Recent Funding

Auto Added by WPeMatico

Auto Added by WPeMatico

SoftBank’s Vision Fund may be facing some challenges when it comes to restocking its massive reserves, but the firm famous for cutting big checks is leading a sizeable round for Collective Health. This startup focused on enterprise employee healthcare management announced a $205 million Series E raise today, bringing its total funding to $434 million since its founding in 2013. Its last raise was a $110 million round in February, 2018.

Collective Healths’ client list includes Red Bull, Pinterest, Zendesk and more, and it counts GV, NEA, DFJ Growth and Sun Life among its financial backers. Its platform is an integrator for the various insurance and benefit providers that large employers offer to their employees, and provides access to info, as well as claims filing, eligibility checks and data sharing across vendors. The funding will also help with additional engineering hires to continue to build out the platform.

The funding will help the company add more partner providers, a process that’s key to continued growth as it seeks to expand its footprint and ensure that it can serve customers and their employees across the U.S. In addition to the Vision Fund, this round included new investors PSP Investments, DFJ Growth and G Squared, as well as new participation from existing investors.

Powered by WPeMatico

Video is the core entertainment medium of the web. Platforms like YouTube, Twitch, Netflix and more deliver millions of hours of videos to hungry consumers every day, and those deliveries will only intensify as video games move increasingly to streaming models.

Yet, delivering all of that content remains an expensive and challenging endeavor. The largest platforms employ hundreds of video-encoding specialist engineers to optimize the transcoding and delivery costs of their product, while also paying millions either for their own cloud infrastructure or to AWS or Google Cloud. Yet, few affordable options exist for startups — such as live-streaming apps like Houseparty (which was bought last week by Epic Games) — or even for large enterprises with streaming needs but without access to specialized hardware.

That’s where Livepeer comes in. The brainchild of multi-time founder duo Doug Petkanics and Eric Tang, Livepeer offers a decentralized platform for video encoding centered on the Ethereum network. Its early success has attracted the attention of media VCs, and the company announced today that it has raised an $8 million Series A venture capital round led by Northzone. Houseparty founder Ben Rubin joined the round as well, and video infrastructure behemoth Brightcove’s former CEO David Mendels also joined as an advisor to the company.

Livepeer is essentially a marketplace between encoding providers (the supply side) and app developers who need video-streaming services (the demand side). Today, developers can integrate Livepeer inside their apps by downloading the node, running the Livepeer media server and funding their account with Ethereum. So far, more than 100 events have streamed their videos using the platform, although Petkanics admits that they have been an “early-adopter, philosophically-aligned crowd.”

At this point in the life cycle of crypto and blockchain, it can be easy to be skeptical of next-generation technologies built on these platforms. But Petkanics believes there is a unique opportunity in video that connects well with this market.

In addition to the absolutely stupendous increase in video streaming across the web, there is a unique compute market for encoding: the millions of GPUs bought by crypto miners over the past few years. Those GPUs calculate the hashes required to make money in crypto, but in many cases according to Petkanics, leave idle the other processing units on those chips that actually handle video encoding. Livepeer sees an opportunity — at least early in the company’s growth cycle — to essentially bootstrap on top of that excess capacity for processing power.

Right now, Petkanics told me the company has more than 30 providers of compute power on the platform, and that the “supply side of the network is running, and it is the last thing that keeps me up at night.”

That excess compute power is driving significantly lower prices for encoding. Petkanics said that Livepeer is 10 times cheaper than incumbent streaming providers, and with additional development work in the coming years, he believes he can further improve that cost advantage. Today, he said that the platform can handle two streams for roughly 70 cents per day, compared to $3 per stream per hour of incumbents (a number that surely varies across companies with different levels of negotiation leverage).

Having compute power is one thing — getting customers to use it is another. The goal of the Series A funding, along with the company’s new Pilot Partner Program, is to begin implementing applications outside of the crypto-fans and enter the enterprise. The company is offering six months free for new participants as an inducement to try the platform.

Ultimately, Petkanics sees Livepeer creating a “token coordinating network” that incentivizes more compute power to join and match the needs of customers. Even more interestingly, the increasing need of particular video-encoding algorithms means there is an incentive for developers to add new functionality to the company’s open-source media server, creating a novel way to improve open-source sustainability.

Petkanics and Tang have previously worked together with Jordan Cooper on Wildcard, a redesign of the mobile browser that had previously raised $10 million, led by General Catalyst. Before that, they worked together at Hyperpublic, which developed databases of local information with an API for developers that sold to Groupon in 2012. Livepeer has 12 employees, with half based in New York City, and half distributed.

In addition to Northzone, Digital Currency Group, Libertus, Collaborative Fund, Notation Capital, Compound, North Island and StakeZero joined the round.

