Recent Funding

Auto Added by WPeMatico

Auto Added by WPeMatico

3D printing has become commonplace in the hardware industry, but because few materials can be used for it easily, the process rarely results in final products. A Swiss startup called Spectroplast hopes to change that with a technique for printing using silicone, opening up all kinds of applications in medicine, robotics and beyond.

Silicone is not very bioreactive, and of course can be made into just about any shape while retaining strength and flexibility. But the process for doing so is generally injection molding, great for mass-producing lots of identical items but not so great when you need a custom job.

And it’s custom jobs that ETH Zurich’s Manuel Schaffner and Petar Stefanov have in mind. Hearts, for instance, are largely similar but the details differ, and if you were going to get a valve replaced, you’d probably prefer yours made to order rather than straight off the shelf.

“Replacement valves currently used are circular, but do not exactly match the shape of the aorta, which is different for each patient,” said Schaffner in a university news release. Not only that, but they may be a mixture of materials, some of which the body may reject.

But with a precise MRI the researchers can create a digital model of the heart under consideration and, using their proprietary 3D printing technique, produce a valve that’s exactly tailored to it — all in a couple of hours.

A 3D-printed silicone heart valve from Spectroplast.

Although they have created these valves and done some initial testing, it’ll be years before anyone gets one installed — this is the kind of medical technique that takes a decade to test. So in the meantime they are working on “life-improving” rather than life-saving applications.

One such case is adjacent to perhaps the most well-known surgical application of silicone: breast augmentation. In Spectroplast’s case, however, they’d be working with women who have undergone mastectomies and would like to have a breast prosthesis that matches the other perfectly.

Another possibility would be anything that needs to fit perfectly to a person’s biology, like a custom hearing aid, the end of a prosthetic leg or some other form of reconstructive surgery. And of course, robots and industry could use one-off silicone parts as well.

![]()

There’s plenty of room to grow, it seems, and although Spectroplast is just starting out, it already has some 200 customers. The main limitation is the speed at which the products can be printed, a process that has to be overseen by the founders, who work in shifts.

Until very recently Schaffner and Stefanov were working on this under a grant from the ETH Pioneer Fellowship and a Swiss national innovation grant. But in deciding to depart from the ETH umbrella they attracted a 1.5 million Swiss franc (about the same as dollars just now) seed round from AM Ventures Holding in Germany. The founders plan to use the money to hire new staff to crew the printers.

Right now Spectroplast is doing all the printing itself, but in the next couple of years it may sell the printers or modifications necessary to adapt existing setups.

You can read the team’s paper showing their process for creating artificial heart valves here.

Powered by WPeMatico

From the time he was a high school student, Rohit Kalyanpur thought it was peculiar that although it’s possible to create energy from a solar panel, the panels have long been used almost exclusively on rooftops and as part of industrial-scale solar grids. “I hadn’t seen [anything solar-powered] in the things people use every day other than calculators and lawn lights,” he tells us from him home in Chicago — though he’s moving to the Bay Area next month.

It wasn’t just a passing thought for Kalyanpur. Through research positions in high school, he continued to learn about energy and work on a solar charging prototype — initially to charge his iPhone — while continuing to wonder what other materials might be powered spontaneously just by shining light on it.

What he quickly discovered, he says, is there were no developer tools to build a self-charging project. Unlike with hardware projects, where developers can turn to the open-source electronic prototyping platform Arduino, and to Raspberry Pi, a tiny computer the size of a credit card and was created in 2012 to help students understand how computers work, there was “nothing you could use to optimize a solar product,” he says.

Fast-forward, and Kalyanpur says there is now — and he helped build it.

It’s been several years in the making. After attending the University of Illinois at Urbana-Champaign for two years and befriending a fellow student, Paul Couston, who helped manage and invest the university’s $10 million green fund, the pair dropped out of school to start their now four-person company, Optivolt Labs. Entry into the accelerator program Techstars Chicago was the impetus they needed, and they’ve been gaining momentum since. In fact, Kalyanpur, now 21, was recently given a Thiel Fellowship, a two-year-long program that includes a $100,000 grant to young people who want to build new things, along with a lot of mentorships and key introductions.

