Recent Funding

Auto Added by WPeMatico

Auto Added by WPeMatico

Managing people is perhaps the most challenging thing most people will have to learn in the course of their professional lives – especially because there’s no one ‘right’ way to do it. But Ottawa-based startup Fellow is hoping to ease the learning curve for new managers, and improve and reinforce the habits of experienced ones with their new people management platform software.

Fellow has raised $6.5 million in seed funding, from investors including Inovia Capital, Felicis Ventures, Garage Capital and a number of angels. The funding announcement comes alongside the announcement of their first customers, including Shopify (disclosure: I worked at Shopify when Fellow was implemented and was an early tester of this product, which is why I can can actually speak to how it works for users).

The Fellow platform is essentially a way to help team leads interact with their reports, and vice versa. It’s a feedback tool that you can use to collect insight on your team from across the company; it includes meeting supplemental suggestions and templates for one-on-ones, and even provides helpful suggestions like recommending you have a one-on-one when you haven’t in a while; and it all lives in the cloud, with integrations for other key workplace software like Slack that help it integrate with your existing flow.

Fellow co-founder and CEO Aydin Mirzaee and his co-founding team have previous experience building companies: They founded Fluidware, a survey software company, in 2008 and then sold it to SurveyMonkey in 2014. In growing the team to over 100 people, Mirzaee says they realized where there were gaps, both in his leadership team’s knowledge and in available solutions on the market.

“Starting the last company, we were in our early 20s, and like the way that we used to learn different practices was by using software, like if you use the Salesforce, and you know nothing about sales, you’ll learn some things about sales,” Mirzaee told me in an interview. “If you don’t know about marketing, use Marketo, and you’ll learn some things about marketing. And you know, from our perspective, as soon as we started actually having some traction and customers and then hired some people, we just got thrown into it. So it was ‘Okay, now, I guess we’re managers.’ And then eventually we became managers of managers.”

Mirzaee and his team then wondered why a tool like Salesforce or Marketo didn’t exist for management. “Why is it that when you get promoted to become a manager, there isn’t an equivalent tool to help you with that?” he said.

Concept in hand, Fellow set out to build its software, and what it came up with is a smartly designed, user-friendly platform that is accessible to anyone regardless of technical expertise or experience with management practice and training. I can attest to this first-hand, since I was a first-time manager using Fellow to lead a team during my time at Shopify – part of the beta testing process that helped develop the product into something that’s ready for broader release. I was not alone in my relative lack of management knowledge, Mirzaee said, and that’s part of why they saw a clear need for this product.

“The more we did research, the more we figured out that obviously, managers are really important,” he explained. “70% of customer engagements are due to managers, for instance. And when people leave companies, they tend to leave the manager, not the company. The more we dug into it the more it was clear that there truly was this management problem – management crisis almost, and that nobody really had built a great tool for managers and their teams like.”

Fellow’s tool is flexible enough to work with specific management methodologies like setting SMART goals or OKRs for team members, and managers can use pre-set templates or build their own for things like setting meeting talking points, or gathering feedback from the colleagues of their reports.

Right now, Fellow is live with a number of clients including Shoify, Vidyard, Tulip, North and more, and it’s adding new clients who sign up on a case-by-case basis, but increasing the pace at which it onboard new customers. Mirzaee explained that it hopes to open sign ups entirely later this year.

