Recent Funding

Auto Added by WPeMatico

Auto Added by WPeMatico

Reference docs and spreadsheets seemingly make the world go ’round, but what if employees could just close those tabs for good without losing that knowledge?

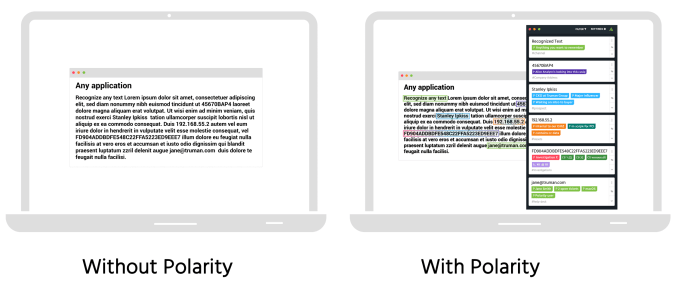

One startup is taking on that complicated challenge. Predictably, the solution is quite complicated, as well, from a tech perspective, involving an AI solution that analyzes everything on your PC screen — all the time — and highlights text onscreen for which you could use a little bit more context. The team at Polarity wants its tech to help teams lower the knowledge barrier to getting stuff done and allow people to focus more on procedure and strategy than memorizing file numbers, IP addresses and jargon.

The Connecticut startup just closed an $8.1 million “AA” round led by TechOperators, with Shasta Ventures, Strategic Cyber Ventures, Gula Tech Adventures and Kaiser Permanente Ventures also participating in the round. The startup closed its $3.5 million Series A in early 2017.

Interestingly, the enterprise-centric startup pitches itself as an AR company, augmenting what’s happening on your laptop screen much like a pair of AR glasses could.

The startup’s computer vision software that uses character recognition to analyze what’s on a user’s screen can be helpful for enterprise teams importing things like a company Rolodex so that bios are always collectively a click away, but the real utility comes from team-wide flagging of things like suspicious IP addresses that will allow entire teams to learn about new threats and issues at the same time without having to constantly check in with their co-workers. The startup’s current product has a big focus on analysts and security teams.

via Polarity

Using character recognition to analyze a screen for specific keywords is useful in itself, but that’s also largely a solved computer vision problem.

Polarity’s big advance has been getting these processes to occur consistently on-device without crushing a device’s CPU. CEO Paul Battista says that for the average customer, Polarity’s software generally eats up about 3-6% of their computer’s processing power, though it can spike much higher if the system is getting fed a ton of new information at once.

“We spent years building the tech to accomplish [efficiency], readjusting how people think of [object character recognition] and then doing it in real time,” Battista tells me. “The more data that you have onscreen, the more power you use. So it does use a significant percentage of the CPU.”

Why bother with all of this AI trickery and CPU efficiency when you could pull this functionality off in certain apps with an API? The whole deliverable here is that it doesn’t matter if you’re working in Chrome, or Excel or pulling up a scanned document, the software is analyzing what’s actually being rendered onscreen, not what the individual app is communicating.

When it comes to a piece of software analyzing everything on your screen at all times, there are certainly some privacy concerns, not only from the employee’s perspective but from a company’s security perspective.

Battista says the intent with this product isn’t to be some piece of corporate spyware, and that it won’t be something running in the background — it’s an app that users will launch. “If [companies] wanted to they could collect all of the data on everybody’s screens, but we don’t have any customers doing that. The software is built to have a user interface for users to interact with so if the user didn’t choose to subscribe or turn on a metric, then [the company] wouldn’t be able to force them to collect it in the current product.”

Battista says that teams at seven Fortune 100 companies are currently paying for Polarity, with many more in pilot programs. The team is currently around 20 people and with this latest fundraise, Battista wants to double the size of the team in the next 18 months as they look to scale to larger rollouts at major companies.

Powered by WPeMatico

Attentive, a startup helping retailers personalize their mobile messages, is announcing that it has raised $40 million in Series B funding.

The startup was founded by Brian Long and Andrew Jones, who sold their previous startup TapCommerce to Twitter. When they announced Attentive’s $13 million Series A last year, Long told me the startup is all about helping retailers find better ways to communicate with customers, particularly as it’s harder for their individual apps to stand out.

Attentive’s first product allowed for what it calls “two-tap” sign-up, where users can tap on a promotion link from a brand’s website, creating a pre-populated text that opts them in to for SMS messages from that retailer.

Since then, it’s built a broader suite of messaging tools, with support for cart abandonment reminders, A/B testing, subscriber segmentation and other features that allow retailers to get smarter and more targeted in their messaging strategy.

The startup says mobile messages sent through its platform are seeing click-through rates of more than 30%, and that it now works with more than 400 customers, including Sephora, Urban Outfitters, Coach, CB2 and Jack in the Box.

The Series B was led by Sequoia, with participation from new investors IVP and High Alpha, as well as previous backers Bain Capital Ventures, Eniac Ventures and NextView Ventures. The plan for the new funding is to grow the entire team, especially sales and engineering.

