Recent Funding

Auto Added by WPeMatico

Auto Added by WPeMatico

Another day, another mega round for a fintech startup. And this one is mega-mega.

Brazil-based Nubank, which offers a suite of banking and financial services for Brazilian consumers, announced today that it has raised a $400 million Series F round of venture capital led by Woody Marshall of TCV. The growth-stage fund is best known for its investment in Netflix but has also made fintech a high priority, with over $1.5 billion in investments in the space. According to Nubank, the company has now raised $820 million across seven venture rounds.

Katie Roof and Peter Rudegeair of The Wall Street Journal reported this morning that the company secured a valuation above $10 billion, potentially making it one of a short list of startup decacorns. That’s up from the $4 billion valuation we wrote about back in October 2018.

Part of the reason for that big-ticket round is the company’s growth. Nubank said in a statement that it has now reached 12 million customers for its various products, making it the sixth-largest financial institution by customer count within its home market. Brazil has a population of roughly 210 million people — indicating that there is still a lot of local growth potential even before the company begins to consider its international expansion options. Nubank announced a few weeks ago that it will start to expand its offerings to Mexico and Argentina.

Over the past year, the company has expanded its product offerings to include personal loans and cash withdrawal options as part of its digital savings accounts.

As I wrote earlier this week, part of the reason for these fintech mega-rounds is that the cost of acquiring a financial customer is critical to the success of these startups. Once a startup has a customer for one financial product — say, a savings account — it can then upsell customers to other products at a very low marketing cost. That appears to be the strategy at Nubank as well, with its quickly expanding suite of products.

As my colleague Jon Shieber discussed last month, critical connections between Stanford, Silicon Valley and Latin America have forged a surge of investment from venture capitalists into the region, as the continent experiences the same digital transformation seen elsewhere throughout the world. As just one example from the healthcare space, Dr Consulta raised more than nine figures to address the serious healthcare needs of Brazilian consumers. Additionally, SoftBank’s Vision Fund, which was rumored to be investing in Nubank earlier this year, has vowed to put $5 billion to work in the region and recently invested $231 million in fintech startup Creditas.

In an email from TCV, Woody Marshall said that, “Leveraging unique technology, David Vélez and his team are continuously pushing the boundaries of delivering best in class financial services, grounded in a culture of tech and innovation. Nubank has all the core tenets of what TCV looks for in preeminent franchise investments.”

NuBank was founded in 2013 by co-founders Adam Edward Wible, Cristina Junqueira, and David Velez. In addition to TCV, existing backers Tencent, DST Global, Sequoia Capital, Dragoneer, Ribbit Capital and Thrive Capital also participated in the round.

Powered by WPeMatico

Unity’s private valuation is climbing but it’s growing unclear whether the company’s leadership is planning to take the 15-year-old gaming powerhouse public anytime soon.

The company announced today that is has received signed agreements from D1 Capital Partners, Canada Pension Plan Investment Board, Light Street Capital, Sequoia Capital, and Silver Lake Partners to fund a $525 million tender offer that will allow Unity’s common shareholders — the majority of which are early or current employees — to sell their shares in the company.

The tender offer gives employees “the opportunity for some liquidity,” Unity CFO Kim Jabal says. The total amount raised will depend on the enthusiasm of common shareholders to sell their stakes in Unity.

This event could potentially signify that the company is pushing back its timeline for an IPO, keeping employees that have been sitting on equity for several years happy as Unity labors on in private markets. It’s worth noting that the company has raised hundreds of million previously with the same intent of buying back employee shares.

It was reported earlier this year that Unity was targeting an IPO in the first half of 2020.

The company also confirmed that it wrapped up a $150M Series E funding round in May that doubled the company’s valuation to $6 billion. The announcement confirms the valuation we reported on in May though at a higher amount of capital raised.

SF-based Unity has more than 2,000 employees. The company builds developer tools which are used game studios to create video games across a number of platforms. The company claims that half of all games are created using the company’s game engine.

Powered by WPeMatico

Amazon’s Alexa ushered in a new dawn of user interfaces, bringing voice into the mix as a viable option. Dozens of companies have sprouted because of this, not least of which being Airbud.io.

Airbud allows any company to add a voice interface to its website. The company just closed a $4 million round led by Hanaco Ventures, with participation from ERA and Spider Capital.

