Recent Funding

Auto Added by WPeMatico

Auto Added by WPeMatico

One of China’s most ambitious artificial intelligence startups, Megvii, more commonly known for its facial recognition brand Face++, announced Wednesday that it has raised $750 million in a Series E funding round.

Founded by three graduates from the prestigious Tsinghua University in China, the eight-year-old company specializes in applying its computer vision solutions to a range of use cases such as public security and mobile payment. It competes with its fast-growing Chinese peers, including the world’s most valuable AI startup, SenseTime — also funded by Alibaba — and Sequoia-backed Yitu.

Bloomberg reported in January that Megvii was mulling to raise up to $1 billion through an initial public offering in Hong Kong. The new capital injection lifts the company’s valuation to just north of $4 billion as it gears up for its IPO later this year, sources told Reuters.

China is on track to overtake the United States in AI on various fronts. Buoyed by a handful of mega-rounds, Chinese AI startups accounted for 48 percent of all AI fundings in 2017, surpassing those in the U.S. for the first time, shows data collected by CB Insights. An analysis released in March by the Allen Institute for Artificial Intelligence found that China is rapidly closing in on the U.S. by the amount of AI research papers published and the influence thereof.

A critical caveat to China’s flourishing AI landscape is, as The New York Times and other publications have pointed out, the government’s use of the technology. While facial recognition has helped the police trace missing children and capture suspects, there have been concerns around its use as a surveillance tool.

Megvii’s new funding round arrives just days after a Human Rights Watch report listed it as a technology provider to the Integrated Joint Operations Platform, a police app allegedly used to collect detailed data from a largely Muslim minority group in China’s far west province of Xinjiang. Megvii denied any links to the IJOP database per a Bloomberg report.

Kai-Fu Lee, a world-renowned AI expert and investor who was Google’s former China head, warned that any country in the world has the capacity to abuse AI, adding that China also uses the technology to transform retail, education and urban traffic among other sectors.

Megvii has attracted a rank of big-name investors in and outside China to date. Participants in its Series E include Bank of China Group Investment Limited, the central bank’s wholly owned subsidiary focused on investments, and ICBC Asset Management (Global), the offshore investment subsidiary of the Industrial and Commercial Bank of China.

Foreign backers in the round include a wholly owned subsidiary of the Abu Dhabi Investment Authority, one of the world’s largest sovereign wealth funds, and Australian investment bank Macquarie Group.

Megvii says its fresh proceeds will go toward the commercialization of its AI services, recruitment and global expansion.

China has been exporting its advanced AI technologies to countries around the world. Megvii, according to a report by the South China Morning Post from last June, was in talks to bring its software to Thailand and Malaysia. Last year, Yitu opened its first overseas office in Singapore to deploy its intelligence solutions to partners in Southeast Asia. In a similar fashion, SenseTime landed in Japan by opening an autonomous driving test park this January.

“Megvii is a global AI technology leader and innovator with cutting-edge technologies, a scalable business model and a proven track record of monetization,” read a statement from Andrew Downe, Asia regional head of commodities and global markets at Macquarie Group. “We believe the commercialization of artificial intelligence is a long-term focus and is of great importance.”

Powered by WPeMatico

As medical devices move to networked technologies, securing those devices becomes increasingly important.

Regulators, seemingly late to the threat that unsecured medical devices posed, only began requiring protections for medical devices like pacemakers and insulin pumps two years ago, and since then new technology companies have leapt into the breach to begin providing security services for the healthcare industry.

Most recently, MedCrypt, a graduate from the most recent batch of Y Combinator companies, raised $5.3 million in a new round of funding, from investors led by Section 32, the investment firm founded by former Google Ventures partner Bill Maris.

Joining Maris’ firm were previous investors Eniac Ventures and Y Combinator itself.

“Internet-connected medical technology is entering the market at light speed, calling for devices to be secure by design, which leads to a heightened level of patient safety at all times,” said MedCrypt chief executive Mike Kijewski in a statement.

Securing patient data has been a longtime requirement for health technology companies, but both patient records and hospital networks are dangerously vulnerable to cyberattacks.

In 2018, more than 6 million patient records in the U.S. were exposed thanks to network intrusions and cyberattacks, according to the publication Health IT Security. And those were just in the 10 largest security breaches.

The healthcare industry has only managed to achieve 72% compliance with the HIPAA Security Rule for protecting patient data, according to an April report from CynergisTek.

Investors have recognized the problem and are investing more into companies focused on the healthcare market specifically. MedCrypt’s competition for these security dollars include companies like Medigate, which raised $15 million earlier this year.