“CRM is changing,” Long said in a statement. “Businesses can’t build a relationship with the modern consumer through email alone. Email performance, as measured by how many subscribers click-through on a message, is down 45% over the last five years. Rather than continuing to shout one-way messages at consumers, smart brands will stay relevant by embracing personalized, real-time, two-way communication channels.”

Powered by WPeMatico

If the sheer amount of information that we can tap into using the internet has made the world our oyster, then the huge success of Google is a testament to how lucrative search can be in helping to light the way through that data maze.

Now, in a sign of the times, a startup called Lucidworks, which has built an AI-based engine to help individual organizations provide personalised search services for their own users, has raised $100 million in funding. Lucidworks believes its approach can produce better and more relevant results than other search services in the market, and it plans to use the funding for its next stage of growth to become, in the words of CEO Will Hayes, “the world’s next important platform.”

The funding is coming from PE firm Francisco Partners and TPG Sixth Street Partners. Existing investors in the company include Top Tier Capital Partners, Shasta Ventures, Granite Ventures and Allegis Cyber.

Lucidworks has raised around $200 million in funding to date, and while it is not disclosing the valuation, the company says it has been doubling revenues each year for the last three and counts companies like Reddit, Red Hat, REI and the U.S. Census among some 400 others of its customers using its flagship product, Fusion. PitchBook notes that its last round in 2018 was at a modest $135 million, and my guess is that is up by quite some way.

The idea of building a business on search, of course, is not at all new, and Lucidworks works is in a very crowded field. The likes of Amazon, Google and Microsoft have built entire empires on search — in Google’s and Microsoft’s case, by selling ads against those search results; in Amazon’s case, by generating sales of items in the search results — and they have subsequently productised that technology, selling it as a service to others.

Alongside that are companies that have been building search-as-a-service from the ground up — like Elastic, Sumo Logic and Splunk (whose founding team, coincidentally, went on to found Lucidworks…) — both for back-office processes as well as for services that are customer-facing.

In an interview, Hayes said that what sets Lucidworks apart is how it uses machine learning and other AI processes to personalise those results after “sorting through mountains of data,” to provide enterprise information to knowledge workers, shopping results on an e-commerce site to consumers, data to wealth managers or whatever it is that is being sought.

Take the case of a shopping experience, he said by way of explanation. “If I’m on REI to buy hiking shoes, I don’t just want to see the highest-rated hiking shoes, or the most expensive,” he said.

The idea is that Lucidworks builds algorithms that bring in other data sources — your past shopping patterns, your location, what kind of walking you might be doing, what other people like you have purchased — to produce a more focused list of products that you are more likely to buy.

“Amazon has no taste,” he concluded, a little playfully.

Today, around half of Lucidworks’ business comes from digital commerce and digital content — searches of the kind described above for products, or monitoring customer search queries sites like Red Hat or Reddit — and half comes from knowledge worker applications inside organizations.

The plan will be to continue that proportion, while also adding other kinds of features — more natural language processing and more semantic search features — to expand the kinds of queries that can be made, and also cues that Fusion can use to produce results.

Interestingly, Hayes said that while it’s come up a number of times, Lucidworks doesn’t see itself ever going head-to-head with a company like Google or Amazon in providing a first-party search platform of its own. Indeed, that may be an area that has, for the time being at least, already been played out. Or it may be that we have turned to a time when walled gardens — or at least more targeted and curated experiences — are coming into their own.

“We still see a lot of runway in this market,” said Jonathan Murphy of Francisco Partners. “We were very attracted to the idea of next-generation search, on one hand serving internet users facing the pain of the broader internet, and on the other enterprises as an enterprise software product.”

Lucidworks, it seems, has also entertained acquisition approaches, although Hayes declined to get specific about that. The longer-term goal, he said, “is to build something special that will stay here for a long time. The likelihood of needing that to be a public company is very high, but we will do what we think is best for the company and investors in the long run. But our focus and intention is to continue growing.”

Powered by WPeMatico

Glow is a new startup that says it wants to help podcasters build media business.

That’s something co-founder and CEO Amira Valliani said she tried to do herself. After a career that included working in the Obama White House and getting an MBA from Wharton, she launched a podcast covering local elections in Cambridge, Mass., and she said that after the initial six episodes, she struggled to find a sustainable business model.

Valliani (pictured above with her co-founder and chief product officer Brian Elieson) recalled thinking, “Well, I got this one grant and I’d love to do more, but I need to figure out a way to pay for it.” She realized that advertising didn’t make sense, but when a listener expressed interest in paying her directly, none of the existing platforms made it easy.

“I just couldn’t figure it out,” she said. “I felt an acute need, and I thought, ‘Are there other people out there who haven’t been able to figure out how to do it, because the lift is just too high?’ ”

That’s the need Glow tries to address with its first product — allowing podcasters to create paid subscriptions. To do that, podcasters create a subscription page on the Glow site, where they can accept payments and then allow listeners to access paywalled content from the podcast app of their choice.

Glow started testing the product with the startup-focused podcast Acquired, which is now bringing in $35,000 in subscription fees through Glow. More recently, it’s signed up the Techmeme Ride Home, Twenty Thousand Hertz, The Newsworthy and others.

