Recent Funding

Auto Added by WPeMatico

Auto Added by WPeMatico

New Enterprise Associates, the 42-year-old venture capital firm, has invested in the $23 million Series B round for Mejuri, a startup capturing millennial women’s penchant for affordable and treat yo’ self type of jewelry rather than diamonds and precious stones for special occasions.

It’s the latest instance of startups drawing investor interest with their direct-to-customer retail model. Based in Toronto and Buenos Aires, four-year-old Mejuri designs, makes and sells jewelry directly to women online and through offline showrooms, bypassing middle-person costs. Besides striving for reasonable prices, Mejuri also wants to upend an entrenched practice in its industry.

Traditional jewelry, the startup points out, targets men for gifting and makes higher markups acceptable. With its D2C play, Mejuri believes it’s putting the purchasing decision back with women; indeed, it found 75 percent of its customers are buying for themselves. Its team of 120 employees is constantly on the watch for trends and consumer feedback, a strategy made possible by its online presence of more than 422,000 Instagram followers. Instead of releasing large batches of seasonal pieces, Mejuri adapts the so-called “drop” model that introduces only a small quantity of products each week, which allows it to timely translate customer sentiments into designs.

Photo source: Mejuri

Another enabling factor is the company’s female-led team: 80 percent of the staff are women, headed by founder Noura Sakkijha, a third-generation jeweler and a former industrial engineer who scored the company’s latest capital when she was seven months pregnant with two twins.

“Mejuri’s mission really hits home for me,” said NEA partner Vanessa Larco in a statement. “I noticed a shift in trends when none of my friends wanted to go to any of the traditional fine jewelry companies to purchase jewelry anymore, and I realized a lot of those big brands were in trouble.”

Natalie Massenet, founder of Net-a-Porter and partner at Imaginary, another venture fund that participated in Mejuri’s Series B, said the startup is set to “disrupt” the jewelry industry through supply chain standards that modern consumers demand, “like sourcing from conflict-free and socially responsible diamond suppliers and maintaining affordable prices to serve a consumer who is buying for herself and her friends.”

The user-centric focus has brought customer loyalty to Mejuri. The startup claims that 30 percent of its monthly transactions come from returning shoppers, and 70,000 customers are on the waitlist for its products. It’s accumulated a total of 20 million visitors to its website and released 1,500 designs since launch. Revenues have quadrupled year-over-year for the fourth consecutive year, and the company, one of TechCrunch’s favorite picks from 500 Startups’ Batch 15 Demo Day three years ago, said it’s on track to achieve the same level of traction in 2019.

The new proceeds bring Mejuri’s total funds raised to more than $29 million to date. Others in the new funding round include follow-on backers Felix Capital, BDC Capital, Incite Ventures and Dash Ventures. The company plans to spend its latest financial injection on offline expansion, overseas growth and investment in branding and customer experience.

Powered by WPeMatico

Coursera, an online learning startup that offers free and paid short courses, skills certifications and complete degrees in partnership with universities and businesses, has raised another $103 million to scale out its business into new geographies, subject areas and products — a Series E led by a strategic investor, the Australian online recruitment and course directory provider SEEK Group, with participation from Future Fund and NEA.

Coursera currently offers 3,200 courses and 310 specializations, with partners including Columbia University, Johns Hopkins and the University of Michigan. Some 40 million people have now taken online classes through the startup — a significant jump on the 26 million figure Coursera noted when it last raised money, in 2017 (a $64 million Series D).

Also jumping is Coursera’s valuation, which had been around $800 million and is now “well over” $1 billion, according to a source close to the company.

Coursera’s growth is coming at a key time in the e-learning sector.

Online education has, overall, become an increasingly viable alternative and complement to in-person learning — bolstered by improvements in technology and methodology, demand for skills that hasn’t been met by more traditional channels and the economic challenges posed by higher education for a large number of people.

On one side, there have been some significant consolidations that speak to the opportunity. Just two weeks ago, 2U (which, like Coursera, works with universities to build online degree programs) acquired Trilogy — which provides training and bootcamps primarily for tech skills — for $750 million.

On the other, there have been some significant stumbles. Udacity, another online education startup valued at $1 billion, recently laid off 20 percent of its staff as part of a wider restructuring, with the aim of curbing costs while still expanding its business focused on “nano degrees.”

