Recent Funding

Auto Added by WPeMatico

Auto Added by WPeMatico

ContractPodAi, a London-based startup that has developed what it describes as AI-powered contract lifecycle management software, is disclosing $55 million in Series B funding. The round is led by U.S.-based Insight Partners, with participation from earlier backer Eagle Investment.

Founded in 2012, ContractPodAi offers an “end-to-end” solution spanning the three main aspects of contract management: contract generation, contract repository and third-party review. Its AI offering, which uses IBM’s Watson, claims to streamline the contract management process and reduce the burden on corporate in-house legal teams.

“The legal profession has been historically behind the curve in technology adoption and our objective here is to support to digital transformation of legal departments via our contract management platform,” ContractPodAi co-founder and CEO Sarvarth Misra tells TechCrunch.

“Our business focuses on providing in-house counsel of corporations across the world with an easy to use, out of the box and scalable end to end contract management platform at a fixed fee SaaS licence model.”

With regards to ContractPodAi’s target customer, Misra says its solution is industry agnostic but is typically sold to large international businesses, including FTSE 500 and Fortune 2000 corporations. Customers include Bosch Siemens, Braskem, EDF Energy, Total Petroleum, Benjamin Moore and Freeview.

Armed with new capital, ContractPodAi says it plans to “significantly” scale up its product development, sales and customer success teams globally. The company already has offices in San Francisco, New York, Glasgow and Mumbai, in addition to its London HQ.

Adds Misra: “We believe the market for contract management solutions is fragmented with providers focusing one or two aspects of contract management functionality. ContractPodAi’s objective has been to provide one contract management ecosystem which covers all aspects of contract management functionality… This, along with our fixed, transparent pricing and ability to provide full implementation as part of the annual SaaS, differentiates us the from the rest of the providers.”

Powered by WPeMatico

Uber Air, the transportation company’s upcoming flying taxi service, needs vehicle partners in order to make it a reality. Karem Aircraft, which Uber partnered with last year, has just raised a $25 million Series A round for its new air taxi spin-off. The round was led by Korean industrial conglomerate Hanwha Systems.

“Karem’s technology for making safe, quiet, and efficient air taxi vehicles excites all of us,” Uber Elevate head Eric Allison said in a statement. “Hanwha’s Series A investment in Karem’s new air taxi entity accelerates efforts to bring the Butterfly to market, and we look forward to flying riders in places like Dallas, Los Angeles, and Melbourne in the near future.”

Uber is aiming to start testing these aircraft next year, and wants to commercially deploy Uber Air in Los Angeles, Calif., Dallas-Fort Worth/Frisco, Texas and Melbourne, Australia in 2023.

Karem’s new venture is designed to focus solely on electric vertical take-off and landing vehicles, specifically its Butterfly air taxi vehicle.

The Butterfly (rendered above) is a quad tiltrotor with four large rotors mounted on the wings and tail. The idea is to combine the vertical lift capability of a helicopter with the speed and range of a fixed-wing aircraft. The Butterfly is also designed to be more efficient as a result of its rotors with variable RPM.

“The new company will be able to focus exclusively on bringing Butterfly to market, leveraging Karem’s optimum speed rotor technology, Hanwha’s industrial scale, and Uber’s ridesharing network,” Ben Tigner, CEO of the new venture, said in a statement. “We look forward to the day when riders will be able to commute to work by flying above the traffic in one of our vehicles. Karem Aircraft will continue to serve the needs of its military customers; we are confident that each company is on a path for long-term success so that our technology can be applied in two distinct but important use cases.”

Powered by WPeMatico

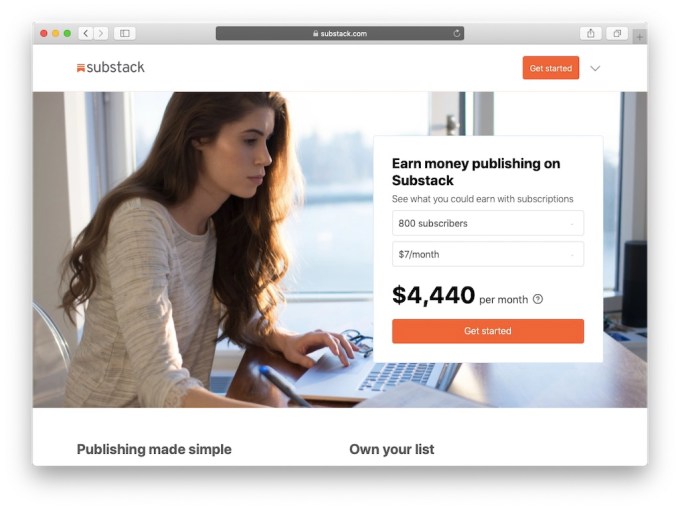

Andreessen Horowitz is betting that there’s still a big opportunity in newsletters — the venture capital firm is leading a $15.3 million Series A in Substack.

