Recent Funding

Auto Added by WPeMatico

Auto Added by WPeMatico

Vectra, a seven-year-old company that helps customers detect intrusions at the network level, whether in the cloud or on premises, announced a $100 million Series E funding round today led by TCV. Existing investors, including Khosla Ventures and Accel, also participated in the round, which brings the total raised to more than $200 million, according to the company.

As company CEO Hitesh Sheth explained, there are two primary types of intrusion detection. The first is end point detection and the second is his company’s area of coverage, network detection and response, or NDR. He says that by adding a layer of artificial intelligence, it improves the overall results.

“One of the keys to our success has been applying AI to network traffic, the networking side of NDR, to look for the signal in the noise. And we can do this across the entire infrastructure, from the data center to the cloud all the way into end user traffic including IoT,” he explained.

He said that as companies move their data to the cloud, they are looking for ways to ensure the security of their most valuable data assets, and he says his company’s NDR solution can provide that. In fact, securing the cloud side of the equation is one of the primary investment focuses for this round.

Tim McAdam, from lead investor TCV, says that the AI piece is a real differentiator for Vectra and one that attracted his firm to invest in the company. He said that while he realized that AI is an overused term these days, after talking to 30 customers he heard over and over again that Vectra’s AI-driven solution was a differentiator over competing products. “All of them have decided to standardize on the Vectra Cognito because to a person, they spoke of the efficacy and the reduction of their threat vectors as a result of standardizing on Vectra,” McAdam told TechCrunch.

The company was founded in 2012 and currently has 240 employees. That is expected to double in a year to 18 months with this funding.

Powered by WPeMatico

The rising popularity of omni-channel commerce — selling to customers wherever they happen to be spending time online — has spawned an army of shopping tools and platforms that are giving legacy retail websites and marketplaces a run for their money. Now, one of the faster growing of these is announcing an impressive round of funding to stay on trend and continue building its business.

Depop, a London startup that has built an app for individuals to post and sell (and mainly resell) items to groups of followers by way of its own and third-party social feeds, has closed a Series C round of $62 million led by General Atlantic. Previous investors HV Holtzbrinck Ventures, Balderton Capital, Creandum, Octopus Ventures, TempoCap and Sebastian Siemiatkowski, founder and CEO of Swedish payments company Klarna, all also participated.

The funding will be used in a couple of areas. First, to continue building out the startup’s technology — building in more recommendation and image detection algorithms is one focus.

And second, to expand in the U.S., which CEO Maria Raga said is on its way to being Depop’s biggest market, with 5 million users currently and projections of that going to 15 million in the next three years.

That’s despite strong competition from other peer-to-peer selling platforms like Vinted and Poshmark, and social platforms that have been doubling down on commerce, like Instagram and Pinterest. On the other hand, the opportunity is big: A recent report from ThredUp, another second-hand clothes sales platform, estimated that the total resale market is expected to more than double in value to $51 billion from $24 billion in the next five years, accounting for 10% of the retail market.

Prior to this, Depop had raised just under $40 million. It’s not disclosing its valuation except to say it’s a definite up round. “I’m extremely happy,” Raga said when I asked her about it this week.

The funding comes on the heels of strong growth and strong focus for the startup.

If “social shopping,” “selling to groups of followers,” and the “use of social feeds” (or my headline…) didn’t already give it away, Depop is primarily aimed at millennial and Gen Z consumers. The company said that about 90% of its active users are under the age of 26, and in its home market of the U.K. it’s seen huge traction, with one-third of all 16 to 24-year-olds registered on Depop.

Its rise has dovetailed with some big changes that the fashion industry has undergone, said Raga. “Our mission is to redefine the fashion industry in the same way that Spotify did with music, or Airbnb did with travel accommodation,” she said.

“The fashion world hasn’t really taken notice” of how things have evolved at the consumer end, she continued, citing concerns with sustainability (and specifically the waste in the fashion industry), how trends are set today (no longer dictated by brands but by individuals) and how anything can be sold by anyone, from anywhere, not just from a store in the mall, or by way of a well-known brand name website. “You can now start a fashion business from your bedroom,” she added.

For this generation of bedroom entrepreneurs, social apps are not a choice, but simply the basis and source of all their online engagement. Depop notes that the average daily user opens the app “several times per day” both to browse things, check up on those that they follow, to message contacts and comment on items and, of course, to buy and sell. On average, Depop users collectively follow and message each other 85 million times each month.

This rapid uptake and strong usage of the service has driven it to 13 million users, revenue growth of 100% year-on-year for the past few years and gross merchandise value of more than $500 million since launch. (Depop takes a 10% cut, which would work out to total revenues of about $50 million for the period.)

When we first wrote about Depop back in 2015 (and even prior to that), the startup and app were primarily aiming to provide a way for users to quickly snap pictures of their own clothes and other used items to post them for sale, one of a wave of flea-market-inspired apps that were emerging at that time. (It also had an older age group of users, extending into the mid-thirties.)