Coursera’s aim, said CEO Jeff Maggioncalda (who joined the company in 2017), is to steer a course that offers a range of learning alternatives as diverse as the mass market it’s hoping to continue targeting.

“We long ago realised that having a range of learning options, from open, free courses to masters degrees and everything in between such as microcredentials, bachelor’s degrees and certifications, is the way to go,” Maggioncalda said. “We look at that as our product portfolio.”

Coursera had its start by opening up the world of university learning to a wider population by putting courses online; it has more recently moved into working with companies and other organizations to build courses for them and to build courses to help train people in specific vocational areas, such as this program it developed with Google for IT certifications last year, and the health vertical that it introduced in January of this year. That is something it plans to continue developing, too.

“Beyond the nobility of providing great access to higher education to a world of people who otherwise wouldn’t have it, there is another imperative,” Maggioncalda said. “The future of work and learning are converging, and companies are realising that there are a lot of jobs that are getting automated, so finding an inexpensive but high-quality way to retrain is turning out to be a historic challenge. We need to get better at making high-quality education accessible.”

The SEEK investment is coming at a timely moment as a complement to this mission. Maggioncalda notes that Coursera is going to start working more directly on developing what you might think of as the next step after you learn something on its platform, which will be getting a job.

“This investment reflects our commitment to online education, which is enabling the up-skilling and re-skilling of people and is aligned to our purpose of helping people live fulfilling working lives,” said SEEK co-founder and CEO Andrew Bassat in a statement.

He noted that to date, some 190 million people have posted resumes on SEEK, with some 900,000 organizations using the platform to recruit for job openings. “It’s not coincidental that we think they’re a great investment partner,” he said.

But the first steps, Maggioncalda noted, will be working with the companies that are already turning to Coursera to build training programs.

“We absolutely see an opportunity to expand what we are doing with them,” he said. “If we are teaching skills to students, it’s not too hard to imagine us saying to that company or related employers, ‘we can introduce you to people with these skills.’ And you can imagine us doing this with others courses that we teach.” That could mean, for example, offering help with job placement for those paying Coursera to get their master’s or bachelor’s degrees.

That in itself could prove to be an interesting way of luring more students as online learning starts to get more competitive itself — not unlike how universities today are partly evaluated by students based on how helpful it will be to leverage those names when looking for jobs.

Other areas where we may see Coursera developing ahead is in its efforts to add a more diverse range of types of courses to its offering. The Trilogy acquisition by 2U highlights a rising demand for “bootcamps” to learn specific skills to enhance one’s work prospects. The growth of Triplebyte (itself also recently raising money) highlights how there is yet another bridge to be built between education and job hunting, in the form of “tests” to help screen and place the right people with the right job opportunities. And Lambda School has had a strong run so far in its model of offering nine-month, very career focused online training sessions in a variety of coding areas.

“It reinforces that people learning different skills need different environments,” Maggioncalda said. Given the right business model, cyberspace has no boundary, and the same might be said for online education.

Powered by WPeMatico

Artificial intelligence and other tech for automating some of the more repetitive aspects of human jobs continues to be a growing category of software, and today a company that builds tools to address this need for salespeople has raised a tidy sum to grow its business.

SalesLoft, an Atlanta-based startup that has built a platform for salespeople to help them engage with their clients — providing communications tools, supporting data and finally analytics to “coach” salespeople to improve their processes — has raised $70 million in a Series D round of funding led by Insight Partners with participation from HarbourVest.

Kyle Porter, SalesLoft’s co-founder and CEO, would not disclose the amount of funding in an interview, but he did confirm that it is more than double its valuation from the previous round — a $50 million Series C that included LinkedIn among the investors (more on that below) — but less than $1 billion. That round was just over a year ago and would have valued the firm at $250 million. That would put SalesLoft’s current valuation at more than $500 million, and a source close to the company notes that it’s around $600 million.

While there are a number of CRM and sales tools out in the market today, Porter believes that many of the big ones might better be described as “dumb databases or repositories” of information rather than natively aimed at helping source and utilise data more effectively.

“They are not focused on improving how to connect buyers to sales teams in sincere ways,” he said. “And anytime a company like Salesforce has moved into tangential areas like these, they haven’t built from the ground up, but through acquisitions. It’s just hard to move giant aircraft carriers.”