When asked about the broader landscape of podcast startups (including several that support paid subscriptions), Valliani said there are three main problems that podcasters face: hosting, monetization and distribution.

Hosting, she said, is “largely a solved problem,” so Glow is starting out by trying to “solve for monetization through the direct relationship with listeners.” Eventually, it could move into distribution, though that doesn’t mean launching a Glow podcast app: “For us, we think distribution means helping podcasts grow their audience.”

The startup announced today that it has raised $2.3 million in seed funding. The round was led by Greycroft, with participation from Norwest Venture Partners, PSL Ventures, WndrCo and Revolution’s Rise of the Rest Seed Fund, as well as individual investors including Nas and Electronic Arts CTO Ken Moss.

“Our first hire after this funding round will be someone focused on podcast success,” Valliani said. “Of course, we’re going to build the product [but we’re] doubling down on this market; we better make sure that [podcasters] are prepared to launch programs that are as successful as possible.”

Powered by WPeMatico

Following many months of pressure, DoorDash, one of the most frequently used food delivery apps in the U.S., said late last month that it was finally changing its tipping policy to pass along to workers 100% of tips, rather than employ some of that money toward defraying its own costs.

The move was a step in the right direction, but as a New York Times piece recently underscored, there are many remaining challenges for food delivery couriers, including not knowing where a delivery is going until a worker picks it up (Uber Eats), having just seconds to decide whether or not to accept an order (Postmates) and not being guaranteed a minimum wage (Deliveroo) — not to mention the threat of delivery robots taking their jobs.

It’s a big enough problem that a young, nine-person startup called Dumpling has decided to tackle it directly. Its big idea: turn today’s delivery workers into “solopreneurs” who build their own book of clients and keep much more of the money.

It newly has $3 million in backing from two venture firms that know the gig economy well, too: Floodgate, an early investor in Lyft (firm co-founder Ann Miura-Ko is on Lyft’s board), and Fuel Capital, where TaskRabbit founder Leah Busque is now a general partner.

We talked with Dumpling’s co-founders and co-CEOs earlier this week to learn more about the company and how viable it might be. Nate D’Anna spent eight years as a director of corporate development at Cisco; Joel Shapiro spent more than 13 years with National Instruments, where he held a variety of roles, including as a marketing director focused on emerging markets.

National Instruments, based in Austin, is also where Shapiro and D’Anna first met back in 2002. Our chat, edited lightly for length, follows:

TC: You started working together out of college. What prompted you to come together to start Dumpling?

JS: We’d stayed good friends as we’d done different things with our careers, but we were both seeing rising inequality happening at companies and within their workforces, and we were both interested in using our [respective] background and experiences to try and make a difference.

ND: When we were first started, Dumpling wasn’t a platform for people to start their own business. It was a place for people to voice opinions — kind of like a Glassdoor for workers with hourly jobs, including in retail. What jumped out at us was how many gig workers began using the platform to talk about the horrible ways they were being treated, not having a traditional boss and not being protected by traditional policies.

TC: At what point did you think you were onto a separate opportunity?

ND: We knew that a mission-driven company that’s trying to do good by people who’ve been exploited by Silicon Valley companies has to be profitable. I was an investor at Cisco, and I was very clear that the money side has to work. So we started talking with gig workers and we asked, ‘Why are you working for a terrible company where you’re getting injured, where you’re getting penalized for not taking the next job?’ And the response was ‘money.’ It was, ‘I need to be able to buy these groceries and I don’t want to put them on my own credit card.’ That was an epiphany for us. If the biggest pain point to running these businesses is working capital and we can solve that — if business owners will pay for access to capital and for tools that help them run their business — that clicked for us.

TC: A big part of your premise is that while gig economy companies have anonymized people as best they can, there’s a meaningful segment of services where a stranger or a robot isn’t going to work.

JS: Shoppers for gig companies often hear, ‘When you [specifically] come, it makes my day,’ so our philosophy was to build a platform that supports the person. When you run a business and build a clientele that you get to know, you’re incentivized for that [client] to have a good experience. So we wondered, how do we provide tools for someone who has done personal shopping and who not only needs funds to shop but also help with marketing and a website and training so they can promote their services?

ND: We also realized that to help business owners succeed that we needed to lower the transaction cost for them to find customers, so we created a marketplace where shoppers can look at reviews, understand different shoppers’ knowledge regarding when it comes to various specialties and stores, then help match them.

TC: How many shoppers are now running their own businesses on Dumpling and what do they get from you exactly?

JS: More than 500 across the country are operating in 37 states. And we want to give them everything they need. A big part of that is capital, so we give [them] a credit card, then it’s effectively the operational support, including order management, customer relationship functionality, customer communication, a storefront, an app that they can use to run their business from their phone. . .

TC: What about insurance, tax help, that sort of stuff?

ND: A lot of VCs pushed us in that direction. The good news is a lot of companies are coming up to provide those ancillary services, and we’ll eventually partner with them if you want to export your data to Intuit or someone else. Right now, we’re really focused on [shoppers’] core business, helping then to operate it, to find customers, that’s our sweet spot for the immediate future.

TC: What are you charging? Who are you charging?