Now, the company has closed on a separate $1.75 million round of seed funding from a long list of notable individual investors, including Eventbrite co-founders Kevin & Julia Hartz; TJ Parker, who is the founder and CEO of PillPack (now an Amazon subsidiary); Pinterest COO Francoise Brougher: and Jeff Lutz, a former Google SVP.

What they’re buying into exactly is the promise of a scalable technology stack for solar integration. Though still nascent, Optivolt has already figured out a way to provide efficient power transfer systems, solar developer and simulation tools and cloud-based API’s to enable fleets of machines to self charge in ambient light, says Kalyanpur. Think e-scooters, EVs, drones, sensors and other connected devices.

Asked how it all works on a more granular level, Kalyanpur declines to dive into specifics, but he says the company will begin testing its technology soon with a number of “enterprise fleets” that have already signed on to work with Optivolt in pilot programs.

If it works as planned, it sounds like a pretty big opportunity. Though some companies have begun making smaller solar-powered vehicles, there are presumably many outfits that would prefer to find a way to retrofit the hardware they already have in the world, which Kalyanpur says will be possible.

He says they can use their existing batteries, too — that the solar won’t just power the devices or vehicles in real time but allow them to store some of that energy, too. Optivolt’s technology “seamlessly integrates into everyday products, so you don’t have to change the product design meaningfully,” he insists.

We’ll be curious to see if see if it does what he thinks it can. It sounds like we aren’t the only ones, either.

Asked about Optivolt’s road map, Kalynapur suggests that one is coming together. The company’s top priority, however — beyond hiring more engineering talent with its brand new round — it to see first how it works in the field.

Powered by WPeMatico

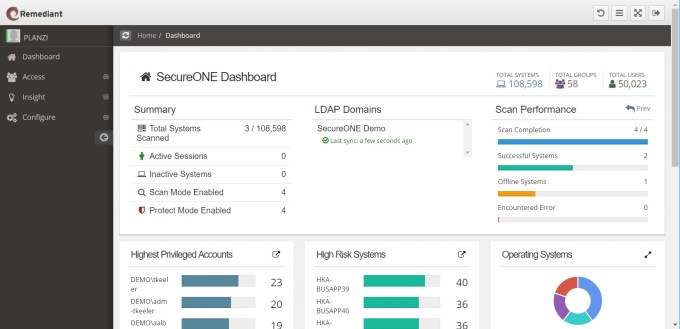

Remediant, a startup that helps companies secure privileged access in a modern context, today announced a $15 million Series A led by Dell Technologies Capital and ForgePoint Capital.

Remediant’s co-founders, Paul Lanzi and Tim Keeler, worked in biotech for years and saw a problem first-hand with the way companies secured privileged access. It was granted to certain individuals in the organization carte blanche, and they believed if you could limit access, it would make the space more secure and less vulnerable to hackers.

Lanzi says they started the company with two core concepts. “The first concept is the ability to assess or detect all of the places where privileged accounts exist and what systems they have access to. The second concept is to strip away all of the privileged access from all of those accounts and grant it back on a just-in-time basis,” Lanzi explained.

If you’re thinking that could get in the way of people who need access to do their jobs, as former IT admins, they considered that. Remediant is based on a Zero Trust model where you have to prove you have the right to access the privileged area. But they do provide a reasonable baseline amount of time for users who need it within the confines of continuously enforcing access.

“Continuous enforcement is part of what we do, so by default we grant you four hours of access when you need that access, and then after that four hours, even if you forget to come back and end your session, we will automatically revoke that access. In that way all of the systems that are protected by SecureOne (the company’s flagship product) are held in this Zero Trust state where no one has access to them on a day-to-day basis,” Lanzi said.