SalesLoft is not the only one that has spotted this opportunity, of course. There are dozens of others that are either competing on single or all aspects of the same services that SalesLoft provides, including the likes of Clari, Chorus.ai, Gong, Conversica, Afiniti and not least Outreach — which is seen as a direct competitor on sales engagement and itself raised $114 million on a $1.1 billion valuation earlier this month.

One of the notable distinctions for SalesLoft is that one of its strategic investors is LinkedIn, which participated in its Series C. Before Microsoft acquired it, LinkedIn was seen as a potential competitor to Salesforce, and many thought that Microsoft’s acquisition was made squarely to help it compete against the CRM giant.

These days, Porter said that his company and LinkedIn have a tight integration by way of LinkedIn’s Sales Navigator product, which SalesLoft users can access and utilise directly within SalesLoft, and they have a hotline to be apprised of and help shape LinkedIn’s API developments. SalesLoft is also increasingly building links into Microsoft Dynamics, the company’s CRM business.

“We are seeing the highest usage in our LinkedIn integration among all the other integrations we provide,” Porter told me. “Our customers find that it’s the third most important behind email and phone calls.” Email, for all its cons, remains the first.

The fact that this is a crowded area of the market does speak to the opportunity and need for something effective, however, and the fact that SalesLoft has grown revenues 100 percent in each of the last two years, according to Porter, makes it a particularly attractive horse to bet on.

“So many software companies build a product to meet a market need and then focus purely on selling. SalesLoft is different. This team is continually innovating, pushing the boundaries, and changing the face of sales,” said Jeff Horing, co-founder and MD of Insight Venture Partners, in a statement. “This is one reason the company’s customers are so devoted to them. We are privileged to partner with this innovative company on their mission to improve selling experiences all over the world.”

Going forward, Porter said that in addition to expanding its footprint globally — recent openings include a new office in London — the company is going to go big on more AI and “intelligence” tools. The company already offers something it calls its “coaching network,” which is not human but AI-based and analyses calls as they happen to provide pointers and feedback after the fact (similar to others like Gong and Chorus, I should note).

“We want to give people a better way to deliver an authentic but ultimately human way to sell,” he said.

Powered by WPeMatico

Embrace, an LA-based startup that offers a mobile-first application performance management platform, today announced that it has raised a $4.5 million funding round led by Pritzker Group Venture Capital. This brings the company’s total funding to $7 million. New investors Greycroft, Miramar Ventures and Vy Captial also participated in this round, as did previous investors Eniac Ventures, The Chernin Group, Techstars Ventures, Tikhon Bernstam of Parse and others.

Current Embrace customers include the likes of Home Depot, Headspace, OkCupid, Boxed, Thrive Market and TuneIn. These companies use the service to get a better view of how their apps perform on their users’ devices.

As Embrace CEO and co-founder Eric Futoran, who also co-founded entertainment company Scopely, argues, too many similar services mostly focus on crashes, yet those only constitute a small number of the actual user experience issues in most apps. “To a large extent, crashes are solved,” he told me. “The crash percentages are often 99.8 percent crash-free and yet users are still complaining.”

That’s because there are plenty of other issues beyond code exceptions, which many tools focus on almost exclusively, that can force an app to close (think memory issues or the OS shutting down the app because it uses too many CPU cycles). “To users, that looks like a crash. Your app closed. But in no way, that’s a crash from a technical perspective,” Futoran noted.

Raising this new round, Futoran told me, was pretty easy. Indeed, Pritzker approached the company. “It was not fundraising,” he said. “They sat us down and said, ‘we want to fund you guys,’ which I find pretty unusual. So I’ve been calling it a pre-emptive round.” He also noted that having Pritzker involved should help open up the mid-west market for Embrace, which is mostly focusing on enterprise customers (though Futoran’s definition of “enterprise” includes the likes of digital-first companies like Headspace).

“We saw many organizations trust Embrace’s seamless and innovative optimization platform to quickly identify and resolve any user-impacting issues within their apps, and we’re optimistic about the future of the company in this growing market,” said Gabe Greenbaum, an LA-based partner for Pritzker Group Venture Capital. “We look forward to this next stage in the company’s growth journey and are honored to partner with Eric and Fredric to help them achieve their vision.”

The company plans to use the new funding to increase its go-to-market capabilities, and grow its team to build out its technology.