Fast-forward a few years and Depop’s growth has been boosted by an altogether different trend: the emergence of people who go to great efforts to buy limited editions of collectable, or just currently very hot, items, and then resell them to other enthusiasts. The products might be lightly used, but more commonly never used, and might include limited-edition sneakers, expensive t-shirts released in “drops” by brands themselves or items from one-off capsule collections.

It may have started as a way of decluttering by shifting unused items of your own, but it’s become a more serious endeavor for some. Raga notes that Depop’s top sellers are known to clear $100,000 annually. “It’s a real business for them,” she said.

And Depop still sells other kinds of goods, too. These pressed-flower phone cases, for example, have seen a huge amount of traction on Twitter, as well as in the app itself in the last week:

Ordered a new phone case off this woman from depop who makes them with pressed flowers n she sent me this :’) pic.twitter.com/oBtRtQ1MJc

— megan (@__meganbenson) June 1, 2019

Alongside its own app and content shared from there to other social platforms, Depop extends the omnichannel approach with a selection of physical stores, too, to showcase selected items.

The startup has up to now taken a very light-touch approach to the many complexities that can come with running an e-commerce business — a luxury that’s come to it partly because its sellers and buyers are all individuals, mostly younger individuals and, leaning on the social aspect, the expectation that people will generally self-police and do right by each other, or risk getting publicly called out and lose business as a result.

I think that as it continues to grow, some of that informality might need to shift, or at least be complemented with more structure.

In the area of shipping, buyers generally do not seem to expect the same kind of shipping tracking or delivery professionals appearing at their doors. Sellers handle all the shipping themselves, which sometimes means that if the buyer and seller are in the same city, an in-person delivery of an item is not completely unheard of. Raga notes that in the U.S. the company has now at least introduced pre-paid envelopes to help with returns (not so in the U.K.).

Payments come by way of PayPal, with no other alternatives at the moment. Depop’s 10% cut on transactions is in addition to PayPal’s fees. But having the Klarna founder as a backer could pave the way for other payment methods coming soon.

One area where Depop is trying to get more focused is in how its activities line up with state laws and regulations.

For example, it currently already proactively looks for and takes down posts offering counterfeit or other illicit goods on the platform, but also relies on people or brands reporting these. (Part of the tech investment into image detection will be to help improve the more automated algorithms, to speed up the rate at which illicit items are removed.)

Then there is the issue of tax. If top sellers are clearing $100,000 annually, there are taxes that will need to be paid. Raga said that right now this is handed off to sellers to manage themselves. Depop does send alerts to sellers, but it’s still up to the sellers themselves to organise sales tax and other fees of that kind.

“We are very close to our top sellers,” Raga said. “We’re in contact on a daily basis and we inform of what they have to do. But if they don’t, it’s their responsibility.”

While there is a lot more development to come, the core of the product, the approach Depop is taking and its success so far have been the winning combination to bring on this investment.

“Technology continues to transform the retail landscape around the world and we are incredibly excited to be investing in Depop as it looks to capture the huge opportunity ahead of it,” said Melis Kahya, General Atlantic head of Consumer for EMEA, in a statement. “In a short space of time the team has developed a truly differentiated platform and globally relevant offering for the next generation of fashion entrepreneurs and consumers. The organic growth generated in recent years is a testament to the impact they are having and we look forward to working with the team to further accelerate the business.”

Powered by WPeMatico

FoodShot Global, a prize platform devoted to transforming the world’s food and agriculture industries, has awarded the first round of prizes for its Innovating Soil 3.0 competition.

Trace Genomics, a startup developing an analytics service for soil health to optimize the use of farmland, has received an undisclosed investment from FoodShot’s investment partner, S2G Ventures.

Additional awards of $250,000 were given to Keith Paustian to speed up the global adaptation of his COMET tool systems, which provide farmers with metrics and information on regenerative farming; and Gerlinde De Deyn, for her work studying biodiversity over time.

A $35,000 award was given to Dorn Cox to support the development of his open-source data project that will look to catalog knowledge around agriculture techniques and distribute that information freely to a global community of farmers.

“I founded FoodShot Global envisioning a new way to harness the power of innovation, capital, and the collaborative spirit of the world’s leading stakeholders to effect change,” said FoodShot Global founder and chairman Victor Friedberg. “We chose to start with soil because any future that imagines 10 billion people eating healthy and sustainably with equal access will require healthy soil. The three people we announced today are all groundbreakers whose inspired work lays the foundation for the next generation of solutions to the urgency we now face as a civilization. I couldn’t be more impressed and inspired by these inaugural FoodShot Global award winners and look forward to sharing what they’re doing with a larger audience.”