Powered by WPeMatico

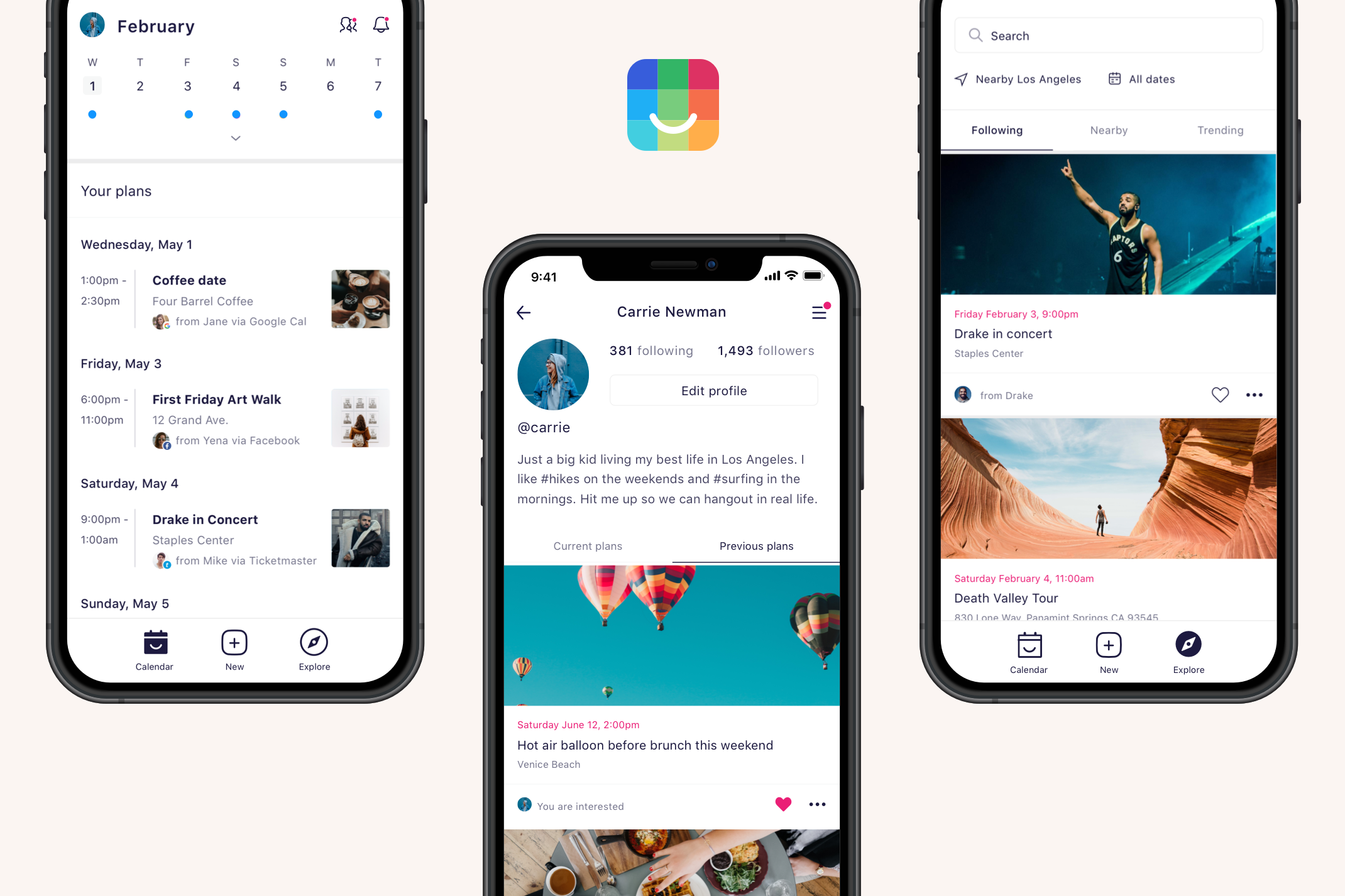

Why is there no app where you can follow party animals, concert snobs or conference butterflies for their curated suggestions of events? That’s the next phase of social calendar app IRL that’s launching today on iOS to help you make and discuss plans with friends or discover nearby happenings to fill out your schedule.

The calendar, a historically dorky utility, seems like a strange way to start the next big social network. Many people, especially teens, either don’t use apps like Google Calendar, keep them professional or merely input plans made elsewhere. But by baking in an Explore tab of event recommendations and the option to follow curators, headliners and venues, IRL could make calendars communal like Instagram did to cameras.

