learners into the world of English at scale, and second, that it can actually be fun to use.

When a user signs up, they are first connected to one of Novakid’s 2,000 live tutors for their first class. Tutors must be native English speakers with a B.A. degree or higher, as well as an international teaching certificate such as DELTA, CELTA, TESOL or TEFL.

“One of the things that is really important, even psychologically, is to start listening to the language, start interacting with a live person, and remove being afraid of not understanding something,” Azarov said. The company wants to recreate the conditions of how a kid likely learned their first language.

In the class, the tutors only speak English, and users are encouraged to do the same to slowly build and mistake their way into confidence. While the live, video-based classes are a key part of Novakid’s product, Azarov said it was important that his company “was not just giving you access to a teacher” as its main value proposition.

“Most of the competitors are taking teachers and making them available remotely so you don’t have to travel and you have a bigger selection,” he said. But if you look at the industry in the bigger picture, guys like Oxford, Cambridge, Pearson who provide content for the language learning industry, their product basically sucks. It’s really bad.” So, Novakid puts most of its energy into rebuilding a curriculum that works with better design, and includes games.

Gamified content lives both in and out of classes. Within the classroom, a teacher may take a student on a VR-enhanced tour through famous landmarks and museums to practice vocabulary. Self-paced content could look like a multiplayer “battle” between two students answering questions within a certain time period to get a better score. Novakid has an entire team dedicated to game design and development.

Students are clicking in. Novakid users spend two-thirds of their time on the website with tutors, and one-third with self-paced content that the company built in-house. The company wants to switch those concentrations because more students are spending time with the asynchronous content around grammar and vocabulary, and teachers are reserved for more complex information like speaking and conversation.

Part of the difficulty of scaling up a language learning business is that users need to stay motivated. Gamification helps with engagement, but Novakid’s clientele of children could also be fast to churn compared to adult learners, simply due to priorities. Azarov said that he sees how some would view selling exclusively to children as a disadvantage, but he views their focus as differentiation.

“You get better brand equity when you’re more focused,” he said. “The way kids learn language is vastly different from the way adults learn language, and I don’t think the general players who do ‘everything from everybody’ will be able to do [the former] as well as we are.” Duolingo recently launched Duolingo ABC, a free English literacy app with hundreds of short-form exercises. While the now-public company has strong branding, Novakid’s strategy differs by adding in more services around live learning and speaking.

So far, the company has proven that its strategy is sticking. Its revenue in 2020 was $9 million, and in 2021 it is expected to hit between $36 million to $45 million in revenue. It declined to disclose the specifics around diversity of the team, but plans to kick off a quite intensive recruiting spree going forward. Azarov plans to add 200 people to his 300-person company in the next six months.

Powered by WPeMatico

Swiss alternative protein company Planted has raised its second round of the year, a CHF 19 million (about $21 million at present) “pre-B” fundraise that will help it continue its growth and debut new products. A U.S. launch is in the cards eventually, but for now Planted’s exclusively European customers will be able to give its new veggie schnitzel a shot.

Planted appeared in 2019 as a spinoff from Swiss research university ETH Zurich, where the founders developed the original technique of extruding plant proteins and water into fibrous structures similar to real meat’s. Since then the company has diversified its protein sources, adding oat and sunflower to the mix, and developed pulled pork and kebab alternative products as well.

Over time the process has improved as well. “We added fermentation/biotech technologies to enhance taste and texture,” wrote CEO and co-founder Christoph Jenny in an email to TechCrunch. “Meaning 1) we can create structures without form limitation and 2) can add a broader taste profile.”

The latest advance is schnitzel, which is of course a breaded and fried piece of pounded-thin meat style popular around the world, but especially in the company’s core markets of Germany, Austria and Switzerland. Jenny noted that Planted’s schnitzel is produced as one piece, not pressed together from smaller bits. “The taste and texture benefit from fermentation approach, that makes the flavor profile mouth watering and the texture super juicy,” he said, though of course we will have to test it to be sure. Expect schnitzel to debut in Q3.