Powered by WPeMatico

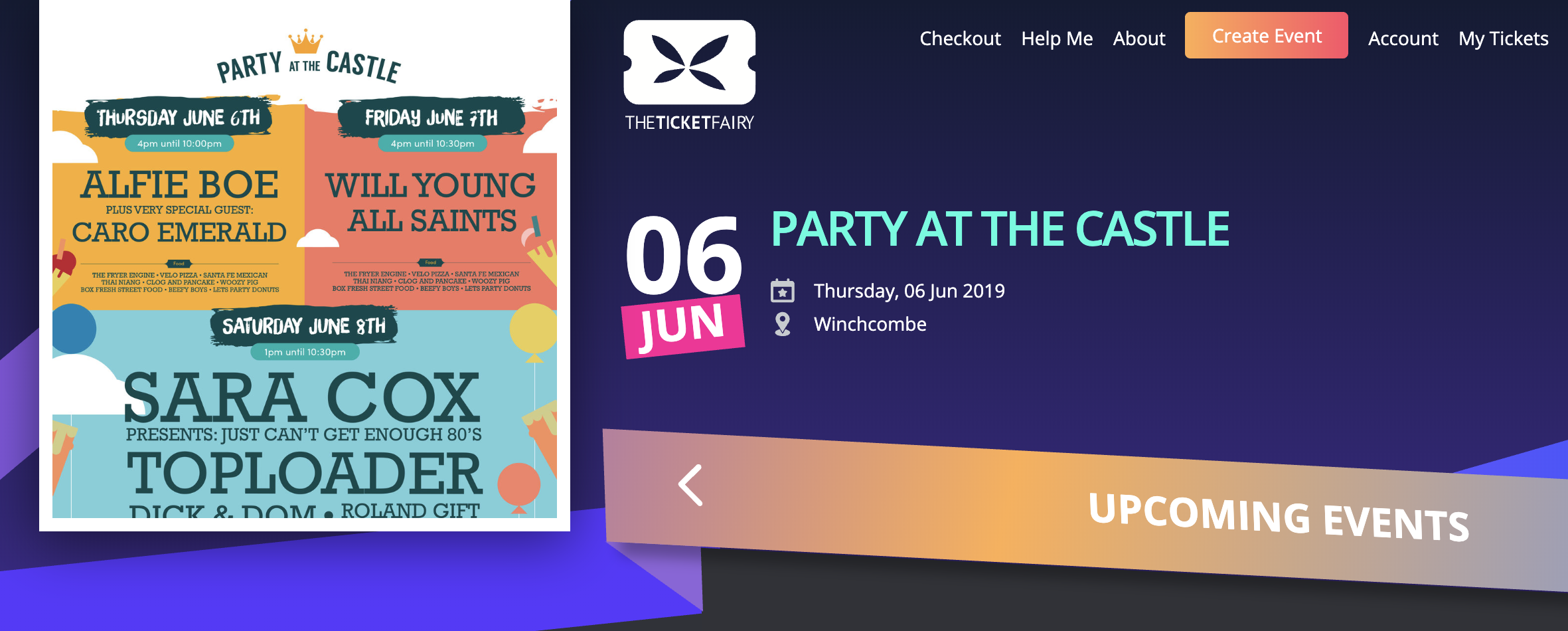

Ticketmaster’s dominance has led to ridiculous service fees, scalpers galore and exclusive contracts that exploit venues and artists. The moronic approval of venue operator and artist management giant Live Nation’s merger with Ticketmaster in 2010 produced an anti-competitive juggernaut. It pressures venues to sign ticketing contracts under veiled threat that artists would otherwise be routed to different concert halls. Now it’s become difficult for venues, artists and fans to avoid Ticketmaster, which charges fees as high as 50% that many see as a ripoff.

The Ticket Fairy wants to wrestle away from Ticketmaster control of venues while giving fans ways to earn tickets for referring their friends. The startup is doing that by offering the most technologically advanced ticketing platform that not only handles sales and check-ins, but acts as a full-stack Salesforce for concerts that can analyze buyers and run ad campaigns while thwarting scalpers. Co-founder Ritesh Patel says The Ticket Fairy has increased revenue for event organizers by 15% to 25% during its private beta focused on dance music festivals.

Now after 850,000 tickets sold, it’s officially launching its ticketing suite and actively poaching venues from Eventbrite as it moves deeper into esports and conventions. With a little more scale, it will be ready to challenge Ticketmaster for lucrative clients.

Ritesh’s combination of product and engineering skills, rapid progress and charismatic passion for live events after throwing 400 of his own has attracted an impressive cadre of angel investors. They’ve delivered a $2.5 million seed round for Ticket Fairy, adding to its $485,000 pre-seed from angels like Twitch/Atrium founder Justin Kan, Twitch COO Kevin Lin and Reddit CEO Steve Huffman.

The new round includes YouTube founder Steve Chen, former Kleiner Perkins partner (and Mark’s sister) Arielle Zuckerberg and funds like 500 Startups, ex-Uber angels Fantastic Ventures, G2 Ventures, Tempo Ventures and WeFunder. It’s also scored music industry angels like Serato DJ hardware CEO AJ Bertenshaw, Spotify’s head of label licensing Niklas Lundberg, and celebrity lawyer Ken Hertz, who reps Will Smith and Gwen Stefani.

“The purpose of starting The Ticket Fairy was not to be another Eventbrite, but to reduce the risk of the person running the event so they can be profitable. We’re not just another shopping cart,” Patel says. The Ticket Fairy charges a comparable rate to Eventbrite’s $1.59 + 3.5% per ticket plus payment processing that brings it closer to 6%, but Patel insists it offers far stronger functionality.