“There’s Twitter for ‘follow my updates,’ there’s SoundCloud for ‘follow my music,’ but there’s no ‘follow my events’ ” IRL CEO Abe Shafi tells me of his plan to turbocharge his calendar app. “They’re arguably the best product that’s been built for organizing what you’re doing, but no one has Superhuman’d or Slack’d the calendar. Let’s build a super f*cking dope calendar!” he says with unbridled excitement. He’ll need that passion to persevere as IRL tries to steal a major use case from SMS, messaging apps and Facebook .

Finding a new opportunity for a social network has attracted a new $8 million Series A funding round for IRL led by Goodwater Capital and joined by Founders Fund and Kleiner Perkins. That builds on its $3 million seed from Founders Fund and Floodgate, whose partner Mike Maples is joining IRL’s board. The startup has also pulled in some entertainment and event CEOs as strategic investors, including Warner Bros. president Greg Silverman, Lionsgate Films president Joe Drake and ClassPass CEO Fritz Lanman to help it recruit calendar influencers users can follow.

In Shafi, investors found a consummate extrovert who can empathize with event-goers. He dropped out of Berkeley to build out his recruitment software startup getTalent before selling it to HR platform Dice, where he became VP of product. He started to become disillusioned by tech’s impact on society and almost left the industry before some time at Burning Man rekindled his fever for events.

IRL CEO Abe Shafi

Shafi teamed up with PayPal’s first board member Scott Banister and early social network founder Greg Tseng. Shafi’s first attempt Gather pissed off a ton of people with spammy invites in 2017. By 2018, he’d restarted as IRL, with a focus on building a minimalist calendar where it was easy to create events and invite friends. Evite and Facebook Events were too heavy for making less formal get-togethers with close friends. He wisely chose to geofence his app and launch state by state to maximize density so people would have more pals to plan with.

IRL is now in 14 states, with a modest 1.3 million monthly active users and 175,000 dailies, plus 3 million people on the waitlist. “Fifty percent of all teens in Texas have downloaded IRL. I wanted to focus on the central states, not Silicon Valley,” Shafi explains. Users log in with a phone number or Google, two-way sync their Google Calendar if they have one, and can then manage their existing schedule and create mini-events. The stickiest feature is the ability to group chat with everyone invited so you can hammer out plans. Even users without the app can chime in via text or email. And unlike Facebook, where your mom or boss are liable to see your RSVPs, your calendar and what you’re doing on IRL is always private unless you explicitly share it.

The problem is that most of this could be handled with SMS and a more popular calendar. That’s why IRL is doubling-down on event discovery through influencers, which you can’t do anywhere else at scale. With the new version of the app launching today, you’ll be recommended performers, locations and curators to follow. You’ll see their suggestions in the Explore tab that also includes sub-tabs of Nearby and Trending happenings. There’s also a college-specific feed for users that auth in with their school email address. Curators and event companies like TechCrunch can get their own IRL.com/… URL people can follow more easily than some janky list of events of gallery of flyers on their website. Since pretty much every promoter wants more attendees, IRL’s had little resistance to it indexing all the events from Meetup.com and whatever it can find.

IRL is concentrating on growth for now, but Shafi believes all the intent data about what people want to do could be valuable for directing people to certain restaurants, bars, theaters or festivals, though he vows that “we’re never going to sell your data to advertisers.” For now, IRL is earning money from affiliate fees when people buy tickets or make reservations. Event affiliate margins are infamously slim, but Shafi says IRL can bargain for higher fees as it gains sway over more people’s calendars.

Unfortunately, without reams of personal data and leading artificial intelligence that Facebook owns, IRL’s in-house suggestions via the Explore tab can feel pretty haphazard. I saw lots of mediocre happy hours, crafting nights and community talks that weren’t quite the hip nightlife recommendations I was hoping for, and for now there’s no sorting by category. That’s where Shafi hopes influencers will fill in. And he’s confident that Facebook’s business model discourages it moving deeper into events. “Facebook’s revenue driver is time spent on the app. While meaningful to society, events as a feature is not a primary revenue driver so they don’t get the resources that other features on Facebook get.”

Unfortunately, without reams of personal data and leading artificial intelligence that Facebook owns, IRL’s in-house suggestions via the Explore tab can feel pretty haphazard. I saw lots of mediocre happy hours, crafting nights and community talks that weren’t quite the hip nightlife recommendations I was hoping for, and for now there’s no sorting by category. That’s where Shafi hopes influencers will fill in. And he’s confident that Facebook’s business model discourages it moving deeper into events. “Facebook’s revenue driver is time spent on the app. While meaningful to society, events as a feature is not a primary revenue driver so they don’t get the resources that other features on Facebook get.”

Yet the biggest challenge will be rearranging how people organize their lives. A lot of us are too scatterbrained, lazy or instinctive to make all our plans days or weeks ahead of time and put them on a calendar. The beauty of mobile is that we can communicate on the fly to meet up. “Solving for spontaneity isn’t our focus so far,” Shafi admits. But that’s how so much of our social lives come together.