While Medigate focuses on network security, MedCrypt is focused on securing devices themselves. Both security functions are critical, according to investors.

“With regulators appropriately taking a hard look at medical device security and the sheer growth in the number of devices being added to already complex clinical networks,” there is a significant opportunity for companies tackling medical device security, according to a statement from Dr. Jonathan Root, who has led several IT-enabled healthcare investments for USVP.

Powered by WPeMatico

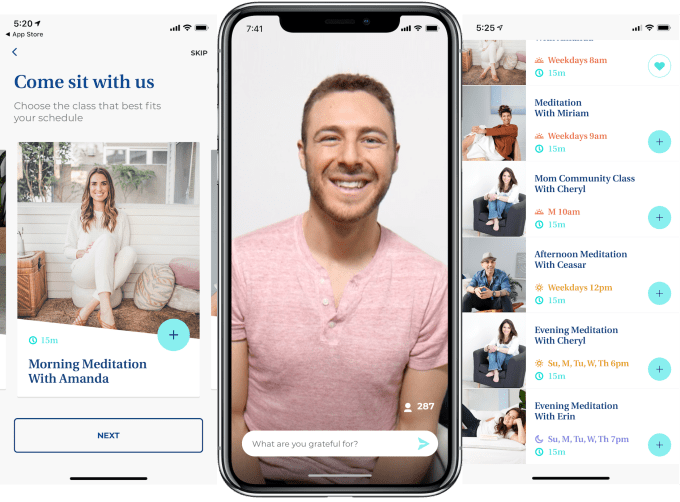

Sitting silently with your eyes closed isn’t fun, but it’s good for you… so you probably don’t meditate as often as you’d like. In that sense, it’s quite similar to exercise. But people do show up when prodded by the urgency and peer pressure of scheduled group cycling or aerobics classes. What’s still in the way is actually hauling your lazy butt to the gym, hence the rise of Peloton’s in-home stationary bike with attached screen streaming live and on-demand classes. My butt is particularly lazy, but I’ve done 80 Peloton rides in four months. The model works.

Now that model is coming to mindfulness with the launch of Journey LIVE, a subscription iOS app offering live 15-minute group meditation classes. With sessions starting most waking hours, instructors that interact with you directly and a sense of herd mentality, you feel compelled to dedicate the time to clearing your thoughts. By video and voice, the teachers introduce different meditation theories and practices, guide you through and answer questions you can type in. Each day, Journey also provides a newly recorded on-demand session in case you need a class on your own schedule.

” ‘I tried Headspace’ or ‘I tried Calm .’ With a lot of the current meditation apps, people go on but they drop off very quickly,” says Journey founder and CEO Stephen Sokoler. “It means that there’s an interest in meditating and having a better life but people fall off because meditating alone is hard, it’s confusing, it’s boring. Meditating with a live teacher who can connect with you and say your name, who makes you feel seen and heard makes a huge difference.”

Journey subscriptions start at $19.99 per month after a week-long free trial. That feels a bit steep, but prices drop to $7.99 if paid annually with the launch discount, or you can dive in with a $399 lifetime pass. The challenge will be keeping users from abandoning meditation and then their subscription without resorting to growth hacking and annoying notifications that are antithetical to the whole concept. Journey has now raised a $2.4 million seed round led by Canaan and joined by Brooklyn Bridge Ventures, Betaworks and more to get the company rolling.

Journey subscriptions start at $19.99 per month after a week-long free trial. That feels a bit steep, but prices drop to $7.99 if paid annually with the launch discount, or you can dive in with a $399 lifetime pass. The challenge will be keeping users from abandoning meditation and then their subscription without resorting to growth hacking and annoying notifications that are antithetical to the whole concept. Journey has now raised a $2.4 million seed round led by Canaan and joined by Brooklyn Bridge Ventures, Betaworks and more to get the company rolling.

Sokoler’s own journey could set an example of the possibilities of sticking with it. “Meditation changed my life. I was fortunate enough to move to Australia, find a book on Buddhism, and then I had the willpower to start practicing meditation every day,” he tells me. “I lost 85 pounds. People ask me how I lost the weight and they expect me to say a diet like keto or Atkins, but it was because of the program I was in.” Suddenly able to sit quietly with himself, Sokoler didn’t need food to stay occupied or feel at ease.

The founder saw the need for new sources of happiness while working in employee rewards and recognition for 12 years. He built up a company that makes mementos for commemorating big business deals. Meditation proved to him the value of developing inner quiet, whether to inspire happiness, calm, focus or deeper connections to other people and the world. Yet the popular meditation apps ignored thousands of years of tradition when meditation would be taught in groups that give a naturally ethereal activity more structure. He founded Journey in 2015 to bring meditation to corporate environments, but now is hoping to democratize access with the launch of Journey LIVE.