To be clear, although Substack started two years ago as a way turn newsletters into a paid subscription business, it’s since added support for podcasts and discussion threads. As CEO Chris Best put it, the goal is to allow writers and creators to run their own “personal media empire.”

Writers using Substack include Nicole Cliffe, Daniel Ortberg, Judd Legum, Heather Havrilesky and Matt Taibbi. The startup says that newsletters on the platform have now amassed a total of 50,000 paying subscribers (up from 25,000 in October), and that the most popular Substack authors are already making hundreds of thousands of dollars a year.

Also, a16z’s Andrew Chen — a blogger and newsletter writer himself — is joining the Substack board of directors. In Chen’s view, the startup represents the combination of the old and the new, allowing writers to reach longstanding “passionate online communities” while also pursuing “a new way of doing micro-entrepreneurship,” where they make money directly from their audience.

“When you combine the two — wow, this is something special,” Chen said.

Y Combinator, where Substack was incubated, is also participating in the funding.

Best told me the team consists entirely of the three co-founders — CTO Jairaj Sethi, COO Hamish McKenzie and Best himself — “working out of my living room.” (The three of them are pictured above.) Even with the new funding, Best and McKenzie said they want to grow cautiously.

“We’re conscious of the writers depending on a reliable and stable Substack for their income,” McKenzie said. “We don’t want to go out there and do a bunch of crazy startup stuff.”

Still, they will be moving out of that living room and hiring a bigger team. Best also said they have plans to build more “writer success” tools that help creators get the most out of the platform, and to expand into other formats, like video.

Even as Substack grows, McKenzie said it will maintain a focus on subscription products for “people who are attracted to the idea of owning their relationship with their audience.” Best argued that this approach avoids the incentives that have pushed online news in the direction of “cheap outrage, attention and addiction.”

He added, “It’s just a better model for creating culture.”

As for whether the newsletter boom might eventually reach a saturation point, making it harder for new titles to find an audience, Best acknowledged that there’s probably “some finite limit” to the number of newsletters that most readers will subscribe to, but he said, “Even if that’s the case, it can still be a very successful model. The magical thing about paid subscriptions is that you don’t need to have millions of people in your audience.”

Powered by WPeMatico

100 Thieves has today announced the close of a $35 million Series B funding round. Artist Capital Management led the round, with ACM’s Chief Investment Officer Josh Dienstag joining Mike Sepso, MLG co-founder, on the board of directors. Aglaé Ventures, which is the technology investment firm of Groupe Arnault, controlling shareholder of Louis Vuitton Moet Hennessy (LVMH), also participated in the round.

CEO and founder Matthew “Nadeshot” Haag confirmed to TechCrunch that this latest round brings 100 Thieves’ post-funding valuation to $160 million, which is up from the $90 million valuation it had in October 2018.

100 Thieves was founded in 2017. Haag is a former pro gamer and content creator with one of the biggest followings in esports.

“The most important lesson I’ve learned going from gaming to leadership is ‘over-communicate, over-communicate, over-communicate,’ ” said Haag, explaining that he went from working by himself creating content to working with many people each day. “Making sure we’re all aligned on our goals for each day and each week and each month, to have an open and transparent environment, really builds a culture where everybody enjoys working with one another. Over-communication helps drive success.”

The org is co-owned by Drake, Dan Gilbert and Scooter Braun, alongside Haag. 100 Thieves has three revenue channels.

The first is esports. Right now, the organization competes in Call of Duty (where its team has won the last two tournaments), League of Legends and Fortnite (100 Thieves is sending six of its players to the Fortnite World Cup).

The second channel is content creation. 100 Thieves includes big-name streamers such as Jack “Courage” Dunlop, who has nearly 1.9 million Twitch followers, and Rachell “Valkyrae” Hofstetter, who has more than 800,000 Twitch followers.

