Recent Funding

Auto Added by WPeMatico

Auto Added by WPeMatico

Hero Labs, a London-based startup that is developing “smart” technology to help prevent water leaks in U.K. properties, has raised £2.5 million in seed funding. The round is led by Earthworm Group, an environmental fund manager, with further support via a £300,000 EU innovation grant and a number of unnamed private investors.

The new capital will be used by Hero Labs to accelerate development of its first product: a smart device dubbed “Sonic” that uses ultrasonic technology to monitor water use within a property, including the early detection of water leaks.

Founded in 2018 by Krystian Zajac after he exited Neos, a smart home insurer that was acquired by Aviva, Hero Labs was born out of the realisation that a lot of smart home technology either wasn’t very smart or didn’t solve mass problems (Zajac had also previously run a smart home company focusing on ultra-high-net-worth individuals that delivered bespoke designs for things like motorised swimming pool floors or home cinemas doubling up as panic rooms).

Coupled with this, the Hero Labs founder learned that water wastage was a very costly problem, both financially and environmentally, with water leaks being the number one culprit for property damage in the U.K., ahead of fires, gas explosions or break-ins combined. This sees water leaks cost the U.K. insurance industry £1 billion per year, apparently.

“My vision for the company is to solve real-life problems with truly smart technology,” Zajac tells me. “From working at Neos and alongside some of the world’s largest home insurers I understood the problems that impacted ordinary homeowners and their families on a day-to-day basis. Perhaps most surprisingly, I learnt that water leaks are far and way the biggest cause of damage to homes… I also wanted to do more for the environment in my next venture after learning that water leaks waste 3 billion litres of water a day in the U.K. alone.”

To that end, the Sonic device and service is described as a smart leak defence system. Aimed at anyone who wants to prevent water leaks in their property — including homeowners, landlords, facilities management, property developers and businesses — the ultrasonic device typically attaches to the piping below your sink and “listens” to the vibrations coming off the interconnected pipes.

Sonic then monitors the water flow using machine learning and its algorithms to identify usage and detect anomalies. This requires the technology to understand the difference between appliances, running taps and even flushing toilets so that it can build up a picture of normal water usage in the home and in turn identify if that pattern is broken. Crucially, if needed, Sonic can automatically shut off the water supply to prevent a water leak from damaging the property or its possessions.

Will a full launch planned for later this year, Sonic is targeting consumers as well as small businesses initially. “We are [also] in discussions with insurers who might subsidise the product or give it away completely for free to certain more affluent customers to minimise the risk of water escape,” adds Zajac.

Powered by WPeMatico

A marketplace dominated by Slack and Microsoft Teams, along with a host of other smaller workplace communication apps, might seem to leave little room for a new entrant, but Swit wants to prove that wrong. The app combines messaging with a roster of productivity tools, like task management, calendars and Gantt charts, to give teams “freedom from integrations.” Originally founded in Seoul and now based in the San Francisco Bay Area, Swit announced today that it has raised a $6 million seed round led by Korea Investment Partners, with participation from Hyundai Venture Investment Corporation and Mirae Asset Venture Investment.

Along with an investment from Kakao Ventures last year, this brings Swit’s total seed funding to about $7 million. Swit’s desktop and mobile apps were released in March and since then more than 450 companies have adopted it, with 40,000 individual registered users. The startup was launched last year by CEO Josh Lee and Max Lim, who previously co-founded auction.co.kr, a Korean e-commerce site acquired by eBay in 2001.

While Slack, which recently went public, has become so synonymous with the space that “Slack me” is now part of workplace parlance at many companies, Lee says Swit isn’t playing catch-up. Instead, he believes Swit benefits from “last mover advantage,” solving the shortfalls of other workplace messaging, collaboration and productivity apps by integrating many of their functions into one hub.

“We know the market is heavily saturated with great unicorns, but many companies need multiple collaboration apps and there is nothing that seamlessly combines them, so users don’t have to go back and forth between two platforms,” Lee tells TechCrunch. Many employees rely on Slack or Microsoft Teams to chat with one another, on top of several project management apps, like Asana, Jira, Monday and Confluence, and email to communicate with people at other companies (Lee points to a M.io report that found most businesses use at least two messaging apps and four to seven collaboration tools).

Lee says he used Slack for more than five years and during that time, his teammates added integrations from Asana, Monday, GSuite and Office365, but were unsatisfied with how they worked.

