Recent Funding

Auto Added by WPeMatico

Auto Added by WPeMatico

Customer reviews play a key role in helping people decide what to buy on consumer-focused marketplaces like Amazon or app stores, and the same tendency exists in the B2B world, where nearly half a trillion dollars is spent annually on software and IT purchases. TrustRadius, one of the startups capitalising on the latter trend, with total feedback sessions today standing at close to 190,000 reviews, has now picked up a Series C of $12.5 million led by Next Coast Ventures, with existing investors Mayfield Fund and LiveOak Ventures also participating.

The funding, which brings the total raised by TrustRadius to $25 million (modest compared to some of its competitors), will be used to build more partnerships and use cases for its reviews, as well as continue expanding that total number of users providing feedback.

In addition to its main site — which goes up against a huge number of other online software comparison services like TrustPilot, G2 Crowd, Owler and many others — TrustRadius is already working with vendors like LogMeIn, Tibco and more (including a number of huge IT companies that have asked not to be named).

TrustRadius mainly works with them on two tracks: to source a wider range of reviews from their existing customer bases to improve their profiles on the site; and then to help them use those reviews in their own marketing materials. Partnerships like these form the core of TrustRadius’s business model: people posting reviews or using the site to read them access it for free.

Vinay Bhagat, founder and CEO of TrustRadius, believes that his company’s mission — to help IT decision makers vet software by tapping into feedback from other IT buyers — has found particular relevance in the current market.

“I think that gravity is on our side,” he said in an interview. “If you think about how the tech industry is evolving and getting things done, IT decisions are getting decentralized and moving out of the CIO’s office. Millennials are ageing into positions of authority, and it means that the way people had previously bought software — by way of salespeople or on the basis of analyst reports — are changing. There is pent-up demand to hear the roar of peers and that’s where we come in.”

User-generated reviews have come under a lot of criticism in recent times. Regulators have been going after companies for not being vigilant enough about policing their platforms for “fake” reviews, either planted to big-up a product, or by rivals to knock it down, or coming from people who are being paid to put in a good word. The argument has been that the marketplaces hosting those reviews are still bringing in eyeballs and product conversions based on that feedback, so they are less concerned with the corruption even if it longer term can likely sour consumers on the trustworthiness of the whole platform.

That belief is not wholly true, of course: Amazon for one has recently been making a huge effort to improve trust, by going after dodgy reviewers and setting up systems to halt the trafficking of counterfeit goods.

And Bhagat argued to me that it doesn’t hold for TrustRadius, either. The company has a focused enough mandate — B2B software purchasing — within a crowded enough field, that losing trust by posting blindly positive reviews would get it nowhere fast.

At the same time, he noted that the company has held a firm line with its customers on making sure that the “truth” about a product is made clear even if it’s not completely rosy, in the hopes that they can use that to work on improvements, and also provide more balanced feedback at the least from existing customers in order to give a more complete picture. (It also, like other reviews sites, makes people who provide feedback do so using professional credentials like work emails and LinkedIn profiles.)

That line has so far carried it into relationships with a number of software companies, which are using reviews as a complement to their own sales teams, and the papers and analysis published by analysts like Gartner and Ovum and Forester, to reach people who are weighing up different options for their IT solutions.

“TrustRadius has become an integral part of today’s economic cycle,” said Bill Wagner, CEO of LogMeIn, in a statement. “Software buyers today need detailed reviews to make sure that the product works for a business professional like themselves. TrustRadius provides that in a transparent way, so buyers can make confident decisions, even about enterprise-grade software.”

The recent swing in the digital world toward data protection and people getting increasingly aware of how their own personal details are used in ways they never intended has presented an interesting challenge for the world of online services. Most of us don’t like getting marketing and will generally opt out of any “yes, I consent to getting updates from XYZ and its partners!” boxes — if we happen to spot them amid the dark patterning of the net.

TrustRadius and companies like it have an opportunity through that, though: by targeting IT buyers who have to make complicated purchasing decisions and most likely more than one, and in a way that ensures each purchase works with the rest of an existing tech stack, they represent one of the rare cases where a user might actually want to hear more.