Remediant SecureONE Dashboard (Screenshot: Remediant)

The company has bootstrapped until now, and has actually been profitable, something that’s unusual for a startup at this stage of development, but Lanzi says they decided to take an investment in order to shift gears and concentrate on growth and product expansion.

Deepak Jeevankumar, managing director at investor Dell Technologies Capital, says it’s not easy for security startups to rise above the noise, but he saw something in Remediant’s founders. “Tim and Paul came from the practitioner’s viewpoint. They knew the actual problems that people face in terms of privileged access. So they had a very strong empathy towards the customer’s problem because they lived through it,” Jeevankumar told TechCrunch.

He added that the privileged access market hasn’t really been updated in two decades. “It’s a market ripe for disruption. They are combining the just-in-time philosophy with the Zero Trust philosophy, and are bringing that to the crown jewel of administrative access,” he said.

The company’s tools are installed on the customer’s infrastructure, either on-prem or in the cloud. They don’t have a pure cloud product at the moment, but they have plans for a SaaS version down the road to help small and medium-sized businesses solve the privileged access problem.

Lanzi says they are also looking to expand the product line in other ways with this investment. “The basic philosophies that underpin our technology are broadly applicable. We want to start applying our technology in those other areas as well. So as we think toward a future that looks more like cloud and more like DevOps, we want to be able to add more of those features to our products,” he said.

Powered by WPeMatico

ThredUp, the 10-year-old fashion resale marketplace, has a lot of big news to boast about lately. For starters, the company just closed on $100 million in fresh funding from an investor syndicate that includes Park West Asset Management, Irving Investors and earlier backers Goldman Sachs Investment Partners, Upfront Ventures, Highland Capital Partners and Redpoint Ventures.

The round brings ThredUP’s total capital raised to more than $300 million, including a previously undisclosed $75 million investment that it sewed up last year.

A potentially even bigger deal for the company is a new resale platform that both Macy’s and JCPenney are beginning to test out, wherein ThedUp will be sending the stores clothing that they will process through their own point-of-sale systems, while trying to up-sell customers on jewelry, shoes, and other accessories.

It says a lot that traditional retailers are coming to see gently used items as a potential revenue stream for themselves, and little wonder given the size of the resale market, estimated to be a $24 billion market currently and projected to become a $51 billion market by 2023.

We talked yesterday with ThredUp founder and CEO James Reinhart to learn more about its tie-up with the two brands and to find out what else the startup is stitching together.

TC: You’ve partnered with Macy’s and JCPenney. Did they approach you or is ThredUp out there pitching traditional retailers?

JR: I think [the two companies] have been thinking about resale for some time. They’re trying to figure out how to best serve their customers. Meanwhile, we’ve been thinking about how we power resale for a broader set of partners, and there was a meeting of the minds six months ago

We’re positioned now where we can do this really effectively in-store, so we’re starting with a pilot program in 30 to 40 stores, but we could scale to 300 or 400 stores if we wanted.

TC: How is this going to work, exactly, with these partners?

JR: We have the [software and logistics] architecture and the selection to put together carefully curated selections of clothing for particular stores, including the right assortment of brands and sizes, depending on where a Macy’s is located, for example. Macy’s then wraps a high-quality experience around [those goods]. Maybe it’s a dress, but they wrap a handbag and scarves and jewelry around the dress purchase. We feel [certain] that future consumers will buy new and used at the same time.

TC: Who is your demographic, and please don’t say everyone.

JR: It is everyone. It’s not a satisfying answer, but we sell 30,000 brands. We serve lots of luxury customers with brands like Louis Vuitton, but we also sell Old Navy. What unites customers across all brands is they want to find brands that they couldn’t have afforded new; they’re trading up to brands that, full price, would have been too much, so Old Navy shoppers are [buying] Gap [whose shopper are buying] J. Crew and Theory and all the way up. Consistently, what we hear is [our marketplace] allows customers to swap out their wardrobes at higher rates than would be possible otherwise, and it feels to them like they’re doing it in a more [environmentally] responsible way.