Constantly clad in his golden disco hoodie over a Ticket Fairy t-shirt, Patel lives his product, spending late nights dancing and taking feedback at the events his clients host. He’s been a savior of SXSW the past two years, injecting the aging festival that shuts down at 2am with multi-night after-hours raves. Featuring top DJs like Pretty Lights in creative locations cab drivers don’t believe are real, The Ticket Fairy’s parties have won the hearts of music industry folks.

The Ticket Fairy co-founders. Center and inset left: Ritesh Patel. Inset right: Jigar Patel

Now the Y Combinator startup hopes its ticketing platform will do the same thanks to a slew of savvy features:

Still, the biggest barrier to adoption remains the long exclusive contracts Ticketmaster and other giants like AEG coerce venues into in the U.S. Abroad, venues typically work with multiple ticket promoters who sell from the same pool, which is why 80% of The Ticket Fairy’s business is international right now. In the U.S., ticketing is often handled by a single company, except for the 8% of tickets artists can sell however they want. That’s why The Ticket Fairy has focused on signing up non-traditional venues for festivals, trade convention halls, newly built esports arenas, as well as concert halls.

“Coming from the event promotion background, we understand the risk event organizers take in creating these experiences,” The Ticket Fairy’s co-founder and Ritesh’s brother Jigar Patel explains. “The odds of breaking even are poor and many are unable to overcome those challenges, but it is sheer passion that keeps them going in the face of financial uncertainty and multi-year losses.” As competitors’ contracts expire, The Ticket Fairy hopes to swoop in by dangling its sales-boosting tech. “We get locked out of certain things because people are locked in a contract, not because they don’t want to use our system.”

The live music industry can be brutal, though. Events can have slim margins, organizers are loathe to change their process and it’s a sales-heavy process convincing them to try new software. But while the record business has been redefined by streaming, ticketing looks a lot like it did a decade ago. That makes it ripe for disruption.

“The events industry is more important than ever, with artists making the bulk of their income from touring instead of record sales, and demand from fans for live experiences is increasing at a global level,” Jigar concludes. “When events go out of business, everybody loses, including artists and fans. Everything we do at The Ticket Fairy has that firmly in mind – we are here to keep the ecosystem alive.”

Powered by WPeMatico

The big social networks and video games have failed to prioritize user well-being over their own growth. As a result, society is losing the battle against bullying, predators, hate speech, misinformation and scammers. Typically when a whole class of tech companies have a dire problem they can’t cost-effectively solve themselves, a software-as-a-service emerges to fill the gap in web hosting, payment processing, etc. So along comes AntiToxin Technologies, a new startup that wants to help web giants fix their abuse troubles with its safety-as-a-service.

It all started on Minecraft. AntiToxin co-founder Ron Porat is cybersecurity expert who’d started ad blocker Shine. Yet right under his nose, one of his kids was being mercilessly bullied on the hit children’s game. If even those most internet-savvy parents were being surprised by online abuse, Porat realized the issue was bigger than could be addressed by victims trying to protect themselves. The platforms had to do more, research confirmed.

A recent Ofcom study found almost 80% of children had a potentially harmful online experience in the past year. Indeed, 23% said they’d been cyberbullied, and 28% of 12 to 15-year-olds said they’d received unwelcome friend or follow requests from strangers. A Ditch The Label study found of 12 to 20-year-olds who’d been bullied online, 42% were bullied on Instagram.

Unfortunately, the massive scale of the threat combined with a late start on policing by top apps makes progress tough without tremendous spending. Facebook tripled the headcount of its content moderation and security team, taking a noticeable hit to its profits, yet toxicity persists. Other mainstays like YouTube and Twitter have yet to make concrete commitments to safety spending or staffing, and the result is non-stop scandals of child exploitation and targeted harassment. Smaller companies like Snap or Fortnite-maker Epic Games may not have the money to develop sufficient safeguards in-house.

“The tech giants have proven time and time again we can’t rely on them. They’ve abdicated their responsibility. Parents need to realize this problem won’t be solved by these companies” says AntiToxin co-founder and CEO Zohar Levkovitz, who previously sold his mobile ad company Amobee to Singtel for $321 million. “You need new players, new thinking, new technology. A company where ‘Safety’ is the product, not an after-thought. And that’s where we come-in.” The startup recently raised a multimillion-dollar seed round from Mangrove Capital Partners and is allegedly prepping for a double-digit millions Series A.