My biggest problem isn’t finding events to fill my calendar, but knowing which friends are free now to hang out and attend one with me. There are plenty of calendar, event discovery and offline hangout apps. IRL will have to prove they deserve to be united. At least Shafi says it’s a problem worth trying to solve. “I know for a fact that the product of a calendar will outlive me.” He just wants to make it more social first.

Powered by WPeMatico

The quest to create a social auditorium in virtual reality has eaten many VC dollars over the years. While plenty of contenders have emerged, it’s likely Against Gravity’s href=”https://rec.net/”> Rec Room has been the most creative in its approach to capturing a niche market while plotting how to build a sustainable business based on users in VR headsets talking to one another.

The Seattle startup has told TechCrunch exclusively that it has bagged $24 million over two rounds of funding. The studio’s Series A was led by Sequoia and their Series B, which just recently closed, was led by Index Ventures . Against Gravity has a bevy of top investors that also participated in the rounds, including First Round Capital, Maveron, Anorak Ventures, Acequia Capital, Betaworks and DAG Ventures.

The company didn’t break down the specific details of the rounds. Against Gravity was authorized to raise up to $15.4 in its Series B at up to a $126 million post-money valuation, according to Delaware stock authorization docs we got from PitchBook. The company didn’t comment on the valuation.

Rec Room is hardly a household name compared to some major console titles, but among virtual reality users, the title has been a standby known for the diversity of gameplay available inside its walls and its wide support for hardware. Users are able to create experiences or “rooms” that can be accessed by other users. They don’t need any coding knowledge to build these spaces, as creation all happens within the game and can be done by multiple users simultaneously.

Rec Room is also about to surpass one million rooms created by users on the platform. The company says these environments include “sports games, shooters, adventure quests, nightclubs, club houses, and escape rooms.”

While companies like Linden Labs, the creator of Second Life, have focused their VR efforts on realistic but unvarying user-created environments, Against Gravity has seemingly one-upped their strategy by focusing on dynamic gameplay modes where the emphasis is on user interactions as opposed to graphic fidelity.

The Seattle startup, which was founded in 2016, now has 35 employees building out and maintaining Rec Room. The company is playable on a variety of platforms, and is about to add iOS support to its roster, an expansion that could bring a lot more users onto the VR-centric platform.

Rec Room’s content isn’t monetized too aggressively at the moment. CEO Nick Fajt thinks some of the user-generated experiences are going to offer an interesting opportunity down the road, prompting users to spend in-game tokens on more than just upgrades to the platform’s Playmobil-like avatars.

“I think a direction that we’re actually excited about is that we want to let the users creating some of this content charge tokens to play them,” Fajt tells TechCrunch. “I think that’s one that we’re kind of on the cusp of doing and we’re hoping to get that out later this year.”

For Against Gravity, timing has always been a key consideration for expansion, especially inside the slow-growing VR market, which has only recently seemed to hit a stride. I chatted with Fajt back in 2017, and he told me that the key for VR startups surviving was staying lean and biding their time until standalone mobile headsets with positional tracking and motion controllers were released. Facebook’s Oculus Quest headset, which came out less than a month ago, is perhaps the first clear device to fit that vision.

One of Facebook’s head AR/VR executives shared earlier this week that more than $5 million in Quest content had been sold in the company’s store in the first two weeks after the device’s launch. That’s a major development for an industry that hasn’t seen many smash hits, but for free-to-play game makers like Against Gravity, which has now raised $29 million to date, there’s plenty of maturation in the VR market that still needs to happen.

Powered by WPeMatico

RealityEngines.AI, a research startup that wants to help enterprises make better use of AI, even when they only have incomplete data, today announced that it has raised a $5.25 million seed funding round. The round was led by former Google CEO and Chairman Eric Schmidt and Google founding board member Ram Shriram. Khosla Ventures, Paul Buchheit, Deepchand Nishar, Elad Gil, Keval Desai, Don Burnette and others also participated in this round.

The fact that the service was able to raise from this rather prominent group of investors clearly shows that its overall thesis resonates. The company, which doesn’t have a product yet, tells me that it specifically wants to help enterprises make better use of the smaller and noisier data sets they have and provide them with state-of-the-art machine learning and AI systems that they can quickly take into production. It also aims to provide its customers with systems that can explain their predictions and are free of various forms of bias, something that’s hard to do when the system is essentially a black box.

As RealityEngines CEO Bindu Reddy, who was previously the head of products for Google Apps, told me, the company plans to use the funding to build out its research and development team. The company, after all, is tackling some of the most fundamental and hardest problems in machine learning right now — and that costs money. Some, like working with smaller data sets, already have some available solutions like generative adversarial networks that can augment existing data sets and that RealityEngines expects to innovate on.