Airbud was co-founded by Israel Krush, Uri Valevski and Rom Cohen after the team saw the growth of voice interfaces and wondered how to capitalize on it.

By allowing companies to add voice/chat bot utility to their websites, Airbud hopes to increase retention of end-users on sites and give them easier access to the information they seek. Krush says that Airbud is focusing on websites that you have to be on, rather than the ones you want to be on.

That means Airbud clients are mostly in the healthcare space and travel space, helping end-users find a physician or book a flight using their voice.

Most importantly, Airbud operates on a plug and play system, meaning that clients don’t have to do the usual heavy lifting involved in creating a chat bot. Most of the time, folks who implement chatbots have to build a conversation tree. Airbud uses existing information scraped from the website, paired with an easy plug-and-play system for clients, to automatically build out a knowledge graph and have conversations with end-users.

Airbud charges based on the number of indexed pages and traffic to those pages.

The company plans to use the funding to increase the size of its team from seven to 15.

Powered by WPeMatico

GDPR, the European data privacy regulations, have been in effect for more than a year, but it’s still a challenge for companies to comply. Ethyca, a New York City startup, has created a solution from the ground up to help customers adhere to the regulations, and today it announced a $4.2 million investment led by IA Ventures and Founder Collective.

Table Management, Sinai Ventures, Cheddar founder Jon Steinberg and Moat co-founder Jonah Goodhart also participated.

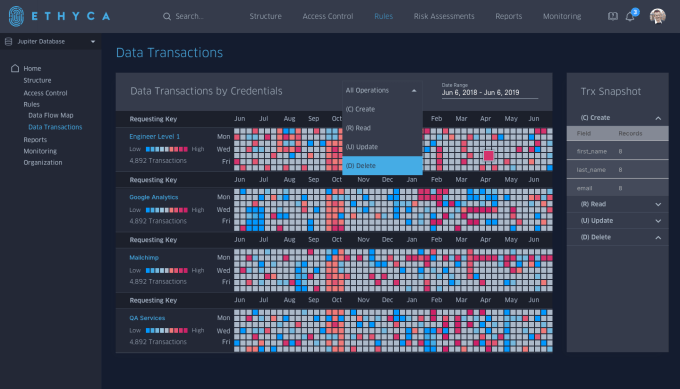

At its heart, Ethyca is a data platform that helps companies discover sensitive data, then provides a mechanism for customers to see, edit or delete their data from the system. Finally, the solution enables companies to define who can see particular types of data across the organization to control access. All of these components are designed to help companies comply with GDPR regulations.

Ethyca enterprise transaction log (Screenshot: Ethyca)

Company co-founder Cillian Kieran says that the automation component is key and should greatly reduce the complexity and cost associated with complying with GDPR rules. From his perspective, current solutions that involve either expensive consultants or solutions that require some manual intervention don’t get companies all the way there.

“These solutions don’t actually solve the issue from an infrastructure point of view. I think that’s the distinction. You can go and use the consultants, or you can use a control panel that tells you what you need to do. But ultimately, at some point you’re either going to have to build or deploy code that fixes some issues, or indeed manually manage or remediate those [issues]. Ethyca is designed for that and takes away those risks because it is managing privacy by design at the infrastructure level,” Kieran explained.

If you’re worried about the privacy of providing information like this to a third-party vendor, Kieran says that his company never actually sees the raw data. “We are a suite of tools that sits between business processes. We don’t capture raw data, We don’t see personal information. We find information based on unique identifiers,” he said.

The company has been around for more than a year, but has been spending its first year developing the solution. He sees this investment as validation of the problem his startup is trying to solve. “I think the investment represents the growing awareness fundamentally from both with the investor community, and also in the tech world, that data privacy as a regulatory constraint is real and will compound itself,” he said.

He also points out that GDPR is really just the tip of the privacy regulation iceberg, with laws in Australia, Brazil and Japan, as well as California and other states in the U.S. due to come online next year. He says his solution has been designed to deal with a variety of privacy frameworks beyond GDPR. If that’s so, his company could be in a good position moving forward.

Powered by WPeMatico

There’s a gap forming in Latin America between the growing digital food delivery market and the number of businesses in the region that are actually online.

Food delivery startups continue to replicate and expand throughout the region, and VCs are channeling mega rounds into them with the hope of capitalizing on consumer online buying trends within growing digital populations.