Finally, 100 Thieves has gotten into apparel, with limited-edition hats, sweaters, jackets and t-shirts. As of right now, everything in the 100 Thieves Shop is sold out.

“What’s hurt me the most is having so many community members not be able to purchase this apparel for themselves,” said Haag. “We want 100 Thieves to be all inclusive. If you want to support us, you should be able to.”

According to Haag, one goal is to expand into new esports titles — a few titles in consideration include “Counter-Strike: Global Offensive,” “Rainbow 6 Siege” and “Rocket League.”

Another top-of-mind goal is building out a new HQ facility in Los Angeles that will house the esports, content creation and apparel divisions all under one roof. The 15,000-square-foot facility will include streaming stations, a content production sound stage for 100 Thieves’ two podcasts and will serve as the storefront for 100 Thieves apparel lines.

Powered by WPeMatico

Financial service companies like banks have seen some of their business cannibalised over the years with the rise of digital-based alternatives — often in the form of apps — that provide lower fees, faster responsiveness and more flexibility to consumers. Today, Toronto-based startup Flybits is announcing $35 million in funding for a platform that it believes can offer these banks a way of continuing to capture their users’ attention and help them pivot into the next generation of services, financial or otherwise.

Today, a typical end product for a customer of Flybits’ services will use insights to upsell a customer by offering financial services; for example, a bank providing an offer of a specific kind of loan or credit card that you are more likely to take; or to offer a loyalty program or rewards for usage. But the longer-term goal, said CEO and co-founder Hossein Rahnama, is to help its customers take on a bigger role as repositories that can be used for more than just money, and used beyond the walls of the bank.

“We don’t think banks will go away, as some do, but we think that they could have a role not just as money vaults, but as data vaults: a place where you can deposit data, which you trust,” he said in an interview. Indeed, some of the funding will be used to put into action some of the AI and machine learning patents the startup has amassed, with the building of a “data” marketplace for banks, fintechs and other data providers to partner and build more services together.

The Series C comes from an interesting group of investors that includes both strategic backers using Flybits’ services, as well as backers of the more non-strategic, financial kind. Led by Point72 Ventures (hedge fund supremo Steve Cohen’s VC fund), the list also includes Mastercard, Citi Ventures and Reinventure (the fund backed by Australia’s Westpac Banking Corporation), Portag3 Ventures, TD Bank and Information Venture Partners. Valuation is not being disclosed, and prior to this the company had raised around $15 million.

Much like another marketing tech company, Near — which today announced $100 million in funding — the premise that underpins Flybits’ technology is that there is a lot of disparate data out there that, if it’s treated correctly, can uncover a lot more insights about consumer behavior, and that by and large many companies are missing this opportunity because they haven’t found the right way of merging the data to unlock insights.

While Near is applying this to location-based data and a range of different verticals, Flybits’ primary target has been banks and the data that they and other financial services providers already possess.

Many smaller startups in the world of financial services have stolen a march on bigger incumbents by building personalization into their products from the ground up. (Indeed, some like Step, aimed at teens, are so personalised that they will actually change their service mix as their customer base grows up and needs new products.) This is something that incumbents might have been more readily able to do in the old days, when people knew their bank managers and tellers and made daily trips into branches to transact. In the digital age they have fallen behind and are now catching up.

Flybits’ investors have spotted that and this in part is why they are banking on technologies like this to help bigger companies catch up, not just in financial services (although with banking alone estimated to be a €6.9 trillion industry, this is clearly a good start).

“Personalization is mission-critical for all D2C businesses in the digital age. Flybits’ integrated platform allows financial services firms to offer contextualized experiences, driving product awareness and adding significant value to the lives of their customers,” said Ramneek Gupta, managing director and co-head of Venture Investing at Citi Ventures, in a statement. “We look forward to partnering with Flybits in its next phase of growth as it continues to set the bar for hyper-personalized customer experiences.”

Indeed, it’s not just banks that are working on upselling, or that have large repositories of data that are not used as well as they could be.

“Mastercard and Flybits share a vision on using data driven insights to enrich consumers’ experiences,” said Francis Hondal, president, Loyalty & Engagement at Mastercard, in a statement. “Our ultimate goal is to develop products and services that engage consumers in a highly contextual manner. Through this collaboration with Flybits, we’ll be able to offer rich, personalized experiences for them throughout their journeys.”