Reddy is also betting on reinforcement learning as one of the core machine learning techniques for the platform.

Once it has its product in place, the plan is to make it available as a pay-as-you-go managed service that will make machine learning more accessible to large enterprise, but also to small and medium businesses, which also increasingly need access to these tools to remain competitive.

Powered by WPeMatico

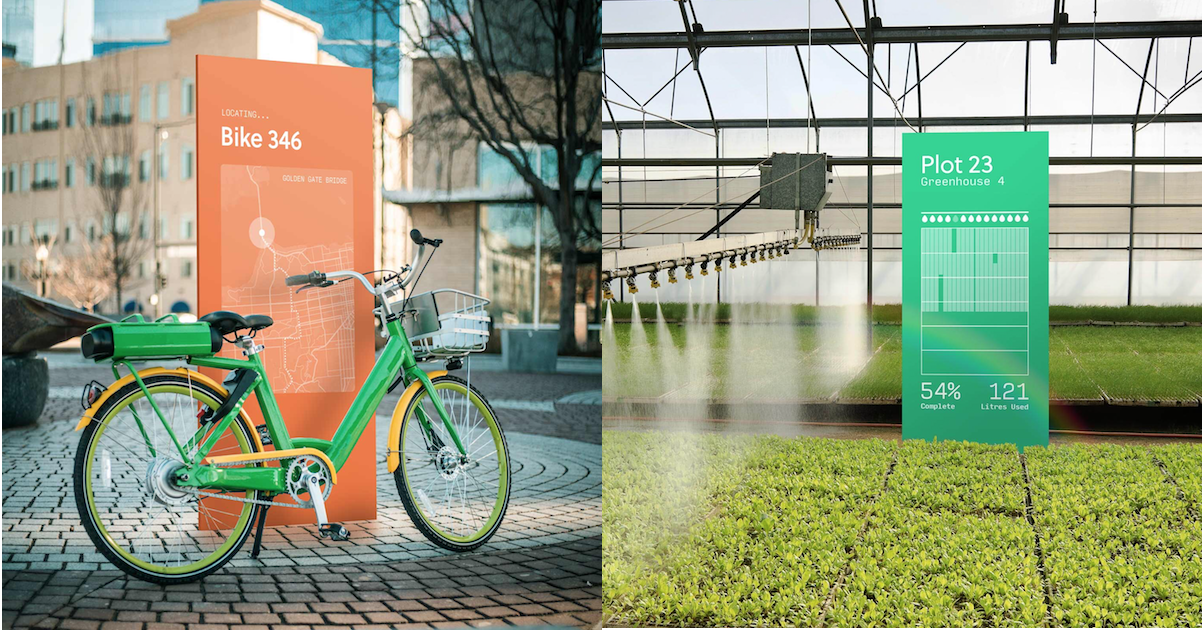

With 200X the range of Wi-Fi at 1/1000th of the cost of a cellular modem, Helium’s “LongFi” wireless network debuts today. Its transmitters can help track stolen scooters, find missing dogs via IoT collars and collect data from infrastructure sensors. The catch is that Helium’s tiny, extremely low-power, low-data transmission chips rely on connecting to P2P Helium Hotspots people can now buy for $495. Operating those hotspots earns owners a cryptocurrency token Helium promises will be valuable in the future…

The potential of a new wireless standard has allowed Helium to raise $51 million over the past few years from GV, Khosla Ventures and Marc Benioff, including a new $15 million Series C round co-led by Union Square Ventures and Multicoin Capital. That’s in part because one of Helium’s co-founders is Napster inventor Shawn Fanning. Investors are betting that he can change the tech world again, this time with a wireless protocol that like Wi-Fi and Bluetooth before it could unlock unique business opportunities.

Helium already has some big partners lined up, including Lime, which will test it for tracking its lost and stolen scooters and bikes when they’re brought indoors, obscuring other connectivity, or their battery is pulled, out deactivating GPS. “It’s an ultra low-cost version of a LoJack” Helium CEO Amir Haleem says.

InvisiLeash will partner with it to build more trackable pet collars. Agulus will pull data from irrigation valves and pumps for its agriculture tech business. Nestle will track when it’s time to refill water in its ReadyRefresh coolers at offices, and Stay Alfred will use it to track occupancy status and air quality in buildings. Haleem also imagines the tech being useful for tracking wildfires or radiation.