“All we could do with the integrations was receive mostly text-based notifications and there were also too many overlapping features,” he says. “We realized that working with multiple environments reduced team productivity and increased communication overhead.” In very large organizations, teams or departments sometimes use different messaging and collaboration apps, creating yet more friction.

Swit’s goal is to cover all those needs in one app. It comes with integrated Kanban task management, calendars and Gantt charts, and at the end of this year about 20 to 30 bots and apps will be available in its marketplace. Swit’s pricing tier currently has free and standard tiers, with a premium tier for enterprise customers planned for fall. The premium version will have full integration with Office365 and GSuite, allowing users to drag-and-drop emails into panels or convert them into trackable tasks.

While being a late-mover gives Swit certain advantages, it also means it must convince users to switch from their current apps, which is always a challenge when it comes to attracting enterprise clients. But Lee is optimistic. After seeing a demo, he says 91% of potential users registered on Swit, with more than 75% continuing to use it every day. Many of them used Asana or Monday before, but switched to Swit because they wanted to more easily communicate with teammates while planning tasks. Some are also gradually transitioning over from Slack to Swit for all their messaging (Swit recently released a Slack migration tool that enables teams to move over channels, workspaces and attachments. Migration tools for Asana, Trello and Jira are also planned).

In addition to “freedom from integrations,” Lee says Swit’s competitive advantages include being developed from the start for small businesses as well as large enterprises that still frequently rely on email to communicate across different departments or locations. Another differentiator is that all of Swit’s functions work on both desktop and mobile, which not all integrations in other collaboration apps can.

“That means if people integrate multiple apps into a desktop app or web browser, they might not be able to use them on mobile. So if they are looking for data, they have to search app by app, channel by channel, product by product, so data and information is scattered everywhere, hair on fire,” Lee says. “We provide one centralized command center for team collaboration without losing context and that is one of our biggest sources of customer satisfaction.”

Powered by WPeMatico

GDPR, and the newer California Consumer Privacy Act, have given a legal bite to ongoing developments in online privacy and data protection: it’s always good practice for companies with an online presence to take measures to safeguard people’s data, but now failing to do so can land them in some serious hot water.

Now — to underscore the urgency and demand in the market — one of the bigger companies helping organizations navigate those rules is announcing a huge round of funding. OneTrust, which builds tools to help companies navigate data protection and privacy policies both internally and with its customers, has raised $200 million in a Series A led by Insight that values the company at $1.3 billion.

It’s an outsized round for a Series A, being made at an equally outsized valuation — especially considering that the company is only three years old — but that’s because of the wide-ranging nature of the issue, according to CEO Kabir Barday, and OneTrust’s early moves and subsequent pole position in tackling it.

“We’re talking about an operational overhaul in a company’s practices,” Barday said in an interview. “That requires the right technology and reach to be able to deliver that at a low cost.” Notably, he said that OneTrust wasn’t actually in search of funding — it’s already generating revenue and could have grown off its own balance sheet — although he noted that having the capitalization and backing sends a signal to the market and in particular to larger organizations of its stability and staying power.

Currently, OneTrust has around 3,000 customers across 100 countries (and 1,000 employees), and the plan will be to continue to expand its reach geographically and to more businesses. Funding will also go toward the company’s technology: it already has 50 patents filed and another 50 applications in progress, securing its own IP in the area of privacy protection.

OneTrust offers technology and services covering three different aspects of data protection and privacy management.

Its Privacy Management Software helps an organization manage how it collects data, and it generates compliance reports in line with how a site is working relative to different jurisdictions. Then there is the famous (or infamous) service that lets internet users set their preferences for how they want their data to be handled on different sites. The third is a larger database and risk management platform that assesses how various third-party services (for example advertising providers) work on a site and where they might pose data protection risks.

These are all provided either as a cloud-based software as a service, or an on-premises solution, depending on the customer in question.

The startup also has an interesting backstory that sheds some light on how it was founded and how it identified the gap in the market relatively early.

Alan Dabbiere, who is the co-chairman of OneTrust, had been the chairman of Airwatch — the mobile device management company acquired by VMware in 2014 (Airwatch’s CEO and founder, John Marshall, is OneTrust’s other co-chairman). In an interview, he told me that it was when they were at Airwatch — where Barday had worked across consulting, integration, engineering and product management — that they began to see just how a smartphone “could be a quagmire of privacy issues.”