Powered by WPeMatico

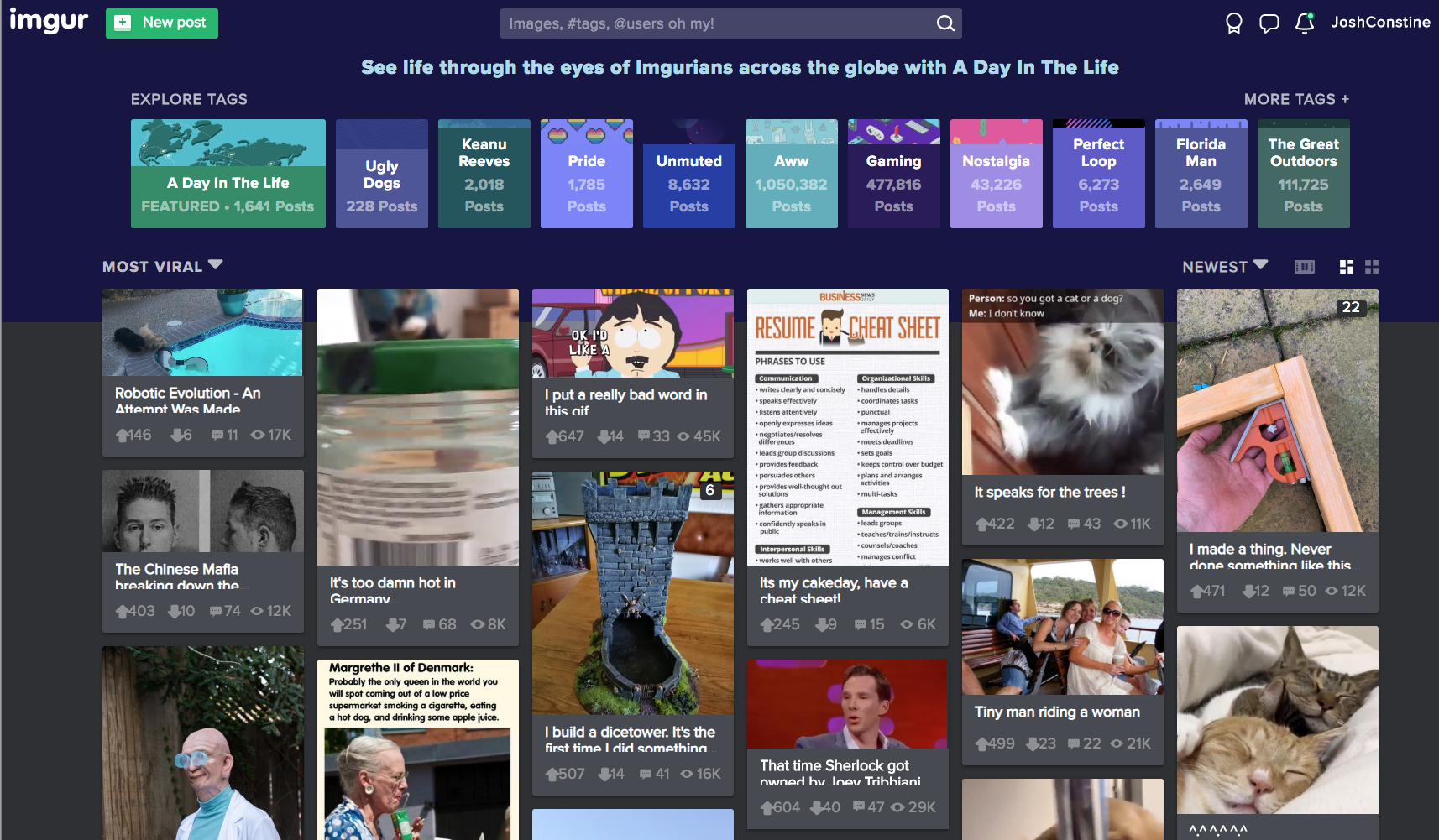

Meme creators have never gotten their fair share. Remixed and reshared across the web, their jokes prop up social networks like Instagram and Twitter that pay back none of their ad revenue to artists and comedians. But 300 million monthly user meme and storytelling app Imgur wants to pioneer a way to pay creators per second that people view their content.

Today Imgur announces that it’s raised a $20 million venture equity round from Coil, a micropayment tool for creators that Imgur has agreed to build into its service. Imgur will eventually launch a premium membership with exclusive features and content reserved for Coil subscribers.

Users pay Coil a fixed monthly fee, install its browser extension, the Interledger protocol is used to route assets around, and then Coil pays creators dollars or XRP tokens per second that the subscriber spends consuming their content at a rate of 36 cents per hour. Imgur and Coil will earn a cut too, diversifying the meme network’s revenue beyond ads.

“Imgur began in 2009 as a gift to the internet. Over the last 10 years we’ve built one of the largest, most positive online communities, based on our core value to ‘give more than we take’” says Alan Schaaf, founder and CEO of Imgur. The startup bootstrapped for its first five years before raising a $40 million Series A from Andreessen Horowitz and Reddit. It’s grown into the premier place to browse ‘meme dumps’ of 50+ funny images and GIFs, as well as art, science, and inspirational tales. With the same unpersonalized homepage for everyone, it’s fostered a positive community unified by esoteric inside jokes.

While the new round brings in fewer dollars, Schaaf explains that Imgur raised at a valuation that’s “higher than last time. Our investors are happy with the valuation. This is a really exciting strategic partnership.” Coil founder and CEO Stefan Thomas who was formerly the CTO of cryptocurrency company Ripple Labs will join Imgur’s board. Coil received the money it’s investing in Imgur from Ripple Labs’ Xpring Initiative, which aims to fund proliferation of the Ripple XRP ecosystem, though Imgur received US dollars in the funding deal.

Thomas tells me that “There’s no built in business model” as part of the web. Publishers and platforms “either make money with ads or with subscriptions. The problem is that only works when you have huge scale” that can bring along societal problems as we’ve seen with Facebook. Coil will “hopefully offer a third potential business model for the internet and offer a way for creators to get paid.”