Indeed, one of the company’s plans longer term is to continue developing how it can work with its users through that IT life cycle by providing suggestions of software based on previous software purchases and also what that users’ feedback has been around a past purchase.

“From day one we have been dealing with complex purchasing decisions,” Bhagat said. “Buying technology that will be used to run your business is not the same as buying an app that you use casually. It can be make or break for your company.”

Powered by WPeMatico

Weed may be legal in California, but the black market is still the top spot for buyers looking for bud on a budget.

Flower Co. graduated from Y Combinator’s latest class on the promise that they could cut customers better deals by focusing on partnering with growers directly to create their own house brands while pushing users to order ahead of time. The company calls itself the “Costco of cannabis.”

The company just announced the close of a $2.8 million seed round from investors including Slome Capital, Prehype, Rob Stavis, Adam Draper, Josh Abramson and Camille Hyde.

Even in California where weed has been legalized, the black market is still king due to the high prices buoyed by high taxes. Flower Co.’s CEO Ted Lichtenberger says the regulated market is just 1/4 the size of the unregulated market. Flower Co.’s ultimate goal is less focused on getting people to ditch their existing dispensary as much as they are focused on getting black market regulars to go legit thanks to the better deals and conveniences of their platform.

Part of building allegiance to the Flower Co. brand is the company’s membership plan. Anybody can make a purchase on the site, but members save up to 40% on purchases, a number that makes a big difference when you’re buying weed by the ounce. An ounce of “Forbidden Fruit” goes for $192 without a membership and $142 with one, for example. With a membership, the company’s “House Sativa” goes for $63 an ounce.

An annual membership to Flower Co. is $119, and in addition to the discounts, users get faster delivery and beta access to the company’s “private events and concert series.” The company just recently launched a two-day delivery service for customers in Sacramento.

The company is just flexing its muscles in a few markets in California, but is hoping that by scaling slowly they can be ready to attack new opportunities as the regulatory environment shifts.

“We understand that we’re in the first inning of what’s probably a pretty long game, because this industry, as it goes federally legalized is going to have another massive transition moment just like it’s having right now as it’s getting legalized and regulated in California,” Lichtenberger says. “So if we have a great understanding of our customers and stay focused on keeping them delighted, and then be nimble in the face of that change, then we can come out as the dominant player in the delivery market.”

Powered by WPeMatico

Uber and Lyft aren’t designed to transport people who need a little help getting out of the house or need someone to help get them from the doctor’s waiting room back to their home. While Uber, for example, has launched Uber Health to help patients get to their appointments, the drivers are not vetted with patient assistance in mind. This is where Onward comes in.

Onward, with $1.5 million in seed funding from Royal Street Ventures, Matchstick Ventures and JPK Capital, launched a few months ago in the San Francisco Bay Area to help seniors safely get from point A to point B. Unlike Uber and Lyft, Onward offers round-trip, door-to-door rides and aims to provide freedom for older adults who may feel isolated, Onward co-founder Mike Lewis told TechCrunch.

The idea for Onward emerged from Lewis’ experience with his mother-in-law who had Alzheimer’s. It got him and his co-founder, Nader Akhnoukh, thinking about the idea of aging in place and how older people may feel isolated as they become unable to do the tasks they’ve spent their whole lives doing, like driving.

“The minute you can’t do that, it’s sad and scary,” Lewis said.

Onward has three types of customers: older adults who are no longer able to drive, someone who can’t drive for medical reasons (surgeries, eye exams, etc.) and caregivers who are unable to provide transportation to their loved ones.

Similar to Uber and Lyft, Onward drivers are 1099 contractors, but a key difference is that they are paid hourly — at least $20 per hour. Currently, there are more than 25 drivers on board who are all trained in CPR, dementia, and have gone through a background check and car inspection.

Onward also ensures its drivers know how to fold wheelchairs, though, only some drivers have the ability to transport those in powered wheelchairs. This time next year, Onward expects to have hundreds of drivers. Lewis says he also expects the number of vehicles with the ability to transport people in powered wheelchairs to increase as the company grows.

For riders, they can expect to pay $35 per hour. The minimum charge for the trip is one hour, so this is definitely geared toward people who may need the driver to wait for them during a doctor’s appointment, for example. After the first hour, Onward charges by the minute.