“We could capture apps that an employee was using so that we could show them to IT to mitigate security risks,” he said, “but that actually presented a big privacy issue. If [the employee] has dyslexia [and uses a special app for it] or if the employee used a dating app, you’ve now shown things to IT that you shouldn’t have.”

He admitted that in the first version of the software, “we weren’t even thinking about whether that was inappropriate, but then we quickly realised that we needed to be thinking about privacy.”

Dabbiere said that it was Barday who first brought that sensibility to light, and “that is something that we have evolved from.” After that, and after the VMware sale, it seemed a no-brainer that he and Marshall would come on to help the new startup grow.

Airwatch made a relatively quick exit, I pointed out. His response: the plan is to stay the course at OneTrust, with a lot more room for expansion in this market. He describes the issues of data protection and privacy as “death by 1,000 cuts.” I guess when you think about it from an enterprising point of view, that essentially presents 1,000 business opportunities.

Indeed, there is obvious growth potential to expand not just its funnel of customers, but to add more services, such as proactive detection of malware that might leak customers’ data (which calls to mind the recently fined breach at British Airways), as well as tools to help stop that once identified.

While there are a million other companies also looking to fix those problems today, what’s interesting is the point from which OneTrust is starting: by providing tools to organizations simply to help them operate in the current regulatory climate as good citizens of the online world.

This is what caught Insight’s eye with this investment.

“OneTrust has truly established themselves as leaders in this space in a very short time frame, and are quickly becoming for privacy professionals what Salesforce became for salespeople,” said Richard Wells of Insight. “They offer such a vast range of modules and tools to help customers keep their businesses compliant with varying regulatory laws, and the tailwinds around GDPR and the upcoming CCPA make this an opportune time for growth. Their leadership team is unparalleled in their ambition and has proven their ability to convert those ambitions into reality.”

Wells added that while this is a big round for a Series A it’s because it is something of an outlier — not a mark of how Series A rounds will go soon.

“Investors will always be interested in and keen to partner with companies that are providing real solutions, are already established and are led by a strong group of entrepreneurs,” he said in an interview. “This is a company that has the expertise to help solve for what could be one of the greatest challenges of the next decade. That’s the company investors want to partner with and grow, regardless of fund timing.”

Powered by WPeMatico

Robotic Process Automation has been the name of the game in enterprise software lately — with organizations using advances in machine learning algorithms and other kinds of AI alongside big-data analytics to speed up everything from performing mundane tasks to more complex business decisions.

To underscore the opportunity and growth in the market, today a startup in the wider segment of process automation is announcing a significant fundraise. Signavio, a company founded out of Berlin that provides tools for business process management — “providing the ‘P’ in RPA,” as the company describes it — has picked up an investment of $177 million at what we understand is a valuation of $400 million.

This round is large on its own, but even more so considering that before this the company — founded in 2009 — had only raised around $50 million, according to data from PitchBook. This latest capital injection is being led by Apax Digital (the growth equity team of Apax Partners), with DTCP. It notes that existing investor Summit Partners is also keeping a stake in the business with this deal.

The company was founded by a team of alums from the Hasso Plattner Institute in Potsdam, Germany, who used research they did there for creating the world’s first web modeler for business process management and analytics as the template for Signavio’s own Process Manager. (The name “Signavio” seems to be a portmanteau of “navigating through signals,” which essentially explains the basics of what BPM aims to do to help a business with its decision making.)

Partly because it’s raised so little money, Signavio has been somewhat under the radar, but it has seen a huge amount of growth. It says that revenues in the last 12 months have grown by more than 70%, and its software is used by more than one million users across 1,300 customers — with clients including SAP, DHL, Liberty Mutual, Deloitte, Comcast and Puma. It counts Silicon Valley as its second HQ these days; that trajectory will be followed further with this latest funding: Signavio says the funding in part will be going to international expansion of the business.

“10 years ago, we set out on a journey to tackle the time-consuming practices that limit business productivity,” said Dr. Gero Decker, CEO and co-founder of Signavio, in a statement. “This significant new investment further validates our approach to solve business problems faster and more efficiently, unleashing the power of process through our unique Business Transformation Suite. We are thrilled to welcome Apax Digital as our new lead partner, and look forward to building upon our success to date by leveraging our partners’ operating capabilities and global platforms for our international expansion.”