Powered by WPeMatico

One of the Holy Grails in the world of advertising and marketing has been finding a way to accurately capture and understand what consumers are doing throughout the day, regardless of whether it’s a digital or offline activity. That goal has become even more elusive in recent years, with the surge of regulations around privacy and data protection that limit what kind of information can be collected and used. Now, a startup believes it has cracked the code, and has raised a large round of funding that underscores its success so far and what it believes is untapped future demand.

Near — which has built an interactive, cloud-based AI platform called Allspark that works across 44 countries to create anonymised, location-based profiles of users (1.6 billion each month at present) based on a trove of information that it sources and then merges from phones, data partners, carriers and its customers, but which it claims was built “with privacy by design” — has raised $100 million.

The company believes that this Series D — from a single backer, Greater Pacific Capital (GPC) out of London — is one of the biggest rounds ever to be raised in this particular area of marketing technology. That’s not to say that others haven’t also been attracting investor attention (as one example, a direct competitor, Factual, raised $42 million last September).

Near is not disclosing its valuation, but founder and CEO Anil Mathews said in an interview that the company has been growing at a rate of 100% year-on-year and described it as “healthy,” with its customer list including News Corp, MetLife, Mastercard and WeWork.

Near (not to be confused with the blockchain startup that raised $12 million last week; yes sometimes startups have the same name…) has to date raised $134 million, with other backers including Sequoia, JP Morgan, Cisco and Telstra (Canaan Partners had been an investor too but sold its stake in a secondary deal).

The problem that Near is tackling is not a new one. The wider swing to digital platforms and using connected devices that we’ve seen in consumer behavior has created an opportunity for (and demand from) companies to better track who is using their products and services, and also to proactively figure out who would be the best audiences to target for future business.

But there have been two catches to that pull: how best to capture activity when it’s not specifically digital (for example, going into a physical store), and how best to capture activity in a way that doesn’t encroach on customers’ privacy and right to be anonymous if they so choose — with the latter becoming more than just a principle in many jurisdictions, but fully fledged rule of law.

Near’s approach is not entirely novel. Like many others that currently exist or preceded Near, the startup uses a collection of data points sourced from a variety of providers — in Near’s case, the list can include your mobile carrier, data providers that work with dozens or hundreds of apps to source activity, app providers directly, retailers and Wi-Fi operators.

The similarities end there, however, said Mathews. He says Near has a (patented) technique based on machine learning algorithms and other inferential AI technology, which it uses to accurately merge all of these details together to create individual profiles, all without ever attaching a name or real identifiers of any kind to that profile.

“If you ask me, that’s actually the hardest problem we’ve solved,” he said. “There is no other company out there that works with all this data to unify it into individual identities.”

Using mobile device IDs, he said Near can “with a high degree of confidence” connect specific profiles with transactions. “But it’s the fact that we can perform the data fusion in a compliant way, marrying that data in a world where privacy and data safety matter,” that makes the company unique, Mathews added.

PlaceIQ, Factual and Lifesight are other providers that are building similar technology, he noted, but Near is the first to extend the offering far (so to speak): none others have the same global reach, making it a popular partner for multinationals researching for campaigns and product development.

Marketing research is one of the main features of Allspark, the company’s flagship platform, where non-technical people can ask questions in natural language — example, show me how many women shop at Whole Foods in San Francisco — and you can get a data-based response, which you can then tweak with more tailored questions about the profile of a user, or use a dragging graphic tool on an interactive map to modify the geography, and so on.

Mathews notes that the “real” numbers that come up from such questions — in the case of the above query, it’s 71,904 women, by the way — are based on the figures of who is actually connected to the Near network. The ratios vary by city and country, but typically, he said that in the Bay Area, it’s capturing around 45% of any live audience (meaning, the actual number of female visitors is probably more like 150,000).

From there, you can save a query to return to it, or even use the Near platform to connect through to other services to craft and launch marketing campaigns. Notably, some features — such as the ability for a client to upload or use cookie data into the platform to use it to build profiles — are not available in all markets, part of how Near keeps itself on the right side of company’s own data compliance policies as well as data protection rules in different markets.

Those kinds of integrations is likely one area that will start to get developed even more with this round of funding, to keep Near’s technology from being too siloed and removed from how marketers and researchers typically work.