JS: A subscription model is an obvious way for us to go at some point, but right now, because we’re in the transaction flow, we’re taking a percentage of each transaction. The [solopreneuer] pays us $5 per transaction as a platform fee; the shopper pays us 5% atop the delivery fee set by the [person who is delivering their goods]. So if someone spends $100 on groceries, that customer pays us $5, and the shopper pays us $5 and the shopper gets that delivery fee, plus his or her tip.

The vast amount goes to the shopper, unlike with today’s model [wherein the vast majority goes to delivery companies]. Our average shopper is bringing home $32 in earnings per order, roughly three times as much as when they work for other grocery delivery apps. I think that’s partly because we communicate to [shoppers] that they are supporting local businesses and local entrepreneurs and they are receiving an average tip of 17% on their orders. But also, when you know your shopper and that person gets to know your preferences, you’re much more comfortable ordering non-perishables, like produce picked the way you like. That leads to huge order sizes, which is another reason that average earnings are higher.

TC: You’re fronting the cost for groceries. Is that money coming from your venture funding? Do you have a debt facility?

ND: We don’t. The money moves so fast. The shoppers are using the card to shop, then getting the money back again, so the cycle time is quick. It’s two days, not six months.

TC: How does this whole thing scale? Are you collecting data that you hope will inform future products?

ND: We definitely want to use tech to empower [shoppers] instead of control them. But [our CTO and third co-founder Tom Schoellhammer] came from Google doing search there, and eventually we [expect to] recommend similar stores, or [extend into] beauty or pet other local services. Grocery delivery is one obvious place where the market is broken, but where you want a trusted person involved, and you’re in the flow when people are looking for something [the opportunity opens up]. Shoppers’ knowledge of their local operation zone can be leveraged much more.

Powered by WPeMatico

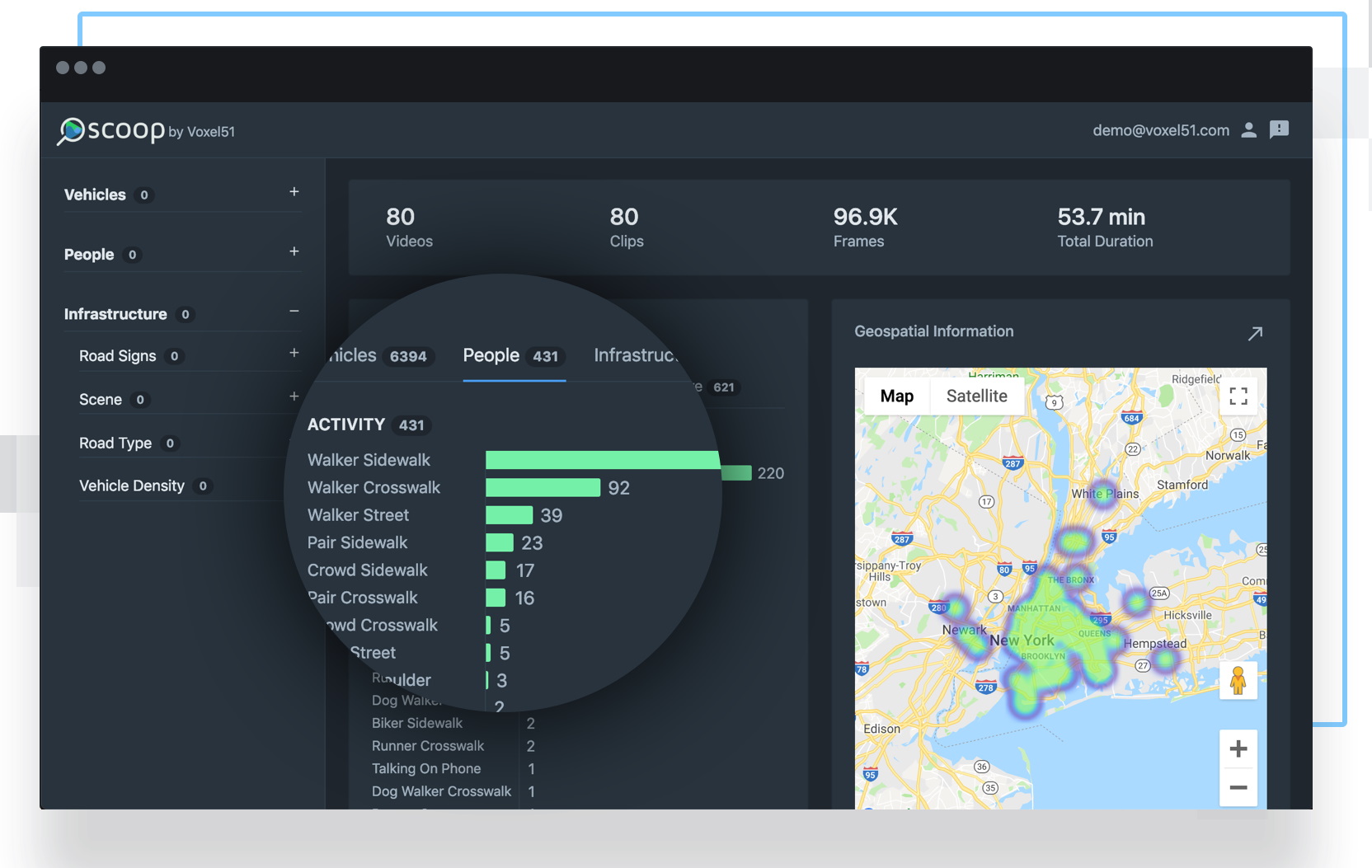

Many companies and municipalities are saddled with hundreds or thousands of hours of video and limited ways to turn it into usable data. Voxel51 offers a machine learning-based option that chews through video and labels it, not just with simple image recognition but with an understanding of motions and objects over time.