Powered by WPeMatico

SalesWhale, a Singapore-based startup that uses AI to help marketers and salespeople generate leads, has announced a Series A round worth $5.3 million.

The investment is led by Monk’s Hill Ventures — the Southeast Asia-focused firm that led SalesWhale’s seed round in 2017 — with participation from existing backers GREE Ventures, Wavemaker Partners and Y Combinator. That’s right, SalesWhale is one a select few Southeast Asian startups to have been through YC, it graduated back in summer 2016.

SalesWhale — which calls itself “a conversational email marketing platform” — uses AI-powered “bots” to handle email. In this case, its digital workforce is trained for sales leads. That means both covering the menial parts of arranging meetings and coordination, and the more proactive side of engaging old and new leads.

Back when we last wrote about the startup in 2017, it had just half a dozen staff. Fast-forward two years and that number has grown to 28, CEO Gabriel Lim explained in an interview. The company is going after more growth with this Series A money, and Lim expects headcount to jump past 70; SalesWhale is deliberating opening an office in California. That location would be primarily to encourage new business and increase communication and support for existing clients, most of whom are located in the U.S., according to Lim. Other hires will be tasked with increasing integration with third-party platforms, and particularly sales and enterprise services.

The past two years have also seen SalesWhale switch gears and go from targeting startups as customers, to working with mid-market and enterprise firms. SalesWhale’s “hundreds” of customers include recruiter Randstad, educational company General Assembly and enterprise service business Unit4. As it has added greater complexity to its service, so the income has jumped from an initial $39-$99 per seat all those years ago to more than $1,000 per month for enterprise customers.

SalesWhale’s founding team (left to right): Venus Wong, Ethan Lee and Gabriel Lim

While AI is a (genuine) threat to many human jobs, SalesWhale sits on the opposite side of that problem in that it actually helps human employees get more work done. That’s to say that SalesWhale’s service can get stuck into a pile (or spreadsheet) of leads that human staff don’t have time for, begin reaching out, qualifying leads and sending them on to living and breathing colleagues to take forward.

“A lot of potential leads aren’t touched” by existing human teams, Lim reflected.

But when SalesWhale reps do get involved, they are often not recognized as the bots they are.

“Customers are often so convinced they are chatting with a human — who is sending collateral, PDFs and arranging meetings — that they’ll say things like ‘I’d love to come by and visit someday,’ ” Lim joked in an interview.

“Indeed, a lot of times, sales team refer to [SalesWale-powered] sales assistant like they are a real human colleague,” he added.

Powered by WPeMatico

Astound, a company selling automated employee help desk services, has raised a new round of $15.5 million from investors led by the Los Angeles investment firm March Capital Partners.

Previous investors Vertex Ventures, Pelion Venture Partners, Moment Ventures and the Slack Fund also participated in the funding, which brings Astound’s total capital raised to $27 million.

The company’s software integrates with ServiceNow, BMC, Jira, Cherwell and Workday, among others.

For co-founder and chief product officer Dan Turchin, the company is the culmination of decades of work spent developing tools for human resources and employee services. It’s the seventh company that Turchin has been involved in around applying technology to help employees, he says. Most recently, Turchin worked at ServiceNow, which he left in 2014 to launch Astound .

Astound said it would use the financing to increase its product development and sales and marketing efforts, according to a statement.

Taking information from structured and unstructured data sources across different information silos within a business and offering it up to employees via automated messages (it’s a chatbot) frees human resources and help desk staff to engage at a higher level with employees, companies like Astound say.

Automation is certainly coming to businesses, whether employees like it or not. A study from McKinsey indicates that 70 percent of companies will bring in at least one automation technology by 2030. And those technologies could contribute up to $120 billion in increased economic value, according to the McKinsey study cited by Astound.

Powered by WPeMatico

Mfine, an India-based startup aiming to broaden access to doctors and healthcare by using the internet, has pulled in a $17.2 million Series B funding round for growth.

The company is led by four co-founders from Myntra, the fashion commerce startup acquired by Flipkart in 2014. They include CEO Prasad Kompalli and Ashutosh Lawania who started the business in 2017 and were later joined by Ajit Narayanan and Arjun Choudhary, Myntra’s former CTO and head of growth, respectively.