That hourly fee gets riders round-trip rides with the driver waiting for you at the destination, door-to-door assistance at each stop and the ability to request favorite drivers.

Onward completed its first ride in March in the San Francisco Bay Area. For the rest of the year, Onward plans to focus on San Francisco as well as one other launch market. To date, Onward has completed more than 500 trips.

Powered by WPeMatico

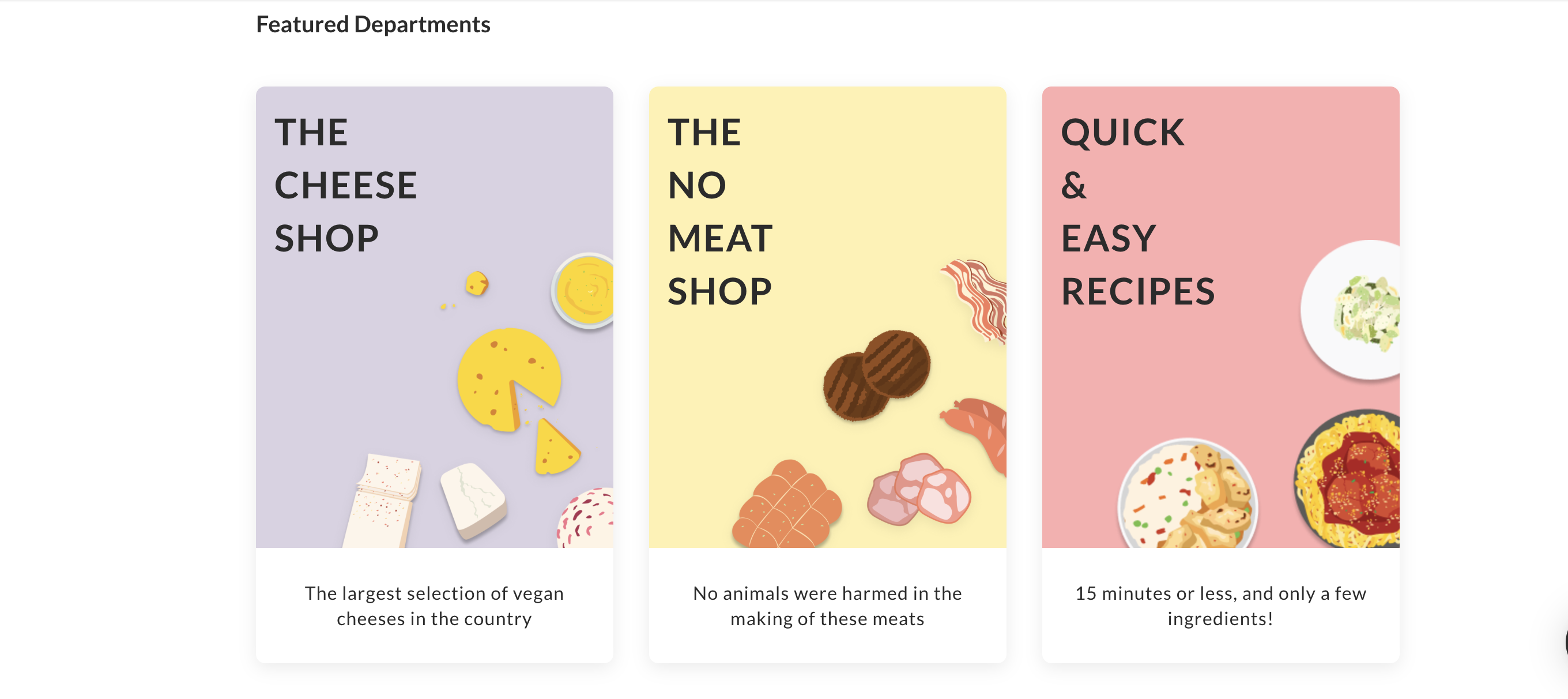

Gaurav Maken, the chief executive officer of the online vegan grocery store Mylk Guys, doesn’t think of his company as a place to just buy food. For him, it’s a testing ground and platform for all of the new food products he expects to be developed as startup entrepreneurs and established food companies start tackling the plant-based and alternative-meat market in earnest.