Haleem met Fanning playing video games in the 2000s. They teamed up with Fanning and Sproutling baby monitor (sold to Mattel) founder Chris Bruce in 2013 to start work on Helium. They foresaw a version of Tile’s trackers that could function anywhere while replacing expensive cell connections for devices that don’t need high bandwith. Helium’s 5 kilobit per second connections will compete with SigFox, another lower-power IoT protocol, though Haleem claims its more centralized infrastructure costs are prohibitive. It’s also facing off against Nodle, which piggybacks on devices’ Bluetooth hardware. Lucky for Helium, on-demand rental bikes and scooters that are perfect for its network have reached mainstream popularity just as Helium launches six years after its start.

Helium says it already pre-sold 80% of its Helium Hotspots for its first market in Austin, Texas. People connect them to their Wi-Fi and put it in their window so the devices can pull in data from Helium’s IoT sensors over its open-source LongFi protocol. The hotspots then encrypt and send the data to the company’s cloud that clients can plug into to track and collect info from their devices. The Helium Hotspots only require as much energy as a 12-watt LED light bulb to run, but that $495 price tag is steep. The lack of a concrete return on investment could deter later adopters from buying the expensive device.

Only 150-200 hotspots are necessary to blanket a city in connectivity, Haleem tells me. But because they need to be distributed across the landscape, so a client can’t just fill their warehouse with the hotspots, and the upfront price is expensive for individuals, Helium might need to sign up some retail chains as partners for deployment. As Haleem admits, “The hard part is the education.” Making hotspot buyers understand the potential (and risks) while demonstrating the opportunities for clients will require a ton of outreach and slick marketing.

Without enough Helium Hotspots, the Helium network won’t function. That means this startup will have to simultaneously win at telecom technology, enterprise sales and cryptocurrency for the network to pan out. As if one of those wasn’t hard enough.

Powered by WPeMatico

As studies show that early diagnosis and preventative therapies can help prevent the onset of Alzheimer’s, startups that are working to diagnose the disease earlier are gaining more attention and funding.

That’s a boon to companies like Neurotrack, which closed on $21 million in new financing led by the company’s previous investor, Khosla Ventures, with participation from new investors Dai-ichi Life and SOMPO Holdings.

Last year, the Japanese life insurance company Dai-ichi Life partnered with Neurotrack to roll out a cognitive assessment tool to the company’s customers in Japan.

And earlier this year, the Japanese health insurer SOMPO conducted a 16-week pilot with Neurotrack, where more than 550 of SOMPO’s employees took Neurotrack’s test and followed the Memory Health Program for four months. Neurotrack and SOMPO are now working to deepen and extend their partnership.

“As the global crisis around Alzheimer’s continues to grow, the private sector is joining government and nonprofits to address the problem in their markets. In Japan, for example, traditional insurance companies are developing novel solutions that incorporate Neurotrack’s products to advance better memory health among its population,” said Elli Kaplan, Neurotrack co-founder and CEO. “These partnerships are innovative models that we hope to replicate in other markets, enabling traditional insurance companies to create new markets while helping to address the Alzheimer’s crisis. And now they’re also investing in our company, so these companies have two ways of doing well by doing good.”

Neurodegenerative disorders are becoming a more serious issue for the island nation — and the rest of the world. In fact, over the weekend the G20 first raised the possibility that aging populations could be a global risk.

“Most of the G20 nations already experience or will experience ageing,” Bank of Japan governor Haruhiko Kuroda, told reporters from Agence France Presse. “We need to discuss problems that arise with societal ageing and how to deal with them.”

In the U.S., the estimated cost of caring for Americans with Alzheimer’s and other dementias was an estimated $277 billion in 2018, according to a study cited by WebMD. Roughly $186 billion of those costs are borne by Medicare and Medicaid, with another $60 billion in payments coming out-of-pocket. That number could top $1.1 trillion by 2050, according to the same report.

Neurotrack uses cognitive assessments that follow eye movements using the camera on a computer or mobile phone to create a baseline for cognitive functions. The company then uses a combination of brain training and diet, exercise and sleep adjustments to try to improve cognitive function and health.

Its technology is one of several different approaches startups are taking to try to provide early diagnoses and potential preventative measures against the disease.

MyndYou, another company tackling neurodegenerative diagnostics, uses an app to monitor movement among its users. The company assesses that data to determine whether there may be any issues related to cognitive function. It recently partnered with the Japanese company Mizuho to test its efficacy among Japan’s aging population.

Then there’s Altoida, another startup that launched recently to tackle the cognitive assessment market. It uses augmented reality and a series of memory tests to assess brain function and attempt to detect neurodegeneration.

Neurotrack’s technology, based on research from Emory University, has managed to attract more than just Japanese corporations. Previous investors like Sozo Ventures, Rethink Impact, AME Cloud Partners and Salesforce founder Marc Benioff have also thrown cash behind the company.

To date, the company has raised more than $50 million, including $6.8 million in grants from the National Institutes of Health and National Institute of Aging.

The company said its new investment will be used to develop new partnerships in additional global markets and continue research and development.