Founded last year, Coil’s $5 per month subscription is now in open beta, and it provides extensions for Chrome and Firefox as it tries to get baked into browsers natively. Unlike Patreon where you pick a few creators and choose how much to pay each every month, Coil lets you browse content from as many creators as you want and it pays them appropriately. Sites like Imgur can code in tags to their pages that tell Coil’s Web Monetization API who to send money to.

The challenge for Imgur will be avoiding the cannibalization of its existing content to the detriment of its non-paying users who’ve always known it to be free. “We’re in the business of making the internet better. We do not plan on taking anything away for the community” Schaaf insists. That means it will have to recruit new creators and add bonus features that are reserved for Coil subscribers without making the rest of its 300 million users feel deprived.

It’s surprising thT meme culture hasn’t spawned more dedicated apps. Decade-old Imgur precedes the explosion in popularity of bite-sized internet content. But rather than just host memes like Instagram, Imgur has built its own meme creation tools. If Imgur and Coil can prove users are willing to pay for quick hits of entertainment and creators can be fairly compensated, they could inspire more apps to help content makers turn their passion into a profession…or at least a nice side hustle.

Powered by WPeMatico

David’s Bridal once owned 50% of the $36 billion wedding gown market before it filed for bankruptcy last year. Brides were growing sick of the lack of styles and sizes plus high prices at expensive brick & mortar shops. The industry was destined for disruption by software that would replace overhead costs and inflexibility with direct-to-consumer personalization.

That’s why I profiled a new custom wedding dress startup back in 2016 called Anomalie despite little funding or traction. The rise of Instagram meant every bride wanted to look unique on a budget, not pay $5000 for a cookie-cutter $200 dress that happened to be white. Anomalie was willing to embrace software to offer 4 billion design permutations and break the markup cartel by selling gowns starting at $1000.

2.5 years later, Anomalie has begun to prove that cheaper doesn’t have to look cheap and custom doesn’t have to cause a headache. 13% of US brides, 275,000 out of 2.1 million, created an Anomalie account in the last year. With David’s Bridal looking shaky and wedding dresses being a seven-times larger market than bedding and mattresses, investors eagerly proposed to Anomalie. Today the startup announces a $13.6 million Series A led by consumer product VC Goodwater Capital .

“I don’t think I’ll ever get tired of working with brides. Other companies would kill for this costumer. She’s so obsessed with every detail of her wedding dress. it’s just a perfect environment to collect data” says Anomalie co-founder and CEO Leslie Voorhees. “Long lead time, high margin, this industry that’s completely f*cked up — it’s the perfect place to start this mass customization engine beginning with the wedding dress” she tells me, hinting at the startup’s potential to customize other clothing too.

Anomalie is also flexing its tech muscle today with the launch of its new dress sketch visualizer. Choose between a few options on shape, cut, color, pattern, and fabric, and you’ll see an algorithmic sketch of your dream dress appear instantly. Anomalie then pairs you with a squad of its designers to finalize the details, ship swatches, and get you your gown with a 100% refund policy if it’s not right.

The startup’s nest egg will go towards hiring more engineers plus bringing more of production in-house to offer additional features like this. But Voorhees insists that “I don’t think we’ll ever completely automate away the stylists. Customer don’t care about AI or machine learning, but they want to trust us to pull the ideas out of their heads.”

Anomalie co-founder and CEO Leslie Voorhees

Anomalie was woven out of Voorhees’ frustrations picking her own wedding dress. She’d been managing factories and supply chains in Asia for Nike and Apple, and it made no sense why slapping “bridal” on a dress could make it up to ten-times more expensive.

Her investigation uncovered that most brands were outsourcing their manufacturing, so she did an end-run, contacted factories directly, and got her dress made custom for a fraction of the price. So many of her pals demanded help doing the same that the Harvard Business School grad soft-launched Anomalie with her husband Calley Means [Disclosure: who I know from college] in the summer of 2016.

The startup’s gowns now average $1,400. Growth has been swift since weddings are so photographed and shared, with Anomalie reaching an outstanding net promoter score of 91. A friend of mine recently bought her dess through the company and it looked stunning and one-of-a-kind without breaking the bank. And since they’re custom, Anomalie makes inclusivity and advantage by offering larger sizes absent elsewhere

Meanwhile, Anomalie’s incumbent competitors have struggled. Gap and J.Crew abandoned the wedding dress business in the last few years. David’s Bridal emerged from bankruptcy with its 300 retail stores still operating, but it’s slipped to 30 percent US market share. It’s now owned by lenders including Oaktree Capital Group, which is a bad omen given that firm was responsible for driving Toys”R”Us into liquidation instead of keeping it open. No other players have a sizable foot or well-known brand besides super high-end designer Vera Wang.