Annotating video is an important task for a lot of industries, the most well-known of which is certainly autonomous driving. But it’s also important in robotics, the service and retail industries, for police encounters (now that body cams are becoming commonplace) and so on.

It’s done in a variety of ways, from humans literally drawing boxes around objects every frame and writing what’s in it to more advanced approaches that automate much of the process, even running in real time. But the general rule with these is that they’re done frame by frame.

A single frame is great if you want to tell how many cars are in an image, or whether there’s a stop sign, or what a license plate reads. But what if you need to tell whether someone is walking or stepping out of the way? What about whether someone is waving or throwing a rock? Are people in a crowd going to the right or left, generally? This kind of thing is difficult to infer from a single frame, but looking at just two or three in succession makes it clear.

That fact is what startup Voxel51 is leveraging to take on the established competition in this space. Video-native algorithms can do some things that single-frame ones can’t, and where they do overlap, the former often does it better.

Voxel51 emerged from computer vision work done by its co-founders, CEO Jason Corso and CTO Brian Moore, at the University of Michigan. The latter took the former’s computer vision class and eventually the two found they shared a desire to take ideas out of the lab.

“I started the company because I had this vast swath of research,” Corso said, “and the vast majority of services that were available were focused on image-based understanding rather than video-based understanding. And in almost all instances we’ve seen, when we use a video-based model we see accuracy improvements.”

While any old off-the-shelf algorithm can recognize a car or person in an image, it takes much more savvy to make something that can, for example, identify merging behaviors at an intersection, or tell whether someone has slipped between cars to jaywalk. In each of those situations the context is important and multiple frames of video are needed to characterize the action.

“When we process data we look at the spacio-temporal volume as a whole,” said Corso. “Five, 10, 30 frames… our models figure out how far behind and forward it should look to find a robust inference.”

In other, more normal words, the AI model isn’t just looking at an image, but at relationships between many images over time. If it’s not quite sure whether a person in a given frame is crouching or landing from a jump, it knows that it can scrub a little forward or backward to find the information that will make that clear.

And even for more ordinary inference tasks like counting the cars in the street, that data can be double-checked or updated by looking back or skipping ahead. If you can only see five cars because one’s big and blocks a sixth, that doesn’t change the fact that there are six cars. Even if every frame doesn’t show every car, it still matters for, say, a traffic monitoring system.

The natural objection to this is that processing 10 frames to find out what a person is doing is more expensive, computationally speaking, than processing a single frame. That’s certainly true if you are treating it like a series of still images, but that’s not how Voxel51 does it.

“We get away with it by processing fewer pixels per frame,” Corso explained. “The total amount of pixels we process might be the same or less as a single frame, depending on what we want it to do.”

For example, on video that needs to be closely examined but speed isn’t a concern (like a backlog of traffic cam data), it can expend all the time it needs on each frame. But for a case where the turnaround needs to be quicker, it can do a fast, real-time pass to identify major objects and motions, then go back through and focus on the parts that are the most important — not the unmoving sky or parked cars, but people and other known objects.

The platform is highly parameterized and naturally doesn’t share the limitations of human-driven annotation (though the latter is still the main option for highly novel applications where you’d have to build a model from scratch).

“You don’t have to worry about, is it annotator A or annotator B, and our platform is a compute platform, so it scales on demand,” said Corso.