“You could think of it as a real-life meditation community or studio in the palm of your hand,” Sokoler explains. Instructors greet you when you join a session in the Journey app and can give you a shout-out for practicing multiple days in a row. They help you concentrate on your breath while giving enough instruction to keep you from falling asleep. You can see or hide a list of screen names of other participants that make you feel less isolated and encourage you not to quit.

Finding a market amidst the popular on-demand meditation apps will be an uphill climb for Journey LIVE. While classes recorded a long time ago might not be as engaging, they’re convenient and can dig deep into certain styles and intentions. Calm and Headspace run around $12.99 per month, making them cheaper than Journey LIVE and potentially easier to scale.

But Sokoler says his app’s beta testing saw better retention than competitors. “If you’ve ever been to the New York Public Library, there’s so many books versus going to a local curated bookstore where something is right there for you. This is much more approachable, much more accessible,” Sokoler tells me. “There’s a paradox of choice, and having so many options makes it hard for people to stick with it and come back every single day.”

With our phones and Netflix erasing the downtime we used to rely on to give our brain a break or reflect on our day, life is starting to feel claustrophobic. We’re tense, anxious and easily overwhelmed. Meditation could be the antidote. Unlike with cycling or weightlifting, you don’t need some expensive Peloton bike or Tonal home gym. What you need is consistency, and an impetus to slow down for 15 minutes you could easily squander. We’re a tribal species, and Journey LIVE group classes could use camaraderie to lure us into the satisfying void of nirvana.

Powered by WPeMatico

India has a new unicorn after BigBasket, a startup that delivers groceries and perishables across the country, raised $150 million for its fight against rivals Walmart’s Flipkart, Amazon and hyperlocal startups Swiggy and Dunzo.

The new financing round — a Series F — was led by Mirae Asset-Naver Asia Growth Fund, the U.K.’s CDC Group and Alibaba, BigBasket said on Monday. The closing of the round has officially helped the seven-year-old startup surpass $1 billion valuation, co-founder Vipul Parekh, who heads marketing and finances for the company, told TechCrunch in an interview. Chinese giant Alibaba, which also led the Series E round in BigBasket last year, is the largest investor in the company, with about 30% stake, a person familiar with the matter said.

The company, which offers more than 20,000 products from 1,000 brands in more than two dozen cities, will deploy the fresh capital into expanding its supply-chain network, adding more cold storage centers and distribution centers to serve customers faster, Parekh said. The company also plans to add about 3,000 vending machines that offer daily eatable items, such as vegetables, snacks and cold drinks in residential apartments and offices by next month, he added.

Infusion of $150 million for BigBasket, which raised $300 million last year, comes at a time when both Walmart’s Flipkart and Amazon are increasingly expanding their grocery businesses in India.

Amazon Retail India, which operates Amazon Pantry and Prime Now services and has a presence in mire than 100 cities, is reportedly planning to expand its business in India. Flipkart Group CEO Kalyan Krishnamurthy said in an interview with the Economic Times last month that the e-commerce giant may pilot a fresh foods business soon. Last week, Flipkart was said to be in talks to acquire grocery chain Namdhari’s Fresh.

Parekh largely brushed off the challenge his company faces from Flipkart and Amazon at this stage, saying that “it is a very large market, and it is unlikely to be dominated by one single company for the simple reason of its complex nature.” Flipkart and Amazon may eventually get serious about this space, but so far their play with groceries is mostly an additional differentiation checkpoint, he said.

“The success in this business requires having the ability to build and manage a very complex supply chain across multiple categories such as vegetables, meat and beauty products among others. Our focus has been on building the supply chain, and also ensuring that we are able to deliver a very large assortment of products to consumers,” he added. He said BigBasket today offers the largest catalog and fastest delivery among any of its rivals.

Besides, BigBasket, which is increasingly growing its subscription business to supply milk and other daily eatables, is also inching closer to becoming financially stronger. Parekh said BigBasket expects to become operationally profitable in six to eight months. “The idea is that business by itself does not consume cash. If we use cash, it will be for investment in new businesses or scaling of existing businesses,” he said.

India’s retail market, valued at mire than $900 billion, is increasingly attracting the attention of VC funds. Since 2014, online retailers alone have participated in more than 163 financing rounds, clocking over $1.38 billion, analytics firm Tracxn told TechCrunch. More than 882 players are operational in the market, the firm said.