Anomalie capitalized on David’s troubles by poaching its head of bridal production Angela Ng, who now leads the startup’s Hong Kong team and relieves Voorhees of constant trips to China. It also hired former Sephora VP of digital Marcy Zelmar and former TrueCar VP of engineering Aaron Tavistock. Their goal is to sell more dresses to get Anomalie more data, more factory modularization, and more control over its manufacturing.

Anomalie’s dress visualizer turns a few style selections into a sketch of your potential gown

The new funding round that builds on its $4.5 million seed round was joined by Signia, SoGal Ventures, Lerer Hippeau’s BN Capital Fund, and Fin’s Sam Lessin also includes strategic angels like former Stitch Fix CTO Jeff Barrett and ThirdLove underwear CEO Heidi Zak. At Anomalie’s San Francisco headquarters, mannequins sporting design prototypes stand beside software teams optimizing the new dress visualizer. And when I say the dresses are custom, I mean they can get about as weird as you want. Anomalie is finishing up a dress with lyrics from the couple’s favorite song embroidered in a secret language from their favorite TV show…and it still looks beautiful.

“One of the coolest things about Anomalie is that they’re not just using digital as a distribution strategy, but to also deliver a differentiated product experience” says Goodwater partner Eric Kim. “Anomalie’s sketch-builder is a great expression of this emphasis on product and customer centricity.” Wedding dresses have been largely ignored by startups despite the market being bigger than luggage ($34 billion), or shaving ($21 billion), oral care ($10 billion) and hair loss ($4 billion) combined.

The challenge is that unlike those products, bridal gowns are “a zero failure game. This is like airplane engines and heart rate monitors” Voorhees stresses. Anomalie must maintain perfect quality, times, and customer experience to avoid ruining someone’s big day. “Never messing up a dress or losing a dress — we take this really, really seriously.” She knows a few viral disasters could sink the ship. It also has to stay ahead of fresh entrants like COUTURME, a new Y Combinator startup making custom evening gowns as well as wedding dresses.

Anomalie’s SF headquarters. Photo by Summer Wilson

Anomalie sees global demand for a better experience, and thinks it can apply its data set to wedding dresses for more cultures as well as additional types of clothing. “We are building up a large repository of female measurements and creating tech plus operational processes around ‘mass customization’ that can be applied to other garments” Voorhees reveals. “Our aspirations are around bringing more body inclusivity + customization to women’s fashion, not just bridal.”

And while Anomalie could always find a retail partner to get more exposure, it’s tough for brick & mortar brands to operate online without cannibalizing their sales. “We think the women’s closet of the future contains staples from Stitch Fix, rotating dresses from Rent the Runway, and signature custom garments from Anomalie.”

The Anomalie just needs to educate brides that they can actually have the dress of their dreams, and now it wants to inspire that dream on-site too. Full of ambition and verve, Voorhees concludes, “What’s Pinterest valued at when it’s basically a wedding dress search engine?”

Powered by WPeMatico

Sales teams have long turned to tech solutions to help improve how they source leads, develop relationships and close deals. Now, one of the startups that helps out at a key point in that trajectory is announcing a round of growth funding to help fuel its own rapid growth. Showpad, a sales enablement platform that lets salespeople source and organise relevant content and other collateral that they use in their deals, has raised a Series D of $70 million.

The funding, which brings the total raised by Showpad to $160 million, is coming in the form of debt and equity. The equity part is co-led by Dawn Capital and Insight Partners, with existing investors Hummingbird Ventures, and Korelya Capital also participating. Silicon Valley Bank is providing debt financing. This is one of the first big investments out of Dawn’s Opportunities Fund that we wrote about last week.

The company is not disclosing its valuation but Pieterjan Bouten, the CEO who co-founded the company with Louis Jonckheere (currently CPO) and Peter Minne (CTO), confirmed that it has doubled since last year, and is seven times the valuation it had when it raised a $50 million Series C in 2016. The company is growing 90% year-on-year at the moment in terms of revenues.

And as a point of reference, another sales enablement player, Seismic, last December raised a Series E of $100 million at a $1 billion valuation.

Founded in Ghent, Belgium, Showpad today operates across two main headquarters, its original European base and Chicago. The latter was the homebase of LearnCore, a company that Showpad acquired last year that focuses on sales coaching and training. This became a strategic acquisition to expand Showpad’s primary product, a platform that acts as a kind of content management system for sales collateral. (Today, while Chicago is where Showpad builds its go-to market efforts and professional services, Ghent focuses on engineering and product, he said.) As it happens, Chicago is also the headquarters of Seismic.