The company has raised $2.5 million in support of that vision from investors, including Khosla Ventures, Pear Ventures and Fifty Years.

“Today we’re an online grocery store,” says Maken. “We are also a place for cultured meats and any genetically engineered food that allows us to scale our food production and allows us to keep feeding people.”

Maken isn’t wedded to plant-based products and envisions a virtual store stocked with products that create more sustainable consumption options for its customers. In fact, 40% of the company’s customers are not vegan, according to Maken.

“We don’t only think about vegans. We think about sustainable food systems,” says Maken. “Our audience is an educated consumer who wants to have less of an impact from their diet… They’re just folks trying to do better with their eating habits.”

Right now, the company sells around 1,300 products through its site. And the pitch that Maken makes to suppliers is that they can access the data around their customers (unlike other online retailers, whose name rhymes with shmamazon).

“We provide analytics and a way for brands to unlock the data coming from their customers,” Maken says. “Our focus is how can we get you a personalized staple that works for you.”

The company’s top sellers are vegan cheeses like Sparrow Camembert, lines of vegan jerkies and the Beyond Burger, Maken said.

“You can build brands that are successful that are $1 million brands or $5 million brands and the reason why you haven’t is because they haven’t had the platform to provide national distribution to be successful,” says Maken.

Mylk Guys launched in 2018 and went through the Y Combinator accelerator program. Now, with its new capital, the company is focusing on expanding its sales and marketing on the East Coast, opening a new warehouse for distribution and reaching out to the vegan community on the Eastern Seaboard.

The model for selling more sustainable foods directly to the consumer has at least one precedent. Los Angeles-based Thrive Market raised $111 million in a 2016 round of funding for its online sustainable product-focused grocery store.

As recent reports indicate, the sustainable food business is only growing. Citing reports from Ecovia Intelligence, the publication Environmental Leader reported that organic food sales topped $100 billion for the first time in 2018.

Powered by WPeMatico

Contract management isn’t exactly an exciting subject, but it’s a real pain point for many companies. It also lends itself to automation, thanks to recent advances in machine learning and natural language processing. It’s no surprise then, that we see renewed interest in this space and that investors are putting more money into it. Earlier this week, Icertis raised a $115 million Series E round, for example, at a valuation of more than $1 billion. Icertis has been in this business for 10 years, though. On the other end of the spectrum, contract management startup Lexion today announced that it has raised a $4.2 million seed round led by Madrona Venture Group and law firm Wilson Sonsini Goodrich & Rosati, which was also one of the first users of the product.

Lexion was incubated at the Allen Institute for Artificial Intelligence (AI2), one of the late Microsoft co-founders’ four scientific research institutes. The company’s co-founder and CEO, Gaurav Oberoi, is a bit of a serial entrepreneur, whose first startup, BillMonk, was first featured on TechCrunch back in 2006. His second go-around was Precision Polling, which SurveyMonkey then acquired shortly after it launched. Oberoi founded the company together with former Microsoft research software development engineering lead Emad Elwany and engineering veteran James Baird.

“Gaurav, Emad, and James are just the kind of entrepreneurs we love to back: smart, customer obsessed and attacking a big market with cutting-edge technology,” said Madrona Venture Group managing director Tim Porter. “AI2 is turning out some of the best applied machine learning solutions, and contract management is a perfect example — it’s a huge issue for companies at every size and the demand for visibility into contracts is only increasing as companies face growing regulatory and compliance pressures.”

Contract management is becoming a bit of a crowded space, though, something Oberoi acknowledged. But he argues that Lexion is tackling a different market from many of its competitors.

“We think there’s growing demand and a big opportunity in the mid-market,” he said. “I think similar to how back in the 2000s, Siebel or other companies offered very expensive CRM software and now you have Salesforce — and now Salesforce is the expensive version — and you have this long tail of products in the mid-market. I think the same is happening to contracts. […] We’re working with companies that are as small as post-seed or post-Series A to a publicly traded company.”

Given that it handles plenty of highly confidential information, it’s no surprise that Lexion says that it takes security very seriously. “I think, something that all young startups that are selling into business or enterprise in 2019 need to address upfront,” Oberoi said. “We realized, even before we raised funding and got very serious about growing this business, that security has to be part of our DNA and culture from the get-go.” He also noted that every new feature and product iteration at Lexion goes through a security review.