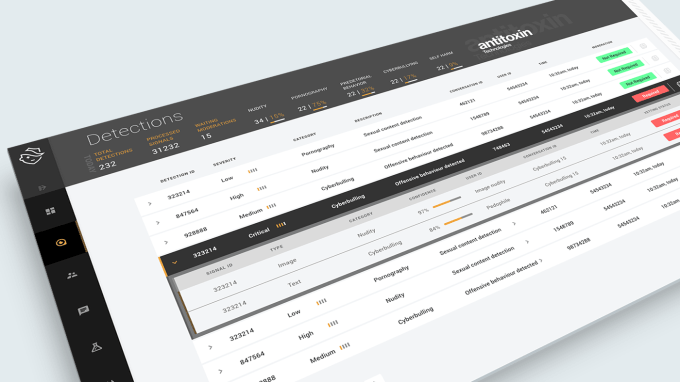

AntiToxin’s technology plugs into the backends of apps with social communities that either broadcast or message with each other and are thereby exposed to abuse. AntiToxin’s systems privately and securely crunch all the available signals regarding user behavior and policy violation reports, from text to videos to blocking. It then can flag a wide range of toxic actions and let the client decide whether to delete the activity, suspend the user responsible or how else to proceed based on their terms and local laws.

Through the use of artificial intelligence, including natural language processing, machine learning and computer vision, AntiToxin can identify the intent of behavior to determine if it’s malicious. For example, the company tells me it can distinguish between a married couple consensually exchanging nude photos on a messaging app versus an adult sending inappropriate imagery to a child. It also can determine if two teens are swearing at each other playfully as they compete in a video game or if one is verbally harassing the other. The company says that beats using static dictionary blacklists of forbidden words.

AntiToxin is under NDA, so it can’t reveal its client list, but claims recent media attention and looming regulation regarding online abuse has ramped up inbound interest. Eventually the company hopes to build better predictive software to identify users who’ve shown signs of increasingly worrisome behavior so their activity can be more closely moderated before they lash out. And it’s trying to build a “safety graph” that will help it identify bad actors across services so they can be broadly deplatformed similar to the way Facebook uses data on Instagram abuse to police connected WhatsApp accounts.

“We’re approaching this very human problem like a cybersecurity company, that is, everything is a Zero-Day for us” says Levkowitz, discussing how AntiToxin indexes new patterns of abuse it can then search for across its clients. “We’ve got intelligence unit alums, PhDs and data scientists creating anti-toxicity detection algorithms that the world is yearning for.” AntiToxin is already having an impact. TechCrunch commissioned it to investigate a tip about child sexual imagery on Microsoft’s Bing search engine. We discovered Bing was actually recommending child abuse image results to people who’d conducted innocent searches, leading Bing to make changes to clean up its act.

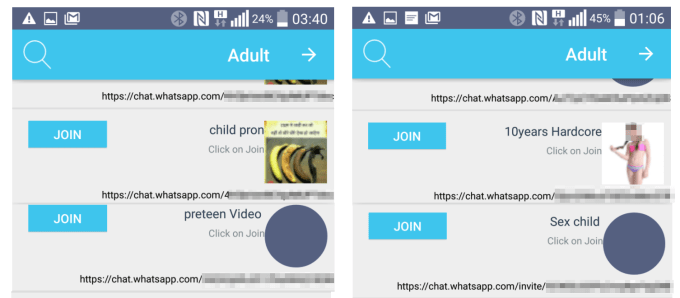

AntiToxin identified publicly listed WhatsApp Groups where child sexual abuse imagery was exchanged

One major threat to AntiToxin’s business is what’s often seen as boosting online safety: end-to-end encryption. AntiToxin claims that when companies like Facebook expand encryption, they’re purposefully hiding problematic content from themselves so they don’t have to police it.

Facebook claims it still can use metadata about connections on its already encrypted WhatApp network to suspend those who violate its policy. But AntiToxin provided research to TechCrunch for an investigation that found child sexual abuse imagery sharing groups were openly accessible and discoverable on WhatsApp — in part because encryption made them hard to hunt down for WhatsApp’s automated systems.

AntiToxin believes abuse would proliferate if encryption becomes a wider trend, and it claims the harm that it causes outweighs fears about companies or governments surveiling unencrypted transmissions. It’s a tough call. Political dissidents, whistleblowers and perhaps the whole concept of civil liberty rely on encryption. But parents may see sex offenders and bullies as a more dire concern that’s reinforced by platforms having no idea what people are saying inside chat threads.

What seems clear is that the status quo has got to go. Shaming, exclusion, sexism, grooming, impersonation and threats of violence have started to feel commonplace. A culture of cruelty breeds more cruelty. Tech’s success stories are being marred by horror stories from their users. Paying to pick up new weapons in the fight against toxicity seems like a reasonable investment to demand.

Powered by WPeMatico

Slack wants to be the new operating system for teams, something it has made clear on more than one occasion, including in its recent S-1 filing. To accomplish that goal, it put together an in-house $80 million venture fund in 2015 to invest in third-party developers building on top of its platform.

Weeks ahead of its direct listing on The New York Stock Exchange, it continues to put that money to work.

Troops is the latest to land additional capital from the enterprise giant. The New York-based startup helps sales teams communicate with a customer relationship management tool plugged directly into Slack. In short, it automates routine sales management activities and creates visibility into important deals through integrations with employee emails and Salesforce.

Troops founder and chief executive officer Dan Reich, who previously co-founded TULA Skincare, told TechCrunch he opted to build a Slackbot rather than create an independent platform because Slack is a rocket ship and he wanted a seat on board: “When you think about where Slack will go in the future, it’s obvious to us that companies all over the world will be using it,” he said.