As Bouten described in an interview, Showpad is part of what he considers to be the fourth pillar of the technology marketing stack: storage (the cloud services where you keep all your data), CRM, marketing automation and sales enablement, where Showpad sits.

While the first three are key to helping to manage a salesperson’s activities and work, the fourth is a crucial one for helping to make sure a salesperson can do his or her job more effectively.

Traditionally a lot of the content that salespeople used — presentations, white papers, other materials — to help make their cases and close their deals would be managed offline and directly by individual salespeople. Showpad has taken some of that process and made it digital, which means that now teams of salespeople can more effectively share materials amongst each other; and interestingly the material and its link to successful sales becomes part of how Showpad “learns” what works and what doesn’t.

That, in turn, helps build Showpad’s own artificial intelligence algorithms, to help suggest the best materials for a particular sales effort either to someone else in that team, or to other salespeople using the platform.

“To date there has been enormous innovation in automating the marketing and sales workflow. However, in the end, sales comes down to one person selling to another,” said Norman Fiore, General Partner at Dawn Capital and member of the Showpad Board, in a statement. “Historically, this has been an offline process that has been wildly inconsistent and opaque. Showpad’s suite of products succeeds in bringing this process online for the first time with data-rich feedback loops on the effectiveness of teams, managers, salespeople and even individual pieces of sales content.”

This is a crowded area of the market with a number of standalone companies building sales enablement solutions, but also other companies within the sales stack also adding on enablement as a value-added service.

For now, though, Bouten notes that these are more strategic partners than competitors. For example, Salesforce and Microsoft are partners, and, he adds, “We integrate with Salesloft to make sure sure emails that are sent out are using the right content. We become the single source of truth but also are being used for outreach.”

Today, the company has around 1,200 enterprise customers, including Johnson & Johnson, GE Healthcare, Bridgestone, Honeywell, and Merck. The plan going forward will be to continue building out the services that it offers around its sales enablement software, alongside the core product itself.

“You can equip sales people with the best content, but if they are not trained and coached in the right way, it goes nowhere,” Bouten said.

Powered by WPeMatico

Nowports, a developer of software and services to track freight shipments from ports to destinations across Latin America, has aims to become the regional answer to Flexport’s billion-dollar digital shipping business.

Almost 54 million containers are imported and exported from Latin America each year, and nearly half of them are either delayed or lost due to mismanagement.

Nowports is pitching shippers on its digital management software to keep track of each container, and has signed on a number of leading venture capital firms to fulfill its mission.

The Monterrey, Mexico-based company raised $5.3 million in its seed round of financing. The round was led by Base10 and Monashees, with participation from Y Combinator and additional investors like Broadhaven, Soma Capital, Partech, Tekton and Paul Buchheit.

“In Nowports we saw a very strong combination: well prepared and ambitious team using technology to help thousands of customers to improve their importing and exporting processes. By adding efficiency, reliability, and transparency to change a multi-billion dollar industry, Nowports has been able to attract many clients that saw significant improvements in their daily routines by using the solution” said Caio Bolognesi, general partner from Monashees, in a statement.

The company said it would use the money to expand into new markets, grow its team and integrate with more companies involved in the (very fragmented) Latin American logistics industry. It’s a market that needs a range of better logistics technologies.

“Even though over 90% of the world’s trade is carried by sea, the most cost-effective way to move goods en masse, there has yet to be a solution that’s able to connect suppliers, customs brokers, carriers and transportation companies to provide an efficient and reliable service,” said Maximiliano Casal, founder and chief executive of Nowports, in a statement. “This is why we launched Nowports, combining our 10 years of industry expertise to fill this void and are currently working with over 40 customers in the region and growing.”

The company now has offices in Chile and Uruguay, and is planning to expand to Brazil, Colombia and Peru.

“With platforms, algorithms with AI and integrations, our platform allows companies to take control of their shipments and plan and predict the best timing to move the freight based on the needs of their own company,” said Alfonso De Los Rios, founder and CTO of Nowports.

As the company looks to expand, it has a strategic road map it can follow in the growth of Flexport, the Silicon Valley startup that has become a billion-dollar business by applying technology to the outdated shipping industry.

The two co-founders of Nowports met at a program at Stanford University, with De Los Rios hailing from a family with deep ties to the shipping industry. He and Casal linked up and the two began plotting a way to make the deeply inefficient industry more modern and transparent. To familiarize himself with the market for which he’d be developing a technology, Casal worked in a freight forwarder in Kansas City that had been operating for more than 30 years.

In all, freight providers are getting paid nearly $40 billion per year to move freight into Latin America.