Like most startups at this stage, Lexion plans to invest the new funding into building out its product — and especially its AI engine — and go-to-market and sales strategy.

Powered by WPeMatico

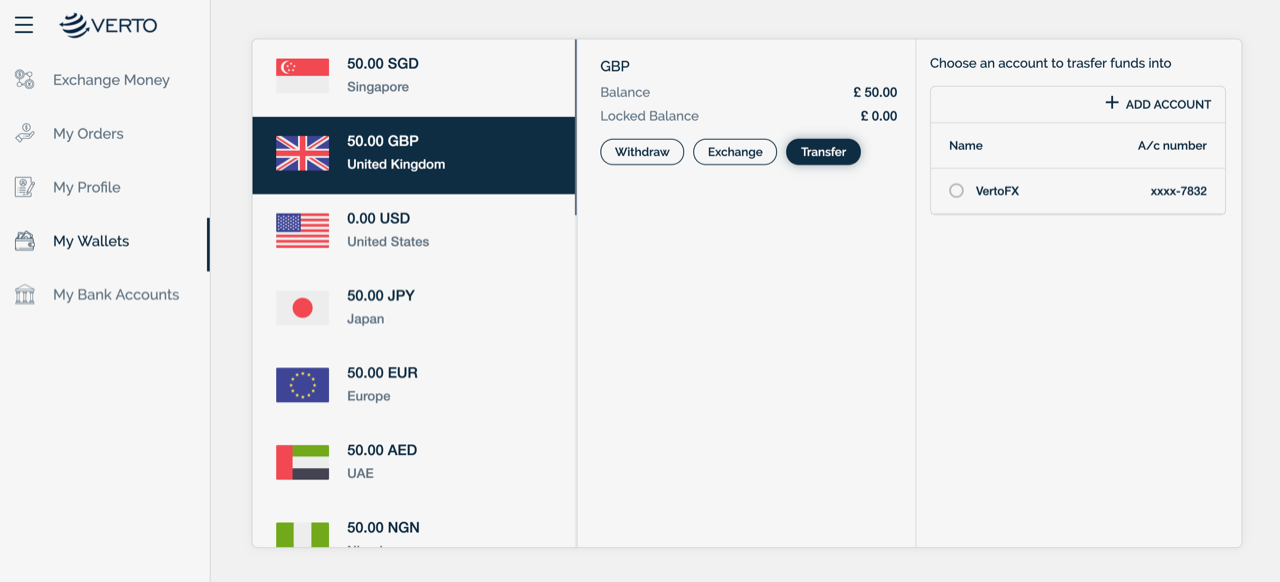

VertoFX, an Africa and emerging markets-focused currency trading and payment startup, has raised a $2.1 million seed round, led by Accelerated Digital Ventures.

The London-based company, with a subsidiary in Lagos, Nigeria, has created a platform that allows businesses and banks to exchange and make payments in exotic foreign currencies that don’t often convert or trade conveniently across businesses or banks.

For example, South Africa’s Rand is Africa’s most convertible and traded currency — with lower spreads and transaction costs — while currencies of countries such as Ethiopia or Egypt may be difficult or expensive to trade or transact B2B payments.

“That’s the reason we are utilizing technology to create a marketplace model and price discovery to create liquidity for these currencies,” VertoFX founder Ola Oyetayo told TechCrunch.

There are around 40 global currencies that are considered exotic or illiquid, most of them in frontier markets in Asia, Africa and the Middle-East, according to Oyetayo.

And there’s a revenue opportunity to creating a convenient online marketplace for trading and payments in these currencies.

And there’s a revenue opportunity to creating a convenient online marketplace for trading and payments in these currencies.

“Our research says there’s about $400 billion being done by small and medium-scale businesses in Africa alone in transactional volume on an annual basis. If we take 1% of that as a commission or transaction fee, that’s a $4 billion addressable market, just in the continent,” said Oyetayo.

VertoFX was founded in 2017 by Oyetayo and Anthony Oduwole — both ex-global bankers born in Nigeria. The company was part of Y Combinator’s 2019 winter cohort and processed around $7 million in transaction volume last month, according to Oyetayo.