It’s the first of several planned “whole” or “prime” cuts, larger pieces that can be prepared like any other piece of meat — the team says their products require no special preparation or additives and can be dropped in as 1:1 replacements in most recipes. Right now the big cuts are leaving the lab and entering consumer testing for taste tuning and eventually scaling.

The funding round came from “Vorwerk Ventures, Gullspång Re:food, Movendo Capital, Good Seed Ventures, Joyance, ACE & Company (SFG strategy) and Be8 Ventures,” and was described as a follow-on to March’s CHF 17M series A. No doubt the exploding demand for alternative proteins and growing competition in the space has spurred Planted’s investors to opt for more aggressive growth and development strategies.

The company plans to enter several new markets over Q3 and Q4, but the U.S. is still a question mark due to COVID-19 restrictions on travel. Jenny said they are preparing so that they can make that move whenever it becomes possible, but for now Planted is focused on the European market.

(Update: This article originally misstated the new round as also being CHF 17M — entirely my mistake. This has been corrected.)

Powered by WPeMatico

It’s no secret that the technology for easy business-to-business payments has not yet caught up to its peer-to-peer counterparts, but Yaydoo thinks it has the answer.

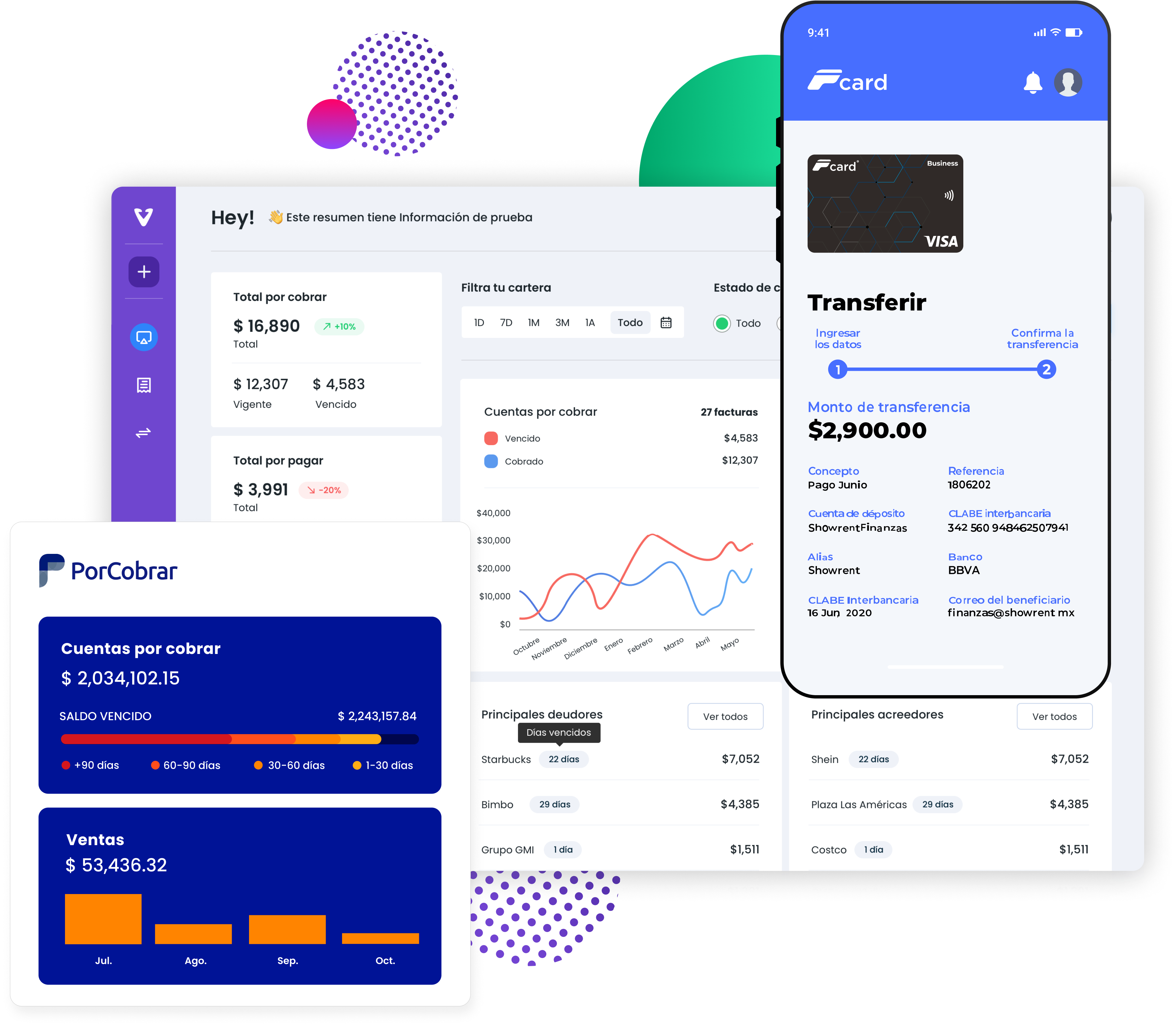

The Mexico City-based B2B software and payments company provides three products, VendorPlace, P-Card and PorCobrar, for managing cash flow, optimizing access to smart liquidity, and connecting small, midsize and large businesses to an ecosystem of digital tools.

Sergio Almaguer, Guillermo Treviño and Roberto Flores founded Yaydoo — the name combines “yay” and “do” to show the happiness of doing something — in 2017. Today, the company announced the close of a $20.4 million Series A round co-led by Base10 Partners and monashees.

Joining them in the round were SoftBank’s Latin America Fund and Leap Global Partners. In total, Yaydoo has raised $21.5 million, Almaguer told TechCrunch.

Prior to starting the company, Almaguer was working at another company in Mexico doing point-of-sale. His large enterprise customers wanted automation for their payments, but he noticed that the same tools were too expensive for small businesses.

The co-founders started Yaydoo to provide procurement, accounts payable and accounts receivables, but in a simpler format so that the collection and payment of B2B transactions was affordable for small businesses.