Companies like Facebook, Google and Amazon have made a huge business out of figuring out how to identify and target audiences and specific users with products and services by way of advertising and more. I asked, and Mathews said, that he doesn’t see them as threats in this area, simply because it would open a can of worms for them.

“They would get into a big privacy issue if they tried,” he said. “Companies like Google and Facebook have done [frankly] an amazing job at identifying audiences, but they are not designed for privacy. We started with privacy by design.”

Indeed, it was Near’s position as one of the “outliers” by emphasizing data protection and anonymity that Mathews said helped it get over the line with investors. “It’s a very tough funding environment for the industry we’re in, but we found interest because of our approach to privacy. That really helped us.”

Ketan Patel, CEO, GPC, echoed that sentiment. “Near provides insights into human behavior by analyzing where people are, and combining that with a multitude of data points to predict and influence behaviour,” he said in a statement. “Given it does this across the globe in a privacy protected manner, it is well-positioned to create an exciting new space that delivers value to both people, and those that wish to build relationships with them.”

Powered by WPeMatico

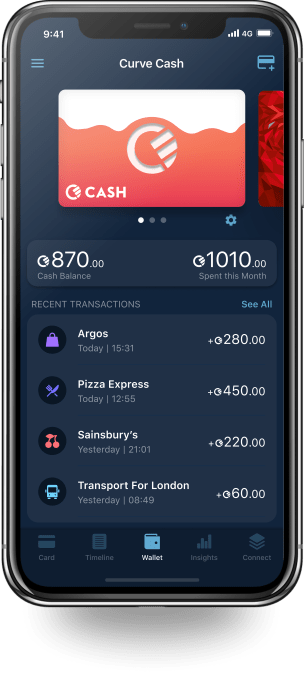

Curve, the London-based “over-the-top banking platform,” has raised $55 million in new funding. The startup lets you consolidate all of your bank cards into a single Curve card and app to make it easier to manage your spending and access other benefits.

Curve’s Series B round is led by Gauss Ventures, the U.S.-based fintech investor, alongside Creditease, IDC Ventures and previous backer Outward VC (formerly Investec’s INVC fund). A number of other early investors, including Santander InnoVentures, Breega, Seedcamp and Speedinvest also followed on.

The new round of funding values Curve at $250 million (or one-quarter unicorn, so to speak), and will be used by the company to continue adding more features to its platform and for further European expansion. The company claims 500,000 users and says it is on track to reach 1 million by the end of the year.

Curve is currently available in 31 countries across Europe, with around 30% of its customer base coming from outside the U.K. “We [have] identified a few countries where the organic pull is fantastic, and we are about to double down on them,” Curve founder and CEO Shachar Bialick tells me.

Like a plethora of fintech startups, Curve is building a platform that essentially turns your mobile phone into a financial control centre that re-bundles disparate financial products or functionality to offer a single app to help you manage “all things money.”

However, rather than building a new current account — as is the case with the challenger banks such as Monzo, Starling and Revolut — Curve’s “attack vector” is a card and app that lets you connect all of your other debit and credit cards (sans Amex) so you only ever have to carry a single card.

Once you’ve added your cards to Curve, you use the app to switch from which underlying debit or credit cards you wish the Curve Mastercard to spend, and can track and see a single and consolidated view of your spending regardless of which card was charged (and therefore which of your bank accounts the money was pulled from).

In other words, Curve isn’t asking to replace your existing bank accounts but is pitched as a cloud-based platform that runs “over-the-top” of existing banking and payments infrastructure. Historically, the over-the-top terminology has been used to describe the way video streaming services such as Netflix run “over-the-top” of existing broadband infrastructure.

“For Curve to succeed in its mission of bringing banking to the cloud, we need [to continue] to build the product; tiny experiences that together create a whole new offering,” Bialick continues. “Our money is everywhere and the job of connecting it all together to one seamless experience requires many resources, and especially many talented people. The latest Series B will enable Curve to re-bundle more of your money: experiences such as Curve Send (peer-to-peer payments), and Curve Credit (post transaction installments for any payment, anywhere).”

Alongside Curve’s all-your-cards-in-one functionality, the Curve app lets you lock your Curve card at a touch of a button, provides instant spend notifications, “zero FX fees” when spending abroad or in a foreign currency and the ability to switch payment sources retroactively. The latter is dubbed “Go Back in Time” and means if you make a purchase via Curve that gets charged to a card other than the one you intended, you have two weeks to change your mind.