VertoFX was founded in 2017 by Oyetayo and Anthony Oduwole — both ex-global bankers born in Nigeria. The company was part of Y Combinator’s 2019 winter cohort and processed around $7 million in transaction volume last month, according to Oyetayo.

VertoFX is registered as a payment services provider with the U.K.’s Financial Conduct Authority. Current clients include several undisclosed banks and San Francisco-based payment venture Flutterwave.

VertoFX doesn’t release revenue figures, but confirmed it earns a commission, or spread, on each transaction processed on its platform. There are currently 19 currencies on the platform and the ability to settle in 120 countries, including China and the U.S.

VertoFX is also moving into offering market research — toward potential subscription services — on the currencies it trades, according to Oyetayo.

The startup will use the round for platform development, expanding the currencies and gaining licenses in new countries. “We’ll also use the round for hiring, primarily in compliance and regulator type roles,” said Oyetayo. VertoFX already has a developer team in India and is looking at local developer talent for its Africa offices.

ADV’s Ryan Proctor confirmed the VC firm’s lead on the investment round, which also included participation from YC and several local angel investors in Africa, Oyetayo told TechCrunch.

On the possibility of becoming acquired by a big bank, VertoFX isn’t so interested, according to Oyetayo.

“We both come from big banks and if we’d wanted to go down that route we’d have developed this more as a software as a service platform,” he said.

“We’re playing the long game here, and I don’t think acquisition is the end game,” he said.

Powered by WPeMatico

The rise of data breaches, along with an expanding raft of regulations (now numbering 80 different regional regimes, and growing) have thrust data protection — having legal and compliant ways of handling personal user information — to the top of the list of things that an organization needs to consider when building and operating their businesses. Now a startup called InCountry, which is building both the infrastructure for these companies to securely store that personal data in each jurisdiction, as well as a comprehensive policy framework for them to follow, has raised a Series A of $15 million. The funding is coming in just three months after closing its seed round — underscoring both the attention this area is getting and the opportunity ahead.

The funding is being led by three investors: Arbor Ventures of Singapore, Global Founders Capital of Berlin and Mubadala of Abu Dhabi. Previous investors Caffeinated Capital, Felicis Ventures, Charles River Ventures and Team Builder Ventures (along with others that are not being named) also participated. It brings the total raised to date to $21 million.

Peter Yared, the CEO and founder, pointed out in an interview the geographic diversity of the three lead backers: he described this as a strategic investment, which has resulted from InCountry already expanding its work in each region. (As one example, he pointed out a new law in the UAE requiring all health data of its citizens to be stored in the country — regardless of where it originated.)

As a result, the startup will be opening offices in each of the regions and launching a new product, InCountry Border, to focus on encryption and data handling that keep data inside specific jurisdictions. This will sit alongside the company’s compliance consultancy as well as its infrastructure business.

“We’re only 28 people and only six months old,” Yared said. “But the proposition we offer — requiring no code changes, but allowing companies to automatically pull out and store the personally identifiable information in a separate place, without anything needed on their own back end, has been a strong pull. We’re flabbergasted with the meetings we’ve been getting.” (The alternative, of companies storing this information themselves, has become massively unpalatable, given all the data breaches we’ve seen, he pointed out.)

In part because of the nature of data protection, in its short six months of life, InCountry has already come out of the gates with a global viewpoint and global remit.

It’s already active in 65 countries — which means it’s already equipped to store, process and regulate profile data in the country of origin in these markets — but that is actually just the tip of the iceberg. The company points out that more than 80 countries around the world have data sovereignty regulations, and that in the U.S., some 25 states already have data privacy laws. Violating these can have disastrous consequences for a company’s reputation, not to mention its bottom line: In Europe, the U.K. data regulator is now fining companies the equivalent of hundreds of millions of dollars when they violate GDPR rules.

This ironically is translating into a big business opportunity for startups that are building technology to help companies cope with this. Just last week, OneTrust raised a $200 million Series A to continue building out its technology and business funnel — the company is a “gateway” specialist, building the welcome screens that you encounter when you visit sites to accept or reject a set of cookies and other data requests.