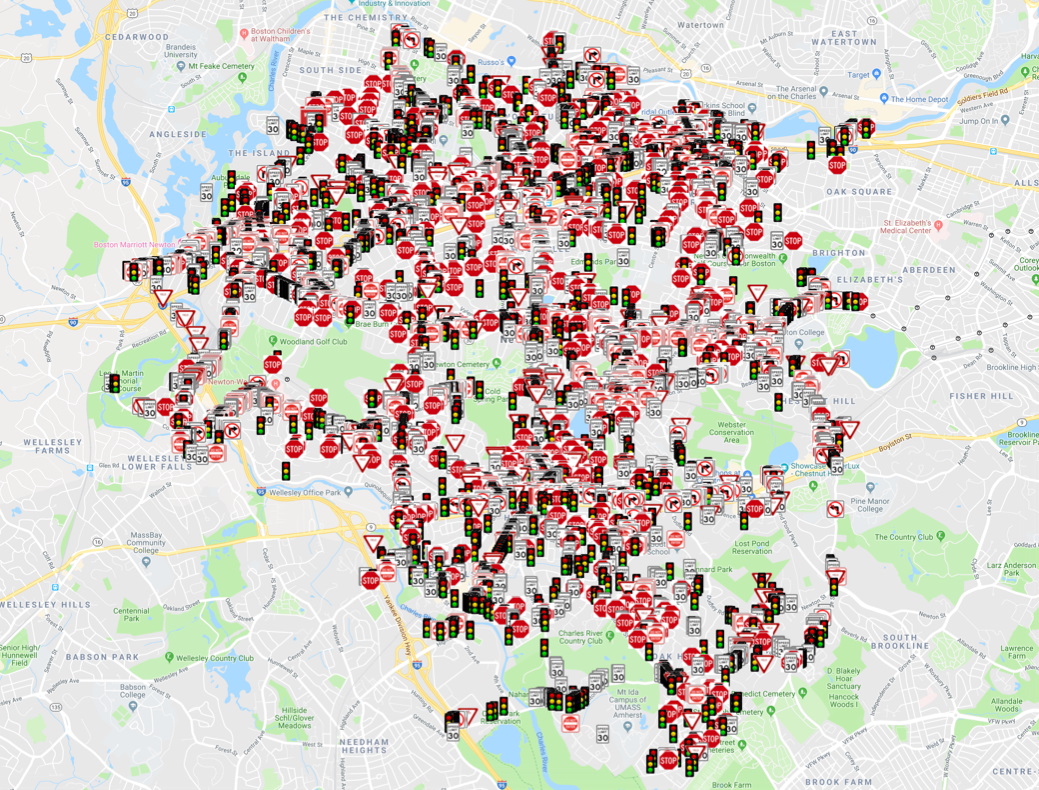

They’ve packed everything into a drag-and-drop interface they call Scoop. You drop in your data — videos, GPS, things like that — and let the system power through it. Then you have a browsable map that lets you enumerate or track any number of things: types of signs, blue BMWs, red Toyotas, right turn only lanes, people walking on the sidewalk, people bunching up at a crosswalk, etc. And you can combine categories, in case you’re looking for scenes where that blue BMW was in a right turn only lane.

Each sighting is attached to the source video, with bounding boxes laid over it indicating the locations of what you’re looking for. You can then export the related videos, with or without annotations. There’s a demo site that shows how it all works.

It’s a little like Nexar’s recently announced Live Maps, though obviously also quite different. That two companies can pursue AI-powered processing of massive amounts of street-level video data and still be distinct business propositions indicates how large the potential market for this type of service is.

Despite its street-feature smarts, Voxel51 isn’t going after self-driving cars to start. Companies in that space, like Waymo and Toyota, are pursuing fairly narrow, vertically oriented systems that are highly focused on identifying objects and behaviors specific to autonomous navigation. The priorities and needs are different from, say, a security firm or police force that monitors hundreds of cameras at once — and that’s where the company is headed right now. That’s consistent with the company’s pre-seed funding, which came from a NIST grant in the public safety sector.

Built with no human intervention from 250 hours of video, a sign/signal map like this would be helpful to many a municipality

“The first phase of go to market is focusing on smart cities and public safety,” Corso said. “We’re working with police departments that are focused on citizen safety. So the officers want to know, is there a fire breaking out, or is a crowd gathering where it shouldn’t be gathering?”

“Right now it’s an experimental pilot — our system runs alongside Baltimore’s CitiWatch,” he continued, referring to a crime-monitoring surveillance system in the city. “They have 800 cameras, and five or six retired cops that sit in a basement watching those — so we help them watch the right feed at the right time. Feedback has been exciting: When [CitiWatch overseer Major Hood] saw the output of our model, not just the person but the behavior, arguing or fighting, his eyes lit up.”

Now, let’s be honest — it sounds a bit dystopian, doesn’t it? But Corso was careful to note that they are not in the business of tracking individuals.

“We’re primarily privacy-preserving video analytics; we have no ability or interest in running face identification. We don’t focus on any kind of identity,” he said.

It’s good that the priority isn’t on identity, but it’s still a bit of a scary capability to be making available. And yet, as anyone can see, the capability is there — it’s just a matter of making it useful and helpful rather than simply creepy. While one can imagine unethical uses like cracking down on protestors, it’s also easy to imagine how useful this could be in an Amber or Silver alert situation. Bad guy in a beige Lexus? Boom, last seen here.

At any rate, the platform is impressive and the computer vision work that went into it even more so. It’s no surprise that the company has raised a bit of cash to move forward. The $2 million seed round was led by eLab Ventures, a Palo Alto and Ann Arbor-based VC firm, and the company earlier attracted the $1.25 million grant from NIST mentioned earlier.

The money will be used for the expected purposes, establishing the product, building out support and the non-technical side of the company and so on. The flexible pricing and near-instant (in video processing terms) results seem like something that will drive adoption fairly quick, given the huge volumes of untapped video out there. Expect to see more companies like Corso and Moore’s as the value of that video becomes clear.

Powered by WPeMatico

Gaming continues to grow in popularity, with esports revenue growing 23% from last year to top $1 billion in 2019.