Alongside Curve’s all-your-cards-in-one functionality, the Curve app lets you lock your Curve card at a touch of a button, provides instant spend notifications, “zero FX fees” when spending abroad or in a foreign currency and the ability to switch payment sources retroactively. The latter is dubbed “Go Back in Time” and means if you make a purchase via Curve that gets charged to a card other than the one you intended, you have two weeks to change your mind.

More recently, Curve has re-vamped its cashback feature in a bid to draw in more customers for the premium versions of the Curve card. With the new Curve Cash programme, customers get 1% instant cash back on top of any existing rewards cards that they have plugged into the app, potentially earning customers double rewards on purchases. You simply pick from the list of retailers supported for cashback — you are allowed to choose between three and six retailers, depending on which Curve plan you are on — and then get 1% cashback for any purchases made at those stores.

Bialick claims that Curve’s over-the-top model is also producing higher engagement than many challenger banks, with customers spending on average £1,500 per month through the Curve platform. (As an imperfect reference point, challenger bank Monzo says that around 30% of its users top up their account by £1,000 or more per month). I’m also told that 15% of Curve’s users have added a challenger bank card to their Curve account, which also makes for an intriguing and even more nuanced comparison.

And whilst Curve is arguably trying to define a new market category — at least here in the West — and therefore isn’t the easiest of products to explain, Bialick says that existing Curve customers are the startup’s biggest advocates.

“There isn’t just one thing that pulls customers to Curve, there are as many pulls as [there are] the number of ‘money jobs’ one has. All your cards in one, fee-free spending abroad, ‘Go Back In Time,’ to name a few, all attract and retain our customer base. Indeed, awareness and brand building is key, especially amongst all the noise, but that’s where our customers are proving invaluable, telling their friends about Curve, which drives most of our adoption with 2,000 plus new accounts per day.”

To win in this new category of banking, Bialick says the company needs to steadfastly stick to its mission to reduce the number of steps it takes to carry out everyday money-related tasks. “The winners will be the companies… [that] create the most seamless experience, removing as much friction between the customer and their money.”

Powered by WPeMatico

AllBright, the London-based women’s membership club backed by private real estate investment firm Cain International, has raised $18.8 million to expand into the U.S.

The company’s new round was led by Cain International and was designed to take AllBright into three U.S. locations — Los Angeles, New York and Washington, DC.

The company said that the new facilities would be opening in the coming months.

Coupled with the launch of a new networking application called AllBright Connect and the company’s AllBright Magazine, the women’s networking organization is on a full-on media blitz.

Other investors in the round include Allan Leighton, who serves as the company’s non-executive chairman; Gail Mandel, who acquired Love Home Swap (a company founded by AllBright’s co-founder Debbie Wosskow); Stephanie Daily Smith, a former finance director to Hillary Clinton; and Darren Throop, the founder, president and chief executive of Entertainment One.

A spokesperson for the company said that the new financing would value the company at roughly $100 million.

The club’s current members include actors, members of the House of Lords and other fancy pants, high-falutin folks from the worlds of politics, business and entertainment.

The club’s first American location will be in West Hollywood, and is slated to open in September 2019. The largest club, in Mayfair, has five floors and boasts more than 12,000 square feet and features rooftop terraces, a dedicated space for coaching and mentoring, a small restaurant and a bar.

Powered by WPeMatico

Tennis superstar and mom to a 22-month-old, Serena Williams has joined Mark Cuban to invest $3 million seed funding in Mahmee, a startup working toward filling the critical care gap in postpartum care.

For those who’ve never given birth or who (count your blessings!) never had any mishaps in the hospital or afterwards, the weeks and months following childbirth can be extremely hard on the new mom, with estimates as high as one in five women suffering from postpartum depression or anxiety and about 9% of women experiencing post traumatic stress disorder (PTSD) following childbirth — and those are just the mood and mental health disorders.

Physical recovery, even for those with a healthy, run-of-the-mill birth, takes at least six weeks — eight weeks if you’ve had a C-section. And then there are all the medical complications. Williams, who has a history of blood clots, ended up basically shouting at the doctors to give her a CT scan that saved her life.

The real issue, at the heart of all this, according to Mahmee co-founder Melissa Hanna, is that “the data is fragmented.” She says this is why she built a network to get new moms the support they need — from their community, other moms and medical providers.