“One can now feel empowered to test for potential memory decline, given that Neurotrack’s Memory Health Program can help stave off cognitive decline. This fully integrated platform enables users to assess the state of their memory, reduce future risk for decline, and monitor progress in order to take better control of one’s memory health. We combine these tools with deep analytics to further target and personalize, creating a very powerful precision medicine solution,” said Kaplan. “Just as when you go on a diet, you use a scale to provide evidence that you’re losing weight. Neurotrack now has the equivalent of both a scale to measure and the Memory Health Program for cognitive health. This is a game-changer for dementia risk.”

Japan has national efforts targeting a reduction in the onset of dementia in 6% of people in their 70s by 2025 (the country has the world’s largest population of the elderly, with more than 20% of the country over the age of 65). Roughly 13 million people are expected to develop Alzheimer’s in Japan by 2025.

Part of the company’s success in fundraising comes from the results of a preliminary study that showed improved cognitive functions for people diagnosed with some decline in cognitive function after a year of using Neurotrack’s Memory Health Program. The company claims it has the the first fully integrated, clinically validated platform that can assess a person’s cognition through its cognitive assessment — which can predict conversion from healthy to mild cognitive impairment (MCI) or MCI to Alzheimer’s disease within three years at 89% accuracy, and within six years at 100% accuracy.

While that kind of assessment is good, Alzheimer’s symptoms can begin to appear as early as 25 years before the onset of the disease. So there’s still work to be done.

“Neurotrack has built an incredible integrative platform that is transforming our battle with Alzheimer’s,” said Jenny Abramson, founder and managing partner of Rethink Impact. “Elli’s two decades of experience in the private sector and in government are helping her scale this solution to the millions of people suffering from cognitive decline around the world. We couldn’t be more excited to continue to support Neurotrack, given both the financial opportunity and the impact they are already having on this critical disease.”

Powered by WPeMatico

Andreessen Horowitz <3 Latin American startups.

Latin America is the only region outside of the U.S. where the venture firm is routinely investing capital, and it just made another commitment, doubling down on its early-stage support for the point-of-sale lending startup ADDI.

ADDI picked up $12.5 million in new financing in April of this year as the company looks to expand its lending services online.

For an American audience, the closest corollary to what ADDI is up to is likely Affirm, the point-of-sale lender that’s raised a ton of cash and come in for some (valid) criticism for its basic business model.

Like Affirm, ADDI lets its borrowers apply for credit at the moment of purchase. The company likens its service to the layaway and credit plans that already exist in Colombia — but involve pretty onerous requirements to use. Company co-founder Santiago Suarez and Andreessen Horowitz general partner Angela Strange both commented on how, in some cases, Colombian shoppers have to have three people vouch for a borrower before a store will issue credit or agree to a layaway plan.

The difference between an ADDI loan — or any loan — and layaway is that an installment payment plan doesn’t charge interest (and even with the fees that installment plans do charge, they are often still cheaper than taking out a loan).

But financial products are coming for consumers in Latin America whether those buyers like it or not — and for the most part, it seems they do like it.

Historically, only the wealthiest clientele in Latin America received anything resembling the kinds of financial products that are more widely available in the United States, according to Strange. And the investment in ADDI is just part of her firm’s thesis in trying to make more services more broadly available in a region where a technological transformation is creating unprecedented opportunities for challengers.

That assessment is what drew Santiago Suarez back to Latin America only two years ago. A former executive at Lending Club who previously had worked as the head of New Product Development and Emerging Services at J.P. Morgan, Suarez saw the tremendous growth happening in Latin America and returned to Colombia to see if he could bring some much needed services to his home country.

Suarez partnered with his childhood friend, Elmer Ortega, who was working as the chief technology officer of the local hedge fund where he had previously been employed as a derivatives trader before learning how to code.

Together, the two men, who had known each other since they were five years old, set out to transform how credit was offered in retail shops. It’s an industry that Suarez had known well since his parents had owned stores.

“In the U.S. there are all of these gaps that fintech companies are filling,” says Suarez. “But the gaps in Latin America are bigger.”

Suarez and Ortega incorporated the company in September 2018, around the same time they raised $2.3 million from the regional investment firm, Monashees, Andreessen and Village Global . They then raised another $1.5 million in an internal round of financing before closing the most recent funding.

The company offers loans at annual percentage rates ranging from 19.99% to 28.90%. The company started with a digital solution for brick and mortar retailers because 90% of retail in Colombia still happens offline.

Although it’s in its early days, the company has already originated 10,000 borrowers and typically loans out roughly $500 since it launched on February 22, according to Suarez. He declined to comment on the company’s default rate on loans.