“Alfonso and Max are the ideal founders we look to invest in as they are industry experts and passionate about evolving the industry using technology and automation,” said Adeyemi Ajao, general partner from Base10. “We are proud to be investors in Nowports alongside our friends at Monashees and look forward to watching the company’s continued growth.”

Powered by WPeMatico

As businesses continue to move more of their computing and data to the cloud, one of the startups that has made a name for itself as a provider of cloud-based solutions to protect and manage those IT assets has raised a big round of funding to build its business.

Druva, which provides software-as-a-service-based data protection, backup and management solutions, has raised $130 million in a round of funding that CEO and founder Jaspreet Singh says takes the company “well past the $1 billion mark” in terms of its valuation.

Alongside this news, it’s making an acquisition to continue building out the storage part of its business (one of several product areas that it’s developing): it’s acquiring CloudLanes, a startup that was backed by Microsoft and others, for an undisclosed sum, in a deal that will likely be formally announced in early July.

The funding is being led by Viking Global Investors, the hedge fund and investment firm, with participation from two other new investors, Neuberger Berman and Atreides Capital, and existing investors Riverwood Capital, Tenaya Capital and Nexus Venture Partners (which were part of Druva’s last round of $80 million in 2017). The company, Singh said, is now nearly at a $100 million annual run rate. And although he would not disclose revenues, he said it’s now in a strong position to consider going public as its next step (or finally entertaining one of the many acquisition offers Singh admitted Druva gets).

“As we look at growth and the potential of what we are doing, the next obvious step is to look at public markets in the next 12 to 18 months,” he said in an interview.

The strong numbers (in terms of funding raised, valuation and performance) are a sign not just of Druva’s own business health, but of the opportunity it is tackling.

Spurred by a number of factors — the unfortunate rise of malicious hacking and data breaches, a massive wave of computing services that are creating mountains of data that can now be parsed for insights and a big move to cloud computing — the data protection industry is booming, with IDC predicting that it will collectively cost some $55 billion by 2020 to store and manage “copy data” (backups of the data), and that the data protection market will likely see revenues of $8 billion by 2020. Druva itself works with some 4,000 organizations today, with many in the mid-market in terms of size, with customers ranging across a number of verticals and including the likes of Build Group, American Cancer Society and Port of New Orleans — but as a measure of the opportunity, IDC notes that as of 2017 it had only about a 1% share (it doesn’t have more updated figures yet).

With a huge opportunity like this, it’s also an unsurprisingly crowded area in terms of competition. Singh points out that others looking to provide services in the same area include huge incumbents like CommVault and IBM, as well as newer entrants like Rubrik (itself on something of a fundraising tear in the last few years to capitalise on the same opportunity).

Singh notes that Druva stands out from these because it is the only one in the pack that started that remains an exclusively cloud-based, SaaS offering, meaning a company requires no hardware changes or appliance purchases in order to use it. While that’s an area that everyone is now moving into, his argument is that having started out here gives Druva a level of expertise and experience that cannot be matched by others — an important point when data protection is at stake.

The reality of today’s enterprise world is that there are a number of companies that are very far from being “in the cloud.” Despite the song and dance that we hear all the time about how cloud is the future, they are more often than not either relying entirely still on on-premises computing, or a hybrid solution. As Singh talks about it, this is almost irrelevant to what Druva is offering, and is in fact a segue to helping those companies come to trust and move more off premises, by giving them a strong example of how a cloud-based solution not only works, but can be less expensive and better than on-premise alternatives.

The CloudLanes acquisition fits in with this strategy, too: the company’s solution stack includes cloud storage that leverages on-premise data as a cache; ransomware protection; audit logs and more. “It will help us cover the gap between the data center and cloud more effectively,” Singh said.

This is also the belief that is propelling Druva to expanding into newer areas of business. Singh noted that business intelligence is going to be a big focus for the company, which makes sense: now that there is a lot of data being stored and managed by Druva, the next obvious move is to help parse it for insights. Security and making a wider move to secure endpoints are also areas that the company is considering, he said.

“We invest in companies based on a thorough assessment of their business models and fundamentals, the quality of their management teams, and cyclical and secular industry trends,” said Harish Belur, managing director, Riverwood Capital, in a statement. “Druva is doing something unique and special and, as a result, has grown at a phenomenal rate over recent years, all while keeping the trust and loyalty of its enterprise customers around the globe. We know this market is taking off and we continue to invest in Druva because we are sure it has the right product, executive team, and market execution to maintain leadership in the industry.”