The other area of investment will be the company’s technology suite. While BPM has been around for years as a concept — and indeed there are a number of other companies that provide tools that are compared sometimes to Signavio’s, such as from biggies like IBM and Microsoft through to Kissflow and others — what’s interesting is how it’s had a surge of interest more recently as organizations increasingly start to add more automation into their IT infrastructure, in part to reduce the human labor needed for more mundane back-office tasks, and in part to reduce costs and speed up processes.

Robotic process automation companies like UiPath and Blue Prism bring some of the same processing tools to the table as Signavio, although the argument is that the latter — which says it helps to “mine, model, monitor, manage and maintain” customers’ data — provides a more sophisticated level of data crunching that can be used for RPA, or for other ends. (It also works with several of the big RPA players, mainly Blue Prism but also UiPath and Automation Anywhere.)

“As businesses have become more global, and workforces more distributed, business processes have proliferated, and become more complex,” noted Daniel O’Keefe, managing partner, and Mark Beith, managing director, of Apax Digital, in a joint statement. “Signavio’s cloud-native suite allows employees across an enterprise to collaborate and transform their businesses by digitizing, optimizing and ultimately automating their processes. We are tremendously excited to partner with the Signavio team and to support their vision.” The two will also be joining Signavio’s board with this round.

Powered by WPeMatico

Maker Faire and Maker Media are getting a second chance after suddenly going bankrupt, but they’ll return in a weakened capacity. Sadly, their flagship crafting festivals remain in jeopardy, and it’s unclear how long the reformed company can survive.

Maker Media suddenly laid off all 22 employees and shut down last month, as first reported by TechCrunch. Now its founder and CEO Dale Dougherty tells me he’s bought back the brands, domains, and content from creditors and rehired 15 of 22 laid off staffers with his own money. Next week, he’ll announce the relaunch of the company with the new name “Make Community“.

Read our story about how Maker Faire fell apart

The company is already working on a new issue of Make Magazine and the online archives of its do-it-yourself project guides will remain available. I hopes to keep publishing books. And it will continue to license the Maker Faire name to event organizers who’ve thrown over 200 of the festivals full of science-art and workshops in 40 countries. But Dougherty doesn’t have the funding to commit to producing the company-owned flagship Bay Area and New York Maker Faires any more.

“We’ve succeeded in just getting the transition to happen and getting Community set up” Dougherty tells me. But sounding shaky, he asks “Can I devise a better model to do what we’ve been doing the past 15 years? I don’t know if I have the answer yet.” Print publishing proved tougher and tougher recently. Combined with declining corporate sponsorships of the main events, Maker Media was losing too much money to stay afloat last time.

“On June 3rd, we basically stopped doing business. And, you know, the bank froze our accounts” Dougherty said at a meetup he held in Oakland to take feedback on his plan, according a recording made by attendee Brian Benchoff. Grasping for a way to make the numbers work, he told the small crowd gathered “I’d be happy if someone wanted to take this off my hands.”

Maker Faire [Image via Maker Faire Instagram]

For now, Dougherty is financing the revival himself “with the goal that we can get back up to speed as a business, and start generating revenue and a magazine again. This is where the community support needs to come in because I can’t fund it for very long.”

Maker Faire founder and Make Community CEO Dale Dougherty

The immediate plan is to announce a new membership model next week at Make.co where hobbyists and craft-lovers can pay a monthly or annual fee to become patrons of Make Community. Dougherty was cagey about what they’ll get in return beyond a sense of keeping alive the organization that’s held the maker community together since 2005. He does hope to get the next Make Magazine issue out by the end of summer or early fall, and existing subscribers should get it in the mail.

The company is still determining whether to move forward as a non-profit or co-op instead of as a venture-backed for-profit as before. “The one thing i don’t like about non-profit is that you end up working for the source you got the money from. You dance to their tune to get their funding” he told the meetup.

Last time, he burned through $10 million in venture funding from Obvious Ventures, Raine Ventures, and Floodgate. That could make VCs weary of putting more cash into a questionable business model. But if enough of the 80,000 remaining Make Magazine subscribers, 1 million YouTube followers, and millions who’ve attended Maker Faire events step up, pehaps the company can find surer footing.

“I hope this is actually an opportunity not just to revive what we do but maybe take it to a new level” Dougherty tells me. After all, plenty of today’s budding inventors and engineers grew up reading Make Magazine and being awestruck by the massive animatronic creations featured at its festivals.

Audibly peturbed, the founder exclaimed at his community meetup “It frustrates the heck out of me thinking that I’m the one backing up Maker Faire when there’s all these billionaires in the valley.”