Mahmee provides not only online group discussions with other moms going through the same thing and at the same stage but also connection to your medical provider. On top of that, it adds support from a trained “maternity coach” who can flag if something is wrong.

One example Hanna used was a new mom who was exhibiting symptoms of septic shock. The co-founder says a coach was able to call this mom on the spot and get her to contact her OB-GYN right away.

There are other online services like Postpartum Support International (PSI) and the Bloom Foundation, which both provide a sort of digital network and resources for new moms, but Hanna believes it is that missing link to medical professionals after mom has gone home from the hospital that really makes a difference.

“We’re so focused on delivering a healthy baby that mom gets side-lined,” she told TechCrunch. Adding in a statement, “And this industry is lacking the IT infrastructure needed to connect these professionals from different organizations to each other, and to follow and monitor patients across practices and health systems. This missing element creates gaps in care. Mahmee is the glue that connects the care ecosystem and closes the gaps.”

While other sites mentioned above are free to use, Mahmee, which goes beyond social support to providing engagement and patient monitoring, makes money through group and individual video calls (the introductory session with a coach is free) and various support groups. There are also different payment tiers starting at $20 a month and up toward $200 per month where new parents can ask unlimited questions through a HIPAA-secure, online dashboard connecting them with their medical providers and Mahmee coaches.

Do new moms need to pay someone to help them out and monitor them medically after they get home from the hospital? Possibly. Some local hospitals and medical networks also provide various types of help — both through counseling and new parent support groups. But often it can take weeks to get a counseling session at a busy hospital and your OB may have too many patients to call and check up on you. Having this type of support could just save your life — and, if anything else, checking in with a group of moms going through the same thing could be the key to saving your sanity.

Hanna admits it’s early days for her startup, but tells TechCrunch there are more than 1,000 providers in the Mahmee network so far. She plans to use the $3 million to grow her team, including engineers, clinicians and sales staff, and hints she’s working on several partnerships within the healthcare industry right now.

Powered by WPeMatico

Amperity is announcing that it has raised $50 million in Series C funding.

The company offers what co-founder and CEO Kabir Shahani said is the ability to “ingest every piece of atomic-level data remotely related to a customer and assemble it into a customer 360.”

To illustrate how Amperity can help businesses use their customer data more intelligently, Shahani (pictured above with his co-founder and CTO Derek Slager) said a company with a branded credit card could start sending targeted offers based on customer activity, while a retailer could start sending promotions targeted at online-only customers to bring them into physical stores.

And just to be clear: This is only using first-party data collected by the brand itself, not third-party data purchased from other companies. In fact, when I brought this up, Shahani told me he has a “very strong and convicted belief in the sanctity of the relationship between the consumer and brands.”

Amperity says that in 2018, its annual recurring revenue grew 355% year-over-year. Although the startup only launched in 2016, it’s already signed up an impressive roster of customers, like Starbucks, Gap Inc., TGI Fridays and Planet Fitness.

Shahani said that when they sign up with Amperity, most of these businesses are already trying to use customer data to improve their messaging, but they aren’t able to do so in “a real-time, in-the-moment, frequent way,” and they aren’t effectively merging data from different channels into a single profile.

He also argued that while Salesforce and Adobe have announced plans to move into this market, it was “kind of an intention announcement” — “There aren’t any real customers behind it, there aren’t any real use cases deployed.”

As the large marketing clouds build up their offerings, Shahani suggested that Amperity will still have the advantage of a “network effect,” with businesses recommending the company’s platform to each other, and will also benefit from an interest in standalone, “best-in-class” products.

“The marketing cloud phenomenon of 10 years ago, 15 years ago has certainly burned a lot of companies,” Shahani said.

Amperity has now raised a total of $87 million. The new funding comes from Tiger Global Management, Goldman Sachs, Declaration Partners, Madera Technology Partners, Madrona Venture Group and investor Lee Fixel (who previously backed Amperity through his role at Tiger).

“It’s been exciting to watch this team execute against their vision and develop the deep technical capability required to become the clear category leader,” Fixel said in a statement.

Among other things, the money should help Amperity beef up its sales and marketing — Shahani said it didn’t start seriously hiring a sales team until a year ago, and it didn’t hire its first chief marketing officer until three months ago.

Powered by WPeMatico