TC: What percentage of your shoppers are also consigning goods?

JR: We don’t track that closely, but it’s typically about a third.

TC: Do you think your customers are buying higher-end goods with a mind toward selling them, to defray their overall cost? I know that’s the thinking of CEO Julie Wainwright at [rival] The RealReal. It’s all supposed to be a kind of virtuous circle of shopping.

JR: We like to talk about buying the handbag, then selling it, but plenty of people will also buy a second-hand Banana Republic sweater because it’s a value [and because] fashion is the second-most polluting industry on the planet.

TC: How far are you going to combat that pollution? I’m just curious if you’re in any way try to bolster the sale of hemp, versus maybe nylon, clothes for example.

JR: We aren’t driving material selection. Our thesis is: we want to stay out of the fashion business and instead ensure there’s a responsible way for people to buy second hand.

TC: For people who haven’t used ThredUp, walk through the economics. How much of each sale does someone keep?

JR: On ThredUp, it isn’t a uniform payment; it depends instead on the brand. On the luxury end, we pay [sellers] more than anyone else — we pay up to 80 percent when we resell it. If it’s Gap or Banana Republic, you get maybe 10 or 15 or 20 percent based on the original price of the item.

TC: How would you describe your standards? What goes into the reject pile?

JR: We have high standards. Items have to be in like-new or gently used condition, and we reject more than half of what people send us. But I think there’s probably more leeway for the Theory’s and J.Crew’s of the world than if you’re buying a Chanel dress.

TC: Unlike some of your rivals, you don’t sell to men. Why not?

JR: Men’s is a small market in secondhand. Men wear the same four colors — blue, black, gray and brown — so it’s not a big resale market. We do sell kids’ clothing, and that’s a big part of our market.

TC: When Macy’s now sells a dress from ThredUp, how much will you see from that transaction?

JR: We can’t share the details of the economics.

TC: How many people are now working for ThredUp?

JR: We have less than 200 in our corporate office in San Francisco, and 50 in Kiev, and then across four distribution centers — in Phoenix; Mechanicsburg [Pa.]; Atlanta; and Chicago — we have another 1,200 employees.

TC: You’ve now raised a lot of money in the last year. How will it be used?

JR: On our resale platform [used by retailers like Macy’s] and on building our tech and operations and building new distribution centers to process more clothing. We can’t get people to stop sending us stuff. [Laughs.]

TC: Before you go, what’s the most under-appreciated aspect of your business?

JR: The logistics behind the scenes. I think for every great e-commerce business, there are incredible logistics [challenges to overcome] behind the scenes. People don’t appreciate how hard that piece is, alongside the data. We’re going to process our 100 millionth item by the end of this year. That’s a lot of data.

Powered by WPeMatico

While some analysts are calling WeWork’s IPO filing a “masterpiece of obfuscation,” the esteemed tech observer Professor Scott Galloway simply calls it “WeWTF.”

There is another company that is coming up fast in the “WeViewMirror” — if you will — and that’s Knotel. Also a “flexible workspace provider,” Knotel has reversed the WeWork model and instead of “We” branding everywhere, simply leases buildings, takes a small office for its staff and then kits out the building with modular furniture a company can just move straight into and call their own.

Knotel has now completed a $400 million financing, led by Wafra, an investment arm of the Sovereign Wealth Fund of Kuwait. Mori Trust (one of Japan’s leading real estate business operators), Itochu (one of Japan’s largest trading conglomerates) and Mercuria (a leading Japanese equity firm) also participated in the financing. Returning and previous Knotel investors include Norwest Venture Partners, Newmark Knight Frank, Bloomberg Beta and Rocket Internet.