Powered by WPeMatico

Growing D2C brands face an interesting challenge. While they’ve eliminated much of the hassle of a physical storefront, they must still deal with all the complications involved in managing inventory and manufacturing and shipping a physical product to suppliers.

Anvyl, with a fresh $9.3 million in Series A funding, is looking to jump in and make a difference for those brands. The company, co-founded by chief executive Rodney Manzo, is today announcing the raise, led by Redpoint Ventures, with participation from existing investors First Round Capital and Company Ventures. Angel investors Kevin Ryan (MongoDB and DoubleClick), Ben Kaufman (Quirky and Camp) and Dan Rose (Facebook) also participated in the round.

Manzo hails from Apple, where with $300 million in spend to manage logistics and supply chain he was still operating in an Excel spreadsheet. He then went to Harry’s, where he shaved $10 million in cash burn in his first month. He says himself that sourcing, procurement and logistics are in his DNA.

Which brings us to Anvyl. Anvyl looks at every step in the logistics process, from manufacture to arrival at the supplier, and visualizes that migration in an easy-to-understand UI.

The difference between Anvyl and other supply chain logistics companies, such as Flexport, is that Anvyl goes all the way to the very beginning of the supply chain: the factories. The company partners with factories to set up cameras and sensors that let brands see their product actually being built.

“When I was at Apple, I traveled for two years at least once a month to China and Japan just to oversee production,” said Manzo. “To oversee production, you essentially have to be boots on the ground and eyes in the factory. None of our brands have traveled to a factory.”

On the other end of the supply chain, Anvyl lets brands manage suppliers, find new suppliers, submit RFQs, see cost breakdowns and accept quotes.

The company also looks at each step in between, including trucks, trains, boats and planes so that brands can see, in real time, their products go from being manufactured to delivery.

Anvyl charges brands a monthly fee using a typical SaaS model. On the other end, Anvyl takes a “tiny percentage” of goods being produced within the Anvyl marketplace. The company declined to share actual numbers around pricing.

This latest round brings Anvyl’s total funding to $11.8 million. The company plans to use the funding toward hiring in engineering and marketing, and grow its consumer goods customer base.

Powered by WPeMatico

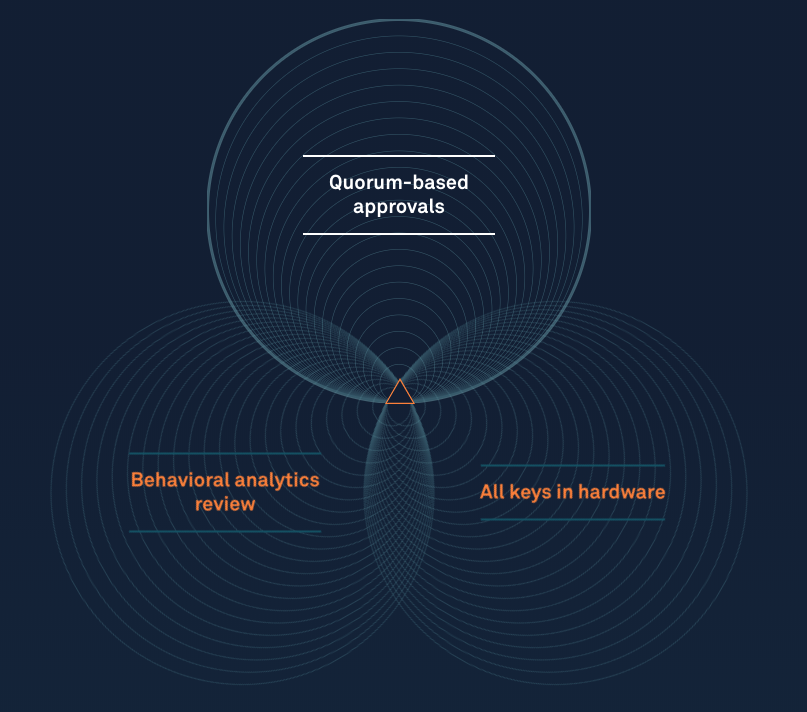

Visa and Andreessen Horowitz are betting even bigger on cryptocurrency, funding a big round for fellow Facebook Libra Association member Anchorage’s omnimetric blockchain security system. Instead of using passwords that can be stolen, Anchorage requires cryptocurrency withdrawals to be approved by a client’s other employees. Then the company uses both human and AI review of biometrics and more to validate transactions before they’re executed, while offering end-to-end insurance coverage.