The challenge for BigBasket remains fighting a growing army of rivals, including hyperlocal delivery startups including Grofers, which raised $60 million earlier this year, unicorn Swiggy and Google-backed Dunzo, which is increasingly becoming a verb in urban Indian cities.

Powered by WPeMatico

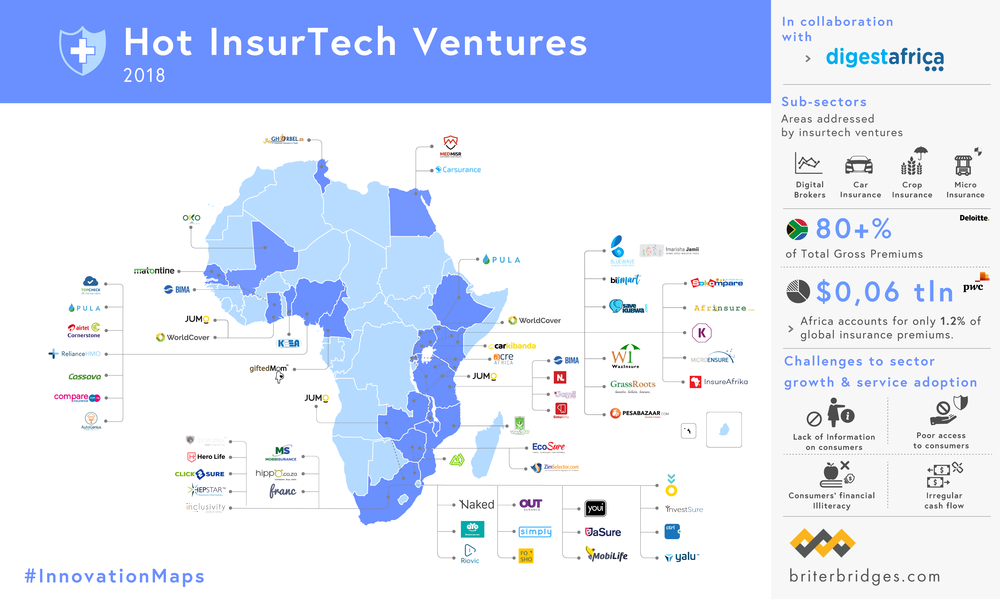

WorldCover, a New York and Africa-based climate insurance provider to smallholder farmers, has raised a $6 million Series A round led by MS&AD Ventures.

Y Combinator, Western Technology Investment and EchoVC also participated in the round.