VCs from all over the world have collectively invested billions into food delivery in the Latin American region. One of the largest rounds to date in Latin American startup history is Movile’s $400 million raise for Brazilian delivery business iFood. SoftBank recently confirmed a $1 billion investment into Colombia’s Rappi in March.

As big checks, new business models and consolidation mold a new on-demand landscape in Latin America, smaller players are coming in to supplement existing marketplaces like Rappi and iFood.

Dataplor founder and CEO Geoffrey Michener saw an opportunity to bring more vendors online. That’s why he invented Dataplor, a platform that indexes micro businesses in emerging markets. Now, Dataplor has raised a third round of seed capital, bringing the company’s total raised to $2 million. Quest Venture Partners led the company’s most recent funding, along with participation from ffVC, Magma Partners, Sidekick Fund and the Blue Startups accelerator.

What does Dataplor actually do? The 13-person company created a platform that recruits, trains and manages what has grown to more than 100,000 independent contractors — or what Dataplor calls Explorers.

Explorers are tasked with feet-on-the-street visits to businesses to capture information like latitude and longitude points, photos, hours of operation, owners’ names and contact info, and whether or not a business accepts credit cards. Dataplor then licenses that data to companies like American Express, iZettle and PayPal. Dataplor also works within a joint partnership to digitize Mexico with Google and Virket.

Michener says that 80% of Mexican businesses don’t have any digital footprint, and less than 5% of businesses have a website. This impacts the reach of what Google can index, as well as from where companies like iFood subsidiaries or Rappi can deliver.

Dataplor, founded in 2016, says it’s responsible for getting 150,000 businesses onto Google in its three years of operation. Michener says Dataplor pays Explorers above-market wages, and is careful about “not using the Uber model to drive down the cost of paying contractors.”

Michener likes to think of his business model as a trifecta of helping small businesses get onto Google for free, creating part-time opportunities for a growing workforce in LatAm and using its tech to help Google and Uber become better populated with accurate info in geos that might be more difficult for a foreign company to access.

Take Mexico for example. Michener says that 80% of Mexican businesses don’t have any digital footprint, and less than 5% of businesses have a website. This impacts the reach of what Google can index, as well as from where companies like iFood or Rappi can deliver. Basically, offline businesses are missing out on new digital distribution opportunities and, therefore, big cash.

In the United States and Europe, companies like Google and Uber scrape data from online directories in order to power their platforms. But this process works differently in Latin America. A small business’ chance of showing up in Google’s index is a lot slimmer, because most businesses are still offline in growing economies. Dataplor first launched in Mexico and bootstrapped its way into Brazil — an aggressive move for a young company due to Brazil’s competitive startup scene and Spanish-Portuguese language barriers. Dataplor says it will expand to Chile, Peru and Colombia in 2019.

Michener tested the minimum viable product by literally going on Craigslist Mexico City and sending money over PayPal to people willing to go out and gather data about small businesses. Turns out there was some traction.

What happens when all the businesses in Latin America are online? Dataplor plans to make money by licensing its data; but there’s another component to the equation. Dataplor is building a relationship with these businesses. Google will pay to know when a menu changes, hours of operation shift or a restaurant goes out of business.

Dataplor’s tech stack could pique interest for any company that wants a hand in the digitization of growing markets. Now that they’ve built a playbook for Explorer logistics, that operational piece of their business may be interesting to companies like Google, Apple and Uber too.

Powered by WPeMatico

LIV, a Prague-based company that wants to make VR gaming more fun to watch, and in turn bring players and spectators closer together, has picked up $1 million in funding. That’s a pretty modest raise as far as ambitious upstarts go — and LIV is certainly ambitious. However, the list of backers includes noteworthy names, such as the founder of Oculus (and designer of Oculus Rift), Palmer Luckey.

Other investors in LIV include Jaroslav Beck, CEO and co-founder of Beat Games (the studio behind VR streaming hit Beat Saber); early-stage VC Seedcamp; accelerator Techstars; Prague’s Credo Ventures; VR company VIVE; and mixed reality production specialist Splitverse.

Founded in 2016, LIV is betting on the premise that VR gaming represents an entirely new platform, and it is new platforms with nascent ecosystems where the biggest opportunities lie. Furthermore, while the watching of video game live streams shows no signs of abating — made popular via sites such as Twitch — the spectator experience hasn’t transitioned very gracefully to VR.