This new-age approach to cryptocurrency protection has attracted a $40 million Series B for Anchorage, led by Blockchain Capital and joined by Visa and Andreessen Horowitz. The round adds to Anchorage’s $17 million Series A that Andreessen led just six months ago, demonstrating extraordinary momentum for the security startup.

“As a custodian, our work is focused on building financial plumbing that other companies depend on for their operations to run smoothly. In this regard we have always looked at Visa as a model,” Anchorage co-founder and president Diogo Mónica tells me.

“Visa was ‘fintech’ before the term existed, and has always been on the vanguard of financial infrastructure. Visa’s investment in Anchorage is helpful not only to our company but to our industry, as a validation of the entire ecosystem and a recognition that crypto will play a key role in the future of global finance.”

Cold-storage, where assets are held in computers not connected to the internet, has become a popular method of securing Bitcoin, Ether and other tokens. But the problem is that this can prevent owners from participating in governance of certain cryptocurrency where votes are based on their holdings, or earning dividends. Anchorage tells me it’s purposefully designed to permit this kind of participation, helping clients to get the most out of their assets like capturing returns from staking and inflation, or joining in on-chain governance.

As three of the 28 founding members of the Libra Association that will govern the new Facebook-incubated cryptocurrency, Anchorage, Visa and Andreessen Horowitz will be responsible for ensuring the stablecoin stays secure. While Facebook is building its own custodial wallet called Calibra for users, other Association members and companies hoping to dive into the ecosystem will need ways to protect their Libra stockpiles.

“Libra is exactly the kind of asset that Anchorage was created to hold,” Mónica wrote the day Libra was revealed. “Our custody solution enables online participation with offline assets, so that asset-holders don’t face a trade-off between security and usability.” The company believes that custodians shouldn’t dictate which coins their clients hold, so it’s working to support all types of digital assets. Anchorage tells me that will include support for securing Libra in the future.

You’ve probably already used technology secured by Anchorage’s founders, who engineered Docker’s containers that are used by Microsoft, and Square’s first encrypted card reader. Mónica was at Square when he met his future Anchorage co-founder Nathan McCauley, who’d been working on anti-reverse-engineering tech for the U.S. military. When a company that had lost the password to a $1 million cryptocurrency account asked for their help with security, they recognized the need for a more idiot-proof take on asset protection.

“Anchorage applies the best of modern security engineering for a more advanced approach: we generate and store private keys in secure hardware so they are never exposed at any point in their life cycle, and we eliminate human operations that expose assets to risk,” Mónica says. The startup competes with other crypto custody firms like Bitgo, Ledger, Coinbase and Gemini.

Last time we spoke, Anchorage was cagey about what I could reveal regarding how its transaction validation system worked. With the new funding, it’s feeling a little more secure about its market position and was willing to share more.

Last time we spoke, Anchorage was cagey about what I could reveal regarding how its transaction validation system worked. With the new funding, it’s feeling a little more secure about its market position and was willing to share more.

Anchorage ditches usernames, passwords, email addresses and phone numbers completely. That way a hacker can’t just dump your coins into their account by stealing your private key or SIM-porting your number to their phone. Instead, clients whitelist devices held by their employees, who use the Anchorage app to submit transactions. You’d propose selling $10 million worth of Bitcoin or transferring it to someone else as payment, and a minimum of two-thirds of your designated co-workers would need to concur to form a quorum that approves the transfer.

But first, Anchorage’s artificial intelligence and human staff would check for any suspicious signals that might indicate a hack in progress. It uses behavioral analysis (do you act like a real human and similar to how you have before), biometric signals (do you look like you) and network signals (is your device what and where it should be) to confirm the transaction is legitimate. The same process goes down if you try to add a new whitelisted device or change who has permission to do what.

The challenge will be scaling security to an ever-broadening range of digital assets, each with their own blockchain quirks and complex smart contracts. Even if Anchorage keeps coins safely in custody, those variables could expose assets to risk while in transit. Now with deeper pockets and the Visa vote of confidence, Anchorage could solve those problems as clients line up.

While most blockchain attention has focused on the cryptocurrencies themselves and the exchanges where you can buy and sell them, a second order of critical infrastructure startups is emerging. Companies like Anchorage could make Bitcoin, Ether, Libra and more not just objects of speculation or the domain of experts, but safely functioning elements of the new world economy.