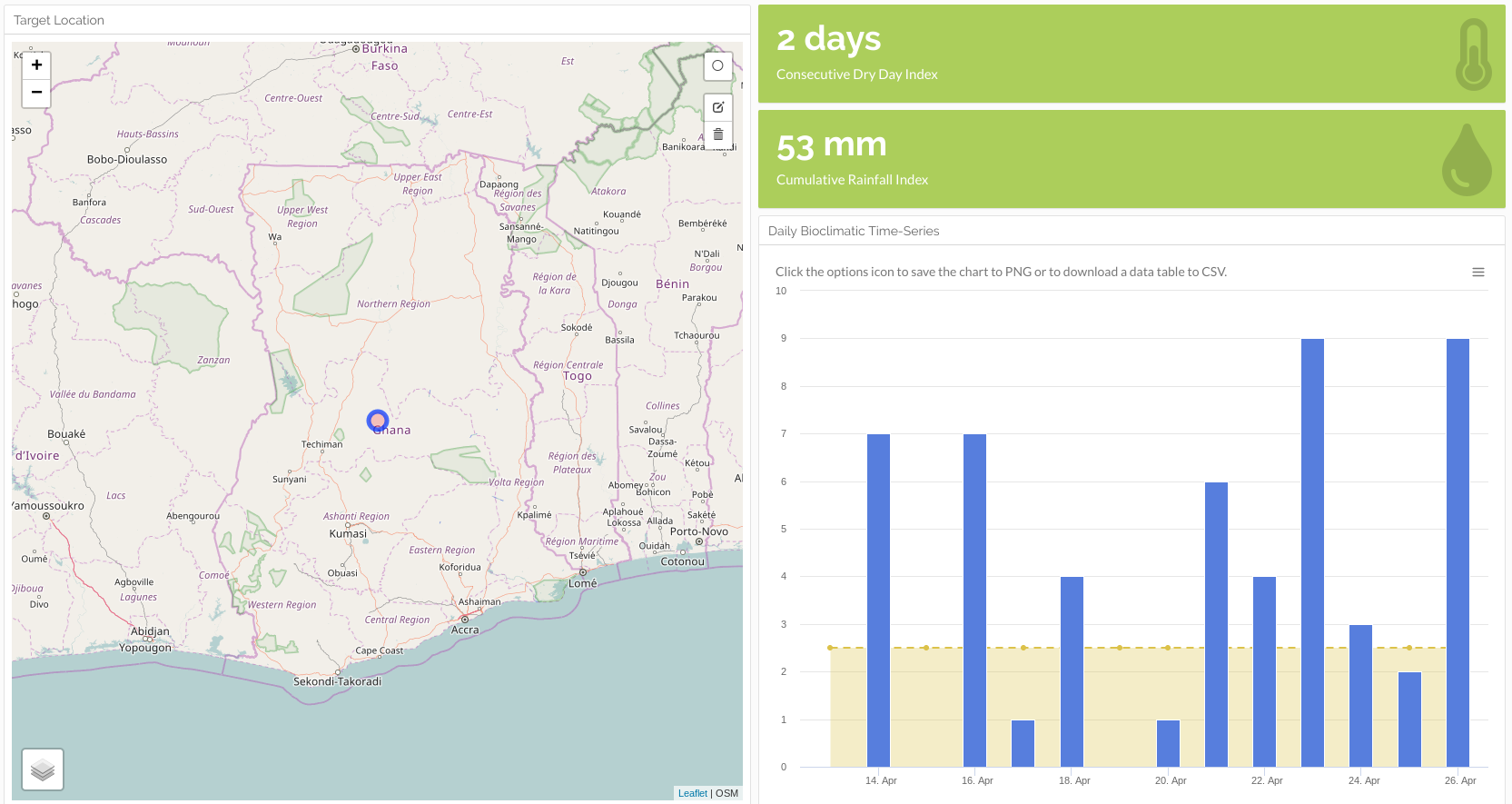

WorldCover’s platform uses satellite imagery, on-ground sensors, mobile phones and data analytics to create insurance options for farmers whose crop yields are affected adversely by weather events — primarily lack of rain.

The startup currently operates in Ghana, Uganda and Kenya . With the new funding, WorldCover aims to expand its insurance offerings to more emerging market countries.

“We’re looking at India, Mexico, Brazil, Indonesia. India could be first on an 18-month timeline for a launch,” WorldCover co-founder and chief executive Chris Sheehan said in an interview.

The company has served more than 30,000 farmers across its Africa operations. Smallholder farmers are those earning all or nearly all of their income from agriculture, farming on 10-20 acres of land and earning around $500 to $5,000, according to Sheehan.

Farmers connect to WorldCover by creating an account on its USSD mobile app. From there they can input their region and crop type and determine how much insurance they would like to buy and use mobile money to purchase a plan. WorldCover works with payments providers such as M-Pesa in Kenya and MTN Mobile Money in Ghana.

The service works on a sliding scale, where a customer can receive anywhere from 5x to 15x the amount of premium they have paid. If there is an adverse weather event, namely lack of rain, the farmer can file a claim via mobile phone. WorldCover then uses its data-analytics metrics to assess it, and, if approved, the farmer will receive an insurance payment via mobile money.

Common crops farmed by WorldCover clients include maize, rice and peanuts. It looks to add coffee, cocoa and cashews to its coverage list.

For the moment, WorldCover only insures for events such as rainfall risk, but in the future it will look to include other weather events, such as tropical storms, in its insurance programs and platform data analytics.

For the moment, WorldCover only insures for events such as rainfall risk, but in the future it will look to include other weather events, such as tropical storms, in its insurance programs and platform data analytics.

The startup’s founder clarified that WorldCover’s model does not assess or provide insurance payouts specifically for climate change, though it does directly connect to the company’s business.

“We insure for adverse weather events that we believe climate change factors are exacerbating,” Sheehan explained. WorldCover also resells the risk of its policyholders to global reinsurers, such as Swiss Re and Nephila.

On the potential market size for WorldCover’s business, he highlights a 2018 Lloyd’s study that identified $163 billion of assets at risk, including agriculture, in emerging markets from negative, climate change-related events.

“That’s what WorldCover wants to go after…These are the kind of micro-systemic risks we think we can model and then create a micro product for a smallholder farmer that they can understand and will give them protection,” he said.

With the round, the startup will look to possibilities to update its platform to offer farming advice to smallholder farmers, in addition to insurance coverage.

WorldCover investor and EchoVC founder Eghosa Omoigui believes the startup’s insurance offerings can actually help farmers improve yield. “Weather-risk drives a lot of decisions with these farmers on what to plant, when to plant, and how much to plant,” he said. “With the crop insurance option, the farmer says, ‘Instead of one hector, I can now plant two or three, because I’m covered.’ ”

Insurance technology is another sector in Africa’s tech landscape filling up with venture-backed startups. Other insurance startups focusing on agriculture include Accion Venture Lab-backed Pula and South Africa based Mobbisurance.