“Creating content in VR is incredibly hard, there are no tools for it, and no shareable content form factor that conveys the experience of being in VR,” says LIV co-founder AJ Shewki, who was previously a competitive gamer under the moniker “Dr Doom.”

“LIV empowers developers and content creators to grow their audience through shareable VR content. Developers integrate our SDK, and content creators are then able to create content with those games and experiences using the LIV App. The content format is called ‘Mixed Reality Capture’ (MRC).”

The “Mixed Reality Capture” experience is inevitably best watched rather than conveyed through the written word (you can see an example below). However, what MRC essentially does is inject a live video or, alternatively, a 3D avatar of the player’s body, inside the video game stream so spectators experience not only what the player sees (the classic VR first-person perspective) but can also follow the “real-world” movements the player makes to execute moves within the game. As a player moves their arms, for example, their avatar can be seen replicating the same moves based on sensor data pulled from the VR gear the player is wearing.

It is this ability to closely watch and potentially learn from the best players that has made video game streaming so popular. But, argues Shewki, the move to VR was initially a backwards step in this regard, as it required additional technology to close the gap between player and spectator.

“The LIV App gives streamers the tools to broadcast themselves as themselves, or as their favourite avatars, inside any of the 100s of games that we support. We support hundreds if not thousands of avatars, including the popular Japanese VRM avatar format,” says Shewki.

“The LIV App also brings utilities like stream chat, stream alerts, scene controls and camera controls natively into the headset using our proprietary 3D overlay system, built specifically with performance in mind (which in VR is already a scarce resource). The LIV SDK is integrated by developers to get their games LIV-ready. We support Unity, Unreal as well as custom engines, and have done integrations with all of them.”

Longer term, Shewki says he wants LIV to not only enable a better live-streaming experience but to evolve into what the company is describing as a “real-time audience interaction platform” for VR streamers and games developers. The thinking here is that spectators of VR can also become participants beyond the simple chatroom experience that exists today.

Dubbed “LIV Play” and targeting a closed alpha release by the end of the year, the idea is to give audiences the ability to influence what happens in-game and in real time, such as purchasing health potions when a player most needs them or spawning extra monsters when they least expect it.

“Our hypothesis was: If we give viewers more engaging ways to participate, as opposed to what you have today with chat, polls and donations, they will,” explains Shewki. “We ran experiments with Beat Saber where we let audiences replace cubes with bombs and do more fun donations. Our experiment results over 120 days were incredible. Week 1 and 2: 700% higher revenue/minute through higher engagement. It petered out to 300% higher rev/min at 120 days, where it’s stayed.”

In other words, take the same monetisation approach that we have seen in games like Fortnite and apply it to the audience side of live-gaming spectatorship. “Creativity is our only limit here,” enthuses Shewki.

Powered by WPeMatico

CircleCI launched way back in 2011 when the notion of continuous delivery was just a twinkle in most developers’ eyes, but over the years with the rise of agile, containerization and DevOps, we’ve seen the idea of continuous integration and continuous delivery (CI/CD) really begin to mainstream with developers. Today, CircleCI was rewarded with a $56 million Series D investment.

The round was led by Owl Rock Capital Partners and Next Equity. Existing investors Scale Venture Partners, Top Tier Capital, Threshold Ventures (formerly DFJ), Baseline Ventures, Industry Ventures, Heavybit and Harrison Metal Capital also participated in the round. CircleCI’s most recent funding prior to this round was a $31 million Series C last January. Today’s investment brings the total raised to $115.5 million, according to the company.

CircleCI CEO Jim Rose sees a market that’s increasingly ready for the product his company is offering. “As we’re putting more money to work, there are just more folks that are now moving away from aspiring about doing continuous delivery and really leaning into the idea of, ‘We’re a software company, we need to know how to do this well, and we need to be able to automate all the steps between the time our developers are making changes to the code until that application gets in front of the customer,’ ” Rose told TechCrunch.

Rose sees a market that’s getting ready to explode and he wants to use the runway this money provides his company to take advantage of that growth. “Now, what we’re finding is that fintech companies, insurance companies, retailers — all of the more traditional brands — are now realizing they’re in a software business as well. And they’re really trying to build out the tool sets and the expertise to be effective at that. And so the real growth in our market is still right in front of us,” he said.