The round is led by Japan’s SBI Investment with participation from sibling fund SBI Ven Capital and another Japanese investor, Beenext. Existing Mfine backers Stellaris Venture Partners and Prime Venture Partners also returned to follow-on. Mfine has now raised nearly $23 million to date.

“In India, at a macro-level, good doctors are far and few and distributed very unevenly,” Kompalli said in an interview with TechCrunch. “We asked ‘Can we build a platform that is a very large hospital on the cloud?,’ that’s the fundamental premise.”

There’s already plenty of money in Indian healthtech platforms — Practo, for one, has raised more than $180 million from investors like Tencent — but Mfine differentiates itself with a focus on partnerships with hospitals and clinics, while others have offered more daily health communities that include remote sessions with doctors and healthcare professionals who are recruited independently of their day job.

“We are entering a different phase of what is called healthtech… the problems that are going to be solved will be much deeper in nature,” Kompalli said in an interview with TechCrunch.

Mfine makes its money as a digital extension of its healthcare partners, essentially. That means it takes a cut of spending from consumers. The company claims to work with more than 500 doctors from 100 “top” hospitals, while there’s a big focus on tech. In particular, it says that an AI-powered “virtual doctor” can help in areas that include summarising diagnostic reports, narrowing down symptoms, providing care advice and helping with preventative care. There are also other services, including medicine delivery from partner pharmacies.

To date, Mfine said that its platform has helped with more than 100,000 consultations across 800 towns in India during the last 15 months. It claims it is seeing around 20,000 consultations per month. Beyond helping increase the utilization of GPs — Mfine claims it can boost their productivity 3 to 4X — the service can also help hospitals and centers increase their revenue, a precious commodity for many.

Going forward, Kompalli said the company is increasing its efforts with corporate companies, where it can help cover employee healthcare needs, and developing its insurance-style subscription service. Over the coming few years, that channel should account for around half of all revenue, he added.

A more immediate goal is to expand its offline work beyond Hyderabad and Bangalore, the two cities where it currently operates.

“This round is a real endorsement from global investors that the model is working,” he added.

Powered by WPeMatico

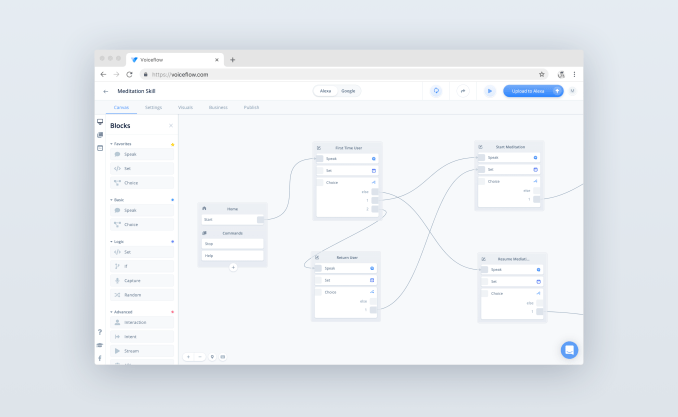

The market for voice apps has opened up — Amazon Alexa’s platform alone has more than 80,000 skills as of earlier this year — and there’s little sign of that growth slowing now that smart speakers have hit critical mass in the U.S. To capitalize on this trend, Voiceflow, a startup making it easier for product teams to build voice applications for Alexa and Google Assistant, has raised $3 million in seed funding.

The round was led by True Ventures, and includes participation from Product Hunt founder Ryan Hoover, Eventbrite founder Kevin Hartz and InVision founder Clark Valberg. The company has previously raised $500,000 in pre-seed funding.

Explains Voiceflow CEO and co-founder Braden Ream, the idea for a collaborative platform for building voice apps came from direct experience as a voice app developer.

The team — which also includes Tyler Han, Michael Hood and Andrew Lawrence — had decided to build a voice application offering interactive children’s stories for Alexa, called Storyflow.

But as the team began to build out its library of these choose-your-own-adventure stories, they realized the process wasn’t scaling fast enough to serve their user base — they simply couldn’t build the storyboards with all their branches fast enough.

“At some point, we had the idea to just do a drag-and-drop,” says Ream. “I wished I could build the flow chart, the scripting and the actual coding — I wished this was all one step. That led us to build a really early iteration of what is now Voiceflow. It was sort of an internal tool,” he continues. “And being the nerds that we are, we kept making the platform better by adding logic, variables and modularity.”