Knotel will use the financing to grow its footprint in existing markets, continue expanding into “the world’s 30 largest cities” and also “deepen its engagement with global enterprise accounts.” Basically, that is code for going after the world’s biggest businesses who now require the flexibility of offices like they require AWS Cloud Service provision for their applications.

In a statement, Amol Sarva, co-founder and CEO of Knotel, said: “Knotel is building the future of the workplace, and we are excited to welcome a group of investors who believe passionately in our product, vision and ability to execute. Wafra will help us continue our rapid global expansion and solidify our position as the leader in a fast-growing, trillion-dollar flexible office market.”

Unlike traditional co-working players, which provide shared spaces for freelancers and company satellite locations, Knotel focuses on providing private and fully furnished workspaces to large enterprises. The whole idea is to make it very simple: flexible workspaces; cheaper capital expenditures; operational flexibility.

There is also a tech play here. Its “Baya” product is a blockchain platform used internally to facilitate data-driven acquisition decisions and reduce company costs, while “Geometry” is a subscription service to make furnishing your office far easier, faster and cost-flexible.

Speaking to TechCrunch, Sarva said: “This funding is timely because that other IPO [referring to the WeWork IPOD] is in the works. People have been complaining about some of the aspects of that and some of the inefficiencies they have. But the core of this new investment for us is about making the business capitally efficient.” He said everything they do is geared toward this.

He said Knotel will do this in three ways: “We will go way deeper into cities. Many individual cities are getting bigger than whole competitor companies in revenue. NYC, Paris, London SF. So doing that is way more efficient and others don’t understand this.

“Secondly we are adding about a dozen more cities. Not 1,200. No-one makes money in Cairo.

“Thirdly, every time we announce a product or tech product it’s about the core business. A product like Geometry, or modular furniture etc. That is all about making us grow faster with less capital. Making real estate less painful, faster and with less friction.”

The company now has more than 4 million square feet across more than 200 locations in New York, San Francisco, London, Los Angeles, Washington, D.C., Paris, Berlin, Toronto, Boston, São Paulo and Rio de Janeiro. In less than four years, the company has raised a total of $560 million, and is now valued at more than $1 billion. Its London footprint now stands at 263,000 square feet across 63 locations. It’s now aiming to be London’s top flexible office provider (by building count), having achieved this in New York earlier in the year, it says.

Powered by WPeMatico

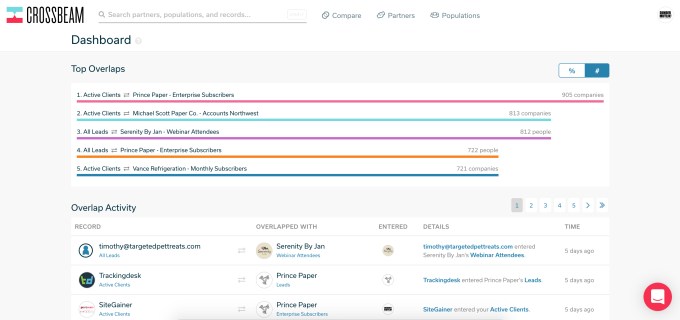

When Crossbeam CEO and co-founder Bob Moore was working at previous startups, he noticed a problem around sharing information with potential partners. In fact, it was so acute he decided to create a startup to solve that problem, and today, Crossbeam announced a $12.5 million Series A round led by FirstMark Capital, with participation from existing investors Uncork Capital and Slack Fund.

Moore says that in his previous jobs, he was encountering issues with getting partners integrated and answering basic questions like how many customers do we have in common or are my sales reps currently selling to any of the same people that your sales reps are selling to, and so forth.

“We eventually realized the reason these questions were hard to answer was that you can’t draw a Venn diagram of all the data unless you have all of the data in both of the circles,” Moore told TechCrunch. In other words, each company has only half of the picture, what they already know, and it’s hard to make data-driven decisions without more information.