As CircleCI matures and the market follows suit, a natural question following a Series D investment is when the company might go public, but Rose was not ready to commit to anything yet. “We come at it from the perspective of keeping our heads down trying to build the best business and doing right by our customers. I’m sure at some point along the journey our investors will be itching for liquidity, but as it stands right now, everyone is really [focused]. I think what we have found is that the bulk of the market is just starting to arrive,” he said.

Powered by WPeMatico

Mixhalo — the startup co-founded by Incubus guitarist Mike Einziger and his wife, violinist Ann Marie Simpson-Einziger — has raised $10.7 million in Series A funding.

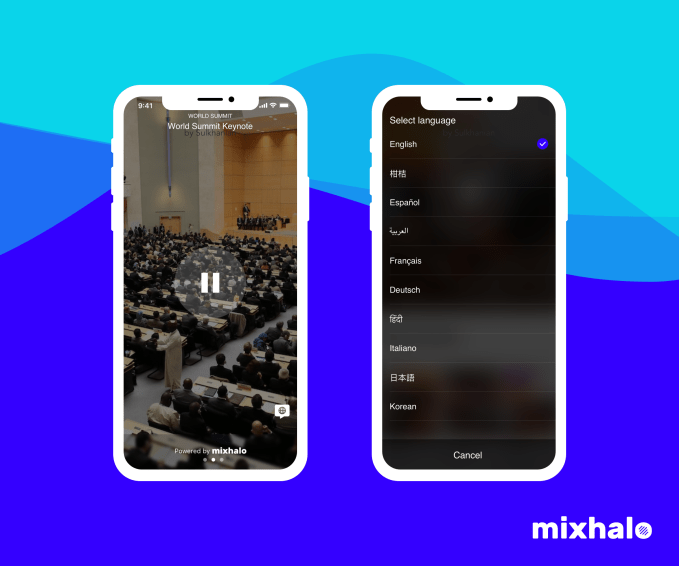

The company’s initial goal was to bring better sound quality to concerts. Instead of hearing music blasted out of speakers, users can connect their smartphone to a network (the startup creates its own wireless channel that doesn’t rely on the venue’s potentially overloaded Wi-Fi or cell networks). Then, through their earbuds, they’ll hear the same sound mix that the musicians receive through their in-ear monitors.

Mixhalo launched two years ago at TechCrunch Disrupt NY, where Incubus and investor Pharrell Williams took the stage to play a couple of songs. The sound arrived loud and clear through my earbuds, and the experience didn’t feel too different from a normal concert.

Since then, Mixhalo has also been used at Y Combinator Demo Day and deployed on tours by Charlie Puth, Incubus and Metallica, as well as Aerosmith’s current Las Vegas residency.

And at the beginning of this year, Marc Ruxin joined as CEO. Ruxin previously led the music discovery startup TastemakerX (which was acquired by Rdio), so this is clearly an area that interests him, but he told me that he wasn’t actually eager to return to the music business. However, he was wowed by Mixhalo’s sound quality, and as he talked to Einziger (who serves as the startup’s chief creative officer), he became convinced that the technology could be used at a wide range of events and venues — conferences, sports, museums, megachurches and more.

Plus, unlike other music startups, Ruxin said the business model here seemed appealingly straightforward: “We sell enterprise software to event organizers.”

When I’ve described the idea in the past, there’s usually some skepticism about whether concertgoers really care that much about sound, and concern about whether wearing headphones diminishes the social experience.

Ruxin countered Mixhalo offers a number of benefits beyond sound quality — there’s the ability for each listener to control their own volume, and an opportunity to create unique experiences, like offering multiple mixes for a single concert, or watching one band at a festival (or one presenter at Demo Day) while listening to another via Mixhalo.

He also argued that people don’t realize how bad most concert audio is until Mixhalo gives the chance to experience something better.

“We’re definitely solving a problem in music that people don’t realize they have,” he said, comparing it to watching an old TV and thinking it was fine, until you had the chance to watch in HD: “Now, sports that’s not in HD looks crappy.”

As for the effect on the social experience, Ruxin said the idea isn’t to turn the whole event into a silent disco. Instead, Mixhalo allows the audience members to choose the experience they want. And that can change from song to song — he recalled seeing some fans listen to Mixhalo for most of a concert, then take their headphones off to sing along with the hits. Others did the opposite, wanting to get the best sound quality on their favorite songs.