Troops has raised $12 million in Series B funding in a round led by Aspect Ventures, with participation from the Slack Fund, First Round Capital, Felicis Ventures, Susa Ventures, Chicago Ventures, Hone Capital, InVision founder Clark Valberg and others. The round brings Troops’ total raised to $22 million.

Launched in 2015 by New York tech veterans Reich, Scott Britton and Greg Ratner, the trio weren’t initially sure of Slack’s growth trajectory. It wasn’t until Slack confirmed its intent to support the developer ecosystem with a suite of developer tools and a fund that the team focused its efforts on building a Slackbot.

“People sometimes thought of us, at least in the early days, as a little bit crazy,” Reich said. “But now Slack is the fastest-growing SaaS company ever.”

“We think the biggest opportunity in the [enterprise SaaS] category is going to be tools oriented around the customer-facing employee (CRM), and that’s where we are innovating,” he added.

Troops’ tools are helpful for any customer-facing team, Reich explains. Envoy, WeWork, HubSpot and a few hundred others are monthly paying subscribers of the tool, using it to interact with their CRM in a messaging interface and to receive notifications when a deal has closed. Troops integrates with Salesforce, so employees can use it to search records, schedule automatic reports and celebrate company wins.

Slack, in partnership with a number of venture capital funds, including Accel, Kleiner Perkins and Index, has also deployed capital to a number of other startups, like Lattice, Drafted and Loom.

With Slack’s direct listing afoot, the Troops team is counting on the imminent and long-term growth of the company’s platform.

“We think it’s still early days,” Reich said. “In the future, we see every company using something like Troops to manage their day-to-day.”

Powered by WPeMatico

When serial entrepreneur Eric Lefkofsky grows a company, he puts the pedal to the metal. When in 2011 his last company, the Chicago-based coupons site Groupon, raised $950 million from investors, it was the largest amount raised by a startup, ever. It was just over three years old at the time, and it went public later that same year.

Lefkofsky seems to be stealing a page from the same playbook for his newest company, Tempus. The Chicago-based genomic testing and data analysis company was founded a little more than three years ago, yet it has already hired nearly 700 employees and raised more than $500 million — including through a new $200 million round that values the company at $3.1 billion.

According to the Chicago Tribune, that new valuation makes it — as Groupon once was — one of Chicago’s most highly valued privately held companies.

So why all the fuss? As the Tribune explains it, Tempus has built a platform to collect, structure and analyze the clinical data that’s often unorganized in electronic medical record systems. The company also generates genomic data by sequencing patient DNA and other information in its lab.

The goal is to help doctors create customized treatments for each individual patient, Lefkofsky tells the paper.

So far, it has partnered with numerous cancer treatment centers that are apparently giving Tempus human data from which to learn. Tempus is also generating data “in vitro,” as is another company we featured recently called Insitro, a drug development startup founded by famed AI researcher Daphne Koller. With Insitro, it is working on a liver disease treatment owing to a tie-up with Gilead, which has amassed related human data over the years from which Insitro can use to learn. As a complementary data source, Insitro, like Tempus, is trying to learn what the disease does in a “dish,” then determine if it can use what it observes using machine learning to predict what it sees in people.

Tempus hasn’t come up with any cancer-related cures yet, but Lefkofsky already says that Tempus wants to expand into diabetes and depression, too.

In the meantime, he tells Crain’s Chicago Business that Tempus is already generating “significant” revenue. “Our oldest partners, have, in most cases, now expanded to different subgroups (of cancer). What we’re doing is working.”

Investors in the latest round include Baillie Gifford; Revolution Growth; New Enterprise Associates; funds and accounts managed by T. Rowe Price; Novo Holdings; and the investment management company Franklin Templeton.

Powered by WPeMatico

Foursquare just made its first acquisition. The location tech company has acquired Placed from Snap Inc. on the heels of a fresh $150 million investment led by The Raine Group. The terms of the deal were not disclosed. Placed founder and CEO David Shim will become president of Foursquare.

Placed is the biggest competitor to Foursquare’s Attribution product, which allows brands to track the physical impact (foot traffic to store) of a digital campaign or ad. Up until now, Placed and Attribution by Foursquare combined have measured more than $3 billion in ad-to-store visits.

Placed launched in 2011 and raised $13.4 million (according to Crunchbase) before being acquired by Snap Inc. in 2017.

As part of the deal with Foursquare, the company’s Attribution product will henceforth be known as Placed powered by Foursquare. The acquisition also means that Placed powered by Foursquare will have more than 450 measureable media partners, including Twitter, Snap, Pandora and Waze. Moreover, more than 50% of the Fortune 100 are partnered with Placed or Foursquare.

It’s also worth noting that this latest investment of $150 million is the biggest financing round for Foursquare ever, and comes following a $33 million Series F last year.

Here’s what Foursquare CEO Jeff Glueck had to say about the financing in a prepared statement:

This is one of the largest investments ever in the location tech space. The investment will fund our acquisition and also capitalize us for our increased R&D and expansion plans, allowing us to focus on our mission to build the world’s most trusted, independent location technology platform.