With its new round and plans for global expansion, WorldCover joins a growing list of startups that have developed business models in Africa before raising rounds toward entering new markets abroad.

In 2018, Nigerian payment startup Paga announced plans to move into Asia and Latin America after raising $10 million. In 2019, South African tech-transit startup FlexClub partnered with Uber Mexico after a seed raise. And Lagos-based fintech startup TeamAPT announced in Q1 it was looking to expand globally after a $5 million Series A round.

Powered by WPeMatico

You probably haven’t heard of Checkout, a digital payments processing company that was founded in 2012 in London. Apparently, however, investors have been keeping tabs on the low-flying company and like what they see. Today, Checkout announced that it has raised $230 million in Series A funding at a valuation just shy of $2 billion co-led by Insight Partners and DST Global, with participation from GIC, the Singaporean sovereign-wealth fund, Blossom Capital, Endeavor Catalyst and other, unnamed strategic investors.

It’s the first institutional round for the company; it’s also one of the biggest Series A rounds ever for a European company.

What’s so special about Checkout that investors felt compelled to write such big checks? In a sea filled with fintech startups, it’s hard to know at first glance what differentiates it — or whether investors merely spy a huge opportunity, particularly given the company’s recent revenue numbers.

Checkout helps businesses — including Samsung, Adidas, Deliveroo and Virgin, among others — to accept a range of payment types across their online stores around the world. According to the WSJ, the fees from these services are adding up, too. It says Checkout’s European business generated $46.8 million in gross revenue and $6.7 million in profit in 2017, information it dug up through Companies House, the United Kingdom’s registrar of companies.

Checkout also plays into two huge trends that seem to be lifting all boats — the ongoing boom in online shopping, and the growing number of businesses using online payments. Little wonder that investors poured into payments startups last year more than four times what they invested in them in 2017 ($22 billion, according to Dow Jones VentureSource data cited by the WSJ).

Little wonder, too, that payments startups that have gone public are faring well, including the global payments company Adyen, which IPO’d on the Euronext in June of last year and has mostly seen its shares move in one direction since. Indeed, the company, valued at $2.3 billion by investors in 2015, is now valued at nearly $21 billion.

Though Checkout’s Series A is stunning for its size, according to Dealroom data, it isn’t the largest for a European company. Among other giant rounds, the U.K.-based biotech company Immunocore closed on $320 million in Series A funding in 2015. In 2017, another U.K. fintech, OakNorth, a digital bank that focuses on loans for small and medium enterprises, raised $200 million in Series A funding. (It has gone on to raise roughly $850 million altogether.)

More recently, TradePlus24, a two-year-old, Zurich, Switzerland-based fintech company that insures against default the accounts receivables of small and mid-size businesses, also raised a healthy amount: $120 million in Series A funding. Its backers include Credit Suisse and the insurance broker Kessler.

Powered by WPeMatico

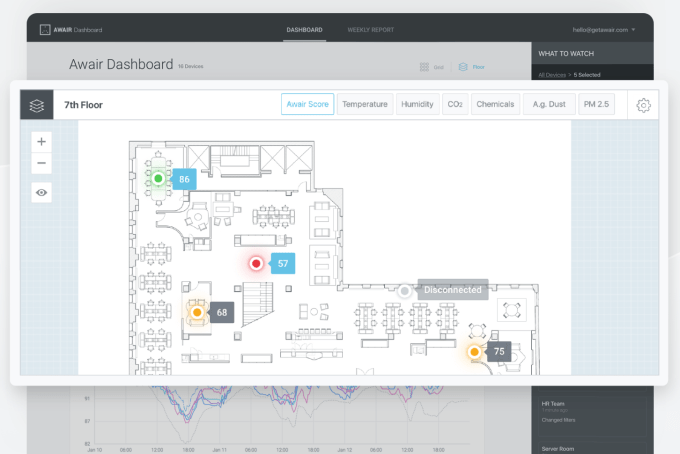

Monitoring a space is about a lot more than security cameras. Awair is trying to help businesses and consumers more deeply understand the environments in which they live and work.

Awair has raised a $10 million Series B led by The Westly Group with participation from iRobot, Altos Ventures, Emerson Electric and Nuovo Capital. The company has raised more than $21 million to date.

The company has been plugging along with air-quality monitors that look like they belong in the MoMa. Awair’s $199 monitor senses things like particulate matter, temperature, humidity, and CO² levels. They’ve built out their product line with a couple other devices, but they’re largely targeting air-conscious consumers that might have allergies of another ailments and “design moms” who are looking to get some well-designed tech into their home.