Ruxin said he’s primarily focused on music and sports for now, but he’s also open to working with partners outside those areas, because the technology can be installed in, say, a Broadway musical with “no technical tweaks.”

The funding was led by Foundry Group, with participation from Sapphire Sport, Founders Fund, Defy Partners, Cowboy Ventures, Red Light Management, Another Planet Entertainment, Rick Farman and Rich Goodstone of Superfly and Charlie Walker of C3. Mixhalo has now raised a total of $15 million.

NEW YORK, NY – MAY 17: (L-R) Pharrell Williams, founder and CEO of MIXhalo Mike Einziger and TechCrunch senior writer Anthony Ha speak onstage during TechCrunch Disrupt NY 2017 – Day 3 at Pier 36 on May 17, 2017 in New York City. (Photo by Noam Galai/Getty Images for TechCrunch)

Powered by WPeMatico

Arrcus has a bold notion to try and take on the biggest names in networking by building a better networking management system. Today it was rewarded with a $30 million Series B investment led by Lightspeed Venture Partners.

Existing investors General Catalyst and Clear Ventures also participated. The company previously raised a seed and Series A totaling $19 million, bringing the total raised to date to $49 million, according to numbers provided by the company.

Founder and CEO Devesh Garg says the company wanted to create a product that would transform the networking industry, which has traditionally been controlled by a few companies. “The idea basically is to give you the best-in-class [networking] software with the most flexible consumption model at the lowest overall total cost of ownership. So you really as an end customer have the choice to choose best-in-class solutions,” Garg told TechCrunch.

This involves building a networking operating system called ArcOS to run the networking environment. For now, that means working with manufacturers of white-box solutions and offering some combination of hardware and software, depending on what the customer requires. Garg says that players at the top of the market like Cisco, Arista and Juniper tend to keep their technical specifications to themselves, making it impossible to integrate ArcOS with those companies at this time, but he sees room for a company like Arrcus .

“Fundamentally, this is a very large marketplace that’s controlled by two or three incumbents, and when you have lack of competition you get all of the traditional bad behavior that comes along with that, including muted innovation, rigidity in terms of the solutions that are provided and these legacy procurement models, where there’s not much flexibility with artificially high pricing,” he explained.

The company hopes to fundamentally change the current system with its solutions, taking advantage of unbranded hardware that offers a similar experience but can run the Arrcus software. “Think of them as white-box manufacturers of switches and routers. Oftentimes, they come from Taiwan, where they’re unbranded, but it’s effectively the same components that are used in the same systems that are used by the [incumbents],” he said.

The approach seems to be working, as the company has grown to 50 employees since it launched in 2016. Garg says that he expects to double that number in the next six-nine months with the new funding. Currently the company has double-digit paying customers and more than 20 in various stages of proofs of concepts, he said.

Powered by WPeMatico

Since co-founding Heap, CEO Matin Movassate has been saying that he wants to take on the analytics incumbents. Today, he’s got more money to fund that challenge, with the announcement that Heap has raised $55 million in Series C funding.

Movassate (pictured above) previously worked as a product manager at Facebook, and when I interviewed him after the startup’s Series B, he recalled the circuitous process normally required to collect and analyze user data. In contrast, Heap automatically collects data on user activity — the goal is to capture literally everything — and makes it available in a self-serve way, with no additional code required to answer new queries.

The company says it now has more than 6,000 customers, including Twilio, AppNexus, Harry’s, WeWork and Microsoft.

With this new funding, Heap has raised a total of $95.2 million. The plan is to fund international growth, as well as expand the product, engineering and go-to-market teams.

The Series C was led by NewView Capital, with participation from new DTCP, Maverick Ventures, Triangle Peak Partners, Alliance Bernstein Private Credit Investors, Sharespost and existing investors (NEA, Menlo Ventures, Initialized Capital and Pear VC). NewView founder and managing partner Ravi Viswanathan is joining the startup’s board of directors.

“Heap offers an innovative approach to automating a company’s analytics, enabling a variety of teams within an organization to obtain the data they need to make educated and, ultimately, smarter decisions,” Viswanathan said in a statement. “We are excited to team up with Heap, as they continue to develop their cutting edge software, expand their analytics automation offerings and help serve their growing numbers of customers.”

Powered by WPeMatico