I asked if companies like Amazon or Microsoft are friends, or frenemies, considering that they have a big part to play in cloud services. Singh said that so far, so good, since they are all more focused on infrastructure — or at least that’s where most of their strength has been up to now. Amazon, in particular, is a strong partner to the company he said, where Druva is often an early adopter of new tools of Amazon’s, and the AWS sales team regularly suggests Druva to customers for data protection and management services. Druva even happened to include a quote from the company in its news release:

“Druva is a leading Advanced Technology Partner in the AWS Partner Network,” said Mike Clayville, vice president Worldwide Commercial Sales and Business Development, Amazon Web Services, Inc., in a statement. “Druva’s solutions powered by AWS are changing the way data is managed and protected at thousands of companies globally. We’d like to congratulate Druva on its latest fund raise, and look forward to innovating with Druva to create new solutions that benefit our customers.”

Seems like that could be one to watch, as well, as both companies continue their cloud expansion, both independently and in competition with others.

Powered by WPeMatico

Startup SafeAI, powered by a founding talent team with experience across Apple, Ford and Caterpillar, is emerging from stealth today with a $5 million funding announcement. The company’s focus is on autonomous vehicle technology, designed and built specifically for heavy equipment used in the mining and construction industries.

Out the gate, SafeAI is working with Doosan Bobcat, the South Korean equipment company that makes Bobcat loaders and excavators, and it’s already demonstrating and testing its software on a Bobcat skid loader at the SafeAI testing ground in San Jose. The startup believes that applying advances in autonomy and artificial intelligence to mining and construction can do a lot to not only make work sites safer, but also increase efficiencies and boost productivity — building on what’s already been made possible with even the most basic levels of autonomy currently available on the market.

What SafeAI hopes to add is an underlying architecture that acts as a fully autonomous (Level 4 by SAE standards, so no human driver) platform for a variety of equipment. Said platform is designed with openness, modularity and upgradeability in mind to help ensure that its clients can take advantage of new advances in autonomy and AI as they become available.

“We have seen and experienced deploying autonomous mining truck in production for last 10 years,” explained SafeAI Founder and CEO, Bibhrajit Halder in an email. “Now it’s time to take it to next level. At SafeAI, we are super excited to built the future of autonomous mine by creating autonomous mining equipment that just works.”

While SafeAI doesn’t have product in market yet, it is running its software on actual construction hardware at its proving ground, as mentioned, and it’s working with an as-yet unnamed large global mining company to deploy SafeAI in a mining truck, according to Halder. The company’s plan is to focus its efforts entirely on deploying fully Level 4 autonomy as its first available commercial product, with a vision of a future where multiple pieces of mining equipment are working together “seamlessly,” the CEO says.

Today’s $5 million round includes investment led by Autotech Ventures, and includes participation from Brick & Mortar Ventures, Embark Ventures and existing investor Monta Vista Capital.

Powered by WPeMatico

Knowledge is the fuel of business. Every decision requires a full understanding of the data underlying it, and that means reaching out not only to an organization’s own staff for insight, but also to experts in the wider world. Management consultants, research agencies, and data providers make hundreds of billions of dollars per year attempting to answer key questions for business executives.

Sometimes they are successful, but many times, finding the right expert can be vexing. For the most important decisions, having multiple experts or even hundreds of experts provide their opinion might be critical to success.

Germain Chastel and Sascha Eder know the problem well. Former McKinsey consultants, they worked with some of the top technology companies in the Valley attempting to answer their questions — but oftentimes struggled to do so given the unique problems that confront those organizations. “We realized it was really hard to find experts who could teach them something and had the insights that were relevant,” Chastel explained.

In early 2017, the two left McKinsey and eventually joined forces with Anuja Ketan, and together the trio formed NewtonX. NewtonX is a “knowledge access platform” which attempts to intelligently answer questions posed to it by business clients. Clients answer a carefully calibrated series of questions to properly vet and scope a query, and then NewtonX farms it out to it network of experts for insight.

That rapid-response network has now gotten the attention of Two Sigma Ventures, the venture wing of the high-flying algorithmic-trading hedge fund, which led a $12 million Series A round into New York City-based NewtonX. That’s a follow up to a $3 million seed round co-led by Third Prime Capital and Xfund last year.

Today, the company offers two main product lines. First is what it calls Expert Calls, which are similar to the traditional expert network offering of companies like GLG. Here, a client answers a series of structured questions to determine a single expert to talk to and get feedback from.

The more interesting product to me, and the one representing 70% of the startup’s revenue right now, is Expert Surveys. With this product, the goal is to ask a business question to a wider number of experts who might provide a variety of responses. So, for instance, NewtonX could potentially answer a query such as how CIOs at large Fortune 500 companies are budgeting for cybersecurity this year.

Where NewtonX gets interesting is that it doesn’t want to just casually facilitate these calls and surveys, but instead, the startup wants to build out a true knowledge graph that can better answer questions faster with each activity on the platform. As the platform gets smarter about knowledge, the idea is that on-boarding a new client or initiating a new survey or question will be faster since the platform will already know many of the nuances of that particular field of business.