Crossbeam Summary Dashboard (Screenshot: Crossbeam)

He added that there is danger in the age of GDPR and the upcoming California Consumer Privacy Act (CCPA) in oversharing of data, but at the other extreme is not sharing at all. Moore said he created Crossbeam to deal with this. “It seemed like the solution would be to build something that could almost function as an escrow service for data, which could sit between companies that are partnering with each other, and allow them to combine their data sets and identify that when certain conditions are met — like an overlapping need, or an overlapping customer — to take very specific precise actions as a result of that overlap,” Moore explained.

The product works by sharing data from tools like Salesforce, HubSpot or even a .csv file and comparing that data inside of Crossbeam. Partners can see the overlap and where it makes sense for them to work together. Sometimes that may involve customer names, but other times it may be common sales reps across accounts. He says that many companies start with highly trusted partners to get comfortable with the product before branching out.

The company, which was founded in July 2018, has 15 employees and is based in Philadelphia. It previously received a $3.3 million seed round at the end of 2018.

Powered by WPeMatico

Cosi, a new Berlin-based startup operating in the hospitality space with an alternative to boutique hotels and managed short-stay apartments, has picked up €5 million in seed funding pre-launch.

Leading the round are venture capital firms Cherry Ventures and e.ventures, with participation from a number of travel, real estate and hospitality entrepreneurs and experts. They include Nils Regge (founder of HomeToGo and Dreamlines), Gleb Tritus (MD Lufthansa Innovation Hub), Manuel Stotz (founder of Kingsway Capital), Mato Peric (founder of Immo), Andreas Brehmke, Loric Ventures, and Lions Venture.

That’s quite a lineup for a company that won’t launch for another few months, but is no doubt based in part on the track record of Cosi’s founders.

They are Christian Gaiser, the startup’s CEO, who preciously founded Bonial.com, the local shopping platform sold to Axel Springer in 2011; Dimitri Chandogin, who co-founded Doc+, a prominent digital healthcare provider in Russia; and CTO Gerhard Maringer, who has a background in fintech and previously built ForexFix, an FX hedging platform.

“More and more guests prefer to stay in a unique apartment versus a boring hotel, i.e. travelers tend to book their stay at a private host via Airbnb. [However], the experience can be frustrating though due to lack of quality and service: long check-in/check-out times, poor interior design, lack of cleanliness, not enough linen, no service hotline in case of questions, to name a few examples,” Gaiser tells TechCrunch.

“Many guests, therefore, decide not to stay in a unique home for quality reasons. Cosi solves this problem as a full-stack hospitality brand: We control the entire guest journey from end-to-end.”

To offer a “full-stack” hospitality service that hopes to compete with well-run boutique hotels or traditional local managed apartments, Gaiser says the company signs long-term leases with property owners, and then furnishes those apartments itself to “control” the interior design experience. “On top of that, we offer a digital service along the entire guest journey from initial contact to loyalty. Finally, we rent out our apartments short-term as a hotel replacement,” he explains.

That requires technology to drive “the entire value chain,” and Gaiser points out that the tech guests experience directly is only the tip of the iceberg. “Running a hospitality business requires a lot of tools in the background for housekeeping, maintenance, yield management, to name a few, that will create an efficiency edge for us,” says the Cosi co-founder.

With regards to target customers, Cosi broadly covers travelers that want the quality assurance of a hotel but appreciate the unique design and “coziness” of a personal home. More specifically, the company has two main target groups in mind: tourists that spend a few days in Berlin to immerse themselves in the local culture and history (“live like a real Berliner”), and business travelers that need to stay several weeks or months and are fed up with the traditional hotel experience.

“Cosi creates a new category, but the closest direct competitors include smaller boutique hotels or traditional local serviced apartment operators for tourists,” says Gaiser. “In a broader sense, we also compete with the big hotel companies like Marriott or Hilton in business travel.”

There are potential U.S. competitors, too, with Sonder and Lyric operating a similar model. “They might also look into Europe,” concedes Gaiser, “[but] it will be challenging for them to comply with local regulations and to establish real estate relationships. It is a very local game.”