Yared says that while InCountry is very young and is still working on its channel strategy — it’s mainly working directly with companies at this point — there is a clear opportunity both to partner with others within the ecosystem as well as integrators and others working on cloud services and security to build bigger customer networks.

That speaks to the complexity of the issue, and the different entry points that exist to solve it.

“The rapidly evolving and complex global regulatory landscape in our technology driven world is a growing challenge for companies,” said Melissa Guzy of Arbor Ventures, in a statement. Guzy is joining the board with this round. “InCountry is the first to provide a comprehensive solution in the cloud that enables companies to operate globally and address data sovereignty. We’re thrilled to partner and support the company’s mission to enable global data compliance for international businesses.”

Powered by WPeMatico

With commercial launch services expected to reach $7 billion by 2024, there’s increasing demand for an array of new technologies that can offer advantages to companies looking to get communications infrastructure in orbit.

That’s one of the reasons behind the new $25.5 million financing for Momentus, which sells in-space shuttle services to move satellites between orbits.

The company joins other satellite and telecommunications technology vendors like Akash Systems, which raised $14.5 million for its advanced telecommunications chipsets used in satellites, that have raised money from investors looking beyond basic launch services.

A motley assortment of venture capital firms, hedge funds, family offices and other institutional investors came in to finance the new round of funding for Momentus including: Y Combinator, the Lerner Family, the University of Wyoming Foundation, Quiet Capital, Mountain Nazca, ACE & Co., Liquid 2 Ventures and Drake Management. The financing was led by Prime Movers Lab.

With $34 million in funding to date, Momentus said it will use its new cash to continue the development of its two shuttles designed to move payloads between different orbits. As the space in space fills up, the ability to maneuver payloads once they reach low Earth orbit will become more important.

“In the past 18 months, Momentus has rapidly matured their water plasma propulsion system to deliver the world’s safest and most affordable in-space transportation services. They recently launched their first demonstration and are on track to radically reshape the landscape of the space economy,” said Dakin Sloss, founder and general partner at Prime Movers Lab, in a statement. “I look forward to Momentus delivering on their massive backlog of contracts and partnerships with NASA, SpaceX and other top players in the space ecosystem.”

A backlog of contracts is impressive, but the down payment on a potential flight is minimal compared to the ability to get on a vehicle, so companies tend to spread the wealth.

The money will also pay for building in-house research and development for the company’s technology and additional flight demonstrations throughout 2020, according to Momentus chief executive Mikhail Kokorich. The company expects to generate its first revenue next year, as well, Kokorich said.

The company has three flights scheduled for 2020.

Powered by WPeMatico

The idea behind Dust Identity was originally born in an MIT lab where the founders developed the base technology for uniquely identifying objects using diamond dust. Since then, the startup has been working to create a commercial application for the advanced technology, and today it announced a $10 million Series A round led by Kleiner Perkins, which also led its $2.3 million seed round last year.

Airbus Ventures and Lockheed Martin Ventures, New Science Ventures, Angular Ventures and Castle Island Ventures also participated in the round. Today’s investment brings the total raised to $12.3 million.

The company has an unusual idea of applying a thin layer of diamond dust to an object with the goal of proving that that object has not been tampered with. While using diamond dust may sound expensive, the company told TechCrunch last year at the time of its seed round funding that it uses low-cost industrial diamond waste, rather than the expensive variety you find in jewelry stores.

As CEO and co-founder Ophir Gaathon told TechCrunch last year, “Once the diamonds fall on the surface of a polymer epoxy, and that polymer cures, the diamonds are fixed in their position, fixed in their orientation, and it’s actually the orientation of those diamonds that we developed a technology that allows us to read those angles very quickly.”

Ilya Fushman, who is leading the investment for Kleiner, says the company is offering a unique approach to identity and security for objects. “At a time when there is a growing trust gap between manufacturers and suppliers, Dust Identity’s diamond particle tag provides a better solution for product authentication and supply chain security than existing technologies,” he said in a statement.

The presence of strategic investors Airbus and Lockheed Martin shows that big industrial companies see a need for advanced technology like this in the supply chain. It’s worth noting that the company partnered with enterprise computing giant SAP last year to provide a blockchain interface for physical objects, where they store the Dust Identity identifier on the blockchain. Although the startup has a relationship with SAP, it remains blockchain agnostic, according to a company spokesperson.