The original plan was to make Storyflow’s platform a “YouTube of voice” so anyone could build their stories easily.

But when the Storyflow community got ahold of what the team had built, they very quickly wanted to use it to build their own voice apps — not just interactive stories.

“That’s when the light bulb went off for us,” notes Ream. “This could easily be the central platform for building voice apps, and not necessarily interactive children’s stories. The pivot was very easy,” he says. “All we had to do was change our name from Storyflow to Voiceflow.”

The platform officially launched in November, and today has more than 7,500 customers who have published some 250 voice apps using its tools.

Voiceflow is designed to be non-technical for those who don’t know how to code. For example, its two basic block types are “speak” and “choice.” Its blocks are organized on the screen through drag-and-drop, as users design the flow of their app. For more technical users, an advanced section allows you to add logic and variables — but it’s still entirely visual.

For enterprise customers, there’s also an API block in Voiceflow that allows the customer to integrate the business’s own API into their voice app.

What’s also interesting about the product is its collaborative features. While Voiceflow is free for individuals, its business model is focused on allowing teams to work together to build voice apps. Priced at $29 per month in its paid workspaces, voice agencies that have a larger staff — including linguists, voice user interface designers and developers, for example — can all work together on one board, share projects and hand off assets more easily.

With the seed funding, Voiceflow plans to grow the team by hiring more engineers and continue to develop the platform.

Longer-term, the company wants to help people design better, more human-sounding voice apps through its platform.

“The problem right now is you have documentation and best practices by Google. Then you have the exact same on the Alexa side, but there’s no coherent industry standard. And there’s certainly no tangible base of examples, or easy way to put these into practice,” Ream explains. “If we can help spawn another 10,000 voice user interface designers — we can help train them and give them a platform that’s accessible, where they can collaborate with each other — I think you’re going to see a tremendous uplift in the quality of conversations.”

On this front, Voiceflow has started a program called Voiceflow University, which today includes video tutorials but will later become a more standardized training course.

In addition to the videos, Voiceflow networks with its community directly on Facebook, where more than 2,500 developers, linguists, educators, designers and entrepreneurs actively discuss the voice app design and development process.

This interaction between Voiceflow and its user base was one of the key selling points for True Ventures’ Tony Conrad.

“After I left the [pitch] meeting and I started digging around a little bit, the thing that blew me away was the engagement of the community of developers. That’s unlike anybody else. The single biggest differentiator of this platform is actually Braden and the team’s engagement with the community,” Conrad says. “It reminds me of early WordPress.”

Voiceflow also recently worked with another visual design tool, Invocable, which has shut down, to allow its users to transition to Voiceflow’s platform.

There is, perhaps, a cautionary tale in there — Invocable, in its farewell blog post, points out that people continue to use smart speakers mainly for things like music, news, reminders and simple commands. It also says that Natural Language Processing and Natural Language Understanding haven’t developed to the point where they can support higher-quality voice apps. That day will likely come to pass, but there’s a bit of a timing issue when it comes to betting on the right platform to support the voice app development market in the meantime, ahead of widespread consumer adoption.

Toronto-based Voiceflow is a team of 12 today and looking to grow.

Powered by WPeMatico

When Chive Media Group spun out its out-of-home TV business last year, co-founder and CEO Leo Resig said the structure should help the new company, called Atmosphere, raise venture capital.

Looks like those fundraising efforts were successful, with Atmosphere announcing that it has raised $10 million in Series A funding led by S3 Ventures, with participation from Capstar Capital.

“I have yet to meet someone who enjoys watching closed-captioning or talking heads at their favorite establishments,” said S3 Ventures partner Charlie Plauche in a statement. (Plauche is joining Atmosphere’s board of directors.) “Yet, that is the best option most businesses have to entertain patrons. That all changes with Atmosphere, who offers engaging content to viewers of all ages with no audio needed.”

Chive Media Group is known for its namesake website, theChive, which focuses on funny and viral content. Chive co-founders (and brothers) Leo and John Resig told me that when the company decided to move into video, it didn’t have the money to create a big production arm.

“We stuck to our roots of what we do best: Seek out and curate and package existing content,” John said. As a result, the company was able to license “a pretty large IP library of short-form, mostly amateur viral videos,” which it then offered to bars and other out-of-home locations as Chive TV.