But the metrics by which talent is evaluated in gaming, and the methods by which gamers can train to better hone their craft, are varied and at times non-existent. That’s where Statespace, and specifically the company’s gaming arm Klutch, come into play.

In 2017, Statespace launched out of stealth with their first product, Aim Lab. Aim Lab is meant to mimic the physical rules of a game to give gamers a practice space where they can improve their skills. Moreover, Aim Lab identifies weaknesses in a player’s gameplay — one person might struggle with their visual acuity in the top-left quadrant of the screen, while another might have trouble spotting or aiming at targets on the bottom-right side of the screen — and allows gamers to focus in on their weaknesses to get better.

Today, the company has announced a $2.5 million seed funding round led by FirstMark Capital, with participation from Expa, Lux Capital and WndrCo. This brings the company’s total funding to $4 million.

Alongside growing Aim Lab, which is on track to soon reach 1 million users, one of the company’s main goals is to create a standardized metric by which gamers’ skills can be measured. In football, college athletes and NFL coaches have the Scouting Combine to make decisions around recruiting. This doesn’t necessarily take into account stats like yardage or touchdowns, but rather the raw skills of a player, such as 40-yard sprint speed.

In fact, Statespace has partnered with the Pro Football Hall of Fame for “The Cognitive Combine,” becoming the official integrative medicine program cognitive assessment partner of the organization. Statespace wants to create a similar “combine” for gaming.

The hope is that the company can offer this metric to publishers, colleges and esports orgs, giving them the ability to not only evaluate talent, but to better serve casual users through improved matchmaking and cheat detection.

“We want to go a level beyond your kill:death ratio,” said co-founder and CEO Dr. Wayne Mackey. Those metrics greatly depend on factors like who you’re playing with. You won’t always be matched against players who are on an even keel with you. So we want to look at fundamental skills like hand-eye coordination, visual acuity, spatial processing skills and working memory capacity.”

Klutch has partnered with the National Championship Series as the official FPS training partner for 2019. NCS has majors for both CS:Go and Overwatch, two of the biggest competitive FPS games in the world. The company is also partnering with top Twitch streamers and Masterclass to create The Academy.

Academy users will be able to get advanced tutorials from streamers like KingGeorge (Rainbox Six Siege), SypherPK (Fortnite), Valkia (Overwatch), Drift0r (CoD) and Launders (CS:GO).

Obviously, gaming is a major part of Statespace’s business model. But the skeleton of the technology has a number of different applications, particularly in medicine. Statespace is currently in the research phase of rolling out an Aim Lab product that is specifically focused on helping people who have had strokes recover and rehabilitate.

Statespace wants to use the funding to build out the team and expand the Klutch Aim Lab platform beyond Steam to mobile and eventually console, with Xbox prioritized over PlayStation, as well as launching the Academy.

Powered by WPeMatico

Rookout, a startup that provides debugging across a variety of environments, including serverless and containers, announced an $8 million Series A investment today. It plans to use the money to expand beyond its debugging roots.

The round was led by Cisco Investments along with existing investors TLV Partners and Emerge. Nat Friedman, CEO of GitHub; John Kodumal, CTO and co-founder of LaunchDarkly; and Raymond Colletti, VP of revenue at Codecov also participated.

“Rookout from day one has been working to provide production debugging and collection capabilities to all platforms,” Or Weis, co-founder and CEO of Rookout told TechCrunch. That has included serverless like AWS Lambda, containers and Kubernetes and Platform-as-a-Service like Google App Engine and Elastic Beanstalk.

The company is also giving visibility into platforms that are sometimes hard to observe because of the ephemeral nature of the technology, and that go beyond its pure debugging capabilities. “In the last year, we’ve discovered that our customers are finding completely new ways to use Rookout’s code-level data collection capabilities and that we need to accommodate, support and enhance the many varied uses of code-level observability and pipelining,” Weiss said in a statement.

It was particularly telling that a company like Cisco was deeply involved in the round. Rob Salvagno, vice president of Cisco Global Corporate Development and Cisco Investments, likes the developer focus of the company.

“Developers have become key influencers of enterprise IT spend. By collecting data on-demand without re-deploying, Rookout created a Developer-centric software, which short-circuits complexities in the production debugging, increases Developer efficiency and reduces the friction which exists between IT Ops and Developers,” Salvagno said in a statement.

Rookout, which launched in 2017, has offices in San Francisco and Tel Aviv, with a total of 20 employees. It has raised more than $12 million.

Powered by WPeMatico

For nearly 15 years LanzaTech has been developing a carbon capture technology that can turn waste streams into ethanol that can be used for chemicals and fuel.

Now, with $72 million in fresh funding at a nearly $1 billion valuation and a newly inked partnership with biotechnology giant Novo Holdings, the company is looking to expand its suite of products beyond ethanol manufacturing, thanks, in part, to the intellectual property held by Novozymes (a Novo Holdings subsidiary).

“We are learning how to modify our organisms so they can make things other than ethanol directly,” said LanzaTech chief executive officer Jennifer Holmgren.