That last bit, about an independent location technology platform, is important here. Foursquare is 10 years old and has transformed from a consumer-facing location check-in app — a game, really — into a location analytics and development platform.

Indeed, when Glueck paints his vision for the company, he lists five key areas of focus:

You’ll notice that its consumer apps, Foursquare and Swarm, are at the bottom of the list. But that’s because Foursquare’s real technological and strategic advantage isn’t in building the best social platform. In fact, Glueck said that more than 90% of the company’s revenue came from the enterprise side of the business. Foursquare’s advantage is in the accuracy of its technology, as afforded by the decade of data that has come from Foursquare, Swarm and the users who have expressly verified their location.

The Pilgrim SDK fits into that top item on the list: developer tools. The Pilgrim SDK allows developers to embed location-smart experiences and notifications into their apps and services. But it also expands Foursquare’s access to data from beyond its own apps to the greater ecosystem, yielding the data it needs to power analytics tools for brands and publishers.

With this acquisition, Placed will be able to leverage Foursquare’s existing map of 105 million places of interest across 190 countries, as well as tap into the measured U.S. audience of more than 100 million monthly devices:

Foursquare and Placed share a similar philosophy of building against a truth set of real consumer responses. Getting real people to confirm the name of their location is the only way to know if your technology is accurate or not. Placed has leveraged over 135 million survey responses in its first-party Placed survey apps, all from consumers opted-in to its rewards app. Foursquare expands the truth set for machine learning exponentially by adding in our over 13 billion consumer confirmations.

The hope is that Foursquare is accurate enough to become the de facto location analytics and services company for measuring ad spend. With enough scale, that may allow the company to break into the walled gardens where most of that ad spend is going: Facebook and Google.

Of course, to win as the “world’s most trusted, independent location technology platform,” consumers have to trust the platform. After all, one’s location may be the most sensitive piece of data about them. Foursquare has taken steps to be clear about what its technology is capable of. In fact, at SXSW this year, Foursquare offered a limited run of a product called Hypertrending, which was essentially an anonymized view of real-time location data showing activity in the Austin area.

Here’s what executive chairman and co-founder Dennis Crowley had to say at the time:

We feel the general trend with internet and technology companies these days has been to keep giving users a more and more personalized (albeit opaquely personalized) view of the world, while the companies that create these feeds keep the broad “God View” to themselves. Hypertrending is one example of how we can take Foursquare’s aggregate view of the world and make it available to the users who make it what it is. This is what we mean when we talk about “transparency” – we want to be honest, in public, about what our technology can do, how it works, and the specific design decisions we made in creating it.

With regards to today’s acquisition of Placed, Jeff Glueck had this to say:

Both companies also share a commitment to privacy and consumers being in control. Our Foursquare credo of “data as a privilege” only deepens as our company expands. We believe location should only be shared when consumers can see real value and visible benefits driven by location. We remain dedicated to elevating the industry through respect for transparency, user control, and instituting layers of privacy safeguards.

This new financing brings Foursquare’s total funding to $390.4 million.

Powered by WPeMatico

Talkspace, the platform that lets patients and therapists communicate online, has today announced the close of a $50 million financing round led by Revolution Growth. Existing investors, such as Norwest Venture Partners, Omura Capital, Spark Capital and Compound Ventures, are also participating in the round.

As part of the deal, Revolution Growth’s Patrick Conroy will join the Talkspace board of directors.

Talkspace launched back in 2012 with a mission to make therapy accessible to as many people as possible. The platform allows users to pay a subscription fee for unlimited messaging with one of the company’s 5,000 healthcare professionals. Since launch, Talkspace has rolled out products specific to certain users, such as teenagers or couples.

The company also partners with insurance providers and employers to offer Talkspace services to their members/employees as part of a commercial business. Today, Talkspace has announced a partnership with Optum Health. This expands Talkspace’s commercial reach to 5 million people.

According to the release, Talkspace will use the funding to accelerate the growth of its commercial business.

Here’s what Talkspace CEO and co-founder Oren Frank had to say in a prepared statement:

Our advanced capabilities in data science enable us to not only open access to therapy, but also identify the attributes of successful therapeutic relationships and apply that knowledge throughout the predictive products we build, to the therapists that use our platform, and in the content we provide.

This brings Talkspace’s total funding to $110 million.

Powered by WPeMatico

Warranties for purchased products is a $40 billion annual market. But in their current form, they are considered by some to be one of the bigger scams in the world of retail because they cost so much and often return too little.

Now there is an alternative emerging. A startup out of Minneapolis, Minn. called Upsie has decided to wage war on the old warranty, with more reasonable pricing (typically 70% lower than what the retailer offers) and a much more modern approach to selling and managing the warranty.

Its bet is that lower prices, and more flexible options for ordering, tracking and claiming against warranties, will drive more users to its service and take some business away from the retailers that largely dominate the market today. Today it’s announcing that it has raised $5 million led by True Ventures to build out that business in the U.S. Techstars Ventures, Matchstick Ventures, Syndicate Fund, M25 and angel investor Marc Belton also participated.