Now with 40 employees on staff, the company is looking to bring its lending tool to more e-commerce and physical retailers, according to Suarez. And despite the threat of cyclical political turmoil, Suarez says there’s no better time to be investing in Colombia.

“It’s the most stable country outside of Chile… Way more stable than Brazil, way more stable than Argentina and way more stable than Mexico,” Suarez says. “What we’re looking at is more than cyclical instability… those things go beyond that. Nubank was able to build a multibillion business in the worst political and economic crisis in Brazil’s history. I think Colombia is an incredibly attractive space with a deep talent pool.”

Powered by WPeMatico

Workhorse Group, the electric vehicle company that grabbed headlines last month over a proposed deal to buy General Motors’ Lordstown, Ohio factory, has raised $25 million from a group of unnamed investors.

The money will not go toward the factory. Instead, it will be used for the more pressing matter of keeping the company running. Under terms of the deal, investors will receive preferred stock and warrants to buy shares. An annual dividend will be paid out in shares of Workhorse stock.

The Cincinnati-based company is small, with fewer than 100 employees. Its biggest problem isn’t ideas or even product pipeline; it’s capital.

Workhorse has struggled financially at various points since its founding in 1998. The company reported just $364,000 in revenue in the first quarter, down from $560,000 in the same period last year. As of March 30, 2019, the company had cash, cash equivalents and short-term investments of $2.8 million, compared to $1.5 million as of December 31, 2018.

Workhorse borrowed $35 million from hedge fund Marathon Asset Management earlier this year.

Workhorse, which was once owned by Navistar and sold in 2013 to AMP Holding, has a customer pipeline for its electric trucks that includes UPS. It’s also hoping to win a contract with the United States Postal Service.

But it needs capital to scale up. The funding gives Workhorse the capital to deliver on its existing backlog and produce its N-GEN delivery van, according to CEO Duane Hughes.

“We now have all necessary pieces in place to bridge Workhorse into full-scale N-GEN production and are looking forward to commencing the manufacturing process, in earnest, during the fourth quarter of this year,” Hughes said in a statement.

Meanwhile, GM has been in talks since early 2019 to sell its Lordstown vehicle factory in Ohio to Workhorse Group. GM’s Lordstown factory stopped producing the automaker’s Chevrolet Cruze in March; without any new vehicles slated for the factory, workers were laid off.

Under the potential Lordstown deal, a new entity led by Workhorse founder Steve Burns would acquire the facility. Workhorse would hold a minority interest in the new entity. This new entity would allow Workhorse to seek new equity without diluting existing shareholder value.

Workhorse would build a commercial electric pickup at the plant if the deal goes through, Hughes has said.

Powered by WPeMatico

Just a few months ago, Innoviz became one of the better capitalized lidar startups when it announced it had raised $132 million in a Series C funding round. But that wouldn’t be the end of it.

The company kept the funding doors propped open and ultimately captured another $38 million from investors. The round has closed at $170 million, Innoviz said Monday.

Initial investors in the Series C round included China Merchants Capital, Shenzhen Capital Group, New Alliance Capital, Israeli institutional investors Harel Insurance Investments and Financial Services and Phoenix Insurance Company. The newest investors, and those responsible for the fresh injection of $38 million, were not named.

The close of the Series C round brings Innoviz’s total funding to $252 million.

The lidar industry is brimming with startups — about 70 according to industry experts — that see an opportunity to sell their tech to companies developing autonomous vehicles. Lidar measures distance using laser light to generate highly accurate 3D maps of the world around the car. It’s considered by most in the self-driving car industry a key piece of technology required to safely deploy robotaxis and other autonomous vehicles.

Innoviz is aiming for this very space with its solid-state lidar sensors and perception software for autonomous vehicles. The company contends that solid-state lidar technology is more reliable over time because of the lack of moving parts.

Innoviz says that its perception software is what helps it stand out in a sea of lidar startups. The perception software identifies, classifies, segments and tracks objects to give autonomous vehicles a better understanding of the 3D driving scene.

The company plans to use the funding, in part, to further develop the perception software piece. That includes bringing on two computer vision experts, Dr. Raja Giryes and Or Shimshi, as “strategic collaborators.”

The funding will also be used to help Innoviz scale up and eventually mass produce its products. Its automotive-grade lidar product called InnovizOne is entering series production in 2021 for global automakers. The company has an existing solid-state lidar (InnovizPro) that is available now.

Innoviz’s strategy has been to partner with a number of OEMs and Tier 1 suppliers, such as Magna, HARMAN, HiRain Technologies and Aptiv, and to package perception software with its lidar sensors and offer it as a complete unit for companies developing autonomous vehicle technology.

Innoviz has locked in several key customers, notably BMW. The automaker picked Innoviz’s tech for series production of autonomous vehicles starting in 2021.

Powered by WPeMatico