From its headquarters in Skokie, Ill., where LanzaTech relocated in 2014 from New Zealand, the biotechnology company has been plotting ways to reduce carbon emissions and create a more circular manufacturing system. That’s one where waste gases and solid waste sources that were previously considered to be un-recyclable are converted into chemicals by LanzaTech’s genetically modified microbes.

The company already has a commercial manufacturing facility in China, attached to a steel plant operated by the Shougang Group, which produces 16 million gallons of ethanol per year. LanzaTech’s technology pipes the waste gas into a fermenter, which is filled with genetically modified yeast that uses the carbon dioxide to produce ethanol. Another plant, using a similar technology, is under construction in Europe.

Through a partnership with Indian Oil, LanzaTech is working on a third waste gas converted to ethanol using a different waste gas taken from a Hydrogen plant.

The company has also inked early deals with airlines like Virgin in the U.K. and ANA in Japan to make an ethanol-based jet fuel for commercial flight. And a third application of the technology is being explored in Japan which takes previously un-recyclable waste streams from consumer products and converts that into ethanol and polyethylene that can be used to make bio-plastics or bio-based nylon fabrics.

Through the partnership with Novo Holdings, LanzaTech will be able to use the company’s technology to expand its work into other chemicals, according to Holmgren. “We are making product to sell into that [chemicals market] right now. We are taking ethanol and making products out of it. Taking ethylene and we will make polyethylene and we will make PET to substitute for fiber.”

Holmgren said that LanzaTech’s operations were currently reducing carbon dioxide emissions by the equivalent of taking 70,000 cars off the road.

“LanzaTech is addressing our collective need for sustainable fuels and materials, enabling industrial players to be part of building a truly circular economy,” said Anders Bendsen Spohr, senior director at Novo Holdings, in a statement. “Novo Holdings’ investment underlines our commitment to supporting the bio-industrials sector and, in particular, companies that are developing cutting-edge technology platforms. We are excited to work with the LanzaTech team and look forward to supporting the company in its next phase of growth.”

Holmgren said that the push into new chemicals by LanzaTech is symbolic of a resurgence of industrial biotechnology as one of the critical pathways to reducing carbon emissions and setting industry on a more sustainable production pathway.

“Industrial biotechnology can unlock the utility of a lot of waste carbon emissions,” said Holmgren. “[Municipal solid waste] is an urban oil field. And we are working to find new sources of sustainable carbon.”

LanzaTech isn’t alone in its quest to create sustainable pathways for chemical manufacturing. Solugen, an upstart biotechnology company out of Houston, is looking to commercialize the bio-production of hydrogen peroxide. It’s another chemical that’s at the heart of modern industrial processes — and is incredibly hazardous to make using traditional methods.

As the world warms, and carbon emissions continue to rise, it’s important that both companies find pathways to commercial success, according to Holmgren.

“It’s going to get much, much worse if we don’t do anything,” she said.

Powered by WPeMatico

Last year, we told you about a New York-based startup that had begun lending cold, hard, cash to cryptocurrency holders who don’t want to offload their holdings but also don’t necessarily want so much of their assets tied up in cryptocurrencies.

Today, that two-year-old company, BlockFi, is announcing $18.3 million in Series A funding led by Peter Thiel’s Valar Ventures, with participation from Winklevoss Capital, Morgan Creek Digital, Akuna Capital and earlier backers Galaxy Digital Ventures and ConsenSys Ventures.

Apparently, BlockFi is gaining some traction.

Last year, after raising $1.5 million in seed funding from ConsenSys Ventures, SoFi and Kenetic Capital, it secured $50 million led by Galaxy Digital Ventures (the digital currency and blockchain tech firm founded by famed investor Mike Novogratz) that is used to loan out cash to customers who use their bitcoin and ethereum holdings as collateral.

The minimum deposit required: $20,000 worth of cryptocurrency.

According to founder Zac Prince, who talked with Bloomberg about BlockFi’s newest round, enough people are now using those loans that BlockFi has seen its monthly revenue grow more than 10 times since January.

No doubt the uptick in loans correlates with the rebound in Bitcoin’s value, which was priced as low as $3,400 earlier this year but is now valued at roughly $11,400.

Prince also told the outlet that he expects annual revenue to hit eight figures by the end of this year. In startup land, that means it’s time to roll out new money-making services. BlockFi already introduced a savings account product earlier this year that it says enables investors to earn interest on their assets. They are not backed by the FDIC, though the company says it “operates with a focus on compliance with U.S. laws and regulations.” And while it won’t say exactly what’s coming up next, it says in a statement about the new round more products are being added to its existing platform.

Prince previously spent roughly five years in consumer lending and began investing his own money in crypto in early 2016.

He told us last year that his “lightbulb moment” for the company came as he was in the process of getting a loan for an investment property. Instead of using a traditional bank, he decided to list his crypto holdings to see what would happen, and the response was overwhelming. “I realized that there was no debt or credit outside of [person-to-person] margin lending on a few exchanges, and I had the feeling that this was a big opportunity that I was well-suited to go after.”

Other companies providing crypto-backed loans that are issued in fiat currencies include CoinLoan, SALT Lending, Nexo.io and Celsius Network, among others.

Powered by WPeMatico