Powered by WPeMatico

NiYO Solutions, a Bangalore-based “neo-bank” that helps salaried employees and blue-collar workers access company benefits and other financial services, has raised $35 million in a new funding round to expand its business in the nation and explore international markets for some of its products.

The four-year-old startup, which serves small and medium businesses and other salaried employees across India, raised its Series B from Horizons Ventures, Tencent and existing investor JS Capital. It has raised $49.2 million to date, with its $13.2 million Series A closing in January last year.

NiYO Solutions serves as a “neo-bank” that relies on traditional financial institutions (Yes Bank and DCB banks, in its case) and offers to customers additional features such as lending and insurance. Blue-collared employees in India (and many other markets) continue to struggle in availing crucial financial services from banks that typically reserve them for the privileged segment. With its payroll solution and other products, NiYO is trying to drive financial inclusion in the country, it said.

The startup also offers a global travel card with no mark-up fee. More than 50,000 users have already signed up for the travel card — and NiYO intends to scale that figure to 500,000 by April next year. In an interview with TechCrunch, Vinay Bagri, co-founder and CEO of NiYO, said the startup is exploring bringing the travel card to other markets — though he did not share any names.

He said the startup will also use the fresh capital to build new product offerings and in expansion of its distribution and marketing efforts. It also wants to grow its customer base from about 1 million currently to 5 million in the next three years. Bagri said NiYO is looking to acquire other startups that are a good fit for its vision.

Neo banks are increasingly becoming popular across the globe as traditional banks show little interest in addressing the needs of niche customer bases. Tide and N26 are showing remarkable growth in European markets, while Azlo in the U.S. and Tyro Payments and Volt Bank in Australia are also among the top players.

In developing regions such as India, too, this tried and tested idea is increasingly being replicated. Open, another Bangalore-based neo-bank, helps businesses automate their finances. It raised $30 million last month.

Powered by WPeMatico

Technology has been used to improve many of the processes that we use to get work done. But today, a startup has raised funding to build tech to improve us, the workers.

15Five, which builds software and services to help organisations and their employees evaluate their performance, as well as set and meet goals, has closed a Series B round of $30.7 million, money that it plans to use to continue building out the functionality of its core product — self-evaluations that take “15 minutes to write, 5 minutes to read” — as well as expand into new services that will sit alongside that.

David Hassell, 15Five’s CEO and co-founder, would not elaborate on what those new services might be, but he recently started a podcast with the startup’s “chief culture officer” Shane Metcalf around the subject of “best-self” management that taps into research on organizational development and positive psychology.

At the same time that 15Five works on productizing these principles into software form, it seems that the secondary idea will be to bring in more services and coaching into the mix alongside 15Five’s existing SaaS model.

This Series B is being led by Next47, the strategic investment arm of manufacturing giant Siemens. Others in the round included Matrix Partners, PointNine Capital, Jason Calacanis’s LAUNCH Fund, Newground Ventures, Bling Capital, Chaifetz Group, and Origin Ventures (which had led 15Five’s Series A). It brings the total raised to $42.6 million, but Hassell said that while the valuation is up, the exact number is not being disclosed.

(Previous investors in the company have included David Sacks, 500 Startups and Ben Ling.)

15Five’s growth comes at a time when we are seeing a significant evolution in how companies are run internally. The digital age has made workforces more decentralised — with people using smartphones, video communications and services like Slack to stay in constant contact while otherwise working potentially hundreds of miles from their closest colleagues, or at least not sitting in one office altogether, all the time.

All well and good, but this has also had an inevitable impact on how employees are evaluated by their managers, and also how they are able to gauge how well they are doing versus those with whom they work. So while communication of one kind — getting information across from one person to another across big distances — has seen a big boost through technology, you could argue that another kind of communication — of the human kind — has been lost.

15Five’s approach is to create a focus on building an easy way for employees to think about and set goals for themselves on a regular basis.

Indeed, “regular” is the operative word here, with key thing being frequency. A lot of companies — especially large ones — already use performance management software (other players in this space include BetterWorks, Lattice, and PeopleGoal among many others), but in many cases, it’s based around self-evaluations that you might make annually, or at six-month intervals.

15Five’s focus is on providing a service that people will use much more often than that. In fact, it encourages use all the time, by way of sending praise to each other when something positive happens (it calls these “High fives” appropriately enough), as well as regular evaluations and goals set by the employees themselves.

Hassell said in an interview that this is in tune with what modern workplaces, and younger employees, expect today, partly fuelled by the rise of social media.