If you’ve ever purchased an expensive consumer electronics product, you know the problem that Upsie is tackling: warranties can cost a lot, and in many cases you’re not sure what you might even be getting out of it. And if you do find yourself in the unfortunate predicament of needing to file a claim, you may find the process a little less than efficient, but hopefully not as bad as this:

“If you buy a product worth $900, a warranty might cost an extra $130, but that warranty might cost only $10 from the insurance company,” said Clarence Bethea, the CEO and founder of Upsie.

When an expensive purchase like a consumer electronics product breaks down, the buyer needs to pay out big money for repairs or replacements, and that worry drives many of those customers to pay a big sum for the guarantee that someone else will cover those liabilities.

When an expensive purchase like a consumer electronics product breaks down, the buyer needs to pay out big money for repairs or replacements, and that worry drives many of those customers to pay a big sum for the guarantee that someone else will cover those liabilities.

The operative words in that last paragraph are “big sum”: a warranty can represent peace of mind, and sometimes actually help in those cases where something relatively new does break down, but one of the big issues is the mark-up that providers put on a service that preys on the fear of needing it — in some cases a warranty can cost as much as 900% more than the policy would cost if it were purchased directly from an insurance provider.

Bethea used to be a consultant to big-box retailers and in the work he did, he realised quickly that the retailers were taking advantage of consumers when they were selling warranties on top of products. “Consumers don’t know what the warranties actually cost,” he said. “That’s what pushed me into this.”

Upsie gives consumers the option to purchase warranties up to 60 days after the sale (or 45 for smartphones). The product itself needs a minimum 90-day warranty from the manufacturers themselves, and the Upsie warranty does not kick in until 30 days after it’s purchased — the idea being that it picks up right after the manufacturer warranty ends.

The warranties can be purchased online or through an app and they apply currently to around 15 categories and hundreds of electric goods covering areas like computers, wearables, phones, TVs, small and large appliances and outdoor tools. The Upsie app in itself is like your warranty file in your filing cabinet, except much simpler and lighter and less cluttered: it stores receipts, lets you scan SKUs to register the goods and more to make it easier. Then after a user purchases the warranty, it can be managed and claims can be filed by way of Upsie’s app.

The basic idea behind Upsie is reminiscent of the direct-to-consumer brands that have grown in popularity over the last several years.

Just as these have leveraged the web, mobile apps and more recently social media to build direct relationships with consumers, Upsie is also bypassing retailers and hoping that consumers will consider their cheaper alternatives, which in actuality have been negotiated with the same warranty service providers that the retailers use. It currently works with Centricity, and the plan is to expand it to a wider range over time.

Other companies have built businesses in the area of providing warranty services outside of what retailers offer, such as SquareTrade, which was acquired by AllState, and Asurion. Puneet Agarwal, a partner at True Ventures, believes that it stands out.

“Upsie is the only consumer-facing brand in the space, whereas everyone else is more of a back-end provider,” he said. “Their subscriber growth and engagement are tremendous and the end consumer identifies with them. Because of their direct consumer focus, they also offer a level of pricing, convenience and customer service the industry has not seen.” He added that the “big ambition” is “to make the idea of ‘upsie-ing’ a product as part of the the everyday lexicon of the consumer.”

Bethea said that one of the big early challenges was convincing insurance companies that D2C was a viable idea — which dissipated as insurance companies, like all brands and B2B2C businesses, began to consider the plethora of ways that people are buying goods today, which increasingly extend well outside the realm of just retailers.

The other challenge that is still one that Upsie will continue to work to surmount as it continues growing is convincing consumers to change their behavior. “Initially it was about convincing the industry that this is a market,” he said. “Today it’s awareness and giving consumers another option. ‘I didn’t know I could leave the register and purchase a plan afterwards’ is what we want people to be thinking.”

So far, the results have been pretty positive. Since exiting beta in 2016, Bethea said the company has grown 300% each year. Services are live only in the U.S., and while it works toward expanding to international markets, it will also be adding auto warranties to its plans next.

Living outside of Silicon Valley as I do, companies that are outliers from the normal pattern that often list the same litany of credentials (including but not limited to grads from Stanford or MIT, possible stint at YC, office in San Francisco, past history at other tech companies), but are still thriving, do tend to catch my eye. Upsie, with its roots in the Midwest and an African American founder (also not very common at the typical SV startup), and tackling something that is fundamentally broken but not flashy, ticks some of those boxes.

Turns out that True sees and wants to seek out more of this, too.

“Great companies are being built everywhere,” said Agarwal. “More and more of the companies we invest in are outside of the Valley or are building teams outside of the Valley and we encourage it. It can be a tremendous competitive advantage both from a talent and cost perspective. We have had great success investing in places like Michigan, Montana, Oregon, Wisconsin, Washington, even recently in Africa, and now in Minnesota with Upsie. I still do see a lot of bias from investors not wanting to invest outside of the Valley. There is no question they will miss out not because of high prices in the Valley but because of the opportunity.”

Powered by WPeMatico