Over the two and a half years since the company’s founding, it has found wide support among businesses. It counts Microsoft, 23&Me, and Gartner as public clients, and also has a list of 20 corporates already on the platform. Chastel told me that nine of the top ten management consulting firms have also used NewtonX services, and many top research firms have also used the product.

The NewtonX team. Courtesy of NewtonX

Early revenues has allowed the company to expand early. It has 32 employees at its offices near Grand Central, and Chastel noted to me that a majority of employees and a majority of managers are women. He said that the firm’s technology to identify experts on the web is also the basis for their own recruiting efforts.

With the new funding, the company intends to grow to 100 head count locally, and also expand out is client success and expert success teams.

Powered by WPeMatico

Optimizely, a platform that offers tools for A/B testing and personalization on the web and in mobile apps, today announced that it has raised a total of $105 million. This includes a $50 million Series D round led by Goldman Sachs Private Capital, with the participation of Accenture Ventures, as well as a $55 million line of credit from Bridge Bank.

Goldman Sachs’s Michael Kondoleon will join Optimizely’s board of directors as a board member.

“We’re excited to reach this milestone because these investments cement our leadership position in the market,” Optimizely CEO Jay Larson told me. “We can invest more in products to put an even bigger gap between Optimizely and our competition. We can expand geographically. And we will continue to grow our team of world-class digital optimization experts. This is a big day for Optimizely and a big day for the experimentation and personalization industry.”

The company notes that about a quarter of the Fortune 100 currently use its services. The company says it now handles more than 6 billion events a day and that its customers have tripled their investments in digital experience optimization in the last two years. Current customers include the likes of Gap, Visa, IBM, StubHub, Metromile, Lending Club and Sonos.

The company notes that about a quarter of the Fortune 100 currently use its services. The company says it now handles more than 6 billion events a day and that its customers have tripled their investments in digital experience optimization in the last two years. Current customers include the likes of Gap, Visa, IBM, StubHub, Metromile, Lending Club and Sonos.

In total, Optimizely has now raised more than $200 million, excluding the line of credit. The additional $55 million from Bridge Bank is a bit unusual, but not completely out of the ordinary for companies at this stage. “Bridge Bank is proud to continue working with Optimizely, a global leader at the forefront of the digital experience optimization market,” said Mike Lederman, senior vice president and western region director of Bridge Bank’s technology banking group. “Optimizely is on a path of substantial growth and the additional capital will help them continue to build market-leading products that are used by an increasing number of top global brands.”

As is pretty much standard for companies at this stage, Optimizely will use the new funding to drive growth.

Powered by WPeMatico

A couple of years ago, London-based startup Zego realised gig-economy workers would need insurance, and went on to raise a very healthy £6 million in Series A funding, led by Balderton Capital. Its first products were pay-as-you-go scooter and car insurance for food delivery workers.

It’s now announced a $42 million raise in one of the largest funding rounds for a European insurtech startup, in a Series B investment led by pan-European investment firm Target Global, specialists in the fintech and mobility space, with other backers including TransferWise founder Taavet Hinrikus. The proceeds will be used to for Zego’s expansion across Europe and to increase the workforce from 75 to 150.

The raise takes the firm to a total of $51 million in funding, with new investors Latitude joining existing backers Balderton Capital and Tom Stafford of DST Global. The investment comes as the company claims a whopping 900% growth over the past 12 months.

Zego caters to the new mobility services, such as ride-hailing, ridesharing, car rental and scooter sharing, and offers a range of policies from minute-by-minute insurance to annual cover, providing more flexibility than traditional insurers, with pricing based on usage data from vehicles.

This means it’s become popular with scooter and car delivery drivers, plus van and taxi fleets. The firm currently insures one-third of the U.K.’s food delivery market, largely through partnerships with Deliveroo, Just Eat and Uber Eats.

Sten Saar, CEO and co-founder of Zego, said: “When we built Zego from scratch three years ago, our mission was to transform the insurance sector by creating products which truly reflected the rapidly changing world of transport… The world is becoming more urbanized and because of this, we are moving from traditional ownership of vehicles to shared ‘usership’. This means that the rigid model of insurance that has existed for hundreds of years is no longer fit for purpose.”

Ben Kaminski, partner of lead investors Target Global, said: “With the growth of new mobility services, Zego identified a major gap in the insurance market and created a unique business model to fill it, which the incumbents will find very difficult to replicate. The potential of this company is almost limitless, and I fully expect to see its U.K. success mirrored across Europe and beyond in the coming years.”

Powered by WPeMatico