The information all plugs into an app that helps consumers understand what’s happening in their home and get tips for how they can improve air quality.

As the company looks to make venture-worthy returns, it’s been scaling beyond the consumer IoT space into the world of enterprise IoT with its Omni product that Await has been selling to large real estate firms, offices and hospitals, aiming to give companies more insight into what life is like in every corner of their physical spaces.

The devices measure the same things their consumer products do, but also can track ambient light and noise in space, and pipe all of that data into a dashboard that can help businesses automate how they push their existing building infrastructure like their HVAC systems to respond to changes in the environment.

While Awair has been selling consumer IoT devices since 2015, its business product is about 18 months old, and a big part of this fundraise is to bring a sales staff onboard to keep the pace of enterprise expansion, which has been faster growing than the consumer business.

The company says they have more than 300 enterprise customers on the platform, including WeWork, Airbnb, Harvard and The Crown Estate.

Powered by WPeMatico

Your last 10 emails with a recruiter before an onsite interview probably shouldn’t be about rebooking your canceled flight.

Pana is a Denver startup now setting its sights on the corporate travel market, with a specific eye towards killing the back-and-forth email or spreadsheet coordination. The startup, founded in 2015, first tried to gain an inroad with consumers, but its $49 per month individual-focused travel concierge plan probably limited its reach.

The company’s latest shot at taking on corporate travel lets companies use the service to outsource dealing with out-of-network “guests.” The startup is looking to take this path as an inroad into the broader corporate travel market, and is making the apparent choice to work with more expansive corporate travel companies like SAP’s Concur rather than against them, initially at least.

The company just closed a $10 million Series A round led by Bessemer Venture Partners with participation from Techstars, Matchstick Ventures, and MergeLane Fund. Previous investors also include 500 Startups, FG Angels and The Galvanize Fund.

Pana is already booking thousands of trips per month for companies using the service to coordinate business travel for interviewees. Rather than leaving recruiters to the arduous process of back-and-forth messaging to hammer out initial details, Pana takes care of it through an omni-channel mesh of automation and human concierge in-app chat, text or email.

“A key piece of the value proposition is that if you do ask something complex, we’re going to instantly connect you to a human agent,” founder Devon Tivona told TechCrunch in an interview. “When it does go to a person, we have a five-minute response time.”

Getting a flight booked for someone outside the company directory can be challenging enough, but with travel, everything grows infinitely more complex the second that something goes awry. In addition to functioning as a tool for coordination, the startup’s team of assistants are there to help re-book flights or re-arrange travel if everything doesn’t go according to plan.

Even if Pana is working with the big corporate travel agencies today, its investors are banking on the startup accomplishing what the giants can’t at their scale.

“…Whenever a really large incumbent, particularly in software gets acquired, and I’m thinking about when SAP acquired Concur five or so years ago, it creates this massive innovation gap that allows, I’d say, new startups to really reinvent the status quo,” Bessemer partner Kristina Shen told TechCrunch in an interview.

Pana’s current customers include Logitech, Quora and Shopify, among others.

Powered by WPeMatico

Edtech and recruitment continue to converge. London-based online degree platform, FutureLearn, is taking £50 million (~$64.6M) from Australian-based online job matching group, Seek, in exchange for a 50 per cent stake in the business — just days after the same group led a massive Series E in U.S. online learning giant Coursera.

U.K. distance learning veteran, the Open University — which had wholly owned the FutureLearn platform up til now — retains a 50 per cent stake in the business following the Seek Group investment.

In a press release announcing the news, FutureLearn said the investment values it at £100M ($129M) — some six years after the initiative was first announced, with the OU bringing together a consortium of U.K. universities to attack the MOOCs/online learning space which was then being rapidly expanded by U.S. edtech startups.

“Our partnership with Seek and the investment in FutureLearn will take our unique mission to make education open for all into new parts of the world. Education improves lives, communities and economies and is a truly global product, with no tariffs on ideas,” said OU vice chancellor Mary Kellett in a statement on the investment.

The joint venture will have “contractual arrangements” to protect its academic independence, teaching methods and curriculum, the OU added — in an attempt to assuage concerns about an (overly) commercially minded takeover of its fledgling digital education platform.

The first FutureLearn courses launched in fall 2013. Since then a cumulative total of nine million+ people have signed up to learn via its platform — which now offers around 2,000 courses in all.

This includes short courses; postgraduate diplomas and certificates; all the way up to fully online degrees. (FutureLearn partners with six U.K. universities on the full degree courses at this stage.)