Powered by WPeMatico

Tala, a Santa Monica, Calif.-headquartered startup that creates a credit profile to provide uncollateralized loans to millions of people in emerging markets, has raised $110 million in a new financing round to enter India’s burgeoning fintech space.

The Series D financing for the five-year-old startup was led by RPS Ventures, with GGV Capital and previous investors IVP, Revolution Growth, Lowercase Capital, Data Collective VC, ThomVest Ventures and PayPal Ventures also participating in the round.

The new round, which takes the startup’s total fundraising to more than $215 million, valued it above $750 million, a person familiar with the matter told TechCrunch. Tala has also raised an additional $100 million in debt, including a $50 million facility led by Colchis in the last year.

Tala looks at a customer’s texts and calls logs, merchant transactions, overall app usage and other behavioral data through its Android app to build their credit profile. Based on these pieces of information, its machine learning algorithms evaluate the individual risk and provide instant loans in the range of $10 to $500 to customers.

This model is different from how banks and most other online lenders assess a person’s eligibility for a loan. Banks look at a user’s credit score while most online lenders check the financial history.

Tala is also much faster. It approves loans within minutes and disburses the money via mobile payment platforms. The startup has lent over $1 billion to more than 4 million customers to date — up from issuing $300 million in loans to 1.3 million customers last year, Shivani Siroya, founder and CEO of Tala, told TechCrunch in an interview.

The startup, which employs more than 550 people, will use the new capital to enter India, said Siroya, who built Tala after interviewing thousands of small and micro-businesses.

In the run up to launch in India, Tala began a 12-month pilot program in the country last year to conduct user research and understand the market. It has also set up a technology hub in Bangalore, she said.

Shivani Siroya (Tala CEO) at TechCrunch Disrupt NY 2017

“The opportunity is very massive in India, so we spent some time customizing our service for the local market,” she said.

According to World Bank, more than 2 billion people globally have limited access to financial services and working capital. For these people, many of whom live in India, securing a small size loan is extremely challenging as they don’t have a credit score.

In recent years, several major digital payment platforms in India, including Paytm and MobiKwik, have started to offer small-sized loans to users. Traditional banks are still lagging to serve this segment, industry executives say. (Outside India, Tala competes with Branch, a five-year-old San Francisco-based startup that has raised more than $170 million to date and earlier this year inked a deal with Visa.)

Tala goes a step further and takes liability for any unpaid returns, Siroya said. More than 90% of Tala users pay back their loan in 20 to 30 days and are recurring customers, she added.

The startup also forwards the positive credit history and rankings to the local credit bureaus to help people secure bigger and long-term loans in the future, she added.

Tala, which charges a one-time fee that is as low as 5% for each loan, relies on referrals, and some marketing through radio and television to acquire new customers. “But a lot of these users come because they heard about us from their friends,” Siryoa said.

As part of the new financing round, Kabir Misra, founding general partner of RPS Ventures, has joined Tala’s board of directors, the startup said.

Tala said it will use a portion of its new fund to expand its footprint and team in its existing markets — East Africa, Mexico and the Philippines — and also build new solutions.

Siroya said the startup has identified some more markets that it wishes to serve. She did not disclose the names, but said she is eyeing more countries in South Asia and Latin America.

Powered by WPeMatico

H2O.ai‘s mission is to democratize AI by providing a set of tools that frees companies from relying on teams of data scientists. Today it got a bushel of money to help. The company announced a $72.5 million Series D round led by Goldman Sachs and Ping An Global Voyager Fund.

Previous investors Wells Fargo, Nvidia and Nexus Venture Partners also participated. Under the terms of the deal, Jade Mandel from Goldman Sachs will be joining the H2O.ai board. Today’s investment brings the total raised to $147 million.