Image Credits: Yaydoo

The idea is taking off, and vendors are adding their own customers so that they are all part of the network to better link invoices to purchase orders and then connect to accounts payable, Almaguer said. Yaydoo estimates that the automation workflows reduced 80% of time wasted paying vendors, on average.

Yaydoo is joining a sector of fintech that is heating up — the global B2B payments market is valued at $120 trillion annually. Last week, B2B payments platform Nium announced a $200 million in Series D funding on a $1 billion valuation. Others attracting funding recently include Paystand, which raised $50 million in Series C funding to make B2B payments cashless, while Dwolla raised $21 million for its API that allows companies to build and facilitate fast payments.

The new funding will enable the company to attract new hires in Mexico and when the company expands into other Latin American countries. Yaydoo is also looking at future opportunities for its working capital business, like understanding how many invoices customers are setting, the access to actual payments, and how money flows out and in so that it can provide insights on working capital funding gaps. The company will also invest in product development.

The company has grown to over 800 customers, up from 200 in the first quarter of 2020. Its headcount also grew to 100 from 30 during the same time. In the last 12 months, over 70,000 companies have transacted on the Yaydoo network, and total payment volume grew to hundreds of millions of dollars.

Yaydoo is a SaaS subscription model, but the new funding will also enable the company to create a pool of potential customers with a “freemium” offering with the goal of converting those customers into the subscription model as they grow, Almaguer said.

Rexhi Dollaku, partner at Base10 Partners, said the firm saw the way B2B payments were becoming modernized and “was impressed” by the Yaydoo team and how it built a complicated infrastructure, but made it easy to use.

He believes Latin America is 10 years behind in terms of B2B payments but will catch up sooner than later because of the digital transformation going on in the region.

“We are starting to see early signs of the network being built out of the payments product, and that is a good indication,” Dollaku said. “With the funding, Yaydoo will be also able to provide more financial services options for businesses to address a working fund gap.”

Powered by WPeMatico