FutureLearn also has partnerships with management consultancy firm Accenture; the British Council; the Chartered Institute of Personnel and Development; learn-to-code foundation Raspberry Pi; and Health Education England (part of the UK’s National Health Service); and is involved in U.K. government-backed initiatives to address skills gaps — including The Institute of Coding and the National Centre for Computing Education.

Last fall the Financial Times reported that the OU was looking for a £40M capital injection for FutureLearn to fund more courses and better compete with the scale of U.S. edtech giants — like Coursera and Lynda.com.

It’s not clear how many more courses FutureLearn plans to add with its new partner on board; a spokesperson told us it is not able to provide a figure at this stage.

For a little comparative context, some 40M people have taken online classes via Coursera to date — with that platform currently offering some 3,200 courses, and partnering with the likes of Columbia University, Johns Hopkins and the University of Michigan. While Coursera’s $103M in Series E reportedly valued its business at well over a $1BN, with Seek coming on board as a strategic investor.

The shared investor is an interesting but perhaps not surprising development given the different markets involved, and the challenge of monetizing free-to-access courses without having massive scale — suggesting the Seek group, which is already well established across Australia, New Zealand, China, South East Asia, Brazil and Mexico — sees more opportunities from strengthening regional online learning platform plays, in Europe and the U.S., to grow the overall online learning pipe and expand adjacent cross-marketing options in employment/job matching.

Last week, when its strategic investment in Coursera was announced, the Seek group talked effusively about how edtech platforms enabling up-skilling and re-skilling are “aligned” with its employment-focused business mission. (Or “our purpose of helping people live fulfilling working lives”, as it put it.)

The FutureLearn partnership provides Seek with access to another pool of potential job seekers — including actively engaged learners in the UK/Europe — to further grow the geographical reach of its recruitment platform.

Commenting on the investment in a statement, Seek co-founder and CEO Andrew Bassat said: “Technology is increasing the accessibility of quality education and can help millions of people up-skill and re-skill to adapt to rapidly changing labour markets. We see FutureLearn as a key enabler for education at scale.”

“FutureLearn’s reputation is strong and it has attracted leading education providers onto its platform. We are excited to come on as a partner with The Open University,” he added.

FutureLearn’s CEO Simon Nelson said the joint venture will allow the learning platform to extend its global reach and impact.

“This investment allows us to focus on developing more great courses and qualifications that both learners and employers will value,” he said in a statement. “This includes building a portfolio of micro-credentials and broadening our range of flexible, fully online degrees and being able to enhance support for our growing number of international partners to empower them to build credible digital strategies, and in doing so, transform access to education.”

Powered by WPeMatico

Sam Altman’s little brother Jack is an entrepreneur, too.

Jack Altman, whose resume includes a stint as vice president of business development at Teespring, has raised $15 million in Series B funding for his startup, Lattice, a modern approach to corporate goal setting. Shasta Ventures led the round, with participation from Thrive Capital, Khosla Ventures and Y Combinator, the latter being the organization his brother led as president until very recently.

Lattice, used by high-growth companies like Reddit, Slack, Coinbase and Glossier, helps human resources professionals develop insights about their teams. Founded in 2015, Altman and Eric Koslow, like most entrepreneurs, developed the idea for Lattice out of their own pain points.

“We realized that with quarterly goal settings, OKRs, we would write them up and get the leadership together and then they would sit on a shelf and nothing would happen,” Altman told TechCrunch.

Lattice, a SaaS business, is a flexible platform that caters to startups and larger businesses’ specific cultures, management practices and varying approaches to employee engagement. The product, inspired by platforms like Gmail and Slack, is designed with consumers in mind. Lattice, the team hopes, has a look and feel that makes incumbent HR platforms feel antiquated.

The product makes it simple for employees and their managers to complete engagement surveys, share feedback, arrange one-on-one meetings and complete comprehensive performance reviews with a larger goal of reworking the company goal-setting process entirely. No more once-yearly check-ins; Lattice enables businesses to check-in with their employees on a weekly basis.

Lattice currently has 1,200 customers, 60 employees and was cash flow break-even for the first time in Q1 2019. With the latest financing, the San Francisco-based startup plans to invest in product development.

“Life is short,” Altman said. “You want to have work that you enjoy and an office that feels good to be at.”

Lattice has previously raised capital from investors including SV Angel, Marc Benioff, Slack Fund and Fuel Capital, Sam Altman, Elad Gil, Alexis Ohanian, Kevin Mahaffey, Daniel Gross and Jake Gibson. Lattice completed the Y Combinator startup accelerator in 2016.

Powered by WPeMatico