Chive TV still exists, but it’s now just one of the channels that Atmosphere offers, with Leo noting that Atmosphere now includes more polished videos from partners like Red Bull and GoPro.

“Everyone’s creating content these days,” John added. “We’re a shiny new distribution vessel for a lot of that content.”

In general, Leo argued that Atmosphere content is better tailored than regular TV to the needs of (say) a restaurant or a doctor’s office.

“It’s ambient TV,” he said. “It’s not episodic, it’s not character-driven, you can pick it up and leave it without missing a touchdown.”

Plus, as Plauche mentioned, it’s designed to be watchable without audio.

The company says Chive TV is already streamed in 4,300 bars, restaurants, gyms and other locations. And it’s adding around 450 venues every month.

At the same time, the Resigs said Atmosphere has been building up a technology backend, with the analytics and ad serving that you get with online video.

Until now, Chive and Atmosphere have been giving the content away for free while monetizing with ads, but Leo said they’ll soon start charging a monthly subscription fee of around $10 or $20, which he suggested is “not a lot of money for what the venues are getting,” particularly compared to their cable bill. There’s an additional product that venues can pay for to insert their own messages and house ads.

The Resigs actually hold the same title at both companies, but Leo (CEO) suggested that he’ll be spending more time on Atmosphere, while John (president) said he’ll be “straddling” the two organizations.

Leo said Atmosphere has around 20 employees — with another 20 who are currently splitting their work between Chive Media and Atmosphere, but will ultimately go work for one of the two organizations.

Powered by WPeMatico

Uber has confirmed it will spin out its self-driving car business after the unit closed $1 billion in funding from Toyota, auto-parts maker Denso and SoftBank’s Vision Fund.

The development has been speculated for some time — as far back as October — and it serves to both remove a deeply unprofitable unit from the main Uber business, helping Uber scale back some of its losses, while giving Uber’s Advanced Technologies Group (known as Uber ATG) more freedom to focus on the tough challenge of bringing autonomous vehicles to market.

The deal values Uber ATG at $7.25 billion, the companies announced. In terms of the exact mechanics of the investment, Toyota and Denso are providing $667 million, with the Vision Fund throwing in the remaining $333 million.

The deal is expected to close in Q3, and it gives investors a new take on Uber’s imminent IPO, which comes with Uber ATG. The company posted a $1.85 billion loss for 2018, but R&D efforts on “moonshots” like autonomous cars and flying vehicles dragged the numbers down by accounting for more than $450 million in spending. Moving those particularly capital-intensive R&D plays into a new entity will help bring the core Uber numbers down to earth, but clearly there’s still a lot of work to reach break-even or profitability.

Still, those crazy numbers haven’t dampened the mood. Uber is still seen as a once-in-a-generation company, and it is tipped to raise around $10 billion from the IPO, giving it a reported valuation of $90 billion-$100 billion.

Like the spin-out itself, the identity of the investors is not a surprise.

The Vision Fund (and parent SoftBank) have backed Uber since a January 2018 investment deal closed, while Toyota put $500 million into the ride-hailing firm last August. Toyota and Uber are working to bring autonomous Sienna vehicles to Uber’s service by 2021 while, in further proof of their collaborative relationship, SoftBank and Toyota are jointly developing services in their native Japan, which will be powered by self-driving vehicles.

The duo also backed Grab — the Southeast Asian ride-hailing company in which Uber owns around 23 percent — perhaps more aggressively. SoftBank has been an investor since 2014, and last year Toyota invested $1 billion into Grab, which it said was the highest investment it has made in ride hailing.

“Leveraging the strengths of Uber ATG’s autonomous vehicle technology and service network and the Toyota Group’s vehicle control system technology, mass-production capability, and advanced safety support systems, such as Toyota Guardian, will enable us to commercialize safer, lower cost automated ridesharing vehicles and services,” said Shigeki Tomoyama, the executive VP who leads Toyota’s “connected company” division, said in a statement.

Here’s Uber CEO Dara Khosrowshahi’s shorter take on Twitter:

Excited to announce Toyota, Denso and the SoftBank Vision Fund are making a $1B investment in @UberATG, as we work together towards the future of mobility. pic.twitter.com/JdqhLkV7uU

— dara khosrowshahi (@dkhos) April 19, 2019

Powered by WPeMatico