While it’s still early days for the company, it has attracted attention from a broad range of investors and intends to use the funding to continue building and expanding the product in the coming year. To this point, it has implemented pilot programs and early deployments across a range of industries, including automotive, luxury goods, cosmetics and oil, gas and utilities.

Powered by WPeMatico

Google and its flagship search portal opened the door to the possibilities of how to build a business empire on the back of organising and navigating the world’s information, as found on the internet. Now, a startup that’s built a search engine tailored to the needs of enterprises and their own quests for information has raised a round of funding to see if it can do the same for the B2B world.

AlphaSense, which provides a way for companies to quickly amass market intelligence around specific trends, industries and more to help them make business decisions, has closed a $50 million round of funding, a Series B that it’s planning to use to continue enhancing its product and expanding to more verticals.

The company counts some 1,000 clients on its books, with a heavy emphasis on investment banks and related financial services companies. That’s in part because of how the company got its start: Finnish co-founder and CEO Jaakko (Jack) Kokko had been an analyst at Morgan Stanley in a past life and understood the labor and time pain points of doing market research, and decided to build a platform to help shorten a good part of the information-gathering process.

“My experience as an analyst on Wall Street showed me just how fragmented information really was,” he said in an interview, citing as one example how complex sites like those of the FDA are not easy to navigate to look for new information and updates — the kind of thing that a computer would be much more adept at monitoring and flagging. “Even with the best tools and services, it still was really hard to manually get the work done, in part because of market volatility and the many factors that cause it. We can now do that with orders of magnitude more efficiency. Firms can now gather information in minutes that would have taken an hour. AlphaSense does the work of the best single analyst, or even a team of them.”

(Indeed, the “alpha” of AlphaSense appears to be a reference to finance: it’s a term that refers to the ability of a trader or portfolio manager to beat the typical market return.)

The lead investor in this round is very notable and says something about the company’s ambitions. It’s Innovation Endeavors, the VC firm backed by Eric Schmidt, who had been the CEO of none other than Google (the pace-setter and pioneer of the search-as-business model) for a decade, and then stayed on as chairman and ultimately board member of Google and then Alphabet (its later holding company) until just last June.

Schmidt presided over Google at what you could argue was its most important time, gaining speed and scale and transitioning from an academic idea into a full-fledged, huge public business whose flagship product has now entered the lexicon as a verb and (through search and other services like Android and YouTube) is a mainstay of how the vast majority of the world uses the web today. As such, he is good at spotting opportunities and gaps in the market, and while enterprise-based needs will never be as prominent as those of mass-market consumers, they can be just as lucrative.

“Information is the currency of business today, but data is overwhelming and fragmented, making it difficult for business professionals to find the right insights to drive key business decisions,” he said in a statement. “We were impressed by the way AlphaSense solves this with its AI and search technology, allowing businesses to proceed with the confidence that they have the right information driving their strategy.”

This brings the total raised by AlphaSense to $90 million, with other investors in this round including Soros Fund Management LLC and other unnamed existing investors. Previous backers had included Tom Glocer (the former Reuters CEO who himself is working on his own fintech startup, a security firm called BlueVoyant), the MassChallenge incubator, Tribeca Venture Partners and others. Kokko said AlphaSense is not disclosing its valuation at this point. (I’m guessing though that it’s definitely on the up.)

There have been others that have worked to try to tackle the idea of providing more targeted, and business-focused, search portals, from the likes of Wolfram Alpha (another alpha!) through to Lexis Nexis and others like Bloomberg’s terminals, FactSet, Business Quant and many more.

One interesting aspect of AlphaSense is how it’s both focused on pulling in requests as well as set up to push information to its users based on previous search parameters. Currently these are set up to only provide information, but over time, there is a clear opportunity to build services to let the engines take on some of the actions based on that information, such as adjusting asking prices for sales and other transactions.

“There are all kinds of things we could do,” said Kokko. “This is a massive untapped opportunity. But we’re not taking the human out of the loop, ever. Humans are the right ones to be making final decisions, and we’re just about helping them make those faster.”

Powered by WPeMatico