“Most millennials will get feedback on what they eat for breakfast more than what they do at work,” he said. “The rest of our lives exist in a real-time feedback loop, filled with continuous, positive reinforcement, but then you go into work and have an annual or maybe biannual performance review? It’s simply not enough.”

He said that he knows some millennial employees who have said that they will not work at a company if it’s not already using or planning to adopt 15Five, and since talent is the cornerstone to a company’s success this could have a significant impact.

The startup was born in San Francisco in more than one sense. It’s based there, but also, its principles seem to be uniquely a product of the kind of self-reflection and self-care/quality of life emphasis that has been associated with California culture for a while now, even amidst the relentless march that comes with being at the epicenter of the tech world.

In that regard, its newest investor, Next47, will help put 15Five to the test, both in terms of how the product will be adopted and used at a company whose holdings are as much manufacturing as technology, and in terms of sheer size: Siemens globally has around 400,000 employees, a huge jump up compared to the smaller and medium-sized businesses that form the core of 15Five’s customer base today.

Matthew Cowan, a partner at the firm, noted that while Siemens is currently not a 15Five user, the thinking behind the investment was strategic and the idea will be to incorporate it into the company’s practices for helping employees’ progress.

“It’s very representative of how the workplace is transforming,” he said

Powered by WPeMatico

Waresix, one of a handful of startups aiming to modernize logistics in Indonesia — the world’s fourth most populous country — has pulled in $14.5 million to grow its 18-month-old business.

This new investment, Waresix’s Series A, is led by EV Growth — the growth-stage fund co-run by East Ventures — with participation from SMDV — the investment arm of Indonesia corporation Sinar Mas — and Singapore’s Jungle Ventures . The startup previously raised $1.6 million last year from East Ventures, SMDV and Monk’s Hill Ventures. It closed a seed round in early 2018.

Waresix is aiming to digitize logistics, the business of moving goods from A to B, which it believes is worth a total of $240 billion in Indonesia.

A large part of that is down to the country’s geography. The archipelago officially has more than 17,000 islands, but there are five main ones. That necessitates a lot of challenges for logistics, which are said to account for 25-30% of GDP — a figure that is typically below 5% in Western markets — while Indonesia barely scraped the top 50 rankings in World Bank’s Logistics Performance Index.

But, as Southeast Asia’s largest economy and the key market for digital growth in the region, that makes this an attractive problem to solve… or, rather, attractive industry to modernize.

Like others in its space worldwide — which include Chinese unicorn Manbang and BlackBuck in India — Waresix is focused on optimizing logistics by making the process more transparent for clients and more efficient for haulage companies and truckers. That includes removing the chain of “middle man” brokers, who add costs and reduce transparency, and provide a one-stop solution for transportation by land or sea, as well as cold storage and general cargo handling.

As of today, Waresix claims a fleet of more than 20,000 trucks and over 200 warehouse partners across Indonesia. The company said it plans to use this new capital to expand that coverage further. In particular, that’ll include additional land transport options and additional warehouse capacity in tier-two cities and more remote areas. That’s a push that founders Andree Susanto (CEO) and Edwin Wibowo (CFO) — who met at UC Berkeley in the U.S. — believe fits with Indonesia’s own $400 billion commitment to improve national infrastructure and transport.

Waresix trucks

It is also consistent with East Ventures, the long-standing early-stage VC, which has backed a pack of young companies aiming to inject internet smarts into traditional industries in Indonesia. Some of that portfolio includes Warung Pintar, which develops smart street vendor kiosks, Kedai Sayur, which is digitizing street vendors, and Fore Coffee, which draws inspiration from China’s digital-first brand Luckin Coffee, which recently listed in the U.S.

Now with EV Growth, which reached a final close of $200 million thanks to LPs that include SoftBank, East Ventures has the firepower to write larger checks that go beyond seed and pre-Series A deals, as it has done with Waresix.

But the company is far from alone in going after the logistics opportunity in Indonesia. Its rivals include Kargo, which was started by a former Uber Asia exec and is backed by Uber co-founder Travis Kalanick’s 10100 fund among others, and Ritase.

Ritase, which claims to be profitable, closed an $8.5 million Series A this week. It said it has 7,500 trucks and, on the client side, some 500 SMEs and a smattering of well-known global brands. Kargo has kept its metrics quiet, but it is a later arrival on the scene. The startup only came out of stealth in March of this year when it announced a $7.6 million funding round.

Powered by WPeMatico