It’s worth noting that Goldman Sachs isn’t just an investor. It’s also a customer. Company CEO and co-founder Sri Ambati says the fact that customers Wells Fargo and Goldman Sachs have led the last two rounds is a validation for him and his company. “Customers have risen up from the ranks for two consecutive rounds for us. Last time the Series C was led by Wells Fargo where we were their platform of choice. Today’s round was led by Goldman Sachs, which has been a strong customer for us and strong supporters of our technology,” Ambati told TechCrunch.

The company’s main product, H2O Driverless AI, introduced in 2017, gets its name from the fact it provides a way for people who aren’t AI experts to still take advantage of AI without a team of data scientists. “Driverless AI is automatic machine learning, which brings the power of a world-class data scientists in the hands of everyone. lt builds models automatically using machine learning algorithms of every kind,” Ambati explained.

They introduced a new recipe concept today, which provides all of the AI ingredients and instructions for building models for different business requirements. H2O.ai’s team of data scientists has created and open-sourced 100 recipes for things like credit risk scoring, anomaly detection and property valuation.

The company has been growing since its Series C round in 2017, when it had 70 employees. Today it has 175 and has tripled the number of customers since the prior round, although Ambati didn’t discuss an exact number. The company has its roots in open source and has 20,000 users of its open-source products, according to Ambati.

He didn’t want to discuss valuation and wouldn’t say when the company might go public, saying it’s early days for AI and they are working hard to build a company for the long haul.

Powered by WPeMatico

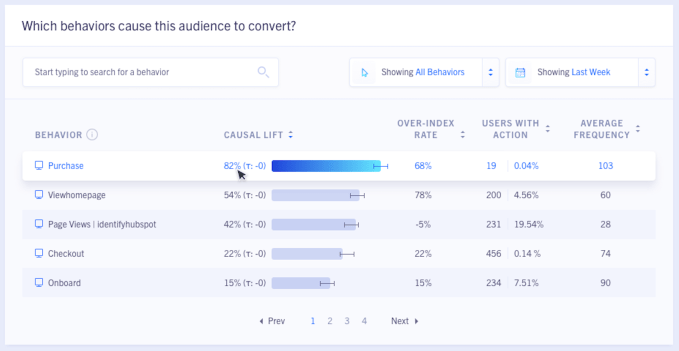

Businesses need to understand cause and effect: Someone did X and it increased sales, or they did Y and it hurt sales. That’s why many of them turn to analytics — but Bilal Mahmood, co-founder and CEO of ClearBrain, said existing analytics platforms can’t answer that question accurately.

“Every analytics platform today is still based on a fundamental correlation model,” Mahmood said. It’s the classic correlation-versus-causation problem — you can use the data to suggest that an action and a result are related, but you can’t draw a direct cause-and-effect relationship.

That’s the problem that ClearBrain is trying to solve with its new “causal analytics” tool. As the company put it in a blog post, “Our goal was to automate this process [of running statistical studies] and build the first large-scale causal inference engine to allow growth teams to measure the causal effect of every action.”

You can read the post for (many) more details, but the gist is that Mahmood and his team claim they can draw accurate causal relationships where others can’t.

The idea is to use this in conjunction with A/B testing — customers look at the data to prioritize what to test next, and to make estimates about the impact of things that can’t be tested. Otherwise, Mahmood said, “If you wanted to measure the actual impact of every variable on your website and your app — the actual impact it has on conversation — it could take you years.”

When I wrote about ClearBrain last year, it was using artificial intelligence to improve ad targeting, but Mahmood said the company built the new analytics technology in response to customer demand: “People didn’t just want to know who was going to convert, they wanted to know why, and what caused them to do so.”

The causal analytics tool is currently available to early access users, with plans for a full launch in October. Mahmood said there will be a number of pricing tiers, but they’ll be structured to make the product free for many startups.

In addition to launching the analytics tool in early access, ClearBrain also announced this week that it’s raised an additional $2 million in funding from Harrison Metal and Menlo Ventures.

Powered by WPeMatico